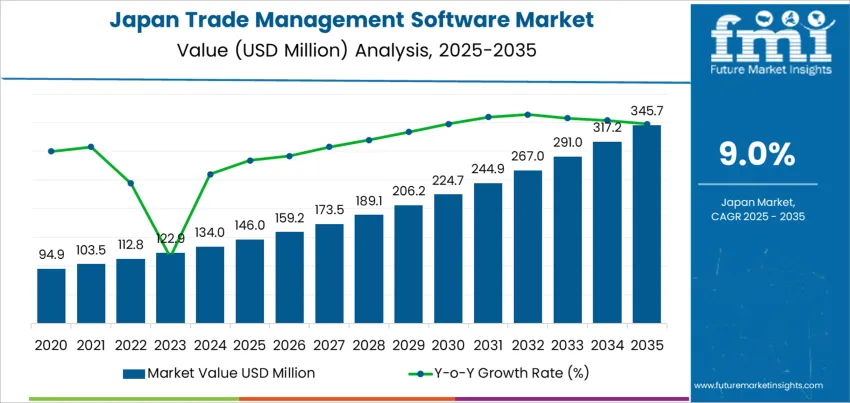

The Japan trade management software demand is valued at USD 146.0 million in 2025 and is forecast to reach USD 345.7 million by 2035, recording a CAGR of 9.0%. Demand is influenced by the digitization of export-import documentation workflows, stricter compliance obligations under customs and free-trade agreements, and a wider transition toward automation in supply-chain operations. Enterprises adopt trade management platforms to reduce manual intervention, minimize clearance delays, and support real-time visibility of cross-border logistics.

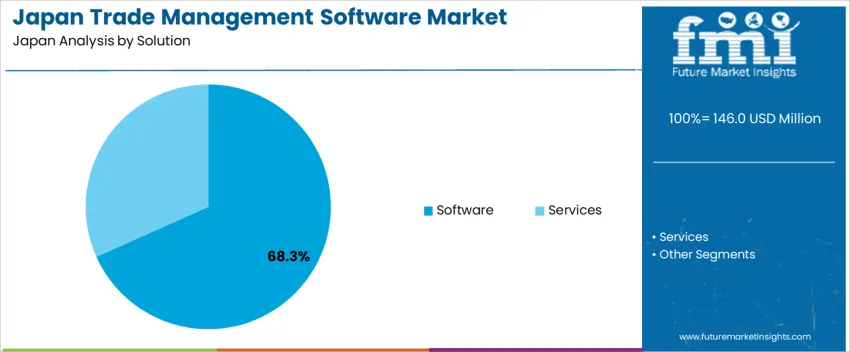

Software remains the leading solution category. These platforms provide centralized control for tariff classification, duty management, trade-license validation, and denied-party screening. Integrated analytics functions assist with regulatory risk mitigation and landed-cost optimization across multi-country distribution networks. Cloud-based deployment also supports system scalability for manufacturers and logistics operators handling variable throughput volumes.

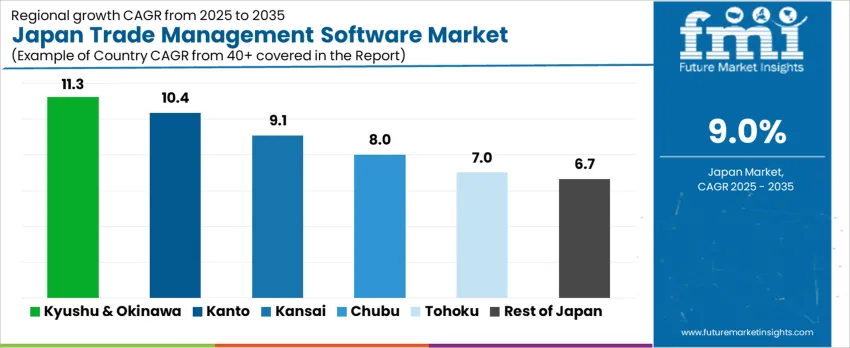

Demand is concentrated in Kyushu & Okinawa, Kanto, and Kansai due to the presence of major ports, export-oriented industrial clusters, and advanced logistics infrastructure. These regions host automotive, electronics, and chemical producers that rely on efficient customs-clearance processes and compliance automation. Key suppliers include MIC Customs Solutions, SAP, Oracle, IBM, and Infor. Their development priorities include integration with customs-clearance gateways, compatibility with evolving trade-compliance rules, and secure data-exchange features that support enterprise-level governance requirements.

Demand for trade management software in Japan shows moderate growth volatility tied to international trade cycles, regulatory adjustments, and technology-investment timing. Acceleration occurs when export industries expand or when customs-compliance requirements intensify, prompting businesses to adopt digital platforms for documentation, tariff classification, and shipment visibility. Uptake is especially responsive within electronics, automotive components, and logistics services that depend on cross-border efficiency.

Volatility emerges when economic uncertainty or supply-chain disruptions delay technology procurement. Small and mid-sized enterprises may postpone adoption due to budget prioritization or reliance on existing manual workflows. Cloud-based and automation-enabled solutions help reduce trough depth by lowering deployment costs and supporting incremental integration rather than full-scale system replacement. The Growth Rate Volatility Index indicates a demand environment that remains sensitive to macroeconomic and regulatory triggers but benefits from digital-transformation continuity. Long-term stability improves as companies align trade-compliance tools with broader operational software, reducing fluctuation and establishing a firmer baseline for future growth.

| Metric | Value |

|---|---|

| Japan Trade Management Software Sales Value (2025) | USD 146.0 million |

| Japan Trade Management Software Forecast Value (2035) | USD 345.7 million |

| Japan Trade Management Software Forecast CAGR (2025-2035) | 9.0% |

Demand for trade management software in Japan is increasing because companies involved in import and export activities need stronger oversight of customs documentation, shipment visibility and compliance with international trade rules. Japan’s manufacturing and electronics sectors depend on precise coordination of cross-border supply chains, and software platforms help reduce delays by automating document handling and tariff classification. Logistics providers adopt trade management tools to track cargo movement across ports and airports while supporting communication with warehouses and customs authorities.

Businesses also use these systems to manage duty savings, optimize inventory placement and evaluate supplier performance within global networks. Rising use of digital trade processes encourages integration of software with enterprise planning platforms, which supports faster decision making for purchasing and distribution teams. Data reporting functions help companies respond to regulatory changes and conduct internal audits. Constraints include cost and effort required to integrate software with legacy systems, especially among small and medium sized exporters. Some firms continue manual processes until trade volume growth justifies digital upgrades. Skilled personnel are needed to interpret analytics and maintain data quality, which can limit adoption in organizations with limited technical resources.

Demand for trade management software in Japan is influenced by increasing cross-border compliance needs, automated customs clearance, and digitalization across import–export workflows. Japanese enterprises prioritize accuracy in tariff classification, security filings, and shipment tracking to reduce operational delays. Government regulatory modernization and regional supply chain integration with Asia-Pacific economies encourage broader adoption. Vendors support scalability for large enterprises while expanding cloud-enabled features valued by mid-market participants.

Software accounts for 68.3%, driven by automation requirements in customs documentation, trade compliance screening, and invoicing accuracy within Japanese corporations. Organizations focus on replacing manual filing with real-time harmonized tariff updates and centralized trade data records. Services represent 31.7%, covering integration, consulting, and system support as companies adapt existing enterprise resource planning and logistics platforms. Service demand rises during infrastructure transformation and cybersecurity audits. Deployment choices emphasize compliance assurance, visibility into shipment pipelines, and smoother coordination with customs authorities at ports and airports. Japanese firms value proprietary features that reduce penalties and support faster clearance under trade agreements.

Key Points:

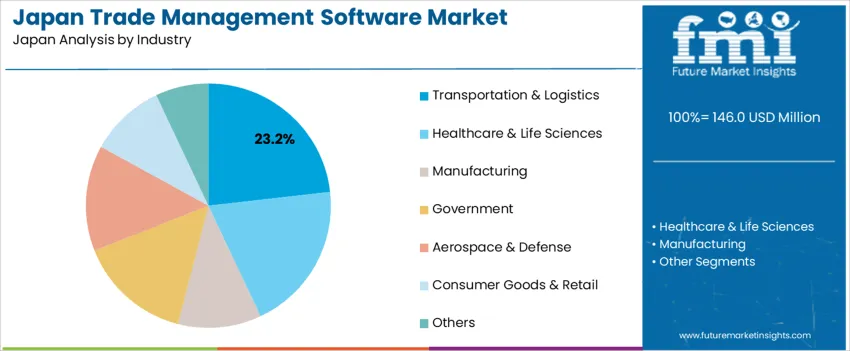

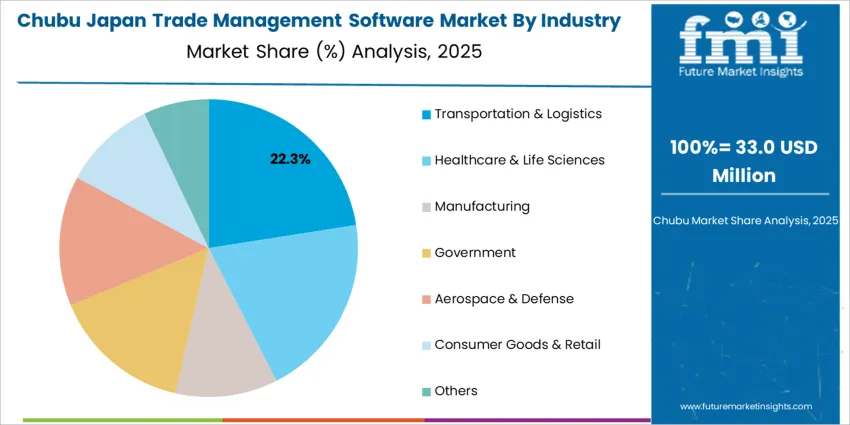

Transportation and logistics account for 23.2%, driven by the country’s extensive port infrastructure, automotive export volumes, and container throughput requiring accurate workflow coordination. Healthcare and life sciences represent 19.8%, maintaining stringent import rules, pharmaceutical serial tracking, and cold-chain monitoring. Government holds 15.0%, advancing digital customs modernization and national security oversight. Aerospace and defense contribute 14.0%, requiring restricted-party screening and multi-jurisdiction licenses. Manufacturing accounts for 11.0%, including electronics and machinery exporters managing global supplier networks. Consumer goods and retail represent 10.0%, while others hold 7.0%, reflecting gradual adoption across smaller sectors. Industry participation prioritizes traceability, shipment security, and compliance with export control regulations.

Key Points:

Growth of cross-border digital commerce, increased compliance requirements under customs modernization and rising adoption of automated documentation systems are driving demand.

In Japan, trade management software gains traction as exporters and importers handle higher documentation volumes linked to e-commerce and diversified sourcing from Asia-Pacific suppliers. Customs procedures aligned with electronic filing standards require accurate tariff classification and origin traceability, encouraging companies to adopt digital tools for risk reduction. Major manufacturers in automotive, electronics and machinery rely on platforms that manage export controls, trade finance paperwork and logistics scheduling. Free trade agreements pursued by Japan create demand for systems that manage preferential tariff eligibility and certificate-of-origin workflows. Trading companies in Tokyo and Osaka use automated dashboards to streamline billing and export declarations, reducing manual effort in high-volume trade operations.

Budget constraints among small exporters, workforce gaps in digital trade skills and varied digital maturity across freight partners restrain adoption.

Small and mid-sized firms often rely on manual spreadsheets due to cost sensitivity and limited IT teams. Employees unfamiliar with digital trade workflows may hesitate to transition from document scanning or paper-based archiving, slowing system implementation. Some logistics partners still operate with mixed digital standards, leading companies to maintain hybrid documentation that reduces expected efficiency. These factors result in uneven deployment across regional industries.

Shift toward cloud platforms integrated with customs systems, increased use of analytics for trade cost optimization and rising demand for real-time compliance monitoring define key trends.

Cloud-based platforms are expanding as companies pursue flexible access for teams coordinating export tasks from multiple office locations. Analytics tools that track landed cost, duty exposure and carrier performance support procurement and supply-chain planning in export-reliant industries. Compliance functions that monitor sanctions updates and dual-use regulations help companies reduce documentation errors and inspection delays. Automated data exchange with customs, ports and financial institutions strengthens workflow reliability in fast-moving trade environments. These trends indicate steady modernization of trade operations and growing demand for digital management tools across Japan’s export-oriented economy.

Demand for trade management software in Japan is shaped by cross-border logistics requirements, customs compliance, electronic documentation, and supply-chain visibility. Manufacturing clusters, port proximity, and digital-workflow adoption influence regional performance. Kyushu & Okinawa leads at 11.3% CAGR, followed by Kanto (10.4%), Kansai (9.1%), Chubu (8.0%), Tohoku (7.0%), and the Rest of Japan (6.7%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 11.3% |

| Kanto | 10.4% |

| Kansai | 9.1% |

| Chubu | 8.0% |

| Tohoku | 7.0% |

| Rest of Japan | 6.7% |

Kyushu & Okinawa achieve 11.3% CAGR supported by port-enabled logistics ecosystems and export activities tied to automotive components, semiconductors, and industrial machinery. Customs documentation remains a continuous requirement for shipments moving through Hakata and other coastal terminals, reinforcing the need for accurate digital filing systems. Manufacturers deploy automated compliance tools to align with import–export documentation standards and tariff-code accuracy. Distribution hubs rely on software that tracks shipment milestones and validates duty-related inputs when coordinating trade across Asia-Pacific routes. E-commerce fulfillment centers implement invoice automation and electronic proof-of-delivery workflows that reduce time spent on manual approvals. Buyers focus on reliability, data accuracy, and traceable records that simplify audit processes. Training support for internal users encourages smoother transitions from traditional reporting formats into integrated trade platforms.

Kanto posts 10.4% CAGR due to Tokyo-centered commercial networks managing significant international trade volumes and customs interactions. Global companies with headquarters in the region deploy standardized trade platforms for monitoring tariff implications and screening regulatory updates. Freight forwarders and logistics operators rely on integration with customs gateways to improve declaration workflows and reduce clearance delays. Multinational manufacturers require stable data synchronization between supply-chain systems and ERP platforms. Dense import distribution into consumer industries strengthens the need for automated compliance screening to maintain delivery timelines. Software choices reflect compatibility with cloud-managed backups ensuring consistent operational continuity. E-commerce retailers rely on accurate landed-cost calculations to plan pricing for imported goods. Continuous movement through Narita, Haneda, and Yokohama logistics networks sustains demand for real-time shipment monitoring dashboards.

Kansai records 9.1% CAGR with Osaka and Kobe facilitating trade volume through large industrial and maritime operations. Companies integrate trade software to maintain address accuracy, shipment data validation, and secure electronic record generation for compliance inspections. Automation assists teams managing recurring export schedules linked to electronics, apparel, and processed materials. Distributors focus on systems with configurable permissions supporting multi-location use across regional warehouses. Local manufacturing requires precise classification tools to meet duty-compliance checks. Platform reliability is prioritized when handling high-frequency shipping lanes operating through Kansai ports. Regional procurement considers subscription costs balanced against continuity and standardized reporting capabilities.

Chubu posts 8.0% CAGR supported by automotive and heavy-industry exporters that require detailed documentation workflows. Export teams use software to ensure HS-code alignment, reduce manual computation errors, and track shipping confirmations across vendor networks. Integration with freight booking systems supports schedule visibility and compliance milestone tracking. Inland distribution centers adopt tools that assist with invoice validation and customs status updates. Software configuration accommodates periodic regulatory changes affecting machinery and component exports. Decision-makers favor systems that reduce administrative workload while maintaining traceability.

Tohoku records 7.0% CAGR as industrial facilities and agrifood exporters transition away from manual filing structures. Software improves error prevention in document creation for small and mid-scale operations. Cold-chain logistics rely on accurate documentation that accompanies perishable shipments passing through ports and airports. Buyers prioritize straightforward platforms that provide reliable tariff code referencing and export-permit tracking. Budget awareness influences selection of systems that scale with demand.

The Rest of Japan grows at 6.7% CAGR as SMEs across non-metropolitan areas adopt trade software for compliance obligations linked to exports of localized goods. Regional agri-processing, craft manufacturing, and specialized equipment suppliers rely on digital solutions to align with customs documentation formats. Systems help maintain record accuracy when teams handle seasonal trade peaks. Logistics partners favor electronic data consistency to improve verification upon arrival at domestic ports.

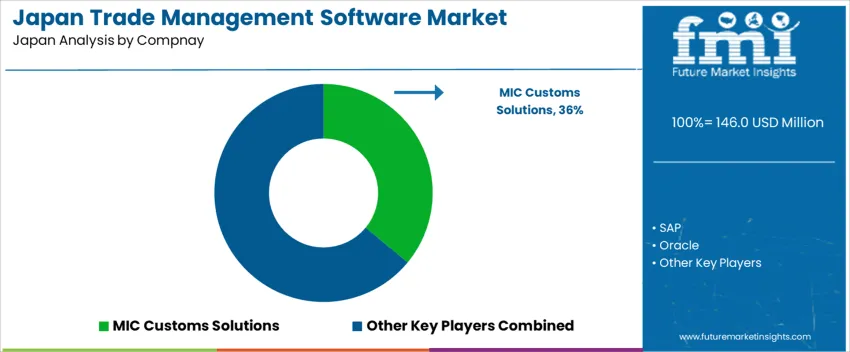

Demand for trade management software in Japan is supported by suppliers delivering customs-declaration automation, tariff-classification logic, restricted-party screening, duty-calculation accuracy, and trade-document control within regulated supply chains. MIC Customs Solutions Japan holds about 36.0% share, supported by controlled integration with NACCS systems and stable compliance-rule maintenance for import and export operations. Its platform ensures consistent data accuracy and secure information exchange across manufacturing and logistics workflows.

SAP Japan maintains strong participation where global manufacturers require harmonized compliance consolidation across multi-plant operations. Oracle Japan contributes functions for tariff code governance and document traceability through integrated trade workflows in enterprise systems. IBM Japan supports selective deployments that require secure data handling and continuous regulatory-logic validation within complex supply networks. Infor Japan provides configurations for industrial and technology exporters that rely on structured document control and reliable customs filing support.

Competition in Japan focuses on regulatory accuracy, software reliability, ERP system compatibility, integration stability, and support for Japanese trade-facilitation rules. Demand remains consistent as manufacturers and logistics providers seek compliant trade-execution systems that ensure secure filing and efficient border-processing in Japan’s export-driven economy.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Solution | Software, Services |

| Industry | Transportation & Logistics, Healthcare & Life Sciences, Manufacturing, Government, Aerospace & Defense, Consumer Goods & Retail, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | MIC Customs Solutions, SAP, Oracle, IBM, Infor |

| Additional Attributes | Revenue breakdown by solution deployment and industry adoption; integration trends of automation and compliance tools with customs regulations; growth driven by export–import digitization, supply chain visibility, and tariff management modernization; adoption among logistics hubs in Kanto and Kansai; alignment with global trade security standards, blockchain-based tracking, and government-driven trade facilitation platforms. |

The demand for trade management software in Japan is estimated to be valued at USD 146.0 million in 2025.

The market size for the trade management software in Japan is projected to reach USD 345.7 million by 2035.

The demand for trade management software in Japan is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in trade management software in Japan are software and services.

In terms of industry, transportation & logistics segment is expected to command 23.2% share in the trade management software in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trade Management Software Market Size and Share Forecast Outlook (2025 to 2035)

Japan Event Management Software Market Growth - Trends & Forecast 2025 to 2035

Demand for Trade Management Software in USA Size and Share Forecast Outlook 2025 to 2035

Japan Software Distribution Market Growth – Innovations, Trends & Forecast 2025-2035

Japan Visitor Management System Market Growth - Trends & Forecast 2025 to 2035

Japan Battery Management System Market Growth – Trends & Forecast 2023-2033

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Exam Management Software Market

Quote Management Software Market Size and Share Forecast Outlook 2025 to 2035

Event Management Software Market Analysis - Size, Share, and Forecast 2025 to 2035

Grant Management Software Market - Trends, Size & Forecast 2025 to 2035

Japan Supplier Quality Management Applications Market Trends – Size, Share & Outlook 2025-2035

Video Management Software Market

Server Management Software Market Size and Share Forecast Outlook 2025 to 2035

Skills Management Software Market Size and Share Forecast Outlook 2025 to 2035

Change Management Software Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA