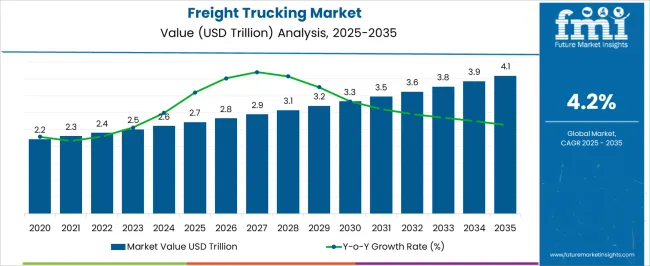

The freight trucking market is projected to be USD 2.7 trillion in 2025 and expand to USD 4.1 trillion by 2035, progressing at a CAGR of 4.2 percent. When observed through a 5-year growth block perspective, the period from 2025 to 2030 highlights a consistent rise from USD 2.7 trillion to USD 3.2 trillion. This increase reflects a phase of stability and consolidation, where growth is largely supported by industrial expansion, e-commerce penetration, and modernization of domestic logistics.

Companies during this stage are expected to focus on fleet upgrades, fuel efficiency, and improved delivery networks. Moving into the next block, from 2030 to 2035, the market rises further from USD 3.2 trillion to USD 4.1 trillion, representing a sharper increase of nearly USD 0.9 trillion within five years. This momentum is linked to growing demand for international trade, expansion of last-mile delivery services, and digital freight platforms improving supply chain transparency. The first block illustrates how the industry builds operational resilience, while the second demonstrates how global trade corridors, technology-driven efficiency, and service integration push expansion at a larger scale. By 2035, an additional USD 1.4 trillion will have been created, signaling the sector’s adaptability and reinforcing its central role in the global economy.

| Metric | Value |

|---|---|

| Freight Trucking Market Estimated Value in (2025 E) | USD 2.7 trillion |

| Freight Trucking Market Forecast Value in (2035 F) | USD 4.1 trillion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The freight trucking market is structured across interconnected parent categories that together shape its revenue distribution and long-term growth. Long-haul freight trucking holds the largest share at nearly 40%, supported by cross-border trade, industrial shipments, and the movement of bulk commodities that form the foundation of global commerce. Regional and short-haul trucking follows with about 28%, fueled by domestic retail supply chains, manufacturing clusters, and steady demand for localized distribution services. Last-mile delivery accounts for approximately 15%, a segment experiencing strong expansion due to the rise of e-commerce, parcel logistics, and consumer demand for same-day delivery commitments. Specialized freight services, including refrigerated, hazardous, and oversized cargo, represent 10%, serving industries such as pharmaceuticals, chemicals, and perishables where precision and safety are critical. The remaining 7% comes from intermodal integration, where trucking operates in coordination with rail, sea, and air networks to provide seamless end-to-end logistics solutions.

This layered structure demonstrates how freight trucking is intertwined with both industrial and consumer cycles. Long-haul and regional segments dominate through necessity and scale, while last-mile and specialized freight show the strongest growth potential due to shifting trade patterns and digital retail expansion. This balance illustrates the resilience of trucking, where traditional bulk freight generates consistent volume while emerging service models create fresh opportunities. The market is positioned as the backbone of global supply chains, with adaptability and integration acting as the defining strengths that secure its role in the decade ahead.

The freight trucking market is experiencing robust growth driven by the expanding global trade activities and increasing demand for efficient goods transportation across long distances. The current market landscape is shaped by technological advancements in logistics management, improved fuel efficiency, and the rising adoption of digital tracking and fleet optimization tools.

Growing e-commerce and retail sectors have accelerated the need for reliable and scalable trucking services, especially for last-mile delivery and just-in-time inventory models. Increasing investments in infrastructure development, including highways and intermodal terminals, are enhancing connectivity and reducing transit times.

Regulatory focus on emission standards and safety compliance is also influencing the market by pushing operators toward modern and sustainable fleets. The outlook remains positive, with continued growth expected as supply chains evolve to become more resilient and customer-centric, emphasizing timely delivery and cost efficiency.

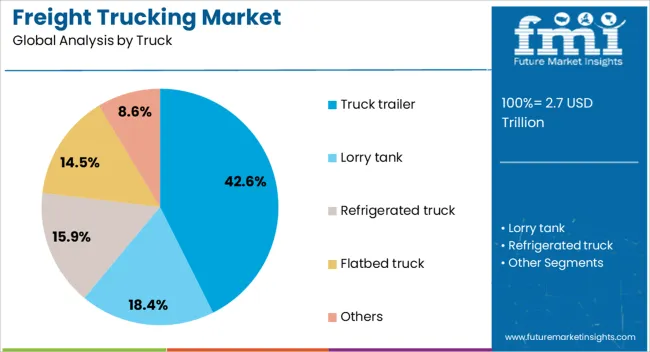

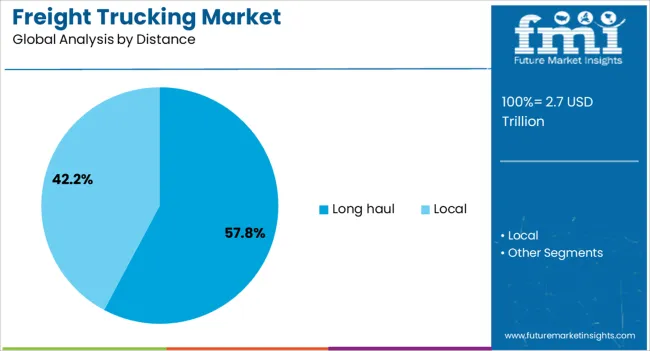

The freight trucking market is segmented by truck, distance, service, freight, end use, and geographic regions. By truck, freight trucking market is divided into Truck trailer, Lorry tank, Refrigerated truck, Flatbed truck, and Others. In terms of distance, freight trucking market is classified into Long haul and Local.

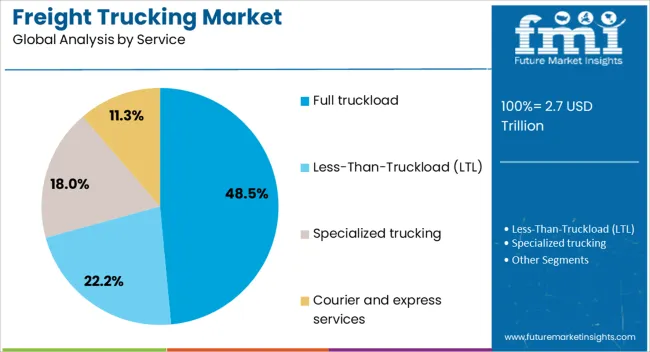

Based on service, freight trucking market is segmented into Full truckload, Less-Than-Truckload (LTL), Specialized trucking, and Courier and express services. By freight, freight trucking market is segmented into Dry, Perishable, Bulk, Oversized & heavy goods, and Others. By end use, freight trucking market is segmented into Retail & e-commerce, Automotive, Oil & gas, Industrial & manufacturing, Pharmaceuticals, Chemicals, Construction & infrastructure, Food & beverages, and Others. Regionally, the freight trucking industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Truck Trailer segment is projected to hold 42.6% of the Freight Trucking market revenue share in 2025, emerging as the leading truck type in the market. This predominance is attributed to the versatility and capacity advantages offered by truck trailers, which facilitate the transport of diverse cargo types across varied distances.

The segment’s growth is supported by the need for flexible load configurations, enabling trucking companies to optimize space utilization and meet specific customer requirements. Additionally, truck trailers are favored for their compatibility with advanced telematics and monitoring systems, allowing enhanced fleet management and operational efficiency.

The durability and standardization of truck trailers further reinforce their adoption in freight transport networks where reliability and scalability are critical.

The Long Haul distance segment is expected to capture 57.8% of the Freight Trucking market revenue in 2025, signifying its dominant role in freight transportation. The growth in this segment is driven by increasing cross-regional trade and the need to connect production centers with consumption markets over extended routes.

Long haul trucking enables the movement of bulk goods efficiently and cost-effectively, supported by ongoing improvements in driver safety technologies and route optimization software. Rising demand for intercity and interstate logistics solutions, particularly in developing economies with expanding manufacturing bases, underpins this segment’s expansion.

The preference for long haul operations is further enhanced by investments in dedicated freight corridors and highway infrastructure, facilitating faster and more reliable delivery schedules.

The Full Truckload service segment is anticipated to hold 48.5% of the Freight Trucking market revenue share in 2025, marking it as the leading service type in the market. This segment’s growth is being propelled by customer demand for dedicated and timely transportation of large shipments without transshipment, reducing handling risks and improving cargo security.

Full truckload services provide logistical advantages such as reduced transit times and direct routes, making them preferred for high-value and time-sensitive freight. Additionally, advances in digital freight matching platforms and real-time tracking have increased the operational efficiency and transparency of full truckload services.

The segment benefits from strong demand across industries such as manufacturing, retail, and automotive, where bulk shipments are common and service reliability is critical.

Freight trucking is propelled by industrial trade, e-commerce expansion, specialized cargo demand, and intermodal integration. These dynamics underscore its critical role as the foundation of global supply chains.

Freight trucking is expanding steadily as global trade and industrial activity remain essential drivers of demand. Long-haul trucking plays a pivotal role in transporting raw materials and finished goods across continents, serving as the backbone of supply chains. Industrial production, mining, and energy projects generate consistent demand for bulk cargo movement, while cross-border trade agreements increase long-haul opportunities. Domestic industries also depend heavily on regional trucking to maintain manufacturing schedules and retail supply chains. Growth in this segment will continue to be supported by industrial investment and global trade flows, ensuring long-term reliance on trucking services to handle diverse commodity and product categories.

The surge in e-commerce is redefining freight trucking by increasing demand for last-mile delivery solutions. Consumer expectations for faster, more reliable parcel delivery have forced logistics providers to expand fleets and optimize distribution networks. Last-mile delivery now accounts for a significant portion of freight demand, with small trucks and vans increasingly used for urban and suburban routes. Companies are investing in route optimization tools and digital tracking to improve efficiency and customer satisfaction. eCommerce will remain a transformative force for trucking, as retail shifts online and consumer preference for rapid delivery accelerates the need for flexible, last-mile solutions.

Specialized freight services, including refrigerated, hazardous, and oversized cargo, are carving out a larger share of the trucking sector. Pharmaceuticals, chemicals, and perishable goods require advanced handling, safety compliance, and precise delivery timelines. Growth in these industries has fueled demand for custom fleets equipped with temperature controls and safety features. This segment offers high-margin opportunities for trucking companies willing to invest in tailored solutions. Specialized freight not only enhances revenue potential but also differentiates operators in an otherwise competitive landscape, creating growth avenues beyond conventional cargo movement and broadening the role of freight trucking.

Intermodal transport is gaining traction as freight trucking integrates with rail, sea, and air to deliver end-to-end logistics solutions. This integration reduces costs, increases efficiency, and expands reach across longer distances. Trucking remains the first and last link in most intermodal shipments, making it indispensable for smooth supply chain operations. Logistics providers are increasingly collaborating with port authorities, rail operators, and airlines to ensure seamless cargo movement. Intermodal growth demonstrates trucking’s adaptability, showing how it reinforces its relevance in a diversified logistics environment. By integrating with other modes, trucking enhances resilience and ensures reliable delivery networks worldwide.

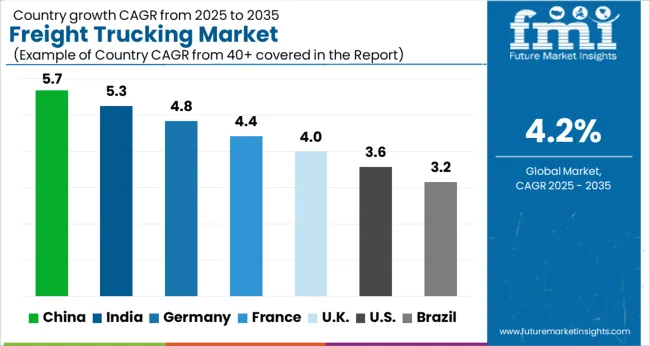

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

| USA | 3.6% |

| Brazil | 3.2% |

The global freight trucking market is projected to grow at a CAGR of 4.2% between 2025 and 2035. China leads with 5.7%, supported by large-scale industrial output, cross-border trade, and logistics infrastructure expansion. India follows at 5.3%, fueled by domestic manufacturing growth, e-commerce penetration, and government-backed highway development. Germany, with 4.8%, benefits from its central role in European logistics, strong automotive exports, and regulatory-driven efficiency standards. France records 4.4%, supported by regional distribution networks, industrial clusters, and modernization of road freight capacity. The UK, at 4.0%, emphasizes demand from retail supply chains, e-commerce-driven last-mile delivery, and replacement of aging fleets. The USA, at 3.6%, shows steady progress, reflecting a mature freight ecosystem with continued investment in intermodal integration and digital logistics solutions. Asia is driving high-volume growth, while Europe focuses on efficiency and compliance, and North America emphasizes modernization and resilience. The analysis spans 40+ countries, with the leading markets highlighted below.

The freight trucking market in China is projected to expand at a CAGR of 5.7% from 2025 to 2035, positioning it as the global leader. Growth is supported by large-scale industrial production, cross-border trade, and expanding logistics infrastructure. Investments in road networks, expressways, and logistics hubs enable smooth cargo flow across provinces and into neighboring countries under initiatives like the Belt and Road. Domestic manufacturing growth continues to create consistent freight volumes, while rising e-commerce adds strong demand for last-mile trucking. China’s dual strength as both a production hub and a consumption-driven economy ensures that its freight trucking sector will remain central to global logistics over the next decade.

The freight trucking market in India is anticipated to grow at a CAGR of 5.3% between 2025 and 2035, driven by expanding domestic consumption, manufacturing growth, and government investment in highways and freight corridors. The rollout of dedicated freight corridors and improved interstate connectivity is reshaping logistics efficiency. E-commerce platforms and modern retail supply chains are boosting last-mile trucking requirements, especially in metro and tier-2 cities. Specialized freight, including cold-chain trucking for pharmaceuticals and perishables, is gaining traction. India’s scale of demand, combined with modernization programs and digital freight platforms, makes it a rapidly growing hub for trucking services with both domestic and cross-border potential.

The freight trucking market in Germany is projected to grow at a CAGR of 4.8% between 2025 and 2035, supported by its central role in European trade and industrial exports. Germany’s logistics network benefits from its advanced road infrastructure, cross-border links with neighboring countries, and strong automotive and manufacturing sectors. Regulatory frameworks around efficiency and emissions are encouraging adoption of fleet upgrades and intermodal integration. Distribution to retail hubs and industrial clusters creates consistent freight movement, while last-mile services are expanding in urban centers. Germany’s strategic position as a logistics gateway to Europe ensures steady demand, underpinned by both export-driven freight and domestic consumption.

The freight trucking market in the United Kingdom is projected to expand at a CAGR of 4.0% from 2025 to 2035, shaped by retail supply chains, import-export dependencies, and last-mile delivery expansion. E-commerce adoption continues to accelerate demand for parcel trucking, while infrastructure modernization supports freight corridors. Logistics operators are focusing on efficiency improvements and replacement of older fleets to meet regulatory standards. Port-to-inland trucking remains vital for imports and exports, ensuring steady demand. While the UK faces challenges from high operating costs and regulatory pressures, demand from retail, e-commerce, and import-reliant industries will sustain long-term trucking growth.

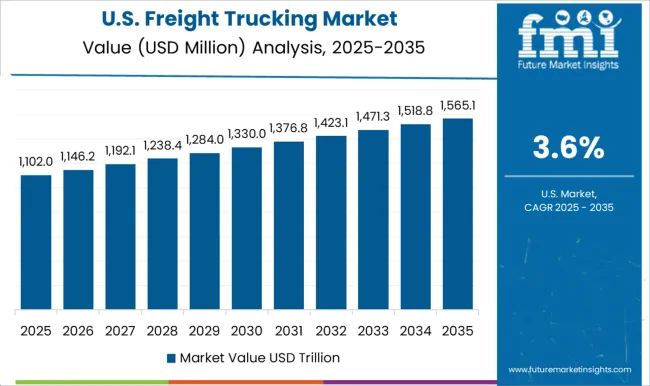

The freight trucking market in the United States is projected to grow at a CAGR of 3.6% between 2025 and 2035, reflecting its mature structure but steady expansion. Growth is anchored by industrial freight, retail supply chains, and strong intermodal connectivity across rail and sea. Replacement demand for older fleets is a major factor, alongside adoption of digital freight platforms to optimize logistics operations. Last-mile delivery from e-commerce remains a strong driver, particularly in suburban and urban areas. While the USA expands at a slower pace compared to Asia, its size, established infrastructure, and role in North American trade ensure that it will remain a key freight trucking market globally.

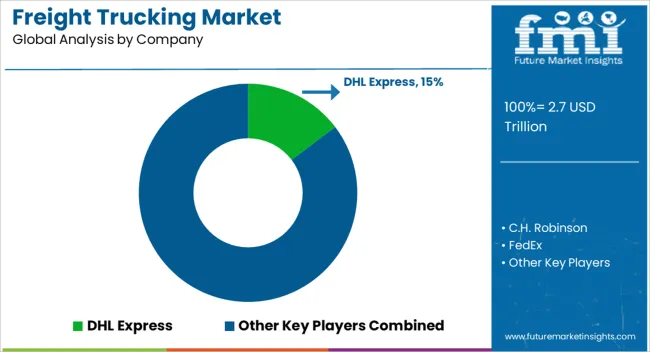

Competition in the freight trucking market is shaped by operational scale, geographic coverage, fleet capacity, and the ability to provide integrated logistics solutions. DHL Express and UPS lead with their global reach, advanced digital tracking systems, and diversified service portfolios, spanning express delivery, freight forwarding, and large-scale contract logistics.

FedEx strengthens its position with strong expertise in time-definite deliveries and large investments in route optimization and intermodal services. C.H. Robinson and XPO Logistics stand out in third-party logistics, focusing on freight brokerage, supply chain optimization, and data-driven trucking solutions. J.B. Hunt and Schneider National are key players in North America, specializing in long-haul trucking, dedicated contract carriage, and intermodal integration with rail systems. Yellow Corporation, despite restructuring challenges, continues to maintain a significant role in less-than-truckload freight services. Nippon Express brings strong presence in Asia with extensive global networks, emphasizing heavy industrial cargo and international trucking services. Maersk, traditionally a shipping giant, has been expanding aggressively into trucking to strengthen its end-to-end logistics offerings, positioning itself as a key multimodal competitor. Competition is defined not only by fleet size and coverage but also by the ability to integrate trucking into broader supply chain services. Companies combining operational efficiency, digital solutions, and intermodal capabilities are best positioned to maintain long-term competitiveness in the freight trucking sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Trillion |

| Truck | Truck trailer, Lorry tank, Refrigerated truck, Flatbed truck, and Others |

| Distance | Long haul and Local |

| Service | Full truckload, Less-Than-Truckload (LTL), Specialized trucking, and Courier and express services |

| Freight | Dry, Perishable, Bulk, Oversized & heavy goods, and Others |

| End Use | Retail & e-commerce, Automotive, Oil & gas, Industrial & manufacturing, Pharmaceuticals, Chemicals, Construction & infrastructure, Food & beverages, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL Express, C.H. Robinson, FedEx, J.B. Hunt, Maersk, Nippon Express, Schneider National, UPS, XPO Logistics, and Yellow Corporation |

| Additional Attributes | Dollar sales, share, growth by region, fleet size trends, cost structures, competitive positioning, demand from e-commerce, regulatory effects, intermodal integration, fuel and maintenance costs, and digital adoption rates. |

The global freight trucking market is estimated to be valued at USD 2.7 trillion in 2025.

The market size for the freight trucking market is projected to reach USD 4.1 trillion by 2035.

The freight trucking market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in freight trucking market are truck trailer, lorry tank, refrigerated truck, flatbed truck and others.

In terms of distance, long haul segment to command 57.8% share in the freight trucking market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Freight Transport Management Market Size and Share Forecast Outlook 2025 to 2035

Freight Railcar Repair Market Size and Share Forecast Outlook 2025 to 2035

Freight Forwarding Software Market Size and Share Forecast Outlook 2025 to 2035

Freight Railcar Parts Market Size and Share Forecast Outlook 2025 to 2035

Freight Management Software Market Insights - Growth & Forecast through 2034

Freight Car Market

Air Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Air Freight Forwarding System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Rail Freight Market Size and Share Forecast Outlook 2025 to 2035

Rail Freight Digital Transformation Market Size and Share Forecast Outlook 2025 to 2035

Ocean Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Management Market Size and Share Forecast Outlook 2025 to 2035

International Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA