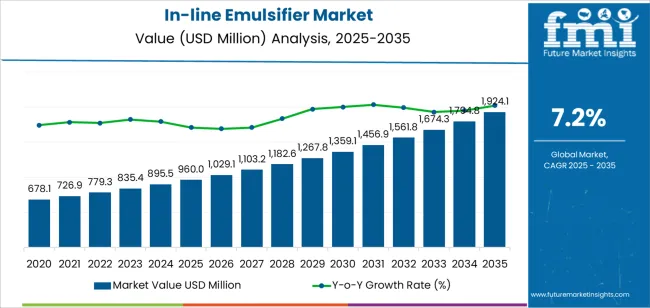

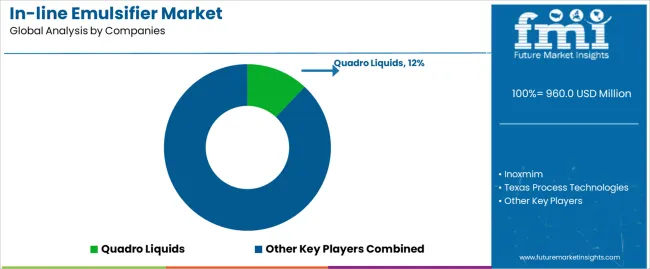

The in-line emulsifier market is valued at USD 960.0 million in 2025 and is expected to reach USD 1924.0 million by 2035, growing by 1.9X over the decade on the back of expanding continuous processing needs and rising product consistency standards across food, pharmaceutical, and chemical manufacturing operations. The market reflects a shift from batch-based emulsification toward integrated, flow-through systems that deliver uniform droplet dispersion, repeatable particle size control, and reduced processing variability. Industries dependent on stable emulsions, such as dairy beverages, topical pharmaceutical formulations, and specialty chemical emulsions, are progressively prioritizing in-line systems to achieve scalable efficiency and reduced production downtime. Growth is further supported by the adoption of sanitary design equipment, CIP-compatible configurations, and stainless-steel construction that aligns with global hygiene and regulatory requirements.

The first half of the forecast period, from 2025 to 2030, marks the transition from conventional high-shear mixers to automated, real-time process-controlled emulsification units. During this time, the market moved from USD 960.0 million to approximately USD 1359.0 million, representing USD 399.0 million of expansion or 41% of the decade's total growth. Process manufacturers prioritize equipment that enables streamlined line integration, stable viscosity management, and reduced formulation heterogeneity in high-volume production environments. Equipment suppliers capable of offering modular skid systems, customizable rotor-stator assemblies, and digital process monitoring capabilities will maintain a competitive advantage as emulsification performance becomes a measurable operational KPI rather than a qualitative processing outcome.

The subsequent phase covering 2030-2035 anticipates continued expansion from USD 1359.0 million to USD 1924.0 million, adding USD 565.0 million or 59% of the decade's total growth. This period defines broader penetration of intelligent processing technologies, integration with process analytical technology systems, and seamless compatibility with existing manufacturing infrastructure. The market development indicates fundamental transformation in emulsion production methodologies and quality management approaches, with participants positioned to capitalize on growing demand across multiple stage configurations and application segments. Geographic expansion patterns show concentrated growth in processing-intensive regions with established manufacturing infrastructure, while emerging markets demonstrate accelerating adoption rates driven by pharmaceutical production initiatives and food processing modernization programs across industrial and specialty manufacturing facilities.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New equipment sales | 46% | Capacity expansion, process upgrades |

| Custom application solutions | 26% | Industry-specific designs, specialized configurations | |

| Spare parts & wear components | 18% | Rotor-stator assemblies, seals, bearings | |

| Service & maintenance | 10% | Preventive maintenance, calibration services | |

| Future (3-5 yrs) | Advanced high-shear systems | 40-44% | Multi-stage configurations, intelligent controls |

| Application engineering services | 22-26% | Process optimization, formulation support | |

| Replacement components | 15-18% | Precision-engineered wear parts, upgrade kits | |

| Digital monitoring solutions | 10-13% | Real-time process analytics, predictive maintenance | |

| Service contracts | 8-11% | Performance guarantees, uptime programs | |

| Training & technical support | 5-8% | Operator certification, process troubleshooting |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 960.0 million |

| Market Forecast (2035) | USD 1924.0 million |

| Growth Rate | 7.2% CAGR |

| Leading Stage Type | Single Stage |

| Primary Application | Biology |

The market demonstrates strong fundamentals with single stage systems capturing dominant share through operational simplicity characteristics and biological processing optimization. Biology applications drive primary demand, supported by increasing pharmaceutical production requirements and biologic manufacturing standards. Geographic expansion remains concentrated in developed markets with established pharmaceutical and food processing infrastructure, while emerging economies show accelerating adoption rates driven by manufacturing modernization initiatives and rising product quality standards. The market benefits from ongoing transition toward continuous manufacturing processes requiring efficient emulsification solutions capable of delivering consistent particle size distribution and stable emulsion characteristics across diverse production environments.

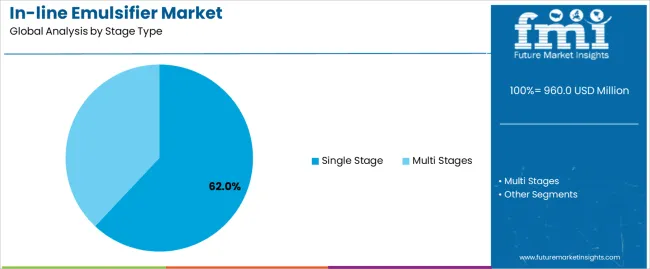

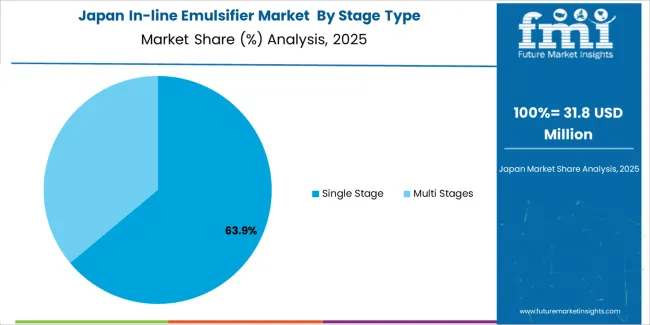

Primary Classification: The market segments by stage type into single stage and multi stages in-line emulsifiers, representing the evolution from basic emulsification equipment to sophisticated multi-step processing solutions for comprehensive product quality optimization.

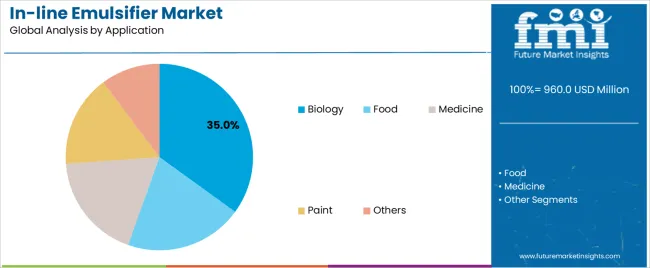

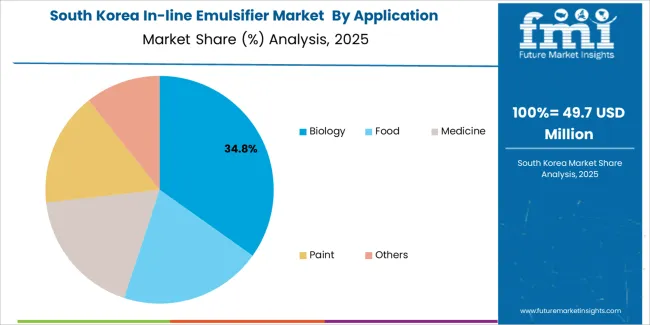

Secondary Classification: Application segmentation divides the market into biology, food, medicine, paint, and others, reflecting distinct requirements for particle size control, shear intensity, and sanitary design standards.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by pharmaceutical and food processing expansion programs.

The segmentation structure reveals technology progression from standard single-pass emulsification toward sophisticated multi-stage systems with enhanced particle size reduction and process control capabilities, while application diversity spans from pharmaceutical biologics to food emulsions requiring precise emulsification solutions.

Market Position: Single Stage systems command the leading position in the in-line emulsifier market with 62% market share through proven operational features, including straightforward process integration, maintenance simplicity, and pharmaceutical production capabilities that enable manufacturing facilities to achieve optimal emulsification performance across diverse biology and food processing environments.

Value Drivers: The segment benefits from manufacturing facility preference for reliable emulsification systems that provide consistent particle size reduction, lower capital investment, and operational efficiency optimization without requiring complex multi-stage configurations. Advanced rotor-stator designs enable effective emulsification, sanitary construction, and integration with existing process lines, where operational reliability and cleaning validation represent critical facility requirements.

Competitive Advantages: Single Stage systems differentiate through proven processing reliability, consistent emulsion quality characteristics, and integration with continuous manufacturing systems that enhance facility productivity while maintaining optimal sanitary standards suitable for diverse pharmaceutical and food applications.

Key market characteristics:

Multi Stages systems maintain a 38% market position in the in-line emulsifier market due to their superior particle reduction properties and process intensity advantages. These systems appeal to facilities requiring ultra-fine emulsions with enhanced stability for pharmaceutical and cosmetic applications. Market growth is driven by product quality requirements, emphasizing nano-emulsion production and process optimization through sequential shear stage designs.

Market Context: Biology applications demonstrate the highest growth rate in the in-line emulsifier market with 9.7% CAGR due to widespread adoption of continuous bioprocessing systems and increasing focus on vaccine production, monoclonal antibody manufacturing, and cell culture media preparation applications that maximize product consistency while maintaining sterility standards.

Appeal Factors: Biological manufacturing operators prioritize system sterility, gentle processing conditions, and integration with aseptic processing infrastructure that enables coordinated production operations across multiple bioprocessing steps. The segment benefits from substantial biopharmaceutical investment and manufacturing capacity expansion programs that emphasize the acquisition of validated emulsification systems for drug substance production and formulation applications.

Growth Drivers: Vaccine production programs incorporate in-line emulsifiers as essential equipment for adjuvant preparation and lipid nanoparticle formulation, while gene therapy manufacturing trends increase demand for precise emulsification capabilities that comply with cGMP standards and minimize product degradation.

Market Challenges: Varying process requirements and validation complexity may limit system standardization across different biologic products or manufacturing scenarios.

Application dynamics include:

Food applications capture market share through large-scale production requirements in dairy processing, sauce manufacturing, and beverage emulsion production. These facilities demand robust emulsification systems capable of operating with food-grade sanitation while providing effective cost-per-batch optimization and production throughput capabilities.

Medicine applications account for market share, including parenteral drug formulation, topical cream production, and controlled-release system manufacturing requiring maximum process control capabilities for therapeutic efficacy optimization and regulatory compliance.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Continuous manufacturing adoption & process intensification (pharmaceutical industry) | ★★★★★ | Regulatory encouragement of continuous processing requires inline emulsification solutions with real-time quality monitoring and validated performance across production campaigns. |

| Driver | Clean label trends & natural ingredient formulation (food industry) | ★★★★★ | Natural emulsifier systems require higher shear energy for stability; vendors offering effective processing of challenging formulations gain competitive advantage. |

| Driver | Biologic drug production growth & vaccine manufacturing expansion (mRNA technology) | ★★★★☆ | Advanced therapies need sophisticated emulsification; demand for lipid nanoparticle production and adjuvant formulation expanding addressable market. |

| Restraint | High capital investment & application-specific customization (especially pharmaceutical) | ★★★★☆ | Small manufacturers face financial barriers; increases adoption hesitation and slows advanced equipment penetration in cost-sensitive markets. |

| Restraint | Cleaning validation complexity & cross-contamination concerns (multi-product facilities) | ★★★☆☆ | Shared equipment faces stringent cleaning requirements and extensive validation procedures, limiting operational flexibility and increasing changeover complexity. |

| Trend | Process analytical technology integration & real-time quality control (PAT frameworks) | ★★★★★ | Inline particle size analyzers with automated process adjustment and quality-by-design implementation transform manufacturing; real-time optimization and data-driven control become core value propositions. |

| Trend | Sustainable processing & energy efficiency optimization (green manufacturing) | ★★★★☆ | Environmental responsibility drives demand for energy-efficient designs; manufacturers offering reduced water consumption and lower power requirements drive competition toward sustainable processing solutions. |

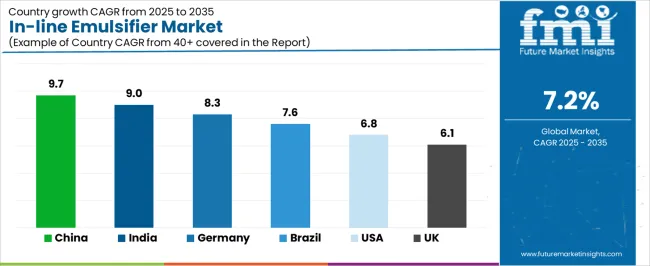

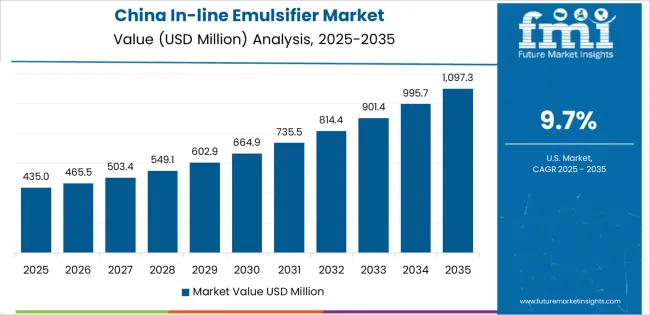

The in-line emulsifier market demonstrates varied regional dynamics with Growth Leaders including China (9.7% growth rate) and India (9.0% growth rate) driving expansion through pharmaceutical manufacturing initiatives and food processing development. Steady Performers encompass Germany (8.3% growth rate), United States (6.8% growth rate), and developed regions, benefiting from established pharmaceutical industries and food processing infrastructure. Emerging Markets feature Brazil (7.6% growth rate) and developing regions, where manufacturing modernization and pharmaceutical production support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through pharmaceutical manufacturing expansion and food processing development, while South Asian countries maintain strong growth supported by generic drug production infrastructure advancement and dairy processing capacity initiatives. North American markets show steady expansion driven by biologic manufacturing requirements and specialty food production standards, while European markets demonstrate moderate growth influenced by pharmaceutical processing applications and clean label food trends.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 9.7% | Lead with local technical support | Price competition; technology transfer requirements |

| India | 9.0% | Focus on pharmaceutical applications | Infrastructure variability; regulatory complexity |

| Germany | 8.3% | Offer validated systems | Documentation requirements; approval timelines |

| Brazil | 7.6% | Provide flexible financing | Economic fluctuations; import duty impacts |

| United States | 6.8% | Push cGMP compliance | FDA scrutiny; validation complexity |

| United Kingdom | 6.1% | Emphasize food safety | Brexit implications; market fragmentation |

China establishes fastest market growth through aggressive pharmaceutical manufacturing programs and comprehensive food processing development, integrating in-line emulsifiers as essential components in vaccine production, pharmaceutical formulation, and dairy processing installations. The country's 9.7% growth rate reflects government initiatives promoting biopharmaceutical industry advancement and food safety improvement that mandate the use of advanced emulsification systems in pharmaceutical and food facilities. Growth concentrates in major manufacturing hubs, including Shanghai, Jiangsu, and Zhejiang provinces, where pharmaceutical operations showcase integrated emulsification systems that appeal to manufacturers seeking advanced processing capabilities and quality optimization applications.

Chinese manufacturers are developing cost-effective emulsification solutions that combine domestic production advantages with adequate processing features, including reliable high-shear designs and basic sanitary construction. Distribution channels through pharmaceutical equipment distributors and food processing suppliers expand market access, while government support for pharmaceutical manufacturing supports adoption across diverse vaccine production and food emulsion segments.

Strategic Market Indicators:

In Hyderabad, Mumbai, and Ahmedabad, pharmaceutical facilities and food processing plants are implementing in-line emulsifiers as standard equipment for production optimization and quality enhancement applications, driven by increasing pharmaceutical manufacturing investment and food processing modernization programs that emphasize the importance of consistent emulsification capabilities. The market holds a 9.0% growth rate, supported by government pharmaceutical promotion initiatives and food safety enhancement programs that promote advanced emulsification systems for pharmaceutical and food facilities. Indian operators are adopting processing systems that provide reliable operational performance and cost-effective features, particularly appealing in urban regions where product quality and regulatory compliance represent critical operational requirements.

Market expansion benefits from growing generic pharmaceutical manufacturing capabilities and dairy processing development that enable domestic demand for emulsification systems for industrial applications. Technology adoption follows patterns established in pharmaceutical equipment, where reliability and value drive procurement decisions and operational deployment.

Market Intelligence Brief:

Germany establishes technology leadership through comprehensive pharmaceutical standards and advanced food processing infrastructure development, integrating in-line emulsifiers across pharmaceutical production, cosmetic manufacturing, and specialty food applications. The country's 8.3% growth rate reflects established process equipment industry relationships and mature emulsification technology adoption that supports widespread use of validated processing systems in regulated manufacturing facilities. Growth concentrates in major pharmaceutical centers, including Bavaria, Hesse, and North Rhine-Westphalia, where pharmaceutical operations showcase premium system deployment that appeals to manufacturers seeking proven cGMP-compliant capabilities and process validation applications.

German equipment providers leverage established distribution networks and comprehensive validation capabilities, including process documentation programs and application engineering support that create customer relationships and operational advantages. The market benefits from mature quality standards and regulatory requirements that support advanced emulsification use while encouraging technology advancement and process optimization.

Market Intelligence Brief:

United States demonstrates market leadership through comprehensive biopharmaceutical programs and advanced food processing infrastructure development, integrating in-line emulsifiers across vaccine production, biologic manufacturing, and specialty food applications. The country's 6.8% growth rate reflects established pharmaceutical industry relationships and mature continuous processing adoption that supports widespread use of validated emulsification systems in regulated facilities. Growth concentrates in major biopharmaceutical centers, including Massachusetts, California, and New Jersey, where vaccine operations showcase mature system deployment that appeals to manufacturers seeking proven FDA-compliant capabilities and process validation applications.

American equipment providers prioritize cGMP compliance and process validation in emulsification equipment development, creating demand for fully-documented solutions with comprehensive support, including validation protocols and regulatory documentation services. The market benefits from established pharmaceutical infrastructure and willingness to invest in continuous manufacturing technologies that provide regulatory compliance and quality assurance benefits.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse manufacturing demand, including pharmaceutical production modernization in São Paulo and food processing development, manufacturing facility upgrades, and government industrial programs that increasingly incorporate advanced emulsification solutions for quality optimization applications. The country maintains a 7.6% growth rate, driven by rising pharmaceutical manufacturing activity and increasing recognition of continuous processing benefits, including improved product consistency and enhanced production efficiency.

Market dynamics focus on cost-effective emulsification solutions that balance adequate processing performance with affordability considerations important to Brazilian manufacturing operators. Growing pharmaceutical and food processing development creates continued demand for modern emulsification systems in new facility infrastructure and manufacturing modernization projects.

Strategic Market Considerations:

The European in-line emulsifier market is projected to grow from USD 328.6 million in 2025 to USD 526.7 million by 2035, registering a CAGR of 4.8% over the forecast period. Germany is expected to maintain its leadership position with a 37.6% market share in 2025, supported by its advanced pharmaceutical infrastructure and major chemical processing centers.

United Kingdom follows with a 20.4% share in 2025, driven by comprehensive pharmaceutical manufacturing programs and food processing innovation initiatives. France holds a 17.8% share through specialized cosmetic applications and pharmaceutical production requirements. Italy commands a 13.7% share, while Spain accounts for 10.5% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.9% to 6.7% by 2035, attributed to increasing emulsification system adoption in Nordic countries and emerging Central European pharmaceutical facilities implementing continuous manufacturing programs.

Japan maintains established market position with 5.4% growth rate through comprehensive pharmaceutical quality standards and advanced food processing infrastructure, integrating in-line emulsifiers across pharmaceutical facilities in Tokyo, cosmetic production in Osaka, and food processing operations throughout industrial regions. The market demonstrates mature adoption patterns with 84% penetration rate in pharmaceutical manufacturing facilities, supported by established quality culture and regulatory compliance standards. Japanese manufacturers emphasize system precision and sanitary design capabilities, creating demand for high-quality solutions with advanced features including automated CIP systems and validation documentation support. Manufacturing operators prioritize emulsification systems that provide exceptional consistency with existing quality infrastructure and maintain strict sanitary standards suitable for Japanese pharmaceutical requirements.

South Korea demonstrates biopharmaceutical innovation with 5.8% growth rate through advanced pharmaceutical manufacturing and comprehensive biotechnology development programs, particularly in Seoul and Incheon biotech clusters where companies implement cutting-edge continuous processing systems. The market benefits from high biopharmaceutical investment rates and established pharmaceutical manufacturing infrastructure, enabling adoption of advanced emulsification solutions with 82% continuous manufacturing consideration rate in new facilities. Korean manufacturers integrate digital monitoring capabilities and process analytical technology features, creating distinctive processing systems that appeal to biopharmaceutical companies seeking manufacturing excellence. Government support for biosimilar production initiatives and pharmaceutical export competitiveness programs drives continued advanced emulsification system adoption across diverse pharmaceutical sectors.

The in-line emulsifier market structure consists of 16-22 credible manufacturers with the top 5-7 companies controlling approximately 58-63% of market revenue. Leadership positions are maintained through application engineering expertise, comprehensive validation support capabilities, and continuous technology innovation encompassing shear optimization, sanitary design advancement, and seamless integration with process control systems. Standard single-stage configurations and basic rotor-stator designs are becoming commoditized offerings as market maturity increases and process requirements become more sophisticated across applications.

Margin opportunities concentrate in multi-stage processing systems, application-specific engineering services, and integration into customer manufacturing ecosystems including process analytical technology platforms, batch management systems, and quality management workflows. Long-term partnerships with pharmaceutical manufacturers, food processors, and specialty chemical producers provide stable revenue streams, while value-added services including formulation development support, process optimization consulting, and validation documentation create differentiation opportunities beyond standard equipment sales.

Manufacturers pursuing growth strategies emphasize vertical specialization into high-growth application segments including vaccine adjuvant production, lipid nanoparticle formulation, and plant-based food emulsion manufacturing. Strategic partnerships with pharmaceutical equipment integrators, process analytical technology providers, and validation service organizations enable comprehensive turnkey solutions addressing complete manufacturing requirements. Technology investments focus on real-time particle size monitoring for quality control, artificial intelligence capabilities for process optimization, and modular designs enabling scalable processing from laboratory to production scale.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global platforms | Distribution reach, validation expertise, technology portfolios | Broad capabilities, regulatory knowledge, comprehensive support | Cost competitiveness; rapid customization |

| Technology innovators | Advanced rotor-stator designs; multi-stage capabilities; PAT integration | Superior performance; process efficiency | Service density outside core markets; price sensitivity |

| Regional specialists | Local support, application knowledge, responsive service | Market understanding; customer proximity; practical solutions | Technology advancement; global reach |

| Application-focused providers | Industry expertise, validated solutions, regulatory compliance | Lowest implementation risk; proven performance | Flexibility constraints; narrow focus |

| Service-oriented ecosystems | Installation support, training programs, maintenance networks | Maximum uptime; comprehensive assistance | Service complexity; customer dependency |

| Item | Value |

|---|---|

| Quantitative Units | USD million |

| Stage Type | Single Stage, Multi Stages |

| Application | Biology, Food, Medicine, Paint, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, Canada, Brazil, France, Australia, South Korea, and 23+ additional countries |

| Key Companies Profiled | Quadro Liquids, Inoxmim, Texas Process Technologies, Process Plant Network Pty Ltd, Zhejiang BYO Flow Co., Ltd, Nantong Clare Mixing Equipment Co., Ltd, Shanghai Farfly Energy Technology Co., Ltd, Shanghai Yile Mechanical and Electrical Equipment Co., Ltd |

| Additional Attributes | Revenue analysis by stage type and application categories, regional adoption trends across East Asia, South Asia Pacific, and Western Europe, competitive landscape with process equipment manufacturers and mixing technology suppliers, manufacturing operator preferences for process consistency and sanitary design, integration with continuous manufacturing systems and quality control platforms, innovations in rotor-stator technology and multi-stage processing, and development of intelligent emulsification solutions with real-time monitoring capabilities and pharmaceutical optimization features. |

The global in-line emulsifier market is estimated to be valued at USD 960.0 million in 2025.

The market size for the in-line emulsifier market is projected to reach USD 1,924.1 million by 2035.

The in-line emulsifier market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in in-line emulsifier market are single stage and multi stages.

In terms of application, biology segment to command 35.0% share in the in-line emulsifier market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Emulsifier Blends / Self-Emulsifying Bases Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Emulsifiers in Personal Care Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Emulsifiers, Stabilizers, and Thickeners Market Size and Share Forecast Outlook 2025 to 2035

Emulsifier-Free Skincare Market Growth – Size, Trends & Forecast 2024-2034

Demulsifier Market

Co-Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Egg Emulsifier Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

AKD Emulsifier Market Growth - Trends & Forecast 2025 to 2035

Evaluating Egg Emulsifier Market Share & Provider Insights

Food Emulsifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analyzing Food Emulsifier Market Share & Growth Trends

Bread Emulsifier Market Analysis by Source, Product Type and Application Through 2035

Bitumen Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

United States Food Emulsifier Market Trends – Growth, Demand & Forecast 2025–2035

Fragrance Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

Amphoteric Emulsifier Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA