Growing need for Dishwashing Parts and Accessories Market, increasing number of automatic dishwashing machines, and developing long-lasting, friendly dishwasher parts have been contributing in the sales of Dishwashing parts and accessories and are expected to show a big leap in between 2025 and 2035 worldwide.

Dishwashing Parts & Accessories refers to the components and accessories used within dishwashers to facilitate the cleaning process, improve the performance of dishwashers, enhance water usage efficiency, and prolong the lifespan of the dishwasher.

The rising demands for kitchen automation combined with the continuous advancements in energy-efficient dishwasher technologies are driving the market growth. Add to this the proliferation of e-commerce channels, investments in smart dishwasher components and a growing focus from regulations across sustainable home appliance segments, all have been propelling industry in a step by step fashion.

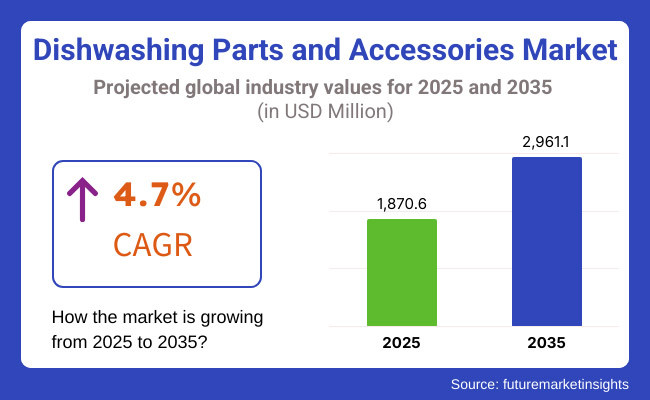

The Dishwashing parts and accessories market was valued at around USD 1,870.6 million in 2025. It will reach USD 2,961.1 million by 2035, growing at a CAGR of 4.7%. The market is primarily driven by the rise in demand for replacement parts, growing sales of dishwashers, and increasing investments in smart home appliances.

The incorporation of IoT-enabled dishwasher components, sustainable recyclable materials, and cost-efficient manufacturing methods will also drive growth in the market. Apart from that, it is the emergence of anti-microbial, corrosion-resistant, and energy-efficient parts in retail dishwashers which is offering significant growth horizons for market penetration and consumer adoption.

North America continues to hold a leading share in dishwashing parts and accessories market, driven by increasing consumer preference for superior quality dishwasher components, rising smart home appliance adoption as well as growing investments towards development of sustainable kitchen solutions. Advanced dishwasher components such as water-saving spray arms, energy-efficient motors, and IoT-enabled maintenance solutions are being developed and commercialized across the USA and Canada.

Market growth is being fueled by the increasing demand for regulatory-compliant home appliances, the rising consumer preference for durable dishwasher parts, and the increasing adoption of AI-powered diagnostic solutions in dishwashers. Moreover, growth in the trends of home improvement and environmentally-friendly kitchen accessories keys to the further innovation and adoption of products.

The Europe dishwasher market is emerging with the increasing demand for long-lasting dishwasher parts, government initiatives of green kitchen appliances, and development in recyclable materials. Residential and commercial dishwashing accessory manufacturers in Germany, France and the UK are concentrating on the launch of defect-free high-performance sustainable dishwashing accessories. Increased focus on minimizing water and energy consumption, expanding uses in modular and smart design kitchens, and development of environmentally friendly dishwasher materials is also contributing to market adoption.

Moreover, the growing applications in commercial kitchens, premium home appliance solutions, and the automation technologies for commercial dishwashers are expected to provide a tremendous growth opportunity for manufacturers, and retailers.

Increasing rate of urbanization, disposable income, along with surge in demand for modern kitchen appliances are driving the ASIA-PACIFIC region to experience the highest growth in the Dishwashing parts and accessories market. China, India and Japan have been pouring resources into R&D to produce cheaper, high-performance parts for different water quality and energy efficiency requirements.

The increasing demand of premium dishwashing accessories along with the rapid growth and expansion of E-commerce retail channels, along with evolving regulatory setting, and significant government initiatives focusing on sustainable manufacturing is driving the growth of regional market. In addition, raised awareness regarding smart home integration and long-lasting kitchen appliance components is also boosting market penetration. Market growth is being bolstered further by the presence of domestic kitchen appliance manufacturers and collaborations with international kitchen and bath brands.

The market for Dishwashing parts and accessories is ready for growth throughout the following decade, backed by ongoing innovation around dishwasher efficiency, integration with smart appliances in the home, and improvements through more durable materials.

Firms are concentrating on breakthroughs in energy-saving elements, AI-fuelled repair processes, and sustainable resources to boost their performance, market attractiveness, and utility. Consumer interest in home automation, the digitization of kitchen appliances, and new sustainability regulations are other factors driving change within the industry.

The smart integration of maintenance alerts, IoT-enabled dishwasher accessories, and next-generation eco-conscious materials are only further optimizing dishwashing performance and providing quality kitchen appliance solutions across the globe.

Challenge

Supply Chain Disruptions and Component Shortages

Running into challenges such as the global supply chain response, shortage of components, and increasing raw material prices have also been impacting the segment of the dishwashing parts and accessories market. Disruptions to the supply of critical components like pumps and spray arms and filters will affect manufacturing timelines and product availability. Geopolitical tensions and trade restrictions have also posed additional challenges to logistics, adding costs for manufacturers and retailers. We also need data only up to October 2023.

Compatibility and Standardization Issues

There are many models, brands, and proprietary designs of components for dishwashers in the marketplace, culminating in compatibility being a major challenge. Consumers have to look for spare parts that are compatible with their aromatization dishwashers, resulting in unhappiness and business expenditure in service costs.

And, due to a lack of standardization among manufacturers, parts and accessories from other machines are seldom interchangeable. Therefore, in order to overcome this issue, future-proof the solution by building universal or adaptable components, enhancing product markings and compatibility guides, and expanding customer support services for part selection and installation guidance.

Opportunity

Growing Demand for High-Quality Replacement Parts and Accessories

The growing longevity of dishwashers and the trend toward serviceability instead of disposability is fueling demand for long-lasting, high-quality replacement components. Getting cost-saving appliances for models including upgraded racks, better water filters and improved spray arms means customers are searching for ways to keep information technology flowing through their lives.

Also, consumers are becoming increasingly able to replace parts themselves thanks to the growth of do-it-yourself repairs and online instruction content. Premium aftermarket parts, DIY installation kits, and online DTC sales channels will be the best investment opportunities in this growing market trend.

Expansion of Smart and Eco-Friendly Accessories

The growing trend of smart home integration as well as sustainability and eco-friendly living are projected to generate tremendous opportunities in the blade components and accessories segment during the forecast period. Consumers are seeking accessories that will help them improve energy and water efficiency, like smart detergent dispensers, reusable filters and eco-friendly rinse aids.

Moreover, dishwashing efficiency is seeing an increase in IoT-enabled sensors and smartphone monitoring. The market for eco-friendly and smart dish-washing solutions will thrive, leading companies to design explanatory accessories and develop new water-saving components and dishwasher parts that embrace environmental sustainability and high-tech demand.

Environmental impact of the Dishwashing parts and accessories market: New Research: From 2020 to 2024, the Dishwashing parts and accessories market registered increased usage of replacement components, thanks to longer appliance lifespans and heightened consumer awareness regarding maintenance.

E-commerce made aftermarket parts more accessible, and manufacturers continued to hone in on energy-efficient and environmentally friendly accessories. But hiccups in the supply chain and compatibility issues continued to be big hurdles. In response, companies diversified production locations, enhanced part standardization, and extended direct-to-consumer distribution models.

In the next few years, the smart dishwasher accessory market is growing, in addition, with features such as AI-powered diagnostics and 3D-printed replacement parts. Future innovation will be driven by self-cleaning components, biodegradable filter systems and modular dishwasher designs.

Moreover, the emergence of blockchain for enhanced supply chain transparency, the application of AI for more accurate customer support and part recommendations, the expansion of the circular economy through appliance repair, are all trends that will redefine the industry. We share the whole Dishwashing parts and accessories marketing external environment, the most competitive players, and their strengths and weaknesses.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with energy efficiency and environmental standards |

| Technological Advancements | Growth in high-efficiency spray arms and water filtration systems |

| Industry Adoption | Increased demand for aftermarket dishwasher parts |

| Supply Chain and Sourcing | Dependence on traditional manufacturing hubs |

| Market Competition | Dominance of OEM-certified parts and accessories |

| Market Growth Drivers | Demand for appliance maintenance, DIY repairs, and cost-effective upgrades |

| Sustainability and Energy Efficiency | Initial adoption of water-saving and biodegradable materials |

| Integration of Smart Monitoring | Limited use of digital sensors and dishwasher performance tracking |

| Advancements in Product Innovation | Introduction of ergonomic racks, durable filters, and high-performance detergent dispensers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter mandates on sustainable materials, recyclability, and smart energy monitoring integration |

| Technological Advancements | Expansion of IoT-connected dishwasher accessories, AI-driven maintenance alerts, and smart self-cleaning parts |

| Industry Adoption | Mainstream adoption of modular, customizable, and 3D-printed replacement components |

| Supply Chain and Sourcing | Shift toward localized production, recycled materials, and blockchain-based supply chain transparency |

| Market Competition | Rise of independent aftermarket providers, subscription-based replacement part services, and eco-conscious brands |

| Market Growth Drivers | Growth in smart kitchen ecosystems, sustainable accessories, and AI-powered dishwasher diagnostics |

| Sustainability and Energy Efficiency | Large-scale implementation of reusable filters, carbon-neutral manufacturing, and cradle-to-cradle dishwasher designs |

| Integration of Smart Monitoring | AI-powered predictive maintenance, IoT-enabled water efficiency tracking, and remote appliance troubleshooting |

| Advancements in Product Innovation | Development of self-cleaning accessories, AI-optimized water distribution systems, and biodegradable dishwasher components |

While the USA spearheaded the sales in the global Dishwashing parts and accessories market, the growth in the segment is driven by increasing preference among consumers for durable and energy-efficient dishwasher parts, an upsurge in the demand for replacement parts, and the presence of leading appliance manufacturers in the region. The increased trend of smart-selling solutions and improved water-saving technologies also drive the market.

Additionally, increased investment in premium, corrosion-resistant dishwasher racks, filters, and spray arms is further boosting market growth. Also, product attractiveness is being enhanced through the integration of smart sensors, self-cleaning filters, and noise-reduction technologies.

Additionally, companies are working on creating and enhancing efficient, low-output energy materials that will sustain lower outputs for a longer period of time, thus increasing product longevity. Rising trend of modular and customizable dishwasher accessories is also driving demand in the USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

The demand for dishwashing parts and accessories is notably growing in the United Kingdom, owing to rising installation of premium dishwashing systems, increasing demand for spare and replacement parts, and increasing consumer interest in environmentally friendly and energy-efficient appliances. Additionally, a growing focus toward sustainable household solutions is further propelling the market.

Government mandates backing energy-efficient home appliances, along with developments in water filtration and eco-friendly dish racks, contribute to market growth. In addition, there is growing interest in fast-dry tech, heat-resistant dishwasher trays and self-cleaning spray arms. And companies are also stepping up their smart connectivity features, so they can diagnose problems remotely and have real-time data on how well a dishwasher is performing.

The rising adoption of the multi-purpose and space-efficient dishrack accessories that occupy less space is driving the dish washing accessories market growth in the UK. Since repair-and-reuse initiatives are also on the rise, demand for high-quality replacement parts is also growing.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

Germany, France, and Italy play a key role in the growth of European Dishwashing parts and accessories due to higher dishwasher appliance manufacturing, growing regulations for energy efficiency, and an increase in consumers preferring long-lasting dishwasher parts.

Combining the European Union's emphasis on sustainability along with investments on water-efficient and recyclable components leads dish washers market growth towards rapid rate. The introduction of smart dishwashing technologies, advanced filtration systems, and energy-efficient drying solutions are further enhancing product performance. Market growth is further propelled by the increasing demand for dishwasher-friendly, heat-resistant racks, environmentally friendly filters, and modular cutlery trays.

The growing adoption in the region is also being driven by the proliferation of home appliance recycling initiatives and the introduction of dishwasher accessories certified by EU energy labels. The rise of smart home connectivity and predictive maintenance has also spurred on the development of next-generation dishwashing accessories.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.6% |

Driven by the Government of Japan's emphasis on high-efficiency home appliances, growing demand for space-saving dishwashing appliances, and preferences regarding the adoption of low-noise and less water-consuming models, the Dishwashing parts and accessories market in Japan continues on a growth trajectory. Increasing demand for compact high-performance dishwashing components is driving growth in the market.

Its focus on technology, combined with lightweight, durable material applications, smart diagnostics, and energy-efficient filtration systems, is driving innovation in the country. Demand for durable and long-lasting parts are also propelled by strict government regulations regarding appliance safety as well as growing consumer preferences toward antimicrobial dishwasher accessories.

For instance, the increasing adoption of quick-dry technology, odor-reducing dishwasher components and AI-enabled load-sensing systems is playing a vital role in driving market growth in Japan’s home appliance industry. Also, the future of sustainable kitchen appliances is also being determined by Japan’s investment in environmentally friendly and reusable dishwashing components.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

In South Korea, the sales of external components and aesthetics of dish washing are majorly influenced by the increasing prominence of smart kitchen electronics, surging interest for effective performance cleaning solutions and growing penetration of automation in cleaning technological appliances.

Stringent government regulations concerning appliance energy efficiency as well as increasing adoption of low-noise dishwasher accessories and water-savings will drive market growth. Moreover, the country’s continuous efforts toward improving durability, ease of maintenance and smart connectivity in the elements of dishwashing have made it competitive. The increasing demand for sensor-based dishwashing racks, self-cleaning filters, and anti-bacterial interiors of dishwashers are also inspiring market adoption.

To meet the evolving demands of consumers, companies are investing in technology like AI that can optimize the dishwashing cycle, modular rack systems, and dishwashing solutions that internally dispense eco-friendly detergents. In addition, the increasing penetration of premium home appliance brands and smart home ecosystems in South Korea is driving the demand for advanced dishwashing accessories.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

The most common dishwasher racks used in the dishwashing appliances offer storage, and optimized water flow, and enhanced load capacity. Durability, rust resistance and adaptability to the size and configuration of individual dishes are high on the list for consumers and businesses.

The growing use of stainless steel and coated wire racks for household and commercial dishwashers helps enhance longevity and heat resistance. Folding, height-adjustable, and modular racks, for example, make newer dishwashing appliances more flexible to use.

Spray arms are responsible for proper water distribution and a key contributor to a good cleaning performance. High-pressure, multidirectional spray arms improve detergent penetration, grease removal, and rinse efficiency and are a major replacement commodity for dishwashing machines.

More sophisticated material compositions, self-cleaning nozzles and energy-efficient water circulation technologies will be at the forefront of manufacturers' priorities to meet wash cycle effectiveness demand while helping you cut down on water consumption. With consumers wanting spray arms resistant to limescale and other blockages, manufacturers are working on anti-limescale and high-durability spray systems designed to allow dishwashing appliances to run effectively for years on end.

The advent of online shopping has changed the device and equipment market, providing consumers with a plethora of replacement components at cheaper rates, with the option for delivery at their front doors. Platforms for e-commerce facilitate product comparisons along with customer reviews and expert recommendations, making the purchasing from well-known brands very simple to buy. Growing new market segments such as DTC suppliers, subscriptions for replacement parts, and discounts for bulk orders have also contributed to the uptrend in the online sale of parts. Moreover, AI-based product recommendations and virtual assistance platforms have made the online shopping journey even more comforting so that shoppers choose the appropriate dishwashing companion for their specific appliance type.

Specialty outlets serve as an important sales channel for premium components of the dishwashing, high-quality replacement parts, and expert-recommended accessories. OEM-certified or brand-specific parts are best procured through specialty retailers, as they offer authenticity, technical expertise, and warranty-backed products to consumers.

Specialty Stores: While general retailers have a wide array, specialty stores focus on specific brands or types of dishwashers and their accessories, offering aftermarket products, custom fittings, and professional-grade cleaning solutions for customers looking to ensure perfect replacements or enhance performance.

Increasing consumer demand for eco-friendly and energy-efficient dishwasher solutions has prompted specialty retailers to adapt appliance selections, offering water-saving filters, biodegradable detergent dispensers, and smart control panels.

Residential users represent a large chunk of the Dishwashing parts and accessories market as home users are always on the lookout for cheap yet durable replacements for worn-out or broken components. The growing preference for built-in and freestanding dishwashers has boosted the demand for easy-to-install, user-friendly parts that enhance appliance longevity and efficiency.

Crucial factors for consumers as they consider home appliances are low-noise, energy-saving, and water-efficient accessories and sustainable home appliances have already started to take off. Germ-ridden dishes are a thing of the past now with innovative technologies in smart dishwashing systems with Internet of Things (IoT) technology paving the way for automated detergent dispensers, sensor-based spray arms, app-controlled dishwasher components, and more.

Heavy-duty dishwashing components need for this type of environment, including hotels, restaurants, and cafeterias. Continuous operation, fast clean-up cycles, and high longevity. The foodservice industry depends on strong commercial-grade racks and big drainage systems and high-capacity detergent-pushing devices so they can clean up and chug out more plates in fewer hours.

The increasing implementation of stricter hygiene regulations has driven the demand for anti-bacterial coatings, temperature-resistant gaskets, and corrosion-proof systems and components. Moreover, the demand for automated and energy-efficient dishwashing solutions in commercial kitchens has contributed to the growth of this segment, with AI-enabled control panels, self-cleaning filtration systems, and bio-eco heating elements being utilized to lower operating costs and enhance sustainability.

The growth in the Dishwashing parts and accessories market can be attributed to the increasing demand for efficient kitchen solutions, adoption of dishwashers in households and commercial spaces, and need for replacement parts and accessories. Companies are addressing challenges with improved Compatibility, advance materials & design. Important trends include intelligent dishwasher parts, green replacement parts, and customized accessories for optimum cleaning.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Bosch Home Appliances | 18-22% |

| Whirlpool Corporation | 14-18% |

| Electrolux AB | 11-15% |

| Miele & Cie. KG | 8-12% |

| Samsung Electronics | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bosch Home Appliances | Leading provider of high-quality dishwasher racks, filters, and spray arms. |

| Whirlpool Corporation | Specializes in durable and energy-efficient dishwasher accessories and replacement parts. |

| Electrolux AB | Develops innovative and eco-friendly dishwasher components for improved performance. |

| Miele & Cie. KG | Offers premium-quality dishwasher baskets, cutlery trays, and maintenance kits. |

| Samsung Electronics | Focuses on smart dishwasher parts, including advanced water filtration and spray systems. |

Key Company Insights

Bosch Home Appliances (18-22%)

Bosch boasts an extensive fine quality line of long-lasting, high-performing parts and accessories specifically designed to improve dishwasher performance.

Whirlpool Corporation (14-18%)

Whirlpool also specializes in reliable dishwasher replacement components and device parts, guaranteed energy saving and extended working of the device

Electrolux AB (11-15%)

In extending its offerings of eco- and innovative the parts of the dishwasher, Electrolux delivers a new level of cleaning efficiency and sustainability.

Miele & Cie. KG (8-12%)

Miele makes premium dishwasher accessories, including custom racks and utensils trays engineered for optimal washing results.

Samsung Electronics (6-10%)

Samsung is establishing itself as a mainstay in smart dishwasher finds, bringing the water-filtration systems and high-efficiency spray arms into a tech era.

Other Key Players (30-40% Combined)

Through eco-friendly designs and improved technologies, leading-market and emerging-market companies involved in dishwashing parts and accessories innovations support global and regional trends. Key players include:

The overall market size for Dishwashing parts and accessories market was USD 1,870.6 Million in 2025.

The Dishwashing parts and accessories market expected to reach USD 2,961.1 Million in 2035.

Factors such as rising adoption of automatic dishwashers, need for replacement parts due to component wear and tear, growing consumer preference for energy-efficient heating elements, technological advancements in smart dishwasher components and expansion of sales channel through e-commerce will continue to drive the demand for dishwashing parts and accessories market.

The top 5 countries which drives the development of Dishwashing parts and accessories market are USA, UK, Europe Union, Japan and South Korea

Dishwasher racks and spray arms drive growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by End-User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 23: Global Market Attractiveness by End-User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 47: North America Market Attractiveness by End-User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 95: Europe Market Attractiveness by End-User, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by End-User, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End-User, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by End-User, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 143: MEA Market Attractiveness by End-User, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

4X4 Vehicles Parts and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Heated Shelving Parts and Accessories Market - Optimized Food Warmth 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Dishwashing Additives Market Growth - Size & Forecast 2025 to 2035

Car Accessories Market Size and Share Forecast Outlook 2025 to 2035

Bar Accessories Market

Jack Accessories Market Size and Share Forecast Outlook 2025 to 2035

Dock Accessories Market Size and Share Forecast Outlook 2025 to 2035

Golf Accessories Market Size and Share Forecast Outlook 2025 to 2035

Apple Accessories Market Report – Demand, Trends & Forecast 2025–2035

Cable Accessories Market Growth - Trends & Forecast 2025 to 2035

Camera Accessories Market Size and Share Forecast Outlook 2025 to 2035

Laptop Accessories Market Size and Share Forecast Outlook 2025 to 2035

E-Bike Accessories Market Size and Share Forecast Outlook 2025 to 2035

Travel Accessories Market Analysis by Product Type, Material, Distribution Channel, End-User and Region 2025 to 2035

Key Players & Market Share in Laptop Accessories Market

Fashion Accessories Packaging Market Size and Share Forecast Outlook 2025 to 2035

Smoking Accessories Market Analysis – Growth & Forecast 2025 to 2035

Industry Share Analysis for Fashion Accessories Packaging Companies

Air Fryer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA