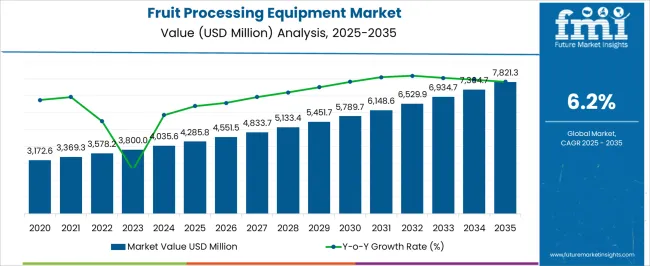

The fruit processing equipment market is estimated to be valued at USD 4285.8 million in 2025 and is projected to reach USD 7821.3 million by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

Processing automation addresses labor shortages, consistency requirements, and operational efficiency through integrated control systems, robotic handling, and predictive maintenance capabilities that minimize downtime and optimize production schedules. Programmable logic controllers coordinate equipment operation, monitor process parameters, and implement safety interlocks that protect operators and prevent equipment damage. Remote monitoring systems enable real-time performance tracking and troubleshooting support from equipment manufacturers and service providers.

Energy efficiency considerations encompass heat recovery systems, variable-speed drives, and process optimization that reduce utility consumption while maintaining processing performance and product quality standards. Heat exchangers capture thermal energy from pasteurization and concentration processes for preheating applications. LED lighting, high-efficiency motors, and intelligent power management systems minimize electrical consumption throughout processing facilities.

Cold-chain infrastructure improvements and zero-waste retail mandates push processors toward upcycling equipment for imperfect raw materials, creating new operational categories that require specialized handling capabilities. Manufacturing facilities must balance sustainability initiatives with production efficiency requirements, often discovering that environmentally focused equipment modifications increase operational complexity while potentially reducing throughput volumes. Quality control departments face expanded responsibilities when implementing waste reduction systems that require additional monitoring and documentation procedures.

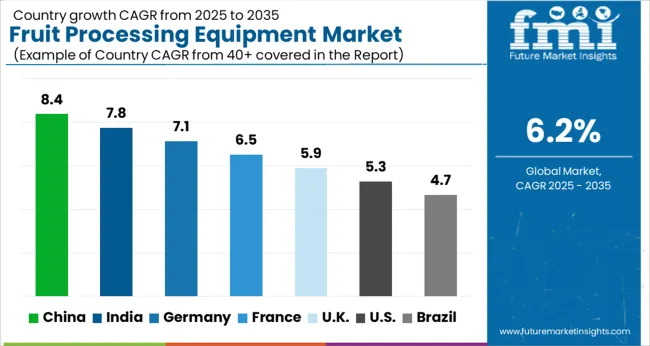

Current market conditions reflect broader manufacturing trends where processors seek equipment solutions that accommodate diverse product formats while maintaining consistent quality standards. Asia-Pacific markets contribute 37% of growth with urbanization and lifestyle changes driving processing equipment demand, yet facilities encounter skilled labor shortages that complicate automation implementation strategies. Plant operators must evaluate equipment capabilities against workforce availability, often discovering that advanced automation systems require technical skills unavailable in local labor markets.

Equipment manufacturers respond to market demands through modular system designs that promise operational flexibility, yet processors often encounter integration challenges when connecting different manufacturer platforms within existing production lines. Processing facilities pursue equipment capable of achieving 95% pesticide residue degradation rates while maintaining flavor, color, and nutritional integrity, creating technical specifications that demand precise calibration between cleaning effectiveness and product quality preservation.

The processing equipment landscape continues evolving as manufacturers address operational realities where maintenance teams, quality assurance departments, and production managers must collaborate on equipment selection decisions that balance competing priorities. Facilities increasingly require equipment solutions that accommodate regulatory compliance demands while maintaining competitive production costs in markets where consumer price sensitivity limits premium positioning opportunities. Processing plants face ongoing challenges when implementing equipment upgrades that promise operational improvements but require substantial workflow modifications and staff retraining investments that impact short-term productivity metrics.

| Metric | Value |

|---|---|

| Fruit Processing Equipment Market Estimated Value in (2025 E) | USD 4285.8 million |

| Fruit Processing Equipment Market Forecast Value in (2035 F) | USD 7821.3 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

The fruit processing equipment market is witnessing robust development driven by increasing global demand for processed and packaged fruit products. Rising urbanization, changing dietary patterns, and growing consumption of ready to eat and convenience foods are accelerating the adoption of advanced processing technologies.

Manufacturers are investing in automation, hygienic design, and energy efficient machinery to meet stringent food safety standards while optimizing operational costs. The expansion of export markets for fruit based products is also reinforcing equipment demand across diverse geographies.

Moreover, the integration of digital monitoring systems and smart technologies is enhancing efficiency and traceability across production lines. The market outlook remains positive as food processors continue to expand capacity, diversify product portfolios, and respond to consumer preference for packaged fruit solutions that are both safe and of consistent quality.

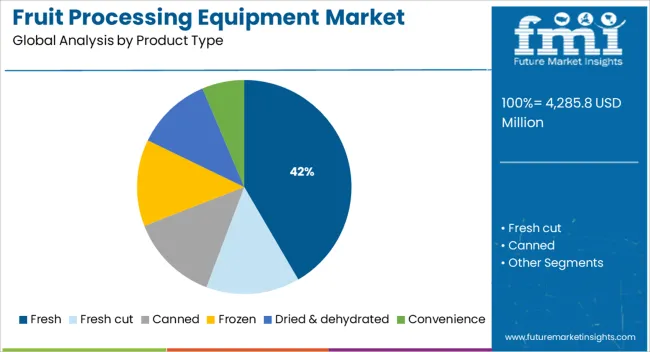

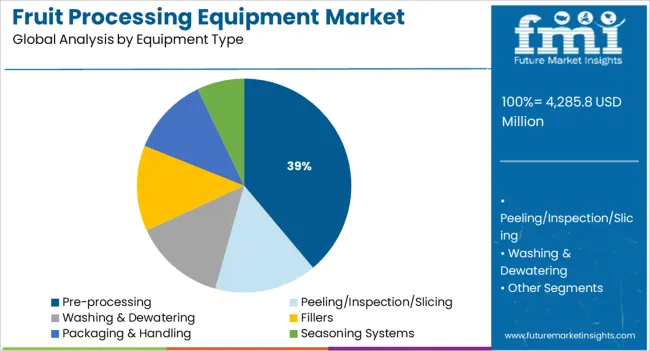

The market is segmented by Product Type and Equipment Type and region. By Product Type, the market is divided into Fresh, Fresh cut, Canned, Frozen, Dried & dehydrated, and Convenience. In terms of Equipment Type, the market is classified into Pre-processing, Peeling/Inspection/Slicing, Washing & Dewatering, Fillers, Packaging & Handling, and Seasoning Systems. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fresh segment is projected to contribute 41.60% of the overall revenue by 2025 within the product type category, positioning it as the most significant segment. Growth is being supported by increasing demand for fresh cut and minimally processed fruit driven by consumer preferences for health, convenience, and natural food products.

The adoption of specialized equipment that ensures hygiene, reduces spoilage, and extends shelf life has strengthened this category. Rising retail sales of packaged fresh fruit and the growing penetration of cold chain logistics are further driving reliance on equipment suited for fresh processing.

This has reinforced the dominance of the fresh segment within the product type category.

The pre processing equipment segment is expected to account for 38.90% of the total market revenue by 2025 under the equipment type category, making it the leading segment. The growth of this segment is being propelled by the need for efficient cleaning, peeling, cutting, and grading machinery that ensures quality consistency in downstream processing.

Adoption has been reinforced by the industry’s focus on reducing manual intervention, improving productivity, and complying with global food safety regulations. Additionally, increasing investments in automated pre processing lines have improved throughput and minimized waste generation.

As fruit processors expand capacity to cater to both domestic and international demand, pre processing equipment continues to hold its position as the cornerstone of modern fruit processing operations.

The global fruit processing equipment market witnessed a moderate growth rate during the historical period from 2020 to 2025. However, with rapid expansion of the fruit processing industry worldwide, the overall demand for fruit processing equipment is projected to expand at a robust CAGR of 6.2% between 2025 to 2035.

Over the years, there has been a rapid surge in the consumption of processed and ready-to-eat foods across the world due to changing lifestyles and the increasing purchasing power of consumers. This, in turn, is generating demand for food processing machinery like fruit processing equipment, and the trend is likely to continue during the forecast period.

Fruit processing equipment is being employed to process and convert raw fruits into consumable fruit products. They help in cleaning fruits by removing harmful contaminants and significantly improve their shelf life.

Growing usage of fruits for making a wide range of products including jams, cakes, ice creams, beverages, etc, and subsequent consumption of these products is expected to drive the global fruit processing equipment swiftly during the forecast period.

A number of influential factors have been identified that are expected to drive global fruit processing forward during the next ten years (2025 to 2035). Besides the proliferating aspects prevailing in the market, the analysts at FMI have also analyzed the restraining elements, lucrative opportunities, and upcoming threats that can significantly change the course of the fruit processing equipment industry.

The drivers, restraints, opportunities, and threats (DROTs) identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

Booming Export of Fruits and Vegetables Pushing Demand in the USA

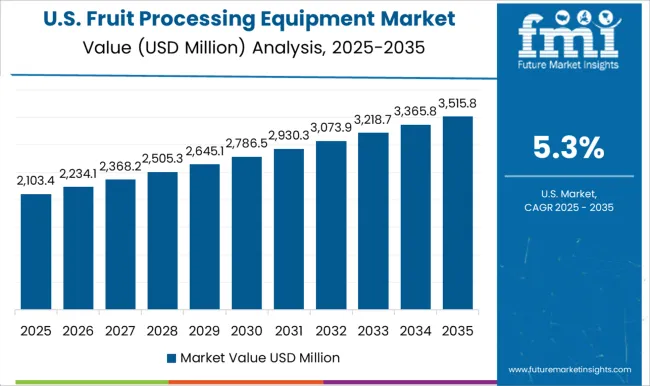

The USA fruit processing equipment market reached a valuation of USD 1,216.0 Million in 2025 and it currently accounts for around 72% of the overall North American fruit processing equipment market. This is due to a boom in fruit orchids across the United States, increasing export of fruits, and rising adoption of advanced fruit processing technologies by end-use industries.

Various processed fruits like avocados, peaches, pears, etc. are hitting the supermarket in the USA in large numbers which are pushing the farms to process more and more organic fruits. This will eventually drive the fruit processing equipment market forward during the next ten years.

Similarly, the rise in the export of fruits along with the growing need for the increased shelf life of fruit-based products will continue to generate demand for fruit processing technologies across the country during the forecast period.

According to the USA Department of Agriculture (USDA), the value of US fresh fruit and vegetable exports to the world reached USD 4035.6 billion in 2024 which is expected to further surge during the upcoming years. This will generate lucrative opportunities for leading fruit processing equipment manufacturers.

Growing Trend of Consuming Nutrient-rich Food Products Driving the UK Market

The UK fruit processing equipment market size reached approximately USD 332.1 Million in 2025 and it is poised to exhibit a steady growth rate during the next ten years.

Growth in the UK fruit processing equipment market is driven by the rapid expansion of the fruit processing industry, growing consumption of nutrient-dense food, and increasing penetration of automation across food manufacturing companies.

Similarly, favorable government support and technological advancements in fruit processing technology will further aid in the expansion of the USA fruit processing equipment market during the next ten years.

Rising Consumption of Fruit-based Products Propelling Sales in China

According to FMI, China's fruit processing equipment machine market is currently valued at USD 255.4 Million and it holds around 32% of the Asia pacific fruit processing equipment market.

Rapidly growing population, changing eating habits, and growing consumption of fruits-based products such as jams, juices, sweets, etc. are some of the key factors driving the growth of the China fruit processing equipment market.

Furthermore, the increasing number of fruit orchids and rising government initiatives to help fruit growers to meet increasing consumer demands are expected to boost sales of fruit processing equipment during the assessment period.

Demand Remains High for Pre-processing Equipment Type

Based on equipment type, the global fruit processing market is segmented into pre-processing, peeling/inspection/slicing, washing & dewatering, fillers, packaging & handling, and seasoning systems.

Among these, the pre-processing segment holds the largest share of the global fruit processing equipment market and it is expected to grow at a significant pace during the next ten years. This can be attributed to the rising adoption of pre-processing equipment in the fruit processing industry for cleaning

Fruits gathered from farms contain dirt, germs, biocides, and other harmful substances which make them unfit for direct consumption. To make them consumable and fit for further processing, pre-processing equipment is being extensively used.

Pre-processing machines automatically clean the gathered fruits in very less time, reduce human intervention, and eventually help industries to improve productivity.

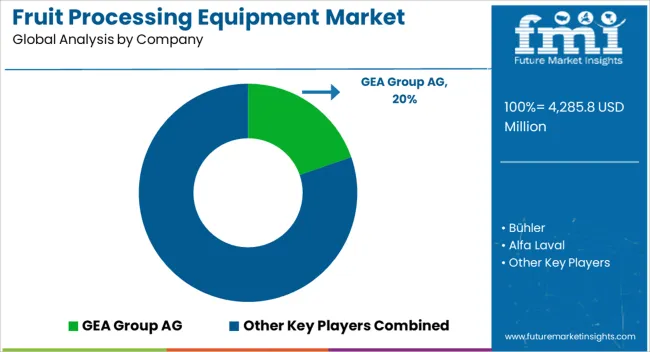

The fruit processing equipment market is driven by leading global manufacturers and food producers focused on efficiency, automation, and sustainability in fruit handling and production systems. GEA Group AG, Bühler Group, and Alfa Laval AB lead the market with advanced fruit processing technologies covering washing, pulping, extraction, and pasteurization. These companies emphasize energy-efficient designs, hygienic engineering, and modular systems suitable for both large-scale and specialized fruit processing plants. JBT Corporation and Syntegon Technology GmbH provide integrated automation and packaging solutions that enhance productivity and product quality across juice, puree, and concentrate manufacturing.

Krones AG and Marel focus on end-to-end processing and packaging systems with strong digital monitoring and control capabilities. Bigtem Makine A.S., FENCO Food Machinery S.R.L., and ANKO Food Machine Co. Ltd. serve regional and niche markets with flexible, customizable fruit processing lines for jams, frozen fruit, and value-added products. Heat and Control, Inc. and Finis specialize in pre-processing and sorting equipment optimized for high throughput and minimal waste.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 4285.8 million |

| Projected Market Size (2035) | USD 6,934.7 Million |

| Anticipated Growth Rate (2025 to 2035) | USD 7821.3 million |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East & Africa (MEA) |

| Key Countries Covered | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | Product Type, Equipment Type, Region |

| Key Companies Profiled | GEA Group AG; Bühler Group; Alfa Laval AB; JBT Corporation; Syntegon Technology GmbH; Krones AG; Marel; Bigtem Makine A.S.; FENCO Food Machinery S.R.L.; ANKO Food Machine Co. Ltd.; Heat and Control, Inc.; Finis; Conagra Brands; Greencore Group; Nestlé S.A.; Olam International; The Kraft Heinz Company; PepsiCo Inc.; AGRANA Group; Bonduelle |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global fruit processing equipment market is estimated to be valued at USD 4,285.8 million in 2025.

The market size for the fruit processing equipment market is projected to reach USD 7,821.3 million by 2035.

The fruit processing equipment market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in fruit processing equipment market are fresh, fresh cut, canned, frozen, dried & dehydrated and convenience.

In terms of equipment type, pre-processing segment to command 38.9% share in the fruit processing equipment market in 2025.

The global fruit processing equipment market is estimated to be valued at USD 4,285.8 million in 2025.

The market size for the fruit processing equipment market is projected to reach USD 7,821.3 million by 2035.

The fruit processing equipment market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in fruit processing equipment market are fresh, fresh cut, canned, frozen, dried & dehydrated and convenience.

In terms of equipment type, pre-processing segment to command 38.9% share in the fruit processing equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fruit Punnet Market Forecast and Outlook 2025 to 2035

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

Fruit and Vegetable Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fruit Pomace Market Size and Share Forecast Outlook 2025 to 2035

Fruit Tea Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fruit Beverages Market Size, Share, and Forecast 2025 to 2035

Fruit Powders Market Trends - Growth, Demand & Forecast 2025 to 2035

Fruit Jams, Jellies, and Preserves Market Analysis by Type, Distribution Channel, and Region Through 2035

Fruit Wine Market Analysis by Platform, By Application, By Type, and By Region – Forecast from 2025 to 2035

Fruit Beer Market Analysis by Flavor Type, Alcohol Content, Packaging Type, and Sales Channel Through 2035

Competitive Breakdown of Fruit Snacks Suppliers

Fruit Concentrate Puree Market Growth - Trends & Forecast 2025 to 2035

Fruit Snacks Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Analysis and Growth Projections for Fruit Pectin Business

Market Share Insights of Fruit Juice Packaging Providers

Fruit Juice Packaging Market Growth – Trends & Forecast through 2035

Global Fruits and Vegetable Bag Market Growth – Trends & Forecast 2024-2034

Fruit Kernel Products Market

Fruit Seed Waste Market

Jackfruit Products Market - Size, Share, and Growth Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA