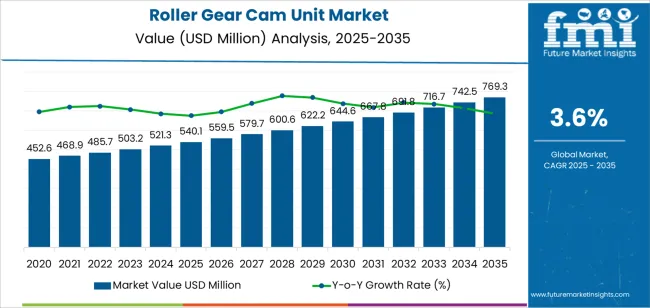

The global roller gear cam unit market is projected to grow from USD 540.1 million in 2025 to approximately USD 769.3 million by 2035, recording an absolute increase of USD 229.2 million over the forecast period. This translates into a total growth of 42.4%, with the roller gear cam unit market forecast to expand at a CAGR of 3.6% between 2025 and 2035. The overall market size is expected to grow by nearly 1.4X during the same period, supported by increasing industrial automation investments, growing demand for precision intermittent motion mechanisms in manufacturing equipment, and rising adoption of advanced indexing systems across pharmaceutical machinery and automotive assembly lines requiring reliable high-speed positioning capabilities.

The roller gear cam unit market is experiencing steady expansion across both developed and emerging manufacturing regions, with automotive applications maintaining dominant market share throughout the forecast period. Growth is particularly pronounced in Asia Pacific markets where automotive production expansion and pharmaceutical manufacturing modernization are establishing comprehensive automation infrastructure requiring precision motion control components. North American and European markets continue expanding through manufacturing facility modernization programs and Industry 4.0 implementation initiatives, while emerging markets in Latin America demonstrate accelerating adoption rates driven by automotive industry development and pharmaceutical manufacturing capacity expansion supporting industrial competitiveness objectives.

Roller gear cam units maintain critical positioning within precision manufacturing through providing reliable intermittent motion with exceptional accuracy, minimal maintenance requirements, and superior operational longevity compared to alternative indexing mechanisms. The technology proves essential for applications requiring precise rotary or linear positioning at high cycle rates, particularly in pharmaceutical tablet press machines, automotive assembly transfer systems, and packaging equipment where positioning accuracy directly impacts product quality and production efficiency. Market expansion reflects broader manufacturing trends toward increased automation complexity, production speed optimization, and quality assurance enhancement across diverse industrial sectors implementing advanced motion control solutions supporting operational excellence objectives.

Technology advantages including zero backlash operation, consistent positioning accuracy throughout operational lifecycles, and simplified maintenance protocols drive continued adoption despite higher initial costs versus pneumatic or servo-driven alternatives. The inherent mechanical reliability and predictable performance characteristics align with pharmaceutical industry validation requirements and automotive manufacturing quality standards, while compact designs enable integration into space-constrained equipment configurations supporting modern manufacturing facility layouts.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 540.1 million |

| Market Forecast Value (2035) | USD 769.3 million |

| Forecast CAGR (2025-2035) | 3.6% |

| INDUSTRIAL AUTOMATION EXPANSION | PRECISION MANUFACTURING REQUIREMENTS | OPERATIONAL EFFICIENCY STANDARDS |

|---|---|---|

| Manufacturing Automation Growth Continuous expansion of automated manufacturing systems across established and emerging industrial markets driving demand for reliable motion control components. Automotive Production Modernization Development of advanced automotive assembly systems requiring precision indexing mechanisms for transfer lines and production equipment. Pharmaceutical Equipment Investment Growing investments in pharmaceutical manufacturing equipment necessitating validated positioning systems for tablet presses and packaging machinery. | High-Speed Positioning Demands Modern manufacturing equipment requires intermittent motion systems delivering exceptional accuracy and repeatability at elevated cycle rates. Zero Backlash Requirements Production processes implementing quality control protocols requiring positioning mechanisms eliminating mechanical play throughout operational lifecycles. Consistent Performance Standards Manufacturing operations maintaining productivity targets necessitating motion control components providing predictable performance and minimal downtime. | Validation Protocol Compliance Regulatory frameworks establishing equipment qualification benchmarks requiring documented motion control performance and operational reliability. Maintenance Efficiency Requirements Quality standards demanding motion control systems minimizing maintenance interventions and supporting continuous production operations. Operational Longevity Expectations Manufacturing facilities prioritizing capital equipment investments providing extended operational lifecycles and predictable replacement intervals. |

| Category | Segments Covered |

|---|---|

| By Type | Flat Type, Wide Angle Type, Others |

| By Application | Automotive Manufacturing, Pharmaceutical Machinery, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

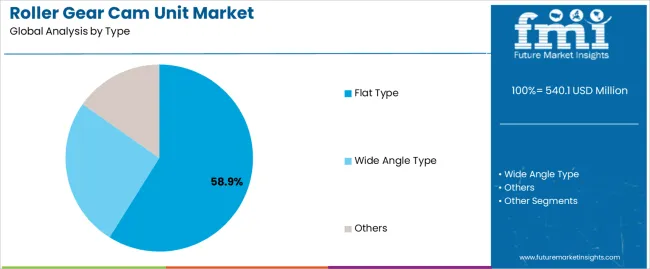

| Flat Type | Leader in 2025 with 58.9% market share; maintains leadership through 2035. Dominant presence in standard rotary indexing applications, established design protocols, proven reliability for general manufacturing equipment. Serves automotive assembly systems, packaging machinery, and pharmaceutical equipment requiring conventional indexing angles. Momentum: steady growth through manufacturing automation expansion and equipment modernization programs. Compact axial dimensions and standardized mounting interfaces support simplified equipment integration. Cost-effective solution for majority of intermittent motion applications requiring positioning accuracy without extreme angular requirements. Watchouts: limited angular positioning range versus wide angle variants, application constraints for specialized motion profiles. |

| Wide Angle Type | Growing segment benefiting from specialized applications requiring extended angular positioning capabilities beyond flat type limitations. Advanced motion profiles including large-angle indexing, complex dwell patterns, and specialized positioning sequences. Serves specialty manufacturing equipment, custom automation systems, and applications requiring unique motion characteristics. Momentum: rising adoption in specialized pharmaceutical equipment and custom automotive assembly systems requiring differentiated motion profiles. Extended angular range enables equipment designs not achievable with flat type configurations. Beneficial for applications consolidating multiple motion stages. Watchouts: higher costs versus flat type, increased complexity for maintenance and replacement. |

| Others | Niche segment including specialty configurations, custom cam profiles, and hybrid motion systems. Specialized applications addressing unique equipment requirements and novel automation architectures. Momentum: selective growth driven by custom machinery development requiring proprietary motion characteristics. Includes experimental designs, research applications, and prototype equipment supporting innovation programs. Limited market presence due to flat type standardization and cost optimization priorities. |

| Segment | 2025 to 2035 Outlook |

|---|---|

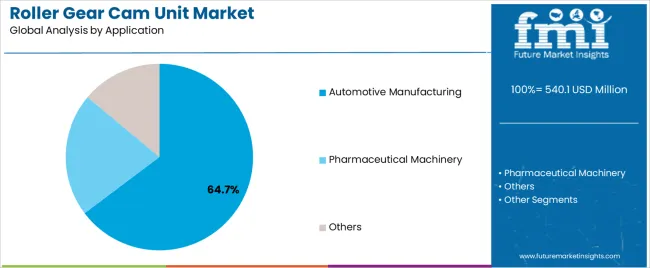

| Automotive Manufacturing | Dominant application with 64.7% market share in 2025, driven by automotive assembly line expansion and production equipment modernization. Serves transfer line systems, parts handling equipment, welding fixtures positioning, and assembly station indexing requiring high-cycle positioning. Roller gear cam units essential for synchronized motion in multi-station assembly systems, parts feeding mechanisms, and automated material handling throughout automotive production facilities. Momentum: strong growth through automotive production capacity expansion in emerging markets and manufacturing modernization in established regions. Electric vehicle production ramp-up creates new automation equipment demand. High-volume production requirements and quality standards support continued adoption. Watchouts: automotive industry cyclicality, cost pressures from manufacturers, alternative motion control technology competition. |

| Pharmaceutical Machinery | Significant high-value application segment for pharmaceutical manufacturing equipment including tablet presses, capsule filling machines, and packaging systems. Serves critical positioning functions in pharmaceutical processing equipment requiring validated performance and regulatory compliance documentation. Roller gear cam units provide repeatable positioning supporting tablet compression consistency, capsule orientation precision, and packaging accuracy throughout pharmaceutical production. Momentum: robust growth driven by pharmaceutical manufacturing capacity expansion and regulatory compliance requirements. Generic drug production growth and emerging market pharmaceutical development support equipment demand. Validation requirements and quality standards favor proven mechanical solutions. Watchouts: stringent validation documentation requirements, specialized sanitary design needs for certain applications. |

| Others | Diverse applications including packaging machinery, food processing equipment, electronics assembly systems, and specialized industrial automation. Serves intermittent motion requirements across material handling systems, precision assembly equipment, and automated inspection machinery. Momentum: steady demand from diverse manufacturing sectors implementing automation and precision positioning capabilities. Applications span consumer goods packaging, industrial component assembly, and specialized production equipment requiring reliable indexing mechanisms. Technology benefits including maintenance simplicity and operational reliability support adoption across diverse manufacturing operations. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Manufacturing Automation Investment Continuing growth of industrial automation infrastructure and equipment modernization programs across global manufacturing sectors driving demand for precision motion control components. Automotive Production Expansion of automotive manufacturing capacity in emerging markets and electric vehicle production ramp-up requiring advanced assembly equipment and positioning systems. Pharmaceutical Manufacturing Growth Increasing emphasis on pharmaceutical production capacity and quality standards supporting adoption of validated motion control systems throughout pharmaceutical equipment. | Initial Cost Considerations Higher upfront costs for roller gear cam systems versus pneumatic cylinders or basic mechanical solutions affecting adoption in cost-sensitive applications. Servo System Competition Advanced servo motor systems providing flexible motion profiles and programmable control creating competition in applications requiring motion adaptability. Technical Expertise Requirements Specialized knowledge for proper application selection and integration creating barriers for facilities lacking experienced automation engineering resources. | Miniaturization Development Design evolution toward more compact configurations supporting space-constrained equipment applications and simplified machine layouts. Material Enhancement Advanced bearing materials and surface treatments improving load capacity, extending operational lifecycles, and reducing maintenance requirements. Integration Simplification Standardized mounting interfaces and modular designs enabling faster equipment integration and simplified replacement procedures. Custom Profile Expansion Growing availability of custom cam profiles addressing specialized motion requirements and enabling differentiated equipment performance characteristics. |

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| Brazil | 3.8% |

| United States | 3.4% |

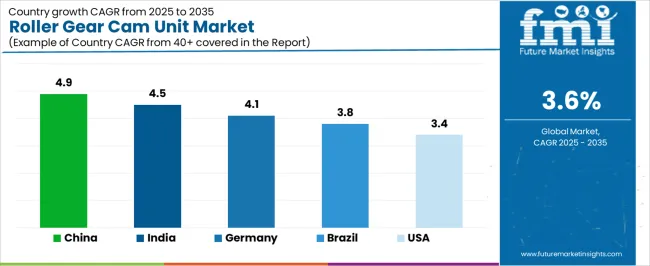

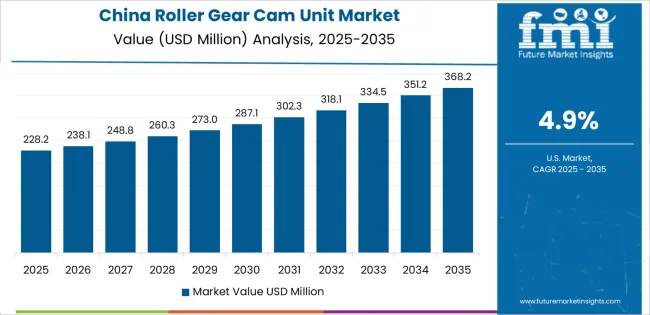

Revenue from roller gear cam units in China is projected to exhibit strong growth at a CAGR of 4.9% by 2035, driven by expanding automotive manufacturing infrastructure and comprehensive pharmaceutical equipment production capability development creating substantial opportunities for motion control component suppliers across automotive assembly operations, pharmaceutical machinery manufacturers, and packaging equipment producers requiring precision indexing systems. The country's dominant automotive production volumes and expanding pharmaceutical manufacturing capabilities are creating significant demand for both standard flat type units and specialized wide angle configurations. Major automotive manufacturers and pharmaceutical equipment producers are establishing comprehensive production facilities to support industrial growth and meet expanding domestic equipment demand.

Demand for roller gear cam units in India is expected to expand at a CAGR of 4.5% by 2035, supported by extensive automotive manufacturing expansion and comprehensive pharmaceutical equipment industry development creating sustained demand for reliable motion control components across diverse industrial applications and equipment categories. The country's growing automotive production capabilities and expanding pharmaceutical manufacturing equipment sector are driving demand for indexing solutions that provide consistent performance while supporting cost-effective equipment manufacturing. Component suppliers and equipment manufacturers are investing in market development to support growing industrial automation capabilities and technology adoption programs.

Demand for roller gear cam units in Germany is projected to grow at a CAGR of 4.1% from 2025 to 2035, supported by the country's leadership in precision machinery manufacturing and advanced automotive production technologies requiring sophisticated motion control systems for equipment manufacturing and production line applications. German machinery manufacturers are implementing high-performance indexing units that support advanced equipment designs, operational efficiency, and comprehensive quality standards. The roller gear cam unit market is characterized by a focus on engineering excellence, component reliability, and compliance with stringent machinery safety and performance standards.

Revenue from roller gear cam units in Brazil is growing with a projected CAGR of 3.8% from 2025 to 2035, driven by automotive manufacturing development programs and increasing industrial equipment production. This creat sustained opportunities for motion control component suppliers serving both automotive assembly operations and pharmaceutical equipment manufacturers. The country's expanding automotive production base and growing pharmaceutical equipment awareness are creating demand for indexing systems that support diverse equipment requirements while maintaining performance standards. Component suppliers and equipment manufacturers are developing distribution strategies to support operational requirements and equipment modernization programs.

Demand for roller gear cam units in the United States is projected to grow at a CAGR of 3.4% from 2025 to 2035, driven by manufacturing facility modernization excellence and automotive production technology advancement supporting advanced equipment capabilities and comprehensive pharmaceutical machinery applications. The country’s established machinery manufacturing tradition and growing reshoring initiatives are creating demand for high-performance indexing components that support equipment quality and manufacturing capability. Component manufacturers and equipment suppliers are maintaining comprehensive distribution capabilities to support diverse industrial requirements.

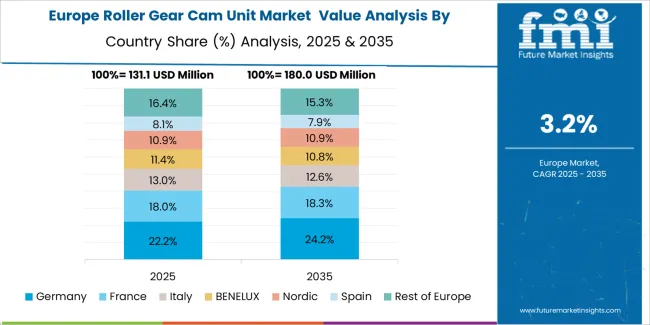

The roller gear cam unit market in Europe is projected to grow from USD 156.8 million in 2025 to USD 225.3 million by 2035, registering a CAGR of 3.7% over the forecast period. Germany is expected to maintain its leadership position with a 32.6% market share in 2025, increasing slightly to 33.1% by 2035, supported by its advanced precision machinery manufacturing infrastructure and comprehensive automotive production technology capabilities.

Italy follows with a 21.3% share in 2025, projected to reach 21.7% by 2035, driven by machinery manufacturing excellence and automotive component production. France holds a 17.9% share in 2025, expected to maintain 17.6% by 2035 through continued automotive manufacturing and pharmaceutical equipment production. The United Kingdom commands a 13.4% share, while Spain accounts for 9.2% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.6% to 6.3% by 2035, attributed to increasing industrial automation in Nordic countries and emerging Eastern European manufacturing operations implementing advanced motion control technologies.

European roller gear cam unit operations reflect regional precision engineering excellence and automotive manufacturing technology leadership. German machinery manufacturers dominate through advanced component engineering and comprehensive automotive equipment production supporting global automotive industry requirements. Italian machinery producers maintain strong positioning through specialized equipment manufacturing and automotive component production excellence requiring precision motion control systems.

French automotive manufacturers and pharmaceutical equipment producers demonstrate consistent component adoption supporting production equipment requirements. United Kingdom machinery operations continue substantial component procurement through automotive manufacturing and specialized equipment production. Spanish facilities expand through automotive component manufacturing growth and industrial equipment development. Eastern European operations in Poland, Czech Republic, and Slovakia develop automotive component manufacturing capabilities and machinery production supporting emerging industrial automation ecosystems.

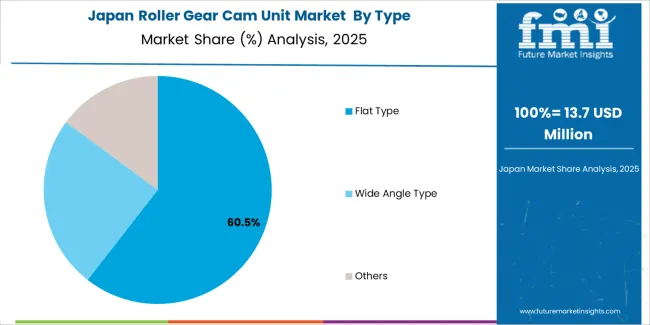

Japanese roller gear cam unit operations reflect the country's precision manufacturing excellence and sophisticated motion control component requirements. Major equipment manufacturers including automotive production equipment suppliers and pharmaceutical machinery producers maintain rigorous component qualification processes that establish industry-leading standards, requiring extensive performance validation, durability testing, and equipment integration verification spanning 12-18 months. This creates substantial technical barriers for new component suppliers but ensures exceptional operational reliability supporting Japan's manufacturing equipment quality requirements.

The Japanese market demonstrates unique specification preferences, with significant demand for ultra-precise manufacturing tolerances and specialized bearing systems tailored to high-cycle applications. Companies require specific positioning accuracy specifications and vibration characteristics that exceed international standards, driving demand for premium component grades and comprehensive performance documentation.

Regulatory oversight through industrial machinery associations and safety standards organizations emphasizes comprehensive component reliability data and operational safety requirements. The manufacturing equipment system requires detailed component qualification documentation and performance validation, creating advantages for suppliers with proven Japanese market experience and comprehensive quality assurance systems.

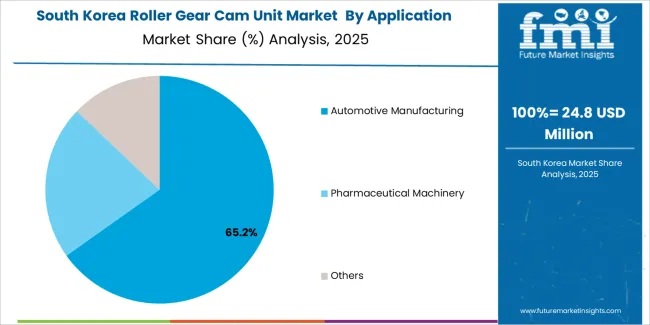

South Korean roller gear cam unit operations reflect the country's advanced automotive manufacturing sector and precision equipment production capabilities. Major automotive manufacturers including Hyundai Motor Group and equipment producers drive sophisticated component procurement strategies, establishing long-term partnerships with proven suppliers to secure consistent performance for their automotive production equipment and manufacturing systems requiring reliable motion control capabilities.

The Korean market demonstrates particular strength in automotive manufacturing equipment applications, with producers implementing advanced assembly systems and automated production lines requiring precision indexing components. This application focus creates demand for components supporting high-cycle operations, extended operational lifecycles, and minimal maintenance requirements throughout intensive production environments.

Regulatory frameworks emphasize manufacturing equipment quality and operational safety, with Korean industrial standards establishing comprehensive requirements for motion control component performance and reliability. This creates preferences for component suppliers demonstrating proven automotive manufacturing experience and comprehensive performance validation documentation supporting equipment certification and operational approval processes.

Profit pools concentrate in high-precision units with proven automotive manufacturing experience and comprehensive technical support capabilities. Value migrates from commodity indexing components to engineered systems offering application-specific customization, extended operational lifecycles, and integrated motion control solutions. Several competitive archetypes dominate: established motion control specialists with comprehensive automotive industry relationships and extensive product portfolios; precision machinery component manufacturers offering custom cam profiles and application engineering; integrated automation suppliers bundling roller gear cam units with complementary motion control products; and regional manufacturers serving local equipment builders through competitive pricing and responsive technical service.

Switching costs remain moderate through standardized mounting interfaces and interchangeable designs, though application-specific customizations and validated pharmaceutical equipment integrations create preferences for proven suppliers with equipment manufacturing experience. Market fragmentation persists with numerous regional suppliers competing against established international manufacturers, though consolidation trends emerge as major automotive equipment producers standardize component selections across multiple production facilities creating strategic supplier relationships.

Technical support capabilities including application engineering, custom cam profile development, and rapid prototyping services increasingly differentiate competitive positioning as equipment manufacturers pursue optimized motion profiles and specialized performance characteristics. Suppliers maintaining comprehensive engineering support organizations and rapid customization capabilities gain advantages in competitive evaluations. Do now: establish reference installations in major automotive production equipment and pharmaceutical machinery with documented performance advantages; develop modular product platforms enabling cost-effective customization and standardized base designs; option: pursue partnerships with equipment manufacturers enabling co-developed motion solutions and integrated design optimization.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Established motion control specialists | Comprehensive product portfolio, proven automotive relationships, global distribution infrastructure | Standardized product lines, technical documentation, strategic equipment manufacturer partnerships |

| Precision machinery component manufacturers | Custom engineering expertise, application specialization, differentiated performance | Tailored cam profiles, specialized applications, rapid customization capabilities |

| Integrated automation suppliers | Comprehensive motion control offerings, bundled solutions, single-vendor convenience | Complete automation packages, integrated engineering support, streamlined procurement |

| Regional manufacturers | Local market knowledge, cost-competitive positioning, responsive service | Domestic equipment manufacturers, standard components, rapid technical support |

| Items | Values |

|---|---|

| Quantitative Units | USD 540.1 million |

| Type | Flat Type, Wide Angle Type, Others |

| Application | Automotive Manufacturing, Pharmaceutical Machinery, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, and other 40+ countries |

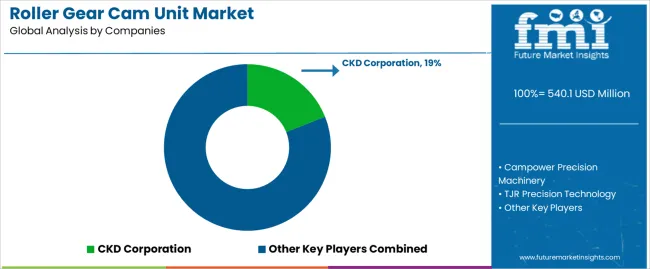

| Key Companies Profiled | CKD Corporation, Campower Precision Machinery, TJR Precision Technology, GSA Technology, SilverCNC, Sango Automation, Kitagawa Corporation, Hosea Precision, Tsubaki, Destaco |

| Additional Attributes | Dollar sales by type/application, regional demand (NA, EU, APAC), competitive landscape, automotive vs. pharmaceutical machinery adoption, precision specifications and performance characteristics, and motion control innovations driving positioning accuracy, operational reliability, and maintenance efficiency |

The global roller gear cam unit market is estimated to be valued at USD 540.1 million in 2025.

The market size for the roller gear cam unit market is projected to reach USD 769.3 million by 2035.

The roller gear cam unit market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in roller gear cam unit market are flat type, wide angle type and others.

In terms of application, automotive manufacturing segment to command 64.7% share in the roller gear cam unit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Roller Sports Product Market Size and Share Forecast Outlook 2025 to 2035

Roller Press Gear Units Market Size and Share Forecast Outlook 2025 to 2035

Grain Roller Market Size and Share Forecast Outlook 2025 to 2035

Paint Rollers Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Baby Strollers & Prams Market Size & Demand 2024-2034

CNC Controller Market Size and Share Forecast Outlook 2025 to 2035

PID Controller Market Size and Share Forecast Outlook 2025 to 2035

Friction Roller Conveyor Market Size and Share Forecast Outlook 2025 to 2035

Microcontroller Socket Market – Trends & Forecast 2025 to 2035

Door Controller Systems Market

Oilfield Roller Chain Market

Microcontroller Unit Market Size and Share Forecast Outlook 2025 to 2035

Robot Controller, Integrator and Software Market Size and Share Forecast Outlook 2025 to 2035

Composite Roller Market Size and Share Forecast Outlook 2025 to 2035

Touch Controller IC Market Size and Share Forecast Outlook 2025 to 2035

AC-DC Controller Market Size and Share Forecast Outlook 2025 to 2035

Atmosphere Roller Furnace Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roller Bearing Market Size and Share Forecast Outlook 2025 to 2035

Industrial Roller Iron Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA