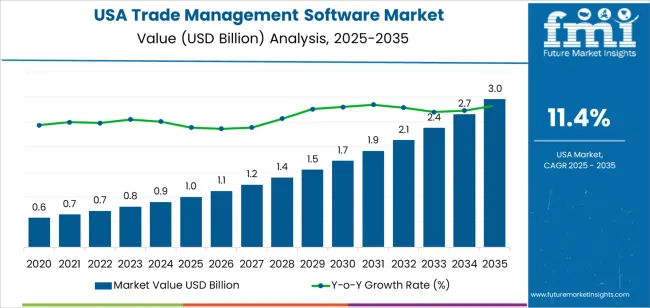

The demand for trade management software in the USA is valued at USD 1.0 billion in 2025 and is projected to reach USD 3.0 billion by 2035, reflecting a CAGR of 11.4%. Under the growth contribution index, the first block from 2025 to 2030 contributes about USD 0.7 billion as the market expands from USD 1.0 billion to nearly USD 1.7 billion. This phase is shaped by stronger adoption among mid-sized importers, exporters, and third party logistics firms seeking automation for tariff classification, documentation, and customs filing. Regulatory complexity, rising cross border e commerce, and tighter audit scrutiny drive early value creation. Cloud deployment becomes the preferred delivery model during this stage.

From 2030 to 2035, the growth contribution rises to roughly USD 1.3 billion as demand advances from about USD 1.7 billion to USD 3.0 billion. This later block accounts for the larger share of total value addition under the growth contribution index. Expansion is driven by enterprise wide integration of trade compliance with supply chain planning, sourcing, and financial systems. Artificial intelligence based risk screening, real time duty optimization, and sanctions monitoring become standard features. Large manufacturers, aerospace firms, and pharmaceutical exporters form the core demand base. Value growth in this phase is led more by rising software spend per user than by new customer onboarding.

The overall demand for trade management software in USA increases from USD 1.0 billion in 2025 to USD 1.1 billion by 2030, adding USD 0.1 billion in absolute value. This phase reflects steady enterprise adoption across export-import compliance, global sourcing, customs documentation, and tariff classification automation. Demand is driven by rising regulatory complexity in cross-border trade, diversified supplier networks, and stricter audit requirements across manufacturing, retail, and life sciences sectors. Growth remains structurally controlled as large enterprises complete phased rollouts while mid-sized firms remain cautious on software consolidation. Expansion during this period is primarily USAge-driven rather than pricing-led, with cloud migration and API-based integration supporting incremental contract growth.

From 2030 to 2035, the market expands sharply from USD 1.1 billion to USD 3.0 billion, adding a substantially larger USD 1.9 billion in the second half of the decade. This back weighted acceleration reflects deeper embedding of trade management platforms into enterprise resource planning systems, logistics orchestration, and dynamic tariff optimization tools. Trade volatility, geopolitical fragmentation, and region-specific compliance requirements increase reliance on automated decision engines rather than manual workflows. As artificial intelligence-driven classification, real-time duty optimization, and denial list screening become standard, value per deployment increases significantly, shifting demand from compliance support toward strategic trade intelligence platforms.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.0 billion |

| Forecast Value (2035) | USD 3.0 billion |

| Forecast CAGR (2025–2035) | 11.4% |

The demand for trade management software in the USA has grown as companies face increasing complexity in international supply chains, import-export regulations, and compliance requirements. Globalization and cross-border trade expansion have raised the volume of transactions that companies must monitor, track, and document. Trade management software helps firms automate customs filings, document generation, tariff classification, duty calculation, and compliance workflows tasks that are error prone and resource intensive when handled manually. In addition, logistics disruptions and shifting trade policies have increased the need for supply-chain visibility and agility. These pressures have encouraged adoption especially among multinational firms, large retailers, manufacturers, and distributors managing global sourcing and distribution networks.

Looking ahead, demand will expand further driven by rising trade compliance requirements, growth in e-commerce and omnichannel distribution, and greater supply-chain complexity. Software that integrates real-time data analytics, risk screening, and automated compliance updates will become more valuable. Small and medium enterprises will also adopt cloud-based trade management solutions owing to lower entry cost and scalability. On the supply side, expansion of global trade volumes and diversified sourcing strategies will create demand for modular, configurable trade-management platforms. At the same time, barriers such as regulatory unpredictability, data integration challenges, and hesitance among smaller firms on upfront software investment may slow adoption. The market is expected to evolve steadily with increasing penetration across industries, especially manufacturing, retail, and logistics.

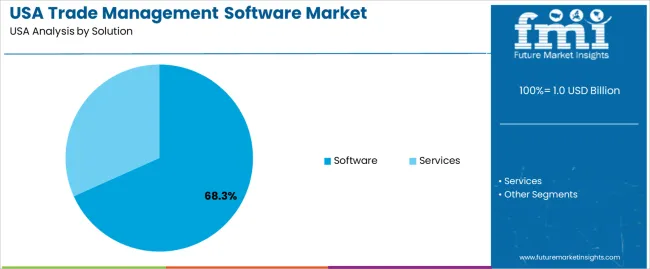

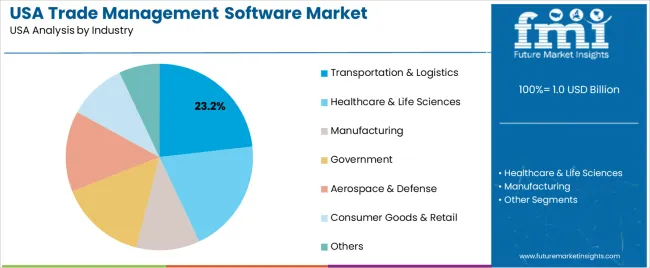

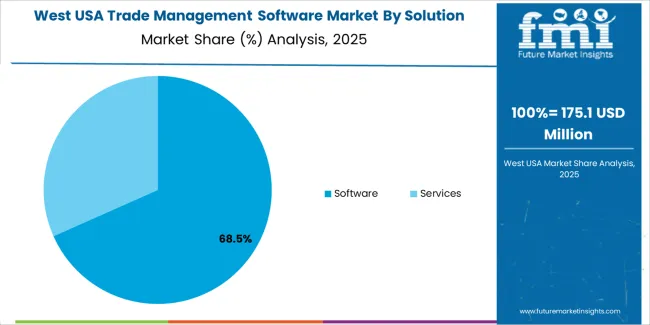

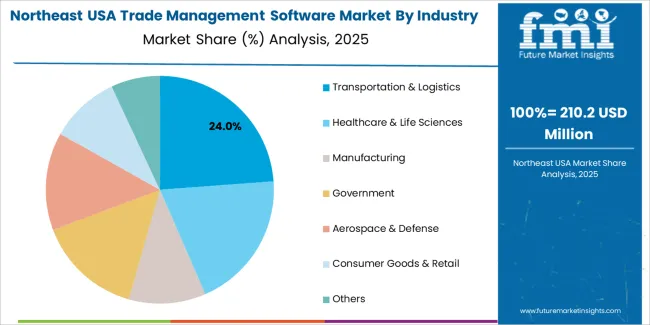

The demand for trade management software in the USA is structured by solution type and industry adoption. Software platforms account for 68% of total demand, followed by service offerings focused on implementation, integration, and compliance support. By industry, transportation and logistics lead with a 23.2% share, followed by healthcare and life sciences, manufacturing, government, aerospace and defense, consumer goods and retail, and other sectors. Demand behavior is shaped by regulatory complexity, cross-border trade volume, documentation requirements, and digital compliance management. These segments reflect how automation priorities and sector-specific trade exposure define software procurement patterns across the USA.

Software solutions account for 68% of total trade management software demand in the USA due to their ability to automate compliance, documentation, classification, and duty calculation processes. Enterprises favor software platforms that centralize import and export workflows, reduce manual errors, and support regulatory reporting in real time. These platforms integrate with enterprise resource planning, warehouse management, and transportation systems to provide end-to-end trade visibility. Large manufacturers and logistics operators rely on software to manage tariff changes, trade agreements, and restricted party screening with consistent accuracy.

Software adoption is also driven by the scale of cross-border trade activity in the USA. High transaction volumes require system-based compliance rather than manual oversight. Cloud deployment models support multi-location access and faster system updates in response to changing trade rules. Subscription pricing supports predictable budgeting across operational cycles. These integration, automation, and scalability benefits sustain software as the dominant solution type within the USA trade management technology landscape.

Transportation and logistics account for 23.2% of total trade management software demand in the USA due to direct exposure to customs procedures, freight documentation, and regulatory enforcement. Logistics operators manage large volumes of import and export shipments across ports, airports, and land borders. Each shipment requires accurate classification, valuation, origin declaration, and compliance verification. Trade management software enables automated document generation, status tracking, and customs interface connectivity that supports time-sensitive cargo movement.

Logistics firms also face continuous regulatory change across tariffs, sanctions, and security filings. Software platforms provide real-time rule updates and audit trails that reduce compliance risk. Integration with transportation management systems allows synchronization between cargo movement and regulatory clearance. As e-commerce, cross-border fulfillment, and nearshoring expand trade flows, logistics providers continue to increase software investment. These regulatory intensity and shipment volume factors position transportation and logistics as the leading industry segment for trade management software demand in the USA.

Demand for trade management software in the USA is driven by the scale and complexity of cross-border commerce, tariff compliance pressure, and growing scrutiny of supply chain documentation. U.S. manufacturers, retailers, and distributors operate across multi-country sourcing networks that require precise control over duties, classifications, and trade documentation. Frequent changes in trade policy and customs enforcement raise the cost of manual compliance errors. E-commerce exporters and third-party logistics providers also require automated trade workflows to process high shipment volumes. These operational and regulatory realities make digital trade management a core infrastructure layer.

U.S. importers face continuous classification, valuation, and origin verification requirements across thousands of SKUs. Tariff volatility increases the financial risk of incorrect duty calculations and trade misreporting. Trade management platforms automate HS coding, free-trade agreement eligibility, landed cost calculation, and denied party screening. Logistics providers use these systems to synchronize customs documentation with freight movements. Retailers importing private-label goods rely on centralized visibility across suppliers. These compliance-intensive workflows drive demand for systems that reduce audit exposure and improve cost predictability across U.S. trade operations.

Trade management software adoption in the USA is restrained by integration complexity with ERP, WMS, and transportation systems. Mid-sized firms struggle with implementation cost, data harmonization, and internal process redesign. Organizational silos between procurement, logistics, and finance slow system-wide alignment. Some firms rely on long-standing manual brokers and spreadsheets due to institutional inertia. Subscription pricing, user license fees, and customization requirements add budget friction. These financial and structural barriers slow adoption outside of large enterprises and high-volume importers.

Trade management software in the USA is shifting toward real-time compliance automation, predictive duty modeling, and centralized risk dashboards. Firms seek dynamic visibility into shipment status, cost exposure, and regulatory exceptions across global supply chains. Artificial intelligence is used to flag misclassification risk and documentation gaps before customs submission. Cloud deployment enables multi-site access across procurement, compliance, and finance teams. Cybersecurity and audit traceability features gain importance as digital trade records replace paper files. These trends show trade management software evolving into a strategic risk-control and cost governance platform.

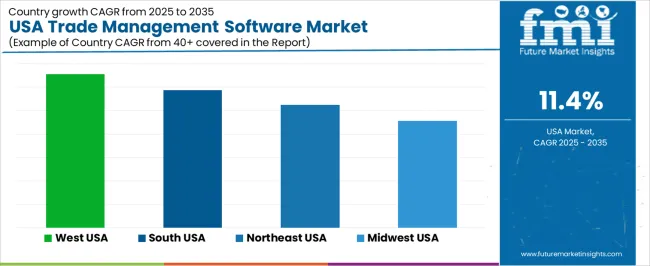

| Region | CAGR (%) |

|---|---|

| West | 13.1% |

| South | 11.7% |

| Northeast | 10.5% |

| Midwest | 9.1% |

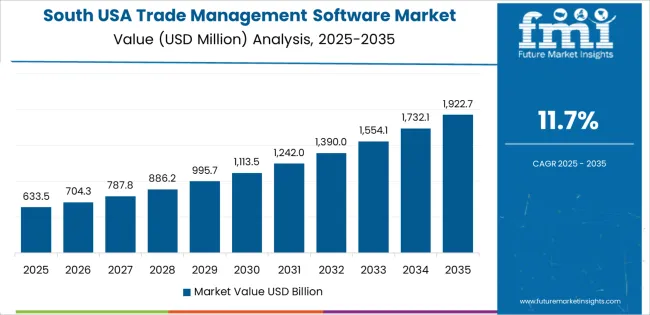

The demand for trade management software in the USA is growing fastest in the West at a CAGR of 13.1%. This region likely leads due to a high concentration of trade-intensive industries, import/export firms, and technology adoption in supply chain and compliance systems. The South, at 11.7%, shows strong growth driven by expanding logistics networks, distribution centers, and increasing trade volume. In the Northeast (10.5%) demand rises with dense industrial and commercial hubs, import/export firms, and financial trade compliance needs. The Midwest’s 9.1% growth reflects more moderate uptake, possibly due to a lower concentration of international trade companies and slower digital transformation in smaller firms.

Expansion in the West reflects a CAGR of 13.1% through 2035 for trade management software demand, supported by dense import export activity, technology led supply chains, and heavy concentration of ecommerce sellers. Ports in California and Washington generate high transaction volumes that require customs documentation, duty calculation, and compliance automation. Cross border trade with Asia increases demand for real time visibility and regulatory screening tools. Software adoption is driven by logistics firms, retail importers, and electronics distributors. Demand remains transaction intensive rather than workforce driven, with cloud deployment supporting rapid regional scaling.

The South advances at a CAGR of 11.7% through 2035 for trade management software demand, driven by expanding manufacturing exports, automotive supply chains, and agricultural commodity trade. Texas ports and inland logistics hubs handle large shipment volumes tied to chemicals, energy equipment, and food products. Duty drawback, tariff classification, and export licensing modules remain core software functions. Mid sized exporters adopt software to standardize compliance across plants. Demand remains operations driven, with procurement influenced by shipment frequency and regulatory audit exposure rather than purely digital transformation goals.

The Northeast records a CAGR of 10.5% through 2035 for trade management software demand, shaped by pharmaceutical exports, medical device distribution, and financial services related trade compliance. High value shipments require strict screening, audit trails, and controlled export documentation. Urban logistics centers and air cargo operations sustain steady system utilization. Regulatory oversight drives continued software upgrades. Adoption remains quality focused rather than volume focused, with emphasis on record accuracy and compliance reporting rather than high frequency shipment processing across institutional exporters and regulated industries.

The Midwest expands at a CAGR of 9.1% through 2035 for trade management software demand, supported by industrial machinery exports, automotive parts trade, and agricultural equipment shipments. Manufacturing led exporters rely on software to manage origin documentation, tariff schedules, and export filings. Regional logistics centers connect inland plants to coastal ports and cross border routes. Software adoption follows production output patterns rather than retail trade cycles. Demand remains steady and process driven, aligned with contract manufacturing and long term international supply agreements across industrial export corridors.

Demand for trade management software in the USA is rising because businesses face growing complexity in cross border trade, compliance requirements, and supply chain operations. Companies engaged in manufacturing, retail, logistics, and global sourcing need tools to automate customs documentation, tariff classification, export/import compliance, and shipment tracking. The shift toward global supply chains, fluctuating trade policies, and the need for supply chain visibility push firms to adopt software that reduces manual effort, increases accuracy, and delivers real time control over transactions. Businesses also seek scalable cloud based platforms to support international operations across multiple jurisdictions.

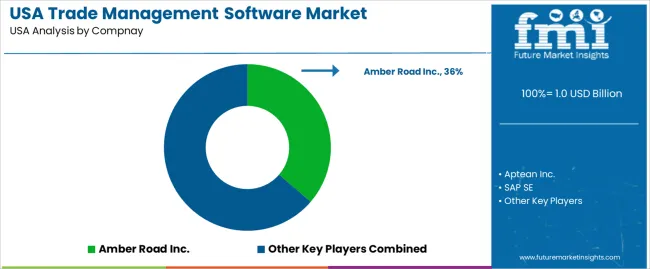

Major vendors influencing the U.S. trade management software market include Amber Road Inc., Aptean Inc., SAP SE, IBM Corporation, and Oracle Corporation. These providers supply comprehensive platforms for trade compliance, customs processing, supply chain visibility, and documentation automation tailored to U.S. and global trade regulations. SAP and Oracle deliver large scale enterprise solutions widely used by multinational firms. IBM offers trade compliance and logistics software integrated with broader enterprise systems. Aptean and Amber Road serve mid sized companies and niche segments needing flexible, modular trade management tools. Their combined offerings shape adoption by balancing enterprise grade features with ease of deployment across industries.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Solution | Software, Services |

| Industry | Transportation & Logistics, Healthcare & Life Sciences, Manufacturing, Government, Aerospace & Defense, Consumer Goods & Retail, Others |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Amber Road Inc., Aptean Inc., SAP SE, IBM Corporation, Oracle Corporation |

| Additional Attributes | Dollar by solution type, industry, and region; regional CAGR projections; software accounts for 68% of total demand due to automation, integration, and compliance efficiency; transportation and logistics lead industry demand at 23.2% due to shipment volume and regulatory exposure; cloud deployment preferred for multi-location access; early phase growth (2025–2030) driven by adoption among mid-sized importers, exporters, and 3PLs; 2030–2035 growth is back-weighted, driven by enterprise integration, AI based risk screening, real-time duty optimization, and sanctions monitoring; key regions: West, South, Northeast, Midwest. |

The demand for trade management software in USA is estimated to be valued at USD 1.0 billion in 2025.

The market size for the trade management software in USA is projected to reach USD 3.0 billion by 2035.

The demand for trade management software in USA is expected to grow at a 11.4% CAGR between 2025 and 2035.

The key product types in trade management software in USA are software and services.

In terms of industry, transportation & logistics segment is expected to command 23.2% share in the trade management software in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trade Management Software Market Size and Share Forecast Outlook (2025 to 2035)

USA Software Distribution Market Report – Growth, Demand & Forecast 2025-2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

USA Supplier Quality Management Applications Market Insights – Trends, Demand & Growth 2025-2035

Exam Management Software Market

Quote Management Software Market Size and Share Forecast Outlook 2025 to 2035

Event Management Software Market Analysis - Size, Share, and Forecast 2025 to 2035

Grant Management Software Market - Trends, Size & Forecast 2025 to 2035

Video Management Software Market

Server Management Software Market Size and Share Forecast Outlook 2025 to 2035

Skills Management Software Market Size and Share Forecast Outlook 2025 to 2035

Change Management Software Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Church Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cattle Management Software Market Size and Share Forecast Outlook 2025 to 2035

Output Management Software Market Insights – Growth & Forecast through 2035

Travel Management Software Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA