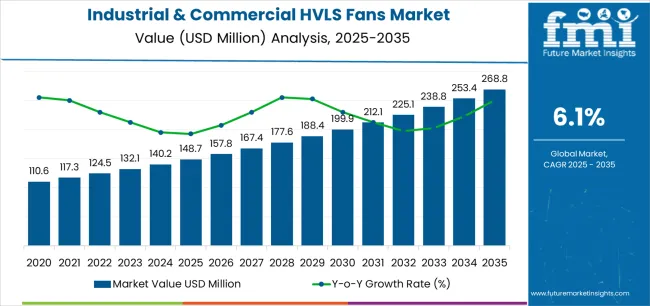

The global industrial & commercial HVLS fans market is projected to reach USD 268.8 million by 2035, recording an absolute increase of USD 565.1 million over the forecast period. The market is valued at USD 148.7 million in 2025 and is set to rise at a CAGR of 6.1% during the assessment period. The market size is expected to grow by nearly 4.8 times during the same period, supported by increasing demand for energy-efficient air circulation solutions across warehouses, manufacturing facilities, and commercial spaces worldwide, driving demand for efficient ventilation systems and increasing investments in facility climate control optimization projects globally.

Industrial and commercial HVLS fans represent large-diameter, low-speed air circulation equipment designed to move substantial air volumes through facilities requiring climate comfort and ventilation improvement. These systems feature blade diameters ranging from 5 feet to over 24 feet, rotating at slow speeds to generate column air flows that circulate throughout building volumes. The technology provides destratification benefits by mixing warm air accumulated at ceiling levels with cooler air near floor areas, reducing heating costs by 20-30% in winter months. Warehouse applications require HVLS fans that operate reliably in dusty environments while moving air throughout storage areas exceeding 100,000 square feet with minimal energy consumption compared to traditional high-velocity fan arrays.

The market expansion reflects fundamental shifts in facility management toward green operations and occupant comfort optimization across industrial sectors. Manufacturing plants adopt HVLS fans to improve worker comfort in non-conditioned facilities where traditional air conditioning proves cost-prohibitive, with air movement creating evaporative cooling effects that reduce perceived temperatures by 8-12°F without refrigeration energy consumption. Distribution centers specify HVLS installations to maintain consistent temperatures throughout picking areas, preventing hot spots that reduce worker productivity and create quality control challenges for temperature-sensitive inventory. Commercial applications including retail spaces, recreational facilities, and transportation terminals deploy HVLS fans to enhance customer comfort while reducing HVAC operating costs through improved air distribution efficiency.

Technology advancement in motor systems and blade aerodynamics enables next-generation HVLS fans with improved energy efficiency and expanded coverage areas. Direct-drive permanent magnet motors eliminate gearbox maintenance requirements while reducing energy consumption by 30-40% compared to legacy belt-driven systems. Advanced airfoil blade profiles optimized through computational fluid dynamics increase air movement effectiveness, allowing single fan installations to serve areas previously requiring multiple units. Variable frequency drive integration enables precise speed control matching ventilation requirements to occupancy patterns and ambient conditions, maximizing energy savings while maintaining comfort levels.

Facility retrofit applications demand HVLS fans that integrate with existing building infrastructure without extensive structural modifications. Mounting systems engineered for diverse roof and ceiling configurations accommodate installations in facilities with varied construction methods including pre-engineered metal buildings, tilt-up concrete warehouses, and timber frame structures. Wireless control systems enable fan operation coordination across multi-unit installations without costly control wiring infrastructure. Safety features including automatic shutdown on detection of excessive vibration or imbalance protect facility operations and comply with industrial safety standards.

Government regulations promoting energy efficiency and workplace safety accelerate HVLS fan adoption across industrial and commercial applications. Building energy codes in developed markets recognize air circulation as energy-saving strategy, offering compliance pathways crediting HVLS installations toward ventilation and thermal comfort requirements. Occupational safety standards mandate adequate ventilation in manufacturing environments, creating regulatory drivers for air circulation solutions in facilities processing materials generating airborne contaminants. Green building certification programs including LEED award points for natural ventilation enhancement strategies, incentivizing HVLS deployment in eco-friendly facility designs.

Technical challenges constrain adoption in certain facility configurations. Achieving adequate air circulation in facilities with ceiling heights below 12 feet proves difficult, as minimum clearance requirements limit HVLS effectiveness in low-bay applications. Initial capital costs ranging from $2,000-$15,000 per fan installation create barriers in cost-sensitive facility upgrade projects, despite operating cost savings justifying investments through 2-4 year payback periods. Structural capacity limitations in older facilities may require costly roof reinforcement before HVLS installation, particularly in buildings not engineered for concentrated ceiling loads exceeding 500 pounds at mounting locations.

Between 2025 and 2030, the industrial & commercial HVLS fans market is projected to expand from USD 148.7 million to USD 330.6 million, resulting in a value increase of USD 181.9 million, which represents 32.2% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for warehouse climate control and manufacturing facility ventilation improvement, product innovation in direct-drive motor technologies and IoT-enabled control systems, as well as expanding integration with building automation platforms and energy management systems. Companies are establishing competitive positions through investment in aerodynamic blade design, motor efficiency optimization, and strategic partnerships with facility management firms and industrial construction contractors.

From 2030 to 2035, the market is forecast to grow from USD 330.6 million to USD 268.8 million, adding another USD 383.2 million, which constitutes 67.8% of the ten-year expansion. This period is expected to be characterized by the expansion of specialized fan configurations, including ultra-large diameter models for mega-warehouses and compact designs for commercial applications with space constraints, strategic collaborations between HVLS manufacturers and building equipment suppliers, and an enhanced focus on noise reduction and aesthetic integration. The growing emphasis on green building operations and worker wellness will drive demand for advanced, high-efficiency HVLS fan solutions across diverse industrial and commercial facility applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 148.7 million |

| Market Forecast Value (2035) | USD 713.8 million |

| Forecast CAGR (2025-2035) | 6.1% |

The industrial & commercial HVLS fans market grows by enabling facility operators to achieve superior air circulation and energy efficiency while meeting climate comfort requirements across large-volume spaces. Building managers face mounting pressure to reduce energy consumption and improve occupant comfort, with HVLS fan solutions typically providing 20-30% reduction in heating costs through destratification compared to facilities without air circulation systems, making large-diameter air movement technologies essential for facility operations. The energy efficiency movement creates demand for ventilation solutions that can deliver comfort improvements across warehouse and manufacturing environments while maintaining operating costs below traditional HVAC system alternatives.

Government initiatives promoting energy conservation and workplace safety drive adoption in warehouses, manufacturing, and commercial applications, where air circulation quality has a direct impact on worker productivity and facility operating expenses. The global shift toward green building operations accelerates HVLS fan demand as facility managers seek proven technologies that reduce carbon footprints while improving environmental conditions for occupants and inventory. Structural capacity limitations in retrofit applications and upfront capital cost considerations may constrain adoption rates among older facilities and budget-limited operations managing tight capital expenditure approvals.

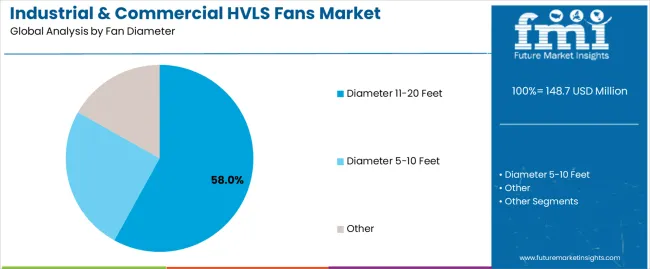

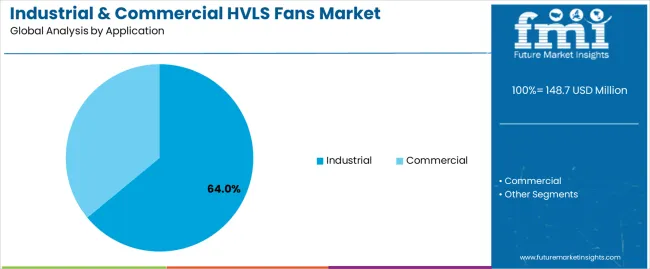

The market is segmented by fan diameter, application, and region. By fan diameter, the market is divided into diameter 5-10 feet, diameter 11-20 feet, and others. Based on application, the market is categorized into industrial and commercial. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

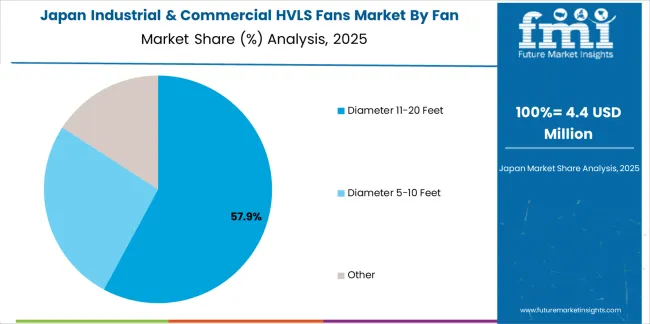

The diameter 11-20 feet segment represents the dominant force in the industrial & commercial HVLS fans market, capturing approximately 58.0% of total market share in 2025. This advanced category encompasses mid-size HVLS configurations optimized for typical warehouse ceiling heights between 20-35 feet and coverage areas ranging from 15,000-25,000 square feet per fan unit, delivering comprehensive air circulation with balanced capital cost and performance characteristics. The diameter 11-20 feet segment leads through its optimal coverage efficiency for standard warehouse and manufacturing facility layouts, proven reliability across diverse industrial applications, and compatibility with typical building structural capacity without requiring roof reinforcement.

The diameter 5-10 feet segment maintains a substantial 28.0% market share, serving applications requiring smaller coverage areas through compact installations suitable for commercial retail spaces, restaurant environments, and light industrial facilities. Other diameter configurations collectively account for 14.0% market share, featuring ultra-large fans exceeding 20 feet diameter for mega-warehouse applications and specialized designs.

Key advantages driving the diameter 11-20 feet segment include optimal air movement effectiveness covering standard facility bay spacing between 40-60 feet matching typical warehouse construction, balanced energy consumption achieving comfort goals at 0.5-1.5 kW power draw per unit, structural compatibility mounting to conventional roof systems without extensive reinforcement requirements, and established manufacturing scale supporting competitive pricing in the $3,000-$8,000 range enabling broad market accessibility across facility types.

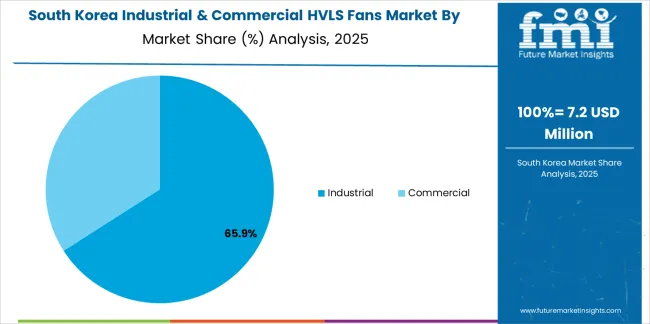

Industrial applications dominate the industrial & commercial HVLS fans market with approximately 64.0% market share in 2025, reflecting the extensive deployment across warehouses, manufacturing plants, and distribution centers requiring large-volume air circulation for worker comfort and process environment control. The industrial segment leads through deployment in logistics facilities managing temperature-sensitive inventory, manufacturing operations requiring dust and fume dispersion, and assembly plants improving worker comfort in non-conditioned production areas.

The commercial segment represents 36.0% market share through applications in retail spaces, recreational facilities, agricultural buildings, and transportation terminals. This segment benefits from increasing focus on customer comfort in large-volume commercial spaces and growing adoption in specialty applications including airplane hangars and exhibition halls.

Key market dynamics supporting application preferences include industrial facilities requiring robust construction withstanding harsh environments including dust, moisture, and temperature extremes, commercial applications emphasizing aesthetic integration with architectural design and noise level minimization, warehouse and distribution center growth driven by e-commerce expansion creating base load demand for climate control solutions, and manufacturing sector investment in worker safety and productivity improvement incentivizing comfort enhancement technologies that maintain performance without air conditioning capital and operating costs.

The market is driven by three concrete demand factors tied to facility operations and objectives. First, e-commerce warehouse expansion creates increasing requirements for climate control systems, with global logistics facility construction adding 50-70 million square meters annually requiring air circulation solutions to maintain worker comfort and inventory quality standards. Second, energy cost pressures drive operational efficiency improvements, with facility managers targeting 15-25% HVAC cost reduction through HVLS fan destratification benefits that reduce heating demand while improving summer cooling effectiveness through enhanced evaporative cooling. Third, worker productivity optimization requires comfort maintenance in non-conditioned facilities, with documented studies showing 3-8% productivity improvements in manufacturing environments implementing adequate air circulation compared to stagnant air conditions.

Market restraints include structural capacity limitations affecting retrofit installations in older facilities, particularly in buildings constructed before 1980 with roof systems not engineered for concentrated ceiling loads from HVLS equipment weighing 300-600 pounds. Capital cost barriers pose adoption challenges in cost-sensitive facility upgrades, as HVLS installations requiring $3,000-$15,000 per unit compete with limited capital budgets despite favorable operating cost economics. Technical effectiveness limitations in low-ceiling applications create additional constraints, since facilities with ceiling heights below 12 feet cannot achieve adequate air circulation coverage due to minimum clearance requirements restricting HVLS deployment effectiveness.

Key trends indicate accelerated adoption in Asia Pacific markets, particularly China and India where rapid industrialization and logistics infrastructure development drive warehouse construction requiring climate control solutions. Technology advancement trends toward IoT-enabled monitoring systems providing remote operation and predictive maintenance capabilities, ultra-efficient permanent magnet motors reducing energy consumption by 40-50% compared to conventional designs, and modular blade systems enabling field serviceability without complete fan removal enable next-generation facility management. The market faces potential disruption if advanced HVAC technologies including displacement ventilation or radiant cooling systems achieve cost-effectiveness sufficient to compete with HVLS solutions in applications currently driving market growth.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| Brazil | 6.4% |

| USA | 5.8% |

| UK | 5.2% |

| Japan | 4.5% |

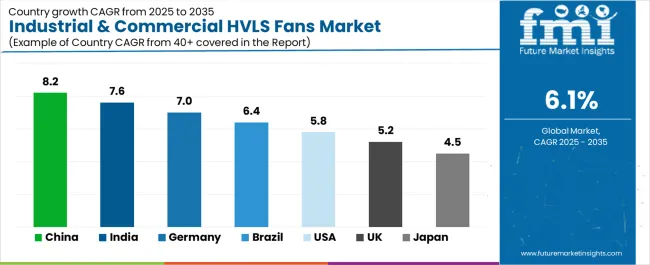

The industrial & commercial HVLS fans market is gaining momentum worldwide, with China taking the lead thanks to aggressive logistics infrastructure expansion and manufacturing facility modernization programs. Close behind, India benefits from warehouse development initiatives and industrial growth, positioning itself as a strategic growth hub in the Asia Pacific region. Germany shows strong advancement, where established manufacturing sector and warehouse automation strengthen its role in European facility equipment supply chains.

The USA demonstrates robust growth through e-commerce logistics expansion and industrial facility upgrades, signaling continued investment in energy-efficient building systems. Meanwhile, Japan stands out for its advanced manufacturing focus and facility technology integration with precision control systems, while UK continues to record consistent progress driven by warehouse development and commercial facility modernization. Together, China and India anchor the global expansion story, while established markets build stability and technical sophistication into the market growth path.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

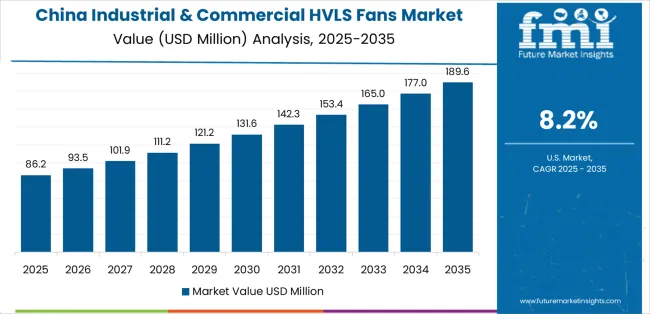

China demonstrates the strongest growth potential in the Industrial & Commercial HVLS Fans Market with a CAGR of 8.2% through 2035. The country leads through comprehensive logistics infrastructure expansion, manufacturing facility modernization, and warehouse construction growth driving adoption of energy-efficient air circulation technologies. Growth is concentrated in major industrial regions, including Jiangsu, Guangdong, Zhejiang, and Shandong, where warehouse developers and manufacturing facilities are implementing climate control improvement programs for operational efficiency and worker comfort.

Distribution channels through building equipment distributors, facility management contractors, and direct developer relationships expand deployment across e-commerce logistics centers, manufacturing plants, and agricultural processing facilities. The country's emphasis on energy efficiency in building operations provides policy support for HVLS technology adoption, while rapid warehouse construction supporting domestic consumption growth creates demand for air circulation systems.

Key market factors:

In the Maharashtra, Gujarat, Tamil Nadu, and Haryana industrial regions, the adoption of industrial & commercial HVLS fan systems is accelerating across warehouse facilities, manufacturing plants, and agricultural processing centers, driven by infrastructure development initiatives and increasing focus on worker comfort standards. The market demonstrates strong growth momentum with a CAGR of 7.6% through 2035, linked to comprehensive logistics sector development and increasing emphasis on energy-efficient facility operations.

Indian warehouse operators and manufacturers are implementing HVLS ventilation systems and climate control optimization to improve working conditions while managing energy costs in facilities without full air conditioning systems. The country's logistics infrastructure development programs create demand for warehouse air circulation solutions, while increasing emphasis on manufacturing competitiveness drives adoption of worker comfort technologies improving productivity.

Germany's advanced manufacturing sector demonstrates sophisticated implementation of industrial & commercial HVLS fan systems, with documented case studies showing 22-28% energy cost reduction through optimized air circulation in production facilities. The country's industrial facility infrastructure in major manufacturing regions, including North Rhine-Westphalia, Bavaria, Baden-Württemberg, and Lower Saxony, showcases integration of HVLS technologies with existing building management systems, leveraging expertise in energy efficiency and facility automation. German facility operators emphasize system reliability and energy performance, creating demand for premium HVLS sources that support long-term operational efficiency and commitments. The market maintains strong growth through focus on manufacturing excellence and logistics sector development, with a CAGR of 7.0% through 2035.

Key development areas:

The Brazilian market leads in warehouse infrastructure development based on integration with agricultural processing and consumer goods distribution driving demand for facility climate control systems. The country shows solid potential with a CAGR of 6.4% through 2035, driven by logistics sector expansion and manufacturing facility investment across major industrial regions, including São Paulo, Minas Gerais, Paraná, and Rio Grande do Sul.

Brazilian warehouse operators are adopting HVLS systems for compliance with worker comfort requirements in non-conditioned facilities, particularly in applications serving agricultural product handling and in manufacturing environments requiring ventilation improvement. Technology deployment channels through building equipment distributors, facility contractors, and direct operator relationships expand coverage across diverse industrial and commercial applications.

Leading market segments:

The USA market leads in HVLS technology adoption based on integration with e-commerce logistics expansion and sophisticated facility management practices for operational optimization. The country shows solid potential with a CAGR of 5.8% through 2035, driven by warehouse construction growth and manufacturing facility upgrades across major logistics regions, including the Midwest distribution corridor, Southeast industrial clusters, Southwest logistics hubs, and Pacific Coast port facilities. American facility operators are adopting advanced HVLS systems for compliance with energy efficiency objectives in warehouse operations, particularly in temperature-controlled distribution centers and in manufacturing plants requiring worker comfort without full air conditioning. Technology deployment channels through building equipment distributors, mechanical contractors, and direct facility relationships expand coverage across industrial and commercial applications.

Leading market segments:

The UK market demonstrates sophisticated implementation focused on logistics facility development and manufacturing plant modernization, with documented integration of HVLS systems achieving energy cost reduction in warehouse and production environments. The country maintains steady growth momentum with a CAGR of 5.2% through 2035, driven by e-commerce warehouse expansion and industrial facility upgrade programs aligned with energy efficiency targets. Major logistics development regions, including Midlands distribution corridors, Southeast warehouse clusters, and Northern industrial areas, showcase advanced facility implementations where HVLS programs integrate seamlessly with existing building systems and energy management protocols.

Key market characteristics:

In Tokyo, Osaka, Aichi, and Kanagawa industrial regions, manufacturers are implementing industrial & commercial HVLS fan programs to enhance facility environments and meet worker comfort requirements, with documented case studies showing integration in automotive production facilities and precision manufacturing plants. The market shows solid growth potential with a CAGR of 4.5% through 2035, linked to Japanese manufacturing industry quality standards, facility management sophistication, and emphasis on operational efficiency optimization. Japanese facility operators are adopting specialized HVLS technologies and advanced control integration to maintain environmental standards while achieving energy efficiency targets through optimized air circulation strategies.

Market development factors:

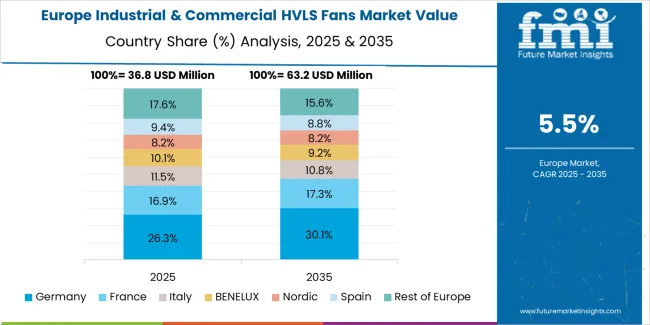

The industrial & commercial HVLS fans market in Europe is projected to grow from USD 41.2 million in 2025 to USD 186.2 million by 2035, registering a CAGR of 16.3% over the forecast period. Germany is expected to maintain its leadership position with a 32.8% market share in 2025, declining slightly to 32.2% by 2035, supported by its advanced manufacturing sector and major logistics infrastructure including Ruhr Valley industrial clusters and Rhine corridor distribution centers. France follows with a 19.5% share in 2025, projected to reach 19.8% by 2035, driven by comprehensive logistics development programs and manufacturing facility modernization initiatives.

The United Kingdom holds a 17.2% share in 2025, expected to decrease to 16.8% by 2035 through established warehouse operations and industrial facility upgrade programs. Italy commands a 12.5% share, while Spain accounts for 9.0% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 9.0% to 9.7% by 2035, attributed to increasing HVLS adoption in Nordic countries and emerging Eastern European warehouse development implementing energy-efficient facility systems.

The Japanese industrial & commercial HVLS fans market demonstrates a mature and technology-focused landscape, characterized by sophisticated integration of variable frequency drive systems and building automation platforms with existing manufacturing facility infrastructure across automotive production, precision manufacturing, and logistics operations. Japan's emphasis on operational efficiency and environmental quality drives demand for advanced HVLS solutions that support facility management objectives and worker comfort standards in demanding industrial applications.

The market benefits from strong partnerships between international HVLS suppliers and domestic facility management companies including major manufacturing operations, creating comprehensive technology ecosystems that prioritize system integration and performance optimization. Manufacturing centers in Aichi, Osaka, Kanagawa, and other major industrial regions showcase advanced facility implementations where HVLS systems achieve precise environmental control while maintaining energy efficiency targets essential for ecological operations.

The South Korean industrial & commercial HVLS fans market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive installation services and technical integration capabilities for manufacturing and logistics applications. The market demonstrates increasing emphasis on facility automation and energy management optimization, as Korean manufacturers and logistics operators increasingly demand advanced HVLS systems that integrate with domestic building management infrastructure and sophisticated control platforms deployed across industrial facilities.

Regional building equipment suppliers are gaining market share through strategic partnerships with international HVLS manufacturers, offering specialized services including Korean building code compliance support and application-specific installation programs for manufacturing and warehouse operations. The competitive landscape shows increasing collaboration between multinational equipment companies and Korean facility management specialists, creating hybrid service models that combine international HVLS expertise with local facility integration knowledge and building system requirements.

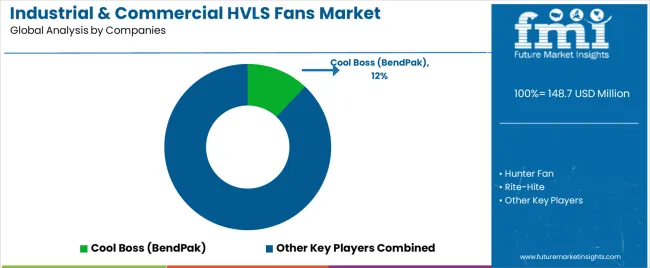

The industrial & commercial HVLS fans market features approximately 30-35 meaningful players with moderate fragmentation, where the top three companies control roughly 30-35% of global market share through established distribution networks and comprehensive product portfolios. Competition centers on motor efficiency, blade aerodynamics, and installation service quality rather than price competition alone. Cool Boss (BendPak) leads with approximately 12.0% market share through its comprehensive HVLS portfolio spanning diverse facility applications with proven reliability.

Market leaders include Cool Boss (BendPak), Hunter Fan, and Rite-Hite, which maintain competitive advantages through decades of air circulation experience, established distribution infrastructure serving industrial and commercial markets, and deep expertise in facility ventilation applications, creating trust and reliability advantages with warehouse operators and manufacturing facility managers. These companies leverage engineering capabilities in aerodynamic optimization and motor efficiency alongside ongoing installation support networks to defend market positions while expanding into emerging markets and specialty applications.

Challengers encompass Airmax Fans and Global Industrial, which compete through specialized product configurations and strong distribution presence in key facility equipment markets. Product specialists, including Refresh Fans, SUNON, and Patterson Fan, focus on specific diameter ranges or application segments, offering differentiated capabilities in compact commercial designs, ultra-large industrial configurations, and agricultural facility solutions.

Regional players and emerging HVLS manufacturers create competitive pressure through localized production advantages and competitive pricing strategies, particularly in high-growth markets including China and India, where domestic manufacturers provide advantages in delivery lead times and responsive technical support. Market dynamics favor companies that combine reliable product performance with comprehensive installation services and ongoing maintenance support addressing the complete facility air circulation needs from initial system design through operational optimization and long-term service.

Industrial & commercial HVLS fans represent critical facility systems that enable operators to achieve 20-30% reduction in heating costs through destratification compared to facilities without air circulation, delivering superior energy efficiency and occupant comfort with validated effectiveness in demanding warehouse and manufacturing applications. With the market projected to grow from USD 148.7 million in 2025 to USD 713.8 million by 2035 at a 6.1% CAGR, these air circulation technologies offer compelling advantages for industrial applications (64.0% market share), commercial (36.0% share), and facility operators seeking energy cost reduction with proven comfort improvement capabilities. Scaling market adoption and technology advancement requires coordinated action across HVLS manufacturers, facility developers, building equipment distributors, energy efficiency advocates, and green building investment capital.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 148.7 million |

| Fan Diameter | Diameter 5-10 Feet, Diameter 11-20 Feet, Others |

| Application | Industrial, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Cool Boss (BendPak), Hunter Fan, Rite-Hite, Airmax Fans, Global Industrial, Refresh Fans, SUNON, Patterson Fan, Humongous Fan, ASSA ABLOY |

| Additional Attributes | Dollar sales by fan diameter and application categories, regional adoption trends across Asia Pacific, North America, and Europe, competitive landscape with HVLS manufacturers and facility equipment distributors, installation requirements and structural specifications, integration with building automation systems and energy management programs, innovations in motor technologies and blade aerodynamics, and development of specialized configurations with enhanced efficiency and coverage capabilities. |

The global industrial & commercial HVLS fans market is estimated to be valued at USD 148.7 million in 2025.

The market size for the industrial & commercial HVLS fans market is projected to reach USD 268.8 million by 2035.

The industrial & commercial HVLS fans market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in industrial & commercial HVLS fans market are diameter 11-20 feet , diameter 5-10 feet and other.

In terms of application, industrial segment to command 64.0% share in the industrial & commercial HVLS fans market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Industrial Floor Mat Market Forecast Outlook 2025 to 2035

Industrial Process Water Coolers Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA