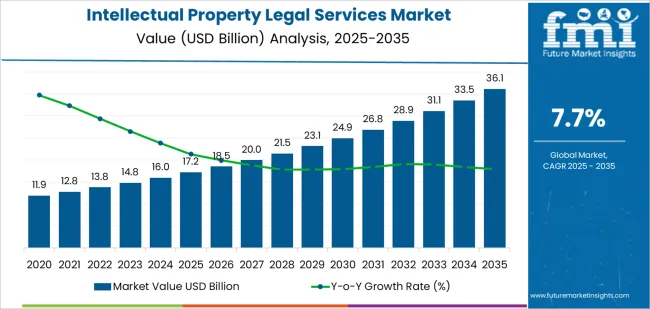

The global intellectual property legal services market is valued at USD 17.2 billion in 2025 and is projected to reach USD 36.0 billion by 2035, reflecting a CAGR of 7.7%. Growth through the first half of the forecast period is shaped by rising patent filings, expanding trademark portfolios, and increased enforcement activity across technology, pharmaceuticals, entertainment, and consumer goods. Companies seek structured guidance on patent drafting, IP due diligence, licensing terms, and infringement risk, supporting steady demand for specialized legal expertise. The expansion of cross-border commerce also prompts more organizations to secure protection in multiple jurisdictions, reinforcing early-cycle growth across major IP markets.

In the later years of the forecast window, demand remains strong as businesses refine their IP strategies and adapt to evolving case law, updated examination standards, and changes in digital content regulation. Legal activity becomes more focused on portfolio management, dispute resolution, global filing coordination, and periodic reassessment of protection strategies for both physical and digital assets. As innovation cycles shorten and IP-intensive industries broaden, the market continues to advance at a stable pace, guided by ongoing needs for technical drafting skills, evidence preparation, and rights-enforcement support across diverse sectors.

Between 2025 and 2030, the Intellectual Property Legal Services Market expands from USD 17.2 billion to USD 24.9 billion, forming a clear peak-to-trough pattern tied to patent-filing cycles, litigation waves, and global R&D investment fluctuations. The trough appears in the early period (2025-2027), with annual growth of USD 1.0 billion and USD 0.9 billion as organizations adjust IP budgets and streamline portfolio management. Mid-cycle activity strengthens as patent prosecution, trademark registrations, and cross-border IP enforcement increase. By 2029-2030, annual gains reach USD 1.8 billion, marking the first peak driven by rising technology commercialization, AI-related filings, and increased disputes in pharmaceuticals and electronics.

From 2030 to 2035, the market grows from USD 24.9 billion to USD 36.0 billion, displaying a second, stronger peak-to-trough sequence. The trough occurs between 2030-2031 with a gain of USD 1.9 billion, followed by escalating annual increases as global IP litigation, licensing negotiations, and portfolio valuation activities intensify. By 2034-2035, the market reaches its peak with a USD 2.6 billion jump in a single year, supported by higher patent-grant volumes, broader adoption of digital IP-management platforms, and expanding multinational filing strategies. This decade-long pattern reflects steadily rising IP complexity and continuous global innovation, driving persistent peak-to-trough growth momentum.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 17.2 billion |

| Market Forecast Value (2035) | USD 36.0 billion |

| Forecast CAGR (2025-2035) | 7.7% |

Demand for intellectual property (IP) legal services is rising as companies expand product portfolios, invest in R&D, and operate across multiple jurisdictions with differing IP rules. Businesses rely on attorneys to secure patents, trademarks, copyrights, and trade secrets that protect competitive advantage in sectors such as software, pharmaceuticals, consumer electronics, and advanced manufacturing. Legal teams assist with prior-art searches, filing strategies, and prosecution processes that determine long-term asset strength. As organizations accelerate innovation cycles, they require guidance on managing invention disclosures, establishing ownership frameworks, and coordinating filings across the United States, Europe, and Asia-Pacific. This need for structured protection and compliance reinforces sustained engagement with IP specialists.

Market expansion is also driven by increased infringement risks and complex global enforcement environments. Companies depend on legal counsel to assess validity challenges, manage oppositions, negotiate licensing agreements, and resolve disputes through litigation or arbitration. Growth in digital content, AI-generated assets, and interconnected platforms creates new questions around authorship, data rights, and algorithmic IP protection. Attorneys strengthen capabilities in portfolio valuation, freedom-to-operate analysis, and cross-border enforcement strategies to support clients entering new markets or launching new technologies. Although legal costs remain significant for small enterprises, clearer monetization pathways such as technology licensing and patent-pool participation encourage sustained investment in IP protection. These factors ensure continued demand for specialized intellectual property legal services across global innovation-driven industries.

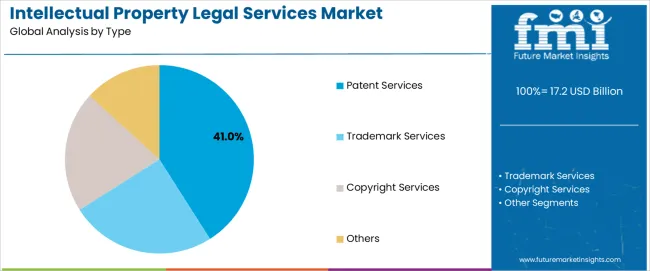

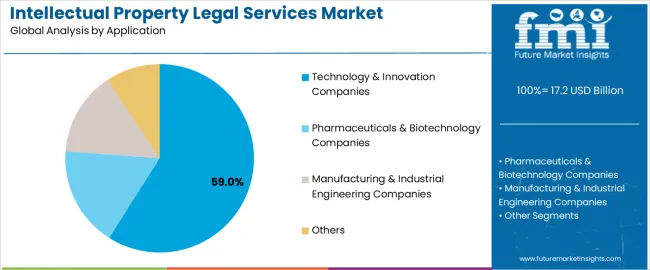

The intellectual property legal services market is segmented by type, application, and region. By type, the market is divided into patent services, trademark services, copyright services, and others. Based on application, it is categorized into technology and innovation companies, pharmaceuticals and biotechnology companies, manufacturing and industrial engineering companies, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect the varied protection needs, regulatory environments, and innovation intensities across industries seeking IP legal support.

The patent services segment accounts for approximately 41.0% of the global intellectual property legal services market in 2025, making it the leading type category. This position reflects the central role patent filings, prosecution, and validity assessments play in sectors that rely on proprietary technology. Patent attorneys and specialized firms prepare technical specifications, claims structures, and prior-art analyses to support applications filed in national and international offices. These activities require detailed subject-matter expertise and structured documentation practices that extend beyond general legal support.

Organizations depend on patent services for invention disclosures, portfolio management, infringement evaluation, and litigation preparation. Adoption is strong in North America, Europe, and East Asia, where patent systems are widely used to secure competitive positioning in electronics, engineering, biotechnology, and software development. Patent service providers invest in analytical tools for search and classification, but delivery continues to rely on technical-legal interpretation performed by specialists. The segment maintains its lead because patents serve as a core protection mechanism in industries where innovation pace, investment recovery, and long development cycles require formal rights that can be enforced, licensed, or commercialized across multiple jurisdictions.

The technology and innovation companies segment represents about 59.0% of the total intellectual property legal services market in 2025, making it the dominant application category. This position stems from the sector’s continuous production of new hardware, software, and integrated systems that require structured rights protection. These companies rely on legal support for patent filings, infringement assessments, licensing agreements, and cross-border protection strategies. The pace of product development in electronics, semiconductors, and digital technologies creates recurring demand for portfolio expansion and enforcement activities.

Legal teams assist with claim drafting, freedom-to-operate evaluations, and documentation required for collaborative research arrangements. Adoption is notable in North America and East Asia, where technology development ecosystems generate significant volumes of patentable material. Europe contributes further demand through active research networks and industrial technology programs. Technology and innovation companies maintain the largest share because their competitive positions depend on protecting technical designs, algorithms, process improvements, and integrated product architectures. These organizations require sustained legal engagement to manage filing cycles, respond to challenges, and coordinate protection strategies across multiple markets where product lines are developed, manufactured, or commercialized.

The intellectual property legal services market is expanding as organizations protect innovations, brands and digital assets across increasingly competitive and globalized industries. IP firms support patent drafting, prosecution, trademark registration, portfolio management and infringement litigation for companies developing new products, software and creative content. Growth is driven by rising R&D activity, digital-economy expansion and heightened focus on intangible asset valuation. Adoption is limited by high legal costs, long prosecution timelines and regulatory differences across jurisdictions. Providers are strengthening technical expertise, integrated global networks and digital docketing systems to manage complex, cross-border IP portfolios more efficiently.

Demand rises as companies invest in new technologies from software and semiconductors to biotech and advanced materials that require strong patent protection. Digital transformation creates additional IP needs linked to data, algorithms, user interfaces and content. Firms rely on IP advisors to secure patents, strengthen brands and navigate global filing strategies. As competition intensifies, organizations seek legal support to mitigate infringement risks, safeguard trade secrets and maintain licensing leverage. These pressures make IP services integral to long-term innovation and market positioning.

Adoption is limited by the high cost of patent drafting, international filings and legal representation during disputes. Small businesses may struggle with the complexity of IP procedures or rely on limited in-house capabilities. Regulatory variations across patent and trademark offices introduce uncertainty and increase administrative workload. Long examination timelines and potential litigation expenses deter aggressive filing strategies. Companies in early development stages may delay IP enforcement due to budget constraints, slowing engagement with full-service IP firms.

Key trends include greater use of digital IP-management platforms, analytics tools for portfolio assessment and automation to streamline docketing and prior-art research. Firms are building deeper technical specialization in fast-moving fields such as AI, renewable energy, biotech and advanced electronics. Growth in cross-border commerce drives demand for coordinated global filing and multinational enforcement strategies. Interest is rising in IP valuation and licensing advisory as intangible assets contribute more heavily to corporate value. As legal environments evolve, IP service providers focus on integrated global teams, transparent workflows and technology-enabled support models.

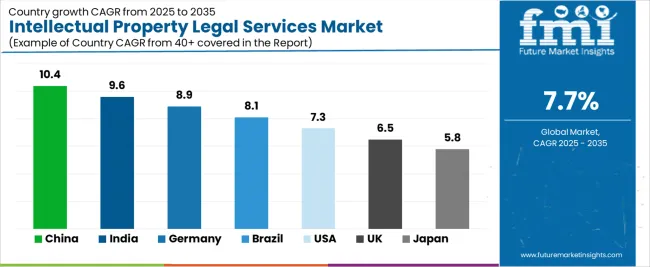

| Country | CAGR (%) |

|---|---|

| China | 10.4% |

| India | 9.6% |

| Germany | 8.9% |

| Brazil | 8.1% |

| USA | 7.3% |

| UK | 6.5% |

| Japan | 5.8% |

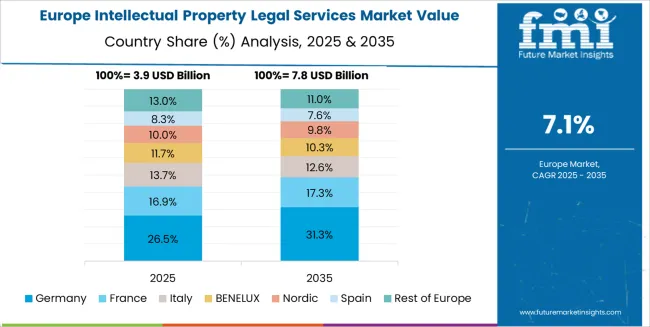

The Intellectual Property Legal Services Market is expanding robustly across global innovation-driven economies, with China leading at a 10.4% CAGR through 2035, fueled by rapid technological advancement, increased patent filings, and strengthening IP protection frameworks. India follows at 9.6%, supported by growth in startups, digital innovation, and rising awareness of IP enforcement needs. Germany records 8.9%, reflecting advanced industrial R&D, strict regulatory environments, and high demand for patent, trademark, and compliance advisory.

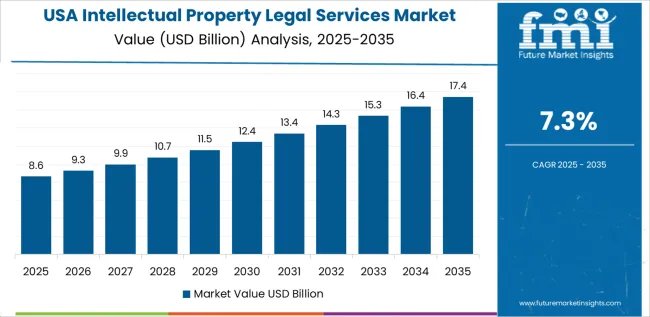

Brazil grows at 8.1%, driven by expanding technological sectors and modernization of IP regulations. The USA, at 7.3%, remains a mature yet dynamic market with strong demand for specialized IP litigation, licensing, and portfolio management services, while the UK (6.5%) and Japan (5.8%) emphasize global IP strategy, cross-border protection, and support for highly innovative manufacturing and tech industries.

China is projected to grow at a CAGR of 10.4% through 2035 in the intellectual property legal services market. Rising patent filings, technology transfers, and domestic innovation hubs increase demand for prosecution, enforcement, and licensing counsel. Firms provide patent drafting, opposition proceedings, and portfolio management for domestic and multinational clients. Trade secret protection and contractual IP clauses are in higher demand across manufacturing and software sectors. Regulatory updates on patentability and compulsory licensing require specialist advice. Corporate R&D centres engage external counsel for freedom to operate studies. Market growth reflects investment in commercialising inventions and aligning IP strategy to timelines.

India is projected to grow at a CAGR of 9.6% through 2035 in the intellectual property legal services market. Rapid startup formation, software exports, and mobile-first product launches increase patent and trademark filings. Counsel advise on provisional filings, patent prosecution pathways, and brand protection filings across multiple jurisdictions. Enforcement against counterfeiting and parallel imports drives litigation and customs recordation services. Technology transfer contracts and open source compliance add complexity to licensing agreements. Service providers scale legal operations to support high-volume application workflows. Market expansion aligns with cross-border commercialisation and investor due diligence requiring documented IP risk assessments.

Germany is projected to grow at a CAGR of 8.9% through 2035 in the intellectual property legal services market. High industrial R&D and precision manufacturing increase demand for patent prosecution and technical claim drafting. Counsel provide validity assessments, opposition filings, and infringement analyses tailored to mechanical and engineering inventions. Standard-essential patents and FRAND negotiations require specialised licensing negotiation support for telecom and automotive sectors. Trade mark portfolios require clearance searches and EU wide registration strategies. Firms expand litigation teams for complex nullity and infringement proceedings. Market growth reflects investment in protecting engineering innovations and managing enforcement in Europe.

Brazil is projected to grow at a CAGR of 8.1% through 2035 in the intellectual property legal services market. Growth in agritech, bioresources, and consumer brands increases trademark and patent activity. Legal counsel advise on plant variety protection, biotechnology patentability, and licensing frameworks for agricultural innovations. Enforcement against counterfeit agrochemicals and brand imitation requires coordinated civil and administrative remedies. Foreign investors seek counsel on local IP ownership rules and technology transfer clauses. Service providers expand prosecution teams and localised clearance processes. Market movement aligns with protecting domestic innovation and supporting export-oriented agricultural and consumer product companies nationwide.

USA is projected to grow at a CAGR of 7.3% through 2035 in the intellectual property legal services market. Advanced software, biotech, and semiconductor sectors drive increased patent prosecutorial work and strategic IP counselling. Firms provide trade secret protection, licensing negotiations, and patent portfolio monetisation advisory services. Litigation in district courts and the PTAB remains a significant component of enforcement strategy. Startups depend on clear assignment procedures and employee invention agreements to preserve ownership. Service providers expand analytics-driven portfolio management and patent valuation capabilities. Market growth reflects commercialisation of inventions and active enforcement strategies across federal jurisdictions, plus litigation readiness.

UK is projected to grow at a CAGR of 6.5% through 2035 in the intellectual property legal services market. Demand for trademark protection, design registration, and domain enforcement rises with digital commerce and cross-border branding. Firms provide clearance searches, opposition filings, and brand policing across online marketplaces. Patent counselling focuses on software-related inventions and licensing models for fintech and medtech firms. Enforcement actions and customs measures address counterfeit imports into national channels. Service providers advise on assignment and co-ownership structures for collaborative research. Market growth reflects emphasis on protecting brand equity and managing cross-border IP risk for trading entities.

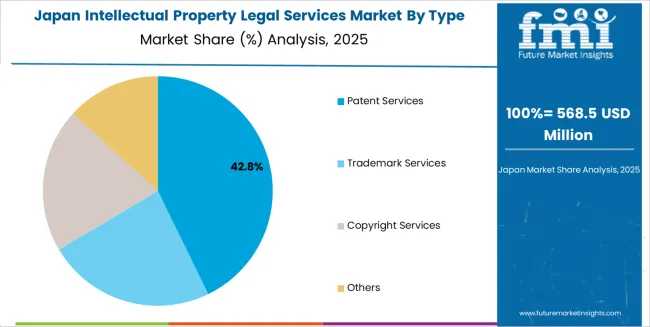

Japan is projected to grow at a CAGR of 5.8% through 2035 in the intellectual property legal services market. Domestic electronics and materials science firms increase demand for patent drafting and international prosecution. Counsel advise on patent family management, invention assignment, and cross-licensing for manufacturing supply chains. Trade mark clearance for export branding and domain registration support market entry for consumer products. Enforcement strategies include cease and desist letters, customs alerts, and coordinated litigation across regional jurisdictions. Service providers offer foreign filing coordination and IP portfolio audits. Market growth aligns with technological refinement and efforts to protect inventions in export markets.

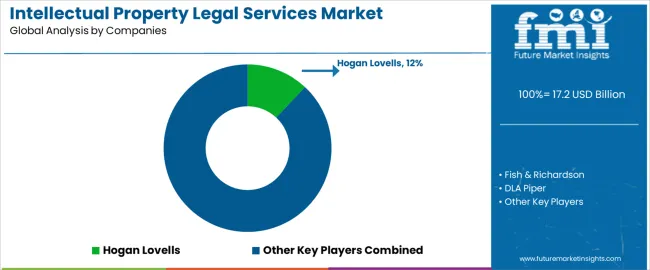

The global intellectual property legal services market is moderately concentrated, shaped by firms advising on patent protection, portfolio management, IP litigation, and cross-border enforcement. Hogan Lovells, Fish & Richardson, and DLA Piper hold strong positions through long-standing patent practices covering litigation, prosecution, and global trademark management. Finnegan, Kirkland & Ellis, and Perkins Coie reinforce the upper tier with deep technical capabilities across electronics, biotechnology, pharmaceuticals, and software.

CMS Law, Jones Day, and Rouse Consultancy expand international support for clients managing multi-jurisdictional filings or navigating emerging-market IP systems. Baker McKenzie, White & Case, and Freshfields Bruckhaus Deringer add broad cross-border experience suited for complex licensing, disputes, and transactional IP work. Competition is shaped by technical depth, litigation capability, and the ability to coordinate filings across varied legal regimes.

Herbert Smith Freehills, Morgan Lewis & Bockius, and Fresenius Patent Group strengthen global coverage with practices supporting patent prosecution, freedom-to-operate reviews, and regulatory-linked IP disputes. Quinn Emanuel Urquhart & Sullivan provides a strong litigation-focused offering with expertise in high-stakes patent and trade-secret cases. Allen & Overy, King & Wood Mallesons, Fangda Partners, and Zhong Lun Law Firm broaden regional capabilities, especially across Europe and Asia-Pacific, where multinational clients require coordinated prosecution and enforcement strategies.

Kim & Chang adds specialist depth in the Korean market, supporting technology and manufacturing clients with complex patent portfolios. Strategic differentiation relies on sector-specific knowledge, global enforcement networks, and efficient management of high-volume filings. As innovation intensifies across pharmaceuticals, electronics, and AI-driven technologies, firms delivering strong technical insight and reliable multi-jurisdictional execution are positioned to maintain long-term competitive advantage in the global IP legal-services landscape.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Patent Services, Trademark Services, Copyright Services, Others |

| Application | Technology & Innovation Companies, Pharmaceuticals & Biotechnology Companies, Manufacturing & Industrial Engineering Companies, Others |

| End User | Technology Firms, Pharmaceutical & Biotech Developers, Industrial Manufacturers, Other End Users |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | Hogan Lovells, Fish & Richardson, DLA Piper, Finnegan, Kirkland & Ellis, Perkins Coie, CMS Law, Jones Day, Rouse Consultancy, Baker McKenzie, White & Case, Freshfields Bruckhaus Deringer, Herbert Smith Freehills, Morgan Lewis & Bockius, Fresenius Patent Group, Quinn Emanuel, Allen & Overy, King & Wood Mallesons, Fangda Partners, Zhong Lun, Kim & Chang |

| Additional Attributes | Dollar sales by type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with IP law firms and advisory practices, processing requirements and jurisdictional specifications, integration with digital IP-management systems and cross-border protection platforms |

East Asia

Europe

North America

South Asia

Latin America

Middle East & Africa

Eastern Europe

The global intellectual property legal services market is estimated to be valued at USD 17.2 billion in 2025.

The market size for the intellectual property legal services market is projected to reach USD 36.1 billion by 2035.

The intellectual property legal services market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in intellectual property legal services market are patent services, trademark services, copyright services and others.

In terms of application, technology & innovation companies segment to command 59.0% share in the intellectual property legal services market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Intellectual Property Rights And Royalty Management Market Size and Share Forecast Outlook 2025 to 2035

Intellectual Property Software Market Size and Share Forecast Outlook 2025 to 2035

Intellectual Property Support Services Market Size and Share Forecast Outlook 2025 to 2035

Enterprise IP Management Software Market Growth – Trends & Forecast 2023-2033

South Korea Intellectual Property Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Intellectual Property Market Size and Share Forecast Outlook 2025 to 2035

Property Management Software Market Growth - Trends & Forecast 2025 to 2035

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Microservices Orchestration Market Growth - Trends & Forecast 2025 to 2035

VOIP Services Market Analysis - Trends, Growth & Forecast through 2034

Global AI HR Services Market Size and Share Forecast Outlook 2025 to 2035

Oracle Services Market Analysis – Trends & Forecast 2024-2034

Seismic Services Market Size and Share Forecast Outlook 2025 to 2035

AR Tour Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tableau Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Walk-in Services Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA