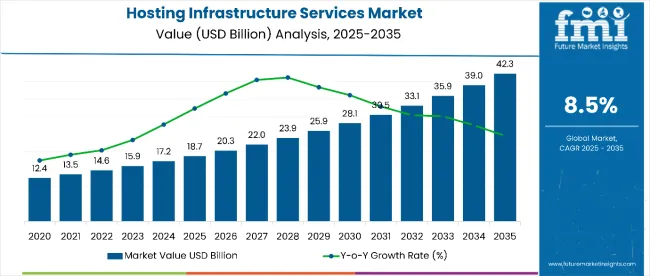

The hosting infrastructure services market is expected to expand significantly from USD 18.7 billion in 2025 to USD 42.3 billion by 2035, progressing at an 8.5% CAGR. This expansion is fueled by growing enterprise adoption of public, hybrid, and private hosting solutions along with rising demand for colocation, managed hosting, and virtual server services. The market expansion is supported by technological advancements, enhanced service offerings, and growing enterprise reliance on flexible hosting infrastructure solutions.

By 2030, the market is forecasted to reach USD 28.1 billion, indicating steady mid-term momentum supported by the rapid adoption of cloud deployments and expansion in emerging markets, such as India. Developed markets like the USA and Europe continue to contribute robust growth due to technological innovation and infrastructural investment. Over the 2025 to 2035 period, the market is poised to achieve an absolute growth of about USD 23.7 billion, highlighting sustained enterprise reliance on hosting infrastructure services, along with continual innovations that enhance security, scalability, and operational efficiency globally.

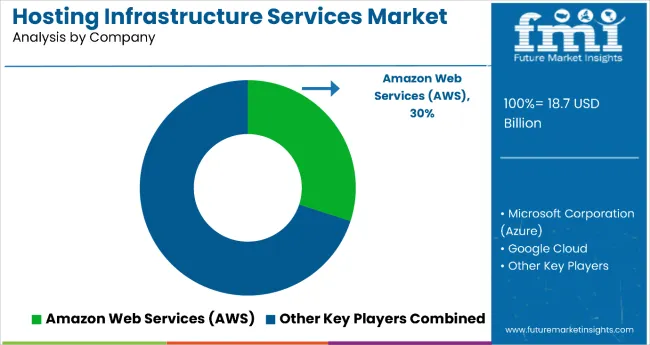

Leading companies such as Amazon Web Services (AWS), Microsoft Corporation (Azure), Google Cloud, IBM Corporation, and Equinix Inc. are consolidating their positions by expanding service portfolios and advancing next-generation hosting infrastructure technologies. Their focus includes enhanced cloud scalability, hybrid and multi-cloud solutions, advanced security features, and energy-efficient data center designs that optimize performance while reducing operational costs. By investing in innovation, reliability, and cost-effective hosting solutions, these players are enhancing access for enterprises while capturing growth opportunities across both developed markets and rapidly growing emerging regions.

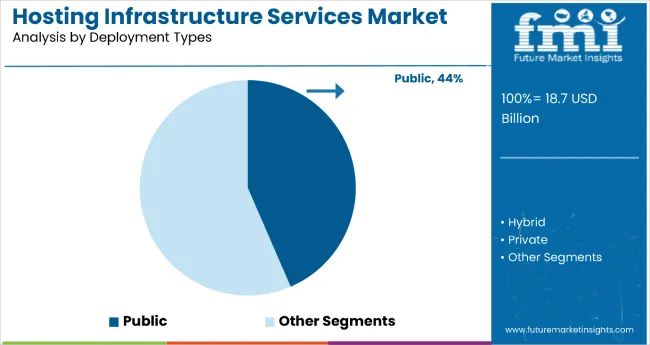

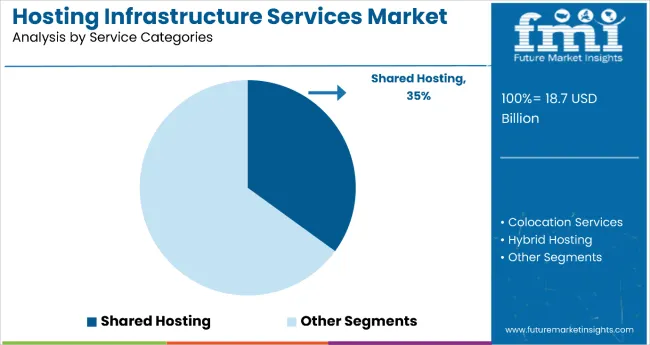

The market holds a critical position within the broader IT and cloud services sector, driven primarily by high demand for public cloud deployments, which account for 44% of the market share, alongside shared hosting services representing 35.0% of usage. Public cloud and hybrid hosting solutions remain central to enterprise IT strategies, enabling flexibility, scalability, and robust data management. This market contributes substantially to the digital transformation landscape, supported by continual technological advancements, expanding data center infrastructure, and increasing adoption across industries worldwide.

The market is evolving similarly to other IT infrastructure and cloud service markets in terms of innovation and strategic advancements. Leading companies like Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM, and Equinix are strengthening their portfolios by incorporating advanced technologies such as scalable cloud architectures, hybrid and multi-cloud environments, enhanced cybersecurity protocols, and energy-efficient data centers. These innovations improve precision in resource allocation, reduce downtime and service disruptions, and enhance performance reliability for enterprise clients.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 18.7 billion |

| Market Forecast Value (2035) | USD 42.3 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The hosting infrastructure services market is growing due to increasing demand for scalable, flexible, and secure digital infrastructure solutions that support enterprise digital transformation and cloud adoption. The rising need for reliable data center hosting, hybrid and public cloud deployments, and managed hosting services is driving market expansion. Enhanced awareness of cost efficiency, operational agility, and robust security in IT infrastructure encourages businesses to adopt advanced hosting solutions.

Innovations in virtualization, automation, and energy-efficient data center technologies are improving service quality and reducing operational costs, further boosting market growth. As enterprises increasingly prioritize cloud-first strategies and hybrid environments, the market outlook remains favorable. Leading providers focusing on continuous service enhancements and expanding regional infrastructure are well-positioned to capture growing demand across developed and emerging markets.

The market is segmented by deployment type, service, enterprise type, vertical, cloud service type, and region. By deployment type, the market is divided into hybrid, public, and private hosting. Based on service, the market is categorized into managed hosting, colocation services, hybrid hosting, shared hosting, website hosting, virtual dedicated servers, and virtual private servers. In terms of enterprise type, the market is bifurcated intoSMEs and large enterprises.

By vertical, the market is categorized into healthcare and life science, energy and utilities, retail and consumer goods, IT and telecommunication, BFSI, government and public sector, manufacturing, media and entertainment, and others such as education, transportation, and real estate. Based on cloud service type, the market is divided into IaaS hosting services, PaaS hosting services, and SaaS hosting services. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The most lucrative deployment segment in the hosting infrastructure services market is the public cloud, which holds the largest market share by offering a flexible balance between cost-efficiency, security, and scalability. While the public cloud segment accounts for 44% market share in 2025, hybrid cloud surpasses this by combining the benefits of both public and private clouds. Hybrid cloud enables enterprises to maintain sensitive data on private infrastructure while utilizing public cloud resources for non-sensitive, scalable workloads, meeting regulatory and compliance requirements effectively.

Growth drivers for public cloud include the increasing complexity of enterprise IT environments, data sovereignty concerns, and the need for agile, multi-cloud strategies. Enterprises across healthcare, BFSI, retail, and government sectors prefer hybrid solutions for enhanced control, security, and operational flexibility. The rising trend of digital transformation projects and edge computing adoption further fuels hybrid cloud demand, making it the preferred hosting infrastructure deployment type. Providers offering integrated hybrid cloud solutions with managed services and automation capabilities are poised to capture this lucrative segment growing at double-digit CAGR globally.

Among the hosting infrastructure services market, shared hosting holds a significant market share of 35% in 2025, making it one of the leading service categories. Shared hosting is popular among small to medium-sized businesses and individual users due to its cost-effectiveness and ease of use. It allows multiple customers to share the same physical server resources, which lowers expenses while providing essential hosting services.

The appeal of shared hosting lies in its affordability and straightforward management, making it ideal for websites and applications with moderate traffic and resource requirements. Despite the rise of cloud and managed hosting solutions, shared hosting maintains a strong presence, especially among startups, SMEs, and personal website owners. Providers continuously enhance shared hosting services with improved security features, user-friendly control panels, and scalability options to cater to a broad spectrum of customers while contributing substantially to market revenue.

Accelerating adoption of digital transformation and cloud migration is driving the hosting infrastructure services market, with enterprises prioritizing scalability, operational efficiency, and security. Significant investments in hybrid and multi-cloud deployments are expanding market reach, especially in regulated sectors like healthcare and finance. Increasing demand for managed hosting and colocation services supports growth, paired with rising need for energy-efficient and sustainable data centers. Regulatory compliance and data sovereignty concerns shape deployment strategies, influencing regional market dynamics. Challenges include high operational costs and cybersecurity threats but are being mitigated through innovations in automation and AI-driven infrastructure management.

Rising Technological Advancements Propel Hosting Infrastructure Services Market Growth

The steady rise of digital transformation and cloud adoption across global enterprises acts as the primary catalyst fueling the hosting infrastructure services market. Increasing deployment of hybrid and multi-cloud strategies helps organizations optimize costs, improve security, and enhance operational flexibility. Breakthroughs in automation, AI-driven infrastructure management, and edge computing improve performance, reliability, and real-time processing. Regulatory compliance and growing data sovereignty concerns are driving the market towards localized and hybrid hosting solutions, shaping procurement strategies.

Integration of AI-Enabled and Sustainable Infrastructure Expands Market Opportunities

Emerging trends in AI integration enable predictive maintenance, enhanced capacity planning, and advanced cybersecurity, significantly boosting operational efficiency. Simultaneously, sustainability initiatives drive investments in green and renewable energy-powered data centers, addressing environmental impacts and reducing operational expenses. The rise of edge computing supports low-latency and high-throughput applications, broadening hosting infrastructure beyond traditional data centers. Enterprises leveraging these advanced technologies benefit from reduced downtime, scalability, and better regulatory compliance, securing competitive advantage. Industry leaders continuously innovate portfolios to embed cutting-edge capabilities, maintaining growth momentum and strengthening leadership positions.

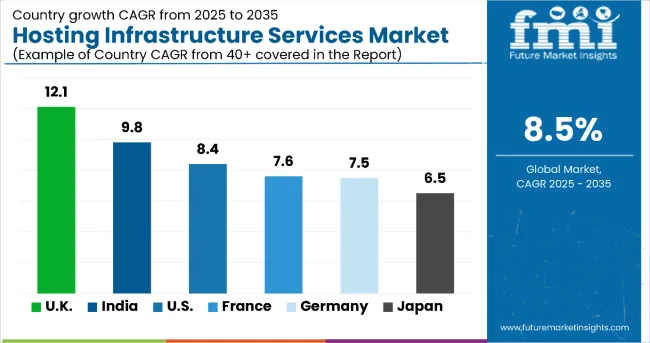

| Countries | CAGR(%)(2025) |

|---|---|

| India | 9.8 |

| UK | 12.1 |

| USA | 8.4 |

| Germany | 7.5 |

| France | 7.6 |

| Japan | 6.5 |

The hosting infrastructure services market growth rates among top countries demonstrate a mix of mature and emerging market dynamics. India leads with a strong CAGR of 9.8%, driven by expanding digital infrastructure, government initiatives, and a thriving startup ecosystem. The UK shows rapid growth at 12.1%, fueled by digital transformation in public and private sectors. The USA maintains steady growth at 8.4% due to mature infrastructure and hyper scaler innovations. Germany and France observe moderate growth at 7.5% and 7.6%, respectively, influenced by regulatory compliance and industrial cloud adoption. Japan’s market grows at 6.5%, focusing on mature ICT infrastructure and smart manufacturing.

The report covers an in-depth analysis of 40+ countries; six top-performing OECD countries are highlighted below.

Revenue from hosting infrastructure services in India is set for rapid expansion, growing at a CAGR of 9.8%. This growth is largely supported by significant investments in digital infrastructure and an increasing push for government-led digitalization initiatives such as Digital India and smart city projects. The country’s burgeoning startup ecosystem and expanding SME sector are also driving the adoption of cloud services and hosting infrastructure. Additionally, increasing awareness around data security, privacy, and data localization laws is leading enterprises to seek hybrid and private cloud solutions that offer better control and compliance. Major cities like Bangalore, Mumbai, and Hyderabad are witnessing extensive data center growth, bolstered by favorable policies and improved connectivity. The rising internet penetration and smartphone usage further contribute to increased demand for scalable hosting services. Indian enterprises are progressively embracing cloud migration strategies to optimize costs and enhance operational agility.

Demand for hosting infrastructure services in the USA is forecasted to grow at a CAGR of 8.4%, characterized by early and extensive adoption of cloud technologies. The nation benefits from a mature IT market supported by large hyper scalers such as AWS, Microsoft Azure, and Google Cloud, which continue to innovate and expand infrastructure. Enterprises are embracing hybrid and multi-cloud strategies to increase flexibility, data security, and regulatory compliance while optimizing costs. The USA market also leads in edge computing and AI workload deployments that require proximity and high computing power. Regulatory compliance, especially regarding data privacy and cybersecurity, strongly influences deployment models. Moreover, sustainability and green data center initiatives are gaining momentum within the market. Significant capital investments are being made to modernize legacy data centers and to support emerging technologies across industries like finance, healthcare, and retail.

Demand for hosting infrastructure services in Germany is expected to maintain a CAGR of 7.5%, with its growth steered by strict data protection regulations such as the GDPR. German enterprises, especially in manufacturing and industrial sectors, are integrating Industry 4.0 technologies which significantly depend on secure and reliable cloud and hosting solutions. The country emphasizes data sovereignty and privacy, leading to a preference for hybrid cloud deployment strategies that offer a blend of control and flexibility. Sustainability trends have also sparked interest in green, energy-efficient data centers, supported by government incentives and policies. Investment in data center infrastructure is concentrated mainly in Berlin, Frankfurt, and Munich, where connectivity is strong. Businesses also prioritize advanced cybersecurity measures to prevent threats and align with compliance mandates, fostering demand for managed hosting and colocation services.

Revenue from hosting infrastructure services in the UK is anticipated to grow at a notable CAGR of 12.1%, propelled by wide-ranging digital transformation initiatives in both government and private sectors. Government programs promoting cloud adoption and modernization of public services have resulted in significant hosting infrastructure investments. Enterprises across healthcare, finance, and retail industries are rapidly adopting hybrid and public cloud solutions to improve operational efficiencies and customer experiences. Data center expansions, centered in London and tech hubs like Manchester and Edinburgh, support this market surge. Cybersecurity remains a primary concern, driving investments in secure hosting environments. Furthermore, the strong collaborative ecosystem in the UK between service providers, government agencies, and enterprises accelerates innovation. The focus on sustainable data center operations also contributes to the market’s growth trajectory.

Revenue from hosting infrastructure services in France projects a CAGR of 7.6%, impacted by national mandates encouraging data localization and sovereign cloud initiatives. This focus appeals to enterprises with strong regulatory compliance requirements, particularly in public sector and finance industries. French SMEs increasingly adopt hosting and cloud services driven by digital transformation trends. Data centers in Paris and surrounding areas are expanding with a growing emphasis on energy efficiency and eco-friendly technologies. Hybrid and managed hosting services see growing demand as businesses balance operational efficiency with security needs. Collaboration between global cloud providers and French technology firms creates localized solutions that cater to specific compliance and market demands. The government's technological support programs bolster innovation and infrastructure growth.

Demand for hosting infrastructure services in Japan is expected to grow at a CAGR of 6.5%, underpinned by mature ICT infrastructure and government initiatives supporting Industry 4.0 and IoT adoption. Japanese enterprises prioritize reliability, innovation, and security in hosting services to support smart manufacturing and digital services. The market sees steady investments in green-certified and energy-efficient data centers, reflecting sustainability commitments. Cloud adoption is strong among manufacturing, telecommunications, and financial sectors, often leveraging hybrid cloud models to meet performance and compliance requirements. The government’s strategy emphasizes digital transformation, AI, and edge computing, further underpinning hosting service growth. Data centers cluster around Tokyo, Osaka, and Nagoya to meet these demands.

The hosting infrastructure services market is highly competitive, featuring a dynamic mix of global technology leaders and specialized managed service providers that continuously innovate to expand their market presence. Amazon Web Services (AWS), Microsoft Corporation (Azure), and Google Cloud Platform lead the sector through extensive cloud infrastructure ecosystems, AI-driven management tools, and globally distributed data centers that ensure reliability, scalability, and security.

IBM Corporation, HPE Development LP, Oracle Corporation, and Dell Technologies further enhance market competitiveness with hybrid and multi-cloud solutions, offering enterprises flexibility to manage workloads across on-premises and cloud environments. Equinix Inc. distinguishes itself through its global interconnection platform and colocation services, enabling efficient data exchange and regional compliance for multinational clients. AT&T Inc. and Rackspace Technology strengthen their positions by focusing on managed hosting, cybersecurity, backup, and disaster recovery services, catering to organizations seeking end-to-end operational support.

Market differentiation increasingly depends on customizable, secure, and energy-efficient hosting models aligned with enterprise digital transformation goals. Providers are investing heavily in automation, edge computing, and AI orchestration, while ensuring compliance with data sovereignty regulations and sustainability targets to retain competitive advantage in an evolving global landscape.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 18.7 billion |

| Service Categories | Managed Hosting, Colocation Services, Hybrid Hosting, Shared Hosting, Website Hosting, Virtual Dedicated Servers, Virtual Private Servers |

| Deployment Types | Public, Private, Hybrid |

| Enterprise Types | SMEs, Large Enterprises |

| Vertical Industries | Healthcare and Life Sciences, Energy and Utilities, Retail and Consumer Goods, IT and Telecommunication, BFSI, Government and Public Sector, Manufacturing, Media and Entertainment, Others (Education, Transportation, Real Estate) |

| Cloud Service Types | Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Key Countries Covered | United States, Canada, Mexico, Germany, France, United Kingdom, India, China, Japan, and 40+ countries |

| Key Companies Profiled |

Microsoft Corporation, IBM Corporation, HPE Development LP, AT&T Inc., Amazon Web Services (AWS), Google Cloud Platform, Oracle Corporation, Dell Technologies, Equinix Inc., Rackspace Technology. |

| Additional Attributes | Dollar sales by deployment, service, enterprise type, vertical, and region, rising cloud adoption, focus on hybrid cloud solutions, AI and automation integration, data sovereignty and compliance requirements, and investment in energy-efficient data centers |

The global hosting infrastructure services market is estimated to be valued at USD 18.7 billion in 2025.

The market size for hosting infrastructure services is projected to reach USD 42.3 billion by 2035.

The hosting infrastructure services market is expected to grow at an 8.5% CAGR between 2025 and 2035.

The public cloud segment is projected to lead in the hosting infrastructure services market with 44% share in 2025.

In terms of service, shared hosting is projected to command 35% share in the hosting infrastructure services market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IaaS/Hosting Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Stream Hosting Market Size and Share Forecast Outlook 2025 to 2035

5G Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

IT Infrastructure Management Tools Market

Cloud Infrastructure Entitlement Management Market Report – Trends & Forecast 2024-2034

Cloud Infrastructure-As-A-Service Market

Virtual Infrastructure Manager Market Size and Share Forecast Outlook 2025 to 2035

Carrier Infrastructure in Telecom Applications Market - Forecast 2025 to 2035

Managed Infrastructure Services Market Analysis by Solution, Application, and Region Through 2035

Cloud IT Infrastructure Hardware Market Size and Share Forecast Outlook 2025 to 2035

Wireless Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Catenary Infrastructure Inspection Market Insights - Demand & Forecast 2025 to 2035

Critical Infrastructure Monitoring Market

Critical Infrastructure Protection Market

Automated Infrastructure Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Converged Infrastructure Management Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management (AIM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Converged Infrastructure Market

Public Key Infrastructure (PKI) Market Analysis - Growth & Forecast through 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA