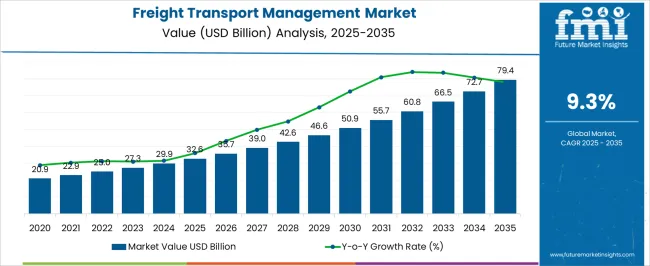

The freight transport management market is estimated to be valued at USD 32.6 billion in 2025 and is projected to reach USD 79.4 billion by 2035, registering a compound annual growth rate (CAGR) of 9.3% over the forecast period. This expansion reflects how freight service providers are being driven toward structured management platforms that enhance operational control and cost-efficiency. The market shows consistent year-on-year growth, climbing from USD 35.7 billion in 2026 to USD 72.7 billion in 2034, before reaching USD 79.4 billion in 2035.

This trajectory demonstrates the rising reliance on integrated freight solutions, digital platforms, and real-time route management to handle growing trade volumes and supply chain complexities. The figures emphasize how companies are compelled to strengthen visibility and streamline processes, which positions management systems as an indispensable element of freight operations. The freight transport management market stood at USD 32.6 billion in 2025 and is anticipated to advance to USD 79.4 billion in 2035, with a CAGR of 9.3% during this period. The forecast signals a consistent rise, backed by heightened investment in digital freight frameworks, predictive scheduling, and coordinated cargo monitoring systems.

The YoY increase portrays a firm reliance on structured processes as logistics providers adapt to competitive pressures and rising costs. By 2030, values are expected to surpass USD 60 billion, suggesting that operators who fail to adopt efficient management strategies may face diminishing returns. The market’s growth is being reinforced by the necessity of operational transparency, compliance tracking, and capacity optimization across global trade routes, making structured management indispensable.

| Metric | Value |

|---|---|

| Freight Transport Management Market Estimated Value in (2025 E) | USD 32.6 billion |

| Freight Transport Management Market Forecast Value in (2035 F) | USD 79.4 billion |

| Forecast CAGR (2025 to 2035) | 9.3% |

The freight transport management market has been positioned as a pivotal segment within broader logistics and supply chain ecosystems, carrying a significant share across its parent industries. Within the transportation and logistics market, it is estimated to contribute around 7.8%, while in the supply chain management market its penetration has been assessed at nearly 9.3%. The freight and cargo services market reflects a share of 6.5%, whereas the logistics automation market records a higher integration level of 11.1%. The fleet management market stands with a share close to 8.6%. When aggregated, the freight transport management market accounts for about 43.3% across these parent sectors, reflecting its strategic relevance in streamlining operations, optimizing routing, reducing bottlenecks, and improving delivery outcomes. Its value is being recognized by enterprises aiming for visibility, efficiency, and resilience in freight flow networks.

Market traction has been driven by the reliance on digital route planning, end-to-end monitoring, compliance adherence, and real-time visibility that has redefined freight execution processes. It has been observed that demand is no longer limited to large corporations but is expanding across small and medium-scale operators, as efficiency and cost predictability are being prioritized. This market is not only capturing share but also reshaping competitive strategies of its parent domains, compelling players to integrate freight management platforms as indispensable elements in their operations. The extent of influence it holds underlines why it is often described as the backbone of modern logistics strategies.

The freight transport management market is undergoing a substantial transformation, driven by increasing globalization, complex supply chain networks, and a heightened focus on operational efficiency. Organizations across sectors are actively investing in digital logistics platforms to optimize freight movement, enhance real-time visibility, and manage rising transportation costs. The market's current landscape reflects strong adoption of intelligent solutions, especially in large enterprises seeking to unify their freight operations under centralized platforms.

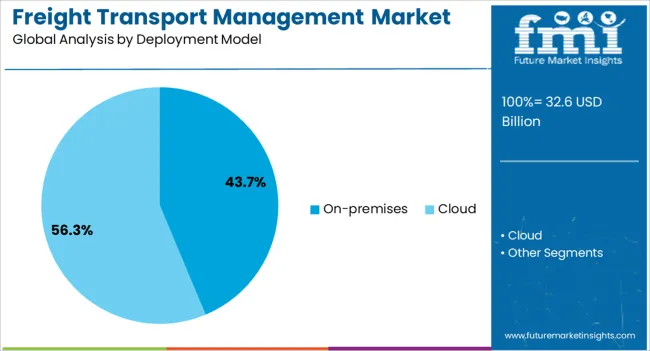

While cloud deployment is gaining traction, traditional on-premises models continue to hold a notable share due to legacy infrastructure and data security priorities. The need for multimodal coordination, demand forecasting, and compliance management is expected to sustain growth momentum across various verticals.

Over the coming years, technological advancements, including AI-enabled route optimization and predictive analytics, will play a pivotal role in reshaping how freight is managed globally. The future outlook remains optimistic, with increased automation and sustainability integration poised to further consolidate the market's value within broader supply chain strategies.

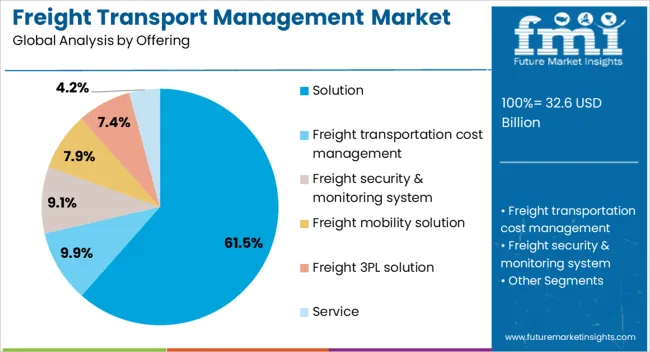

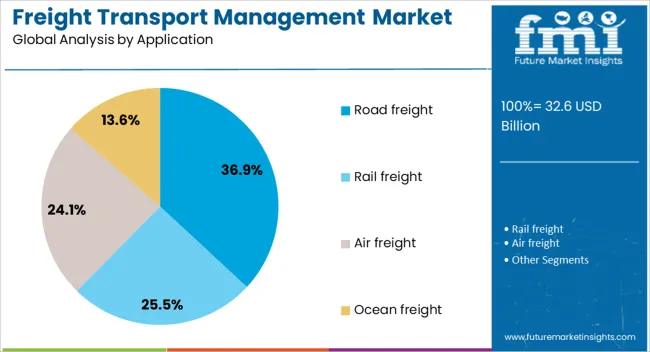

The freight transport management market is segmented by offering, deployment model, application, end user, and geographic regions. By offering, freight transport management market is divided into Solution, Freight transportation cost management, Freight security & monitoring system, Freight mobility solution, Freight 3PL solution, and Service. In terms of deployment model, freight transport management market is classified into On-premises and Cloud. Based on application, freight transport management market is segmented into Road freight, Rail freight, Air freight, and Ocean freight. By end user, freight transport management market is segmented into Manufacturing, Retail, Healthcare, Oil & gas, Food & Beverage, and Others. Regionally, the freight transport management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solution segment dominates the offering category in the freight transport management market, contributing approximately 61.5% of the total share. This leadership is supported by widespread adoption of comprehensive transport management software suites designed to address end-to-end logistics challenges. Enterprises are leveraging these solutions for functions such as route planning, freight auditing, carrier management, and load optimization, thus enhancing visibility and cost efficiency across transport networks.

Integration capabilities with ERP and warehouse systems have further elevated the value proposition of solutions, driving sustained demand across both global and regional supply chains. The trend toward digitalization and real-time data processing has reinforced the preference for unified platforms, particularly in industries facing dynamic freight volumes.

As companies continue to focus on efficiency, risk mitigation, and customer service enhancement, the demand for advanced and modular transport solutions is expected to persist. The solution segment is projected to maintain its leading position, backed by continuous innovation and strategic vendor offerings.

The on-premises segment holds a significant 43.7% share within the deployment model category of the freight transport management market. Its strong position is driven by long-standing reliance on in-house IT infrastructure among enterprises with complex logistics operations and heightened security requirements. Organizations with high-volume freight transactions often prefer on-premises deployment to ensure complete data control, customized integration, and operational continuity.

Despite the growing appeal of cloud-based systems, on-premises platforms remain critical for sectors where regulatory compliance and latency concerns dictate deployment strategies. The segment has benefited from legacy system upgrades and the extension of existing hardware capabilities to support advanced freight applications.

In regions with limited cloud penetration or stringent data residency laws, the on-premises approach continues to be the preferred model. As modernization efforts persist within secure operational frameworks, this segment is expected to maintain its relevance, especially in logistics-intensive industries and government-led transport systems.

The road freight segment leads the application category with a 36.9% market share, driven by the dominance of road transportation in global logistics chains. This mode of freight movement remains the backbone of last-mile delivery, regional distribution, and cross-border trade across various economies. The segment’s leadership is underpinned by its flexibility, cost-efficiency, and capacity to reach remote and underserved areas.

Increased e-commerce activity, urbanization, and the proliferation of just-in-time delivery models have intensified the need for robust road freight management solutions. Businesses are increasingly adopting digital tools to streamline vehicle tracking, fleet scheduling, and regulatory compliance within this segment.

Moreover, road freight operators are focusing on fuel efficiency, emissions tracking, and dynamic routing to meet evolving sustainability targets. As freight volumes continue to grow and service expectations rise, the road freight segment is expected to retain its lead, supported by continuous investment in telematics, automation, and infrastructure development initiatives worldwide.

The freight transport management market is being shaped by shifting global trade flows, regulatory frameworks, and an increasing reliance on streamlined supply chain coordination. Demand has been spurred by the need for efficient cargo movement, while opportunities emerge from digital platforms and integrated service models. Noticeable trends are being recorded in data-driven freight routing and multimodal management, though challenges persist in infrastructure gaps, fuel cost volatility, and compliance obligations. The sector’s trajectory suggests growth will be influenced by regional adoption, consolidation, and cross-border collaboration.

The mobile broadband infrastructure market is driven by the growing demand for high-speed mobile data and reliable internet connectivity. As mobile usage continues to surge globally, there is a rising need for faster and more efficient mobile broadband networks. This trend is particularly evident with the increasing adoption of smartphones, streaming services, and IoT devices. Operators are compelled to upgrade their infrastructure to support greater data capacity, prompting the demand for advanced mobile broadband solutions to meet consumer expectations for seamless connectivity.

The opportunities in freight transport management are being shaped by the consolidation of services, with integrated digital platforms offering carriers and shippers enhanced visibility and coordination. Platforms that combine warehouse management, transport scheduling, and freight brokerage into one unified system are being perceived as growth drivers, as businesses prefer centralized control over dispersed functions. The rising complexity of supply chains presents significant opportunities for service providers who can deliver multimodal coordination and end-to-end logistics support. Companies offering predictive analytics, load optimization, and collaborative platforms are expected to capture strong market share, as the industry continues shifting toward seamless integration. The freight transport management market is expected to witness favorable opportunities in regions where cross-border trade corridors are expanding, as logistics firms will be pressured to invest in platforms that optimize freight routing, reduce idle time, and streamline multi-country regulatory compliance.

Prominent Trends Reshaping Freight Routing and Multimodal Strategies The freight transport management industry has been shaped by trends revolving around digital freight matching, predictive route planning, and data-driven decision-making. Market participants have been aligning themselves toward multimodal strategies, where the integration of sea, rail, road, and air freight is being prioritized to minimize costs and optimize efficiency. The trend of predictive analytics has gained momentum as businesses seek to anticipate delivery timelines, manage fuel consumption, and improve capacity utilization. It has been observed that carriers are increasingly relying on automated scheduling systems and freight visibility platforms to improve collaboration with shippers and reduce empty miles. Such trends are expected to play a decisive role in reshaping the competitive landscape, as companies that fail to adopt integrated strategies may face declining customer loyalty. Multimodal logistics corridors, trade alliances, and regional connectivity are also reinforcing these trends, making the industry more data-reliant and performance-driven.

Challenges in the freight transport management market are evident in infrastructure bottlenecks, unpredictable fuel price fluctuations, and varying regulatory frameworks across countries. The lack of harmonized transport policies, particularly in cross-border logistics, has been viewed as a major obstacle to efficient freight movement. Fuel price volatility has remained an enduring challenge, influencing freight rates and disrupting cost predictability for shippers and carriers. Infrastructure gaps in emerging markets, including inadequate warehousing and poor road connectivity, further delay efficient adoption of management systems. These challenges have been underestimated by some market participants, leading to cost overruns and delivery failures. Compliance with customs, emissions policies, and safety standards has also been a concern, forcing companies to divert resources into regulatory adherence rather than operational efficiency. Overcoming these challenges requires collaborative efforts between governments, logistics providers, and carriers, but delays in such coordination have kept the market fragmented.

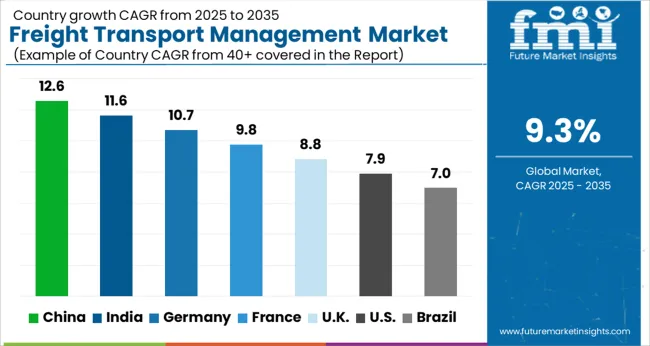

| Country | CAGR |

|---|---|

| China | 12.6% |

| India | 11.6% |

| Germany | 10.7% |

| France | 9.8% |

| UK | 8.8% |

| USA | 7.9% |

| Brazil | 7.0% |

The global freight transport management market is projected to grow at a CAGR of 9.3% from 2025 to 2035. China leads with a growth rate of 12.6%, followed by India at 11.6%, and Germany at 10.7%. The United Kingdom records a growth rate of 8.8%, while the United States shows the slowest growth at 7.9%. Expansion is being driven by demand for integrated route planning, multimodal logistics management, and real time freight visibility solutions. China and India are witnessing rapid growth due to expanding manufacturing output and strong e commerce activity, while Germany, the UK, and the USA are focusing on advanced deployments, compliance management, and enterprise scale logistics digitization to strengthen freight networks. This report includes insights on 40+ countries, with top markets shown here for reference.

Prevailing Trends in Digital Monitoring and Modular Reactor Designs

The freight transport management market in China is growing at a CAGR of 12.6%, driven by large scale manufacturing exports, e commerce logistics, and intermodal freight corridors. Chinese logistics operators are adopting digital freight platforms to enhance visibility, streamline route optimization, and reduce inefficiencies in carrier management. Government initiatives supporting smart logistics and digital supply chains are creating a favorable environment for technology adoption. The market benefits from extensive port and rail networks that require advanced orchestration solutions to manage volumes. Growth is reinforced by investments in consolidation hubs and automation tools, enabling Chinese operators to expand regional and global freight capabilities.

The freight transport management market in India is expanding at a CAGR of 11.6%, supported by growing logistics parks, e commerce expansion, and the rapid digitization of transport operations. Indian companies are adopting SaaS-based platforms to simplify carrier collaboration, last mile coordination, and freight documentation. Government focus on improving infrastructure and freight corridors enhances opportunities for digital management solutions. Service providers are scaling operations to assist SMEs in transitioning from manual processes to automated freight handling systems. Rising demand for cost efficiency, transparency, and integration with payment systems is contributing to increased adoption across industries ranging from retail to manufacturing.

The freight transport management market in Germany is projected to grow at a CAGR of 10.7%, supported by precision manufacturing supply chains, automotive logistics, and regulated compliance requirements. German logistics operators are prioritizing certified freight management systems to handle documentation, claims management, and tracking with strict accuracy. Integration with warehouse and production planning solutions is becoming central to ensure smooth end to end logistics. Investments in real time visibility platforms and audit trails are reinforcing trust among industrial buyers. Growth is further supported by emphasis on efficiency in cross border trade, creating a favorable environment for vendors offering compliance-ready logistics solutions.

The freight transport management market in the United Kingdom is advancing at a CAGR of 8.8%, driven by e commerce logistics, port operations, and cross border freight requirements. British operators are investing in systems that allow dynamic carrier selection and improved ETA accuracy to reduce congestion and enhance customer delivery experience. Public sector infrastructure programs and private investments in logistics hubs are reinforcing adoption. Freight technology providers are partnering with enterprises to align solutions with customs requirements and international trade processes. Market growth is also being influenced by emphasis on interoperability and standardisation across freight management platforms to ensure consistency in operations.

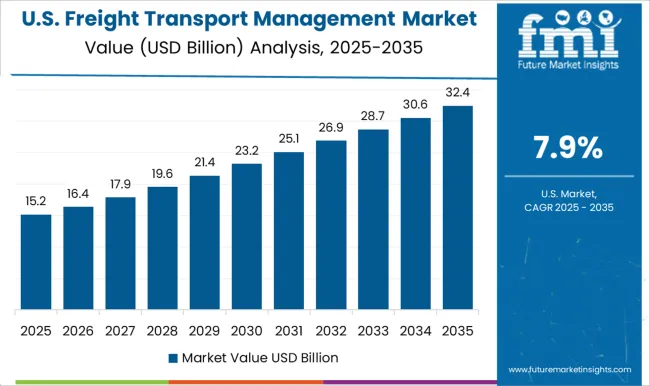

The freight transport management market in the United States is growing at a CAGR of 7.9%, supported by large scale enterprise rollouts, predictive analytics, and strong demand for visibility in freight flows. USA shippers are procuring solutions that integrate freight audit automation, predictive ETAs, and carrier scorecards to optimize performance and reduce costs. Growth is reinforced by investments in on site distribution models and API based systems that integrate seamlessly with ERP and transportation suites. Logistics operators are emphasizing blended carrier pools and electronic proof of delivery to expand distribution flexibility. While slower compared to emerging markets, the USA remains a leader in enterprise adoption and advanced applications.

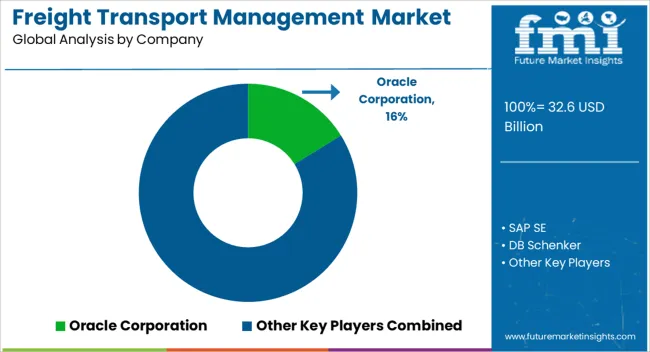

The freight transport management market is being shaped by intense competition among established technology giants and logistics providers. Oracle Corporation and SAP SE are being recognized for deploying integrated software platforms that optimize planning, execution, and visibility across global supply chains. Their strategy is being centered on modular solutions with AI-driven analytics, cloud compatibility, and subscription-based models, allowing scalability for enterprises of different sizes. IBM Corporation is being positioned through data-centric logistics solutions and blockchain-enabled platforms, aiming to reduce inefficiencies and strengthen trust in freight transactions.

DB Schenker and CEVA Logistics are being viewed as logistics majors adopting freight management systems not just for internal optimization but also as service offerings for customers, leveraging operational scale as a strategic advantage. Korber AG and Infor are being directed toward niche strengths, with Korber delivering warehouse management precision and Infor emphasizing industry-specific ERP integration.

| Item | Value |

|---|---|

| Quantitative Units | USD 32.6 Billion |

| Offering | Solution, Freight transportation cost management, Freight security & monitoring system, Freight mobility solution, Freight 3PL solution, and Service |

| Deployment Model | On-premises and Cloud |

| Application | Road freight, Rail freight, Air freight, and Ocean freight |

| End User | Manufacturing, Retail, Healthcare, Oil & gas, Food & Beverage, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Oracle Corporation, SAP SE, DB Schenker, IBM Corporation, CEVA Logistics, Korber AG, and Infor |

| Additional Attributes | Dollar sales by solution type (freight tracking, fleet management, warehousing, logistics software) and mode (road, rail, air, sea) are key metrics. Trends include rising demand for efficient supply chain visibility, growth in e-commerce logistics, and increasing adoption of digital freight solutions. Regional deployment, technological advancements, and regulatory compliance are driving market growth. |

The global freight transport management market is estimated to be valued at USD 32.6 billion in 2025.

The market size for the freight transport management market is projected to reach USD 79.4 billion by 2035.

The freight transport management market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in freight transport management market are solution, freight transportation cost management, freight security & monitoring system, freight mobility solution, freight 3pl solution and service.

In terms of deployment model, on-premises segment to command 43.7% share in the freight transport management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Freight Railcar Repair Market Size and Share Forecast Outlook 2025 to 2035

Freight Trucking Market Size and Share Forecast Outlook 2025 to 2035

Freight Forwarding Software Market Size and Share Forecast Outlook 2025 to 2035

Freight Railcar Parts Market Size and Share Forecast Outlook 2025 to 2035

Freight Car Market

Freight Management Software Market Size and Share Forecast Outlook 2025 to 2035

Air Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Air Freight Forwarding System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Rail Freight Market Size and Share Forecast Outlook 2025 to 2035

Rail Freight Digital Transformation Market Size and Share Forecast Outlook 2025 to 2035

Ocean Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Management Market Size and Share Forecast Outlook 2025 to 2035

International Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Transport Cases & Boxes Market Size and Share Forecast Outlook 2025 to 2035

Transportation and Security System Market Size and Share Forecast Outlook 2025 to 2035

Transportation Biofuel Market Size and Share Forecast Outlook 2025 to 2035

Transportation Infrastructure Construction Market Size and Share Forecast Outlook 2025 to 2035

Transportation Aggregators Market Size and Share Forecast Outlook 2025 to 2035

Transport Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA