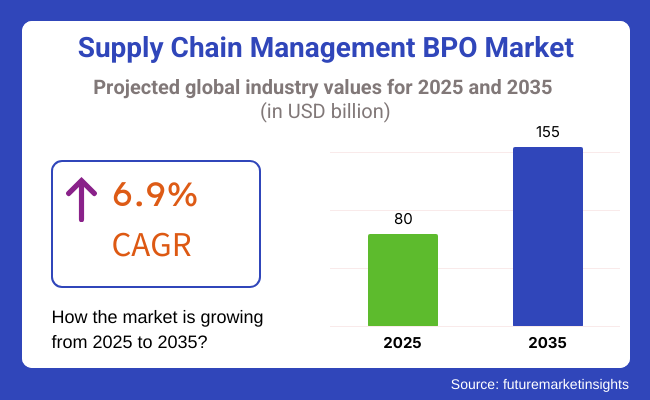

The supply chain management BPO market is expected to grow significantly from USD 80 billion in 2025 to USD 155 billion by 2035, with a CAGR of 6.9% over the forecast period. Some of the primary drivers for the growth in the industry are the increasing complexity of global supply chains, the need for real-time tracking and analytics, and risk management solutions.

That is where supply chain management BPO services are becoming the best thing about conducting business today because businesses are seeking a means of making their organizations leaner and more efficient.

Supply chain/Merge/Change management BPO services also streamline critical organizations that comprise procurement, logistics, inventory control, and even order treatment. Organizations are more and more using AI-based predictive analytics, blockchain-based transparency, and RPA to enhance supply chain performance. These technologies are enhancing decision-making, lowering operational costs, and enhancing overall productivity, making outsourced supply chain solutions more appealing to businesses across a variety of industries.

One of the principal forces behind industry expansion is the ongoing development of digital technologies. AI-driven demand forecasting gives organizations the power to stay ahead of the industry swings and control inventory with more precision. IoT-monitored logistics allow freight and shipments to flow through the supply chain with complete transparency logistics are traceable in real time, which helps to minimize disruption.

Cloud-based supply chain networks are facilitating collaboration among stakeholders, making data interchange silky smooth, and enhancing overall supply chain agility and resilience. Additionally, increasing investments in risk management strategies and regulatory compliance are also inducing growth in the industry.

Though its promising course, there are several challenges to be faced by the supply chain management BPO industry. The privacy and protection of data are changing as key issues because supply chain outsourcing usually entails dealing with sensitive business information. Moreover, offering complexity between existing enterprise systems and new BPO solutions can delay adoption.

Economic uncertainty and geopolitical uncertainties pose their share of influence on supply chain strategy, so businesses are being cautious regarding major outsourcing moves. In order to maintain long-term industry growth, these hurdles need to be overcome through sound cybersecurity strategies and, along with this risk management structure, adopted in a strategic manner.

The industry was USD 9.3 billion in 2022 and is expected to grow at USD 14.51 billion by 2032, at a CAGR of 5.77% over the forecast period. Development of AI-caused automation, blockchain driven supply chain transparency, and IoT based logistics solutions are some of the increasing investments made by companies to enable improved operations of business.

The growth of digital transformation projects is also driving demand for outsourced supply chain solutions. Additionally, BPO suppliers are still collaborating with enterprises on new solutions to enable businesses to react to changing industry dynamics. BPO service demand in the supply chain space will witness a steady growth over the next several years as the firms continue looking for efficiency, speed, and sustainability in their supply chain projects

Offshoring remains the key industry trend in the SCM BPO, with a projected industry share of 64 percent in 2025. Its draw is cost savings, the availability of skilled labor, and round-the-clock ops. Countries such as India, the Philippines, and Mexico with an established outsourcing ecosystem that also has companies like Accenture, Genpact, and IBM, offering end-to-end supply chain management (SCM) solutions, including procurement, logistics, and inventory management.

Deloitte estimates that companies that offshore SCM activities can save up to 40% by streamlining supply chain workflows using AI-powered automation, predictive analytics, and robotic process automation (RPA).

Nearshoring is on the rise and will account for 36% of the SCM BPO industry in 2025, boosted by geopolitical risks and trade disruptions, as well as the need for more agile supply chains. American firms are outsourcing more to Latin America, and European companies are offshoring to Eastern Europe, both for faster response, fewer time zone problems, and better regulatory consistency.

Nearshoring also shrinks supply chain risks, especially in sectors such as retail, healthcare, and automotive, which need real-time tracking and collaborative relationships with suppliers. Industry players, including Capgemini and TCS, are looking to expand nearshore centers to maturity, thereby aiming to deliver enhanced demand planning, logistics management, and operational agility.

From local manufacture to local resource extraction, offshoring and nearshoring will be important elements in supply chain resilience which will prove to be a strategic element in reducing costs, reducing exposure risk, and maintaining a steady flow in The Global Marketplace.

Supply chain management is key to better inventory optimization, demand forecasting, and omnichannel logistics for the retail and CPG sectors. As e-commerce and fast fulfilment models have proliferated, companies have been outsourcing SCM operations to BPO providers such as Accenture, Genpact, and Capgemini.

Telematics and AI-powered inventory management solutions continue to enhance supply chain visibility and minimize stockouts. Rapidly rising consumer demands for faster and more cost-effective deliveries are, therefore, expected to drive the Retail & CPG SCM BPO industry division to a 42% industry share during 2025.

In the Healthcare and Life Sciences sector, supply chain efficiency is simply mission-critical to the timely influx of pharmaceuticals, medical devices, and critical healthcare supplies. The regulatory compliance requirement, temperature-sensitive logistics, and real-time tracking as needed for the pharmaceutical industry have led to the strategic imperative for SCM outsourcing for leaders such as Pfizer, Johnson & Johnson, and Medtronic.

Cloud supply chain analytics and demand sensing with the help of AI vendors like TCS and WNS Global are being used by BPO providers to add resilience to the supply chain. As personalized medicine and biologics demand increases, this segment is anticipated to account for 38% industry share by 2025, providing clear insight and improved cost control on healthcare logistics.

The industry is on the growth drive with the increasing demand for cost reduction, business efficiency, and digitalization. In the retail and e-commerce sectors, businesses outsource supply chain services to enhance supply chain logistics, inventory management, and last-mile delivery. Consumers use BPO services for forecasting demand, management of suppliers, and procurement, cutting down manufacturing costs. Healthcare depends on SCM BPO for cold chain shipping and regulatory adherence, providing smooth medical supply delivery.

Logistics and transportation companies enjoy route optimization, fleet management, and real-time tracking capabilities for improved delivery efficiency. In BFSI, supply chain BPO facilitates risk management and compliance tracking for vendor contracts and procurement activities. The use of AI-powered analytics, blockchain for transparency, and cloud-based solutions is redefining the future of the market, rendering scalability and security as major buying factors for enterprises.

| Company | Contract/Development Details |

|---|---|

| Infosys and Tecsys | Infosys collaborated with Tecsys, a supply chain management software company, to enhance its service offerings. This partnership aims to provide clients with advanced supply chain solutions, leveraging Tecsys' platform to improve operational efficiency and visibility. |

In 2024 and the early part of 2025, the Industry observed significant growth via collaborations and technological advancement. A good example of these efforts in niche software implementations towards improved service delivery is Infosys' alliance with Tecsys.

This collaboration will allow customers to achieve increased operational visibility and efficiency, it's a called for normalcy of sophisticated technology adoption in supply chain management. The industry's overall trend seems unlikely to stall anytime soon, as companies continue to partner with new BPOs for supply chain streamlining.

During 2020 to 2024, the SCM BPO industry witnessed high growth because of the complexity of global supply chains, digitalization, and cost pressure. Companies outsourced order fulfillment, procurement, logistics, and inventory management to third-party service providers in a bid to avail maximum operational flexibility and utilization of resources.

The COVID-19 pandemic also drove cloud-based supply chain analytics, artificial intelligence (AI) forecasting, and robotic process automation (RPA), which helped companies navigate disruptions and enhance resilience. Blockchain enhanced transparency and reduced fraud risks, and AI-enabled route optimization and predictive analysis benefited e-commerce and omnichannel retail needs.In spite of these advancements, issues such as data security, regulatory compliance, and integration with legacy systems still lingered, leading companies to seek BPO providers that can provide end-to-end visibility and real-time monitoring.

SCM BPO will be born during 2025 to 2035 on the basis of AI-powered autonomous supply chains, blockchain-based secure digital payments, and hyper-automated logistics networks. Cognitive supply chains will leverage artificial intelligence to anticipate disruptions and real-time adapt operations, and smart contracts and digital twins will automate supply chain functions and increase transparency.

Industry 5.0 will propel AI-based RPA and machine learning in demand planning and warehouse management. Blockchain and distributed ledger technologies will make secure, automatic payments between suppliers possible via smart contracts. Green logistics, monitoring of carbon footprints, and circular supply chain practices will become the focus with sustainability being emphasized by BPO providers. Geopolitical insight and climate forecasting will be infused into AI-powered risk management systems, creating adaptable, robust, and low-cost global supply chains.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Companies focused on trade rules, cybersecurity, and regulatory adherence and outsourced supply chain activities. | AI-driven regulatory compliance, blockchain-secured supply chain transactions, and automated risk management will define future governance. |

| AI-driven supply chain analytics, RPA, and blockchain-enhanced transparency improved operational efficiency. | Quantum computing, AI-driven cognitive supply chains, and IoT-enabled autonomous logistics will redefine SCM BPO services. |

| SCM BPO services enabled e-commerce expansion, omnichannel retailing, and digital industrial transformation. | Artificial intelligence-based supply chain orchestration, supplier negotiations with smart contracts, and autonomous logistics networks will increase market applications. |

| Enterprises utilized AI, IoT, and cloud-based platforms to automate warehouses, manage procurement, and perform logistics. | Next-gen supply chain operations will be enabled by decentralized, blockchain-enabled digital supply chains, AI-driven demand sensing, and predictive procurement software. |

| Companies had the highest priority for green logistics, minimizing the carbon footprint, and transportation optimization. | Carbon tracking with artificial intelligence, circular supply chain strategies, and real-time carbon credit optimization will drive optimal sustainability and cost savings. |

| AI-powered predictive analytics improved demand forecasting, inventory optimization, and supply chain visibility. | Quantum-enhanced predictive risk management, AI-driven cognitive supply chain decision-making, and real-time geopolitical risk assessment will redefine predictive modeling. |

| Disruption in the supply chain, microchip shortages, and volatility of demand made supply chains unpredictable. | Artificial intelligence-tailored supply chain risk management, self-directed networked suppliers, and decentralized blockchain-based logistics will make supply chains more resilient and agile. |

| Cyber-transformation, electronic shopping growth, and rising need for supply chain agility drove growth. | AI-facilitated automated supply chain ecosystems, quantum-enhanced logistics networks, and decentralized supplier collaboration will drive future growth. |

The industry is on the brink of burgeoning because more and more companies are looking for the best, technological, and cost-efficient ways for logistics and procurement. Nevertheless, outsorcing usually involves dealing with confidential business data, which in turn, raises the concerns over cybersecurity. Implementation of robust encryption, compliance with global data protection regulations, and enforcement of strict access control measures are the only options to get rid of data leaks and to be certain of safety. Supply chain disruptions, globally, such as trade restricted, geopolitical instability, and raw materials, shortages create uncertainties in the industry.

On top of that, the reliance on third parties increases risks. To overcome that, businesses can try suppliers sourcing, contingency plans, and allow AI, and blockchain tech to transparency, efficiency, and resilience in operations of supply chains. The reformed BPO services of AI, automation, and data analysis are the products of the said technologies, but the fast pace of innovation is a barrier to adaptation.

The companies must prioritize investment in skilling up the human resource, integrating easily scalable AI programming, and flexible systems management to remain in the game competitively and for catering to the whims of the client who is changing all the time. Excess competition and cost pressure lead to service price cutting, with the subsequent impact on profitability. The focus of businesses to be unique should be value-adding service delivery, operational efficiency maximization, and tailor-made solutions development. Winning the supply chain management BPO sector depends on cyber security toughness, advanced tech, and tactical risk management for staying in the competitive race.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

| UK | 7.2% |

| France | 7% |

| Germany | 7.3% |

| Italy | 7.1% |

| South Korea | 7.6% |

| Japan | 7.4% |

| China | 8% |

| Australia | 6.9% |

| New Zealand | 6.7% |

7.5% CAGR during 2025 to 2035 is forecasted. The USA Industry is continuing its high-growth path, with business organizations emphasizing efficiency, cost-cutting, and technology adoption. Retail behemoths Walmart and Amazon utilize third-party supply chain services to automate procurement, logistics, and inventory management.

Analytics and automation through AI optimize operation workflows and enable informed decision-making and risk mitigation. Sustainability initiatives and policy climates continue to propel organizations towards greener supply chain strategies, further fueling the need for innovative BPO services.

Manufacturing and retail industries continuously adopt cloud-based supply chain software to enhance visibility and minimize bottlenecks within the process. The latest technologies, such as IoT-observed and robotics-assisted warehousing, lead the industry growth process forward. Supply chain disruptions in global networks also compel companies to develop diversified and robust sourcing architectures, enhancing the role of BPO service providers in the supply chain process.

2025 to 2035 CAGR is projected at 7.2%. UK's Industry grows as companies invest in digitalization and automation to optimize logistics functions. Top retail giants such as Tesco and Marks & Spencer use outsourced supply chain services to enhance real-time inventory visibility and minimize costs. Cloud-based solutions and AI-based demand forecasting optimize supply chain visibility and decision-making and reduce waste in operations.

Financial services and the pharmaceutical industry also contribute to industry growth, embracing BPO solutions to automate procurement and distribution. Brexit-influenced trade complexity forces companies to rethink supply chain approaches, driving demand for responsive and nimble BPO services. Regulations on sustainability also force companies to embrace greener logistics solutions, enhancing the contribution of BPO providers in integrating carbon-efficient initiatives.

The 7.0% CAGR during 2025 to 2035 is projected. French Industry expands as manufacturers, auto firms, and luxury brands look for effective logistics. Multinational companies such as Renault and L'Oréal leverage AI-driven supply chain analytics to improve demand planning and procurement. Predictive analytics and blockchain technology improve supply chain security and minimize the risk of fraud.

France's focus on carbon neutrality and sustainability is setting the pace in demand for green logistics solutions. Businesses are actively embracing circular economy principles in their supply chain strategies to minimize waste and maximize the use of resources. Further growth of the BPO industry also stems from higher e-commerce penetration, which is fueling demand for real-time inventory management and the optimization of last-mile delivery.

2025 to 2035 CAGR is estimated to be 7.3%. Supply Chain Management The BPO industry in Germany thrives based on its strong industrial base and leadership in technology. Automotive giants like BMW and Volkswagen use third-party outsourced logistics companies to achieve just-in-time production and supply chains across the globe. Automation powered by AI improves operational effectiveness, reducing costs and lead times.

Germany's high regulatory requirements force organizations to deploy compliance-oriented supply chain solutions, increasing the usage of BPO providers. Environmental protection programs push organizations to utilize power-saving transport and warehouse management systems. IoT and blockchain technology advancements improve the deployment of real-time supply chain monitoring, strengthening risk management and resiliency.

7.1% CAGR is anticipated for the years 2025 to 2035. Italy's Industry grows as fashion, automotive, and food companies invest in outsourcing logistics. Gucci and Ferrari are some of the luxury fashion brands that optimize supply chain operations using AI analytics and automation. Inventory tracking is supplemented by digital platforms, minimizing disruptions and streamlining the process overall.

Italy's focus on quality and sustainability shapes supply chain decisions and demand for sustainable logistics solutions increases. Its strategic location in the heart of Europe as a regional logistics hub itself is a reason for digital supply chain investment. Growth in electronic commerce further fuels the demand for effective warehousing and distribution, which also fuels the adoption of BPO services.

CAGR during the period 2025 to 2035 is projected at 7.6%. South Korea's supply chain management (BPO) industry is developing at a fast pace owing to the country's robust technology and manufacturing sectors. Electronics powerhouse Samsung and LG employ AI-technology-based logistic solutions to deliver maximum supply chain efficiency and reduced cost the engagement of the government's wise logistics infrastructure fuels automation consumption.

The growth of 5G and IoT provides greater real-time end-to-end visibility of the supply chain, improving inventory management and demand forecasting. Green logistics solutions are prompted by sustainability efforts, which force companies to adopt green logistics solutions, increasing the role of BPO providers in creating sustainable supply chain solutions. The growth of e-commerce and international trade partnerships also increases the demand for outsourced logistics services even more.

The CAGR between 2025 and 2035 would be 7.4%. The supply chain management (BPO) industry in Japan is growing as companies focus on lean manufacturing and automation. Toyota and Sony, among others, adopt AI-based procurement and logistics solutions to enhance efficiency and reduce operational expenses. Robotics and IoT are at the forefront of warehousing automation and real-time inventory monitoring.

Japan's emphasis on sustainability and energy-efficient supply chain management promotes BPO industry growth. The demand for cloud platforms grows as businesses look for real-time monitoring of the supply chain, as well as predictive analytics. Furthermore, e-commerce and digital trade expansion enhance the demand for efficient logistics and last-mile delivery solutions.

8.0% estimated CAGR during 2025 to 2035. China Industry grows at a faster pace fueled by its massive manufacturing and e-commerce industries. Alibaba and Huawei utilize AI-based logistics solutions to increase efficiency and cost savings. Advanced automation and robotics considerably enhance supply chain operations.

China's administration has invested in smart logistics infrastructure that promotes quick resolution of digitalization and real-time tracking solutions. Global sustainability demands companies to implement green logistics practices, which in turn increases the demand for BPO services. Trade partnership policies and supply chain diversification policies also drive business growth in the industry.

6.9% is the forecast CAGR between 2025 to 2035. The Australian Industry expands as organizations invest in AI-based logistics solutions. BHP and Woolworths are among the players that are leveraging automation and real-time tracking to manage supply chain operations efficiently. Expansion in e-commerce also continues to fuel demand for outsourced logistics services.

Australia's geographical complexities force investment in digital supply chain solutions to improve efficiency. Focus on sustainability encourages businesses to adopt carbon-neutral warehousing and transportation operations. Also, improvements in AI and blockchain enhance security and transparency in supply chains and boost the BPO industry.

2025 to 2035 CAGR is 6.7%. The New Zealand Industry grows as companies focus on efficiency and cost-effectiveness. Farmers and retailers implement AI-based logistics solutions integrated into agricultural produce exportation.

Sustainability influences logistics planning with greater demand for green transport and environmentally friendly packaging options. Digitalization speeds up the shift towards cloud-based supply chain platforms that support more efficient inventory management as well as decision-making. The rise in e-commerce also compels greater use of outsourced supply chain services.

The increasing demand for efficient supply chain solutions is driving the growth of the industry. Artificial intelligence (AI)-driven automation, predictive analytics, and blockchain-generated transparency are some of the significant drivers of the industry as they help improve the visibility of the supply chain and decision-making.

According to the analysts, global consulting firms (including Accenture, IBM, and Genpact) and niche business process outsourcing (BPO) players who cater to digital transformation blueprints, cloud-led transformations, and data analytics will lead the industry. In addition, technology-based logistics companies are emphasizing computerization and real-time tracking to streamline the supply chains.

A range of trends shaping the evolution of the industry include robotic process automation (RPA), artificial intelligence for demand forecasting, and a growing emphasis on sustainability in supply chain operations. Strategic partnerships, 360-degree digitalization, and resilience in the supply chain are key agendas for firms to use in writing about their competitive positioning.

Cost pressures, changing trade regulations, and the growing use of cloud-based supply chain solutions shape the competitive landscape. To grow, businesses need to industry their businesses using technology, analytics in real-time, and supply chain solutions that are both agile and effective.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Accenture | 20-25% |

| IBM Corporation | 15-20% |

| Genpact | 12-17% |

| Capgemini | 8-12% |

| Wipro Limited | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Accenture | Heading end-to-end supply chain optimization, with AI, cloud solutions and data analytics |

| IBM Corporation | Offers blockchain-powered logistics, automation solutions, and AI-driven supply chain insights |

| Genpact | Expertise in procurement outsourcing, demand planning, digital supply chain transformation. |

| Capgemini | This focus on supply chain consulting, automation and integrated logistics management. |

| Wipro Limited | Provides technology-led BPO services to enhance supply chain visibility, efficiency, and cost. |

Key Company Insights

Accenture (20-25%)

Its focus areas include AI-enabled optimization, cloud-based logistics, and predictive analytics to enhance efficiency in global supply chain management operations.

IBM Corporation (15-20%)

IBM provides AI-powered supply chain insights, blockchain for transparency, and automated logistics management solutions.

Genpact (12-17%)

Genpact specializes in digital procurement transformation & supply chain analytics & demand forecasting to improve efficiency.

Capgemini (8-12%)

Capgemini offer Strategic supply chain consulting, supply chain management, automation, and advanced analytics to improve logistics and inventory management.

Wipro Limited (5-9%)

Wipro designs advanced BPO solutions to optimize supply chain processes, gain meaningful cost savings, and achieve real-time visibility via digital tools.

Other Key Players (30-40% Combined)

By outsourcing model, the industry covers offshoring, nearshoring, and onshoring, with offshoring leading due to cost efficiency and access to global expertise.

By application, the industry includes retail and CPG, healthcare and life sciences, manufacturing, energy and utilities, telecom, and others, with retail and CPG dominating due to increasing demand for inventory management and last-mile delivery solutions.

By service type, the industry covers inventory management outsourcing, demand forecasting and planning, logistics management outsourcing, risk and compliance outsourcing, vendor management outsourcing, order management outsourcing, and others, with logistics management outsourcing holding the largest share.

By enterprise size, the industry includes small offices (1-9 employees), small enterprises (10-99 employees), medium-sized enterprises (100-499 employees), large enterprises (500-999 employees), and very large enterprises (1,000+ employees), with large enterprises leading due to their complex supply chain needs.

By region, the industry spans North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Central Asia, Russia and Belarus, Balkan and Baltics, and the Middle East & Africa (MEA), with North America holding the largest share due to strong outsourcing adoption across industries.

The industry will generate USD 80 billion in 2025.

The market is projected to reach USD 155 billion by 2035, growing at a CAGR of 6.9%.

Key players include Accenture, IBM Corporation, Genpact, Capgemini, Wipro Limited, Tata Consultancy Services (TCS), Infosys, DHL Supply Chain, Cognizant, and EXL Service.

North America and Asia-Pacific, driven by increasing digital transformation, automation, and demand for cost-effective supply chain solutions.

Procurement and logistics outsourcing dominate due to their role in optimizing operations, reducing costs, and improving supply chain efficiency.

Table 01: Global Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Outsourcing Model

Table 02: Global Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 03: Global Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 04: Global Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Service Type

Table 05: Global Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 06: Global Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Region

Table 07: North America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Outsourcing Model

Table 08: North America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 09: North America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 10: North America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Service Type

Table 11: North America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 12: North America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Country

Table 13: Latin America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Outsourcing Model

Table 14: Latin America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 15: Latin America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 16: Latin America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Service Type

Table 17: Latin America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 18: Latin America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Country

Table 19: South Asia and Pacific Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Outsourcing Model

Table 20: South Asia and Pacific Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 21: South Asia and Pacific Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 22: South Asia and Pacific Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Service Type

Table 23: South Asia and Pacific Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 24: South Asia and Pacific Market Value (US$ million) Analysis and Forecast (2018 to 2033) by country

Table 25: East Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Outsourcing Model

Table 26: East Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 27: East Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 28: East Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Service Type

Table 29: East Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 30: East Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Country

Table 31: Western Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Outsourcing Model

Table 32: Western Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 33: Western Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 34: Western Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Service Type

Table 35: Western Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 36: Western Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Country

Table 37: Eastern Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Outsourcing Model

Table 38: Eastern Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 39: Eastern Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 40: Eastern Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Service Type

Table 41: Eastern Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 42: Eastern Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Country

Table 43: Central Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Outsourcing Model

Table 44: Central Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 45: Central Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 46: Central Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Service Type

Table 47: Central Asia Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 48: Russia and Belarus Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Outsourcing Model

Table 49: Russia and Belarus Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 50: Russia and Belarus Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 51: Russia and Belarus Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Service Type

Table 52: Russia and Belarus Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 53: Balkan and Baltics Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Outsourcing Model

Table 54: Balkan and Baltics Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 55: Balkan and Baltics Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 56: Balkan and Baltics Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Service Type

Table 57: Balkan and Baltics Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 58: Middle East and Africa Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Outsourcing Model

Table 59: Middle East and Africa Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 60: Middle East and Africa Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Application

Table 61: Middle East and Africa Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Service Type

Table 62: Middle East and Africa Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 63: Middle East and Africa Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Country

Figure 01: Global Market Value (US$ million), 2018 to 2022

Figure 02: Global Market Value (US$ million), 2023 to 2033

Figure 03: Global Market Size (US$ million) and Y-o-Y Growth Rate from 2023 to 2033

Figure 04: Global Market Size and Y-o-Y Growth Rate from 2023 to 2033

Figure 05: Global Market: Market Share Analysis, by Outsourcing Model – 2023 to 2033

Figure 06: Global Market: Y-o-Y Growth Comparison, by Outsourcing Model, 2023 to 2033

Figure 07: Global Market: Market Attractiveness, by Outsourcing Model

Figure 08: Global Market: Market Share Analysis, by Application– 2023 and 033

Figure 09: Global Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 10: Global Market: Market Attractiveness, by Application

Figure 11: Global Market: Market Share Analysis, by Service Type 2023 to 2033

Figure 12: Global Market: Y-o-Y Growth Comparison, by Service Type, 2023 to 2033

Figure 13: Global Market: Market Attractiveness, by Service Type

Figure 14: Global Market: Market Share Analysis, by Enterprise Size – 2023 to 2033

Figure 15: Global Market: Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 16: Global Market: Market Attractiveness, by Enterprise Size

Figure 17: Global Market: Market Share Analysis, by Region – 2023 to 2033

Figure 18: Global Market: Y-o-Y Growth Comparison, by Region, 2023 to 2033

Figure 19: Global Market: Market Attractiveness, by Region

Figure 20: North America Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 21: Latin America Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 22: East Asia Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 23: South Asia and Pacific Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 24: Western Europe Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 25: Eastern Europe Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 26: Central Asia Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 27: Russia and Belarus Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 27: Russia and Belarus Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 28: Balkan and Baltics Countries Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 29: Middle East and Africa Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 30: North America Market Value (US$ million), 2018 to 2022

Figure 31: North America Market Value (US$ million), 2023 to 2033

Figure 32: North America Market: Market Share Analysis, by Outsourcing Model – 2023 to 2033

Figure 33: North America Market: Y-o-Y Growth Comparison, by Outsourcing Model, 2023 to 2033

Figure 34: North America Market: Market Attractiveness, by Outsourcing Model

Figure 35: North America Market: Market Share Analysis, by Application– 2023 to 2033

Figure 36: North America Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 37: North America Market: Market Attractiveness, by Application

Figure 38: North America Market: Market Share Analysis, by Service Type 2023 to 2033

Figure 39: North America Market: Y-o-Y Growth Comparison, by Service Type, 2023 to 2033

Figure 40: North America Market: Market Attractiveness, by Service Type

Figure 41: North America Market: Market Share Analysis, by End Use Enterprise Size – 2023 to 2033

Figure 42: North America Market: Y-o-Y Growth Comparison, by End Use Enterprise Size, 2023 to 2033

Figure 43: North America Market: Market Attractiveness, by End Use Enterprise Size

Figure 44: North America Market: Market Share Analysis, by Country – 2023 to 2033

Figure 45: North America Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 46: North America Market: Market Attractiveness, by Country

Figure 47: United States Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 48: Canada Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 49: Latin America Market Value (US$ million), 2018 to 2022

Figure 50: Latin America Market Value (US$ million), 2023 to 2033

Figure 51: Latin America Market: Market Share Analysis, by Outsourcing Model – 2023 to 2033

Figure 52: Latin America Market: Y-o-Y Growth Comparison, by Outsourcing Model, 2023 to 2033

Figure 53: Latin America Market: Market Attractiveness, by Outsourcing Model

Figure 54: Latin America Market: Market Share Analysis, by Application– 2023 and 033

Figure 55: Latin America Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 56: Latin America Market: Market Attractiveness, by Application

Figure 57: Latin America Market: Market Share Analysis, by Service Type 2023 to 2033

Figure 58: Latin America Market: Y-o-Y Growth Comparison, by Service Type, 2023 to 2033

Figure 59: Latin America Market: Market Attractiveness, by Service Type

Figure 60: Latin America Market: Market Share Analysis, by Enterprise Size – 2023 to 2033

Figure 61: Latin America Market: Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 62: Latin America Market: Market Attractiveness, by Enterprise Size

Figure 63: Latin America Market: Market Share Analysis, by Country – 2023 to 2033

Figure 64: Latin America Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 65: Latin America Market: Market Attractiveness, by Country

Figure 66: Brazil Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 67: Mexico Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 68: Argentina Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 69: Rest of LATAM Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 70: South Asia and Pacific Market Value (US$ million), 2018 to 2022

Figure 71: South Asia and Pacific Market Value (US$ million), 2023 to 2033

Figure 72: South Asia and Pacific Market: Market Share Analysis, by Outsourcing Model – 2023 to 2033

Figure 73: South Asia and Pacific Market: Y-o-Y Growth Comparison, by Outsourcing Model, 2023 to 2033

Figure 74: South Asia and Pacific Market: Market Attractiveness, by Outsourcing Model

Figure 75: South Asia and Pacific Market: Market Share Analysis, by Application– 2023 and 033

Figure 76: South Asia and Pacific Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 77: South Asia and Pacific Market: Market Attractiveness, by Application

Figure 78: South Asia and Pacific Market: Market Share Analysis, by Service Type 2023 to 2033

Figure 79: South Asia and Pacific Market: Y-o-Y Growth Comparison, by Service Type, 2023 to 2033

Figure 80: South Asia and Pacific Market: Market Attractiveness, by Service Type

Figure 81: South Asia and Pacific Market: Market Share Analysis, by End Use Enterprise Size – 2023 to 2033

Figure 82: South Asia and Pacific Market: Y-o-Y Growth Comparison, by End Use Enterprise Size, 2023 to 2033

Figure 83: South Asia and Pacific Market: Market Attractiveness, by End Use Enterprise Size

Figure 84: South Asia and Pacific Market: Market Share Analysis, by Country – 2023 to 2033

Figure 85: South Asia and Pacific Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 86: South Asia and Pacific Market: Market Attractiveness, by Country

Figure 87: India Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 88: ASEAN Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 89: Australia and New Zealand Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 90: Rest of South Asia and Pacific Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 91: East Asia Market Value (US$ million), 2018 to 2022

Figure 92: East Asia Market Value (US$ million), 2023 to 2033

Figure 93: East Asia Market: Market Share Analysis, by Outsourcing Model – 2023 to 2033

Figure 94: East Asia Market: Y-o-Y Growth Comparison, by Outsourcing Model, 2023 to 2033

Figure 95: East Asia Market: Market Attractiveness, by Outsourcing Model

Figure 96: East Asia Market: Market Share Analysis, by Application– 2023 and 033

Figure 97: East Asia Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 98: East Asia Market: Market Attractiveness, by Application

Figure 99: East Asia Market: Market Share Analysis, by Service Type 2023 to 2033

Figure 100: East Asia Market: Y-o-Y Growth Comparison, by Service Type, 2023 to 2033

Figure 101: East Asia Market: Market Attractiveness, by Service Type

Figure 102: East Asia Market: Market Share Analysis, by Enterprise Size – 2023 to 2033

Figure 103: East Asia Market: Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 104: East Asia Market: Market Attractiveness, by Enterprise Size

Figure 105: East Asia Market: Market Share Analysis, by Country – 2023 to 2033

Figure 106: East Asia Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 107: East Asia Market: Market Attractiveness, by Country

Figure 108: China Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 109: Japan Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 110: South Korea Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 111: Western Europe Market Value (US$ million), 2018 to 2022

Figure 112: Western Europe Market Value (US$ million), 2023 to 2033

Figure 113: Western Europe Market: Market Share Analysis, by Outsourcing Model – 2023 to 2033

Figure 114: Western Europe Market: Y-o-Y Growth Comparison, by Outsourcing Model, 2023 to 2033

Figure 115: Western Europe Market: Market Attractiveness, by Outsourcing Model

Figure 116: Western Europe Market: Market Share Analysis, by Application– 2023 and 033

Figure 117: Western Europe Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 118: Western Europe Market: Market Attractiveness, by Application

Figure 119: Western Europe Market: Market Share Analysis, by Service Type 2023 to 2033

Figure 120: Western Europe Market: Y-o-Y Growth Comparison, by Service Type, 2023 to 2033

Figure 121: Western Europe Market: Market Attractiveness, by Service Type

Figure 122: Western Europe Market: Market Share Analysis, by Enterprise Size – 2023 to 2033

Figure 123: Western Europe Market: Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 124: Western Europe Market: Market Attractiveness, by Enterprise Size

Figure 125: Western Europe Market: Market Share Analysis, by Country – 2023 to 2033

Figure 126: Western Europe Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 127: Western Europe Market: Market Attractiveness, by Country

Figure 128: Germany Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 129: Italy Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 130: France Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 131: United Kingdom Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 132: Spain Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 133: BENELUX Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 134: Nordics Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 135: Rest of Western Europe Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 136: Eastern Europe Market Value (US$ million), 2018 to 2022

Figure 137: Eastern Europe Market Value (US$ million), 2023 to 2033

Figure 138: Eastern Europe Market: Market Share Analysis, by Outsourcing Model – 2023 to 2033

Figure 139: Eastern Europe Market: Y-o-Y Growth Comparison, by Outsourcing Model, 2023 to 2033

Figure 140: Eastern Europe Market: Market Attractiveness, by Outsourcing Model

Figure 141: Eastern Europe Market: Market Share Analysis, by Application– 2023 and 033

Figure 142: Eastern Europe Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 143: Eastern Europe Market: Market Attractiveness, by Application

Figure 144: Eastern Europe Market: Market Share Analysis, by Service Type 2023 to 2033

Figure 145: Eastern Europe Market: Y-o-Y Growth Comparison, by Service Type, 2023 to 2033

Figure 146: Eastern Europe Market: Market Attractiveness, by Service Type

Figure 147: Eastern Europe Market: Market Share Analysis, by Enterprise Size – 2023 to 2033

Figure 148: Eastern Europe Market: Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 149: Eastern Europe Market: Market Attractiveness, by Enterprise Size

Figure 150: Eastern Europe Market: Market Share Analysis, by Country – 2023 to 2033

Figure 151: Eastern Europe Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 152: Eastern Europe Market: Market Attractiveness, by Country

Figure 153: Poland Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 154: Hungary Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 155: Romania Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 156: Czech Republic Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 157: Rest of Eastern Europe Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 158: Central Asia Market Value (US$ million), 2018 to 2022

Figure 159: Central Asia Market Value (US$ million), 2023 to 2033

Figure 160: Central Asia Market: Market Share Analysis, by Outsourcing Model – 2023 to 2033

Figure 161: Central Asia Market: Y-o-Y Growth Comparison, by Outsourcing Model, 2023 to 2033

Figure 162: Central Asia Market: Market Attractiveness, by Outsourcing Model

Figure 163: Central Asia Market: Market Share Analysis, by Application– 2023 and 033

Figure 164: Central Asia Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 165: Central Asia Market: Market Attractiveness, by Application

Figure 166: Central Asia Market: Market Share Analysis, by Service Type 2023 to 2033

Figure 167: Central Asia Market: Y-o-Y Growth Comparison, by Service Type, 2023 to 2033

Figure 168: Central Asia Market: Market Attractiveness, by Service Type

Figure 169: Central Asia Market: Market Share Analysis, by End Use Enterprise Size – 2023 to 2033

Figure 170: Central Asia Market: Y-o-Y Growth Comparison, by End Use Enterprise Size, 2023 to 2033

Figure 171: Central Asia Market: Market Attractiveness, by End Use Enterprise Size

Figure 172: Russia and Belarus Market Value (US$ million), 2018 to 2022

Figure 173: Russia and Belarus Market Value (US$ million), 2023 to 2033

Figure 174: Russia and Belarus Market: Market Share Analysis, by Outsourcing Model – 2023 to 2033

Figure 175: Russia and Belarus Market: Y-o-Y Growth Comparison, by Outsourcing Model, 2023 to 2033

Figure 176: Russia and Belarus Market: Market Attractiveness, by Outsourcing Model

Figure 177: Russia and Belarus Market: Market Share Analysis, by Application– 2023 and 033

Figure 178: Russia and Belarus Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 179: Russia and Belarus Market: Market Attractiveness, by Application

Figure 180: Russia and Belarus Market: Market Share Analysis, by Service Type 2023 to 2033

Figure 181: Russia and Belarus Market: Y-o-Y Growth Comparison, by Service Type, 2023 to 2033

Figure 182: Russia and Belarus Market: Market Attractiveness, by Service Type

Figure 183: Russia and Belarus Market: Market Share Analysis, by End Use Enterprise Size – 2023 to 2033

Figure 184: Russia and Belarus Market: Y-o-Y Growth Comparison, by End Use Enterprise Size, 2023 to 2033

Figure 185: Russia and Belarus Market: Market Attractiveness, by End Use Enterprise Size

Figure 186: Balkan and Baltics Market Value (US$ million), 2018 to 2022

Figure 187: Balkan and Baltics Market Value (US$ million), 2023 to 2033

Figure 188: Balkan and Baltics Market: Market Share Analysis, by Outsourcing Model – 2023 to 2033

Figure 189: Balkan and Baltics Market: Y-o-Y Growth Comparison, by Outsourcing Model, 2023 to 2033

Figure 190: Balkan and Baltics Market: Market Attractiveness, by Outsourcing Model

Figure 191: Balkan and Baltics Market: Market Share Analysis, by Application– 2023 and 033

Figure 192: Balkan and Baltics Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 193: Balkan and Baltics Market: Market Attractiveness, by Application

Figure 194: Balkan and Baltics Market: Market Share Analysis, by Service Type 2023 to 2033

Figure 195: Balkan and Baltics Market: Y-o-Y Growth Comparison, by Service Type, 2023 to 2033

Figure 196: Balkan and Baltics Market: Market Attractiveness, by Service Type

Figure 197: Balkan and Baltics Market: Market Share Analysis, by End Use Enterprise Size – 2023 to 2033

Figure 198: Balkan and Baltics Market: Y-o-Y Growth Comparison, by End Use Enterprise Size, 2023 to 2033

Figure 199: Balkan and Baltics Market: Market Attractiveness, by End Use Enterprise Size

Figure 200: Middle East and Africa Market Value (US$ million), 2018 to 2022

Figure 201: Middle East and Africa Market Value (US$ million), 2023 to 2033

Figure 202: Middle East and Africa Market: Market Share Analysis, by Outsourcing Model – 2023 to 2033

Figure 203: Middle East and Africa Market: Y-o-Y Growth Comparison, by Outsourcing Model, 2023 to 2033

Figure 204: Middle East and Africa Market: Market Attractiveness, by Outsourcing Model

Figure 205: Middle East and Africa Market: Market Share Analysis, by Application– 2023 to 2033

Figure 206: Middle East and Africa Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 207: Middle East and Africa Market: Market Attractiveness, by Application

Figure 208: Middle East and Africa Market: Market Share Analysis, by Service Type 2023 to 2033

Figure 209: Middle East and Africa Market: Y-o-Y Growth Comparison, by Service Type, 2023 to 2033

Figure 210: Middle East and Africa Market: Market Attractiveness, by Service Type

Figure 211: Middle East and Africa Market: Market Share Analysis, by End Use Enterprise Size – 2023 to 2033

Figure 212: Middle East and Africa Market: Y-o-Y Growth Comparison, by End Use Enterprise Size, 2023 to 2033

Figure 213: Middle East and Africa Market: Market Attractiveness, by End Use Enterprise Size

Figure 214: Middle East and Africa Market: Market Share Analysis, by Country – 2023 to 2033

Figure 215: Middle East and Africa Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 216: Middle East and Africa Market: Market Attractiveness, by Country

Figure 217: Saudi Arabia Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 218: United Arab Emirates Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 219: Türkiye Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 220: Northern Africa Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 221: South Africa Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 222: Israel Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 223: Rest of Middle East and Africa Market Absolute $ Opportunity (US$ million), 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Supply Chain Analytics Market Size and Share Forecast Outlook 2025 to 2035

Supply Chain Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Supply Chain Management Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Office Supply Market Forecast and Outlook 2025 to 2035

IoT in Supply Chain Market Insights – Trends, Growth & Forecast 2023-2033

Shipping Supply Market Size and Share Forecast Outlook 2025 to 2035

DC Power Supply Module Market – Powering IoT & Electronics

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Supply Chain Market Forecast Outlook 2025 to 2035

Commodity Supply Chain Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Aviation Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Sulphate Supply Market-Trends & Forecast 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Digital Transformation in Supply Chain Market

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

PVC-M High Impact Resistant Water Supply Pipe Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA