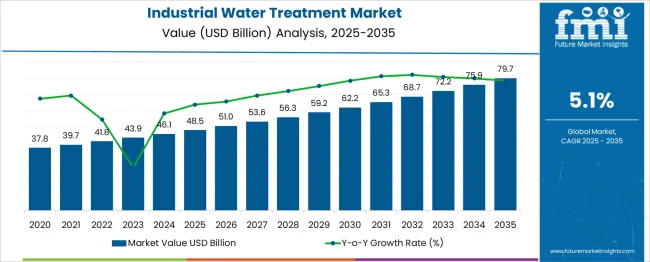

The industrial water treatment market is projected to reach 48.5 USD billion in 2025 and is anticipated to grow to 79.7 USD billion by 2035, registering a CAGR of 5% over the forecast period. The market is clearly growing over the 10-year timeline, driven by increasing industrial demand for efficient water management, rising regulatory pressures on wastewater discharge, and the adoption of advanced treatment technologies such as reverse osmosis, ultrafiltration, and chemical dosing systems. Early years show steady gains as industries focus on compliance and operational efficiency, establishing a strong foundation for future growth.

| Item | Value |

|---|---|

| Industrial Water Treatment Market Value (2025) | USD 48.5 billion |

| Industrial Water Treatment Market Forecast Value (2035) | USD 79.7 billion |

| Industrial Water Treatment Market Forecast CAGR | 5.1% |

During the mid-phase of the forecast period, the market is expected to rise from 48.5 USD billion to 59.2 USD billion, with moderate annual growth. This phase benefits from expanding industrial infrastructure in emerging economies, increasing awareness about water scarcity, and investments in water management practices. Adoption of smart water treatment solutions, process optimization, and automation in industrial facilities further accelerates the market. The rolling growth during this period indicates a transition from steady foundational scaling to stronger momentum, ensuring that demand remains consistent across multiple sectors such as power generation, chemicals, and food & beverage manufacturing.

The market is anticipated to advance from 59.2 USD billion to 79.7 USD billion by 2035, marking the strongest growth interval. This period sees significant incremental gains due to large-scale industrial adoption of integrated water treatment systems, expansion of capacity in high-demand regions, and technological upgrades that improve efficiency and lower operational costs. Regional contributions, particularly from Asia-Pacific, are expected to drive higher adoption rates, while mature markets in North America and Europe maintain stable growth.

Market expansion is being supported by the rapid industrialization in emerging economies and the corresponding need for effective water treatment solutions to manage increasing volumes of industrial wastewater. Manufacturing facilities across sectors require sophisticated treatment systems to comply with environmental regulations and maintain operational efficiency while minimizing water consumption and discharge impacts.

The growing complexity of industrial processes and increasing regulatory scrutiny are driving demand for advanced treatment technologies that can handle diverse contaminants and achieve higher purification standards. Companies are investing in comprehensive water treatment systems to reduce operational costs through water recycling, minimize environmental liability, and ensure regulatory compliance across multiple jurisdictions.

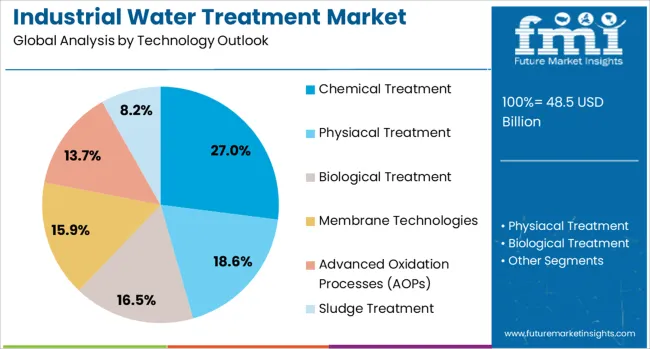

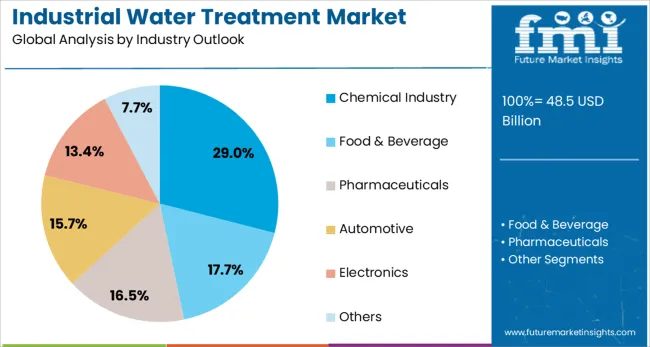

The market is segmented by technology outlook, industry outlook, and region. By technology outlook, the market is divided into chemical treatment, physical treatment, biological treatment, membrane technologies, advanced oxidation processes (AOPs), and sludge treatment. Based on industry outlook, the market is categorized into chemical industry, food & beverage, pharmaceuticals, automotive, electronics, and others. Regionally, the market is divided into China, India, Germany, France, UK, US, and Brazil.

Chemical treatment is projected to account for 27% of the Industrial Water Treatment market in 2025. This leading share is supported by the widespread adoption of chemical processes for neutralization, coagulation, flocculation, and disinfection across various industrial applications. Chemical treatment provides effective removal of dissolved contaminants and suspended solids, making it the preferred method for primary treatment in most industrial facilities. The segment benefits from established treatment protocols and comprehensive chemical supply networks from multiple vendors.

The chemical industry is expected to represent 29% of industrial water treatment demand in 2025. This dominant share reflects the high water consumption and complex wastewater characteristics typical of chemical manufacturing processes. Chemical plants require sophisticated treatment systems to handle diverse contaminants, including heavy metals, organic compounds, and acidic or alkaline effluents. The segment benefits from stringent environmental regulations and increasing focus on manufacturing practices that emphasize water conservation and recycling.

The industrial water treatment market is advancing steadily due to increasing industrialization and growing recognition of the importance of water conservation. The market faces challenges including high capital investment requirements, need for specialized technical expertise, and varying treatment requirements across different industrial processes. Technological advancement and regulatory standardization continue to influence system performance and market development patterns.

The growing deployment of digital monitoring systems is enabling real-time tracking of water quality parameters, treatment efficiency, and system performance across industrial facilities. Smart sensors and automated control systems provide continuous monitoring capabilities while reducing operational costs and improving treatment reliability. These technologies are particularly valuable for large industrial complexes that require consistent water quality management across multiple treatment processes.

Modern treatment providers are incorporating advanced technologies that eliminate liquid waste discharge through comprehensive water recovery and solid waste management. Integration of membrane technologies, thermal processes, and crystallization systems enables complete water recycling while producing manageable solid residues. Advanced systems also support recovery of valuable materials from industrial wastewater streams.

| Countries | CAGR (2025–2035) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| United Kingdom | 4.8% |

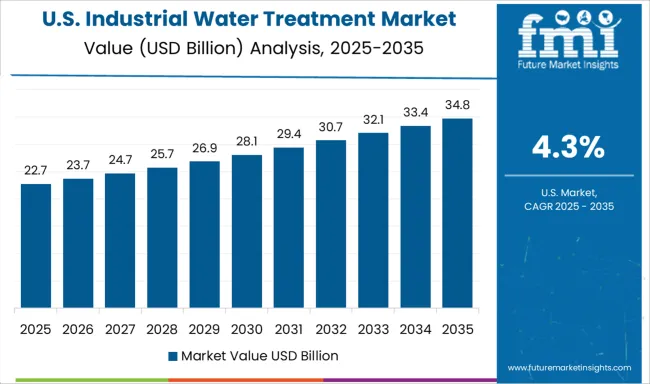

| United States | 4.3% |

| Brazil | 3.8% |

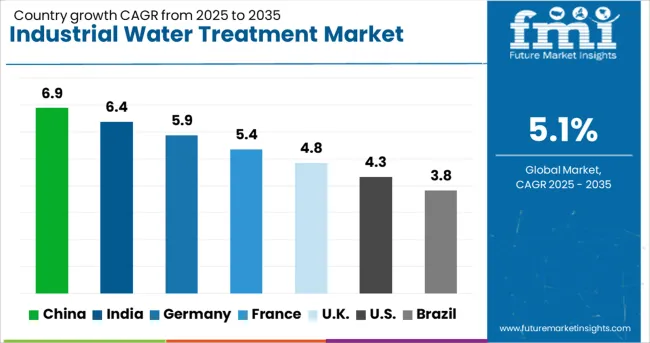

The global industrial water treatment market is projected to grow at a CAGR of 5% between 2025 and 2035. China leads this expansion with a 6.9% CAGR, driven by increasing industrial production, rising water quality regulations, and growing adoption of advanced treatment technologies. India follows at 6.4%, supported by expanding manufacturing sectors, government initiatives for water management, and rising demand for industrial wastewater solutions. Germany shows growth at 5.9%, emphasizing regulatory compliance in industrial operations and advanced treatment systems. France records 5.4%, fueled by the modernization of industrial facilities and the adoption of efficient water treatment methods. The UK is experiencing growth of 4.8%, with a focus on industrial process optimization and water reuse initiatives. The USA stands at 4.3%, reflecting steady demand for reliable water treatment solutions, while Brazil follows at 3.8%, influenced by emerging industrialization and growing need for water management technologies.

The report covers an in-depth analysis of 40+ countries; the top-performing OECD countries are highlighted below.

The industrial water treatment market in China is projected to grow at a CAGR of 6.9% from 2025 to 2035, driven by increasing industrialization, stringent environmental regulations, and rising demand for water recycling in power generation, chemicals, and manufacturing sectors. Factories and utility plants are adopting advanced treatment solutions such as reverse osmosis, ultrafiltration, and chemical dosing systems to meet quality standards and reduce operational costs. Investments in zero-liquid discharge systems and wastewater reuse technologies are accelerating as industries aim to conserve freshwater resources and comply with government mandates. Municipal-industrial collaborations are also promoting integrated water management strategies. The rising presence of domestic and international solution providers ensures the availability of turnkey systems, service contracts, and technical support.

Revenue from industrial water treatment in India is expanding at a CAGR of 6.4%, supported by rapid industrialization across pharmaceutical, textile, chemical, and automotive sectors. The country's growing manufacturing base and increasing environmental awareness are driving demand for comprehensive treatment solutions. Industrial facilities are implementing advanced treatment systems to comply with pollution control regulations and achieve water management objectives. Manufacturing industry expansion is creating opportunities for specialized treatment providers that can support diverse industrial applications and regulatory requirements across different states and regions. Industrial development programs are facilitating adoption of modern treatment technologies that enable water recycling and reduce environmental impact across manufacturing operations.

The industrial water treatment market in Germany is projected to grow at a CAGR of 5.9% from 2025 to 2035, supported by strict environmental regulations, industrial automation, and increasing water reuse initiatives. German industries are focusing on energy-efficient and low-chemical water treatment solutions to reduce operational costs and environmental impact. Advanced membrane systems, biological treatment, and ultrafiltration are widely adopted across chemical, food, and pharmaceutical manufacturing. Research and development in treatment process optimization and sensor-based monitoring systems are enhancing operational efficiency. Collaborative projects between industrial associations and technology providers are further strengthening adoption. The growing focus on resource efficiency and circular economy practices ensures continued market growth.

The industrial water treatment market in France is anticipated to grow at a CAGR of 5.4% from 2025 to 2035, driven by rising industrial water consumption, tightening wastewater regulations, and demand for process water optimization. Industries including pharmaceuticals, food and beverage, and chemicals are implementing ultrafiltration, reverse osmosis, and advanced oxidation processes to ensure compliance and operational efficiency. Domestic solution providers are offering integrated treatment solutions with monitoring and service support. Municipal-industrial partnerships are promoting the reuse and recycling of treated water, particularly in water-scarce regions. Awareness of environmentally friendly and industrial responsibility is motivating companies to adopt innovative water treatment technologies and improve water footprint management.

Demand for industrial water treatment in the United Kingdom is growing at a CAGR of 4.8%, supported by comprehensive regulatory frameworks and increasing focus on manufacturing practices across industrial sectors. British manufacturing facilities are implementing advanced treatment systems to meet environmental standards while achieving operational efficiency improvements. The market is characterized by a focus on regulatory compliance, technological innovation, and integration with existing industrial infrastructure. Industrial development initiatives are promoting the adoption of modern treatment technologies that support manufacturing while meeting comprehensive environmental and quality standards. Professional service providers are offering specialized expertise in system design and regulatory compliance across diverse industrial applications.

The industrial water treatment market in the United States is expected to grow at a CAGR of 4.3% from 2025 to 2035, driven by industrial expansion, environmental regulations, and increasing focus on water reuse and conservation. Industries including power generation, chemicals, pharmaceuticals, and food processing are adopting ultrafiltration, reverse osmosis, and wastewater recycling technologies. Advanced treatment systems with real-time monitoring and automation are being deployed to reduce operational costs and ensure regulatory compliance. Public-private partnerships and incentives for water-efficient technologies are encouraging large-scale adoption. Investment in R&D for energy-efficient treatment methods and modular systems is supporting the development of scalable solutions for diverse industrial needs.

The industrial water treatment market in Brazil is forecast to grow at a CAGR of 3.8% from 2025 to 2035, supported by rising industrialization, stricter wastewater discharge standards, and increasing awareness of water conservation. Industrial sectors such as chemicals, pulp and paper, food and beverage, and energy are implementing membrane filtration, chemical treatment, and wastewater recycling technologies. Local solution providers are offering modular and cost-effective treatment units to cater to SMEs and large-scale operations. Government incentives for water reuse and industrial efficiency are promoting adoption, while growing collaboration with international technology providers ensures access to advanced treatment solutions. Awareness campaigns highlighting industrial responsibility and water management practices are further driving market growth.

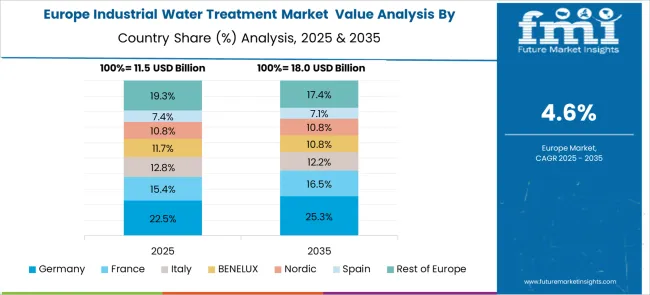

The industrial water treatment market in Europe is led by Germany, which stands out for advanced technology adoption, stringent regulations, and rapid investment in membrane bioreactors and smart water systems. France shows steady, mature growth focused on infrastructure upgrades and efficiency improvements, with chemical treatment and new membrane technologies gaining traction. The UK and Italy benefit from modernization and compliance-driven industrial demand. Spain is among the fastest-growing, propelled by expanding manufacturing activities and stricter environmental standards. Eastern Europe and the Nordics display rising adoption of advanced treatment solutions as industrialization and awareness increase.

The industrial water treatment market is witnessing rapid expansion, driven by rising industrialization, stringent environmental regulations, and growing demand for efficient water management solutions across diverse sectors such as power generation, chemicals, food and beverage, pharmaceuticals, and manufacturing. Companies operating in this market are investing heavily in advanced treatment technologies, including membrane filtration, biological treatment, and chemical dosing systems, to enhance process efficiency, ensure regulatory compliance, and reduce environmental impact. Automation, IoT-enabled monitoring, and real-time process control are increasingly integrated into treatment solutions, enabling industries to optimize water consumption, minimize wastewater discharge, and achieve cost savings. The market is also shaped by the growing importance of circular water practices, where treated water is reused and recycled to reduce freshwater dependency, particularly in water-stressed regions.

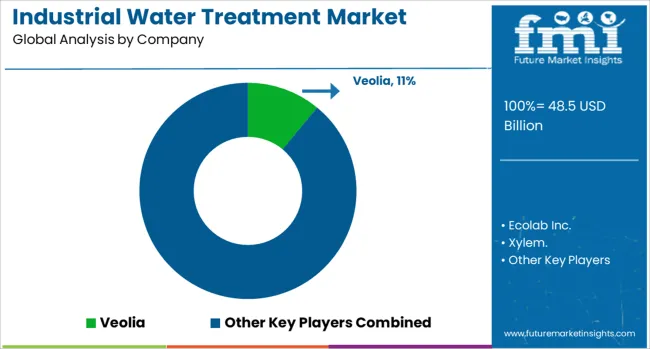

Key players in the industrial water treatment market include Veolia, Ecolab Inc., Xylem, Pentair, Kurita Water Industries Ltd., Solenis, SWA Water Australia, WOG GROUP, Kemira, and Feralco AB. Veolia, a global leader, offers comprehensive water and wastewater treatment solutions across multiple industrial sectors, combining advanced technology with extensive service capabilities. Ecolab Inc. delivers water treatment services and chemicals to a wide range of industries, leveraging its strong global presence and focus on operational efficiency. Xylem specializes in advanced membrane and biological water treatment technologies while emphasizing water recycling and reuse, with notable facilities in Sweden showcasing its capabilities. Pentair provides filtration and separation solutions, strengthening industrial processes with innovative and reliable equipment. Kurita Water Industries Ltd. and Solenis focus on water treatment chemicals and process optimization services, supporting industrial operations worldwide.

Other notable market participants include SWA Water Australia, which delivers tailored water treatment solutions for local industrial needs, and WOG GROUP, offering equipment and service-based solutions for effective water management. Kemira and Feralco AB provide specialized chemicals and treatment solutions to enhance water quality, operational efficiency, and environmental compliance.

| Item | Value |

|---|---|

| Quantitative Units | USD 48.5 billion |

| Technology Outlook | Chemical Treatment, Physical Treatment, Biological Treatment, Membrane Technologies, Advanced Oxidation Processes (AOPs), Sludge Treatment |

| Industry Outlook | Chemical Industry, Food & Beverage, Pharmaceuticals, Automotive, Electronics, Others |

| Regions Covered | China, India, Germany, France, United Kingdom, United States, Brazil |

| Country Covered | China, India, Germany, France, United Kingdom, United States, Brazil |

| Key Companies Profiled | Veolia, Ecolab Inc., Xylem, Pentair, Kurita Water Industries Ltd., Solenis, SWA Water Australia, WOG GROUP, Kemira, Feralco AB |

| Additional Attributes | Dollar sales by technology outlook and industry outlook, regional demand trends across major industrial economies, competitive landscape with established global providers and regional specialists, integration with digital monitoring and control systems, innovations in membrane technologies and advanced oxidation processes, and adoption of zero liquid discharge solutions for comprehensive water recovery and environmental compliance |

The global industrial water treatment market is estimated to be valued at USD 48.5 billion in 2025.

The market size for the industrial water treatment market is projected to reach USD 79.7 billion by 2035.

The industrial water treatment market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in the industrial water treatment market are chemical treatment, physical treatment, biological treatment, membrane technologies, advanced oxidation processes (AOPS) and sludge treatment.

In terms of industry outlook, chemical industry segment to command 29.0% share in the industrial water treatment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Wastewater Treatment Chemical Market Insights - Growth & Demand 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA