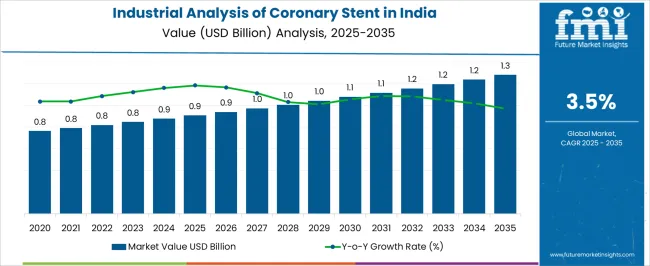

The Industrial Analysis of Coronary Stent in India is estimated to be valued at USD 0.9 billion in 2025 and is projected to reach USD 1.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

| Metric | Value |

|---|---|

| Industrial Analysis of Coronary Stent in India Estimated Value in (2025 E) | USD 0.9 billion |

| Industrial Analysis of Coronary Stent in India Forecast Value in (2035 F) | USD 1.3 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The coronary stent market in India is witnessing robust growth driven by increasing prevalence of cardiovascular diseases, rising awareness of early intervention, and expanding healthcare infrastructure. Current market dynamics are shaped by growing adoption of minimally invasive procedures, government initiatives to improve cardiac care accessibility, and rising investments in advanced medical devices. Demand is being supported by enhanced diagnostic capabilities and the availability of skilled interventional cardiologists.

The future outlook is characterized by technological advancements in stent design, including drug-eluting and bioresorbable variants, which improve patient outcomes and reduce post-procedure complications. Growth rationale is anchored on increasing hospital procedures, improved insurance coverage, and patient preference for advanced stent technologies.

Additionally, strategic collaborations between device manufacturers and healthcare providers are enhancing distribution networks and accessibility Collectively, these factors are expected to drive sustained market expansion, improve penetration in tier-2 and tier-3 cities, and solidify India’s position as a growing market for coronary intervention devices.

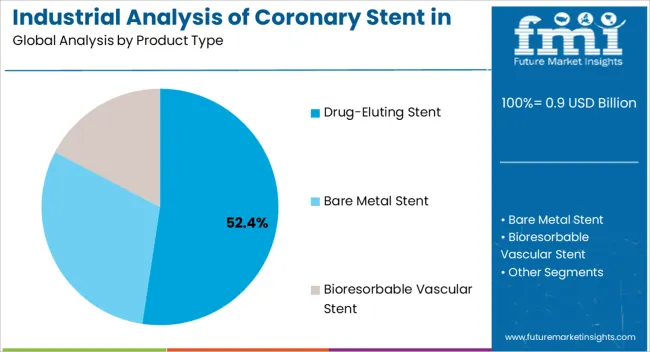

The drug-eluting stent segment, accounting for 52.40% of the product type category, has maintained dominance due to its effectiveness in reducing restenosis rates and improving long-term patient outcomes. Adoption has been supported by clinical evidence favoring drug-eluting technology over bare-metal alternatives.

Hospitals and cardiac care centers have been increasingly procuring these stents due to patient preference and improved reimbursement coverage. Manufacturing standards and regulatory approvals have ensured high quality and safety, while technological refinements in drug coatings and stent architecture have enhanced performance.

Market share has been reinforced by strategic collaborations between international and domestic manufacturers, facilitating wider availability and competitive pricing Continued innovation and increasing preference for drug-eluting stents in interventional cardiology procedures are expected to sustain leadership in the product type segment.

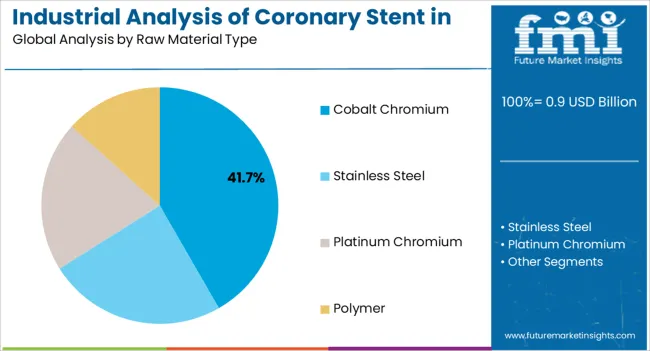

The cobalt chromium segment, representing 41.70% of the raw material category, has emerged as the leading material due to its superior strength, corrosion resistance, and biocompatibility, which are critical for stent performance. Its adoption has been facilitated by advancements in manufacturing techniques that allow precise stent fabrication and coating adherence.

Regulatory compliance and quality control measures have reinforced its preference among device manufacturers. The segment benefits from stable supply chains and established procurement practices, which ensure consistent availability for large-scale production.

Performance advantages, combined with growing adoption of drug-eluting stents, have reinforced cobalt chromium’s leading position Future growth is expected to be supported by continued material innovation and cost optimization, ensuring its sustained contribution to the market.

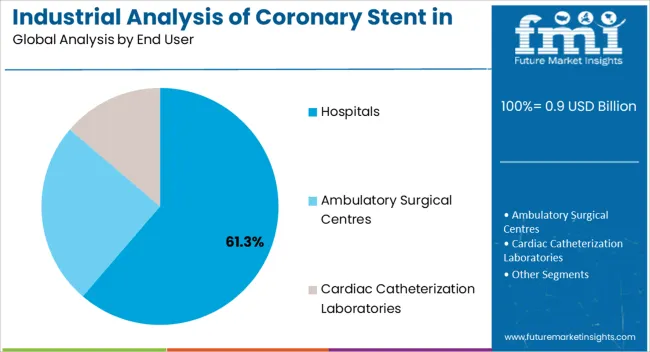

The hospitals segment, holding 61.30% of the end-user category, has dominated due to the high volume of interventional cardiology procedures conducted in institutional settings. Adoption has been driven by well-equipped cardiac care units, trained interventional cardiologists, and integration of advanced stent technologies into routine practice.

Hospital procurement policies, bulk purchasing arrangements, and regulatory compliance have strengthened accessibility and ensured quality standards. The segment benefits from ongoing expansions in private and government hospitals across urban and semi-urban regions.

Availability of insurance coverage and patient preference for hospital-based procedures have further reinforced market share Continued hospital network expansion and enhanced cardiac care services are expected to sustain the segment’s leadership and drive adoption of coronary stents in India.

Rising Cardiovascular Disorders are Fueling Surge in Coronary Stent Sales in India: One of the primary variables propelling coronary stent sales in India is the increased incidence of cardiovascular disorders. The prevalence of non-communicable diseases (NCDs), such as cardiovascular disease (CVD), is an increasing threat to public health in India. Analysis of India's stent industry by current state officials shows that more than 63% of fatalities in the country are now associated with NCDs. The greater prevalence of heart-related illnesses is attributed to factors including poor lifestyles, stress, and shifting food patterns.

India's Aging Population Drives Surge in Coronary Stent Application: Cardiovascular disorders are more common in India's aging population. As the senior population is rapidly growing, the greater risk of coronary heart disease among them bolsters the demand for coronary stents in India. The increase in percutaneous coronary interventions and angioplasty operations in India is directly associated with the adoption of coronary stents. Medical professionals prefer using them since these stents significantly reduce angina and increase patient survival chances. These trends in Indian interventional cardiology ensure the arteries remain open throughout the treatment.

Bioresorbable and Drug-eluting Stents Revolutionize Cardiac Care in India: The recent innovations in stent technology, like the development of bioresorbable stents and drug-eluting stents in India, are leading to a substantial demand. The improved patient outcomes, safety, and efficacy of these novel devices are precisely driving the demand for coronary stents. Stents that address the acute problem and also reduce long-term consequences are preferred by patients and medical professionals more frequently. For instance, bioresorbable stents provide an interim solution that parallels the body's natural healing process.

Government Initiatives are Making Coronary Stent More Accessible: Given the inclusion of coronary stent on the Indian government's list of essential medicines, the adoption of coronary stents in India is predicted to increase significantly. For instance, the Union Health Ministry of India stated in November 2025 that cardiac stents are going to be included in the National List of Essential Medicines 2025, causing them to be more inexpensive in India. Moreover, patients now have more access to and affordability for cardiac stents because of programs like Ayushman Bharat. The use of stents has increased by 30–40% as a result of better stent affordability.

World-class Cardiac Care and Affordable Coronary Stent Attract Global Medical Tourists: For cardiac care solutions in the India industry, like the implantation of coronary stents, the country has developed into a hotspot for medical tourism. India's status as a sought-after location for cardiac treatments has been cemented by the country's combination of top-notch medical facilities, knowledgeable healthcare experts, and affordable prices. The National Pharmaceutical and Pricing Authority (NPPA) of India made the historic choice in February 2020 to set pricing limitations for coronary stents at USD 108 for bare metal stents and USD 444 for drug-eluting stents. This has assisted in the industry's expansion. The cost-effectiveness of coronary artery blockage treatment in India has become a powerful magnet for visitors from around the globe.

Between 2020 and 2025, the adoption of coronary stents in India experienced significant growth, climbing from USD 657.5 million to USD 810.6 million. This indicates an average CAGR of 4.1%, underscoring the increasing acceptance and demand for these medical devices. Improved knowledge and a rise in the proportion of patients seeking angioplasty procedures have been the main factors responsible for the initial boost in adoption.

| Adoption of Coronary Stent in India in 2020 | USD 657.5 million |

|---|---|

| Adoption of Coronary Stent in India in 2025 | USD 810.6 million |

| Historical Value CAGR from 2020 to 2025 | 4.1% |

Looking forward to 2025, projections a little slower pace, with the adoption of coronary stents in India is anticipated to rise from USD 0.9 million in 2025 to USD 1,213.5 million by 2035, reflecting a steady 3.7% CAGR. Industry saturation is likely to cause the CAGR for coronary stents in India to slow down a bit, commencing in 2025. An industry's growth frequently slows down naturally as it ages. Overall, while the growth rate may slow down, it is essential to note that a steady CAGR of 3.7% still indicates a sustainable expansion of coronary stent adoption in India, underlining the continued importance of these devices in cardiac healthcare.

The adoption is anticipated to be driven by increasing health awareness and rising healthcare spending during the forecast period. The demand is also expected to rise as a result of certain macroeconomic factors, including favorable government reimbursement policies and an increase in FDI in the healthcare sector.

The use of telemedicine and remote monitoring technology is changing how cardiac care is provided and managed, affecting coronary stent implementation. For interventional cardiology devices in India, investments in healthcare infrastructure, particularly in tier 2 and tier 3 cities, represent a sizable potential opportunity. Increased penetration of health insurance, coupled with favorable policies, is likely to make coronary stents more accessible to a larger population.

| Emerging Trends in Coronary Stents |

|

|---|---|

| Possible Opportunities in Coronary Stents |

|

| Challenges Hindering Coronary Stent Adoption |

|

The coronary stent adoption in India is segmented by product type into drug-eluting stent, bare metal stent, and bioresorbable vascular stent. The drug-eluting stent segment dominates coronary stent adoption in India in 2025, accounting for an impressive 77.9% share. Similarly, when considering the raw material type, coronary stent adoption in India is categorized into cobalt chromium, stainless steel, platinum chromium, and polymer. Notably, the polymer segment takes the lead, commanding a 33.5% industry share in 2025.

| Segment | 2025 Value Share in India |

|---|---|

| Drug-eluting Stent | 77.9% |

| Polymer | 33.5% |

Since they have been demonstrated to be quite efficient in preventing restenosis, a condition where the treated artery narrows once more following angioplasty or stent placement, drug-eluting stents have grown in popularity in India. This is essential in India, where a sizable section suffers from cardiovascular conditions. There have been 511,389 stents utilized throughout India as of 2020, and 494,769 (96.75%) of them were drug-eluting stents.

Another aspect of their appeal is their affordability. While DES can initially cost more than bare-metal stents, the decreased requirement for follow-up surgeries and hospital stays more than makes up for this. This is crucial in the context of the healthcare system, where affordability and accessibility are two pressing issues.

With medical infrastructure and knowledge improvements, DES implantation and other complex cardiac surgeries are now being completed in India. Given this, patients and healthcare professionals are now more confident in the effectiveness and safety of these stents.

Since they are recognized for being biocompatible or well-tolerated by the human body, polymer-coated stents have grown in favor of India. This is essential for a coronary stent since it assures that there is going to be no discomfort or negative responses when the device is put in. The claim that stents coated with biodegradable polymer are supposed to be more expensive was refuted by several studies. They found no difference between stents coated with permanent polymer and those coated with biodegradable polymer. Polymer-coated stents tend to be more affordable than their drug-eluting counterparts.

Everyone needs to collaborate to make sure that patients with coronary artery disease have access to high-quality coronary stents in India. The heart stent industry in India is flooded with polymer-coated stents, giving doctors multiple choices to choose from depending on the specific anatomy and medical needs of each patient. Given recent developments in polymer technology, stents now have better mechanical qualities, ensuring greater flexibility and deliverability during the process. This results in smoother implantation, possibly lowering the chance of problems.

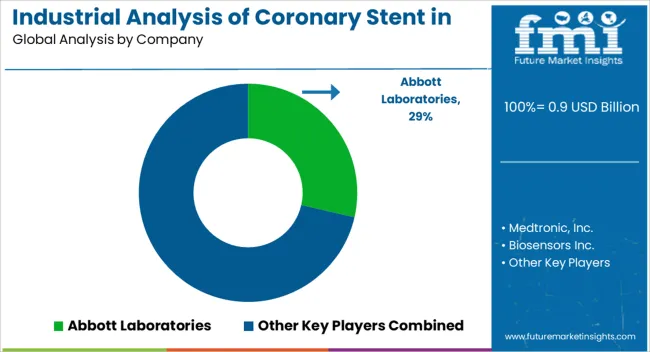

The coronary stent industry is characterized by a degree of fragmentation, with several players vying for industry share. While there are dominant leaders, there is also a significant presence of smaller and regional players, contributing to a competitive landscape. Manufacturers have allocated substantial resources to research and development. They have strategically adjusted pricing models to remain competitive, targeting a broader customer base without compromising product quality.

Recent Developments Related to Coronary Stent in India

The global industrial analysis of coronary stent in India is estimated to be valued at USD 0.9 billion in 2025.

The market size for the industrial analysis of coronary stent in India is projected to reach USD 1.3 billion by 2035.

The industrial analysis of coronary stent in India is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in industrial analysis of coronary stent in India are drug-eluting stent, bare metal stent and bioresorbable vascular stent.

In terms of raw material type, cobalt chromium segment to command 41.7% share in the industrial analysis of coronary stent in India in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coronary Stents Market Insights – Trends, Growth & Forecast 2025-2035

Industrial Lubricants Industry Analysis in India - Growth Trends, Regional Insights 2025 to 2035

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Coronary Artery Bypass Grafts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA