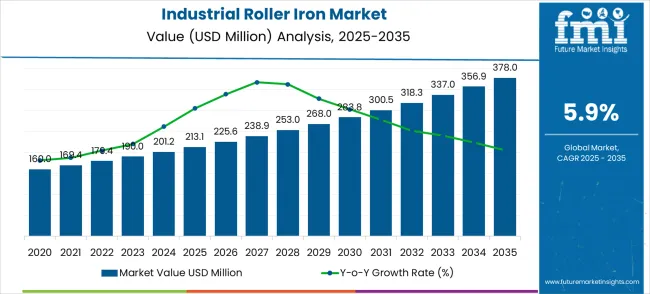

The industrial roller iron market is valued at USD 213.1 million in 2025 and is expected to reach USD 378.0 million by 2035, with a CAGR of 5.9%. From 2021 to 2025, the market grows from USD 169.4 million to USD 213.1 million, passing through intermediate values of USD 179.4 million, USD 190.0 million, and USD 201.2 million. This early growth phase is driven by increasing demand for industrial roller irons in the textile and manufacturing sectors, where the equipment plays a critical role in the production of high-quality fabrics and materials. The rising demand for improved production efficiencies and the growing need for durable, energy-efficient equipment contribute significantly to market growth.

Between 2026 and 2030, the market expands from USD 213.1 million to USD 300.5 million, with intermediate values of USD 225.6 million, USD 238.9 million, USD 253.0 million, and USD 268.0 million. During this period, the market experiences a heavier weighted growth, with both volume and price growth contributing. The adoption of more advanced roller irons, which offer higher throughput and energy efficiency, helps drive both volume and price increases. As industries continue to modernize, higher-performance machinery with improved durability and energy-saving features becomes more desirable, driving price growth. By 2030, the market will reach USD 318.3 million, and from 2031 to 2035, the market will grow to USD 378.0 million, fueled by continued demand and enhanced product innovation.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 213.1 million |

| Forecast Value in (2035F) | USD 378.0 million |

| Forecast CAGR (2025 to 2035) | 6% |

The textile machinery market contributes about 30-35%, driven by the increasing use of industrial roller irons in the textile industry for pressing and finishing fabrics, which is critical for achieving high-quality, wrinkle-free products. The commercial laundry market adds roughly 20-25%, as industrial roller irons are essential for large-scale garment pressing operations, particularly in hotels, hospitals, and laundromats, where high volumes of laundry require efficient and durable equipment.

The manufacturing and automation market contributes around 15-18%, as industrial roller irons are used in the production of various industrial goods that require precise and consistent heat treatment during the manufacturing process. The automotive and transportation market accounts for approximately 10-12%, with industrial roller irons being utilized in the production of automotive interior components such as upholstery, where smooth finishes and high-quality pressings are necessary. The packaging market contributes about 8-10%, where roller irons are used for packaging films and labels that require smooth, uniform surfaces for proper adhesion and printing.

Market expansion is being supported by the increasing scale of commercial laundry operations and the corresponding need for high-capacity ironing equipment that can process large volumes of textiles efficiently while maintaining consistent quality standards. Modern commercial laundry facilities require sophisticated ironing systems that can handle diverse fabric types, achieve professional finishing quality, and maintain high throughput rates to meet growing demand from hospitality, healthcare, and industrial sectors. Industrial roller irons provide the necessary processing capacity, consistent quality performance, and operational reliability to ensure optimal productivity in demanding commercial applications.

The growing emphasis on operational efficiency and cost optimization in commercial laundry operations is driving demand for advanced roller iron solutions that can reduce processing time, minimize energy consumption, and improve overall productivity while maintaining superior finishing quality. Commercial laundry facilities are implementing comprehensive equipment modernization programs that focus on maximizing operational efficiency, reducing labor costs, and enhancing service quality through advanced equipment selection and process optimization. Industry standards and customer quality requirements are establishing stringent performance and efficiency protocols that require specialized ironing technologies with validated productivity characteristics and comprehensive quality assurance capabilities.

The industrial roller iron market (USD 213.1M → 378.0M, CAGR ~6%) unlocks roughly USD 165M of incremental revenue by 2035. Below are practical, investable pathways that capture that upside — each with a short rationale and an estimated revenue pool (ranges sum to the market expansion).

Pathway H — Eco-Friendly & Textile Recycling Integration

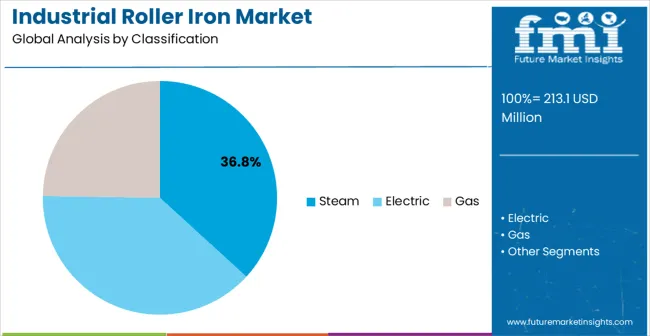

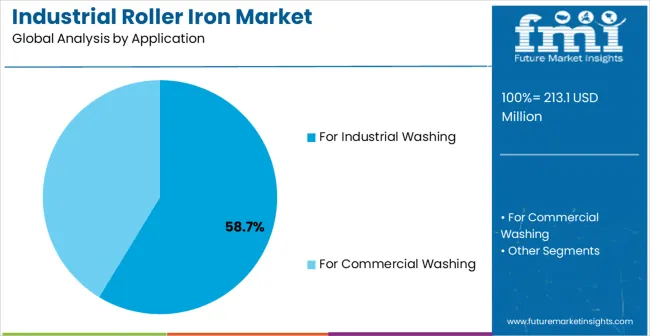

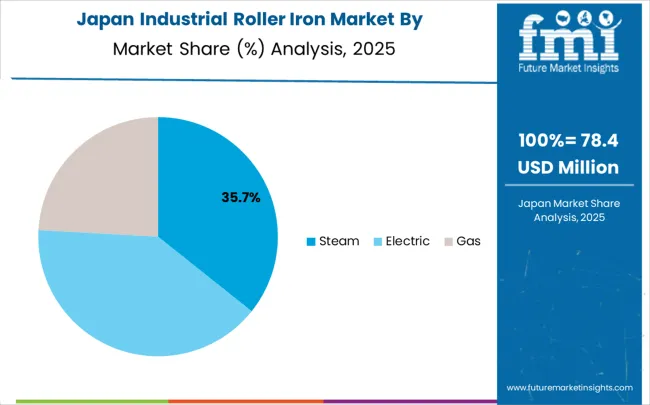

The market is segmented by power type, end-use, and region. By power type, the market is divided into steam, electric, and gas configurations. Based on end-use, the market is categorized into industrial washing and commercial washing applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Steam power type industrial roller irons are projected to account for 36.8% of the industrial roller iron market in 2025. This leading share is supported by the superior ironing performance and energy efficiency characteristics of steam-powered systems in demanding commercial applications. Steam roller irons provide excellent moisture control, consistent temperature distribution, and superior finishing quality that make them ideal for high-volume commercial laundry operations requiring professional results. The segment benefits from established infrastructure compatibility, proven reliability characteristics, and extensive operational databases that facilitate adoption across diverse commercial laundry facilities requiring superior performance and operational efficiency.

Steam roller iron technology continues advancing through integration of sophisticated control systems, enhanced steam generation capabilities, and improved energy efficiency features that support modern commercial laundry requirements. The segment growth reflects increasing adoption of steam solutions in expanding commercial laundry facilities and growing hospitality industry operations that require superior finishing quality and operational reliability. Manufacturers are developing next-generation steam roller irons with automated moisture control, integrated monitoring systems, and comprehensive safety features that support advanced operational management and quality assurance in high-volume processing environments.

Industrial washing applications are expected to represent 58.7% of industrial roller iron demand in 2025. This dominant share reflects the extensive use of roller irons in large-scale industrial laundry operations, textile processing facilities, and commercial laundry services that require high-capacity finishing equipment for diverse textile applications. Modern industrial laundry operations depend on advanced roller ironing systems for processing work uniforms, linens, towels, and specialized textiles that require consistent finishing quality and high throughput capabilities. The segment benefits from ongoing industrial expansion, increasing outsourcing of laundry services, and growing demand for professional textile finishing across manufacturing, healthcare, and service industries.

Industrial washing sector transformation toward higher efficiency and quality standards is driving significant roller iron demand as operators implement advanced finishing technologies and process optimization strategies to meet growing customer expectations and operational requirements. The segment expansion reflects increasing emphasis on productivity maximization, quality consistency, and operational cost management that depend on superior ironing performance and comprehensive automation capabilities. Advanced industrial washing applications are incorporating real-time quality monitoring, automated process control, and comprehensive productivity management that require sophisticated roller iron technologies with enhanced performance characteristics and operational integration features.

The industrial roller iron market is advancing steadily due to increasing commercial laundry capacity development and growing emphasis on operational efficiency optimization. The market faces challenges including high initial investment costs, complex maintenance requirements, and need for skilled operators for optimal performance. Technological advancement efforts and automation development programs continue to influence product development and market expansion patterns across diverse applications.

The growing implementation of automation systems and smart technology integration in industrial roller irons is enabling enhanced operational control, predictive maintenance capabilities, and comprehensive performance monitoring that improve overall equipment effectiveness and productivity. Advanced automation technologies provide real-time process optimization, automated quality control, and integrated connectivity that support efficient laundry management and operational decision-making. These technological advances enable commercial laundry operators to achieve higher levels of productivity and quality consistency while reducing labor costs and maintenance requirements through improved operational approaches.

Industrial roller iron manufacturers are advancing energy management systems and environmentally responsible technologies that lower energy consumption, reduce environmental impact, and improve operational cost-effectiveness, all while maintaining superior performance. Next-generation energy-efficient systems offer reduced utility costs, enhanced eco-friendly profiles, and full regulatory compliance, addressing evolving environmental standards and customer expectations. These innovations foster wider market adoption by delivering operational benefits that meet rigorous commercial demands while supporting eco-conscious initiatives.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| Brazil | 6.2% |

| United States | 5.6% |

| United Kingdom | 5.0% |

| Japan | 4.4% |

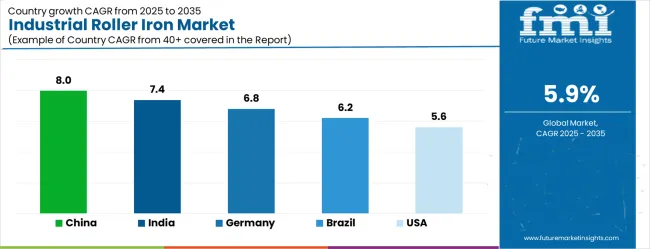

The industrial roller iron market demonstrates varied growth patterns across key countries, with China leading at an 8.0% CAGR through 2035, driven by expanding commercial laundry capacity, growing hospitality industry development, and increasing industrial textile processing requirements. India follows at 7.4%, supported by expanding commercial laundry infrastructure, growing healthcare sector development, and increasing textile processing capabilities. Germany records 6.8% growth, emphasizing precision engineering, advanced commercial equipment, and comprehensive laundry industry development. Brazil shows steady growth at 6.2%, expanding commercial laundry services and hospitality industry modernization. The United States maintains 5.6% growth, focusing on operational efficiency improvement and commercial laundry technology advancement. The United Kingdom demonstrates 5.0% expansion, supported by commercial laundry modernization and hospitality industry development. Japan records 4.4% growth, leveraging technological excellence and precision manufacturing capabilities.

The report covers an in-depth analysis of 40+ countries with top-performing countries highlighted below.

Revenue from industrial roller irons in China is projected to expand at the highest growth rate with a CAGR of 8.0% through 2035, driven by massive commercial laundry capacity development, growing hospitality industry expansion, and increasing textile processing requirements across diverse regional markets. The country's comprehensive service industry development includes significant investments in commercial laundry facilities, hotel chains, and healthcare facilities that require advanced ironing equipment for high-volume textile processing. Major commercial laundry operators and equipment manufacturers are establishing comprehensive service capabilities to support domestic demand growth and operational efficiency requirements. Government initiatives promoting service industry modernization are driving adoption of advanced laundry equipment across commercial and industrial sectors. Urbanization trends and rising living standards are creating substantial demand for professional laundry services requiring efficient processing equipment.

The industrial roller iron market in India is projected to grow at a CAGR of 7.4%, supported by expanding commercial laundry infrastructure, growing healthcare sector development, and increasing textile processing capabilities across diverse industrial applications. The country's emphasis on service sector development and urban infrastructure growth is driving demand for industrial roller iron solutions that support commercial laundry operations, hospitality services, and healthcare facility management. Government programs promoting service industry development are creating favorable conditions for commercial equipment adoption and technology advancement. Major international companies are establishing service facilities that require comprehensive laundry processing capabilities and technical support services. Educational institutions and training programs are developing workforce capabilities that support advanced equipment operation and maintenance requirements.

Demand for industrial roller irons in Germany is expected to expand at a CAGR of 6.8%, supported by the country's leadership in precision engineering, advanced commercial equipment manufacturing, and comprehensive laundry industry development capabilities. German manufacturers and service operators are implementing sophisticated roller iron solutions that meet stringent performance standards while supporting complex commercial laundry operations and hospitality industry requirements. The country's extensive hospitality and healthcare industries are driving significant roller iron demand for professional textile finishing and high-volume processing applications. Advanced manufacturing partnerships are facilitating technology development and knowledge sharing across equipment manufacturers and service providers. Research institutions are collaborating with industry partners to develop next-generation ironing technologies that maintain German competitiveness in global commercial equipment markets.

Revenue from industrial roller irons in Brazil is anticipated to grow at a CAGR of 6.2%, driven by expanding hospitality industry infrastructure, growing commercial laundry services, and increasing emphasis on service sector modernization across diverse regional markets. Brazilian hospitality and service companies are investing in roller iron solutions to enhance operational efficiency and service quality while supporting domestic tourism development and commercial service requirements. Government programs supporting tourism industry development are facilitating access to advanced commercial equipment and operational expertise. Regional service centers are developing specialized capabilities that support roller iron applications across hospitality, healthcare, and commercial laundry industries. International partnerships are providing technology transfer opportunities and technical assistance for advanced equipment implementations.

Demand for industrial roller irons in the United States is projected to grow at a CAGR of 5.6%, driven by commercial laundry modernization, operational efficiency improvement initiatives, and ongoing technology advancement programs across hospitality and healthcare sectors. American service operators are implementing advanced roller iron solutions to maintain competitive advantages while supporting efficient commercial laundry operations and service delivery requirements. The hospitality industry is driving significant roller iron demand for hotel operations, restaurant services, and commercial accommodation facilities requiring professional textile finishing capabilities. Government initiatives supporting domestic service industry competitiveness are creating opportunities for advanced equipment adoption and technology development. Regional service clusters are developing specialized expertise that supports diverse roller iron applications and emerging operational requirements.

The industrial roller iron market in the United Kingdom is growing at a CAGR of 5.0%, supported by commercial laundry sector modernization, hospitality industry development, and increasing emphasis on operational efficiency improvements across diverse service applications. British commercial laundry operators are investing in roller iron solutions to support service quality enhancement, operational cost management, and competitive positioning while maintaining professional processing capabilities. The country's established hospitality infrastructure is facilitating equipment modernization through comprehensive facility upgrade programs and operational improvement initiatives. Government initiatives supporting service sector competitiveness are creating favorable conditions for advanced equipment adoption and technology development. Advanced service partnerships are enabling knowledge sharing and technical collaboration that supports comprehensive roller iron implementation across commercial applications.

Revenue from industrial roller irons in Japan is expanding at a CAGR of 4.4%, supported by advanced manufacturing capabilities, precision engineering expertise, and emphasis on operational excellence across commercial laundry and hospitality applications. Japanese manufacturers and service operators are implementing sophisticated roller iron solutions that demonstrate superior performance characteristics while supporting diverse commercial applications requiring precision textile finishing and quality consistency. The country's commercial laundry and hospitality industries are driving demand for advanced roller iron technologies that support precision processing and stringent quality control requirements. Collaborative research programs between industry and academic institutions are developing innovative ironing technologies that maintain Japan's competitive advantage in global commercial equipment markets.

The industrial roller iron market in Europe is projected to expand from USD 57.6 million in 2025 to USD 102.2 million by 2035, registering a CAGR of 6% over the forecast period. Germany is expected to maintain its leadership with 32.1% market share in 2025, projected to grow to 32.8% by 2035, supported by its extensive commercial laundry infrastructure and advanced manufacturing capabilities. France follows with 20.4% market share in 2025, expected to reach 20.7% by 2035, driven by hospitality industry development and commercial laundry modernization.

The Rest of Europe region is projected to maintain stable share at 18.3% throughout the forecast period, attributed to emerging commercial laundry development in Eastern European countries and expanding hospitality industry infrastructure. United Kingdom contributes 15.7% in 2025, projected to reach 15.2% by 2035, supported by commercial laundry sector modernization and operational efficiency initiatives. Italy maintains 13.5% share in 2025, expected to grow to 14.3% by 2035, while other European countries demonstrate steady growth patterns reflecting regional commercial development and laundry industry advancement.

The industrial roller iron market is characterized by competition among specialized laundry equipment manufacturers, commercial equipment providers, and industrial machinery companies. Companies are investing in advanced automation technologies, energy-efficient designs, comprehensive service capabilities, and technical support programs to deliver productive, reliable, and cost-effective industrial ironing solutions. Strategic partnerships, technological innovation, and market expansion initiatives are central to strengthening product portfolios and market presence.

CLM (Jiangsu Chuandao Laundry Machinery), China-based, offers comprehensive industrial roller iron solutions with focus on commercial laundry applications, advanced manufacturing capabilities, and competitive pricing for diverse market segments. CLM (Chuandao Laundry Machinery) provides specialized roller iron systems emphasizing reliability, operational efficiency, and comprehensive technical support for demanding commercial applications. GMP Ironers delivers advanced ironing technologies with focus on European markets, quality engineering, and professional service capabilities.

Danube International provides specialized equipment with focus on emerging markets and cost-effective solutions. Other key players including Miele Professional, GIRBAU, IMESA SpA, SCHULTHESS, Grandimpianti, Speed Queen, The Ironing Equipment, and various Chinese manufacturers including Taizhou Tongjiang, Shanghai Flying Fish, Shanghai Lijing, Shanghai Sailstar, and Jiangsu Sea-lion contribute specialized expertise and diverse technical capabilities across global and regional markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 213.1 million |

| Power Type | Steam, Electric, and Gas Configurations |

| End-Use | Industrial Washing and Commercial Washing Applications |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | CLM (Chuandao Laundry Machinery), GMP Ironers, Danube International, Miele Professional, GIRBAU, IMESA SpA, SCHULTHESS, Grandimpianti, Speed Queen, The Ironing Equipment, Taizhou Tongjiang Washing Machinery Factory, Shanghai Flying Fish Machinery Manufacturing Co., Ltd., Shanghai Lijing Washing Machinery Manufacturing Co., Ltd., Shanghai Sailstar Machinery (Group) Co., Ltd., Jiangsu Sea-lion Machinery Group |

| Additional Attributes | Dollar sales by power type and end-use segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established commercial laundry equipment manufacturers and specialized ironing technology providers, buyer preferences for steam versus electric power systems, integration with commercial laundry operations and hospitality industry applications, innovations in automation technologies and energy-efficient designs, and adoption of smart monitoring systems and predictive maintenance capabilities for enhanced operational efficiency and productivity optimization. |

The global industrial roller iron market is estimated to be valued at USD 213.1 million in 2025.

The market size for the industrial roller iron market is projected to reach USD 378.0 million by 2035.

The industrial roller iron market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in industrial roller iron market are steam, electric and gas.

In terms of application, for industrial washing segment to command 58.7% share in the industrial roller iron market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA