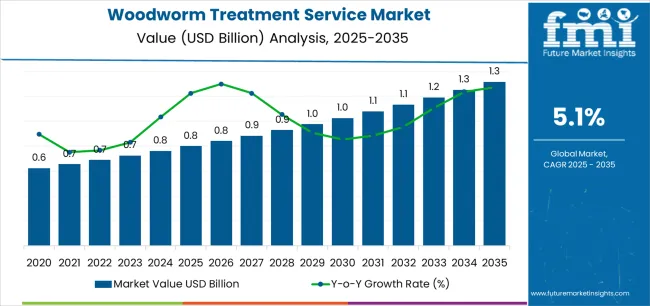

The global woodworm treatment service market is projected to grow from USD 0.8 billion in 2025 to USD 1.3 billion by 2035, expanding at a CAGR of 5.1 percent. The market dynamics are being shaped by rising focus on heritage building preservation, particularly in regions with large stocks of aging timber architecture. Conservation authorities, restoration contractors, and private estate managers are increasingly prioritizing long-term structural protection to prevent timber decay, loss of historical value, and costly reconstruction. Preventive inspection programs are gaining importance, with scheduled treatments, moisture management, and integrated property maintenance practices playing key roles in early detection and mitigation. Residential owners are also becoming more aware of the risks associated with untreated infestations, supporting steady service demand in both urban and rural property markets.

The market is further influenced by regulatory compliance requirements and professional certification standards, particularly in areas where wood-boring beetle infestations have been historically prevalent. Specialized treatment methods such as micro-emulsion insecticides, fumigation techniques, heat treatment systems, and borate-based timber preservation are being adopted to provide long-lasting protection while maintaining building material integrity. Commercial demand is increasing in hospitality, education, cultural heritage facilities, and public infrastructure, where structural safety standards and asset longevity drive recurring service contracts.

Regional growth patterns demonstrate particular strength in European markets, where aging building stock and heritage property protection regulations drive consistent professional service demand. Asian markets maintain steady growth through property management awareness and commercial building requirements, while North American markets show increasing activity in residential property treatment leveraging favorable insurance coverage conditions. Property management consolidation and professional certification requirements continue to support demand for established service providers with proven treatment methodologies.

Technology advancement in chemical formulations, application equipment, and inspection technologies continues to improve treatment efficacy while reducing environmental impact. The integration of thermal treatment methods and monitoring systems enhances service delivery for sensitive heritage properties. Service providers are developing comprehensive property survey capabilities and long-term monitoring programs to reduce repeat infestation risks and improve customer retention.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.8 billion |

| Market Forecast Value (2035) | USD 1.3 billion |

| Forecast CAGR (2025-2035) | 5.1% |

| HERITAGE PROPERTY PRESERVATION | PROPERTY MANAGEMENT REQUIREMENTS | REGULATORY & INSURANCE FACTORS |

|---|---|---|

| Historical Building Conservation | Professional Service Standards | Building Survey Requirements |

| Continuous expansion of heritage property protection programs across established markets driving demand for specialized timber treatment solutions. | Modern property management requiring certified service providers delivering comprehensive treatment protocols and documentation. | Regulatory requirements establishing treatment standards favoring qualified professional service providers. |

| Structural Timber Protection | Preventive Maintenance Programs | Insurance Compliance |

| Growing emphasis on structural integrity preservation and long-term timber protection creating demand for professional treatment services. | Property managers investing in preventive treatment programs offering comprehensive protection while maintaining property values. | Insurance policy requirements and building certification standards requiring professional treatment documentation and warranties. |

| Period Property Maintenance | Quality and Documentation Standards | Environmental Compliance |

| Superior treatment methodologies and heritage-appropriate techniques making professional services essential for period property applications. | Certified providers with proven track records required for comprehensive timber treatment applications and warranty provision. | Environmental protection standards and chemical usage regulations driving need for licensed professional service providers. |

| Category | Segments Covered |

|---|---|

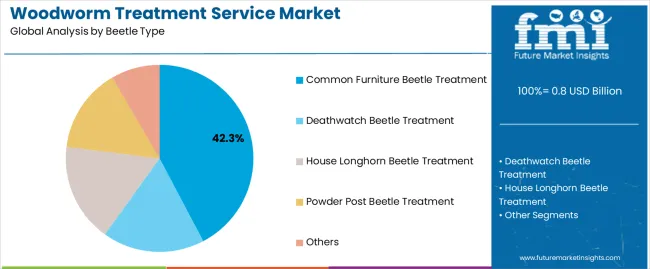

| By Beetle Type | Common Furniture Beetle Treatment, Deathwatch Beetle Treatment, House Longhorn Beetle Treatment, Powder Post Beetle Treatment, Others |

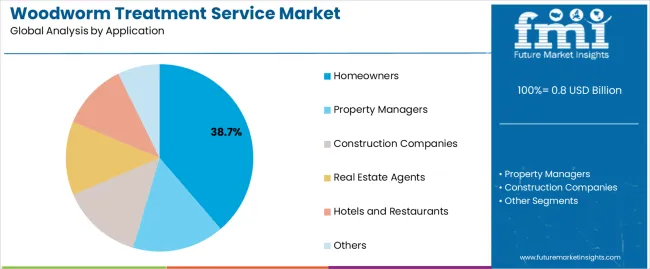

| By Application | Homeowners, Property Managers, Construction Companies, Real Estate Agents, Hotels and Restaurants, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Common Furniture Beetle Treatment |

|

| Deathwatch Beetle Treatment |

|

| House Longhorn Beetle Treatment |

|

| Powder Post Beetle Treatment |

|

| Others |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Homeowners |

|

| Property Managers |

|

| Construction Companies |

|

| Real Estate Agents |

|

| Hotels and Restaurants |

|

| Others |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Heritage Property Conservation | Treatment Cost Barriers | Thermal Treatment Methods |

| National heritage building protection programs and conservation requirements driving professional timber treatment across established markets. | High treatment costs for comprehensive property applications affecting adoption in cost-sensitive residential segments. | Integration of heat treatment technologies and chemical-free methods for sensitive heritage properties and occupied residential applications. |

| Property Transaction Requirements | DIY Treatment Competition | Inspection Technology |

| Building survey standards and property purchase conditions requiring professional treatment documentation and warranties. | Homeowner self-treatment options and retail pest control products reducing professional service demand in minor infestation cases. | Development of moisture meters, borescopes, and thermal imaging capabilities improving infestation detection and treatment verification. |

| Insurance Policy Conditions | Seasonal Demand Variations | Preventive Treatment Programs |

| Property insurance requirements and warranty conditions mandating professional treatment services and documentation. | Treatment activity concentrated in spring and summer months creating operational capacity challenges and revenue fluctuations. | Comprehensive property protection contracts offering regular monitoring and preventive applications supporting recurring revenue models. |

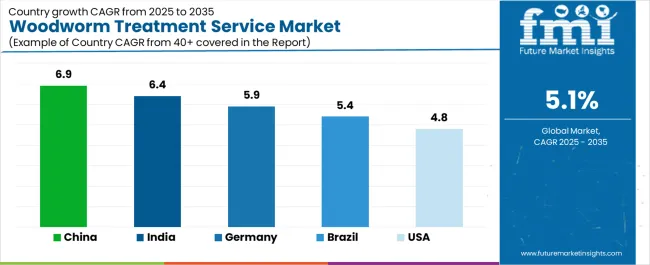

| Country | CAGR (2025-2035) |

|---|---|

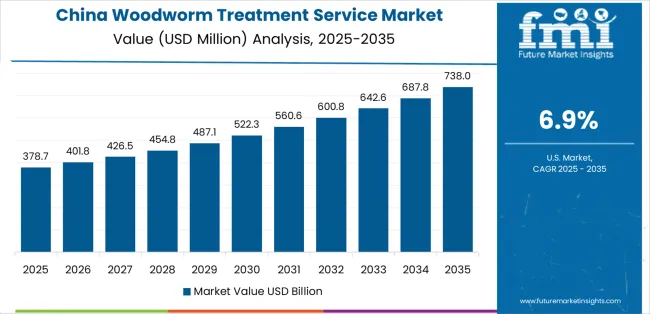

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| USA | 4.8% |

Revenue from woodworm treatment services in China is projected to exhibit strong growth with a market value of USD 243.8 million by 2035, driven by expanding commercial property development and comprehensive building maintenance infrastructure creating substantial opportunities for professional service providers across property management operations, construction projects, and heritage building sectors. The country's established timber construction tradition and expanding property management capabilities are creating significant demand for both preventive and remedial treatment solutions. Major property management companies and construction contractors are establishing comprehensive pest control service procurement programs to support large-scale building operations and meet growing building quality standards.

Commercial property development programs are supporting widespread adoption of preventive timber treatment across building operations, driving demand for cost-effective professional services. Building quality standards initiatives and property management professionalization are creating substantial opportunities for service providers requiring reliable treatment methodologies and competitive service pricing. Regional property development growth and provincial building regulation development are facilitating adoption of professional treatment services throughout major urban regions.

Revenue from woodworm treatment services in India is expanding to reach USD 123.7 million by 2035, supported by extensive residential construction growth and comprehensive property management development creating sustained demand for professional treatment services across diverse building categories and commercial property segments. The country's growing property management sector and expanding building maintenance awareness are driving demand for treatment services that provide consistent pest control performance while supporting cost-effective service requirements. Property developers and facility management companies are investing in pest control service relationships to support growing building portfolios and tenant requirements.

Urban residential development expansion and commercial property capability development are creating opportunities for treatment services across diverse building segments requiring reliable performance and competitive service costs. Property management professionalization and building maintenance standard advancement are driving investments in service provider relationships supporting pest control requirements throughout major metropolitan regions. Insurance policy development and building survey practice programs are enhancing demand for professional timber treatment services throughout Indian property markets.

Demand for woodworm treatment services in Germany is projected to reach USD 97.3 million by 2035, supported by the country's leadership in heritage building preservation and advanced timber protection technologies requiring professional treatment services for historical property and conservation applications. German property management companies are implementing treatment services that support comprehensive building surveys, operational excellence, and stringent quality protocols. The market is characterized by focus on treatment efficacy, environmental compliance, and adherence to cultural heritage protection standards.

Heritage property industry investments are prioritizing treatment methodologies that demonstrate superior preservation performance and sustainability while meeting German building protection and environmental standards. Building conservation leadership programs and operational excellence initiatives are driving adoption of professional treatment services that support comprehensive building maintenance and heritage protection. Research and development programs for low-toxicity treatments are facilitating adoption of environmentally responsible techniques throughout major heritage building centers.

Revenue from woodworm treatment services in USA is growing to reach USD 78.9 million by 2035, driven by property management consolidation programs and increasing pest control awareness creating sustained opportunities for service providers serving both residential property owners and commercial facility contractors. The country's extensive building stock and expanding property maintenance awareness are creating demand for treatment services that support diverse building requirements while maintaining service quality standards. Pest control companies and specialty timber treatment providers are developing service delivery strategies to support operational efficiency and insurance compliance.

Property transaction requirements and building inspection standards are facilitating adoption of treatment services capable of supporting diverse property protection requirements and competitive service delivery. Residential property maintenance and commercial facility management programs are enhancing demand for professional timber treatment services that support operational reliability and warranty provision. Heritage building preservation expansion and historical property protection are creating opportunities for specialized treatment capabilities across American property markets.

Demand for woodworm treatment services in Brazil is projected to reach USD 64.2 million by 2035, expanding at a CAGR of 5.4%, driven by commercial property development and building maintenance capabilities supporting urban construction growth and comprehensive facility management applications. The country's expanding property management sector and growing building maintenance market segments are creating demand for professional treatment services that support operational performance and pest control standards. Property management companies and facility service suppliers are maintaining comprehensive service capabilities to support diverse building requirements.

Commercial building development and property management programs are supporting demand for timber treatment services that meet contemporary performance and reliability standards. Urban construction growth and facility maintenance programs are creating opportunities for professional services that provide comprehensive pest control support. Building regulation development and service quality enhancement programs are facilitating adoption of professional treatment capabilities throughout major metropolitan regions.

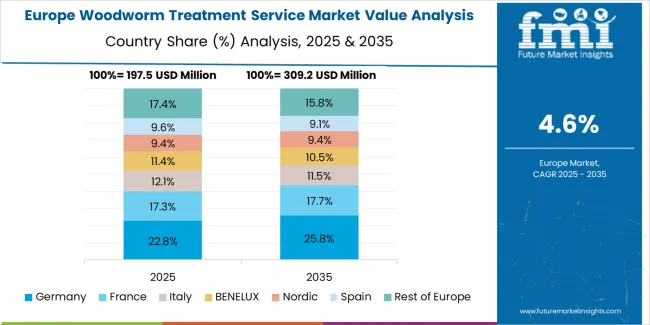

The woodworm treatment service market in Europe is projected to grow from USD 412.0 million in 2025 to USD 677.6 million by 2035, registering a CAGR of 5.1% over the forecast period. The United Kingdom is expected to maintain its leadership position with a 34.2% market share in 2025, declining slightly to 33.8% by 2035, supported by its extensive heritage property stock and established professional service infrastructure.

Germany follows with a 26.5% share in 2025, projected to reach 27.1% by 2035, driven by comprehensive building preservation regulations and property management service requirements. France holds a 18.7% share in 2025, expected to reach 19.2% by 2035 due to heritage building conservation programs. Italy commands a 11.4% share, while Spain accounts for 5.9% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 3.3% to 3.8% by 2035, attributed to increasing professional service adoption in Eastern European markets and Nordic countries implementing building preservation standards.

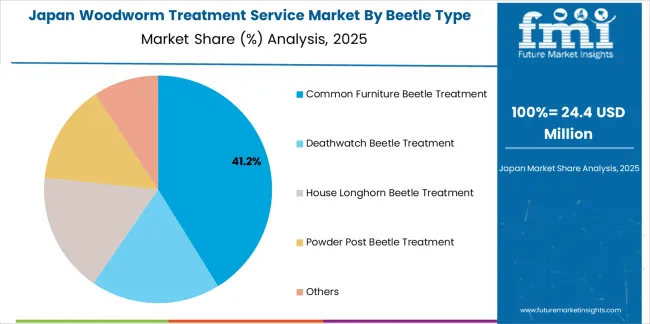

Japanese woodworm treatment service operations reflect the country's emphasis on traditional timber construction and heritage temple preservation. Major property management companies including Daiwa Living and Tokyu Community maintain rigorous service provider qualification processes requiring extensive treatment methodology documentation, chemical safety certification, and comprehensive insurance coverage. This creates barriers for service providers but ensures treatment quality for valuable heritage properties.

The Japanese market demonstrates preference for low-odor chemical formulations and minimal disruption treatment methods suitable for occupied residential properties. Companies require specific application techniques that address traditional timber joinery and minimize moisture introduction into historic structures. Treatment protocols differ from Western standards, driving demand for locally adapted service methodologies.

Regulatory oversight through the Ministry of Health, Labour and Welfare emphasizes chemical safety standards and applicator certification requirements. The building inspection system supports treatment demand through property transaction surveys, creating advantages for service providers with surveyor referral relationships and rapid response capabilities.

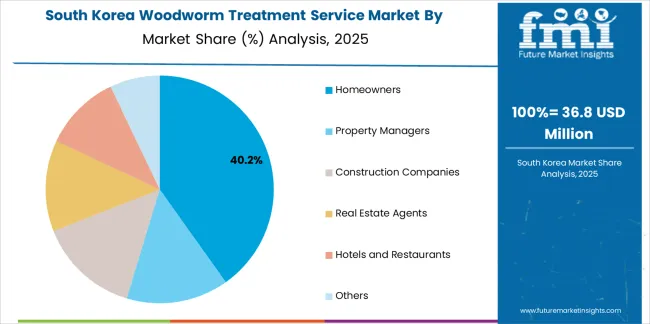

South Korean woodworm treatment service operations reflect the country's modern construction practices and limited heritage timber building stock. Major facility management companies including Samsung Everland and Lotte Property & Development drive service procurement strategies, establishing relationships with certified providers to support commercial property portfolios and residential complex maintenance programs.

The Korean market demonstrates growing awareness of timber pest management in imported furniture and architectural timber applications. Companies integrate treatment services with broader pest control contracts, requiring service providers to offer comprehensive building maintenance capabilities. This consolidation trend creates demand for multi-service providers with diverse technical expertise.

Regulatory frameworks emphasize environmental protection and occupant safety standards. Korea Environment Corporation oversight establishes chemical usage restrictions that favor low-toxicity treatment methods and thermal treatment alternatives. This benefits service providers with diverse treatment methodology capabilities and environmental certification.

Profit pools are consolidating around established service providers with proven treatment methodologies and comprehensive warranty programs. Value is migrating from basic chemical treatment applications to integrated property protection services offering inspection capabilities, monitoring programs, and long-term maintenance contracts that reduce customer churn. Several archetypes set the pace: national franchise networks defending share through brand recognition and standardized service delivery; regional specialists capturing premium heritage property segments through technical expertise and conservation accreditation; property maintenance integrators offering timber treatment within broader building service portfolios; and technology-focused entrants providing inspection innovations and digital customer management platforms.

Switching costs remain moderate due to treatment methodology similarities and limited customer lock-in, creating competitive pressure on pricing and service quality differentiation. However, warranty provisions, insurance relationships, and surveyor referral networks create barriers for new entrants lacking established market presence. Customer acquisition costs favor suppliers with property transaction touchpoints and property management contracts that generate recurring service opportunities.

Consolidation continues as larger pest control companies acquire regional timber treatment specialists to expand service capabilities and geographic coverage. Franchise models accelerate market penetration in fragmented regional markets where brand recognition and standardized training support rapid expansion. Digital platforms for customer acquisition and service scheduling are becoming important for reaching homeowner segments directly, requiring marketing investment that pressures smaller independent operators.

Market dynamics favor service providers who can demonstrate treatment efficacy through documented case studies, offer comprehensive warranties backed by insurance coverage, and maintain surveyor referral relationships that generate consistent lead flow. Price competition intensifies in residential segments where treatment complexity is limited, while heritage property applications offer opportunities for premium pricing through specialized expertise. Establish property management contract portfolios with preventive treatment programs and long-term monitoring relationships; develop surveyor referral networks and property transaction service capabilities; invest in inspection technology and digital customer management platforms for direct homeowner acquisition.

| Items | Values |

|---|---|

| Quantitative Units | USD 0.8 billion |

| Beetle Type | Common Furniture Beetle Treatment, Deathwatch Beetle Treatment, House Longhorn Beetle Treatment, Powder Post Beetle Treatment, Others |

| Application | Homeowners, Property Managers, Construction Companies, Real Estate Agents, Hotels and Restaurants, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United Kingdom, Germany, France, China, India, USA, and other 40+ countries |

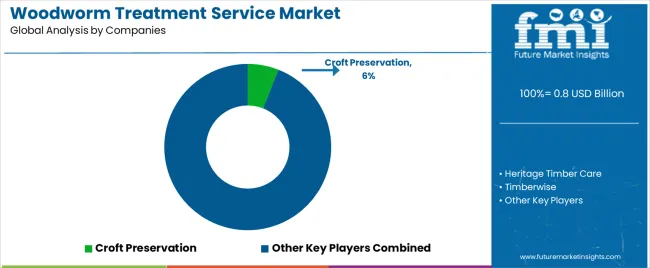

| Key Companies Profiled | Croft Preservation, Heritage Timber Care, Timberwise, Rentokil Property Care, Peter Cox, Richardson & Starling, Hillcrest, ProTen, JG Pest Control, Garratt's Damp & Timber, Prokil, Kenwood, Beechwood Pest Control, Pestco, Aspect Pest Control, Woodsure, Advanced Damp, ADEPT, Woodworm Services, Catrake, Pestforce, Max Damp Proofing, Crown Damp Proofing Company, B&W, Brit Rem, RH Preservation, Protect Pest Control, Wise Property Care, Adstock, Prestige Preservation |

| Additional Attributes | Dollar sales by beetle type/application, regional demand (NA, EU, APAC, LATAM, MEA), competitive landscape, residential vs commercial adoption, treatment methodology integration, and service innovations driving treatment efficacy, environmental compliance, and customer retention |

The global woodworm treatment service market is estimated to be valued at USD 0.8 billion in 2025.

The market size for the woodworm treatment service market is projected to reach USD 1.3 billion by 2035.

The woodworm treatment service market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in woodworm treatment service market are common furniture beetle treatment, deathwatch beetle treatment, house longhorn beetle treatment, powder post beetle treatment and others.

In terms of application, homeowners segment to command 38.7% share in the woodworm treatment service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Asthma Treatment Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA