The market for action figures is expected to rise significantly between 2025 and 2035 as a result of growing franchise branding, nostalgia-driven purchases, and consumer demand for collectibles. The market is expected to increase at a compound annual growth rate (CAGR) of 8.9% from USD 10.6 billion in 2025 to USD 24.7 billion by 2035.

Market Forecast

| Attributes | Details |

|---|---|

| Industry Size (2025E) | USD 10.6 billion |

| Industry Value (2035F) | USD 24.7 billion |

| CAGR (2025 to 2035) | 8.9% |

Manufacturers continue to favor plastic as the primary material for action figures due to its durability, affordability, and moldability. Plastic action figures dominate the market because they offer lightweight, detailed designs and cost-effective production.

Leading brands like Hasbro, Mattel, and Bandai use high-quality PVC and ABS plastics to ensure flexibility, color retention, and detailed craftsmanship. These materials enable manufacturers to produce intricate designs while keeping costs low, making action figures accessible to both casual buyers and serious collectors.

Plastic action figures also benefit from mass production, allowing companies to create large quantities without compromising quality. The rise of 3D printing and advanced molding technologies has further improved precision and customizability, enabling brands to introduce limited-edition figures and collector’s items with enhanced detailing.

While plastic action figures dominate, concerns over sustainability push companies toward eco-friendly alternatives. Manufacturers now explore biodegradable plastics and recycled materials to meet consumer expectations for environmentally friendly collectibles. As sustainability gains importance, brands that incorporate eco-conscious materials may gain a competitive edge in the market.

The superhero action figure segment continues to dominate as global franchises like Marvel, DC, and independent comic book publishers expand their fan base. Superhero figures attract both children and adult collectors, fueling market growth through merchandising, movie tie-ins, and exclusive releases.

Consumers actively purchase superhero figures inspired by blockbuster movies, TV shows, and comic books. Popular characters such as Spider-Man, Batman, and Iron Man consistently rank among the best-selling action figures worldwide. Leading brands capitalize on superhero franchises by introducing collectible editions, special accessories, and battle-ready versions.

Toy manufacturers also boost sales through crossover collaborations and limited-edition releases. For example, companies partner with movie studios and video game developers to launch special edition superhero action figures featuring in-game armor, rare costumes, or alternate universe designs.

In addition, the superhero action figure market benefits from nostalgic appeal, with retro-style reissues and anniversary editions driving collector interest. Many adults reconnect with childhood favorites, leading to increased demand for premium, highly detailed superhero figures with interchangeable parts and dynamic poses.

The online distribution channel surpasses offline sales as e-commerce platforms, specialty toy websites, and direct-to-consumer sales become the preferred shopping method for action figure collectors.

Consumers prefer online shopping because they gain access to a wider variety of figures, pre-order exclusive editions, and compare prices easily. Amazon, eBay, Big Bad Toy Store, and Japanese import sites dominate online sales, offering rare figures, international shipping, and auction-style buying options.

Toy manufacturers also leverage social media marketing, influencer collaborations, and unboxing videos to drive online engagement. Live-streamed product launches, Kickstarter-backed limited editions, and collector forums further enhance the online shopping experience.

Subscription-based services and monthly figure boxes also gain popularity as collectors subscribe to exclusive mystery figures and themed action figure bundles. These services create excitement and boost sales through anticipation-driven marketing.

Key Players: The USA market is dominated by global toy giants. Companies like Hasbro and Mattel lead in action figures, alongside others such as LEGO, Playmates Toys, Jakks Pacific, Bandai Namco, and Spin Master, which collectively command significant market share

These firms produce figures for top franchises (Marvel, Star Wars, etc.), and specialty manufacturers (e.g. McFarlane, NECA) cater to collector niches.

Overall Sentiment: Consumer interest is robust, fueled by nostalgia and blockbuster entertainment. Many adults who grew up in the 1980s-90s “golden age” of action figures have returned as collectors seeking classic characters (Star Wars, G.I. Joe, Transformers), prompting re-releases of vintage-style figures and premium collectibles

Simultaneously, the ongoing rise of superhero movies and streaming series (Marvel, DC, Star Wars) introduces fresh characters that drive up demand for figures

The audience has broadened to both kids and adults, with firms offering budget-friendly toys for children and highly detailed editions for collectors, keeping overall sentiment and demand strong

Regulatory Process: USA toy manufacturers and importers must comply with stringent safety regulations. The Consumer Product Safety Improvement Act (CPSIA) imposes strict limits on lead content, phthalates (plastics chemicals), and mandates adherence to ASTM F963 toy safety standards

All action figures for children undergo third-party testing and certification to meet these federal safety requirements. Regulations also require clear choking-hazard labels for small parts and have standards for toys that resemble weapons (e.g. toy guns must have bright markings). These measures ensure products are safe and maintain consumer trust.

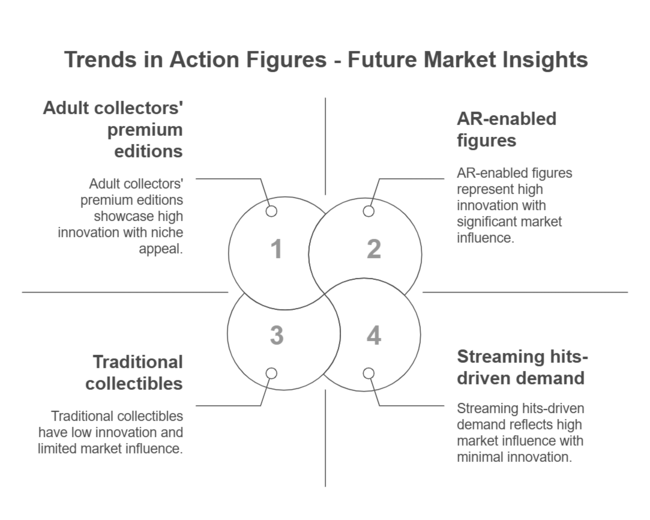

Opportunities: Innovation and pop-culture trends create growth avenues. Tech integration is rising - for example, NFC-enabled figures and augmented reality apps (like Nintendo’s Amiibo series) blend physical toys with digital content. Manufacturers are using advanced design technology to improve durability, articulation, and lifelike detail, making figures more appealing to collectors

Key Players: The UK action figure market features many of the same global players. Mattel and Hasbro are leading brands, with LEGO, Spin Master, and Bandai Namco (via its UK subsidiaries) also holding strong positions

These companies dominate popular lines from superheroes to movie tie-ins. A notable local contender is Character Options (known for licensed figures like Doctor Who), though the market is largely driven by international brands and licenses. Retail distribution often runs through major chains (e.g. Smyths, The Entertainer) that carry these top brands.

Overall Sentiment: Despite recent economic pressures, sentiment is positive due to a growing adult fanbase and enduring popularity of licensed toys. The UK has seen the rise of “kidults” - collectors aged 12 and up - now making up nearly 29% of toy industry value

In 2023, this kidult segment reached £1 billion, with action figures among the favored categories for older collectors.

Consumers are enthusiastic about figures tied to blockbuster franchises (Marvel, Star Wars, Harry Potter), and UK retailers report solid demand for limited-edition and retro figures appealing to nostalgia. Notably, licensed toys are a bright spot - the UK’s licensed toy sales grew +4% in 2023 (outpacing the EU average) and now account for about a third of the market, indicating strong fan engagement with action figure merchandise.

Key Players: France’s action figure market is served by major international toy companies. Hasbro and Mattel (with their extensive portfolio of superhero, movie, and gaming figures) are prominent, as are Bandai Namco (which has a strong presence through anime-related toys) and Spin Master. Construction toy giant LEGO also competes via its minifigure-driven sets. These global players dominate shelves across France

In addition, French consumers have access to European brands like Playmobil (Germany) and local specialty brands for collectibles. However, domestic French companies in the action figure space are relatively few - instead, French retailers rely on distributing popular USA and Japanese character merchandise, often localized with French language packaging and marketing.

Consumer sentiment in France is mixed but with bright spots in collectibles. Economic strains in 2023 led to an overall -5% dip in toy sales and the action figure category saw a decline as some families cut discretionary spending. However, the adult collector trend is gaining momentum in France as well - the kidulte (kidult) phenomenon is recognized, with more teenagers and adults buying figurines for themselves.

Notably, collectible vinyl figures (like Funko Pop!) have been booming: Funko became the #1 action figure manufacturer in the EU5 region, and in France its sales were up +13% year-to-date in 2023 even as the total French toy market was down about 4%

This indicates strong niche enthusiasm that offsets broader market softness. Popular culture conventions (Japan Expo, Comic Con Paris) also reflect high demand for anime and game character figures among French fans. Overall, while parents’ spending on kids’ toys has been cautious, France’s community of collectors and pop-culture enthusiasts keeps the action figure segment lively, with innovation and nostalgia driving interest.

Key Players: Germany’s action figure market is influenced by both global and local players. Major international brands Hasbro and Mattel are top contributors, offering a wide range of figures (from Marvel and Star Wars by Hasbro to Mattel’s licenses like Jurassic World). Collector-oriented brands like NECA (known for highly detailed figures from movies and games) also have a significant following in Germany

German toy companies play a role primarily in niche segments - for example, Schleich (Germany) produces hand-painted figurines including superheroes and fantasy characters, and Playmobil (a German brand) provides poseable figures in themed playsets (though not articulated “action figures” in the traditional sense, they compete in the figures category). Overall, the market is vibrant with a mix of imports and domestic products, but it’s largely dominated by the big global franchises and their manufacturers

German consumers have a strong interest in collectibles and character merchandise, making sentiment generally positive.

Nostalgia is a driving factor - many Germans seek figures of beloved characters from classic movies, TV shows, comics, and video games. As a result, action figures in Germany are often seen not just as kids’ toys but as collectible items for teens and adults. Popular franchises like Marvel, DC Comics, Star Wars, and various anime series enjoy a large fanbase, and figures from these universes are highly sought-after

The enduring desire to connect with familiar characters has kept demand steady. In 2023, like elsewhere in Europe, Germany’s toy sector faced a downturn (around -5%), which affected traditional toy sales

Even so, the action figure segment benefits from Germany’s “collector culture” - evident in thriving comic-cons (e.g. Comic Con Stuttgart) and hobby expos. Limited-edition releases and high-quality imports tend to sell well among enthusiasts. In sum, industry sentiment in Germany regards action figures as a stable and growing collectibles segment, buoyed by devoted fans, even if children’s sales fluctuate with trends.

Key Players: Japan’s action figure industry is dominated by domestic toy powerhouses and established global franchises. The top two companies in the Japanese toy market are Bandai Namco and Takara Tomy, which accordingly lead in action figures as well

Bandai Namco produces a vast array of figures (from Gundam and Dragon Ball to Kamen Rider and Ultraman), leveraging its many anime and game licenses. Takara Tomy (Tomy) is known for Transformers (co-produced with Hasbro), Pokémon toys, and other character figures. Other notable players include Kaiyodo, Good Smile Company, and Kotobukiya - these smaller firms focus on high-detail collector figures and model kits, especially for anime, and enjoy strong fan followings domestically and abroad.

While international brands like Hasbro and Mattel have a smaller direct footprint in Japan, their products (e.g. Marvel Legends or Barbie dolls) often enter the market through local distribution partnerships. Overall, Japanese companies largely drive the market with homegrown intellectual properties and a reputation for quality and innovation in figure design.

Overall Sentiment: In Japan, action figures are a staple of pop culture, and sentiment is very positive. The country has a deeply rooted otaku collector culture, where teens and adults enthusiastically collect figures from anime, manga, and video games. This makes action figures not just children’s toys, but prized collectibles at all ages. Iconic Japanese franchises (like Gundam, One Piece, Evangelion) consistently fuel demand for new figures and model kits.

Consumers in Japan expect high craftsmanship - highly articulated “figma” figures, poseable mecha robots, and detailed scale figures are popular. The market is also dynamic: trends can surge with hit anime (for example, a breakout series like “Demon Slayer” leads to sell-out character figures).

Overall industry sentiment remains innovative; companies frequently release new editions and crossover collaborations. While Japan’s shrinking child population is a long-term concern for toy sales, the void is offset by adult hobbyists. The result is a stable or growing interest in action figures. In fact, the anime character figure segment is booming - even outpacing traditional superhero toys - reflecting how domestic and global fans alike are focusing on Japanese IPs

South Korea’s action figure market is smaller and more niche, with a mix of local and international players. The leading domestic toy company is Young Toys Inc., known for creating its own animated IPs and toy lines. Young Toys produces the popular transforming robot car series TOBOT, along with other characters like Kongsuni and Secret Jouju, and has been a flagship South Korean toy maker since 1980.

These homegrown action toys (especially Tobot, which has sold over 17 million units globally cater to young children and compete with foreign brands. Otherwise, the market is heavily influenced by imports: global brands such as Bandai (for Gundam models and anime figures), Hasbro (Marvel, Transformers via local distributors), and Mattel (e.g. WWE figures) have a strong presence through partnerships or importers.

Niche Korean companies and hobby shops import Japanese and USA collectible figures to serve adult fans. Overall, the market lacks a multitude of domestic action-figure-specific manufacturers; instead, it relies on a few key local players and the availability of popular foreign products in retail and online stores.

Overall Sentiment: Consumer sentiment in South Korea’s action figure segment is moderate but gradually growing. Traditionally, Korean parents have prioritized educational toys, tech gadgets, and video games over action figures, so the category for children is smaller compared to Western markets. Nonetheless, the popularity of global franchises (Marvel superheroes, K-pop influenced characters, etc.) and Japanese anime has cultivated a dedicated fan following.

There’s an emerging collector community in Korea - for instance, enthusiasts of Japanese anime figures or limited-edition collectibles are increasingly visible, with specialty shops in Seoul and Busan catering to them. Overall toy industry data shows growth (the Korean toys & games market grew ~8% annually from 2017 to 2022) but action figures remain a niche within that.

Many Korean consumers view action figures as collectibles or display pieces rather than playthings, and there’s a positive sentiment towards high-quality figures (often imported). Cultural trends like the Korean Wave (Hallyu) could also play a role; while not yet common, we see potential interest in figures of Korean game characters or even K-pop idols. In summary, sentiment is cautiously positive - not a mainstream hobby for all ages yet, but fan-driven demand is on the rise.

Australia’s action figure market is relatively small in absolute terms, but it features a strong presence of international brands and a notable local company. Hasbro and Mattel are dominant through their global product lines (Marvel, Star Wars, Barbie, etc.), often distributed by local partners.

Spin Master and Bandai products (like Paw Patrol or Gundam models) also reach Australian shelves. Uniquely, Australia is home to Moose Toys, an Australian-owned toy company known internationally for hits like Shopkins and Heroes of Goo JitZu (a line of stretchy action figures popular with kids)

Moose’s success in categories like collectibles and action-driven figures has made it a significant player, showing that homegrown brands can thrive. Retail in Australia is concentrated in chains like Big W, Kmart, and Target, which stock these key brands, as well as hobby shops that cater to collectors with imports (e.g. NECA, McFarlane figures from the US). In summary, global franchises largely drive the Australian action figure market, with Moose Toys adding local innovation and flair.

Consumer sentiment in Australia around action figures is fairly positive, though the market is niche. Australian children and collectors generally enjoy the same blockbuster franchises as UK/USA audiences - Marvel superheroes, Star Wars, and gaming/anime characters all have fan followings down under.

Per capita spending on toys in Australia has historically been high (reflecting the country’s relatively affluent economy and gift-giving culture), which benefits action figure sales. That said, the overall toy market in recent years saw a slight slump during 2021 to 2023, followed by a rebound in 2024.

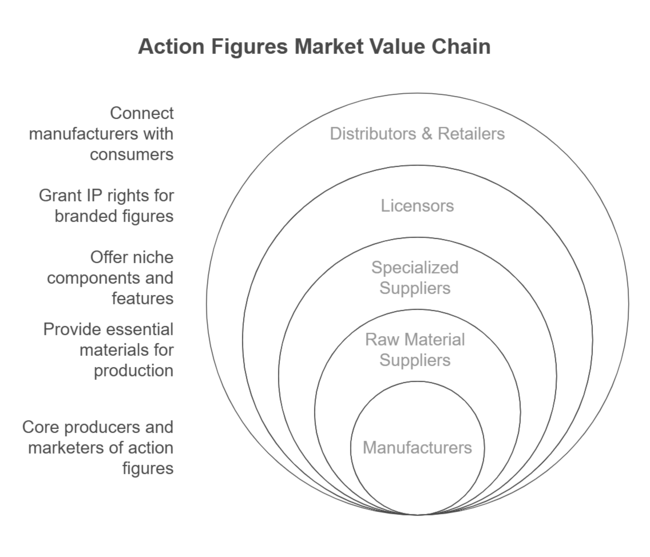

Manufacturers

Role: Design, produce, and market action figures.

Functions

Market Focus

Examples

Raw Material Suppliers

Role: Provide base materials for production. Functions:

Market Focus

Examples

Specialized Suppliers

Role: Deliver niche components enhancing product value. Functions:

Market Focus

Examples

Other Stakeholders

The action figures market continues to grow as demand for collectible toys, licensed characters, and nostalgia-driven purchases rises. Key players in this market focus on high-quality craftsmanship, innovation in materials, and exclusive collaborations with entertainment franchises. The industry thrives on limited-edition releases, high-end figures, and expanding consumer bases, including both children and adult collectors. Companies differentiate themselves through licensing agreements, technological integrations, and fan engagement strategies.

| Company Name | Estimated Market Share (%) |

|---|---|

| The LEGO Group | 18-24% |

| Hasbro | 14-20% |

| Bandai Namco Holdings Inc. | 10-16% |

| Mattel | 8-12% |

| Spin Master | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| The LEGO Group | Offers action figures integrated into LEGO playsets and collectibles. Expands franchise partnerships and launches limited-edition minifigures. |

| Hasbro | Produces Star Wars, Marvel, and Transformers action figures. Invests in digital enhancements and customizable collectibles. |

| Bandai Namco Holdings Inc. | Specializes in anime and gaming action figures, including Gundam and Dragon Ball. Expands premium collectible product lines. |

| Mattel | Develops action figures based on classic and modern entertainment brands. Enhances digital play integration with figures. |

| Spin Master | Creates action figures from TV shows and movies, including PAW Patrol and DC Universe. Leverages augmented reality features. |

Strategic Outlook of Key Companies

The LEGO Group (18-24%)

The LEGO Group leads in the collectible minifigure space by integrating action figures within LEGO playsets. The company continuously expands its licensing agreements with entertainment franchises such as Marvel, Star Wars, and DC Comics. LEGO's digital expansion includes augmented reality-based play experiences and customization options for collectors. The company invests in sustainable materials for minifigures, aligning with its eco-friendly initiatives.

Hasbro (14-20%)

Hasbro dominates with its Star Wars, Marvel, and Transformers action figure lines. The company leverages AI-driven customization for limited-edition collectibles and continues to expand its HasLab crowdfunding platform for premium figures. Hasbro strengthens direct-to-consumer sales through exclusive launches and online fan events. The brand also integrates digital connectivity, allowing figures to interact with virtual gaming ecosystems.

Bandai Namco Holdings Inc. (10-16%)

Bandai Namco excels in anime and gaming-related action figures, particularly through its Gundam, Dragon Ball, and One Piece franchises. The company introduces hyper-detailed, poseable figures targeting serious collectors. Bandai Namco expands its presence in Western markets through collaborations with major entertainment properties and increases production of high-end, limited-run collectibles.

Mattel (8-12%)

Mattel continues to innovate in action figures with a focus on brands like Masters of the Universe, Jurassic World, and WWE. The company enhances digital interactions with figures, incorporating mobile apps and AR technology. Mattel’s strategy includes leveraging retro toy revivals and capitalizing on nostalgia marketing to attract adult collectors.

Spin Master (6-10%)

Spin Master specializes in children's action figures with successful franchises like PAW Patrol and DC Universe. The company integrates augmented reality and interactive features, enhancing the play experience for younger audiences. Spin Master strengthens partnerships with global entertainment studios to maintain brand relevance and launches animated series to complement its toy lines.

Other Key Players (30-40% Combined)

Several smaller and niche players contribute to the action figures market. These companies focus on high-end, collectible-grade figures, regional franchise partnerships, and specialty distribution channels. Notable brands include:

The market segments into Plastic, Silica Rubber, and Others.

It includes Superheroes, Anime Characters, and Movie Characters.

It categorizes into Up to 8 Years, 9 - 15 Years, and 15 Years & Above.

It includes Online and Offline.

It covers North America, Latin America, Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The Global Action Figures industry is projected to witness a CAGR of 8.9% between 2025 and 2035.

The Global Action Figures industry stood at USD 10.6 billion in 2025.

The Global Action Figures industry is anticipated to reach USD 24.7 billion by 2035 end.

North America is expected to record the highest CAGR, driven by strong collector demand and franchise-based product expansions.

The key players operating in the Global Action Figures industry include The LEGO Group, Hasbro, Bandai Namco Holdings Inc., Mattel, Spin Master, and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-user, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by End-user, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by End-user, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End-user, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by End-user, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by End-user, 2023 to 2033

Figure 95: Europe Market Attractiveness by Distribution channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by End-user, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by End-user, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Distribution channel, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by End-user, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 141: MEA Market Attractiveness by Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by End-user, 2023 to 2033

Figure 143: MEA Market Attractiveness by Distribution channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Action Camera Market

Fractionated Fatty Acid Market Size, Growth, and Forecast for 2025 to 2035

Traction Motors Market Growth - Trends & Forecast 2025 to 2035

Traction Battery Market Growth - Trends & Forecast 2025 to 2035

Fractionated Lecithin Market Growth - Source & Industry Trends

Traction Inverter Market

Traction Transformer Market

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compaction Machines Market Growth - Trends & Forecast 2025 to 2035

Compaction equipment Market

DC Traction Switchgear Market Size and Share Forecast Outlook 2025 to 2035

EV Traction Inverter Market Size and Share Forecast Outlook 2025 to 2035

Transaction Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Transactional Video on Demand Market

Skin Traction Kits Market

Rail Traction Transformers Market

Orbital Action Jigsaw Market Size and Share Forecast Outlook 2025 to 2035

Data Extraction Software Market

Lipid Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

LNG Liquefaction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA