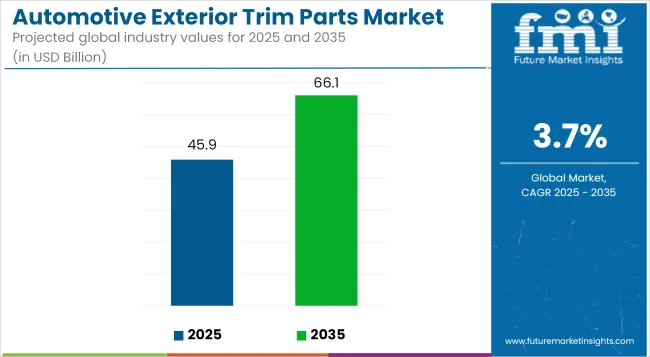

The global automotive exterior trim parts market is projected to be valued at USD 45.9 billion in 2025 and is expected to reach USD 66.1 billion by 2035, reflecting a compound annual growth rate of 3.7%. Growth has been supported by rising demand for aerodynamic, lightweight, and aesthetic enhancements across passenger and commercial vehicles. Increasing EV production and stricter fuel-efficiency norms have also influenced material selection and trim design.

In 2024, Trinseo highlighted the growing role of engineered plastics in enhancing vehicle exteriors. The company confirmed that thermoplastic solutions, such as polycarbonate blends and ABS compounds, were being adopted to replace heavier metal trims.

These materials have been selected to improve impact resistance, UV stability, and design flexibility. According to Trinseo’s Mobility segment update, exterior parts such as rocker panels, roof moldings, and wheel arch trims have been increasingly manufactured using lightweight plastics that offer Class A surface finish with lower VOC emissions.

This shift toward advanced polymer systems has been driven by the need to reduce vehicle weight without compromising safety or visual appeal. As OEMs pursue aggressive electrification strategies, exterior trims are being reengineered to integrate sensors, lighting elements, and aerodynamic enhancements. Functional integration is being prioritized to eliminate redundant structural components and streamline manufacturing.

In 2025, European and North American automakers have intensified collaboration with material suppliers to co-develop trims that meet regional recyclability mandates and styling preferences. Trinseo has reported an increase in demand for post-consumer recycled (PCR) content in molded exterior panels, particularly from European OEMs aligning with EU Green Deal targets.

High-gloss, paintable plastics with UV coatings have also gained traction in mid-segment SUVs and electric sedans. The adoption of seamless exterior trims, including hidden charging ports and flush door handles, has been observed as part of next-gen vehicle styling.

As consumers seek personalized, energy-efficient, and tech-integrated vehicle exteriors, the trim parts segment is expected to undergo further transformation. Innovation in lightweight polymers, coupled with regulatory alignment and modular design strategies, will continue to shape the market’s growth over the next decade.

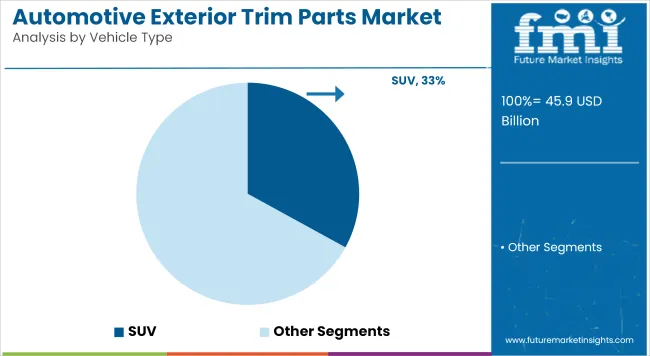

In 2025, SUVs accounted for 33% of the global vehicle market and are projected to expand at a CAGR of 4.2% from 2025 to 2035. The segment’s performance was supported by growing consumer preference for multi-utility vehicles across both urban and semi-urban regions.

Automakers prioritized SUV production in India, China, and Mexico to address domestic requirements and export volumes, especially in compact and mid-size formats. Shared platforms across ICE and hybrid powertrains enabled modularity and part standardization, reducing production complexity.

In 2025, the segment witnessed steady installations of driveline components, suspension assemblies, and NVH systems across both mid-range and premium models. Market performance was influenced by the continued appeal of SUVs as family vehicles, with high resale value and road clearance contributing to steady sales across Asia-Pacific, North America, and Latin America.

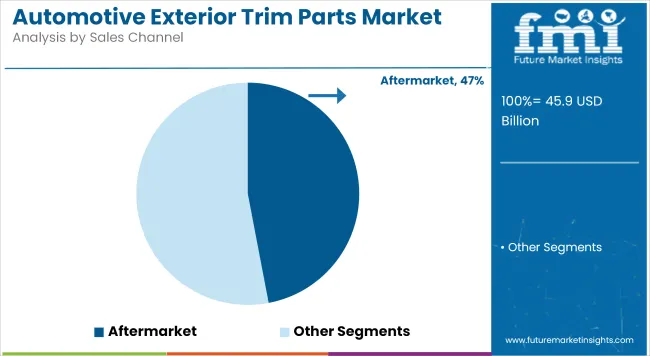

The replacement channel captured 47% of the global market in 2025 and is forecast to grow at a CAGR of 4.0% through 2035. This growth was driven by aging vehicle fleets, extended service intervals, and the availability of cost-effective aftermarket parts. In 2025, parts replacement cycles for components such as brake pads, suspension kits, filters, and cooling units remained consistent across passenger and light commercial vehicles.

Regional distributors and service stations expanded their inventories to cater to increasing demand in the mid-life and late-life vehicle segments. In emerging markets, the availability of compatible non-OEM components further supported replacement part penetration. The channel also benefited from greater transparency in product selection through digital catalogs, enabling improved fitment accuracy and faster service delivery across independent garages and workshops.

Challenge

volatility in raw material prices

Volatility of Plastics and metals prices of these materials can lead to changes in production costs and profits for the manufacturers. The industry must also grapple with growing pressure to adopt sustainable practices, which require a shift towards eco-friendly materials and technologies that may raise operational costs.

Both trim part designs and materials used still need to adapt to the transition to electric vehicles which is also challenging for traditional combustion engine vehicle manufacturers.

Opportunity

Development and adoption of lightweight, sustainable materials

The demand for components aiding in weight reduction is largely driven by the ongoing trend in the automotive industry towards fuel efficiency and consequent reduction in emissions. New materials science innovations can give manufacturers the opportunity to satisfy regulatory and consumer demand through the use of innovative composites and bio-based plastics. The partnerships between material suppliers and vehicle Assembly can also result in high-performance, low-impact trim parts, giving competitive advantages in the marketplace.

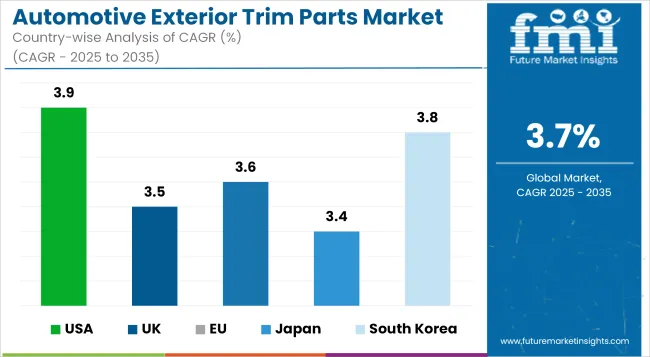

Automotive Exterior Trim Parts Market in US as major automakers are widely established in the United States, the industrial country is still one of the top markets for automotive exterior trim parts, along with consumer demand for customized vehicles and advancements in lightweight materials.

Thanks to the rising popularity of electric vehicles (EVs) and stricter fuel efficiency standards, manufacturers are being forced to create aerodynamic and energy-efficient trim parts. Moreover, mathematical innovations in smart trim parts, integrated with LED in mouldings and sensor in bumpers, are impacting the market ecosystem. This growth of the market is also propelled by the increase in online automotive spare parts retail and aftermarket customization trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

Rapid raw material research leading to advanced and eco-friendly design process is estimated to bolster the UK Automotive Exterior Trim Parts (Plastic & Other) Market growth at a CAGR of 11.0% during the forecast period. Increasing premium and luxury car segments and demand for high-grade trim parts such as carbon fibre, chrome, and advanced polymer are augmenting the automotive tailgate trim parts market.

And incentives from government bodies, convincing car manufacturers to design lightweight and aerodynamically favourable exterior trim parts. The growth of aftermarket vehicle customization is another key factor driving market growth, along with the growing e-commerce platforms for the distribution of auto parts.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.5% |

Germany, France, and Italy dominate the European automotive exterior trim parts market, supported by robust automotive manufacturing hubs, advanced material technologies, and stringent environmental regulations. The move to lower emissions in cars has seen investment in lighter, recyclable trim materials.

High-end aesthetic applications in both passenger and commercial vehicles the need for aerodynamic efficiency will drive new innovations in trim designs. Manufacturers are increasingly integrating smart sensors and LED-enhanced trim components under the influence of rising rate of electric and autonomous vehicles in the region. The future development of products will be defined by stringent regulatory compliance with sustainable material.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 3.6% |

Japan's automotive exterior trim parts market is driven by its robust automobile manufacturing sector, focus on precision engineering, and rising demand for fuel-efficient vehicles. Some over the following months is producing aerodynamic trim functions to arrive vehicles industry can improve as well as efficiency. Moreover, nanomaterials and high-durability plastics are improving the look and feel of the trim components.

Japan’s drive for sustainability and eco-friendly vehicle design is also encouraging manufacturers to use recyclable materials for exterior trim parts. Increasing aftermarket industry in addition to the rising interest in vehicle cosmetics are other factors driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.4% |

The sector is growing in south Korea, as the expansion of domestic automotive industry, continuous investment and growth of electric and autonomous automotive technologies are driving its expansion, making it an important market for automotive exterior trim components. Top tier South Korean automakers are utilising sophisticated exterior trim designs to improve vehicle aerodynamics and aesthetics.

Market growth of high-performance materials like carbon fibre-reinforced composites and smart trim components integrated with sensors is also fuelling the growth of the smart car body materials market. As a result, rising demand for customized vehicles and aftermarket modification is aiding the growth of external trim parts market. The government initiatives for green and sustainable automotive manufacturing practices are also shaping the growth trajectory of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

Factors driving the growth of this market include: advancements in vehicle aesthetics, increasing demand for lightweight and durable materials, and the expansion of the EV segment. So, the market has been growing steadily with automakers having a focus on aerodynamic efficiency and customization options. Some of the principal trends influencing the segments such as automotive textiles include the use of sustainable materials, smart trim components, and optimized manufacturing processes.

Magna International Inc. (12-16%)

Magna leads in the automotive exterior trim market, leveraging advanced materials and aerodynamics to enhance vehicle efficiency.

Plastic Omnium (10-14%)

Plastic Omnium focuses on innovative, lightweight, and smart trim solutions, aligning with sustainability and digitalization trends.

Toyoda Gosei Co., Ltd. (8-12%)

Toyoda Gosei excels in rubber and plastic exterior trim manufacturing, ensuring high durability and precision engineering.

SMP Deutschland GmbH (6-10%)

SMP specializes in premium automotive exterior trims, catering to the luxury and high-performance vehicle segments.

Minth Group Ltd. (4-8%) Minth provides cost-effective, customizable trim components, serving major global automakers with an extensive product portfolio.

Other Key Players (45-55% Combined)

Several global and regional players contribute to the expanding automotive exterior trim parts market. These include:

The overall market size for the Automotive Exterior Trim Parts market was USD 45.9 Billion in 2025.

The Automotive Exterior Trim Parts market is expected to reach USD 66.1 Billion in 2035.

The demand for automotive exterior trim parts will be driven by the growing vehicle production, rising demand for vehicle customization, advancements in lightweight and durable materials, and increasing adoption of electric vehicles.

The top 5 countries driving the development of the Automotive Exterior Trim Parts market are the USA, China, Germany, Japan, and India.

The Bumpers & Grilles segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA