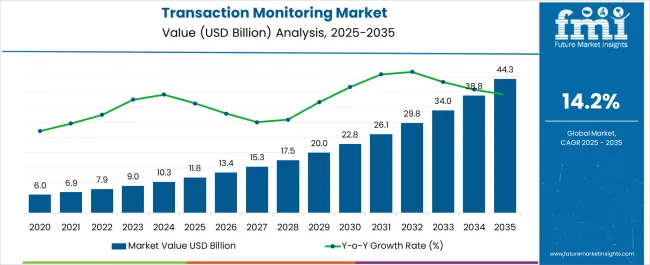

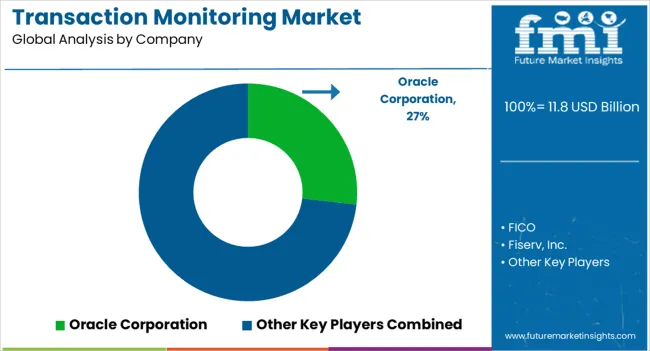

The Transaction Monitoring Market is estimated to be valued at USD 11.8 billion in 2025 and is projected to reach USD 44.3 billion by 2035, registering a compound annual growth rate (CAGR) of 14.2% over the forecast period.

| Metric | Value |

|---|---|

| Transaction Monitoring Market Estimated Value in (2025 E) | USD 11.8 billion |

| Transaction Monitoring Market Forecast Value in (2035 F) | USD 44.3 billion |

| Forecast CAGR (2025 to 2035) | 14.2% |

The transaction monitoring market is expanding rapidly as financial institutions, fintech firms, and enterprises prioritize compliance, fraud prevention, and risk management. Rising incidences of money laundering, identity theft, and cyber fraud have accelerated the demand for advanced monitoring solutions that offer real time analysis and anomaly detection.

Regulatory mandates such as anti money laundering and counter terrorism financing requirements are further driving adoption across industries. Technological innovations including AI driven analytics, machine learning, and cloud deployment models are enhancing the efficiency and scalability of monitoring platforms.

Enterprises are increasingly seeking solutions that integrate seamlessly with existing systems while providing actionable insights and regulatory reporting support. The future outlook remains strong as the convergence of compliance pressure and digital payment expansion continues to fuel investment in advanced transaction monitoring infrastructure.

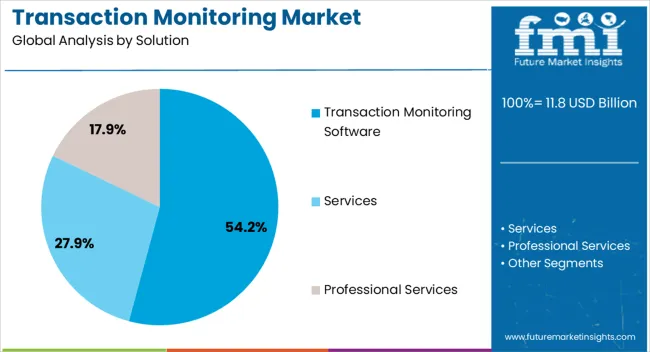

The transaction monitoring software segment is projected to hold 54.20% of the overall market revenue by 2025, making it the leading solution. Its dominance is attributed to the ability to provide automated, real time tracking of financial transactions, ensuring both regulatory compliance and enhanced security.

The software segment has gained preference due to its adaptability across diverse financial ecosystems, scalability for high volume processing, and integration with fraud detection modules. Increasing complexity of digital payment networks and cross border transactions has further strengthened reliance on advanced software solutions.

With continuous innovation in AI powered algorithms and predictive analytics, this segment is expected to retain leadership in meeting the evolving compliance and security needs of global enterprises.

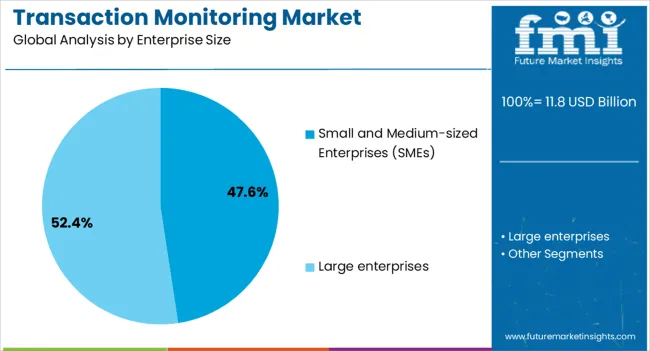

The small and medium sized enterprises segment is expected to account for 47.60% of total revenue by 2025 within the enterprise size category, establishing it as the most prominent segment. Growth in this segment is being driven by the rising exposure of SMEs to digital payment fraud and compliance obligations.

Increasing adoption of affordable and cloud based monitoring solutions has enabled SMEs to implement effective fraud prevention measures without large infrastructure costs. Vendors are offering tailored platforms with simplified interfaces and cost efficiency, making adoption more accessible for smaller businesses.

Regulatory authorities are also enforcing stricter compliance standards on SMEs, prompting accelerated adoption of transaction monitoring solutions. These factors have positioned SMEs as a critical growth driver within the transaction monitoring market.

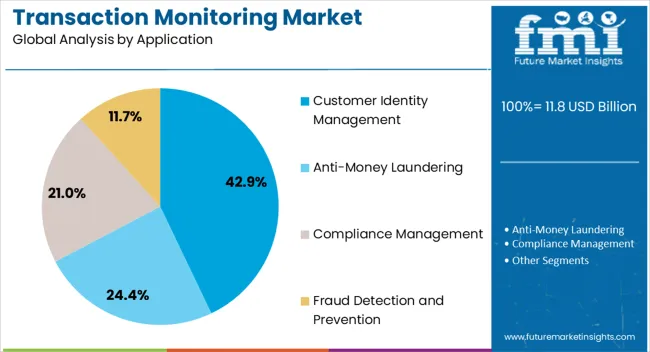

The customer identity management application is projected to represent 42.90% of total market revenue by 2025, making it the leading application category. This growth is being driven by the urgent need to verify and authenticate customer identities to prevent fraudulent transactions and identity theft.

Enterprises are focusing on deploying advanced identity management systems that integrate biometric authentication, KYC compliance, and behavioral analytics. These systems enhance customer trust, streamline onboarding processes, and improve overall fraud detection capabilities.

Growing digital payment volumes and rising cybercrime activity have further emphasized the importance of robust identity management solutions. As organizations continue to prioritize security and compliance while delivering seamless customer experiences, the customer identity management application segment is expected to maintain its dominance.

Transaction monitoring solutions can be utilized to analyze the plausibility of all transactions. It offers various benefits such as secure business applications, analysis of business cases regarding plausibility, the flexible and transparent configuration of rules, and analysis of business cases and risk management systems, among others.

Transaction monitoring market value is expected to reach US$ 44.3 Bn by 2035, at a CAGR of 15% during the forecast period 2024 to 2035.

Transaction monitoring solutions provide a wide range of applications such as anti-money laundering, customer identity management, fraud detection and prevention, and compliance management.

There is continuous development and implementation of new technology such as artificial intelligence (AI), Internet of Things (IOT), and robotic process automation (RPA) which holds considerable promise for overcoming money laundering, terrorist financing, fraud, market abuse, or trade misconduct. This is creating new growth opportunities for transaction monitoring solutions, in the coming years.

The market is projected to witness significant growth during the forecast period, due to several factors such as the need to manage organizational KYC compliance, use of progressive analytics to offers proactive risk alerts and mitigate money laundering, and Counter-Terrorist Financing (CTF) activities.

The solutions offers different features such as real-time transaction monitoring, detection of the unusual flow of funds over a period, identify suspicious behavior, historical profiling, account level, and minimize unnecessary alerts by tailoring scenarios and others.

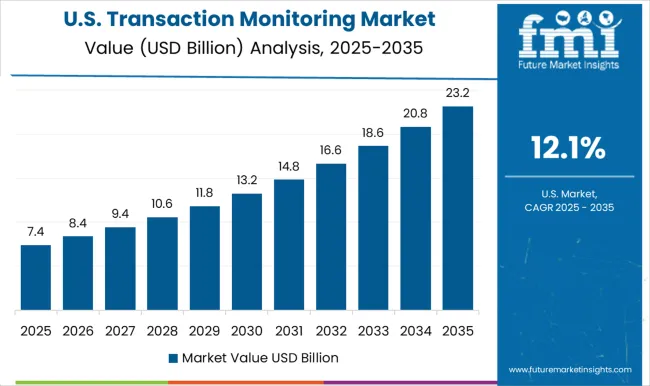

The USA is the largest market for transaction monitoring, owing to the strong presence of transaction monitoring software and service provider, and the increasing adoption of digital technologies in the USA region. The USA transaction monitoring market is set to tread on the historic pattern of bust and boom during the assessment period 2024 to 2035.

Demand is likely to remain muted in the next couple of years, as several end-use industries make a gradual recovery.

Moreover, increasing emphasis on regulating the USA government regarding money laundering, and terrorist financing activities, and fraud protection, is also expected to drive the USA market. The USA and Canada-based transaction monitoring providers focus on offering cost-effective cloud-based solutions across the North American market.

The adoption of a transaction monitoring solution is expected to rise considerably across small- and medium-sized enterprises in South Asia & the Pacific region.

Also, enterprises in South Asian countries are demanding efficient systems, such as anti-money laundering software solutions to handle AML compliance at financial institutions and other firms, which is creating new growth opportunities for transaction monitoring in South Asia and the Pacific region.

The financial industry is projected to show sustainable growth due to investments by multinational players such as BAE Systems, and Software AG, among others, in the country, and government initiatives to support the growth of the BFSI industry. Demand for transaction monitoring solutions is increasing in emerging countries like India, Indonesia, Malaysia and others, as they provide proactive security measures for preventing data breaches.

Some of the leading providers of Transaction Monitoring include

Market participants are adopting the product diversification strategy to enhance their market presence. Moreover, emerging companies are significantly investing in new product development. For instance, ACAMS launched new transaction monitoring certification for compliance professionals.

This certification sets a new global standard for compliance staff tasked with investigating, reviewing, and escalating the transactional alerts that is potentially lead to the filing of suspicious activity reports.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments and geographies.

The global transaction monitoring market is estimated to be valued at USD 11.8 billion in 2025.

The market size for the transaction monitoring market is projected to reach USD 44.3 billion by 2035.

The transaction monitoring market is expected to grow at a 14.2% CAGR between 2025 and 2035.

The key product types in transaction monitoring market are transaction monitoring software, services, professional services and _managed services.

In terms of enterprise size, small and medium-sized enterprises (smes) segment to command 47.6% share in the transaction monitoring market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Monitoring Tool Market Size and Share Forecast Outlook 2025 to 2035

Transactional Video on Demand Market

Pet Monitoring Camera Market Size and Share Forecast Outlook 2025 to 2035

Pain Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Dose Monitoring Devices Market - Growth & Demand 2025 to 2035

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Neuro-monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Media Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Noise Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Nerve Monitoring Devices Market Insights - Growth & Forecast 2025 to 2035

Power Monitoring Market Report - Growth, Demand & Forecast 2025 to 2035

Urine Monitoring Systems Market Analysis - Size, Trends & Forecast 2025 to 2035

Brain Monitoring Systems Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Flare Monitoring Market

Yield Monitoring Systems Market

Driver Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Tunnel Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Voltage Monitoring Integrated Circuit Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA