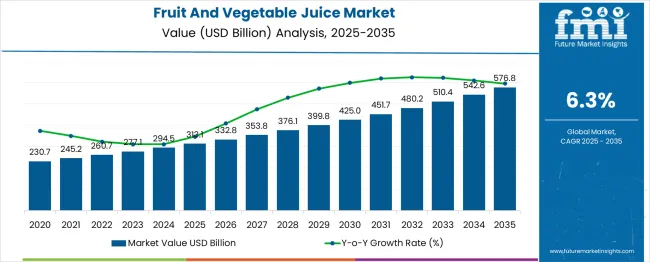

The fruit and vegetable juice market is projected to reach 313.1 USD billion in 2025 and is anticipated to grow to 576.8 USD billion by 2035, registering a CAGR of 6% across the forecast period. Rolling CAGR analysis indicates that growth will build steadily in the initial phase as health-focused consumers drive demand for nutrient-rich and clean-label beverages. Early momentum is expected to come from wider retail availability, convenience-focused packaging, and growing preference for natural juice alternatives over carbonated drinks, setting a firm base for upcoming acceleration.

The market, as it moves beyond its midpoint, is expected to witness stronger rolling CAGR gains, showing faster compounding growth in the later years. This acceleration is likely to be driven by expanding premium juice segments such as cold-pressed, organic, and fortified varieties, supported by rising online grocery adoption and increasing marketing efforts. Asia-Pacific and Latin America are projected to contribute the strongest rolling gains, while North America and Europe maintain consistent demand from mature consumer groups. This rolling growth pattern points to a shift from steady scaling to stronger momentum as the forecast period progresses.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 313.1 billion |

| Forecast Value in (2035F) | USD 576.8 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The fruit and vegetable juice market is shaped by five interconnected parent markets that define its growth and product adoption. The packaged beverage segment contributes the largest share at 40%, driven by rising demand for ready-to-drink juices among urban households seeking quick and convenient nutrition. The retail and supermarket segment holds 25%, supported by the wide availability of branded and private-label products. The foodservice and hospitality sector accounts for 15%, as juices are commonly offered in cafés, restaurants, and hotels to attract health-conscious customers. The online and e-commerce segment contributes 12%, fueled by subscription-based juice delivery services and the growth of digital grocery platforms. The health and wellness segment adds 8%, as consumers increasingly choose cold-pressed, organic, and fortified juices for immunity and fitness support.

Collectively, these parent markets drive strong dollar sales, with packaged beverages and retail channels together making up over 65% of total demand. The market is expected to grow further with increasing interest in natural ingredients, sugar-free blends, and cleaner labels. Demand is rising in emerging regions where expanding middle-class populations and higher disposable incomes are shaping healthier beverage choices. Growth will be supported by product diversification, innovative flavors, and the combined influence of supermarkets, online platforms, and wellness-focused consumption patterns.

Market expansion is being supported by the increasing consumer focus on health and wellness and the corresponding demand for nutritious beverage options that can provide essential vitamins, minerals, and antioxidants in convenient formats. Modern consumers are increasingly focused on preventive health measures and functional nutrition that can support wellness and immune system function. Fruit and vegetable juices' proven ability to deliver concentrated nutrition while providing refreshing taste experiences makes them essential components of healthy lifestyle choices and daily nutrition routines.

The growing focus on natural and organic products is driving demand for juice products that are free from artificial additives, preservatives, and excessive sugar while maintaining authentic fruit and vegetable flavors. Consumer preference for clean-label products that combine nutritional benefits with transparent ingredient lists is creating opportunities for premium and organic juice innovations. The rising influence of social media wellness trends and nutritionist recommendations is also contributing to increased consumption of cold-pressed juices, superfruit blends, and vegetable-based nutrition beverages.

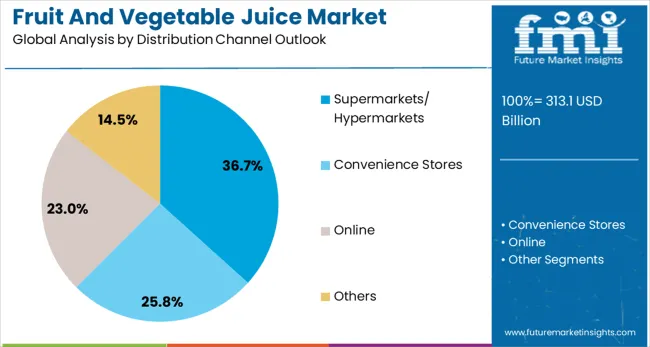

The market is segmented by product, distribution channel, and region. By product, the market is divided into fruit juices, fruit & vegetable blends, vegetable juices, and others. Based on distribution channel, the market is categorized into supermarkets/hypermarkets, convenience stores, online, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The fruit juices segment is projected to account for 43.3% of the fruit and vegetable juice market in 2025, reaffirming its position as the dominant product category. Consumers increasingly prefer fruit juices for their familiar flavors, natural sweetness, and wide variety of options ranging from traditional orange and apple juices to exotic tropical fruit combinations. Fruit juices' proven appeal across all age groups and their established role in daily nutrition routines directly address consumer preferences for refreshing and nutritious beverage options.

This product category forms the foundation of the juice market, as it represents the most popular and widely consumed juice type with established consumer acceptance and brand recognition. Manufacturer investments in premium fruit sourcing, cold-pressed technologies, and organic certifications continue to strengthen the adoption of fruit juice products. With consumers prioritizing taste and nutritional benefits, fruit juices align with both flavor preferences and health objectives, making them the central component of juice consumption patterns and market growth.

Supermarkets/hypermarkets are projected to represent 36.7% of fruit and vegetable juice distribution in 2025, underscoring their critical role as primary retail channels for juice products. Consumers prefer shopping for juices in supermarkets and hypermarkets due to wide product selection, competitive pricing, convenient one-stop shopping experiences, and the ability to compare different brands and product types. Positioned as essential retail infrastructure for juice distribution, supermarkets/hypermarkets offer both product accessibility benefits and promotional opportunities.

The segment is supported by established retail relationships and a comprehensive cold chain infrastructure that ensures product quality and freshness throughout the distribution process. Supermarkets and hypermarkets provide prominent shelf space and promotional platforms that enable effective brand marketing and consumer engagement. As juice consumption becomes more mainstream and diverse, supermarkets/hypermarkets will continue to dominate distribution while supporting broad market accessibility and consumer choice.

The fruit and vegetable juice market is being strongly influenced by ongoing product innovation and strict regulatory compliance. Manufacturers are actively developing new flavor combinations, seasonal variants, and blends incorporating vegetables, herbs, and superfoods to maintain consumer interest and drive repeat purchases. Focus on sugar reduction, natural preservatives, and clean-label formulations to address growing health awareness. At the same time, adherence to food safety standards and certifications, including ISO, HACCP, and organic labels, ensures quality and consumer confidence. Traceable sourcing, rigorous testing, and effective cold chain management preserve product integrity.

Product Innovation And Flavor Diversification Trends Fruit and vegetable juice manufacturers are focusing on flavor diversification to attract consumers and maintain engagement. Blends combining multiple fruits or incorporating vegetables, herbs, and superfoods are gaining popularity. Limited-edition flavors, seasonal variants, and exotic fruit offerings encourage repeat purchases. Brands are also experimenting with sugar reduction, clean-label ingredients, and natural preservatives to cater to health-conscious consumers. Innovative processing techniques, such as high-pressure processing and cold pressing, maintain nutritional integrity and fresh taste. The development of functional beverages targeting immunity, energy, and digestion further diversifies product portfolios.

Regulatory Compliance And Quality Assurance Standards Compliance with food safety regulations and quality standards is a significant dynamic shaping the juice market. Manufacturers are increasingly adhering to local and international certifications, such as ISO, HACCP, and organic labels, to ensure consumer trust. Stringent monitoring of pesticide residues, microbial contamination, and labeling accuracy is conducted across the supply chain. Traceability from farm to bottle, transparent sourcing practices, and third-party audits reinforce credibility. Packaging integrity, shelf life testing, and cold chain management remain crucial for preserving juice quality.

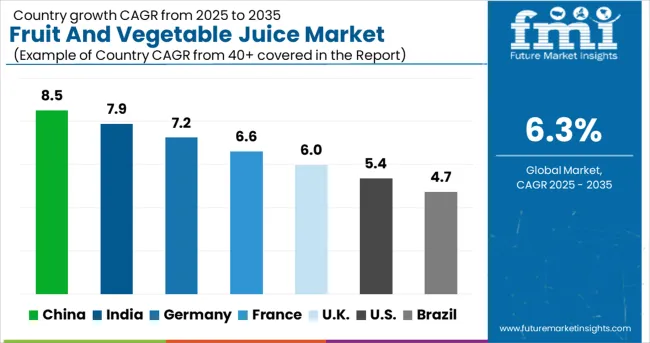

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6% |

| USA | 5.4% |

| Brazil | 4.7% |

The global fruit and vegetable juice market is projected to grow at a CAGR of 6% between 2025 and 2035. China leads this expansion with an 8.5% CAGR, driven by rising health-conscious consumption, expanding retail distribution, and increasing demand for premium juice blends. India follows at 7.9%, supported by growing urban populations, higher disposable incomes, and a preference for packaged nutritional beverages. Germany shows growth at 7.2%, emphasizing functional juice varieties and clean-label offerings. France records 6.6%, fueled by rising demand for natural and cold-pressed juices. The UK grows at 6.0%, focusing on health-focused juice ranges and convenience packaging. The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

The fruit and vegetable juice market in China is projected to grow at a CAGR of 8.5% from 2025 to 2035, driven by changing dietary habits, rising disposable incomes, and growing interest in functional beverages. Consumers are shifting from carbonated drinks to natural juices as part of healthier routines, and premium cold-pressed juices are gaining popularity in urban centers. Domestic beverage companies are expanding their product portfolios with innovative blends of tropical fruits, vegetables, and superfoods to target younger demographics. Supermarkets and convenience stores are increasing their shelf space for fresh and packaged juices, while e-commerce platforms enable direct delivery of cold-pressed products. The adoption of advanced processing and cold-chain logistics is preserving product quality and extending shelf life. Celebrity endorsements and social media promotions are influencing consumer preferences, creating brand-driven demand in the premium segment.

Revenue from fruit and vegetable juices in India is expanding at a CAGR of 7.9%, supported by rising disposable income, expanding modern retail infrastructure, and increasing awareness about the health and nutrition benefits of natural juice consumption. The country's large population and growing health consciousness are driving demand for affordable and nutritious juice products. International beverage companies and domestic manufacturers are establishing comprehensive distribution networks to address the growing consumer demand. Rising consumer purchasing power and expanding retail accessibility are creating opportunities for juice product adoption across urban centers and emerging markets seeking convenient nutrition solutions.

Demand for fruit and vegetable juices in Germany is projected to grow at a CAGR of 7.2%, supported by the country's strong consumer preference for organic and premium quality food products and established health and wellness culture. German consumers consistently demand high-quality juice products that meet stringent organic standards and provide superior taste and nutritional profiles. Premium product positioning and organic market leadership are driving demand for specialized juice products that combine superior ingredients with production practices for health-conscious and environmentally aware consumers. Consumer preference for quality and authenticity is supporting the adoption of artisanal and craft juice products that provide enhanced flavor profiles and nutritional benefits compared to mass-market alternatives.

The fruit and vegetable juice market in France is anticipated to grow at a CAGR of 6.6% from 2025 to 2035, driven by rising health awareness and preference for premium beverages. French consumers are increasingly opting for juices with no added sugars, preservatives, or artificial flavors. Local producers are introducing gourmet blends using regional fruits and seasonal vegetables, appealing to consumers seeking authentic flavors. Juice bars and cafés are expanding their offerings with cold-pressed juices and smoothie-style blends for urban professionals. Supermarkets are dedicating larger shelf space to organic juices and freshly squeezed options. Marketing campaigns emphasizing wellness, detoxification, and energy-boosting benefits are influencing purchase behavior, especially among younger adults. The rise of direct-to-consumer delivery models is also helping niche juice brands gain visibility in urban markets.

The fruit and vegetable juice market in the United Kingdom is projected to grow at a CAGR of 6% from 2025 to 2035, supported by increasing demand for natural beverages and healthy on-the-go options. British consumers are adopting cold-pressed and fresh juice products as part of their daily routines. Beverage companies are launching functional juices with added vitamins, probiotics, and plant-based proteins to target fitness-conscious segments. Convenience stores and supermarkets are expanding their chilled juice sections, while e-commerce platforms are facilitating direct delivery subscriptions for premium juice brands. The growth of juice bars in metropolitan areas is also promoting freshly prepared juices. Product labeling regulations promoting clear ingredient disclosure are building consumer trust, and promotional campaigns focusing on immunity and wellness are accelerating category adoption.

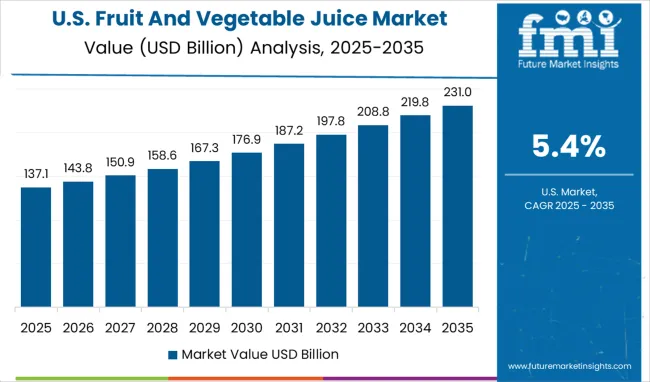

The fruit and vegetable juice market in the United States is expected to grow at a CAGR of 5.4% from 2025 to 2035, driven by the shift from sugary soft drinks to nutrient-rich alternatives. American consumers are increasingly choosing juices with clean labels, reduced sugar, and high nutritional content. Cold-pressed juices are becoming a staple in health-focused retail chains and cafés. Beverage brands are launching blends incorporating superfoods like kale, spinach, turmeric, and ginger to cater to wellness-conscious segments. Subscription-based direct-to-home juice delivery services are expanding in major cities. Retailers are collaborating with local juice startups to offer exclusive products and limited-edition seasonal blends. Marketing strategies focusing on detox, energy, and immunity benefits are resonating with millennials and Gen Z consumers.

The fruit and vegetable juice market in Brazil is forecast to grow at a CAGR of 4.7% from 2025 to 2035, supported by increasing demand for convenient and nutritious beverages. Local fruit varieties like açaí, acerola, and guava are being incorporated into premium juice blends targeting domestic and export markets. Brazilian beverage companies are investing in cold-pressed production units and advanced packaging to maintain freshness and nutritional value. Juice consumption is increasing across supermarkets, convenience stores, and online platforms, especially among urban youth. Marketing efforts highlighting immunity-boosting and energy-enhancing properties are influencing consumer preferences. Partnerships between juice brands and fitness centers are also boosting category visibility. Small juice startups are leveraging social media marketing to reach health-focused consumers seeking clean-label and natural options.

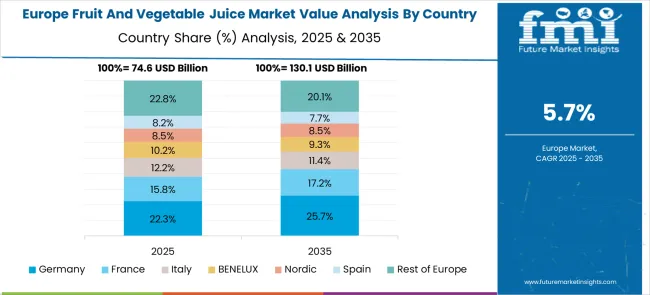

The fruit and vegetable juice market in Europe demonstrates mature development across major economies, with Germany showing a strong presence through its established beverage industry and consumer preference for natural and organic juice products, supported by retailers leveraging distribution expertise to provide comprehensive juice selections that emphasize quality, freshness, and variety across fruit and vegetable categories for health-conscious consumers. France represents a significant market driven by its food and beverage culture and sophisticated understanding of nutrition and wellness, with consumers focusing on premium juice products that combine French culinary appreciation with high-quality ingredients for enhanced taste and nutritional benefits in retail and food service applications.

The UK exhibits considerable growth through its focus on health and wellness trends and convenience-focused consumption patterns, with strong adoption of functional juices, cold-pressed products, and organic options across supermarkets, convenience stores, and specialty retailers. Germany and France show expanding interest in organic juice applications, particularly in premium market segments and health-focused product innovations. BENELUX countries contribute through their focus on quality food products and health-conscious consumption. At the same time, Eastern Europe and Nordic regions display growing potential driven by increasing disposable income and expanding retail infrastructure for premium beverage products.

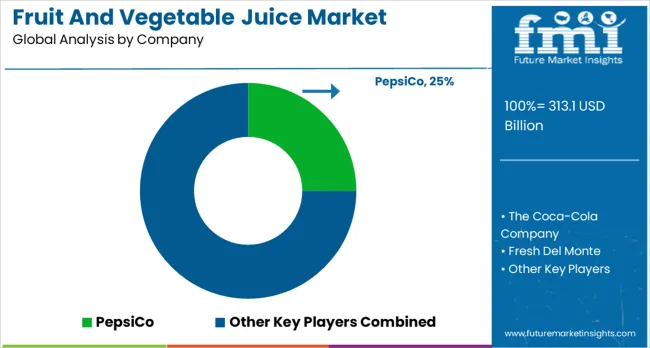

Competition in the fruit and vegetable juice market is intense, driven by product innovation, functional formulation, and strong distribution networks. Leading global beverage companies such as PepsiCo, The Coca-Cola Company, and Fresh Del Monte leverage their brand recognition, extensive product portfolios, and well-established retail and distribution channels to maintain leadership positions. These companies focus on delivering juices across multiple categories and price points, ensuring wide availability to both mass-market and premium consumer segments.

Bolthouse Farms Inc. and Lakewood Organic Juices concentrate on premium and organic juice offerings, emphasizing high-quality ingredients, minimal processing, and functional health benefits, catering to the growing consumer preference for wellness-oriented beverages. Welch’s and Ocean Spray target traditional and superfruit juice segments, promoting antioxidant properties, functional benefits, and family-friendly brand positioning. Strategic focus across the market centers on product differentiation, portfolio expansion, and channel optimization. Companies are actively developing innovative flavor combinations, fortified and functional juice blends, and limited-edition variants to capture consumer attention and drive loyalty.

Manufacturing efficiency, cold-chain logistics, and partnerships with modern trade retailers and e-commerce platforms enable large players to scale operations while maintaining quality standards. Health-focused juices, including immunity-boosting, detoxifying, or energy-enhancing options, are increasingly emphasized to meet growing wellness-conscious consumer demand. Packaging innovation, including convenient single-serve bottles, resealable cartons, and eco-friendly containers, supports both consumer convenience and brand visibility on shelves.

Marketing strategies highlight global reach, consumer education, and brand credibility. Campaigns emphasize natural ingredients, functional health benefits, purity, and taste authenticity. Supply chain integration, traceable sourcing, and technological enhancements in extraction, pasteurization, and bottling processes improve efficiency, product consistency, and safety. Continuous consumer feedback, regional flavor adaptations, and targeted promotional campaigns ensure relevance across diverse geographic and demographic markets. Collectively, these strategies enhance brand loyalty, expand market share, and sustain long-term growth in the fruit and vegetable juice sector.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 313.1 billion |

| Product | Fruit Juices, Fruit & Vegetable Blend, Vegetable Juices, Others |

| Distribution Channel | Supermarkets/Hypermarkets, Convenience Stores, Online, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | PepsiCo, The Coca-Cola Company, Fresh Del Monte, Bolthouse Farms Inc., Lakewood Organic Juices, Welch's, Ocean Spray, Keurig Dr Pepper Inc., The Kraft Heinz Company, and Dole Packaged Foods LLC |

| Additional Attributes | Dollar sales by product type and distribution channel, regional demand trends, competitive landscape, buyer preferences for fruit versus vegetable juices, integration with health and wellness trends, innovations in cold-pressed technology, functional ingredient addition, and packaging development |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global fruit and vegetable juice market is estimated to be valued at USD 313.1 billion in 2025.

The market size for the fruit and vegetable juice market is projected to reach USD 576.8 billion by 2035.

The fruit and vegetable juice market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in fruit and vegetable juice market are fruit juices, fruit & vegetable blend and vegetable juices.

In terms of distribution channel outlook, supermarkets/ hypermarkets segment to command 36.7% share in the fruit and vegetable juice market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fruit Punnet Market Forecast and Outlook 2025 to 2035

Fruit Pomace Market Size and Share Forecast Outlook 2025 to 2035

Fruit Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fruit Tea Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fruit Beverages Market Size, Share, and Forecast 2025 to 2035

Fruit Powders Market Trends - Growth, Demand & Forecast 2025 to 2035

Fruit Wine Market Analysis by Platform, By Application, By Type, and By Region – Forecast from 2025 to 2035

Fruit Beer Market Analysis by Flavor Type, Alcohol Content, Packaging Type, and Sales Channel Through 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Analysis and Growth Projections for Fruit Pectin Business

Fruit Kernel Products Market

Fruit Seed Waste Market

Market Share Insights of Fruit Juice Packaging Providers

Fruit Juice Packaging Market Growth – Trends & Forecast through 2035

Fruit and Vegetable Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Global Fruits and Vegetable Bag Market Growth – Trends & Forecast 2024-2034

Fruit Jams, Jellies, and Preserves Market Analysis by Type, Distribution Channel, and Region Through 2035

IQF Fruits & Vegetables Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA