The industrial dust detector instruments market is valued at USD 639.2 million in 2025 and is projected to reach USD 1,081.5 million by 2035, advancing at a CAGR of 5.4%. Growth is driven by the rising demand for occupational safety compliance, increasing environmental protection initiatives, and expanding industrial sectors that require real-time particulate monitoring. Industrial dust detectors are critical for maintaining air quality, ensuring worker safety, and complying with stringent regulations across industries such as cement, steel, mining, chemical processing, and power generation. These instruments help monitor hazardous particulate levels, providing reliable data collection for workplace safety and environmental management.

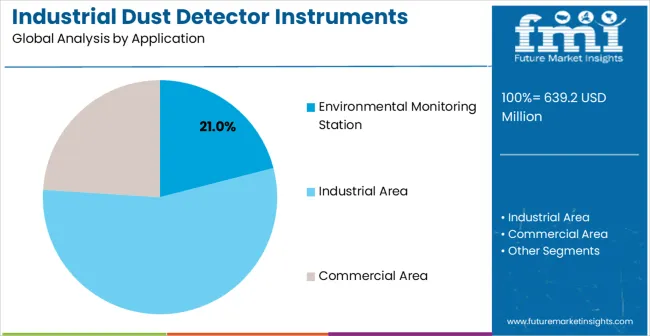

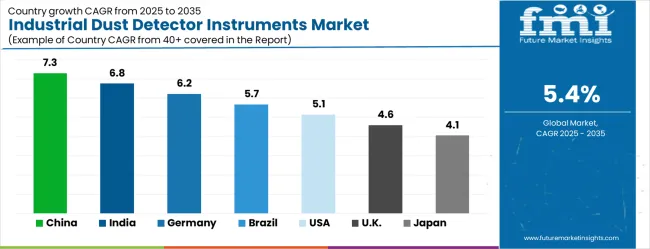

Portable dust detector instruments account for the largest share, representing 45% of the market, due to their flexibility, mobility, and ease of deployment in diverse industrial environments. Industrial area applications dominate demand, contributing 55% of the market share as manufacturing and heavy industries increasingly adopt dust monitoring solutions for safety and regulatory compliance. The growth is especially strong in Asia Pacific, led by China (7.3% CAGR) and India (6.8% CAGR), driven by rapid industrialization, growing investments in safety infrastructure, and government-backed environmental protection programs. In contrast, North America and Europe exhibit steady demand, supported by established industrial safety standards and regulatory enforcement.

The regulatory landscape is another key factor driving the growth of the market. Governments around the world are introducing stricter guidelines for air quality and dust emissions, particularly in high-risk industries. These regulations are prompting industries to adopt dust detection systems to monitor air quality and ensure compliance with local and international standards. Industries such as construction, mining, and chemicals, which often generate high levels of dust, are particularly impacted by these regulations and are increasingly turning to industrial dust detector instruments to maintain compliance. The rising pressure to avoid fines, legal repercussions, and reputational damage is further accelerating market adoption.

Opportunities in the market remain strong, particularly as the demand for sustainable industrial practices and employee health and safety continues to rise. The adoption of dust detection systems is expected to increase in emerging markets as industrialization accelerates, and companies invest in modern monitoring solutions to ensure safe and efficient operations. Furthermore, the ongoing development of low-cost, high-performance dust monitoring devices, as well as the integration of artificial intelligence (AI) and machine learning for advanced data analysis, presents exciting growth prospects for the market.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 639.2 million |

| Forecast Value in (2035F) | USD 1,081.5 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

Market expansion is being supported by the increasing global demand for occupational safety compliance and the corresponding need for advanced monitoring solutions that can maintain workplace air quality while providing real-time alerts and data logging across various industrial applications and safety requirements. Modern industrial facilities are increasingly focused on implementing monitoring systems that can detect hazardous particulate levels, minimize health risks, and provide consistent data collection for regulatory compliance and safety management programs. Industrial dust detector instruments' proven ability to deliver accurate measurements, reliable operation, and comprehensive monitoring capabilities make them essential components for contemporary workplace safety and environmental compliance solutions.

The growing emphasis on environmental protection and public health safety is driving demand for dust detector instruments that can support emission monitoring, air quality assessment, and pollution control in industrial operations and surrounding communities. Industrial safety managers' preference for monitoring systems that combine real-time detection with data logging and alarm capabilities is creating opportunities for innovative dust detection implementations. The rising influence of regulatory enforcement and insurance requirements for workplace safety monitoring is also contributing to increased adoption of dust detector instruments that can provide documented compliance and risk management without compromising operational efficiency or worker productivity.

The industrial dust detector instruments market represents a critical workplace safety and environmental monitoring opportunity driven by stringent regulatory compliance requirements, expanding manufacturing sectors, and growing awareness of occupational health risks. As industrial facilities worldwide face increasing pressure to maintain air quality standards, provide real-time particulate monitoring, and ensure worker safety compliance, dust detection instruments are evolving from basic measurement tools to intelligent, connected safety management systems.

The convergence of environmental regulations enforcement, Industry 4.0 adoption, and IoT-enabled monitoring technologies creates sustained demand drivers across multiple industrial sectors. Geographic expansion opportunities are particularly pronounced in Asia-Pacific markets, where China (7.3% CAGR) and India (6.8% CAGR) lead global growth through rapid industrialization, manufacturing expansion, and government-backed environmental protection initiatives.

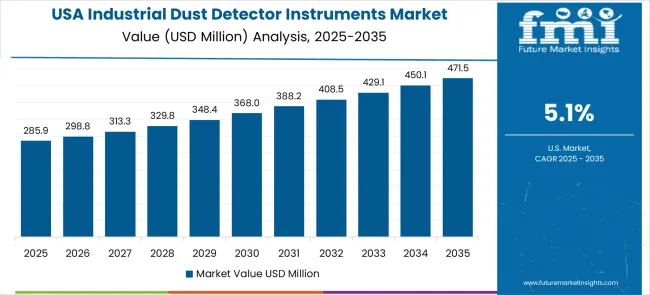

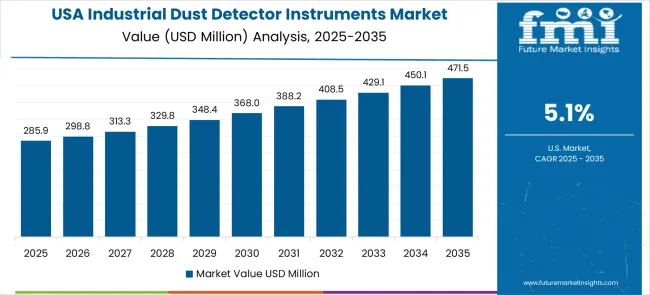

Technology differentiation through IoT connectivity, artificial intelligence integration, and predictive analytics enables premium positioning. At the same time, application diversification beyond the dominant industrial area segment (55.0% market share) into environmental monitoring stations and commercial applications opens new revenue streams. The market's growth from USD 639.2 million in 2025 to USD 1,081.5 million by 2035 reflects fundamental shifts toward comprehensive workplace safety management and automated environmental compliance systems.

Rapid industrial development across China (7.3% CAGR) and India (6.8% CAGR) creates substantial expansion opportunities through government environmental protection programs, manufacturing sector growth, and stringent workplace safety regulation enforcement. Growing industrial infrastructure, foreign investment in manufacturing facilities, and mandatory environmental compliance create sustained demand for comprehensive dust monitoring solutions. Market entry strategies focusing on local partnerships, regulatory compliance expertise, and cost-effective monitoring systems unlock penetration in price-sensitive markets while building scale for premium technology deployment. Expected revenue pool: USD 120-170 million

Integration of Internet of Things technologies, artificial intelligence, and cloud-based data analytics transforms traditional dust detectors into intelligent monitoring ecosystems capable of predictive maintenance, automated compliance reporting, and real-time facility management. This pathway encompasses wireless connectivity, remote monitoring capabilities, predictive analytics, and integration with comprehensive facility management systems. Premium positioning reflects enhanced operational efficiency and regulatory compliance automation, enabling subscription-based services and ongoing revenue generation through data analytics and thorough safety management platforms. Expected revenue pool: USD 95-140 million

Strengthening the dominant portable dust detector segment (45.0% market share) through advanced sensor technologies, enhanced mobility features, multi-location monitoring capabilities, and specialized configurations for diverse industrial applications. This pathway focuses on operational flexibility, rapid deployment capabilities, and comprehensive measurement accuracy across challenging industrial environments. Market leadership consolidation through superior engineering, extended battery life, rugged design features, and extensive calibration services enables premium pricing while defending market position against fixed installation alternatives. Expected revenue pool: USD 80-120 million

Expansion beyond industrial areas (55.0% share) into environmental monitoring stations and commercial applications requiring specialized air quality assessment, pollution control monitoring, and public health protection. This pathway addresses growing ecological consciousness, urban air quality concerns, and commercial building safety requirements with advanced detection capabilities and regulatory compliance features. Environmental monitoring applications command premium pricing reflecting scientific accuracy requirements and long-term reliability standards necessary for regulatory reporting and public health protection. Expected revenue pool: USD 65-95 million

Development of comprehensive safety management systems combining dust detection with automated compliance reporting, risk assessment capabilities, and integrated workplace safety protocols. This pathway addresses complex regulatory requirements through automated documentation, real-time alert systems, and comprehensive safety data management. Premium positioning reflects regulatory expertise, automated compliance features, and thorough safety management capabilities that reduce administrative burden while ensuring consistent regulatory adherence and risk mitigation across diverse industrial applications. Expected revenue pool: USD 50-75 million

Investment in next-generation sensor technologies, precision measurement capabilities, and specialized detection algorithms addressing challenging industrial environments, hazardous material monitoring, and ultra-fine particulate detection. This pathway encompasses scientific-grade accuracy, specialized dangerous material detection, and advanced calibration capabilities meeting stringent laboratory and research requirements. Technology leadership through superior measurement accuracy, specialized applications, and comprehensive technical support enables premium pricing for high-precision applications requiring certified measurement standards. Expected revenue pool: USD 45-70 million

Transformation from equipment sales to service-centric solutions, including calibration services, maintenance contracts, training programs, regulatory consulting, and monitoring-as-a-service models, addressing technical complexity and regulatory compliance challenges. This pathway leverages specialized expertise requirements to create recurring revenue streams while reducing customer technical burden and compliance risks. Comprehensive service offerings, including predictive maintenance, regulatory updates, and technical support, enable higher customer lifetime values and market differentiation through service excellence and regulatory expertise. Expected revenue pool: USD 35-60 million

The market is segmented by Product Type, application, and region. By Product Type, the market is divided into portable dust detector instruments, desktop dust detector instruments, and online dust detector instruments. Based on application, the market is categorized into environmental monitoring stations, industrial areas, and commercial areas. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The portable dust detector instruments segment is projected to account for 45% of the industrial dust detector instruments market in 2025, reaffirming its position as the leading Product Type category. Industrial safety professionals increasingly utilize portable detection systems for their mobility advantages, flexible deployment capabilities, and convenience in multi-location monitoring applications across construction sites, manufacturing facilities, mining operations, and temporary work environments. Portable dust detector technology's advanced sensor capabilities and consistent measurement accuracy directly address the industrial requirements for versatile monitoring solutions and operational flexibility in diverse working conditions.

This Product Type segment forms the foundation of modern workplace safety operations, as it represents the monitoring solution with the greatest adaptability and established market demand across multiple industrial categories and safety applications. Safety manager investments in portable monitoring equipment and training programs continue to strengthen adoption among industrial organizations. With facilities prioritizing comprehensive safety coverage and flexible monitoring capabilities, portable dust detectors align with both operational efficiency objectives and regulatory compliance preferences, making them the central component of comprehensive workplace safety monitoring strategies.

Industrial area applications are projected to represent 55% of the demand for industrial dust detector instruments in 2025, underscoring their critical role as the primary commercial consumers of advanced monitoring solutions for manufacturing, processing, and heavy industrial operations requiring continuous air quality surveillance. Industrial facility managers prefer dust detection systems for their reliability, comprehensive monitoring coverage, and ability to support large-scale operations while maintaining regulatory compliance and worker safety standards. Positioned as essential infrastructure for modern industrial safety management, dust detector instruments offer both operational advantages and compliance benefits.

The segment is supported by continuous innovation in industrial monitoring technologies and the growing availability of integrated safety management systems that enable comprehensive facility monitoring with enhanced data collection and analysis capabilities. Additionally, industrial facilities are investing in automated monitoring solutions to support large-scale safety programs and regulatory reporting requirements. As industrial safety regulations become more stringent and workplace protection requirements increase, industrial area applications will continue to dominate the end-user market while supporting advanced safety management protocols and comprehensive risk mitigation strategies.

The industrial dust detector instruments market is advancing steadily due to increasing consumer demand for workplace safety compliance and growing adoption of advanced monitoring technologies that provide real-time particulate detection and enhanced regulatory compliance across diverse industrial applications. However, the market faces challenges, including high equipment costs, calibration and maintenance requirements, and the need for specialized technical expertise and training for proper operation. Innovation in wireless connectivity and IoT integration continues to influence product development and market expansion patterns.

The growing adoption of Internet of Things technologies and cloud-based data analytics is enabling industrial facilities to deploy comprehensive dust monitoring networks with real-time data transmission, predictive maintenance alerts, and centralized monitoring dashboard capabilities. Advanced IoT integration provides improved operational efficiency while allowing remote monitoring and automated compliance reporting across multiple facility locations and monitoring points. Industrial organizations are increasingly recognizing the competitive advantages of connected monitoring systems for operational optimization and enhanced safety management beyond traditional standalone detection devices.

Modern dust detector manufacturers are incorporating intelligent sensor technologies and machine learning algorithms to enhance detection accuracy, reduce false alarms, and provide predictive maintenance capabilities that optimize system performance and reduce operational costs. These technologies improve monitoring reliability while enabling new applications, including predictive air quality management and automated ventilation system control based on real-time particulate levels. Advanced smart sensor integration also allows facilities to support comprehensive safety automation and data-driven decision making beyond traditional manual monitoring approaches.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| Brazil | 5.7% |

| USA | 5.1% |

| United Kingdom | 4.6% |

| Japan | 4.1% |

The industrial dust detector instruments market is experiencing steady growth globally, with China leading at a 7.3% CAGR through 2035, driven by the expanding manufacturing sector, growing investment in industrial safety infrastructure, and significant government enforcement of environmental protection regulations. India follows at 6.8%, supported by large-scale industrial development, growing occupational safety awareness, and increasing investment in workplace health and safety monitoring systems. The USA shows growth at 5.1%, emphasizing advanced monitoring technology development and stringent regulatory compliance requirements. Brazil records 5.7%, focusing on industrial safety modernization and growing environmental monitoring requirements. Germany demonstrates 6.2% growth, prioritizing precision monitoring technology and comprehensive industrial safety standards. The United Kingdom exhibits 4.6% growth, emphasizing workplace safety innovation and regulatory compliance systems. Japan shows 4.1% growth, supported by an established industrial safety culture and advanced monitoring technology development.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Demand for industrial dust detector instruments in China is projected to exhibit strong growth with a CAGR of 7.3% through 2035, driven by expanding manufacturing infrastructure and rapidly growing industrial safety regulation enforcement supported by government environmental protection initiatives and comprehensive workplace safety development programs. The country's massive industrial production and increasing investment in safety monitoring technologies are creating substantial demand for advanced detection solutions. Major industrial equipment manufacturers and safety technology companies are establishing comprehensive dust detection capabilities to serve both domestic industrial development and international export markets.

Revenue from industrial dust detector instruments in India is expanding at a CAGR of 6.8%, supported by the country's large-scale industrial expansion, growing workplace safety awareness, and increasing investment in occupational health monitoring systems focusing on worker protection and regulatory compliance enhancement. The country's comprehensive industrial growth and modernization of safety practices are driving demand for sophisticated monitoring capabilities. International safety equipment companies and domestic technology providers are establishing extensive distribution and service capabilities to address the growing demand for industrial safety monitoring solutions.

The industrial dust detector instrument market in the United States is expanding at a CAGR of 5.1%, supported by the country's advanced industrial safety standards, strong emphasis on technological innovation, and robust regulatory enforcement requiring comprehensive workplace monitoring and environmental compliance. The nation's mature industrial sector and sophisticated safety management practices are driving advanced dust detection adoption throughout major industrial operations. Leading safety equipment companies and technology providers are investing extensively in premium monitoring solutions and advanced detection technologies to serve both domestic and international markets that adhere to safety standards.

The industrial dust detector instrument market in Brazil is growing at a CAGR of 5.7%, driven by expanding industrial safety modernization, increasing environmental monitoring requirements, and growing investment in workplace protection systems focusing on regulatory compliance and worker health protection. The country's developing industrial infrastructure and modernization of safety practices are supporting demand for advanced monitoring technologies across major industrial centers. Safety equipment distributors and industrial technology companies are establishing comprehensive service programs to serve both domestic industrial development and regional safety standard improvement initiatives.

Revenue from industrial dust detector instruments in Germany is expanding at a CAGR of 6.2%, supported by the country's strong industrial safety culture, advanced precision monitoring technology development, and strategic focus on comprehensive workplace protection requiring sophisticated detection and measurement capabilities. Germany's established engineering expertise and emphasis on safety excellence are driving demand for premium monitoring solutions focusing on accuracy, reliability, and comprehensive safety management integration. Technology companies are investing in comprehensive development capabilities to serve both domestic industrial safety requirements and European market leadership with advanced monitoring systems.

The industrial dust detector instrument market in the United Kingdom is growing at a CAGR of 4.6%, driven by the country's innovative workplace safety sector, comprehensive regulatory compliance requirements, and strong emphasis on occupational health protection, focusing on advanced monitoring and risk management solutions. The UK's established safety industry and regulatory expertise are supporting investment in sophisticated monitoring systems throughout major industrial and commercial centers. Safety technology companies are establishing comprehensive development programs to serve both domestic workplace protection requirements and international safety standard development with innovative monitoring solutions.

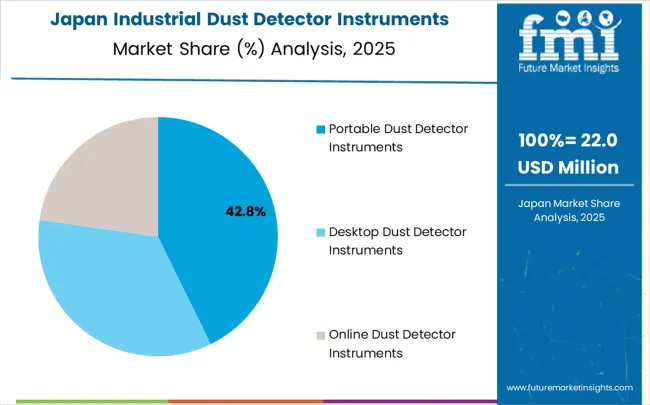

Revenue from industrial dust detector instruments in Japan is expanding at a CAGR of 4.1%, supported by the country's established industrial safety culture, advanced precision manufacturing expertise, and strong focus on workplace protection requiring sophisticated monitoring and quality control systems for comprehensive safety management. Japan's sophisticated industrial development culture and emphasis on safety excellence are driving demand for advanced monitoring components, including precision detection, automated data collection, and integrated safety management systems. Leading industrial companies are investing in comprehensive monitoring system development to serve domestic manufacturing operations and international technology leadership with high-performance safety solutions.

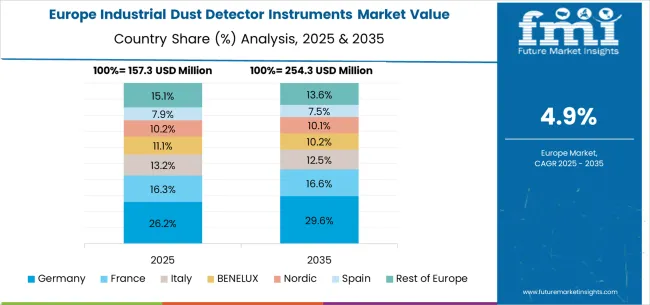

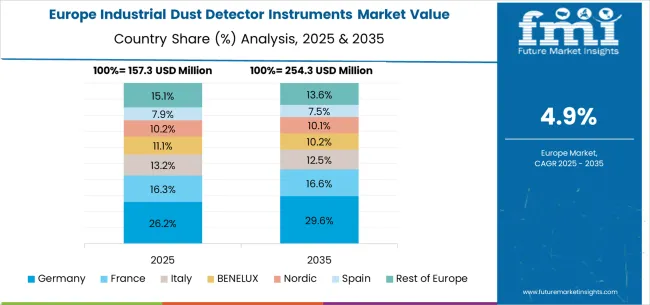

The industrial dust detector instruments market in Europe is projected to grow from USD 140.6 million in 2025 to USD 237.9 million by 2035, registering a CAGR of 5.4% over the forecast period. Germany is expected to maintain its leadership position with a 35.0% market share in 2025, growing to 36.0% by 2035, supported by its strong industrial manufacturing sector, advanced safety technology development, and comprehensive workplace protection regulations serving major European industrial markets.

The United Kingdom follows with a 22.0% share in 2025, projected to reach 21.5% by 2035, driven by robust workplace safety innovation, established regulatory compliance frameworks, and strong occupational health sector development, combined with comprehensive safety consulting services and advanced monitoring technology adoption. France holds an 18.0% share in 2025, expected to reach 18.5% by 2035, supported by industrial safety modernization and increasing adoption of advanced monitoring systems in manufacturing and processing facilities. Italy commands a 12.0% share in 2025, projected to reach 12.2% by 2035, while Spain accounts for 7.0% in 2025, expected to reach 7.3% by 2035. The Netherlands maintains a 3.5% share in 2025, growing to 3.7% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Portugal, Belgium, Switzerland, and Austria, is anticipated to maintain steady growth, expanding its collective share from 2.5% to 2.8% by 2035, attributed to increasing industrial safety awareness and growing adoption of monitoring technologies across Eastern European markets implementing workplace protection modernization programs.

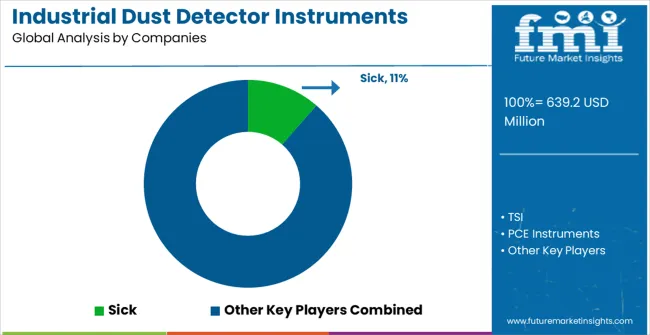

The industrial dust detector instruments market comprises 18–22 active manufacturers, with the top five companies holding around 48–54% of global market share. Growth is driven by tightening workplace safety regulations, explosion-prevention standards, air-quality monitoring requirements, and Industry 4.0–enabled plant automation across manufacturing, mining, cement, pharmaceuticals, and power generation. Competition centers on detection accuracy, particle-size sensitivity, real-time data analytics, integration with SCADA/DCS systems, and long-term calibration stability, rather than price. Sick leads the market with an 11% share, supported by its advanced optical and laser-scattering technologies, robust industrial sensors, and strong global footprint in dust, gas, and particulate monitoring solutions.

Other major players such as TSI, PCE Instruments, Kanomax, and Acoem Dynoptic maintain strong positions through high-precision dust analyzers, explosion-proof detectors, and continuous emission monitoring systems designed for heavy industry. Their deep expertise in airflow measurement, PM2.5/PM10 detection, and multi-parameter particulate analysis secures their presence in critical production environments.

Challengers including Matsushima Measure Tech Co., SKC, Sintrol, and Sibata differentiate through specialty dust monitors for mining conveyors, pneumatic transport lines, and occupational hygiene applications. Additional players such as Helmut Hund GmbH, Met One Instruments, Aeroqual, Envea, Trolex, Thermo Fisher, Ioner (Ramen), Laftech, Afriso, Siemens, Turnkey Instruments, GRIMM (Durag Group), Guangzhou Luftmy, and Hunan Rika strengthen regional competition by offering competitively priced sensors, IoT-enabled dust monitors, and compact multi-environment detectors tailored for local regulatory standards—particularly in Asia-Pacific and Europe, where industrial air monitoring requirements continue to intensify.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 639.2 million |

| Product Type | Portable Dust Detector Instruments, Desktop Dust Detector Instruments, Online Dust Detector Instruments |

| Application | Environmental Monitoring Station, Industrial Area, Commercial Area |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Sick, TSI, PCE Instruments, Kanomax, Acoem Dynoptic, Matsushima Measure Tech Co., SKC, Sintrol, Sibata, Helmut Hund GmbH, Met One Instruments, Aeroqual, Envea, Trolex, Thermo Fisher, Ioner (Ramen), Laftech, Afriso, Siemens, Turnkey Instruments, GRIMM (Durag Group), Guangzhou Luftmy, and Hunan Rika |

| Additional Attributes | Dollar sales by Product Type and application category, regional demand trends, competitive landscape, technological advancements in sensor technologies, IoT integration innovation, wireless connectivity development, and data analytics optimization |

The global industrial dust detector instruments market is estimated to be valued at USD 639.2 million in 2025.

The market size for the industrial dust detector instruments market is projected to reach USD 1,081.5 million by 2035.

The industrial dust detector instruments market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in industrial dust detector instruments market are portable dust detector instruments, desktop dust detector instruments and online dust detector instruments.

In terms of application, environmental monitoring station segment to command 0.0% share in the industrial dust detector instruments market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA