The USA food service equipment market is projected to reach a value of USD 5,759.4 Million in 2025, growing at a CAGR of 6.2% over the next decade to an estimated value of USD 6,658.6 Million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 5,759.4 Million |

| Projected USA Value in 2035 | USD 6,658.6 Million |

| Value-based CAGR from 2025 to 2035 | 6.2% |

This market growth maintains momentum through advancing end-user needs for food service equipment that provides advanced features along with energy-efficient performance throughout multiple sectors, including hospitality demand and foodservice facilities. Shifts toward dining outside restaurants have intensified market expansion.

Food service equipment refers to a wide selection of necessary appliances and tools that play a vital role in executing food preparation tasks and ensuring cooking methods and food storage as well as the service process.

Current market transitions focus on advanced high-tech automated equipment, which enables businesses to boost their productivity and raise security while cutting expenses. The growth of cloud kitchens alongside quick-service restaurants (QSRs) is transforming market demand toward small multifunctional appliances that suit high-speed kitchens.

Health-conscious dining preferences are changing foodservice markets around the world. The rising consumer interest in dietary choices prompts food service operators to change their menus while creating new demand for specialized ingredients preparation systems. Due to rising takeout service popularity, restaurants are investing in equipment that streamlines their takeaway process.

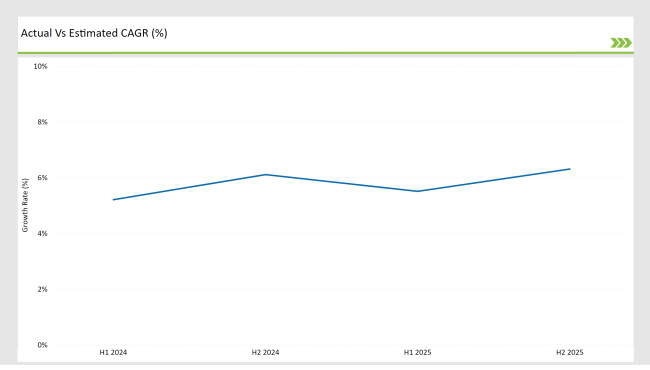

The following table indicates semi-annual growth trends of the USA food service equipment market, with steady increases in CAGR for successive years. This analysis reveals the market's ability to adjust to consumer trends, technological advancements, and demand patterns in food services.

H1 signifies period from January to June, H2 Signifies period from July to December

Market growth continues on an upward trajectory because of escalating use of energy-efficient and modular food service equipment which hotels and restaurants of all types continuously adopt. The market demonstrates its capacity to meet the rising demand for rugged high-capacity kitchen appliances that serve both commercial kitchens and institution-level canteens.

| Date | Development/M&A Activity & Details |

|---|---|

| January 25 | Expansion Plans by McDonald's: McDonald's announced plans to open an additional 1,000 restaurants in the USA by 2027, driving equipment demand. |

| December 24 | Focus on Energy Efficiency by Electrolux: Electrolux launched a new line of energy-efficient kitchen appliances aimed at reducing operational costs for food service operators. |

| December 24 | Acquisition by Middleby Corporation: Middleby Corporation acquired a leading manufacturer of smart kitchen technology to enhance its product offerings in the food service sector. |

| November 24 | New Product Launch by Welbilt Inc.: Welbilt Inc. introduced a range of modular cooking equipment designed for quick-service restaurants to optimize space and efficiency. |

| October 24 | Sustainability Initiative by Hoshizaki Corporation: Hoshizaki Corporation announced a sustainability initiative focusing on eco-friendly refrigeration solutions to meet growing environmental standards. |

Shift Toward Sustainable and Energy-Efficient Equipment

Overall, industries are now focusing on sustainability, which prompts food service operators to choose energy-efficient equipment to reduce their environmental impact and meet government requirements. Foodservice operators adopt high-efficiency ovens, smart refrigerators, and energy-saving dishwashers because these tools minimize energy usage while producing cost reductions in the long term.

Foodservice operators take the lead in sustainability by implementing waste reduction approaches that include both composting systems and recycling programs. Establishments seek solutions to achieve lower food waste levels by merging better inventory controls with their equipment systems. The consumer market now supports businesses that make environmental sustainability a central part of their operations.

Advancements in Smart and Automated Equipment

Internet of Things in the equipment that includes Artificial Intelligence in its applications contributes to modern changes in the industry. Modernized kitchens employ advanced appliances that embrace smartness characteristics with predictive features on maintenance; monitoring is online and automated system of cooking among other attributes that integrate the enhanced performance, increase the quality products, and reduction in operational shutdown, meeting requirements in commercial or institution facilities foodservice industries today.

The new smart ovens now have the feature of automatically adjusting cooking time according to simultaneous real-time temperature feedback and humidity inside the chamber. This system will ensure consistent outcomes and reduce energy costs by optimized cooking loop operations.

It provides operational insights based on the analytics tools generated from AI software through kitchen usage patterns, such as detecting areas of improvement for efficiency, such as reducing idle machine time and enhancing menu-driven ingredient utilization.

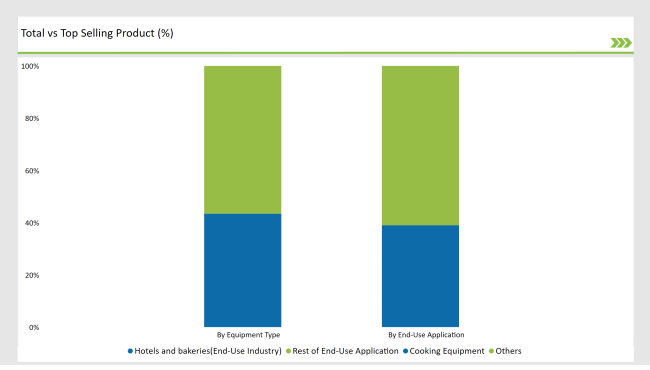

% share of Individual categories by Product Type and Applications in 2025

The USA food service equipment market leaders for 2025 include hotels and bakeries, pointing to their joint dominance of 39% market control. equipment used by hotels evolves into extended food and beverage offerings that employ big-capacity cooking systems together with fridge units and buffet preparations equipment alongside bakery requirements that necessitate specific baking apparatus like ovens and mixers to ensure production consistency in high-volume output.

The fine dining industry is also experiencing growth, although it has its drawbacks. For instance, ingredient prices have been increasing, forcing operators to find more efficient ways of cooking that do not affect the quality and experience of their customers.

Cooking equipment remains the biggest segment at 43.4%, and encompasses those essential appliances in the likes of grills, ovens, fryers, steamers, and ranges used across all kinds of foodservice establishments. Versatile, energy-efficient cooking solutions are highly demanded as operators aim to optimize kitchen space while minimizing energy costs.

Refrigeration and refrigeration equipment are crucial in meeting the set standards for food safety in terms of storage temperatures for perishable goods-this is rapidly gaining importance, given the growing consumer awareness of food safety issues. Bakery equipment remains vital in bakeries but gains growing interest by restaurants to offer freshly baked items as a part of their menu entries-a trend triggered by consumer preference for artisanal products.

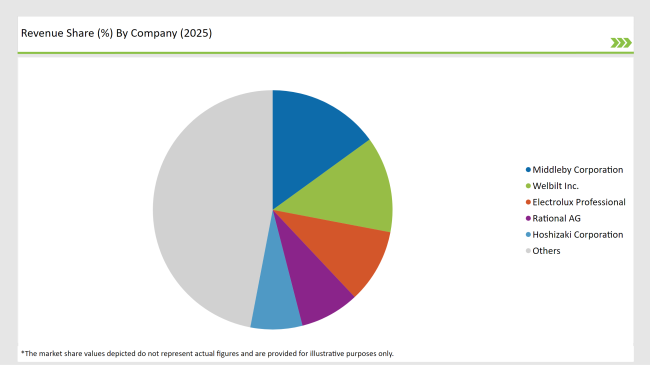

2025 Market share of USA Food Service Equipment suppliers

Note: above chart is indicative in nature

Decades of research shows the USA food service equipment market consists of leading worldwide companies and indigenous manufacturers both functioning together inside this market sector.

Middleby Corporation together with Welbilt Inc. and Electrolux Professional dominate the food service equipment market through extended product variety and innovative technology applications and robust industry reach. These companies focus on energy efficiency, smart connectivity, and customized solutions to cater to diverse customer needs.

Regional and niche players play a very important role in fulfilling local needs and providing cheaper solutions for smaller operators. Increased consumer consciousness regarding the environment and sustainability have also motivated manufacturers to develop energy-efficient kitchen appliances and products consisting of recyclable materials.

The symbiotic relationship of equipment manufacturers with the foodservice chains has contributed towards the increased market concentration, which enables the provision of customized products based on specific operating requirements.

By end-use industry, the market has been segmented into hotels, fine dine restaurants, casual dining restaurants, fast food and quick service restaurants (QSRs), bakeries, cafeterias, institutional canteens and catering, travel retail services, and households.

By equipment type, the market includes food preparation equipment, drink preparation equipment, cooking equipment, heating and holding equipment, table tops, food safety and sanitation equipment, dishwashers, refrigerators and chillers, baking equipment, storage and shelving equipment, and food packaging and wrapping equipment.

The market is expected to grow at a CAGR of 6.2% from 2025 to 2035.

The USA food service equipment market is projected to reach USD 6,658.6 Million by 2035.

Key drivers include rising demand for energy-efficient and automated equipment, the expansion of foodservice industries, and the growing trend of cloud kitchens and QSRs.

Cooking equipment dominates by equipment type, while hotels and bakeries lead among end-use industries.

Top manufacturers include Middleby Corporation, Welbilt Inc., Electrolux Professional, Rational AG, and Hoshizaki Corporation.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Food Service Industry Analysis from 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Distribution Among Food Service Equipment Companies

USA Food Testing Services Market Outlook – Share, Growth & Forecast 2025–2035

UK Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Europe Food Service Equipment Market Outlook – Size, Trends & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Commercial Food Service Equipment Market Growth – Trends & Forecast 2024-2034

Latin America Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

United States Food Emulsifier Market Trends – Growth, Demand & Forecast 2025–2035

USA Food Stabilizers Market Analysis – Size, Share & Forecast 2025–2035

USA Food Hydrocolloids Market Trends – Size, Share & Growth 2025-2035

Competitive Overview of Foodservice Paper Bag Companies

Europe Foodservice Disposables Market Insights – Growth & Trends 2024-2034

Foodservice Disposable Market Growth & Trends Forecast 2024-2034

Food Service Industry - Size, Share, and Forecast 2025 to 2035

Food Service Coffee Market Analysis by Type and End User Through 2035

USA Bird Food Market Insights - Trends & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA