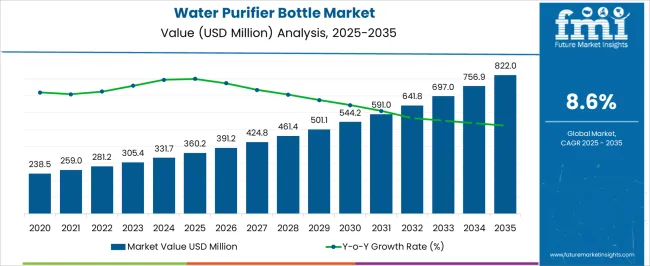

The water purifier bottle market reaches USD 360.2 million in 2025 and is expected to expand to USD 822.0 million by 2035, reflecting a CAGR of 8.6%. The growth rate volatility index captures fluctuations in annual expansion, reflecting periods of rapid adoption, market maturation, and evolving consumer demand for portable water purification solutions. From 2021 to 2025, the market rises from USD 238.5 million to USD 360.2 million, passing through USD 259.0 million, 281.2 million, 305.4 million, and 331.7 million. In this early stage, volatility is moderate as awareness and adoption increase gradually.

Product launches with advanced filtration, lightweight designs, and convenience features drive gains, while pricing pressures and distribution challenges in certain regions slightly temper growth rates. Between 2026 and 2030, the market grows from USD 391.2 million to USD 501.1 million, with intermediate points at USD 424.8 million, 461.4 million, and 501.1 million. During this phase, volatility eases as leading brands expand their reach, optimize production, and leverage e-commerce channels. Consumer preference for durable, reusable, and eco-friendly bottles supports steady growth.

From 2031 to 2035, the market further strengthens, increasing from USD 544.2 million to USD 822.0 million, moving through USD 591.0 million, 641.8 million, 697.0 million, and 756.9 million. Occasional growth spikes occur due to rising adoption in emerging markets, growing health consciousness, and technological innovation.

| Metric | Value |

|---|---|

| Water Purifier Bottle Market Estimated Value in (2025 E) | USD 360.2 million |

| Water Purifier Bottle Market Forecast Value in (2035 F) | USD 822.0 million |

| Forecast CAGR (2025 to 2035) | 8.6% |

The water purifier bottle market is strongly influenced by interrelated parent markets, each contributing uniquely to overall demand and growth. The consumer packaged goods and household products market holds the largest share at 35%, as households increasingly prioritize safe, filtered drinking water for daily use, combining convenience with health benefits. The outdoor and sports equipment market contributes 25%, with hikers, travelers, and athletes adopting portable water purifier bottles for on-the-go hydration during recreational and fitness activities.

The travel and tourism market accounts for 15%, where hotels, resorts, and tour operators provide purified water solutions to guests, ensuring safety and convenience. The emergency preparedness and disaster relief market holds a 15% share, driven by the need for clean water in disaster zones, relief camps, and emergency kits, enhancing public health outcomes. Finally, the retail and e-commerce distribution market represents 10%, facilitating product availability, online reach, and consumer awareness.

The water purifier bottle market is gaining significant traction driven by rising awareness of waterborne diseases, increased demand for on-the-go hydration, and growing outdoor and travel activities. Urban consumers are showing strong interest in portable purification solutions that combine convenience with health assurance.

The shift toward single-user, reusable, and eco-friendly bottles is further propelling innovation in materials and purification technologies. Regulatory initiatives focused on plastic waste reduction and clean drinking water access are reinforcing consumer shift toward advanced and refillable purifier bottles.

With technological upgrades and compact filtration mechanisms becoming more affordable, the market is poised for stable expansion across both urban and rural settings.

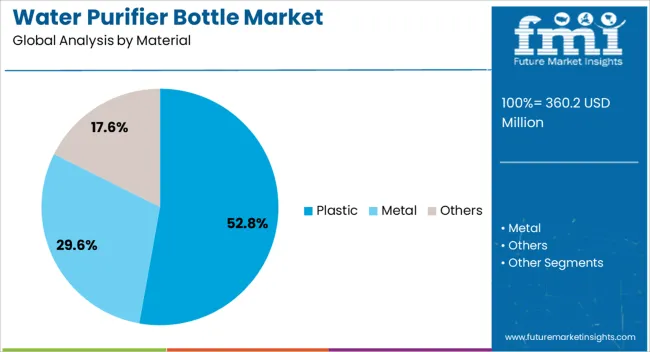

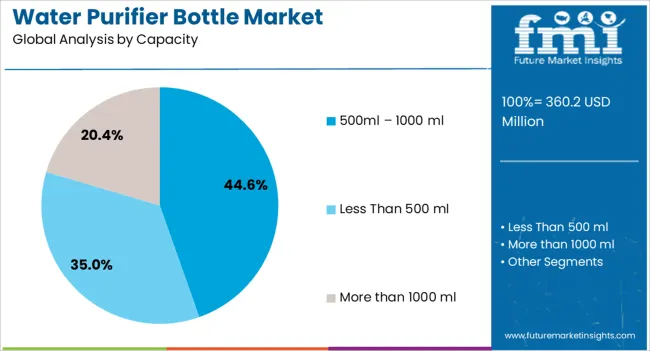

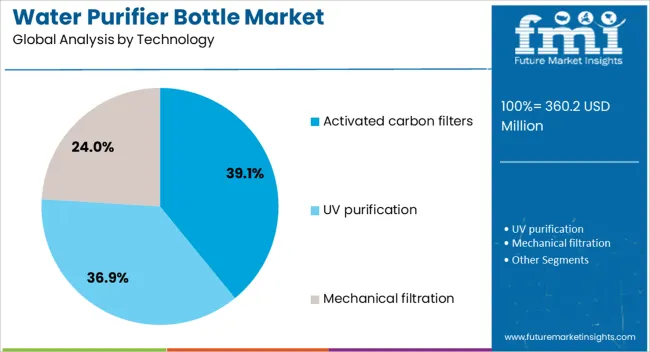

The water purifier bottle market is segmented by material, capacity, technology, category, distribution channel, and geographic regions. By material, water purifier bottle market is divided into Plastic, Metal, and Others. In terms of capacity, water purifier bottle market is classified into 500ml – 1000 ml, Less Than 500 ml, and More than 1000 ml. Based on technology, water purifier bottle market is segmented into Activated carbon filters, UV purification, and Mechanical filtration.

By category, the water purifier bottle market is segmented into without a straw and with a straw. By distribution channel, water purifier bottle market is segmented into Offline and Online. Regionally, the water purifier bottle industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Plastic bottles are anticipated to dominate the market with a 52.80% share in 2025, owing to their lightweight, cost-effective, and shatter-resistant properties. Manufacturers are increasingly using BPA-free and recyclable plastics to meet consumer demand for safety and sustainability.

The portability of plastic bottles makes them ideal for outdoor, fitness, and daily commute scenarios, thereby widening their market reach. Additionally, the lower production cost of plastic enables broader price accessibility, especially in emerging economies.

Enhanced designs with insulation and ergonomic features have also contributed to their mainstream acceptance across all demographics.

The 500ml – 1000ml capacity range is projected to lead the segment with a 44.60% share in 2025. This size range offers an ideal balance between portability and sufficient water volume, making it suitable for daily use by students, professionals, and travelers.

Consumers favor this segment for its easy storage in bags and cup holders while still offering enough purified water to meet hydration needs during short trips or commutes.

Manufacturers are targeting this sweet spot with advanced filtration systems, leak-proof designs, and stylish form factors, contributing to sustained demand within this category.

Activated carbon filters are set to hold a dominant 39.10% market share by 2025 due to their widespread effectiveness in removing odors, chlorine, and organic contaminants. Their ease of replacement, affordability, and proven safety record have made them a preferred choice for both consumers and manufacturers.

As awareness of harmful micropollutants increases, these filters are gaining ground due to their multi-stage compatibility with other technologies such as UV or membrane filtration.

Additionally, their compact size and low energy requirements make them particularly suitable for portable bottle applications.

The water purifier bottle market is growing as consumers seek safe, portable, and convenient hydration solutions. Demand is driven by urban commuters, outdoor enthusiasts, travelers, and students who require on-the-go access to clean drinking water. Challenges include filter replacement costs, variability in purification efficiency, and regulatory compliance across regions.

Opportunities exist in multi-stage filtration, compact designs, and reusable bottles with long-lasting cartridges. Trends highlight portable UV and carbon-based purification, ergonomic designs, and digital monitoring of filter life. Suppliers providing reliable filtration technology, durable bottles, and consistent after-sales support are best positioned to capture expanding consumer adoption across travel, fitness, and everyday use scenarios.

Consumers are increasingly prioritizing portable access to safe drinking water amid growing awareness of waterborne contaminants and urban mobility needs. Water purifier bottles enable individuals to purify tap or outdoor water in real-time, reducing dependency on bottled water. Fitness enthusiasts, office-goers, and travelers prefer lightweight, easy-to-carry bottles that integrate filtration systems capable of removing bacteria, microplastics, and chlorine. School and university students also drive adoption through convenience and safety considerations. Compact, single-handed operation and fast filtration rates are major selling points. As lifestyles become more mobile and health-conscious, water purifier bottles are being positioned as essential everyday hydration tools, combining portability with reliable water purification.

Challenges in the water purifier bottle market stem from the cost of advanced filtration components, including carbon, ceramic, and UV modules. Consistent purification efficiency and durability of filters are critical for consumer trust. Supply chain issues affecting filter media, bottle materials, and assembly components can impact availability. Compliance with regional health, safety, and material regulations is required for consumer protection and claims validation. Cartridge lifespan, replacement availability, and water flow rate are technical considerations influencing product adoption. Buyers increasingly prioritize suppliers who provide validated purification performance, easy cartridge replacement, and responsive after-sales service to ensure reliable operation and consumer confidence.

Opportunities exist in multi-stage filtration systems, combining carbon, ceramic, and UV purification for enhanced performance. Smart bottles with integrated sensors that indicate filter status or water quality are gaining traction among tech-savvy consumers. Compact and ergonomic designs allow portability without compromising capacity, appealing to commuters and outdoor enthusiasts. Collaboration with gyms, travel retailers, and educational institutions can drive bulk adoption. Regional growth in Asia-Pacific, Europe, and North America is fueled by urbanization, water quality concerns, and increased outdoor activity. Suppliers offering innovative filtration solutions, long-lasting cartridges, and value-added features such as digital monitoring are well positioned to capture repeat purchases and strengthen brand loyalty.

Bottles with ergonomic designs, leak-proof caps, and lightweight construction improve user experience and portability. Integration of smart sensors and app-based notifications for filter replacement is becoming increasingly common. Reusable and durable bottles with easily replaceable cartridges appeal to everyday consumers and travelers alike. Partnerships between filtration component manufacturers and bottle producers are enhancing product performance, reliability, and lifecycle support. Overall, suppliers that provide high-quality filtration, convenient design, and consistent service support are best positioned to meet the growing demand for portable, safe hydration solutions.

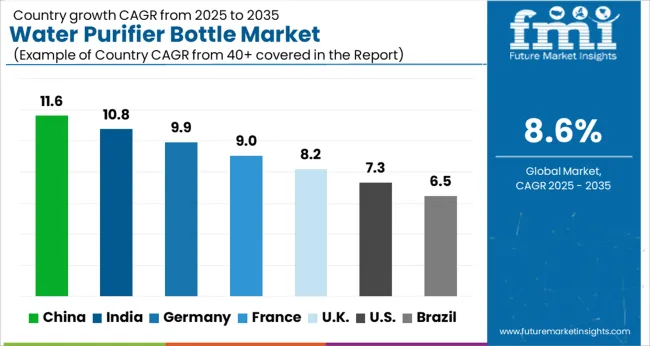

| Country | CAGR |

|---|---|

| China | 11.6% |

| India | 10.8% |

| Germany | 9.9% |

| France | 9.0% |

| UK | 8.2% |

| USA | 7.3% |

| Brazil | 6.5% |

The global water purifier bottle market is projected to grow at a CAGR of 8.6% from 2025 to 2035. China leads at 11.6%, followed by India at 10.8%, France at 9.0%, the UK at 8.2%, and the USA at 7.3%. Growth is driven by rising health awareness, urbanization, outdoor activities, and travel safety concerns. Asia, particularly China and India, shows the fastest expansion due to water quality challenges and disposable income growth. Europe and North America focus on advanced filtration, ergonomic design, and institutional adoption. Increasing availability through e-commerce and retail channels, along with innovations in filter technology and portability, continues to accelerate market penetration worldwide. The analysis spans over 40+ countries, with the leading markets shown below.

The water purifier bottle market inn China is projected to grow at a CAGR of 11.6% from 2025 to 2035, driven by increasing urbanization, rising health awareness, and concerns over water quality in cities. Consumers are seeking portable, easy-to-use purification solutions for home, travel, and office use. Advanced filtration technologies, including activated carbon, UV, and ceramic filters, are gaining adoption for their ability to remove bacteria, heavy metals, and other contaminants. E-commerce platforms and retail chains are expanding distribution, making innovative products more accessible. Domestic manufacturers are investing in R&D to improve filter lifespan, durability, and design, while collaborating with international brands to meet rising consumer expectations.

The water purifier bottle market in India is expected to expand at a CAGR of 10.8% from 2025 to 2035, fueled by growing health consciousness, water contamination issues, and rising disposable incomes. Increasing urban and semi-urban populations are adopting portable water purification systems for home, outdoor, and travel applications. Companies are offering products with advanced multi-stage filters, UV sterilization, and antibacterial coatings to cater to diverse water conditions. E-commerce and organized retail channels are improving market penetration, while awareness campaigns by private and government initiatives emphasize the importance of safe drinking water. Domestic players are innovating in lightweight, ergonomic designs and extended filter life to capture urban millennials and working professionals. Schools, offices, and fitness centers are also driving institutional demand.

Demand for water purifier bottles in France is forecasted to grow at a CAGR of 9.0% from 2025 to 2035, driven by increasing health and wellness trends, outdoor activities, and travel safety concerns. Consumers are preferring compact, portable bottles with advanced filtration systems such as activated carbon and UV sterilization. The market benefits from premium and ergonomic designs appealing to professionals and adventure enthusiasts. Supermarkets, specialty retailers, and online platforms are expanding product availability, while local manufacturers focus on enhancing filter lifespan and design. Outdoor tourism, hiking, and sports participation are additional growth drivers, as individuals seek on-the-go hydration solutions with assured water quality. Partnerships between French brands and international technology providers further improve product performance and brand appeal.

The UK water purifier bottle market is expected to grow at a CAGR of 8.2% from 2025 to 2035, driven by health-conscious consumers and rising interest in clean, safe drinking water. Portable bottles with UV, carbon, and multi-stage filters are popular for travel, office, and fitness applications. Manufacturers are focusing on innovative, lightweight, and ergonomic designs to differentiate their products. Online retail and supermarket chains are key channels for distribution, enhancing consumer access. Schools, offices, and gyms are increasingly adopting water purifier bottles for staff and students, creating institutional demand. Public awareness campaigns about the importance of water safety further support market adoption, while collaborations with international filtration technology providers improve product reliability and performance.

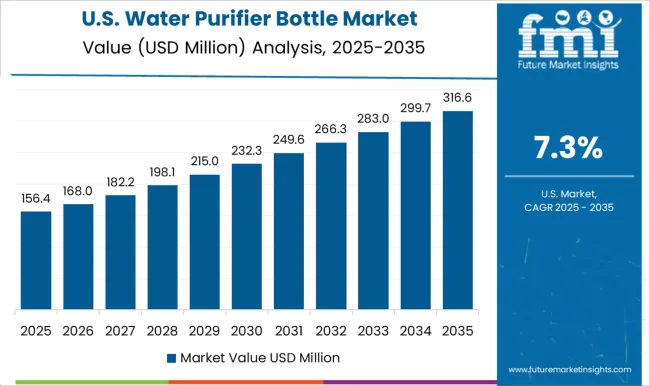

The USA market is projected to grow at a CAGR of 7.3% from 2025 to 2035, supported by increasing health awareness, travel, and outdoor activity trends. Consumers prefer water purifier bottles with advanced filtration technologies including UV sterilization, activated carbon, and multi-stage systems. The market is driven by urban professionals, outdoor enthusiasts, and students seeking portable, reliable hydration solutions. E-commerce, mass retailers, and specialty stores provide broad distribution channels, enabling faster adoption. Manufacturers focus on improving filter longevity, bottle durability, and ergonomic design to meet consumer expectations. Corporate wellness programs and educational institutions increasingly integrate water purification solutions, adding to the growth. Product innovation, combined with marketing emphasizing health and convenience, further strengthens adoption across residential and institutional segments.

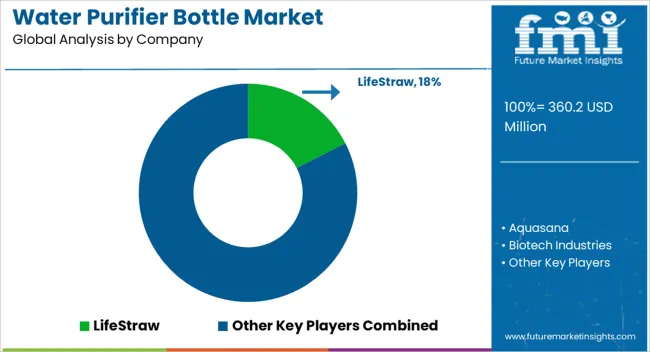

Competition in the water purifier bottle market is defined by filtration efficiency, portability, and durability. LifeStraw leads with high-performance microfiltration technology and widespread adoption in outdoor, travel, and emergency-use segments. Brita and Aquasana compete with integrated activated carbon filters and multi-stage purification for taste improvement and contaminant reduction. Camelbak, Nalgene, and Cello World differentiate through ergonomic design, spill-proof lids, and lightweight construction suitable for sports and everyday use. Doulton Water Filters and Icon Lifesaver emphasize ceramic and hollow-fiber membrane technologies for pathogen removal in harsh environments. Emerging and regional players like Biotech Industries, Kor Water, Membrane Solutions, NKD Life, Pure Clear Filters, Rapid Pure, Sawyer, and Water To Go International compete through niche features, including UV sterilization, replaceable cartridges, and modular designs. Strategies focus on portability, ease of maintenance, and global availability.

Filtration certifications, BPA-free materials, and ergonomic bottle shapes are marketed as differentiators. Product bundling with outdoor gear, travel kits, and emergency preparedness sets is used to enhance adoption. Product brochure content is precise. Bottles are described with filtration capacity, flow rate, pore size, and removal efficiency for bacteria, protozoa, and microplastics. Multi-stage cartridges, activated carbon, ceramic filters, and UV sterilizers are detailed with replacement intervals and maintenance instructions. Ergonomic designs, spill-proof caps, and carry options are highlighted. Travel and outdoor suitability, BPA-free materials, and compliance with WHO or NSF standards are emphasized. Accessories such as replacement filters, cleaning kits, and storage caps are presented, reflecting a market oriented toward convenience, health protection, and reliable portable water purification.

| Item | Value |

|---|---|

| Quantitative Units | USD 360.2 Million |

| Material | Plastic, Metal, and Others |

| Capacity | 500ml – 1000 ml, Less Than 500 ml, and More than 1000 ml |

| Technology | Activated carbon filters, UV purification, and Mechanical filtration |

| Category | Without straw and With straw |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | LifeStraw, Aquasana, Biotech Industries, Brita, Camelbak, Cello World, Doulton Water Filters, Gryal, Icon Lifesaver, Kor Water, Membrane Solutions, Nalgene, NKD Life, Pure Clear Filters, Rapid Pure, Sawyer, and Water To Go International |

| Additional Attributes | Dollar sales by filter type (activated carbon, ceramic, membrane, UV), capacity (single-use, multi-use), and application (outdoor recreation, travel, emergency preparedness, household use). Demand dynamics are driven by rising health awareness, portable water filtration needs, and increasing concerns about water contamination. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, supported by outdoor activity popularity, disaster preparedness initiatives, and growing adoption of personal water purification solutions. |

The global water purifier bottle market is estimated to be valued at USD 360.2 million in 2025.

The market size for the water purifier bottle market is projected to reach USD 822.0 million by 2035.

The water purifier bottle market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in water purifier bottle market are plastic, metal and others.

In terms of capacity, 500 ml – 1000 ml segment to command 44.6% share in the water purifier bottle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Water Surface Conditioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water-based Inks Market Size and Share Forecast Outlook 2025 to 2035

Water Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA