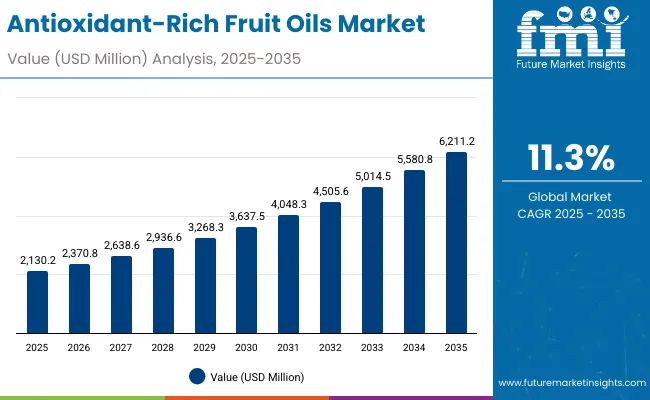

The market for antioxidant-rich fruit oils is expected to be valued at USD 2,130.2 million in 2025 and projected to reach USD 6,211.2 million by 2035, reflecting a total incremental growth of USD 4,081 million over the decade. This trajectory indicates a CAGR of 11.3%, suggesting the market is set to expand by nearly three times its initial size.

Antioxidant-Rich Fruit Oils Market Key Takeaways

| Metric | Value |

| Market Estimated Value In (2025e) | USD 2,130.2 million |

| Market Forecast Value In (2035f) | USD 6,211.2 million |

| Forecast CAGR (2025 to 2035) | 11.30% |

The scale of transformation is expected to be particularly significant in the latter half of the forecast period, during which consumer demand is anticipated to shift toward clinically backed natural actives and skin-rejuvenating oil blends.

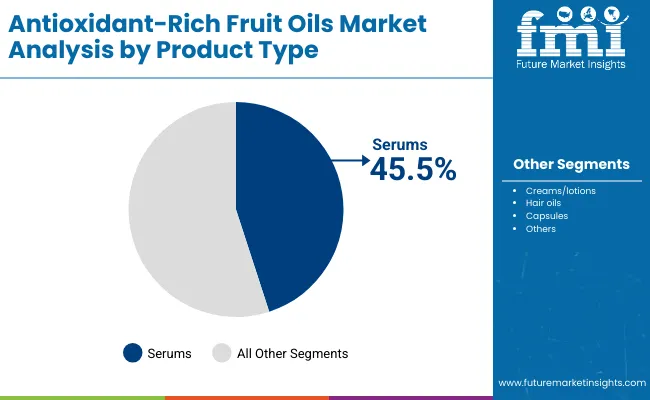

Between 2025 and 2030, the market is expected to grow from USD 2,130.2 million to USD 3,637.5 million, witnessing a net increase of USD 1,507.3 million. This growth phase is likely to be driven by a surge in serum applications and a rise in anti-aging skincare routines, as more consumers seek multifunctional natural oils over synthetic actives. Serums are anticipated to maintain their dominance within product types, accounting for approximately 45.5% of the market share in 2025, due to their rapid absorption and compatibility with fruit-oil infusion.

From 2030 to 2035, a stronger acceleration is expected as the market progresses from USD 3,637.5 million to USD 6,211.2 million, contributing USD 2,573.7 million in growth, or nearly 63% of the decade’s overall increase. This momentum will likely be shaped by wider acceptance of plant-based beauty solutions across Asia-Pacific, along with e-commerce-driven premium oil launches tailored for personalized skincare systems.

From 2020 to 2024, the market expanded from USD 1,500.7 million to USD 2,016.4 million, driven by growing demand for botanical skincare actives. During this period, major players such as Croda, DSM-Firmenich, and Givaudan captured a combined 41.6% share, owing to their integrated ingredient portfolios and supply chain strength. Innovation was centered around fruit-based antioxidant oils tailored for clean-label cosmetic applications.

By 2025, demand is projected to reach USD 2,130.2 million, marking a significant turning point as digitally-native brands, white-label D2C models, and ayurveda-aligned beauty startups expand market participation. The revenue mix is expected to shift from commodity bulk oils to premium, functional extracts with targeted claims (e.g., anti-aging, UV protection, barrier repair). As recurring demand rises, the focus will increasingly move toward bioavailability, sustainability certifications, and traceability mechanisms. Competitive advantage is set to be defined by brand transparency, scientific validation, and personalized wellness integration.

Rapid growth in the antioxidant-rich fruit oils market is being driven by increased consumer awareness around natural skincare solutions and the growing demand for functional botanical ingredients. Rising concerns over oxidative stress, premature aging, and environmental damage have prompted a shift toward fruit oils rich in polyphenols and vitamins. These oils are being preferred due to their dual functionality offering both cosmetic enhancement and long-term skin health support. Greater efficacy has been observed in anti-aging and brightening applications, especially in serums, which are being used more frequently in both mass and premium skincare routines.

The clean beauty movement has played a central role in shaping purchase behavior, with transparency, plant-origin certification, and ingredient traceability being emphasized. Growth has also been supported by the expansion of e-commerce channels, allowing direct-to-consumer brands to offer targeted formulations. As demand rises across Asia-Pacific, particularly in China and India, newer product formats and personalized oil blends are expected to further accelerate adoption across mainstream and niche categories.

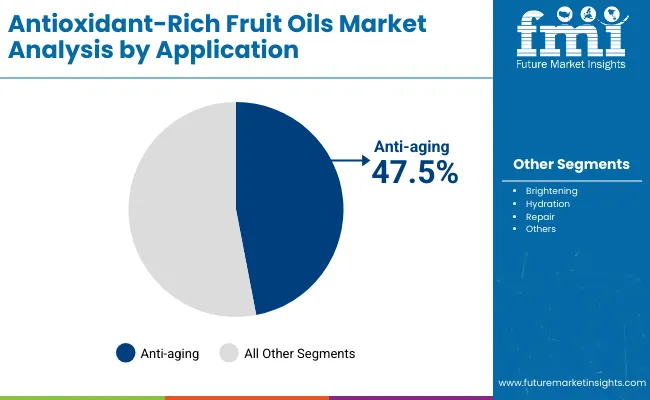

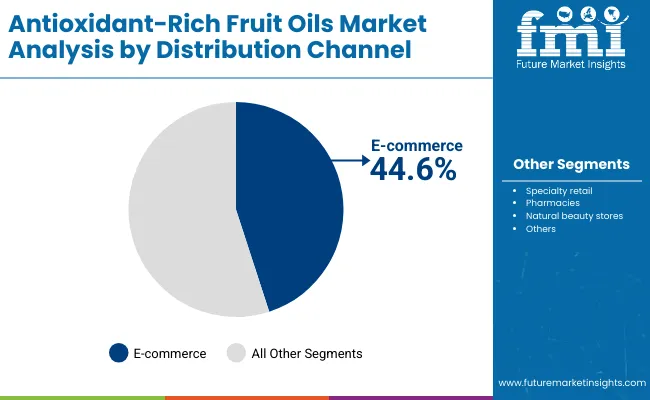

The antioxidant-rich fruit oils market has been segmented based on application, product type, and distribution channel to capture evolving consumer preferences, format innovations, and retail dynamics. Application-wise segmentation highlights functional demand, with anti-aging, hydration, and brightening uses driving differentiation. Product type segmentation emphasizes how these oils are being incorporated into formats such as serums, lotions, and hair oils, enabling tailored skincare routines.

Channel-wise segmentation reveals structural shifts in consumer buying behavior, with e-commerce and specialty retail emerging as high-impact touchpoints. Each segment is expected to evolve independently, influenced by personalization trends, ingredient transparency, and changing shelf presentation. Regional nuances, particularly in Asia-Pacific and North America, are likely to further shape performance across these categories. Strategic focus is being placed by brands on optimizing value per segment, as demand expands across price points and demographic groups.

| Application | Market Value Share, 2025 |

|---|---|

| Anti-aging | 47.5% |

| Others | 52.5% |

The anti-aging segment is expected to hold 47.5% of the market value in 2025, driven by rising concerns around visible skin aging, oxidative damage, and environmental stressors. Fruit oils, especially those derived from pomegranate, acai, and grape seed, are being included in premium routines due to their ability to support collagen synthesis and skin repair. Their compatibility with daily-use formats and long-standing perception as clean-label actives has encouraged broad consumer trust. Brands are increasingly positioning antioxidant-rich oils as both preventive and restorative, appealing to consumers seeking non-invasive skincare solutions. With increasing clinical support and innovation in delivery systems, the anti-aging segment is expected to remain a key revenue contributor throughout the forecast period.

| Product Type | Market Value Share, 2025 |

|---|---|

| Serums | 45.5% |

| Others | 54.5% |

Serums are projected to contribute 45.5% of total market sales in 2025, emerging as the preferred product type for delivering antioxidant-rich fruit oils. Their rapid absorption, lightweight nature, and compatibility with layering routines have supported widespread usage. Brands are focusing on high-purity, cold-pressed oils in serum formats, enabling better stability and bioavailability. Growing awareness about ingredient lists and active concentrations has led consumers to favor serums over conventional creams. Newer oil-in-serum hybrids and waterless formats are also entering the market, targeting sensitive and oily skin types. The flexibility of serum applications from AM/PM routines to booster shots is expected to solidify their role as the most innovation-friendly format in the antioxidant-rich fruit oils space.

| Channel | Market Value Share, 2025 |

|---|---|

| E-commerce | 44.6% |

| Others | 55.5% |

E-commerce is projected to account for 44.6% of market value in 2025, reflecting the growing digitization of beauty and personal care purchases. The segment is being driven by the increasing popularity of skincare education content, user reviews, and ingredient-focused product filters. Direct-to-consumer brands are leveraging digital channels to offer targeted formulations and build community-driven marketing ecosystems. Subscription models and personalized quizzes are being used to improve retention and conversion.

In parallel, major online retailers are expanding their clean beauty categories, offering curated collections of antioxidant-rich oils. As consumer confidence in online beauty purchases grows, and delivery reliability improves, the e-commerce channel is expected to unlock greater access and assortment differentiation across both emerging and mature markets.

Increasing consumer scrutiny around ingredient transparency is reshaping the antioxidant-rich fruit oils market, even as innovation in sustainable sourcing, dermal delivery systems, and therapeutic narratives drives accelerated adoption across premium, niche, and dermocosmetic segments.

Clinical Hybridization of Oils with Nutraceutical Attributes

A new era of antioxidant-rich fruit oils is being defined by their clinical repositioning beyond cosmetic hydration toward dermatologically inspired nutraceutical benefits. Oils previously considered cosmetic-grade are now being included in oral capsules and transdermal systems for systemic antioxidant delivery. This evolution is being enabled by joint research initiatives between skincare brands and nutraceutical firms, where the bioactivity of compounds like punicic acid (from pomegranate oil) and resveratrol (from grape seed oil) is being mapped for cellular impact. As cosmeceutical boundaries blur, hybrid oil-based formats are expected to dominate personalization-led premium portfolios.

AI-Personalized Skincare Routines Boosting Functional Oil Customization

Advanced AI-driven diagnostics are being deployed by brands to build tailored oil regimens based on skin pH, melanin index, and oxidative stress levels. This data-backed personalization is encouraging modular oil blending, where fruit oils are selected by algorithmic matching to individual skin biomarkers. These AI-supported platforms are being integrated into D2C and e-commerce ecosystems, creating scalable personalization while enhancing product efficacy narratives. This trend is expected to shift focus from static SKUs to adaptive oil libraries curated in real time.

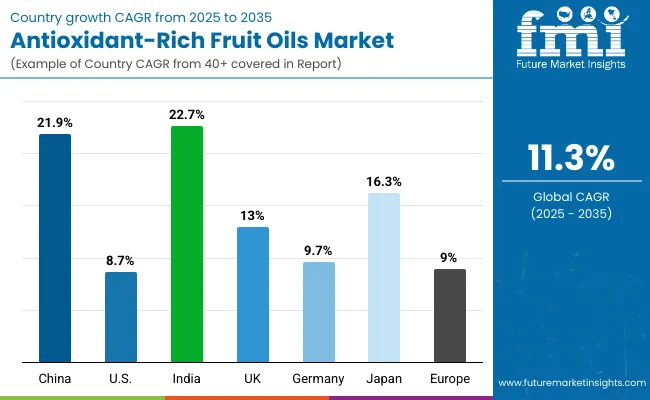

| Countries | CAGR |

|---|---|

| China | 21.9% |

| USA | 8.7% |

| India | 22.7% |

| UK | 13.0% |

| Germany | 9.7% |

| Japan | 16.3% |

The global antioxidant-rich fruit oils market is exhibiting clear geographic divergence in growth patterns, shaped by regional wellness culture, regulatory maturity, and consumer sophistication. Asia-Pacific is expected to emerge as the fastest-growing region, led by India at a projected CAGR of 22.7% and China at 21.9%. In both countries, rising urbanization, strong digital commerce ecosystems, and ingredient-led consumer marketing are enabling deeper penetration of clean-label, oil-based skincare products. India's positioning of fruit oils within Ayurvedic and nutraceutical frameworks is creating a differentiated pathway for growth, while China’s expanding middle class and dermocosmetic crossover products are accelerating mass-market accessibility.

Japan is projected to post a CAGR of 16.3%, supported by minimalist routines, high R&D investments, and a consumer base receptive to advanced formulations. Europe presents moderate momentum, with the UK at 13.0% and Germany at 9.7%, driven by regulatory backing for natural actives, dermatological claims compliance, and high-margin premium skincare formats. Market maturity in Germany is influencing product standardization and retail consolidation.

The United States, with a CAGR of 8.7%, reflects a more stabilized yet preimmunized market, where clinical proof, direct-to-consumer channels, and hybrid wellness positioning are being prioritized. Growth across countries is being influenced by local sourcing initiatives, evolving delivery systems, and regulatory harmonization with global natural cosmetic standards.

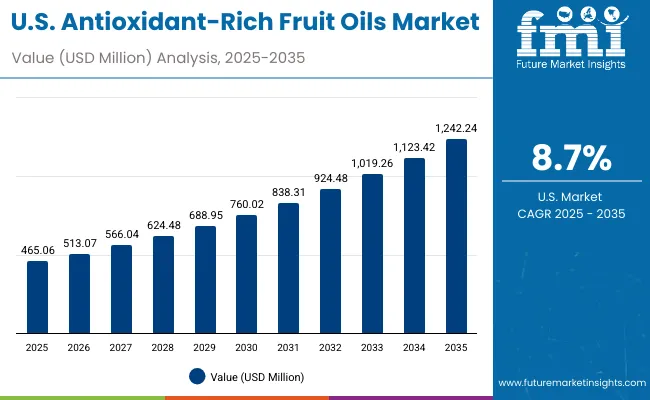

| Year | USA Antioxidant-Rich Fruit Oils Market (USD Million) |

|---|---|

| 2025 | 465.06 |

| 2026 | 513.07 |

| 2027 | 566.04 |

| 2028 | 624.48 |

| 2029 | 688.95 |

| 2030 | 760.02 |

| 2031 | 838.31 |

| 2032 | 924.48 |

| 2033 | 1,019.26 |

| 2034 | 1,123.42 |

| 2035 | 1,242.24 |

The antioxidant-rich fruit oils market in the United States is expected to expand from USD 465.06 million in 2025 to USD 1,242.24 million by 2035, reflecting a CAGR of 8.7%. This steady rise is being enabled by premiumization trends, ingredient-conscious consumers, and the clinical positioning of natural oils within dermocosmetic frameworks. Consumer behavior has been increasingly shaped by personalized wellness solutions, leading to greater demand for clean-label fruit oils with traceable origins.

Multi-use formats particularly those combining antioxidant-rich oils with retinols, peptides, or vitamins are being introduced to satisfy minimalist skincare routines. Anti-aging continues to anchor product demand, supported by growing interest in collagen support and barrier protection. Retailers are emphasizing digital-first assortments, while subscription-led models are enabling recurring engagement.

A CAGR of 13.0% is projected for the UK antioxidant-rich fruit oils market between 2025 and 2035. Growth is expected to be guided by regulatory shifts favoring natural actives and a maturing consumer preference for skin microbiome-safe oils. British consumers are adopting antioxidant oils not only for facial care but also as part of multifunctional wellness rituals, often tied to stress relief and hormonal balance. Clinical certification, COSMOS-standard compliance, and dermatological endorsements are being used by brands to elevate credibility.

Mass retailers and pharmacy-led chains are integrating premium oils into their natural skincare shelves, while hybrid offerings that combine seed oils with niacinamide or ceramides are expanding. Influencer-led brands are accelerating D2C channel growth, especially within skinimalism trends.

India is forecasted to grow at a CAGR of 22.7% between 2025 and 2035, positioning it as the fastest-growing market globally. Growth is being shaped by traditional Ayurvedic familiarity with oil-based treatments, now being modernized into cosmeceutical-grade serums, capsules, and multi-functional topicals. Domestic brands are combining antioxidant-rich fruit oils with heritage botanicals like neem, tulsi, and sandalwood to build trust among diverse consumer segments.

Demand is being driven not just by urban elites but by rising disposable incomes in tier-2 and tier-3 cities, where social commerce platforms are enabling access. E-commerce exclusives and festival-linked launches are being used to promote premium oils with clinically supported claims.

The Chinese antioxidant-rich fruit oils market is anticipated to grow at a CAGR of 21.9% through 2035, fueled by dermocosmetic convergence and ingredient traceability mandates. Consumers are favoring high-efficacy natural actives supported by TCM (Traditional Chinese Medicine) principles and clinical evidence. Oils derived from goji berries, pomegranate, and citrus peel are being infused into multi-step routines for skin tone correction and oxidative damage repair.

China's regulatory environment is accelerating the clean beauty transition, with stricter INCI disclosures and domestic R&D investment in oil stabilization technologies. Functional oils are being integrated into ampoules, emulsions, and cloud-cream formats tailored to East Asian skin tones and textures.

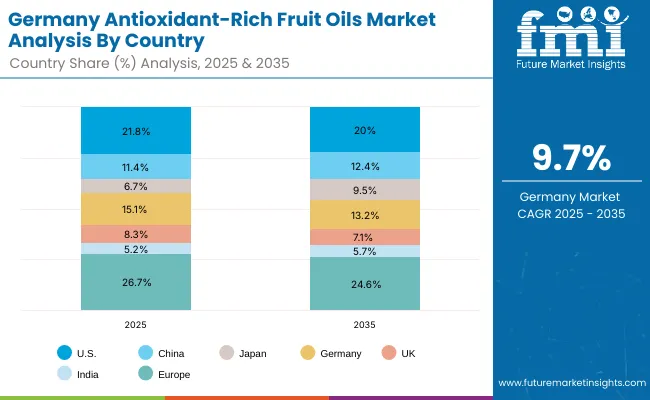

| Countries | 2025 |

|---|---|

| USA | 21.8% |

| China | 11.4% |

| Japan | 6.7% |

| Germany | 15.1% |

| UK | 8.3% |

| India | 5.2% |

| Countries | 2035 |

|---|---|

| USA | 20.0% |

| China | 12.4% |

| Japan | 9.5% |

| Germany | 13.2% |

| UK | 7.1% |

| India | 5.7% |

Germany’s antioxidant-rich fruit oils market is projected to grow at a CAGR of 9.7% between 2025 and 2035, supported by high demand for certified organic skincare and pharmacist-recommended formats. German consumers are more cautious, preferring oils tested for sensitization, sustainability, and efficacy under EU cosmetic directives. The market is being driven by aging demographics seeking clinically proven anti-aging oils that offer long-term skin barrier support.

Apothecary-style retail and beauty-pharma hybrids are acting as trust enablers, while BDIH and NATRUE certifications are influencing stocking decisions. Functional oils are being combined with squalene, hyaluronic acid, or bakuchiol to target sensitive, aging skin types.

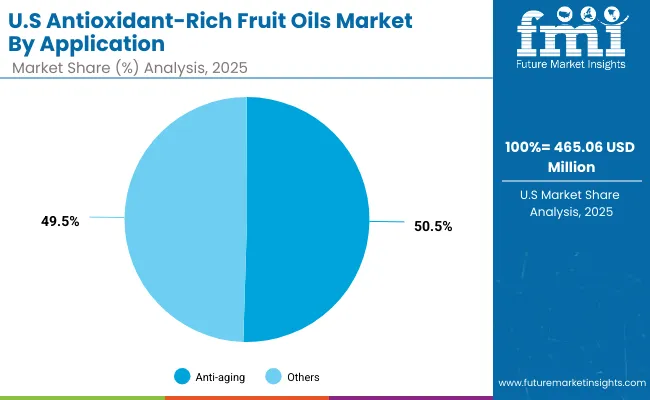

| Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging | 50.5% |

| Others | 49.5% |

The USA Antioxidant-Rich Fruit Oils Market is projected at USD 465.06 million in 2025 and is anticipated to expand robustly over the next decade. Anti-aging applications contribute 50.5% of market value, reflecting consumer focus on wrinkle reduction, skin-firming, and protection from oxidative stress, while other applications account for 49.5%, driven by demand for brightening and hydration routines.

This slight dominance of anti-aging reflects a clear consumer shift toward longevity-oriented skincare. Demand is expected to be driven by the rising prevalence of photoaging concerns, pollution exposure, and a cultural emphasis on preventive skincare routines. The growing use of clinically validated antioxidants supported by dermatologist-endorsed claims is expected to enhance brand credibility and lift premiumization.

E-commerce channels are anticipated to amplify reach, offering personalized recommendations and subscription models, which will likely accelerate adoption among younger cohorts seeking early-age intervention products. Innovation in delivery systems, such as microencapsulation and rapid-absorption carriers, is projected to further differentiate offerings and improve bioavailability, strengthening repeat purchase behavior.

With regulatory frameworks increasingly emphasizing ingredient transparency and efficacy substantiation, players investing early in compliance, traceability, and clean-label communication are expected to secure competitive advantage. The market will likely be shaped by integrated solutions combining high-efficacy actives with digital skin diagnostics, creating an environment where science-backed narratives become essential for market leadership.

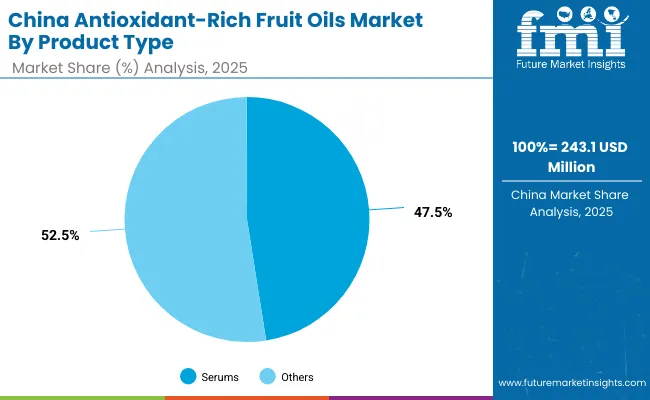

| Segment | Market Value Share, 2025 |

|---|---|

| Serums | 47.5% |

| Others | 52.5% |

The Antioxidant-Rich Fruit Oils Market in China is projected to reach USD 243.1 million in 2025, supported by a rapidly expanding premium skincare consumer base and growing affinity for science-backed, natural-origin formulations. Serums contribute 47.5% of the market, reflecting China’s strong demand for highly concentrated formats associated with visible results, while other product formats hold 52.5%, indicating broad-based adoption across creams, oils, and hybrid solutions.

This balanced product-type distribution signals that consumers are embracing a layered skincare approach, where serums act as targeted treatment boosters complemented by other leave-on and rinse-off formats. The strong positioning of serums is expected to be reinforced by K-beauty and C-beauty trends that emphasize multi-step regimens, personalization, and ingredient transparency.

Digital-first commerce ecosystems are projected to play a decisive role in shaping demand. Livestreaming campaigns, influencer-led education, and algorithm-driven product recommendations are likely to boost penetration in Tier 2 and Tier 3 cities. Innovation pipelines are anticipated to prioritize rapid-absorption, bioavailable formulations to meet expectations of younger consumers seeking instant radiance and long-term skin health benefits.

Supply chain resilience and provenance assurance are expected to become critical differentiators as consumers increasingly demand traceable, sustainably sourced fruit oils. Domestic players investing in vertical integration and local processing capabilities are forecast to capture market share by offering price-accessible yet premium-positioned products.

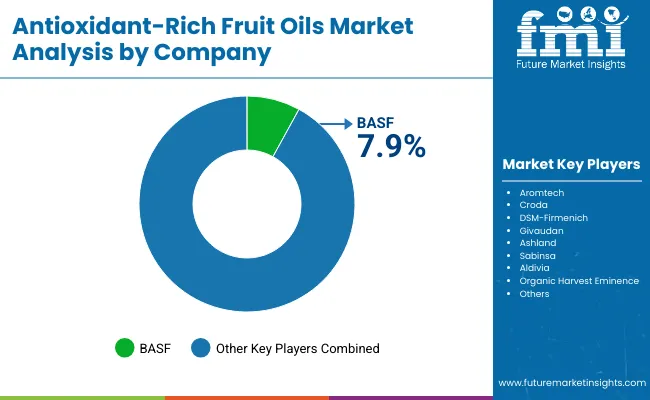

The antioxidant-rich fruit oils market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused specialists competing across personal care, nutraceutical, and therapeutic oil applications. Global leaders such as BASF, DSM-Firmenich, and Croda are recognized for their dominance in bioactive ingredient manufacturing, including cold-pressed and stabilized antioxidant-rich oils derived from pomegranate, grape seed, and acai. BASF is estimated to hold the highest global share at approximately 7.9% in 2024, supported by its extensive dermocosmetic portfolio, sustainability certifications, and distribution partnerships.

Mid-sized players including Ashland, Givaudan, and Sabinsa are leveraging their expertise in botanical actives, encapsulation technology, and Ayurvedic ingredient integration. Their competitive edge lies in high-purity, clinically tested oils tailored for anti-aging and brightening applications in cosmeceuticals and clean beauty brands.

Niche-focused specialists such as Aromtech, Aldivia, Organic Harvest, and Eminence Organics are targeting regional markets and functional skincare through limited-edition oils, ethical sourcing, and organic certifications. These brands cater to conscious consumers seeking transparency and artisanal extraction processes.

Competitive focus is shifting toward oil stability enhancement, AI-based personalization, and wellness crossovers. Strategic M&A activity and private-label collaborations are also being used to expand footprint across emerging markets. Long-term differentiation will depend on traceability, formulation compatibility, and omnichannel branding.

Key Developments in Antioxidant-Rich Fruit Oils Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Market Size (2025) | USD 2,130.2 Million |

| Market Size (2035) | USD 6,211.2 Million |

| CAGR (2025-2035) | 11.30% |

| By Source | Pomegranate oil, Grape seed oil, Acai oil, Berry oils, Citrus oils |

| By Application | Anti-aging, Brightening, Hydration, Repair, Others |

| By Product Type | Serums, Creams/lotions, Hair oils, Capsules |

| By Distribution Channel | E-commerce, Specialty retail, Pharmacies, Natural beauty stores |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

The global Antioxidant-Rich Fruit Oils Market is estimated to be valued at USD 2,130.2 million in 2025, fueled by demand for natural skincare oils, sustainable beauty formulations, and increased consumer preference for antioxidant-rich actives in cosmeceuticals.

The market size for the Antioxidant-Rich Fruit Oils Market is projected to reach USD 6,211.2 million by 2035. Expansion will be driven by rising clean beauty adoption, D2C brand innovation, and growing awareness about bioavailable, plant-based antioxidants.

The Antioxidant-Rich Fruit Oils Market is expected to grow at a CAGR of 11.3% during the forecast period, underpinned by advances in botanical extraction, clean label demand, and shifting preferences toward preventative, non-synthetic skin nutrition.

The primary product types include serums, creams & lotions, nutraceutical capsules, and hair oils, with multifunctional claims like anti-aging, skin repair, UV protection, and hydration driving formulation trends across beauty and wellness segments.

Pomegranate oil and grape seed oil are expected to hold significant share in 2025, owing to their high polyphenol content, skin rejuvenation properties, and increasing usage in organic skincare, particularly in face oils and leave-on applications.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fruit Punnet Market Forecast and Outlook 2025 to 2035

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

Fruit and Vegetable Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fruit Pomace Market Size and Share Forecast Outlook 2025 to 2035

Fruit Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fruit Tea Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fruit Beverages Market Size, Share, and Forecast 2025 to 2035

Fruit Powders Market Trends - Growth, Demand & Forecast 2025 to 2035

Fruit Jams, Jellies, and Preserves Market Analysis by Type, Distribution Channel, and Region Through 2035

Fruit Wine Market Analysis by Platform, By Application, By Type, and By Region – Forecast from 2025 to 2035

Fruit Beer Market Analysis by Flavor Type, Alcohol Content, Packaging Type, and Sales Channel Through 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Analysis and Growth Projections for Fruit Pectin Business

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Market Share Insights of Fruit Juice Packaging Providers

Fruit Juice Packaging Market Growth – Trends & Forecast through 2035

Global Fruits and Vegetable Bag Market Growth – Trends & Forecast 2024-2034

Fruit Seed Waste Market

Fruit Kernel Products Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA