The USA Chickpea Protein Market is projected to reach a value of USD 53.4 Million in 2025, growing at a CAGR of 11.3% over the next decade to an estimated value of USD 155.7 Million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 53.4 Million |

| Projected USA Value in 2035 | USD 155.7 Million |

| Value-based CAGR from 2025 to 2035 | 11.3% |

The recognition of chickpea protein as an environmentally friendly alternative to traditional protein ingredients soy and whey has been noticeably greater. Consumer demand for protein sources derived from chickpeas that do not contain GMO or gluten and are safe for individuals with allergies drives the market for chickpea-based protein isolates and concentrates as well as textured proteins.

People find chickpea protein attractive because it boasts high protein levels alongside a beneficial amino acid nutrient profile, which improves digestion better than other plant protein sources. Market expansion happens because industries are adopting chickpea protein to create plant-based meat alternatives together with protein bars, dairy-free yogurts, and infant nutrition products.

Chickpea protein continues to gain prominence in food manufacturing because manufacturers commit to innovative, sustainable ingredient sourcing, which will make it a standard element in vegan-friendly, health-focused products.

Chickpea protein stands out in processed food applications because of its ability to perform as an emulsifier and binder and form gels. Researchers inside the USA are actively investing resources to develop advanced extraction methods and sensory improvements for chickpea protein-based food products.

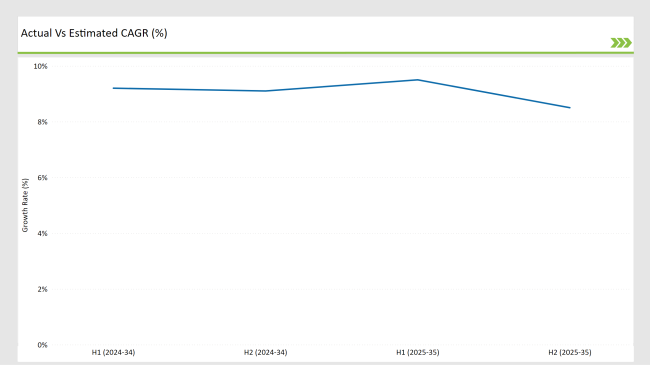

The semi-annual market update reveals a consistent increase in demand for chickpea protein. Increased awareness concerning the health benefits of chickpea protein has, however, accelerated its adoption among consumers who seek natural and minimally processed protein alternatives.

H1 signifies period from January to June, H2 Signifies period from July to December

New investments aimed at sustainable farming practices combined with alternative protein research will drive the market's growth. Industry organizations invest in protein processing improvements while creating new products because consumers increasingly prefer nutritious alternatives.

| Date | Development/M&A Activity & Details |

|---|---|

| January 24 | Ingredion Incorporated: Expansion of chickpea protein production capabilities to meet rising demand. |

| February 24 | Roquette: Launch of a new chickpea protein isolate targeting the sports nutrition market. |

| March 24 | AGT Foods: Partnership with local farmers to enhance chickpea sourcing and sustainability practices. |

| April 24 | Benson Hill: Introduction of a new line of plant-based protein products featuring chickpea protein in retail stores. |

| May 24 | Burcon NutraScience: Completion of a successful trial for a new extraction process improving chickpea protein yield and quality. |

There is increasing demand for chickpea protein in plant-based food formulations.

Plenty of consumers now follow plant-based diets which has sparked the growth of chickpea protein in dairy substitutes alongside meat-alternative products and functional drinks. Consumers today choose protein sources which provide nutritional advantages while maintaining pure labeling and non-processed features.

Chickpea protein, with its balanced amino acid profile and some advantages in digestibility, has started gaining popularity as manufacturers have become increasingly keen on developing innovative plant-based formulations.

Through the diverse applications in bakery, confectionery, and snack foods, chickpea protein assists in improving texture and moisture retention besides the nutritional profile. As the demand for high-protein, free from allergens, and gluten-free products increase continuously, the addition of chickpea protein to mainstream food production is likely to garner massive intake.

Advancements in Chickpea Protein Processing and Extraction Technologies

Members of the industries work toward advancing extractions of chickpea proteins to optimize quantity and quality and flavor satisfaction. The food industry uses innovative enzymatic extraction techniques to optimize protein solubility activities and reduce bitterness levels while creating functional properties with new potential uses.

New processing methods, including dry fractionation and precision fermentation, are now making it possible to produce high-quality chickpea protein isolates and concentrates with excellent taste and texture properties. Innovations in new processes are opening doors to much wider applications for chickpea protein, which can be better incorporated into dairy-free yogurts, protein-enriched cereals, and plant-based performance nutrition products.

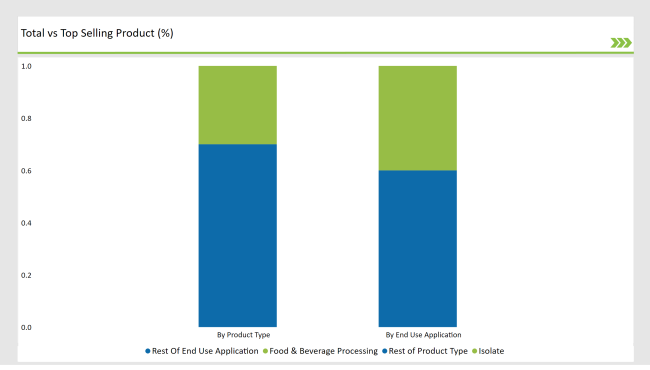

% share of Individual categories by Product Type and End-Use Application in 2025

In 2025, the market share is dominated by chickpea protein isolates at 30%. The demand for isolates is strong because of their high protein content, neutral flavor, and better functional properties in food and beverage formulations.

The broad application spectrum extends to plant-based dairy alternatives along with high-protein beverages and meat substitutes that require both clean flavor performance and effective emulsification capabilities. The plant protein industry identifies chickpea protein isolates as fundamental elements that will sustain its dominance.

Determining food and beverage processing as the dominant end-use segment with 40% expected market occupancy in 2025. Clean-label and high-protein food products continue to gain momentum, especially in plant-based yogurts protein bars and dairy-free beverages.

Manufacturers are finding the emulsifying and foaming properties of chickpea protein useful in providing appealing food textures and enhancing the stability of products. The growing interest in sustainable and plant-based formulations by the food industry also supports chickpea protein as the dominant player in that segment.

.png)

Note: above chart is indicative in nature

The USA's chickpea protein market experiences aggressive competition because major players keep developing innovative solutions with sustainable manufacturing at large scales. The market leadership belongs to companies such as Ingredion, Roquette, and AGT Foods because they employ refined extraction methods together with proven supply chain infrastructure. Specialty products for chickpea protein are emerging from smaller companies and startups because they target customers interested in organic or non-GMO protein alternatives from sustainable sources

The competitive market conditions are getting more intense due to growing research and development investments together with mutually beneficial partnerships between food manufacturers and their ingredient suppliers.

Health food stores, alongside online sales and direct consumer channels, operate as key elements that boost access to chickpea protein across retail networks. Evolutionary market trends toward plant-based proteins force companies to develop enhanced functional attributes while optimizing production systems to achieve business leadership positions.

By product type, the market includes isolates, concentrates, textured, and hydrolyzed chickpea protein.

By end-use application, the market covers food & beverage processing, sports nutrition, infant nutrition, pharmaceutical products, personal care products, and animal nutrition.

The market is expected to grow at a CAGR of 11.3% from 2025 to 2035.

The USA Chickpea Protein market is projected to reach USD 155.7 Million by 2035.

The market is driven by increasing demand for plant-based proteins, rising health consciousness, and advancements in chickpea protein extraction and processing technologies.

Chickpea protein is widely used in food and beverage processing, sports nutrition, infant nutrition, pharmaceutical products, personal care products, and animal nutrition.

Top manufacturers include Ingredion Incorporated, Roquette, AGT Foods, Benson Hill, and Burcon NutraScience.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA