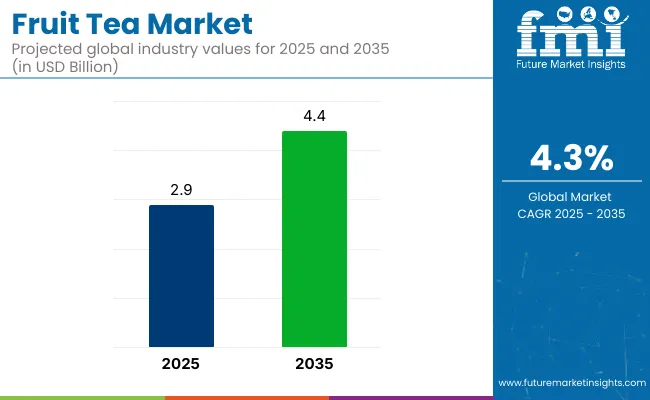

The global fruit tea market has been valued at USD 2.9 billion for 2025 and is expected to reach USD 4.4 billion by 2035, reflecting a steady 4.3% CAGR during the forecast period.

| Attribute | Value |

|---|---|

| Industry Value (2025) | USD 2.9 billion |

| Industry Value (2035) | USD 4.4 billion |

| CAGR (2025 to 2035) | 4.3% |

The fruit tea category has grown steadily by gaining wider visibility across supermarkets, wellness cafés, and online stores. Fruit-infused teas are now positioned alongside traditional black and green teas, helping attract new customers. This growth has been supported by existing tea-processing infrastructure, which allowed producers to expand freeze-dried powders, RTD concentrates, and single-serve formats without major new investments.

Between 2020 and 2024, value-added products such as cold-brew and immunity blends drove much of the growth. To secure reliable supply, producers signed farming contracts in regions like Sri Lanka’s Uva province and Chile’s Maule Valley, focusing on ingredients such as hibiscus, elderberry, and passion fruit.

In response, blending units in Germany and Poland upgraded their equipment to reduce aroma loss during processing. Demand also rose for premium tea sachets sold through specialty and online channels, where clear sourcing labels and optimized textures helped brands justify higher pricing.

The industry accounts for an estimated 22-25% of the herbal tea market, supported by rising demand for berry, citrus, and hibiscus infusions. Within the flavored tea category, its share stands near 18%, with exotic fruit blends expanding seasonal offerings. In the functional beverages market, product contributes around 9%, driven by interest in antioxidant-rich and vitamin-infused drinks.

As part of the non-carbonated ready-to-drink beverages segment, fruit tea captures nearly 6%, where on-the-go formats are rising. In the natural and organic beverage space, its contribution is pegged at 12%, owing to clean-label sourcing and fair-trade positioning. These shares reflect consumer alignment with caffeine-free, health-positioned infusions and strong uptake through specialty cafés, wellness retailers, and direct-to-consumer online platforms.

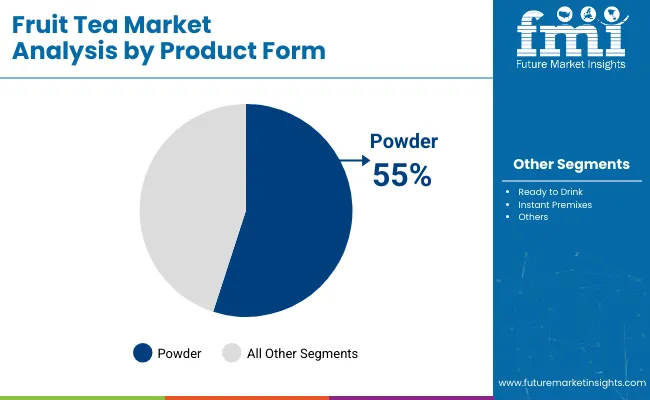

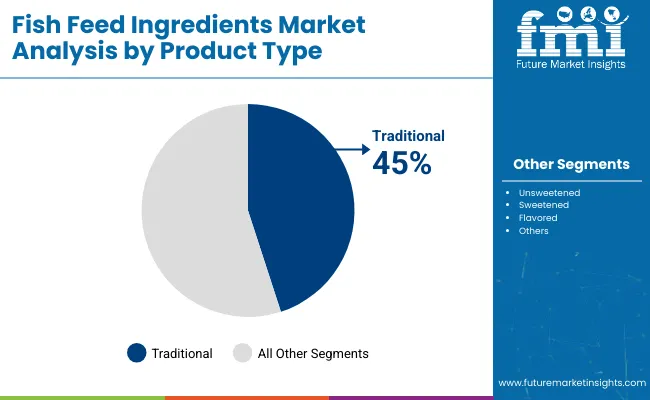

Powdered fruit tea leads demand due to its shelf stability, customization, and e-commerce adaptability. Traditional variants dominate by type, backed by cultural use and health associations. Supermarkets remain the primary distribution channel, favored for product visibility, variety, and trusted brand presence.

Powder is projected to account for nearly 55% industry share by 2025. Powdered form has emerged as the leading segment due to its extended shelf life, transport efficiency, and flexibility in preparation.

Traditional fruit tea is expected to hold 45% of the industry share in 2025,it retains strong cultural relevance and is deeply associated with natural wellness routines across multiple regions.

Supermarkets and hypermarkets hold the leading share in the distribution of fruit tea, accounting for an estimated 42% of total sales in 2025. Their dominance is driven by wide shelf space allocation, strong visibility, and consumer preference for one-stop beverage shopping.

Caffeine-free fruit teas gained traction through wellness-driven hydration, with 12.6% retail growth and strong café and specialty retail adoption. Powder formats expanded online, growing 17.4% via lightweight packaging and subscription models that boosted repeat purchases and lowered logistics costs.

Functional Tea Demand Driven by Health-First Hydration Trends

Fruit-tea uptake accelerated as caffeine-free infusions addressed daily hydration across North America, Europe, and East Asia. Supermarket turnover for hibiscus- and berry-based blends expanded 12.6% between 2023 and 2025, while unsweetened lines contributed roughly 60% of that incremental value.

Specialty retailers in Germany and the United Kingdom doubled shelf space for adaptogen-fortified products, and 46% of large café chains in Japan carried immunity-positioned infusions by late 2024. Relaxation blends featuring vitamins and botanicals accounted for 31% of global SKU launches after mid-2023, illustrating sustained product pipeline momentum that continues to reinforce the category’s wellness credentials.

Powder Format Expansion Backed by Digital Route-to-Market Scale

Logistical and channel efficiencies positioned powdered fruit tea for rapid expansion. E-commerce volumes rose 17.4% between Q1 2023 and Q1 2025, aided by lighter cartons that trimmed average transport cost per unit by about 13% and reduced breakage risk in last-mile delivery.

Asia-Pacific generated 42% of incremental online demand, while subscription boxes drove 28% of North American powder sales, lifting 90-day repeat-purchase rates to 36%. Lower spoilage, ambient storage, and customizable serving sizes strengthened retailer margins and encouraged digital-first brands to scale without traditional shelf-placement fees or cold-chain constraints.

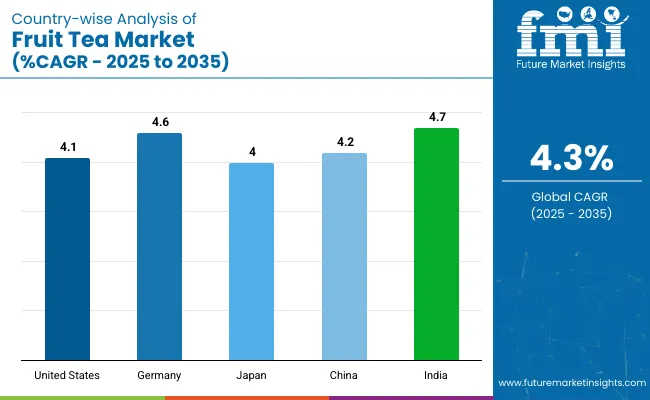

This report includes a detailed comparative analysis of over 40 countries, with the top five presented here for reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.1% |

| Germany | 4.6% |

| Japan | 4.0% |

| China | 4.2% |

| India | 4.7% |

The fruit tea market, forecast to grow globally at a CAGR of 4.3% from 2025 to 2035, reflects differentiated regional dynamics across key economies. India, a BRICS member, leads among the top five with a 4.7% CAGR, propelled by rising demand for Ayurvedic-inspired infusions and fast urban penetration via quick-commerce channels. Germany follows at 4.6%, an OECD country where organic labeling and sugar-free herbal blends are driving shelf expansion across national drugstore chains.

China, another BRICS country, records a 4.2% CAGR as regional fruit-based powders gain popularity through live stream commerce and cross-border e-retail platforms. The United States, an OECD member, posts a 4.1% CAGR, with supermarkets and cafés pushing unsweetened, functional blends as alternatives to high-calorie beverages.

Japan rounds out the group with a 4.0% CAGR, supported by vending-machine placements of citrus-forward SKUs and seasonal gift-pack campaigns. While OECD nations maintain stable demand via retail, BRICS countries like India and China show higher potential through digital-led expansion and domestic ingredient sourcing.

The USA market is projected to advance at a 4.1% CAGR across the forecast period. Growth is being powered by consumers who have pivoted from sugary carbonates toward botanically infused hydration, a trend amplified by the calorie-labeling mandates rolled out nationwide.

Major grocery chains are allocating additional shelf frontage to freeze-dried and functional powder blends positioned for immunity, while ready-to-drink formats have entered convenience outlets that once focused on energy drinks. National café franchises now rotate seasonal hibiscus-berry infusions, driving menu visibility and social-media engagement.

Germany’s industry is set to expand at a 4.6% CAGR from 2025 to 2035. Domestic growth is being underwritten by the country’s long-standing herbal-infusion tradition and strict sugar-reduction targets adopted in retail. Drugstore chains such as dm and Rossmann have doubled facings for unsweetened hibiscus-apple and elderberry blends bearing Bio (organic) seals, a move that aligns with Germany’s preference for certified clean-label beverages.

Cold-brew fruit tea, launched in PET carafes for at-work consumption, has captured incremental office-snack occasions. Bavarian processors have invested in low-oxygen bottling lines, preserving polyphenol content and extending shelf life for export shipments into Austria, Switzerland, and the Benelux.

The market in China is forecast to climb at a 4.2% CAGR between 2025 and 2035. The rise of domestic beverage chains, from Shanghai to Chengdu, has normalized fruit-based infusions as everyday refreshers, especially among consumers seeking a mild alternative to sugary milk tea.

Provincial fruit processors are supplying freeze-dried pitaya, lychee, and kumquat inclusions, giving brands a provenance story that resonates on Douyin and WeChat channels. Cross-border e-commerce hubs in Hangzhou have shortened import clearance for premium European berry blends, widening assortment on leading marketplaces. Live-stream promotions run by key-opinion leaders routinely sell out limited bundles, converting impulse interest into high-frequency orders.

Japan’s market is anticipated to record a 4.0% CAGR throughout the projection horizon. Convenience-store operators, known for rapid product-cycle testing, have adopted single-serve chilled fruit-tea bottles positioned beside unsweetened green-tea classics, capturing impulse-buy traffic during commuting hours. Vending-machine networks, covering almost every urban corner, now feature rotating fruit-tea SKUs with regional fruit icons such as Yuzu and Shikuwasa, reinforcing local-produce narratives.

Beverage firms have leveraged in-house R&D to blend amino-acid fortifiers with citrus bases, framing the drinks as post-workout hydration aids. Collaboration between tea houses and confectionery brands has produced limited-edition gift packs, intensifying holiday demand.

The market in India is projected to register a 4.7% CAGR during the forecast period, the fastest among the five nations considered. Urban cafés in Bengaluru, Mumbai, and Delhi have introduced tropical fruit infusions aligned with Ayurvedic wellness themes, appealing to young professionals shifting away from sugar-laden soft drinks.

Domestic tea start-ups leverage smartphone commerce, offering sachet bundles via quick-delivery apps that reach consumers within an hour, reinforcing trial loops in densely populated metros. Cold-chain investments along the Mumbai-Ahmedabad corridor enable distribution of ready-to-drink fruit-tea cans in temperatures exceeding 35 °C, protecting flavor integrity and extending shelf life.

In the fruit tea market, leading companies leverage a combination of health-focused innovation, ethical sourcing, and streamlined distribution. Brands like Twinings, Unilever, and Hain Celestial are expanding globally by offering functional blends tied to sleep, digestion, and immunity, often positioned within wellness aisles or online platforms.

Their strategies rely heavily on existing tea-processing infrastructure, allowing them to scale RTD and single-serve formats without major capital investment. Ingredient suppliers such as Martin Bauer and Van Rees play a backend role by supporting private-label and bulk needs, enabling faster SKU turnover for retailers across Europe and Asia. Regional players like Dilmah and The London Tea Company are growing in premium segments by emphasizing single-origin sourcing, Fairtrade credentials, and limited-edition seasonal blends. Duncans Industries is tapping into India’s biodiversity to develop tropical variants for ASEAN and Gulf buyers.

Competitive intensity in this space is increasing due to low entry barriers at the mid-tier level and strong consumer appetite for variety. However, defending market share in the premium and functional categories requires tighter control over sourcing, traceability, and health-related claims. Most players are focusing on three core strategies: building product differentiation through botanicals and flavor systems, expanding into RTD and digital channels, and forming co-manufacturing or private-label alliances to reduce production risk and respond to fast-changing demand.

Recent Fruit Tea Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.9 billion |

| Projected Market Size (2035) | USD 4.4 billion |

| CAGR (2025 to 2035) | 4.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Form Analyzed (Segment 1) | Powder, Ready To Drink, And Instant Premixes. |

| Product Type Analyzed (Segment 2) | Traditional, Unsweetened, And Sweetened. |

| Distribution Channel Analyzed (Segment 3) | Supermarkets/Hypermarkets, Specialty Stores, Online Sales, Retail Stores, And Departmental Stores. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Twinings, Tetley, Unilever, Martin Bauer Group, Typhoo Tea Ltd, Van Rees, The London Tea Company, Dilmah, Hain Celestial Group Inc, and Duncans Industries Ltd. |

| Additional Attributes | Dollar sales, share, flavor trends, format preferences, pricing benchmarks, key regions, consumer buying behavior, growth by channel, private label impact, competitor SKUs, and opportunities. |

The industry is segmented into powder, ready to drink, and instant premixes.

The industry is segmented into traditional, unsweetened, and sweetened.

The industry finds supermarkets/hypermarkets, specialty stores, online sales, retail stores, and departmental stores.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 2.9 billion in 2025.

It is forecasted to reach USD 4.4 billion by 2035.

The industry is anticipated to grow at a CAGR of 4.3% during this period.

Powder are projected to lead the market with a 55% share in 2025.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 4.7%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fruit Punnet Market Forecast and Outlook 2025 to 2035

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

Fruit and Vegetable Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fruit Pomace Market Size and Share Forecast Outlook 2025 to 2035

Fruit Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fruit Beverages Market Size, Share, and Forecast 2025 to 2035

Fruit Powders Market Trends - Growth, Demand & Forecast 2025 to 2035

Fruit Jams, Jellies, and Preserves Market Analysis by Type, Distribution Channel, and Region Through 2035

Fruit Wine Market Analysis by Platform, By Application, By Type, and By Region – Forecast from 2025 to 2035

Fruit Beer Market Analysis by Flavor Type, Alcohol Content, Packaging Type, and Sales Channel Through 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Analysis and Growth Projections for Fruit Pectin Business

Market Share Insights of Fruit Juice Packaging Providers

Fruit Juice Packaging Market Growth – Trends & Forecast through 2035

Global Fruits and Vegetable Bag Market Growth – Trends & Forecast 2024-2034

Fruit Kernel Products Market

Fruit Seed Waste Market

IQF Fruits & Vegetables Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA