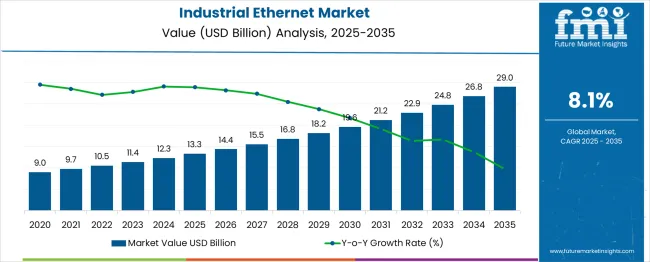

The industrial ethernet market is projected to reach 13.3 USD billion in 2025 and is anticipated to grow to 29 USD billion by 2035, registering a CAGR of 8.1% across the forecast period. A 5-year growth block analysis of the forecast data highlights distinct phases of market expansion, showing how momentum builds progressively in structured intervals. In the first 5-year block (2020–2025), the market moves from 9 USD billion to 13.3 USD billion, generating an absolute gain of 4.3 USD billion and marking a percentage growth of nearly 48%.

The second 5-year block (2025–2030) shows stronger expansion, climbing from 13.3 USD billion to 19.6 USD billion, which represents an increase of 6.3 USD billion and about 47% growth. This stage is expected to be influenced by wider integration of Ethernet protocols in industrial machinery, energy systems, and logistics infrastructure, with more enterprises shifting from legacy fieldbus to Ethernet-based architectures. The final 5-year block (2030–2035) displays the steepest rise, advancing from 19.6 USD billion to 29.0 USD billion, adding 9.4 USD billion at nearly 48% growth. This 5-year block pattern shows a market moving from steady foundational growth toward accelerated scaling, with each interval contributing a larger absolute gain and pushing the market closer to its projected 2035 value.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 13.3 billion |

| Forecast Value in (2035F) | USD 29 billion |

| Forecast CAGR (2025 to 2035) | 8% |

The industrial ethernet market has secured an estimated 30–35% share within the broader industrial communication market. This notable share stems from the rising adoption of high-speed and reliable networking solutions across process industries, discrete manufacturing plants, and automated production lines. Industrial Ethernet has been favored over traditional fieldbus systems due to its superior bandwidth, scalability, and ability to integrate operational and information technologies on a unified network. Manufacturers have increasingly turned to Ethernet-based protocols to support real-time data exchange, predictive maintenance, and machine-to-machine communication, which has elevated its position within the industrial communication landscape.

Within the industrial networking ecosystem, Industrial Ethernet has become a preferred backbone for digital factory infrastructures, offering standardized connectivity for programmable logic controllers (PLCs), human–machine interfaces (HMIs), and industrial robots. The segment’s market share has been reinforced by the push toward interconnected production environments and the demand for flexible, interoperable systems that can handle both legacy and next-generation equipment. Vendors providing comprehensive Ethernet-based solutions, including hardware, software, and network management services, have secured long-term contracts with large manufacturing firms, further consolidating the Industrial Ethernet segment’s foothold within the broader industrial communication market.

Modern manufacturing facilities require seamless connectivity between various automation components, sensors, and control systems to achieve optimal operational efficiency and productivity. Industrial Ethernet's proven capability in providing deterministic communication, real-time data transmission, and robust network performance makes it an essential infrastructure component in smart manufacturing environments.

The growing focus on predictive maintenance and condition monitoring is driving demand for Industrial Ethernet solutions that can support advanced analytics and machine learning applications. Manufacturing companies are increasingly focused on reducing downtime, optimizing asset utilization, and improving equipment effectiveness through real-time data collection and analysis. The rising influence of industrial IoT implementations and digital twin technologies is also contributing to increased product adoption across different industrial sectors and geographical regions.

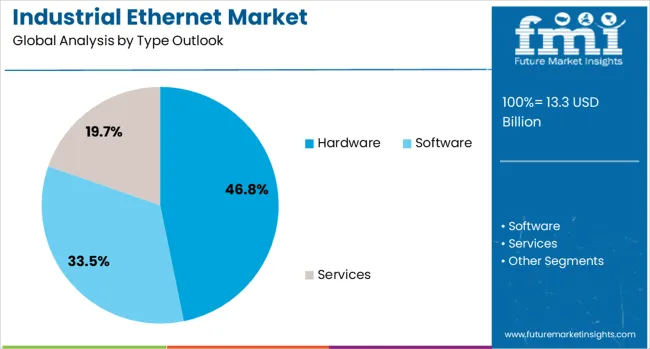

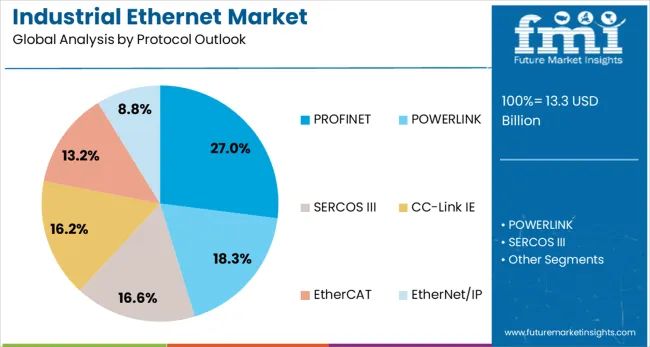

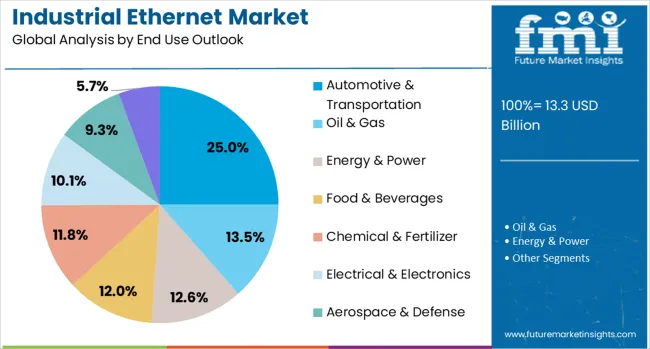

The market is segmented by type, protocol, end use, and region. By type, the market is divided into hardware, software, and services. Based on protocol, the market is categorized into PROFINET, POWERLINK, SERCOS III, CC-Link IE, EtherCAT, EtherNet/IP, and others. In terms of end use, the market is segmented into automotive & transportation, oil & gas, energy & power, food & beverages, chemical & fertilizer, electrical & electronics, aerospace & defense, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The hardware segment is projected to account for 47% of the industrial ethernet market in 2025, reaffirming its position as the category's fundamental component. Industrial facilities require robust physical infrastructure including switches, routers, gateways, and network interface cards to establish reliable Ethernet communication networks. The hardware segment forms the backbone of Industrial Ethernet implementations, enabling high-speed data transmission, network redundancy, and seamless integration with existing automation systems.

This segment dominates market share due to the essential nature of physical networking equipment in industrial environments that demand rugged, reliable, and high-performance communication infrastructure. The increasing complexity of manufacturing processes and the growing number of connected devices in industrial facilities continue to drive hardware demand. Advanced hardware solutions offer features such as managed switching capabilities, Power over Ethernet support, and industrial-grade environmental resistance, making them indispensable for modern industrial communication networks.

PROFINET is projected to represent 27% of industrial ethernet protocol demand in 2025, establishing its leadership in industrial automation communication standards. PROFINET's widespread adoption stems from its comprehensive feature set including real-time communication capabilities, integrated safety functions, and seamless integration with existing fieldbus systems. The protocol's support for both standard Ethernet and real-time industrial applications makes it particularly attractive for complex manufacturing environments requiring diverse communication requirements.

The segment benefits from strong support from major automation vendors and its adoption in automotive, process automation, and discrete manufacturing industries. PROFINET's ability to provide deterministic communication while maintaining compatibility with standard IT infrastructure positions it as a preferred choice for Industry 4.0 implementations. The protocol's continuous development and enhancement of features such as Time-Sensitive Networking (TSN) further strengthen its market position and future growth prospects.

The automotive & transportation segment is forecasted to contribute 25% of the Industrial Ethernet market in 2025, reflecting the industry's leadership in automation technology adoption and manufacturing sophistication. Automotive manufacturing facilities require highly synchronized communication networks to support complex assembly line operations, robotic systems, and quality control processes. Industrial Ethernet enables the precise coordination required for modern automotive production, including real-time control of welding robots, painting systems, and automated guided vehicles.

The segment's dominance is reinforced by the automotive industry's continuous pursuit of higher production efficiency, quality consistency, and flexibility in manufacturing processes. The growing adoption of electric vehicle production and the increasing complexity of automotive electronics are driving demand for more sophisticated communication networks. Industrial Ethernet's ability to support high-speed data transmission and deterministic communication makes it essential for next-generation automotive manufacturing facilities seeking to optimize production processes and maintain a competitive advantage.

The industrial ethernet market is growing rapidly as industries adopt connected networks to enhance communication, operational control, and reliability across manufacturing, energy, automotive, and food processing sectors. Its high-speed data transfer and real-time capabilities support seamless interaction between machines, sensors, and control systems, while ruggedized equipment ensures performance in harsh environments. Modern solutions are integrating Time-Sensitive Networking standards, enabling guaranteed latency and bandwidth for critical applications and allowing convergence of control, safety, and information networks on a single infrastructure.

The Industrial Ethernet market is experiencing rapid expansion as enterprises deploy connected networks to improve operational control. Manufacturing, energy, automotive, and food processing industries are adopting industrial ethernet to enhance communication between machines, sensors, and control systems. Its ability to support high-speed data transfer and real-time communication is increasing its presence on factory floors. Vendors offer ruggedized switches, cables, and protocols suited for harsh industrial environments. The demand is also driven by the rising need for standardized communication networks to reduce downtime and improve equipment reliability, which encourages large-scale adoption across various industrial domains seeking streamlined production workflows.

Modern industrial ethernet solutions are incorporating Time-Sensitive Networking (TSN) standards to provide guaranteed latency and bandwidth for time-critical applications while supporting standard Ethernet protocols. These technologies enable convergence of control, safety, and information networks on a single infrastructure, reducing complexity and costs. Advanced cybersecurity features including network segmentation, encryption, and intrusion detection systems are being integrated to protect industrial networks from evolving cyber threats and ensure operational security.

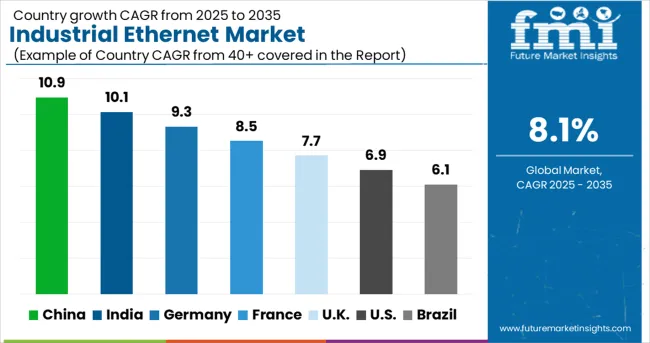

| Countries | CAGR (2025-2035) |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

| USA | 6.9% |

| Brazil | 6.1% |

The global industrial ethernet market is projected to grow at a CAGR of 8% between 2025 and 2035. China leads this expansion with a 10.9% CAGR, driven by growing automation in manufacturing, expanding industrial infrastructure, and rising demand for high-speed industrial communication networks. India follows at 10.1%, supported by increasing factory automation projects, expanding electronics production, and adoption of ethernet-based control systems. Germany shows growth at 9.3%, emphasizing advanced industrial connectivity and precision engineering. France records 8.5%, fueled by demand from automotive and aerospace sectors for reliable data networks. The UK grows at 7.7%, focusing on smart manufacturing initiatives and ethernet-enabled process control. The USA stands at 6.9%, reflecting stable demand from industrial modernization efforts, while Brazil follows at 6.1%, influenced by growing industrial digitization and adoption of ethernet infrastructure.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

Revenue from industrial ethernet in China is projected to exhibit strong growth with a CAGR of 10.9% through 2035, driven by massive industrial expansion and government initiatives promoting smart manufacturing and industrial digitalization. The country's position as the world's largest manufacturing hub creates enormous demand for reliable industrial communication infrastructure. Major multinational and domestic companies are establishing comprehensive Industrial Ethernet networks to support advanced automation systems across manufacturing facilities in key industrial regions. Government support for Made in China 2025 initiative and Industry 4.0 adoption is driving demand for advanced industrial communication systems throughout major manufacturing centers. Rapid expansion of electric vehicle production and renewable energy manufacturing is supporting Industrial Ethernet adoption for advanced automation and quality control applications.

The industrial ethernet market in India is anticipated to rise at a CAGR of 10.1% between 2025 and 2035. The country's push toward smart manufacturing and digital infrastructure is leading to a spike in Ethernet deployments across production lines. Indian enterprises are investing in advanced network architecture to handle growing data traffic from industrial robots and automated systems. Local system integrators are also collaborating with global vendors to deliver scalable solutions, which supports stronger market penetration. This trend shows a steady transition from traditional networking methods toward Ethernet-based architectures.

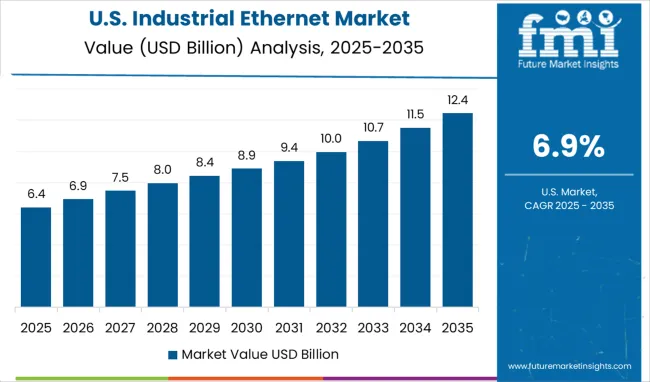

Demand for industrial ethernet in the United States is projected to grow at a CAGR of 6.9%, supported by manufacturing reshoring initiatives, industrial IoT adoption, and focus on advanced manufacturing technologies. American manufacturers are increasingly investing in digital transformation and smart manufacturing capabilities to maintain competitiveness. The market is characterized by strong demand for cybersecure, reliable industrial communication systems that support predictive maintenance and operational analytics applications. Manufacturing reshoring trends and focus on domestic production capabilities are driving investment in modern industrial infrastructure and communication systems across various industrial sectors. Growing focus on cybersecurity and operational technology protection is supporting demand for secure Industrial Ethernet solutions with advanced threat detection and network segmentation capabilities.

Revenue from industrial ethernet in Germany is projected to grow at a CAGR of 9.3% through 2035, driven by the country's leadership in Industry 4.0 implementation, advanced manufacturing technologies, and precision engineering excellence. German manufacturers consistently demand high-quality, reliable communication systems that support complex automation applications and maintain operational efficiency. Ongoing investment in research and development is supporting next-generation Industrial Ethernet solutions that combine high-speed communication with advanced security features and TSN capabilities. Collaboration between industrial automation companies and technology providers is enhancing product innovation, reinforcing Germany's position as a leader in industrial communication technology development.

The industrial ethernet market in France is estimated to grow at a CAGR of 8.5% from 2025 to 2035. French factories are deploying Ethernet networks to enhance operational visibility and reduce downtime. The push for energy efficiency and production flexibility is fueling the demand for Ethernet-enabled automation systems. Local enterprises are adopting Ethernet-based control systems to enable seamless connectivity between machines, sensors, and enterprise platforms. The government’s digitalization policies are also encouraging small and medium industries to upgrade their network infrastructure.

Revenue from industrial ethernet in the UK is projected to grow at a CAGR of 7.7% through 2035, supported by smart manufacturing initiatives, digital transformation programs, and focus on operational efficiency improvement. British manufacturers prioritize technological innovation and competitive advantage through advanced automation systems. Growing focus on manufacturing digitalization and Industrial IoT implementations is driving demand for robust industrial communication networks that support real-time monitoring and control applications. Rising focus on energy efficiency and manufacturing practices is encouraging adoption of Industrial Ethernet systems that enable precise process control and resource optimization.

The industrial ethernet in Brazil is projected to grow at a CAGR of 6.1% through 2035, supported by industrial sector expansion, foreign investment inflows, and modernization of manufacturing facilities. Brazilian manufacturers are increasingly adopting automation technologies to improve productivity and compete in global markets. Expansion in automotive, food processing, and mining industries is driving demand for reliable industrial communication systems that support complex manufacturing and process control applications. Growing focus on operational efficiency and safety improvements is supporting adoption of Industrial Ethernet solutions with advanced monitoring and diagnostic capabilities across industrial facilities.

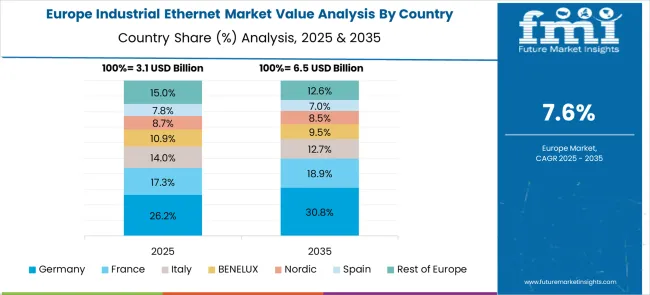

The industrial Ethernet market in Europe demonstrates mature development across major economies with Germany showing a strong presence through its advanced manufacturing sector and consumer appreciation for precision engineering and automation technologies, supported by companies leveraging industrial digitalization expertise to develop effective Industrial Ethernet solutions that enhance production efficiency and manufacturing flexibility across automotive, machinery, and process industries.

France represents a significant market driven by its industrial heritage and sophisticated understanding of automation technology, with companies pioneering advanced Industrial Ethernet implementations that combine French engineering excellence with cutting-edge communication technologies for enhanced manufacturing performance and operational optimization. The UK exhibits considerable growth through its focus on smart manufacturing and digital transformation initiatives, with companies leading the adoption of innovative Industrial Ethernet solutions and comprehensive industrial digitalization strategies.

Italy and Spain show expanding interest in manufacturing modernization solutions, particularly in Industrial Ethernet implementations targeting automotive, food processing, and machinery manufacturing sectors. BENELUX countries contribute through their focus on high-tech manufacturing and industrial practices, while Eastern Europe and Nordic regions display growing potential driven by increasing foreign direct investment in manufacturing facilities and expanding adoption of advanced automation technologies across diverse industrial applications.

The market has been witnessing consistent investments in protocol enhancement, network security architectures, and edge computing integration to address growing requirements for high-speed, reliable, and secure data transfer in industrial environments. Companies are channeling resources into developing advanced network management software, predictive maintenance tools, and unified communication platforms that enable real-time data analytics and seamless operational control. This strategic approach is driven by the need to support Industry 4.0-driven smart factories, where uninterrupted connectivity and low-latency communication are vital for automated systems, robotics, and connected machinery.

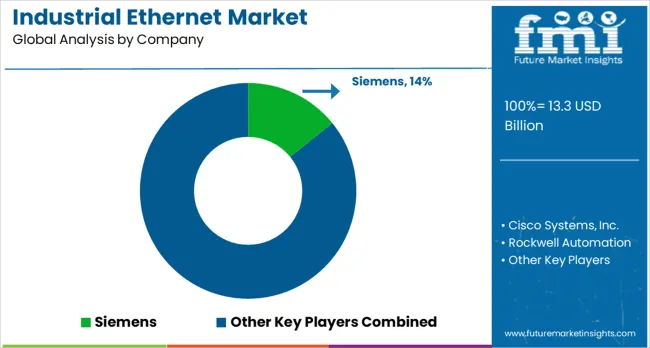

Siemens, based in Germany, dominates the market with a 14.0% global value share by offering end-to-end Industrial Ethernet solutions with a strong focus on PROFINET protocol development. Siemens integrates industrial automation hardware, software, and networking systems, enabling synchronized control and monitoring across production lines. Cisco Systems Inc., headquartered in the USA, provides enterprise-class networking products optimized for industrial environments, with a heavy focus on cybersecurity layers, network segmentation, and centralized management capabilities. Rockwell Automation delivers comprehensive automation and Ethernet/IP-based communication platforms integrated with manufacturing intelligence and analytics tools, targeting process industries and discrete manufacturing sectors.

OMRON Corporation, Japan-based, focuses on compact, modular networking solutions that blend seamlessly with its advanced automation controllers and motion systems. Moxa Inc. from Taiwan specializes in ruggedized industrial networking devices engineered for reliability in harsh operational settings like oil & gas, transportation, and energy. Phoenix Contact in Germany offers scalable industrial Ethernet switches and connectors with modular architectures supporting easy plant-level deployment. Belden Inc., USA-based, emphasizes high-speed cables, connectors, and cyber-secure data transmission solutions tailored for mission-critical industries.

ABB, headquartered in Switzerland, delivers industrial communication systems integrated with its automation portfolio, mainly targeting energy, utilities, and heavy industries. Schneider Electric in France focuses on energy-aware industrial Ethernet platforms, offering seamless integration with its automation controllers and software for digital factory environments. These companies are increasingly forming technology alliances, ecosystem partnerships, and co-development agreements to broaden their market reach, address interoperability challenges, and accelerate deployment of scalable industrial Ethernet infrastructure across global markets. This competitive drive is reinforcing innovation cycles and reshaping the global industrial networking landscape.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 13.3 billion |

| Type | Hardware, Software, Services |

| Protocol | PROFINET, POWERLINK, SERCOS III, CC-Link IE, EtherCAT, EtherNet/IP, Others |

| End Use | Automotive & Transportation, Oil & Gas, Energy & Power, Food & Beverages, Chemical & Fertilizer, Electrical & Electronics, Aerospace & Defense, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Siemens, Cisco Systems Inc., Rockwell Automation, OMRON Corporation, Moxa Inc., Phoenix Contact, Belden Inc., ABB, Schneider Electric, and Bosch Rexroth AG |

| Additional Attributes | Dollar sales by protocol type and implementation complexity, regional demand trends, competitive landscape, buyer preferences for managed versus unmanaged solutions, integration with cybersecurity and TSN technologies, innovations in edge computing integration, predictive maintenance capabilities, and industrial IoT platform compatibility |

The global industrial ethernet market is estimated to be valued at USD 13.3 billion in 2025.

The market size for the industrial ethernet market is projected to reach USD 29.0 billion by 2035.

The industrial ethernet market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in industrial ethernet market are hardware, software and services.

In terms of protocol outlook, profinet segment to command 27.0% share in the industrial ethernet market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA