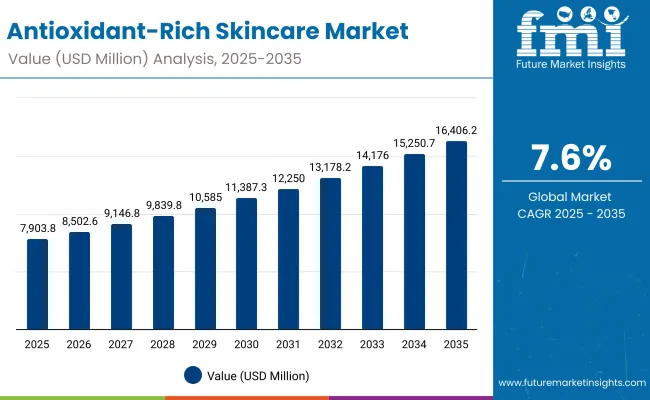

The Antioxidant-Rich Skincare Market is expected to record a valuation of USD 7,903.8 million in 2025 and reach USD 16,406.2 million by 2035, with an increase of USD 8,502.4 million, representing a growth of nearly 2.1x over the decade. The overall expansion reflects a CAGR of 7.6% during the forecast period.

Antioxidant-Rich Skincare Market Key Takeaways

| Metric | Value |

|---|---|

| Antioxidant-Rich Skincare Market Estimated Value (2025E) | USD 7,903.8 million |

| Antioxidant-Rich Skincare Market Forecast Value (2035F) | USD 16,406.2 million |

| Forecast CAGR (2025 to 2035) | 7.6% |

During the first five-year phase from 2025 to 2030, the market increases from USD 7,903.8 million to USD 11,387.3 million, adding USD 3,483.5 million, which accounts for about 41% of the total decade growth. This period marks sustained adoption of antioxidant-based skincare driven by anti-aging, brightening, and UV-protection functions. Serums and creams & lotions dominate, supported by increasing consumer focus on firming and elasticity repair.

In the second half, from 2030 to 2035, the market grows from USD 11,387.3 million to USD 16,406.2 million, contributing USD 5,018.9 million, equivalent to 59% of the total decade growth. Acceleration is driven by expanding digital beauty commerce, ingredient transparency, and cross-category innovation with nutraceuticals and dermocosmetics. E-commerce-led sales channels capture a dominant share, while vitamin C and E-based formulations remain core revenue drivers. Regional gains are led by China, India, and Japan, with double-digit CAGRs exceeding 16%, indicating premiumization and clinical-grade product adoption.

From 2020 to 2024, the Antioxidant-Rich Skincare Market expanded steadily, driven by rising consumer awareness of oxidative stress and preventive skincare. During this period, the market witnessed a transition from basic moisturization to antioxidant-enriched formulations powered by vitamin C, vitamin E, and polyphenol-based ingredients. Competitive dynamics were led by global beauty conglomerates such as Estée Lauder, L’Oréal (SkinCeuticals), and Unilever (Murad, Kiehl’s), collectively accounting for nearly 70% of total revenue. Product differentiation was centered on ingredient purity, absorption efficiency, and clinical validation, while digital retail adoption remained in its early growth phase. Services such as AI-based skin diagnostics and personalized formulation platforms contributed less than 10% of the total market value during this phase.

Demand for antioxidant-based skincare is expected to expand to USD 7,903.8 million in 2025, with the revenue mix shifting toward e-commerce and premium serums. Traditional luxury brands now face intensified competition from digital-native entrants like The Ordinary and Drunk Elephant, which leverage transparency, simplified formulations, and online consumer engagement to capture share. Established players are pivoting toward clinical-grade antioxidants, subscription-based skincare ecosystems, and ingredient traceability platforms to sustain relevance. The competitive edge is progressively shifting from legacy brand equity to innovation in delivery systems, digital scalability, and long-term customer retention models.

The market is expanding as consumers increasingly prioritize preventive skincare over corrective treatments. Growing awareness of oxidative stress, pollution-induced skin damage, and premature aging has fueled demand for antioxidant-rich formulations that protect against free radicals. Ingredients such as vitamin C, vitamin E, and resveratrol are gaining prominence for their proven efficacy in restoring elasticity and radiance. This shift toward functional skincare with long-term protection benefits is driving consistent growth across both mass and premium segments globally.

E-commerce and digital-first brands are accelerating the antioxidant skincare market by promoting ingredient transparency and clinical validation. Consumers are now more informed, seeking simplified formulations backed by visible results. Digital platforms enable personalized skincare routines, product education, and subscription-based replenishment models. The success of brands like The Ordinary and Paula’s Choice illustrates how online retail and open-label communication have reshaped purchase behavior, driving faster adoption across younger demographics and boosting overall market value between 2025 and 2035.

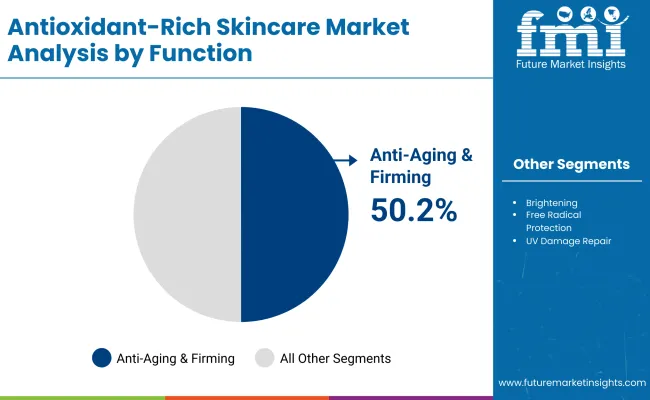

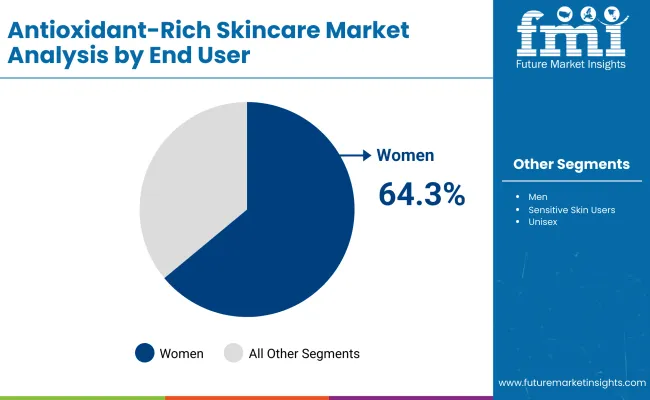

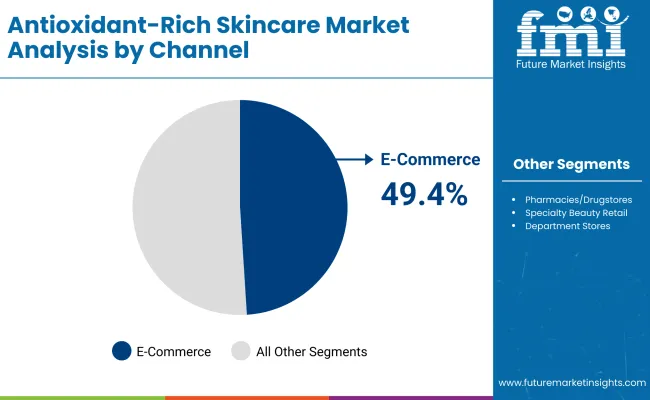

The Antioxidant-Rich Skincare Market is segmented by product type, key ingredients, function, channel, end user, and region. Product types include serums, creams and lotions, masks, toners, and essences each addressing specific skincare needs across anti-aging, brightening, and protection segments. Key ingredients such as vitamin C, vitamin E, green tea polyphenols, resveratrol, and coenzyme Q10 form the core of antioxidant formulations, driving efficacy and brand differentiation.

Functional categories cover anti-aging and firming, brightening, free radical protection, and UV damage repair. Distribution channels encompass e-commerce, pharmacies, specialty beauty retail, and department stores, reflecting the market’s omnichannel evolution. End-user segments include women, men, unisex, and sensitive-skin consumers, supported by gender-neutral innovation and personalization trends. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with accelerated growth in China, India, and Japan due to rising demand for clinical-grade skincare and premium formulations.

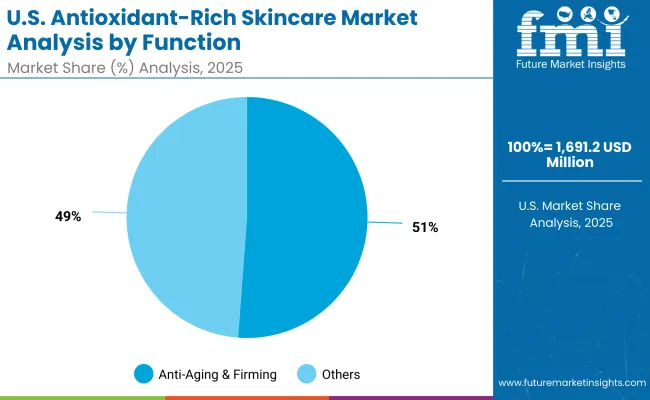

| Function | Value Share% 2025 |

|---|---|

| Anti-aging & firming | 50.2% |

| Others | 49.8% |

The anti-aging and firming segment is projected to contribute the highest share of the Antioxidant-Rich Skincare Market revenue in 2025, maintaining its position as the leading functional category. This dominance is driven by the increasing prevalence of premature aging, environmental damage, and consumer demand for clinically proven antioxidant formulations.

Vitamin C, vitamin E, and coenzyme Q10 are key actives delivering elasticity restoration, collagen synthesis, and wrinkle reduction. The segment’s growth is reinforced by expanding clinical skincare adoption among women aged 30-55 and the integration of multi-functional products offering firming, hydration, and protection benefits. With scientific validation and dermocosmetic innovation driving consumer trust, anti-aging and firming formulations are expected to remain the backbone of antioxidant-rich skincare portfolios through 2035.

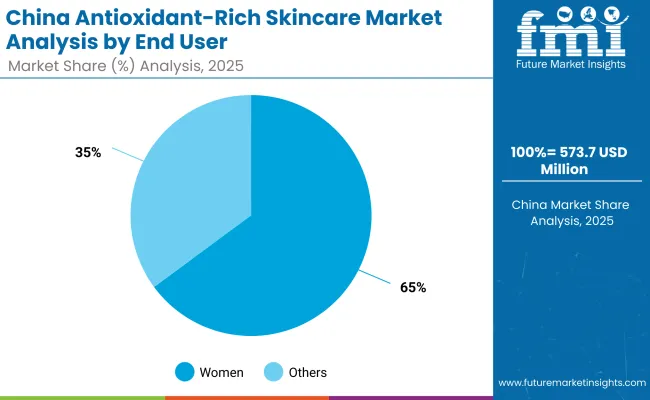

| End User | Value Share% 2025 |

|---|---|

| Women | 64.3% |

| Others | 35.7% |

The women segment is forecasted to hold the largest share of the Antioxidant-Rich Skincare Market in 2025, driven by increasing awareness of skin health, anti-aging benefits, and preventive care. Women continue to be the primary consumers of antioxidant-enriched formulations, particularly in serums, creams, and lotions aimed at firming, brightening, and protecting against free radical damage.

The segment’s expansion is supported by rising disposable incomes, skincare personalization, and digital engagement through beauty commerce platforms. As clean-label and clinically validated antioxidants gain traction, women-led demand will remain the key force shaping product innovation and premiumization across global skincare markets through 2035.

| End User | Value Share% 2025 |

|---|---|

| E-commerce | 49.4% |

| Others | 50.6% |

The e-commerce segment is projected to account for nearly half of the Antioxidant-Rich Skincare Market revenue in 2025, establishing it as the most influential distribution channel. Online platforms have transformed consumer access to antioxidant-rich skincare by offering personalized product recommendations, ingredient transparency, and peer-reviewed feedback. The rise of digital-native beauty brands and subscription-based skincare models has strengthened online engagement, especially among younger demographics.

Enhanced logistics, virtual try-on tools, and direct-to-consumer campaigns are further driving growth. As consumers increasingly prioritize convenience and product authenticity, e-commerce is expected to remain the leading channel shaping global antioxidant skincare sales through 2035.

Growing Awareness of Oxidative Skin Damage and Preventive Care

Rising consumer awareness about oxidative stress, pollution exposure, and UV-induced skin damage is a key growth catalyst for the Antioxidant-Rich Skincare Market. Consumers are increasingly adopting antioxidant-based skincare products to neutralize free radicals and prevent premature aging. Ingredients such as vitamin C, vitamin E, resveratrol, and green tea polyphenols are gaining strong traction for their proven efficacy. With social media and dermatological endorsements amplifying ingredient education, preventive skincare routines are becoming mainstream, driving consistent global demand across both premium and mass-market categories.

Expansion of Premium and Functional Skincare Formulations

The market is witnessing strong momentum due to the premiumization of skincare products and the integration of functional actives. Brands are increasingly formulating multi-benefit products combining antioxidants with peptides, hyaluronic acid, and ceramides to target multiple concerns simultaneously. This evolution from cosmetic to therapeutic skincare aligns with the clean beauty and science-backed trends dominating the industry. Clinical validation, dermatologist-tested claims, and transparent labeling have further reinforced consumer confidence, while rising disposable incomes across Asia-Pacific markets continue to accelerate the adoption of high-performance antioxidant skincare products.

High Product Cost and Limited Ingredient Stability

Despite growing demand, the antioxidant-rich skincare market faces constraints from high product costs and ingredient instability. Active ingredients such as vitamin C and coenzyme Q10 are sensitive to light, heat, and oxidation, which can degrade their efficacy during formulation or storage. Maintaining product stability requires advanced encapsulation and preservation technologies, increasing production costs. This limits affordability for mass consumers and restricts wider market penetration, especially in price-sensitive regions. Additionally, consumer skepticism about product shelf life and ingredient potency continues to challenge long-term brand trust.

Shift Toward Clean, Transparent, and Tech-Integrated Skincare

A prominent trend in the antioxidant-rich skincare market is the convergence of clean beauty principles with digital personalization. Consumers increasingly favor formulations free from parabens, sulfates, and artificial fragrances, paired with full ingredient disclosure. Brands are leveraging AI-driven skincare diagnostics, augmented reality tools, and subscription-based digital platforms to personalize product recommendations. This tech-integrated approach enhances engagement and retention while emphasizing ingredient integrity. The trend signifies a broader transition toward science-backed, environmentally responsible skincare solutions designed for transparency, traceability, and long-term skin health optimization.

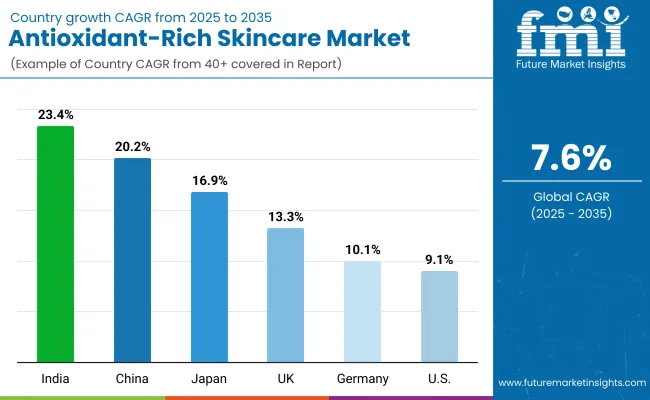

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 20.2% |

| USA | 9.1% |

| India | 23.4% |

| UK | 13.3% |

| Germany | 10.1% |

| Japan | 16.9% |

The global Antioxidant-Rich Skincare Market demonstrates clear regional differentiation in growth pace, driven by lifestyle shifts, income expansion, and cultural beauty preferences. Asia-Pacific emerges as the fastest-growing region, led by India (23.4%) and China (20.2%), where demand is fueled by rapid urbanization, growing middle-class awareness of anti-aging skincare, and the popularity of K-beauty and J-beauty-inspired regimens. India’s trajectory is reinforced by rising e-commerce penetration and affordable clinical-grade products, while China benefits from premium brand adoption and strong influencer marketing ecosystems. Japan (16.9%) maintains steady growth through innovation in lightweight, antioxidant-infused formulations emphasizing natural actives and minimal irritation. In Europe, the UK (13.3%) and Germany (10.1%) show consistent expansion driven by regulatory emphasis on ingredient transparency and sustainable packaging.

North America, led by the USA (9.1%), reflects a mature yet evolving market characterized by digital skincare diagnostics, wellness-driven branding, and the growing prominence of clean-label antioxidant formulations. Collectively, Asia-Pacific’s dominance stems from consumer education, localized innovation, and the blending of science with holistic skincare traditions, positioning the region as the global growth engine through 2035.

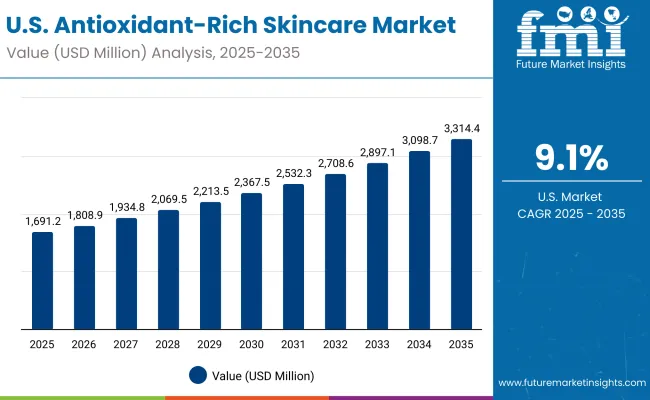

| Year | USA Antioxidant-Rich Skincare Market (USD Million) |

|---|---|

| 2025 | 1691.2 |

| 2026 | 1808.9 |

| 2027 | 1934.8 |

| 2028 | 2069.5 |

| 2029 | 2213.5 |

| 2030 | 2367.5 |

| 2031 | 2532.3 |

| 2032 | 2708.6 |

| 2033 | 2897.1 |

| 2034 | 3098.7 |

| 2035 | 3314.4 |

The Antioxidant-Rich Skincare Market in the United States is projected to grow at a CAGR of 9.1% from 2025 to 2035, driven by the rapid adoption of functional and clinically validated skincare solutions. Growth is underpinned by increasing consumer focus on preventive anti-aging care, clean beauty formulations, and dermatologist-endorsed brands. Premium serums and antioxidant creams dominate the segment, supported by extensive online retail penetration and product personalization trends. Demand is further strengthened by rising awareness of pollution-related oxidative stress and the role of antioxidants in maintaining long-term skin health. Digital-native brands are expanding rapidly through direct-to-consumer models, while legacy players invest in AI-driven skin diagnostics and customized regimens to enhance engagement.

The Antioxidant-Rich Skincare Market in the United Kingdom is expected to grow at a CAGR of 13.3% between 2025 and 2035, supported by strong consumer preference for clean, transparent, and clinically validated skincare. Growth is driven by the rapid adoption of antioxidant-based formulations featuring vitamin C, vitamin E, and green tea extracts aimed at combating pollution-related skin damage and premature aging. The UK market’s premium segment is expanding through department stores, dermatology clinics, and digital platforms promoting ingredient-led storytelling. Rising demand for cruelty-free, vegan-certified products and recyclable packaging continues to influence purchase decisions. Strategic collaborations between beauty brands, research institutions, and dermatological laboratories are fostering innovation in advanced antioxidant delivery systems and encapsulated formulations.

India is witnessing rapid expansion in the Antioxidant-Rich Skincare Market, which is forecast to grow at a CAGR of 23.4% through 2035, making it one of the fastest-growing markets globally. Growth is propelled by rising disposable incomes, increasing consumer awareness of oxidative stress, and the growing influence of dermatology-led skincare routines. Tier-2 and Tier-3 cities are emerging as major consumption hubs, driven by affordable product availability, influencer marketing, and digital retail penetration. Indian consumers are increasingly opting for serums and creams enriched with vitamin C, green tea extracts, and coenzyme Q10 to address pigmentation, dullness, and sun-induced damage. The country’s young demographic base and preference for daily-use multifunctional skincare have prompted both domestic and global brands to localize product formulations for the Indian climate.

The Antioxidant-Rich Skincare Market in China is expected to grow at a CAGR of 20.2%, the highest among major global economies. This rapid expansion is driven by rising consumer awareness of environmental stress, pollution-induced skin damage, and the preventive benefits of antioxidants. Chinese consumers are increasingly seeking skincare products featuring vitamin C, resveratrol, and green tea polyphenols for brightening and anti-aging effects. Domestic beauty brands are leveraging traditional herbal ingredients alongside advanced antioxidant actives to cater to hybrid wellness trends. E-commerce platforms such as Tmall and JD.com have amplified access to clinical-grade skincare, while cross-border collaborations with Korean and Japanese brands are introducing innovative antioxidant formulations. China’s younger population, digital-first beauty culture, and willingness to experiment with science-backed products make it the global epicenter for antioxidant skincare innovation.

| Countries | 2025 Share (%) |

|---|---|

| USA | 21.4% |

| China | 11.2% |

| Japan | 6.6% |

| Germany | 14.7% |

| UK | 8.1% |

| India | 4.9% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 20.2% |

| China | 12.2% |

| Japan | 9.1% |

| Germany | 12.8% |

| UK | 7.1% |

| India | 5.7% |

The Antioxidant-Rich Skincare Market in Germany is projected to grow at a CAGR of 10.1% from 2025 to 2035, supported by the country’s strong position in dermatological research, sustainable cosmetics, and regulatory-backed formulation standards. Germany remains one of Europe’s most mature skincare markets, characterized by a high preference for clean, fragrance-free, and dermatologically tested products. Consumers are increasingly prioritizing antioxidant-based skincare featuring vitamin E, coenzyme Q10, and resveratrol to combat pollution-related oxidative stress and signs of aging. The presence of major dermocosmetic brands such as Nivea, Eucerin, and La Roche-Posay reinforces clinical credibility and consumer trust. Furthermore, Germany’s commitment to sustainability, recyclable packaging, and ingredient transparency aligns with EU Green Deal objectives, strengthening its market leadership in ethical skincare.

| USA by Function | Value Share% 2025 |

|---|---|

| Anti-aging & firming | 51.2% |

| Others | 48.8% |

The Antioxidant-Rich Skincare Market in the United States is projected at USD 1,691.2 million in 2025, with anti-aging and firming products holding a dominant 51.2% share of total market value. This leadership reflects strong consumer preference for clinically proven formulations addressing fine lines, loss of elasticity, and environmental stress. Vitamin C, retinol blends, and coenzyme Q10 remain key active ingredients driving efficacy-based skincare choices. The growing popularity of dermatologist-endorsed products and preventive routines has elevated antioxidant serums and creams into daily essentials for consumers aged 30-60. E-commerce platforms and subscription-based skincare services are further amplifying accessibility and personalization. As the market evolves, the convergence of science, clean beauty, and digital retail will define long-term growth momentum across the USA antioxidant skincare landscape.

| China by End User | Value Share% 2025 |

|---|---|

| Women | 64.9% |

| Others | 35.1% |

The Antioxidant-Rich Skincare Market in China presents significant growth opportunities, with women accounting for 64.9% of total market value in 2025. Rising urban pollution, expanding middle-class income, and evolving beauty standards have accelerated the demand for preventive, antioxidant-based skincare. Chinese consumers are increasingly drawn to products featuring vitamin C, resveratrol, and green tea polyphenols, reflecting strong interest in brightening, anti-aging, and pollution-defense benefits.

Domestic beauty innovators are capitalizing on this momentum through hybrid formulations blending traditional herbal extracts with advanced antioxidants, enhancing both performance and cultural resonance. E-commerce ecosystems like Tmall and Douyin are amplifying access and awareness through influencer-led education and real-time product trials. As ingredient transparency, clean-label beauty, and personalization define the next decade, China’s antioxidant skincare market offers expansive opportunities for global and local brands alike to capture sustained, high-value growth.

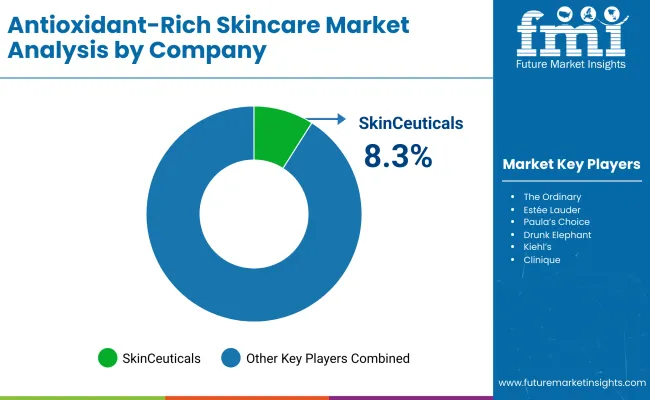

| Companies | Global Value Share 2025 |

|---|---|

| SkinCeuticals | 8.3% |

| Others | 91.7% |

The Antioxidant-Rich Skincare Market is moderately consolidated, led by global dermatology-backed and clinical skincare brands that prioritize science-driven formulations and consumer education. SkinCeuticals, with an 8.3% global value share, maintains leadership through its pioneering work in vitamin C serums and dermatologist-recommended antioxidant solutions. Its dominance stems from a robust clinical research foundation and partnerships with aesthetic professionals worldwide. Other major participants, including The Ordinary, Estée Lauder, Paula’s Choice, Drunk Elephant, and La Roche-Posay, are reshaping competition through transparency, simplified ingredient lists, and sustainability commitments.

Mid-sized innovators are expanding rapidly in the clean beauty and dermocosmetic space by merging antioxidant actives with probiotics, peptides, and encapsulation technologies to enhance skin delivery and stability. Meanwhile, niche and regional brands across Asia-Pacific and Europe are emphasizing natural extracts and plant-derived antioxidants to target local consumer preferences.

Competitive differentiation is shifting from traditional luxury positioning to efficacy, ingredient purity, and personalized formulation ecosystems supported by AI skin diagnostics and digital skincare platforms. Subscription-based and D2C distribution models are further redefining long-term consumer loyalty and recurring revenue streams across the global antioxidant skincare landscape.

Key Developments in Antioxidant-Rich Skincare Market

| Item | Value |

|---|---|

| Quantitative Units | USD 7,903.8 Million |

| Product Type | Serums, Creams & lotions, Masks, Toners & essences |

| Key Ingredients | Vitamin C, Vitamin E, Green tea polyphenols, Resveratrol, Coenzyme Q10 |

| Function | Anti-aging & firming, Brightening, Free radical protection, UV damage repair |

| Channel | E-commerce, Pharmacies/drugstores, Specialty beauty retail, Department stores |

| End User | Women, Men, Sensitive skin users, Unisex |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SkinCeuticals, The Ordinary, Estée Lauder, Paula’s Choice, Drunk Elephant, Kiehl’s, Murad, La Roche-Posay, Olay, Clinique |

| Additional Attributes | Dollar sales by product type and ingredient composition, adoption trends in anti-aging and brightening skincare, rising demand for antioxidant-rich serums and creams, segmental growth across women’s and unisex skincare lines, revenue segmentation by online and offline retail channels, integration of AI-driven skin diagnostics and personalized formulation platforms, regional demand shifts influenced by urban pollution and clean beauty awareness, and ongoing innovations in stabilized vitamin C, encapsulated coenzyme Q10, and polyphenol-based formulations for improved absorption, efficacy, and long-term skin protection. |

The global Antioxidant-Rich Skincare Market is estimated to be valued at USD 7,903.8 million in 2025.

The market size for the Antioxidant-Rich Skincare Market is projected to reach USD 16,406.2 million by 2035.

The Antioxidant-Rich Skincare Market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in the Antioxidant-Rich Skincare Market are serums, creams & lotions, masks, and toners & essences.

In terms of function, the anti-aging & firming segment is expected to command the most significant share in the Antioxidant-Rich Skincare Market in 2025, contributing around 50.2% of total market value.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

Ceramide Skincare Market Size and Share Forecast Outlook 2025 to 2035

BPA-Free Skincare Market Trends – Demand & Forecast 2024-2034

Camellia Skincare & Cosmetics Market

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Menopause Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA