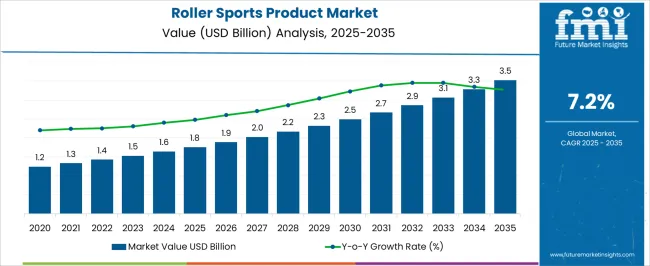

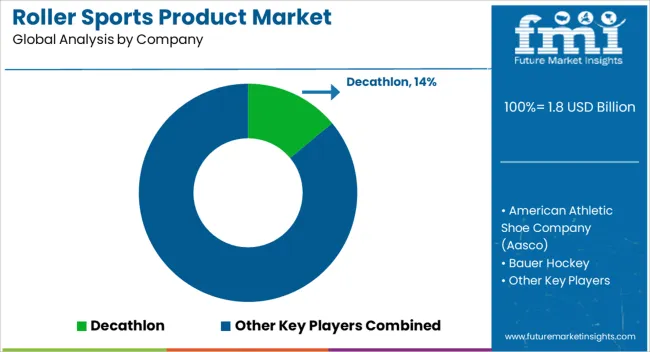

The roller sports product market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 3.5 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period. This moderate yet steady trajectory highlights a cost-structure and value-chain shaped by material inputs, manufacturing efficiency, and distribution networks. Raw materials form the foundation of the cost structure, with polyurethane, aluminum, carbon composites, and high-grade plastics being critical inputs. Fluctuations in these materials significantly influence production expenses, making procurement strategies essential.

Manufacturing represents another major cost center, where economies of scale and automation reduce unit costs. Skilled labor adds precision, particularly in high-performance products, but remains cost-intensive in smaller production setups. Within the value chain, brand-driven design and R&D investment add differentiation but raise upfront costs. Distribution exerts a strong influence, as specialty sports retailers, e-commerce platforms, and direct-to-consumer channels create diverse cost burdens. Marketing and sponsorship also carry weight since visibility in global sporting events enhances brand equity. Aftermarket services, including maintenance kits and replacement parts, extend value capture.

The market cost-structure is balanced between raw materials and manufacturing, while the value chain emphasizes product quality, distribution agility, and brand influence. Firms that optimize material sourcing and streamline logistics while sustaining innovation are positioned to enhance profitability in this expanding sector.

| Metric | Value |

|---|---|

| Roller Sports Product Market Estimated Value in (2025 E) | USD 1.8 billion |

| Roller Sports Product Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

Rising disposable income, urbanization, and the popularity of outdoor activities have continued to elevate demand for roller sports equipment. According to insights derived from industry news, investor statements, and product manufacturer updates, the shift toward active lifestyles and personal mobility trends has supported this market’s growth trajectory. In particular, the fusion of sport and leisure, amplified through social media and community-led skating initiatives, has influenced purchase behavior across all age groups.

Product innovations, advancements in materials, and the emergence of branded roller sports events have strengthened the market ecosystem. The market is expected to benefit from increased retail penetration, e-commerce availability, and rising interest in eco-friendly commuting alternatives, further supporting long-term demand across global regions.

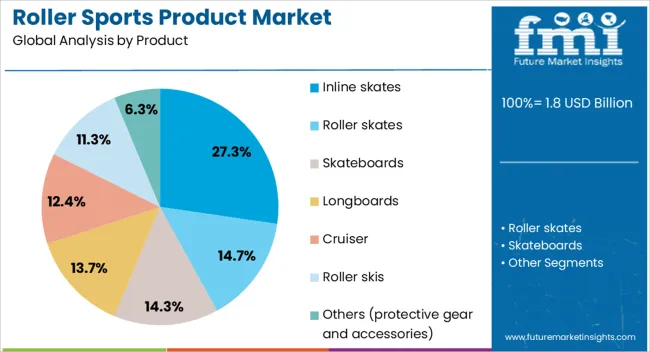

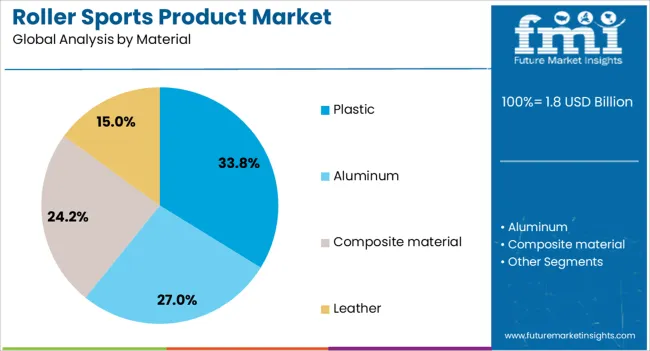

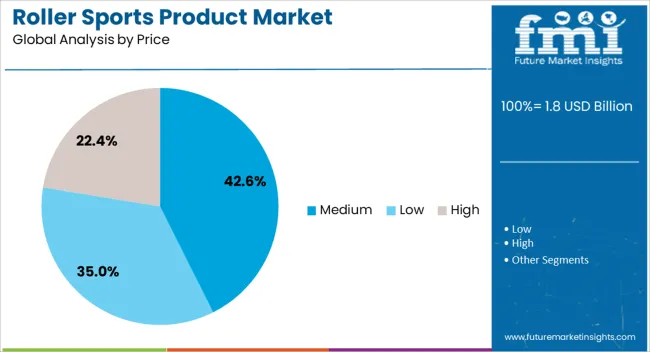

The roller sports product market is segmented by product, material, price, age group, end use, sales channel, and geographic regions. By product, the roller sports product market is divided into Inline skates, Roller skates, Skateboards, Longboards, cruisers, Roller skis, and Others (protective gear and accessories). In terms of material, the roller sports product market is classified into Plastic, Aluminum, Composite material, and Leather. Based on price, the roller sports product market is segmented into Medium, Low, and High. By age group, the roller sports product market is segmented into adults and Kids. By end use, the roller sports product market is segmented into Individual consumers and Professional athletes. By sales channel, the roller sports product market is segmented into Online and Offline. Regionally, the roller sports product industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The inline skates segment is projected to hold 27.3% of the Roller Sports Product Market revenue share in 2025, making it the leading product category. This position has been supported by the segment’s alignment with urban fitness and recreational trends, as highlighted in sports product reviews and company announcements. Inline skates are being widely preferred for their versatility, smoother ride quality, and adaptability for both casual skating and professional training.

Users have recognized their compact design and high-speed capability as beneficial for navigating cityscapes and engaging in cardiovascular workouts. Additionally, innovations in wheel configurations and braking mechanisms have improved safety and performance, appealing to a broader demographic.

The influence of digital skating content and community challenges has also contributed to increased brand engagement and sales These factors have collectively ensured the segment’s continued leadership in the roller sports product landscape.

The plastic segment is expected to contribute 33.8% of the Roller Sports Product Market revenue share in 2025, maintaining its dominance by material type. This performance has been shaped by plastic’s lightweight, cost-efficient, and durable nature, which aligns well with the functional requirements of recreational and beginner skaters. Plastic-based components are being widely used in boot shells, frames, and protective parts, making them essential to both entry-level and mid-tier product lines.

Manufacturers have been leveraging advanced plastic compounds to improve flexibility and shock absorption, enhancing user comfort and performance. Additionally, the ease of manufacturing and design customization associated with plastic has enabled product diversification across various price points.

The material’s contribution to aesthetic appeal through color and form also plays a role in consumer choice. These product and supply chain advantages have positioned plastic as the dominant material in roller sports product manufacturing.

The medium price segment is forecasted to account for 42.6% of the Roller Sports Product Market revenue share in 2025, securing its place as the leading price category. Its prominence has been driven by strong consumer demand for quality products that balance performance with affordability. This segment is being increasingly favored by recreational skaters, hobbyists, and semi-professional users who seek reliable performance without premium pricing.

Brands have been observed to invest in this segment by offering enhanced features, such as improved fit, ventilation, and better maneuverability, while maintaining accessible price points. The medium price range has also benefited from distribution through both online and offline retail platforms, which has expanded its reach to urban and semi-urban consumers. Moreover, marketing efforts focused on value-driven innovation and lifestyle branding have further reinforced this segment’s mass appeal.

The market has experienced renewed momentum due to increasing recreational activities, growing youth participation, and the influence of sports culture in both urban and suburban communities. Equipment such as roller skates, inline skates, protective gear, and accessories has gained wider consumer attention. Organized leagues and amateur competitions have encouraged adoption while brand endorsements and digital promotion strategies have broadened the customer base. The integration of advanced materials, ergonomic design, and safety features has supported the global expansion of roller sports products in multiple demographics.

The roller sports product market has been positively influenced by lifestyle trends emphasizing fitness, leisure, and outdoor activities. Participation in roller skating has expanded beyond children to include adults seeking recreational exercise and social interaction. Inline skating has been embraced as a cardiovascular activity with health benefits that attract fitness-conscious consumers. The use of roller sports in community parks, indoor arenas, and schools has created consistent demand. Retailers and manufacturers have promoted products as lifestyle-oriented rather than purely sports-focused, thereby widening the customer base. Social media platforms have amplified the visibility of roller sports by showcasing performances, tricks, and group activities. This trend has reshaped roller skating into a community-driven experience rather than an individual pursuit. The appeal of combining entertainment with exercise has been pivotal in driving consistent growth for roller sports products across multiple consumer segments.

The popularity of roller sports has been strengthened by its recognition as a competitive discipline in national and international events. Sports federations have organized tournaments in disciplines such as speed skating, artistic skating, and roller hockey. The inclusion of roller sports in youth championships and regional competitions has expanded visibility. Professional athletes and associations have collaborated with brands to promote products, influencing both enthusiasts and beginners. Competitive skating has encouraged the purchase of specialized equipment such as precision bearings, lightweight frames, and performance wheels. Training centers and academies have also boosted sales by creating structured learning environments. International sporting bodies have played a role in establishing standardized regulations, which has increased credibility and global appeal. As a result, roller sports products have transcended recreational boundaries, gaining recognition as part of mainstream sports culture, thereby stimulating consistent product innovation and market expansion.

Product innovation has been central to the growth of the roller sports product market. Manufacturers have focused on lightweight composite materials, improved cushioning, and shock-absorbing wheels to enhance performance and safety. Protective gear such as helmets, knee pads, and wrist guards has been developed with advanced materials to ensure durability and comfort. The introduction of customizable skates with adjustable sizing has catered to young consumers and recreational users. Integration of ventilation features, ergonomic designs, and improved ankle support has enhanced user experience. The research has been directed toward wheels with enhanced grip and reduced rolling resistance. These developments have allowed athletes to achieve greater performance while minimizing injury risks. Safety has remained a key consideration, influencing consumer trust and market acceptance. Technological advancements have ensured that roller sports products remain relevant in a highly competitive leisure and sports equipment sector.

The retail landscape for roller sports products has expanded with the rapid growth of e-commerce platforms. Consumers have gained access to a wide range of brands and product categories through online marketplaces. Discounts, product reviews, and customization options have influenced purchasing behavior, particularly among younger consumers. Physical sporting goods stores and specialty outlets have continued to play an important role by offering personalized fitting services. Manufacturers have collaborated with retailers to launch exclusive collections and promotional campaigns. Social media influencers and digital marketing strategies have further enhanced product visibility. Regional expansion has been facilitated by online distribution, making roller sports equipment accessible in markets with limited physical retail presence. This hybrid retail approach has enabled manufacturers to strengthen brand presence and engage with diverse consumer groups. As a result, the retail ecosystem has become an essential driver of growth in the roller sports product market.

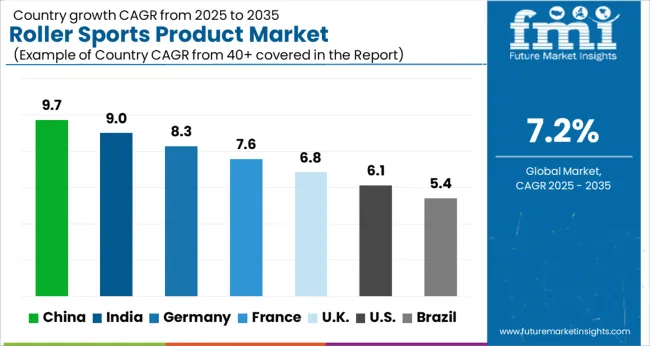

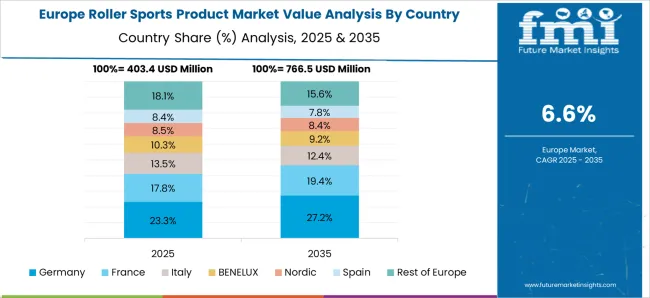

The market is expected to grow at a CAGR of 7.2% from 2025 to 2035, supported by increasing recreational participation, growing youth engagement, and product innovation in skates, protective gear, and accessories. China, with a 9.7% CAGR, expands through mass adoption and a rising sports culture. India follows at 9.0%, adopting roller sports rapidly due to urban lifestyle changes and youth-driven demand. Germany grows at 8.3%, driven by organized sports clubs and advanced product manufacturing. The UK, at 6.8%, innovates through premium product offerings and growing popularity in schools and communities. The USA, at 6.1%, maintains steady demand supported by fitness-oriented consumers and recreational leagues. This report covers 40+ countries, with the top markets highlighted here for reference.

China is forecasted to grow at a CAGR of 9.7% in the market between 2025 and 2035. Rising youth participation in recreational sports and increasing awareness of fitness benefits are shaping demand trends. Urban centers are witnessing growing adoption of inline skates and protective gear, supported by domestic manufacturing and expanding retail presence. Government initiatives to promote physical activity are further contributing to market expansion. With an evolving sports culture and rising consumer interest, China is expected to remain one of the largest contributors to global roller sports product consumption.

India is anticipated to record a CAGR of 9.0% in the market from 2025 to 2035. Increasing adoption of recreational sports among youth and rising influence of school sports programs are boosting demand. Tier 1 and Tier 2 cities are witnessing higher sales of inline skates and accessories, driven by rising disposable spending. Domestic manufacturers are expanding their product range to cater to growing consumer preferences, while international brands are enhancing their presence. Supportive initiatives in sports infrastructure are expected to accelerate market growth across the forecast period.

Germany is projected to grow at a CAGR of 8.3% in the market during 2025 to 2035. Strong fitness culture and rising interest in outdoor leisure activities are fostering demand. Inline skating is gaining popularity as both a recreational and fitness activity, leading to increased purchases of high-performance equipment. The presence of established sports goods manufacturers and specialized retailers supports market availability. Enhanced focus on safety gear, including helmets and pads, further strengthens product sales. Germany’s consumer preference for high-quality and durable products positions it as an important European market.

The United Kingdom is set to expand at a CAGR of 6.8% in the market through 2025 to 2035. Increasing participation in roller derby, recreational skating, and school-level sports initiatives is stimulating demand. Availability of branded roller skates, accessories, and protective equipment in both physical and online retail platforms is widening consumer reach. Social influence through sports clubs and online communities is also boosting adoption. With growing awareness of health benefits and a rising trend of outdoor recreational activities, the UK is likely to remain a promising market for roller sports products.

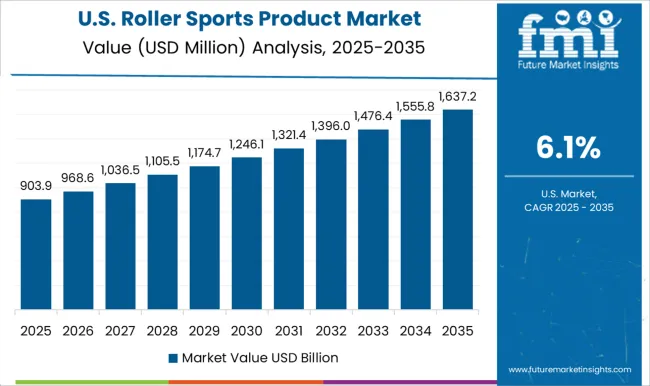

The United States is projected to record a CAGR of 6.1% in the market between 2025 and 2035. Growing participation in recreational skating, fitness activities, and roller hockey is driving steady demand. The market benefits from strong brand presence, product innovations, and the popularity of community sports events. Increasing adoption of eco-friendly materials in skate manufacturing and rising consumer interest in custom equipment are influencing product trends. Expansion of e-commerce platforms and strong promotional campaigns are further supporting the US roller sports product market.

The market has evolved into a highly competitive industry supported by global sports brands and specialized manufacturers that continue to expand participation across recreational and professional segments. Decathlon holds a dominant role with wide distribution networks and affordable product ranges that appeal to beginners and enthusiasts. American Athletic Shoe Company (Aasco) and Bauer Hockey have strengthened their positions by focusing on performance-driven roller hockey gear, combining durability with innovation in boot and wheel design. Premium skate makers such as Bont Skates, Chaya Skates, Seba Skates, and Powerslide are recognized for advanced technology that enhances speed, agility, and comfort, catering to professional and competitive skaters worldwide.

Rollerblade, one of the most iconic names in the sector, remains central to inline skating with innovations that attract both fitness users and recreational communities. Roces, Epic Skates, and Fila Skates contribute with diverse product portfolios that balance affordability and quality, expanding accessibility across markets. Emerging brands like Hudora, Lynskey Performance, and SFR Skates emphasize youth-focused and entry-level products, widening adoption in schools and family recreation. Together, these providers shape the market with differentiated strategies that range from professional-grade innovations to mass-market offerings. With increasing interest in fitness, leisure, and competitive sports, these companies are expected to play a crucial role in the global growth of roller sports participation.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Product | Inline skates, Roller skates, Skateboards, Longboards, Cruiser, Roller skis, and Others (protective gear and accessories) |

| Material | Plastic, Aluminum, Composite material, and Leather |

| Price | Medium, Low, and High |

| Age Group | Adult and Kids |

| End Use | Individual consumers and Professional athletes |

| Sales Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Decathlon, American Athletic Shoe Company (Aasco), Bauer Hockey, Bont Skates, Chaya Skates, Epic Skates, Fila Skates, Hudora, K2 Sports, Lynskey Performance, Powerslide, Roces, Rollerblade, Seba Skates, and SFR Skates |

| Additional Attributes | Dollar sales by product type and distribution channel, demand dynamics across recreational, fitness, and competitive roller sports, regional trends in participation levels and consumer spending, innovation in lightweight frames and wheel materials, environmental impact of synthetic rubber and plastic components, and emerging use cases in urban commuting, indoor arenas, and professional sports leagues. |

The global roller sports product market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the roller sports product market is projected to reach USD 3.5 billion by 2035.

The roller sports product market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in roller sports product market are inline skates, roller skates, skateboards, longboards, cruiser, roller skis and others (protective gear and accessories).

In terms of material, plastic segment to command 33.8% share in the roller sports product market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Grain Roller Market Size and Share Forecast Outlook 2025 to 2035

Paint Rollers Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Baby Strollers & Prams Market Size & Demand 2024-2034

CNC Controller Market Size and Share Forecast Outlook 2025 to 2035

PID Controller Market Size and Share Forecast Outlook 2025 to 2035

Friction Roller Conveyor Market Size and Share Forecast Outlook 2025 to 2035

Microcontroller Unit Market Size and Share Forecast Outlook 2025 to 2035

Microcontroller Socket Market – Trends & Forecast 2025 to 2035

Door Controller Systems Market

Oilfield Roller Chain Market

Composite Roller Market Size and Share Forecast Outlook 2025 to 2035

Touch Controller IC Market Size and Share Forecast Outlook 2025 to 2035

AC-DC Controller Market Size and Share Forecast Outlook 2025 to 2035

Robot Controller & Software Market Trends & Forecast 2024-2034

Automotive Roller Bearing Market Size and Share Forecast Outlook 2025 to 2035

Industrial Roller Iron Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Stroller Market Size and Share Forecast Outlook 2025 to 2035

Charge Controller System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Motion Controllers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA