The global infrastructure projects legal services market is valued at USD 105.6 billion in 2025 and is projected to reach USD 153.3 billion by 2035, reflecting a CAGR of 3.8%. Seasonality in this market is minimal, as legal work associated with infrastructure planning, procurement, land acquisition, and regulatory compliance is typically carried out on long timelines rather than in short, recurring intervals. Activity levels are influenced more by multiyear project cycles than by seasonal fluctuations, placing the market in a low-seasonality category with steady engagement throughout each year.

Cyclicality is present but moderate, driven primarily by infrastructure spending patterns, government budget cycles, and broader economic conditions. During periods of strong public and private capital allocation, legal service demand increases due to heightened project approvals, contract negotiations, and financing activities. In slower economic phases, project starts may be delayed, creating temporary dips rather than sharp contractions. Over the forecast horizon, the market shows a stable growth trajectory shaped by long project lead times and ongoing legal requirements across planning, construction, and operational phases.

Between 2025 and 2030, the Infrastructure Projects Legal Services Market grows from USD 105.6 billion to USD 127.2 billion, displaying a clear peak-to-trough pattern driven by fluctuating project approvals and funding cycles. The trough occurs in the early phase (2025–2027), where annual increases remain modest at USD 3.4 billion (2025–2026) and USD 3.4 billion (2026–2027). These years reflect slower movement in project financial closure, early-stage feasibility reviews, and environmental compliance work. Momentum strengthens mid-cycle, with yearly gains rising to USD 4.5 billion by 2029–2030 as large transport, energy, and water-infrastructure programs enter procurement, increasing demand for contract structuring, dispute-avoidance strategies, and regulatory advisory.

From 2030 to 2035, the market advances from USD 127.2 billion to USD 153.3 billion, forming a second peak-to-trough sequence. The trough is observed in 2030–2031 with a USD 4.9 billion increase, followed by accelerating annual gains that reach USD 6.1 billion by 2034–2035. This peak reflects intensified legal activity associated with megaproject delivery, cross-border infrastructure financing, PPP renegotiations, and compliance with evolving ESG-linked procurement standards. Late-cycle demand is further supported by replacement of aging assets and long-horizon capital-expenditure commitments, creating a stable but rising peak-to-trough growth pattern through 2035.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 105.6 billion |

| Market Forecast Value (2035) | USD 153.3 billion |

| Forecast CAGR (2025–2035) | 3.8% |

Demand for infrastructure projects legal services is rising as governments and private developers pursue transportation, energy, water, and social-infrastructure programs that require detailed contractual, regulatory, and risk-management support. Large capital projects involve complex procurement frameworks, land-acquisition procedures, environmental permitting, and multi-jurisdictional compliance obligations. Legal teams draft concession agreements, design–build contracts, and public-private partnership structures that allocate construction, financing, and operational risks with precision. Lenders and investors depend on counsel to verify project bankability, conduct due diligence, and negotiate security packages aligned with local laws. As national infrastructure pipelines expand in Asia-Pacific, the Middle East, Europe, and North America, demand strengthens for advisors capable of coordinating documentation, managing dispute-avoidance strategies, and supporting government-mandated transparency requirements.

Market expansion is also supported by increasing complexity in renewable-energy installations, digital infrastructure, climate-resilience programs, and long-term operations contracts. Legal advisers assist clients with grid-connection agreements, environmental-impact assessments, rights-of-way negotiation, and compliance with procurement rules governing competitive tenders. Construction claims, delay analysis, and contract-administration oversight require specialized legal expertise as project timelines tighten and supply-chain disruptions persist. Firms strengthen capabilities in international arbitration, contract interpretation, and ESG governance to support investors facing heightened regulatory scrutiny. Although transaction costs can challenge smaller sponsors, the scale and risk profile of modern infrastructure projects make specialized legal services essential for achieving financial close, maintaining compliance, and minimizing disputes throughout the project lifecycle.

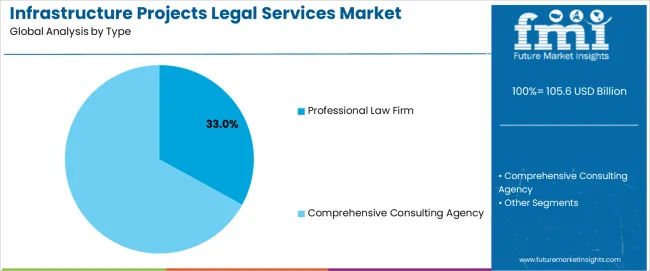

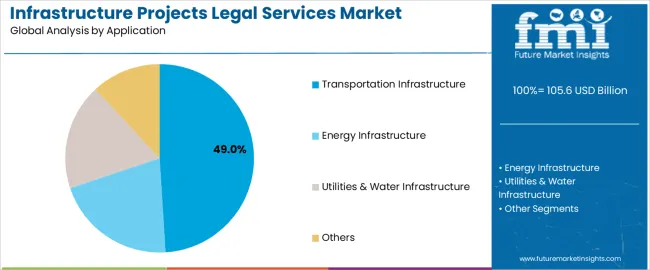

The infrastructure projects legal services market is segmented by type, application, and region. By type, the market is divided into professional law firms and comprehensive consulting agencies. Based on application, it is categorized into transportation infrastructure, energy infrastructure, utilities and water infrastructure, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These groups reflect the legal, contractual, and regulatory complexities that differ across infrastructure sectors and across regional project-delivery frameworks.

The professional law firm segment accounts for approximately 33.0% of the global infrastructure projects legal services market in 2025, making it the leading type category. This position is supported by the extensive legal documentation and risk review tasks required during planning, procurement, financing, and construction phases of major infrastructure projects. Professional law firms prepare and negotiate concession agreements, construction contracts, right-of-way documents, land-acquisition packages, and regulatory submissions that must meet jurisdiction-specific legal requirements. These activities depend on detailed statutory interpretation and contract drafting that general consulting agencies cannot provide at the same technical depth.

Law firms also support dispute management, claims assessment, and compliance reviews for multi-party projects involving public authorities, lenders, and private contractors. Adoption is significant in North America and Europe, where transport, utility, and energy projects rely on structured procurement formats and established legal oversight channels. East Asia and South Asia contribute additional demand as large projects require consistent documentation across government agencies and private developers. The segment retains its lead because its services address core legal functions risk allocation, contract enforceability, regulatory conformity, and documentation accuracy that determine project viability and are essential across varied infrastructure types.

The transportation infrastructure segment represents about 49.0% of the total infrastructure projects legal services market in 2025, making it the dominant application category. This position reflects the wide scope and high capital cost of transportation projects, including roads, bridges, rail systems, and airports. These projects require extensive contractual frameworks, environmental approvals, land-acquisition support, and financing arrangements that rely on specialized legal guidance. Legal advisors structure procurement documents, evaluate risk allocation, and manage compliance steps associated with safety, permitting, and public-sector regulatory oversight.

Transportation projects often involve public–private partnerships, multi-phase construction schedules, and cross-agency coordination, all of which generate recurring demand for legal review. Adoption is strong in North America and Europe, where transport infrastructure upgrades require detailed regulatory alignment, and in East Asia, where large-scale network expansion continues. Legal teams assist clients with right-of-way claims, project-finance terms, bonding requirements, and contract-variation procedures during construction. The transportation segment maintains its leading share because these projects require consistent legal intervention throughout planning and execution, and because the contractual environment governing transport networks is more extensive than in many other infrastructure categories.

The infrastructure projects legal services market is expanding as governments, private developers and financiers undertake large-scale transport, energy, water and urban development projects that require extensive legal oversight. Legal teams support contract structuring, regulatory compliance, land acquisition, risk allocation and dispute management across long project cycles. Growth is supported by rising investment in public–private partnerships, complex cross-border funding structures and stricter governance expectations. Adoption is limited by high legal fees, slow project timelines and the variability of regulatory regimes. Firms are strengthening sector expertise and integrated advisory models to meet the legal demands of modern infrastructure programs.

Demand increases as new roads, ports, transmission lines, renewable energy assets and urban projects require nuanced legal frameworks to manage procurement, permitting and stakeholder coordination. Public–private partnership models rely on precise contractual allocation of construction, financial and operational risks. Large developers and financiers use legal advisors to navigate regulatory approvals, negotiate concession agreements and manage claims throughout construction. As infrastructure programs multiply across emerging and developed regions, institutions rely on legal teams to manage compliance across fragmented local, national and international guidelines.

Adoption is moderated by high legal costs, extensive documentation requirements and the lengthy nature of infrastructure project cycles. Smaller developers may limit engagement due to budget pressures or preference for in-house counsel. Regulatory uncertainty and frequent policy changes in some jurisdictions reduce confidence in long-term advisory commitments. Coordination between multiple stakeholder’s contractors, lenders, agencies and local communities can increase complexity and slow legal workflows. These challenges limit full-scale engagement for projects with constrained funding or rapidly shifting scopes.

Key trends include increased integration of legal advisory with technical, financial and environmental consulting; wider use of digital tools for contract management; and greater emphasis on dispute-avoidance strategies during early project planning. Legal teams are building specialized expertise in renewable energy, smart-city projects, and sustainability-focused compliance frameworks. Cross-border investment growth increases need for unified legal strategies across multiple jurisdictions. Demand is also rising for advisory support in ESG-linked financing, land acquisition diligence and resilience-focused infrastructure planning. As projects become more complex, legal service providers differentiate through sector depth, collaborative delivery models and proactive risk-management practices.

| Country | CAGR (%) |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| Brazil | 4.0% |

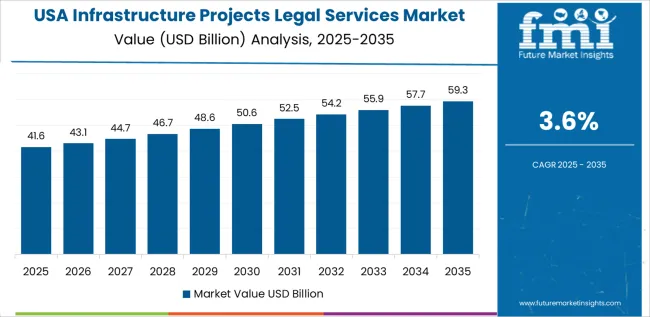

| USA | 3.6% |

| UK | 3.2% |

| Japan | 2.9% |

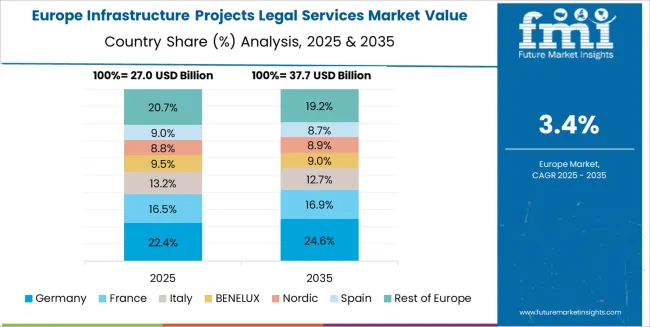

The Infrastructure Projects Legal Services Market is expanding steadily across global economies, with China leading at a 5.1% CAGR through 2035, supported by large-scale national infrastructure programs, complex PPP structures, and increasing demand for regulatory, contractual, and compliance advisory. India follows at 4.8%, driven by major transportation, energy, and urban development initiatives requiring legal expertise in procurement, land acquisition, and dispute resolution. Germany records 4.4%, reflecting strong governance frameworks, advanced project financing structures, and emphasis on sustainable infrastructure compliance. Brazil grows at 4.0%, fueled by modernization of transport and energy networks and rising public–private collaboration. The USA, at 3.6%, remains a mature but active market dominated by regulatory navigation, project finance, and risk management. The UK (3.2%) and Japan (2.9%) maintain stable demand, emphasizing legal oversight in complex infrastructure modernization, environmental compliance, and long-term contracting.

China is projected to grow at a CAGR of 5.1% through 2035 in the infrastructure projects legal services market. Large urban transport and power projects require detailed contract drafting and risk allocation reviews. Legal teams support procurement, concession agreements, and complex multi-party delivery models. Regulatory permitting and land-rights negotiations increase demand for specialist counsel across provinces. International firms coordinate cross-border financing arrangements and lender due diligence for large projects. Dispute-avoidance clauses and early claims management services reduce construction delays and cost overruns. Market growth reflects continued investment in transport corridors, urban renewal, and energy infrastructure programmes across multiple regions nationwide.

India is projected to grow at a CAGR of 4.8% through 2035 in the infrastructure projects legal services market. Rapid urbanisation, highway expansion, and renewable energy projects increase contractual complexity for developers. Legal teams advise on procurement frameworks, bid documentation, and compliance monitoring. Land acquisition and community consultation processes require extensive regulatory navigation and documentation. Foreign investors demand counsel for cross-border contracting and currency risk mitigation. Dispute resolution services for construction delays and payment disputes remain high priority. Market expansion aligns with infrastructure financing programmes, utility upgrades, and rural connectivity investments across multiple states supporting ongoing project delivery needs nationwide.

Germany is projected to grow at a CAGR of 4.4% through 2035 in the infrastructure projects legal services market. Strong engineering standards and regulated procurement increase demand for detailed contract compliance work. Legal providers support tender evaluations, warranty structures, and supplier performance clauses. Environmental permitting and technical certification requirements need specialist legal interpretation. Infrastructure funds and institutional investors request governance and due diligence advice. Contractual risk allocation and delay adjudication services support predictable project timelines. Market activity reflects ongoing rail, bridge, and renewable installation programmes requiring comprehensive legal frameworks for procurement, performance bonds, and long-term maintenance obligations across federal regions.

Brazil is projected to grow at a CAGR of 4.0% through 2035 in the infrastructure projects legal services market. Large transport and water projects increase demand for licensing and contract management. Local content rules and supplier qualification standards require legal advisory support. Land regularisation and indigenous consultation obligations add complexity to project delivery. Contract renegotiation and force majeure assessments are common during variable climate events. Investors seek counsel on concession models and tariff structures for long-term viability. Market growth aligns with infrastructure financing programmes, coastal port upgrades, and urban drainage schemes requiring updated legal documentation and bond arrangements nationwide coordination.

USA is projected to grow at a CAGR of 3.6% through 2035 in the infrastructure projects legal services market. Complex federal, state, and local permitting regimes require coordinated legal strategies. Public-private partnerships and utility-scale renewables drive structured contract negotiations. Environmental impact assessments and mitigation plans form core advisory tasks. Bonding requirements and payment security mechanisms are essential for contractor protection. Dispute resolution through arbitration and prompt-payment schemes supports cashflow stability. Market activity reflects renewed infrastructure funding, broadband rollouts, and port modernisation projects requiring consistent legal oversight, contractual certainty, and public procurement compliance across jurisdictions and state-level coordination and federal reporting requirements.

UK is projected to grow at a CAGR of 3.2% through 2035 in the infrastructure projects legal services market. Regulated procurement, planning consent, and public consultation drive legal demand. Counsel advise on contract forms, guarantees, and performance bond structures. Planning appeals, compulsory purchase orders, and environmental statements require specialist representation. Network operators seek counsel for regulated asset base and tariff arrangements. Dispute avoidance through robust contract drafting reduces risk of protracted litigation. Market activity aligns with investment in rail upgrades, energy grid reinforcement, and urban regeneration requiring clear legal frameworks, timely approvals, and enforceable contractor warranties across regional authorities nationwide.

Japan is projected to grow at a CAGR of 2.9% through 2035 in the infrastructure projects legal services market. Seismic design requirements and densely constrained sites increase contractual complexity. Legal advisors assist with specification compliance, contractor selection, and warranty terms. Land assembly and easement negotiations are sensitive and require precise documentation. Public procurement rules and bid evaluation processes demand specialist legal support. Dispute prevention and design defect management limit costly remediation and delay. Market growth reflects steady investment in transport upgrades, coastal defences, and urban renewal projects requiring rigorous technical specifications, inspector certification, and long-term warranty administration across metropolitan regions.

The global infrastructure projects legal services market shows moderate concentration, led by international law firms advising on large-scale transport, energy, water, and urban-development projects. Herbert Smith Freehills and Kramer Levin hold strong positions with established construction, procurement, and project-finance practices that support governments and private sponsors. Pinsent Masons, Baker McKenzie, and Clifford Chance maintain significant global reach across PPP frameworks, EPC contracting, and cross-border investment structures. Skadden and King & Wood Mallesons contribute depth in complex financings, sovereign negotiations, and dispute management. DLA Piper and Norton Rose Fulbright strengthen the upper tier with advisory capabilities covering regulatory compliance, construction risk, and multi-jurisdictional delivery. Competition in this segment is shaped by sector expertise, precision in contract drafting, and the ability to coordinate counsel across regions with different infrastructure regulations.

Latham & Watkins, Dentons, Allen & Overy, and Linklaters broaden the market through integrated project-finance and development practices supporting renewable energy, digital infrastructure, and transport-corridor investment. These firms offer extensive experience in lender negotiations, concession agreements, and long-term operational risk allocation. Strategic differentiation depends on familiarity with procurement rules, ability to manage multi-stakeholder negotiations, and depth in construction-related dispute resolution. As global infrastructure pipelines expand through energy transition programs and public-private investment, firms offering coordinated international coverage, rigorous risk analysis, and strong financing capabilities are positioned to maintain long-term advantage in the infrastructure legal-services landscape.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Professional Law Firm, Comprehensive Consulting Agency |

| Application | Transportation Infrastructure, Energy Infrastructure, Utilities & Water Infrastructure, Others |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | Herbert Smith Freehills, Kramer Levin, Pinsent Masons, Baker McKenzie, Clifford Chance, Skadden, King & Wood Mallesons, DLA Piper, Norton Rose Fulbright, Latham & Watkins, Dentons, Allen & Overy, Linklaters |

| Additional Attributes | Contract types (concession, EPC, O&M), PPP structuring, procurement & bidding frameworks, land-acquisition and compulsory purchase guidance, environmental-permitting workflows, lender due-diligence checklists, dispute-avoidance and arbitration strategies, ESG/Resilience clauses, performance-bonding & guarantee structures, cross-border tax and foreign-investment considerations, regional cost drivers for legal services, digital contract-management adoption, timeline impacts on fee models |

The global infrastructure projects legal services market is estimated to be valued at USD 105.6 billion in 2025.

The market size for the infrastructure projects legal services market is projected to reach USD 153.3 billion by 2035.

The infrastructure projects legal services market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in infrastructure projects legal services market are professional law firm and comprehensive consulting agency.

In terms of application, transportation infrastructure segment to command 49.0% share in the infrastructure projects legal services market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

5G Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

IT Infrastructure Management Tools Market

Cloud Infrastructure Entitlement Management Market Report – Trends & Forecast 2024-2034

Cloud Infrastructure-As-A-Service Market

Virtual Infrastructure Manager Market Size and Share Forecast Outlook 2025 to 2035

Carrier Infrastructure in Telecom Applications Market - Forecast 2025 to 2035

Hosting Infrastructure Services Market Analysis - Size Share and Forecast Outlook 2025 to 2035

Managed Infrastructure Services Market Analysis by Solution, Application, and Region Through 2035

Cloud IT Infrastructure Hardware Market Size and Share Forecast Outlook 2025 to 2035

Wireless Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Catenary Infrastructure Inspection Market Insights - Demand & Forecast 2025 to 2035

Critical Infrastructure Monitoring Market

Critical Infrastructure Protection Market

Automated Infrastructure Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Converged Infrastructure Management Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management (AIM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Converged Infrastructure Market

Public Key Infrastructure (PKI) Market Analysis - Growth & Forecast through 2034

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA