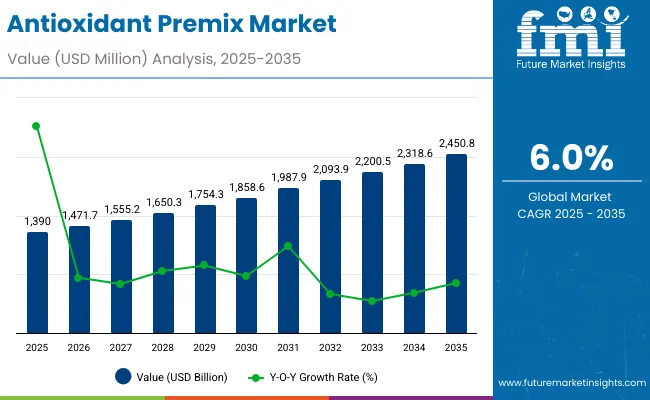

A valuation of USD 1.39 Billion is projected for the Antioxidants Premix Market in 2025, with expansion expected to reach USD 2.49 Billion by 2035. This growth reflects an absolute increase of over USD 1.15 Billion across the decade, representing a compound annual growth rate (CAGR) of 6.0%. The trajectory signals more than a more than a 1.79X enlargement in overall market size within the forecast horizon.

| Metrics | Value |

|---|---|

| Antioxidant Premix Market Estimated Value in (2025E) | USD 1.39 Billion |

| Antioxidant Premix Market Forecast Value in (2035F) | USD 2.49 Billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

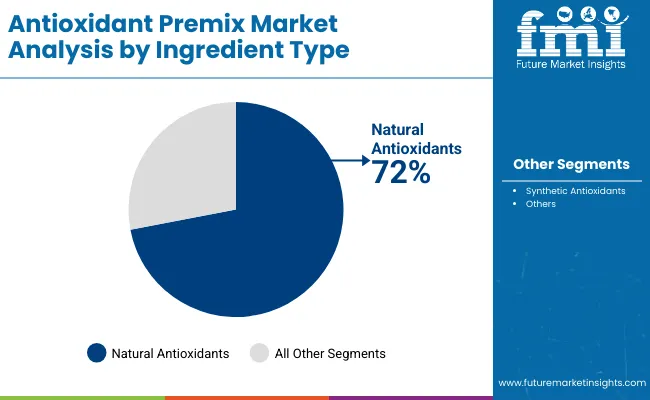

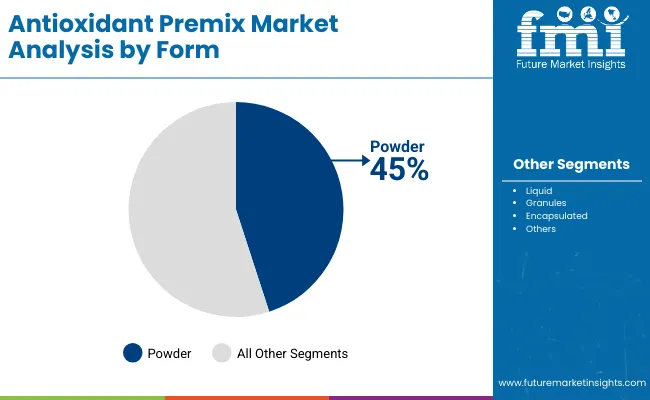

During the initial phase from 2025 to 2030, the market is forecast to advance from USD 1.39 Billion to USD 1.86 Billion, adding nearly USD 0.48 Billion, equal to about 42% of the total decade expansion. This stage is anticipated to be shaped by greater adoption of natural antioxidant blends in food and beverage applications, where shelf-life extension and stability assurance remain central. Natural antioxidants, commanding a 72% share in 2025, are positioned to anchor growth momentum, while powders are set to maintain their lead with a 45% share.

In the latter half from 2030 to 2035, acceleration is expected as valuations rise from USD 1.86 Billion to USD 2.49 Billion, adding USD 0.63 Billion or 58% of total growth. This period is projected to be reinforced by strong dietary supplement demand, where sports nutrition and geriatric formulations are set to expand above market average. Cosmetics and personal care are also anticipated to strengthen their contribution, supported by anti-aging and skin care segments growing at over 7.3% CAGR.

Between 2020 and 2024, the Antioxidants Premix Market expanded steadily, supported by food and beverage manufacturers adopting premixes to achieve consistent shelf-life extension and reduce oxidative stress in processed products. During this period, global suppliers dominated, controlling the majority of industry revenues by leveraging wide ingredient portfolios and strong distribution networks. Differentiation was largely based on formulation consistency, regulatory compliance, and cost efficiency, while online ingredient marketplaces and direct-to-brand services remained in their infancy, contributing minimally to total value.

Demand is forecast to reach USD 1.39 Billion in 2025, and the revenue structure is expected to shift as dietary supplements and cosmetics accelerate. Traditional premix leaders are projected to face rising competition from regional suppliers offering plant-extract based formulations with clean-label positioning. Leading incumbents are anticipated to pivot toward hybrid models by integrating encapsulation technologies, stability testing services, and digital ordering platforms to retain their relevance. Emerging participants focusing on polyphenol and carotenoid innovation are forecast to gain share, particularly in Asia-Pacific where demand for functional nutrition and beauty-from-within supplements is expanding rapidly. Competitive advantage is expected to move away from cost-driven supply alone toward end-to-end ecosystem strength, combining scientific validation, regulatory assurance, and recurring contract-based supply models

Growth in the Antioxidants Premix Market is being is being supported by shelf-life targets and oxidative stability requirements across food, beverage, supplement, and cosmetic applications. Increased consumer awareness regarding immune health, anti-aging, and chronic disease prevention has been translated into higher usage of natural antioxidants such as vitamin C, vitamin E, carotenoids, and polyphenols within premix formulations.

A shift toward natural and clean-label solutions is being reinforced by regulatory scrutiny of synthetic antioxidants, encouraging manufacturers to prioritize safer, plant-extract-based blends. Demand for dietary supplements, particularly in sports nutrition and geriatric health, is accelerating the adoption of specialized antioxidant premixes. Cosmetics and personal care sectors are integrating premixes for anti-aging and skin protection benefits, further supporting momentum. Technological advances in encapsulation and micro-delivery systems are enabling greater bioavailability and stability, ensuring long-term application viability. Collectively, these forces are positioning antioxidant premixes as strategic components in global nutrition and wellness innovation.

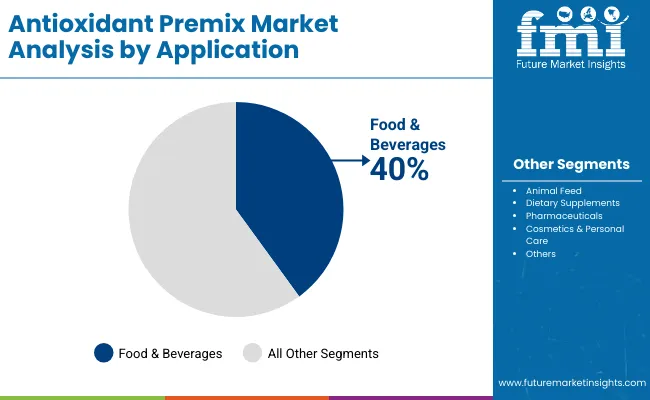

The Antioxidants Premix Market has been segmented across ingredient type, form, application, functionality, end-user, distribution channel, and region. Each category reflects the diverse adoption pathways and performance priorities driving demand across industries. Ingredient type segmentation highlights the rising prominence of natural antioxidants such as vitamins, carotenoids, and polyphenols, while synthetic variants continue to serve cost-sensitive uses.

By form, powders remain widely utilized for formulation flexibility, though encapsulated formats are advancing quickly due to enhanced stability and bioavailability. Applications span food and beverages, animal feed, dietary supplements, pharmaceuticals, and cosmetics, each representing unique demand drivers. This segmentation framework provides a comprehensive lens into evolving market preferences, offering clarity on where growth opportunities are concentrated over the 2025-2035 forecast horizon.

| Ingredient Type | Market Value Share, 2025 |

|---|---|

| Natural Antioxidants | 72% |

| Synthetic Antioxidants | 28% |

Natural antioxidants are projected to dominate with a 72% share of the market in 2025, outpacing synthetic alternatives due to rising health awareness and regulatory scrutiny over chemical additives. Growth will be driven by consumer preference for vitamin C, vitamin E, carotenoids, and plant-derived extracts, each offering functional and clean-label advantages. A CAGR of 6.8% is anticipated for natural antioxidants through 2035, making them the leading growth engine of the category. Synthetic antioxidants, while still relevant for cost-sensitive formulations, are expected to grow more moderately at 5.4%. As transparency and safety documentation gain importance, natural antioxidants are expected to solidify their role as the backbone of premix innovation, with applications stretching from fortified foods to nutraceuticals and skincare.

| Form | Market Value Share, 2025 |

|---|---|

| Powder | 45% |

| Liquid | 25% |

| Granules | 18% |

| Encapsulated | 1 2% |

Powders are forecast to maintain their lead with a 45% market share in 2025, favored for their compatibility with a wide range of formulations in food, feed, and supplements. Their longer shelf-life, ease of storage, and ability to blend consistently across applications make powders the preferred format for manufacturers. While powders dominate, encapsulated formats are projected to record the fastest CAGR of 7.3%, driven by technological advancements that improve antioxidant stability and targeted release. Liquids and granules will continue to serve specialized uses, yet powders will remain the most scalable and cost-effective solution. As personalized nutrition and advanced formulations expand, encapsulated solutions are expected to complement powders, creating a dual pathway of dominance and innovation within the segment.

| Application | Market Value Share, 2025 |

|---|---|

| Food & Beverages | 40% |

| Animal Feed | 22% |

| Dietary Supplements | 20% |

| Pharmaceuticals: | 8% |

| Cosmetics & Personal Care | 10% |

The food and beverages segment is anticipated to lead with a 40% share in 2025, supported by continuous demand for shelf-life extension, flavor preservation, and nutritional fortification. Bakery, meat, dairy, and beverage applications will sustain demand, reinforced by rising consumption of packaged and convenience foods. Dietary supplements are expected to post faster growth at a CAGR of 7.2%, particularly within sports nutrition and geriatric health. Cosmetics and personal care, though smaller at 10% share, are projected to expand at 7.5%, making them a high-potential growth avenue. As functional foods and personalized supplements accelerate globally, applications in nutrition and beauty are expected to increasingly complement the dominance of traditional food and beverage uses.

Regulatory shifts, evolving consumer expectations, and formulation innovation are reshaping the Antioxidants Premix Market. While clean-label preferences and preventive health awareness support expansion, compliance costs, synthetic scrutiny, and complex raw material supply networks introduce barriers that companies must strategically navigate through 2035.

Integration into Preventive Healthcare and Nutraceutical Platforms

The Antioxidants Premix Market is being reinforced by integration into preventive healthcare frameworks, where premixes are positioned as enablers of long-term wellness. Health systems and insurers are increasingly emphasizing preventive nutrition to reduce chronic disease burdens, encouraging supplement and fortified food manufacturers to embed antioxidant premixes into their offerings. Multivitamin complexes, geriatric formulations, and immune-support blends are forecast to gain stronger adoption under this paradigm, backed by rising clinical validation for polyphenols, carotenoids, and tocopherols. As digital health platforms expand, premixes with measurable health claims and biomarker-linked evidence are expected to become a strategic differentiator across nutraceutical and functional food portfolios.

Regulatory Tightening on Synthetic Antioxidant Classes

Market growth is being constrained by intensifying regulatory scrutiny surrounding synthetic antioxidant classes such as BHA, BHT, TBHQ, and propyl gallate. Food safety agencies across North America and Europe are re-evaluating additive thresholds, requiring extensive documentation, toxicological data, and safety dossiers from manufacturers. This process elevates compliance costs and lengthens approval cycles, thereby discouraging smaller entrants and slowing reformulation timelines for multinational brands. Consumer advocacy groups and NGO campaigns have further heightened reputational risks, creating pressure on brands to accelerate the transition toward natural antioxidant premixes. This regulatory tightening is anticipated to reshape portfolio strategies, favoring plant-derived and encapsulated alternatives.

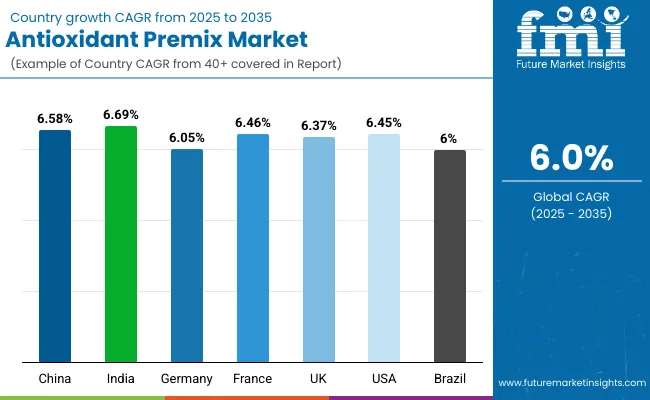

| Country | CAGR |

|---|---|

| China | 6.58% |

| India | 6.69% |

| Germany | 6.05% |

| France | 6.46% |

| UK | 6.37% |

| USA | 6.45% |

| Brazil | 6.00% |

A varied country trajectory is observed for the Antioxidants Premix Market, reflecting regulatory stance, nutrition transitions, and category sophistication. Asia’s momentum is projected to be led by India (6.69% CAGR) and China (6.58%), where fortified foods, sports nutrition, and beauty‑from‑within formats are expected to scale under supportive policy and expanding retail distribution. The United States is anticipated to advance at 6.45% CAGR, with steady uptake across food, supplements, and cosmetics as natural premix architectures and encapsulated delivery gain prominence.

Europe is set to remain a high‑value hub; however, intra‑regional share is forecast to rebalance by 2035 France, Spain, Nordic markets, and “Rest of Europe” are expected to gain mix, while Germany, the UK, Italy, and BENELUX are projected to cede share as reformulation cycles mature and demand broadens eastward and southward. Brazil’s 6.00% CAGR positions it as Latin America’s anchor, aided by organized retail penetration and feed premix usage. Regionally, North America (30% share) and Europe (28%) will continue to concentrate value, while South Asia & Pacific (25%) is expected to contribute a rising portion of incremental growth. Across countries, documentation strength, clean‑label positioning, and application‑level efficacy are projected to determine competitive advantage through 2035.

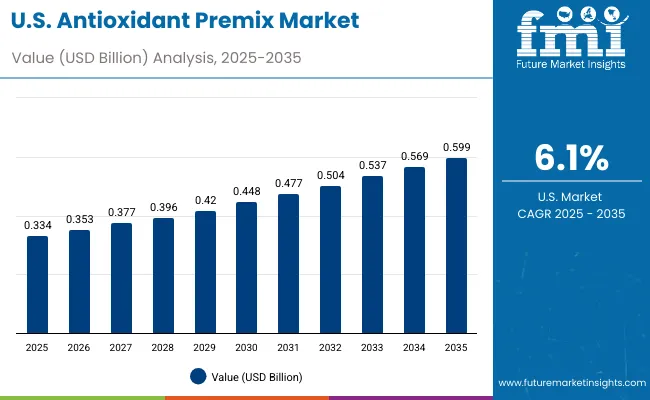

| Year | USA Mushroom-Based Snack Market (USD Million) |

|---|---|

| 2025 | 333.60 |

| 2026 | 352.8 |

| 2027 | 374.8 |

| 2028 | 395.2 |

| 2029 | 418.3 |

| 2030 | 444.9 |

| 2031 | 472.5 |

| 2032 | 497.3 |

| 2033 | 532.1 |

| 2034 | 566.0 |

| 2035 | 602.4 |

The antioxidant premix market in the United States is forecasted to grow from USD 333.6 Million in 2025 to USD 602.4 Million by 2035, reflecting a CAGR of 6.1%. Growth momentum is expected to remain steady, with annual increases ranging from 5.2% to 7.0%, demonstrating resilience across end-use sectors.

The expansion is being driven by higher utilization of antioxidant premixes in functional foods, dietary supplements, and fortified beverages, where preventive healthcare and immunity enhancement are prioritized by consumers. Demand in the animal nutrition sector is projected to strengthen, as feed manufacturers focus on extending shelf life, improving palatability, and ensuring livestock health. The cosmetic and personal care industry is also expected to integrate antioxidant premixes at a faster pace, aligning with rising consumer preference for clean-label and anti-aging formulations.

A transition toward customized premix solutions tailored for sports nutrition, geriatric health, and pediatric applications is anticipated, as manufacturers emphasize product differentiation. Strategic collaborations between premix formulators and food manufacturers are expected to improve market penetration. By 2035, the United States is projected to remain a pivotal market, supported by regulatory frameworks encouraging food fortification and preventive health solutions.

The antioxidant premix market in the United Kingdom is expected to advance at a CAGR of 6.37% between 2025 and 2035, supported by rising consumer emphasis on functional nutrition and healthy aging. A surge in fortified food and beverage launches is anticipated, aligned with regulatory support for reducing lifestyle-related diseases. Demand is expected to be reinforced by the sports nutrition sector, where antioxidant premixes are integrated for recovery and endurance. The cosmetics and personal care market is forecasted to experience significant adoption, as antioxidant-based formulations align with clean-label and sustainability trends. By 2035, the UK is projected to remain a leading European hub for antioxidant innovation, particularly in personalized nutrition and nutraceutical solutions.

The antioxidant premix market in India is projected to grow at the highest CAGR of 6.69% from 2025 to 2035, reflecting increasing awareness of preventive health and government-backed food fortification programs. The integration of antioxidant premixes in staples such as flour, rice, and dairy is anticipated to expand, driven by national nutrition missions. Rapid urbanization and rising disposable incomes are expected to accelerate demand for dietary supplements and functional beverages. The animal nutrition sector is also projected to benefit significantly, with premixes used to improve feed efficiency and animal health. By 2035, India is forecasted to be a key growth engine in Asia-Pacific, with tailored premixes targeting both pediatric and geriatric populations.

The antioxidant premix market in China is forecasted to expand at a CAGR of 6.58% between 2025 and 2035, sustained by rising demand across fortified foods, nutraceuticals, and beverages. Growing consumer focus on immunity and preventive healthcare is expected to accelerate adoption. The feed industry is anticipated to generate substantial opportunities, as antioxidant premixes are increasingly used to improve poultry and aquaculture productivity. The cosmetics market is projected to integrate antioxidant-based formulations at scale, aligning with the popularity of natural and anti-aging solutions. By 2035, China is likely to retain its position as the largest market in Asia-Pacific, supported by innovation in customized premix solutions and strategic collaborations with domestic FMCG players.

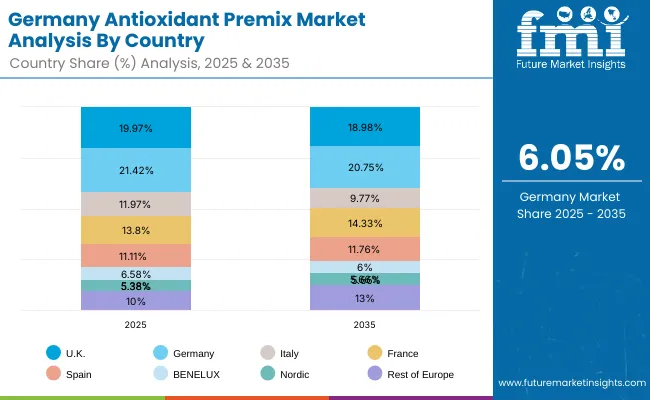

| Countries | 2025 |

|---|---|

| UK | 19.97% |

| Germany | 21.42% |

| Italy | 11.97% |

| France | 13.80% |

| Spain | 11.11% |

| BENELUX | 6.58% |

| Nordic | 5.38% |

| Rest of Europe | 10% |

| Countries | 2035 |

|---|---|

| UK | 18.98% |

| Germany | 20.75% |

| Italy | 9.77% |

| France | 14.33% |

| Spain | 11.76% |

| BENELUX | 6.00% |

| Nordic | 5.66% |

| Rest of Europe | 13% |

The antioxidant premix market in Germany is expected to advance at a CAGR of 6.05% between 2025 and 2035, supported by strong adoption in functional foods and clinical nutrition. Regulatory emphasis on quality and food safety is anticipated to foster greater use of antioxidant premixes across fortified dairy, bakery, and beverages. The nutraceutical industry is projected to expand rapidly, with antioxidants used for cardiovascular, cognitive, and metabolic health solutions. The personal care industry is also expected to increase utilization of premixes, particularly in anti-aging skincare formulations. By 2035, Germany is forecasted to remain a pillar of Europe’s antioxidant premix demand, driven by innovation, compliance, and consumer trust.

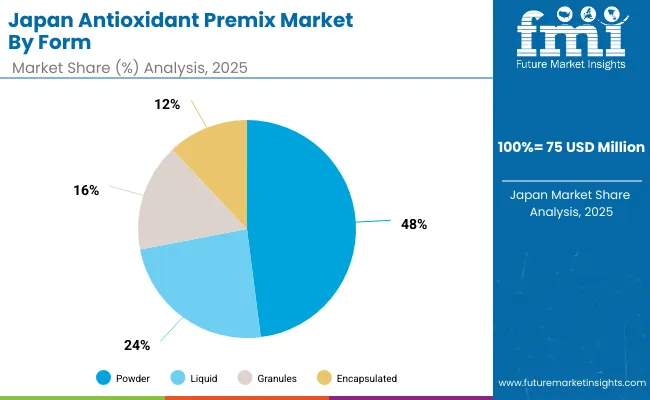

| Range Segment | Market Value Share, 2025 |

|---|---|

| Powder | 48% |

| Liquid | 24% |

| Granules | 16% |

| Encapsulated | 12% |

The Antioxidant Premix Market in Japan is projected at USD 75 Million in 2025, contributing nearly 5.4% of global sales. Powder form dominates with a 48% share, reflecting strong integration into fortified foods, sports nutrition, and dietary supplements. Liquid formats represent 24%, supported by adoption in functional beverages, while granules account for 16%, used mainly in livestock and aqua feed applications. Encapsulated premixes, though only 12% in 2025, are expected to grow fastest at a 7.0% CAGR, driven by demand for enhanced bioavailability and precision delivery in health supplements. Japan’s aging population and preference for natural antioxidants such as green tea extracts and carotenoids are anticipated to reinforce long-term uptake. By 2035, the market is estimated to reach USD 135-140 Million, with encapsulated innovations and personalized nutrition platforms expected to reshape competitive dynamics.

| Component Segment | Market Value Share, 2025 |

|---|---|

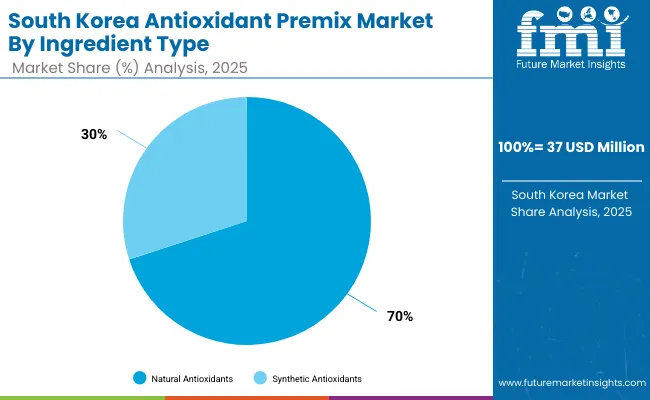

| Natural Antioxidants | 70% |

| Synthetic Antioxidants | 30% |

The Antioxidant Premix Market in South Korea is projected at USD 37 Million in 2025, representing ~2.7% of global sales. Natural antioxidants dominate with a 70% share, supported by strong consumer affinity for clean-label nutrition and plant-based solutions. Polyphenols (14%) and plant extracts (14%) are gaining traction, driven by functional beverages, skincare formulations, and fortified dietary supplements. Synthetic antioxidants account for 30%, with TBHQ (9%) leading due to its application in processed foods and edible oils. While synthetic antioxidants remain cost-effective, their long-term share is expected to decline as regulatory scrutiny and consumer health concerns intensify. The market is projected to expand to USD ~72 Million by 2035, with encapsulated natural blends and advanced delivery systems expected to capture incremental demand. South Korea’s innovation in beauty-from-within products and functional foods positions the country as a trend-setter in antioxidant-based wellness.

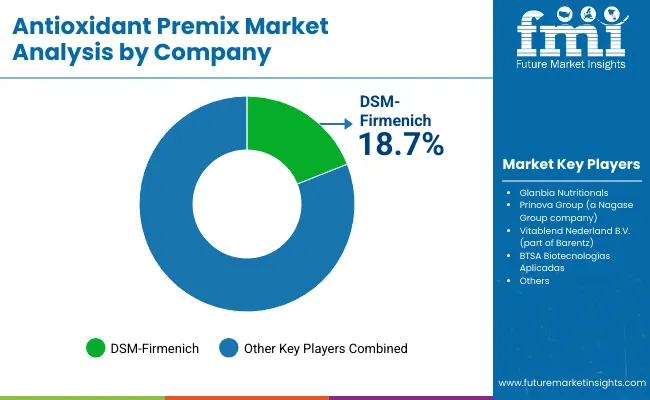

The Antioxidant Premix Market is moderately fragmented, with global ingredient leaders, regional formulators, and niche-focused specialists competing across diverse end-use sectors. Global nutrition and ingredient leaders such as DSM-Firmenich, BASF SE, and Archer Daniels Midland (ADM) hold significant market positions, supported by strong R&D pipelines, integrated supply chains, and strategic partnerships with food, pharmaceutical, and cosmetic companies. Their approaches are increasingly centered on natural antioxidant innovation, encapsulation technologies, and customized premix formulations aligned with clean-label and functional wellness trends.

Established mid-sized players, including Prinova Group, Barentz, and Kemin Industries, are actively addressing demand for application-specific blends tailored to bakery, dairy, and nutraceutical formulations. Their strengths are anchored in flexible manufacturing, regional presence, and rapid response to evolving regulatory frameworks. Value-added services such as formulation consultancy and stability testing are being leveraged to strengthen customer stickiness.

Specialized providers and regional blenders focus on cost-effective solutions for animal nutrition, personal care, and localized food markets. Their adaptability in customizing small-batch formulations and addressing specific health claims provides them with resilient positioning despite limited scale.

Competitive differentiation is expected to continue shifting away from bulk ingredient supply toward integrated solutions that combine science-backed claims, traceable sourcing, and digital formulation support platforms, ensuring stronger customer alignment and long-term value creation.

Key Developments in Antioxidant Premix Market

On June 4, 2025, Premix Group was awarded an EcoVadis Gold Medal, placing it in the top 5% globally for sustainability or the 98th percentile recognizing excellence in environmental, labor, ethics, and sustainable procurement practices. This is expected to elevate trust in green antioxidant premix solutions.

In early 2025 (around January-February), new USA tariffs ranging from 5-15% were imposed on select micronutrients and carrier materials, increasing cost pressure across the antioxidant premix value chain. As a result, many manufacturers initiated near-shoring and diversified sourcing to maintain margin stability.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.39 Billion (2025) → USD 2.49 Billion (2035) |

| Component | Natural Antioxidants (Vitamin C, Vitamin E, Carotenoids, Polyphenols, Plant Extracts), Synthetic Antioxidants (BHA, BHT, TBHQ, Propyl Gallate) |

| Range | Powder, Liquid, Granules, Encapsulated |

| Technology | Encapsulation Technology, Spray Drying, Microencapsulation, Nanotechnology-based Delivery |

| Type | Functional Blends, Customized Premixes, Standardized Premixes |

| End-use Industry | Food & Beverages, Animal Feed, Dietary Supplements, Pharmaceuticals, Cosmetics & Personal Care |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, France, United Kingdom, China, India, Japan, Brazil, South Korea |

| Key Companies Profiled | Cargill Inc., Archer Daniels Midland (ADM), DSM-Firmenich, BASF SE, DuPont Nutrition & Biosciences, Glanbia Nutritionals, Kerry Group, Barentz International, Vitablend Netherlands BV, Camlin Fine Sciences |

| Additional Attributes | Dollar sales by ingredient type and application, adoption trends in fortified foods, supplements, and cosmetics, rising preference for natural antioxidants over synthetic, sector-specific growth in sports nutrition and geriatric health, increasing demand for clean-label and plant-based solutions, regional growth shaped by preventive healthcare initiatives, regulatory scrutiny driving synthetic reformulation, and innovation through encapsulation and nanotechnology for improved stability and bioavailability. |

The global Antioxidant Premix Market is estimated to be valued at USD 1.39 Billion in 2025, supported by increasing applications across food, dietary supplements, and cosmetics.

The market size for the Antioxidant Premix Market is projected to reach USD 2.49 Billion by 2035, driven by sustained demand for natural antioxidants and functional nutrition.

The Antioxidant Premix Market is expected to expand at a 6.0% CAGR between 2025 and 2035, reflecting rising preference for clean-label, fortified, and plant-derived products.

The key product types in the Antioxidant Premix Market are natural antioxidants (Vitamin C, Vitamin E, Carotenoids, Polyphenols, Plant Extracts) and synthetic antioxidants (BHA, BHT, TBHQ, Propyl Gallate).

In terms of form, the powder segment is expected to command 45% share in 2025, supported by its wide application in food, supplements, and feed formulations.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antioxidant Skincare Market Forecast Outlook 2025 to 2035

Antioxidant and Stabilizer Agents Market Size and Share Forecast Outlook 2025 to 2035

Antioxidant-Rich Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antioxidants Cosmetic Market (Personal Care Actives) Analysis - Size and Share Forecast Outlook 2025 to 2035

Antioxidant-Rich Fruit Oils Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antioxidant Drinks Market Size and Share Forecast Outlook 2025 to 2035

Antioxidant-Rich Sea Buckthorn Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antioxidants Market Size, Growth, and Forecast for 2025 to 2035

Antioxidants Reagent Market Analysis – Trends & Future Outlook 2024-2034

Food Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Food Antioxidants Market Analysis by Product, Application and Form Through 2035

Super Antioxidant Supplement Market Size and Share Forecast Outlook 2025 to 2035

Natural Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Phenolic Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Vitamin E Antioxidant Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Moringa Oil Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Antioxidants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Tocopherol-Rich Antioxidants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Blueberry Extract Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA