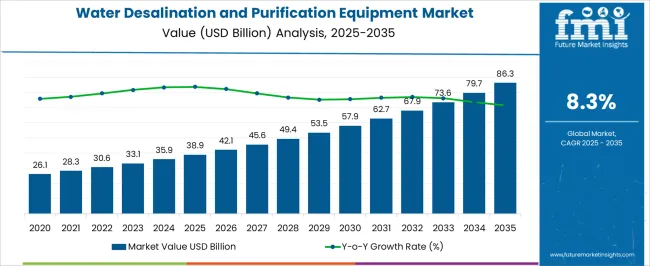

The water desalination and purification equipment market is expected to expand steadily from USD 38.9 billion in 2025 to USD 86.3 billion by 2035, advancing at a compound annual growth rate (CAGR) of 8.3%. Between 2025 and 2030, the market will rise from USD 38.9 billion to USD 57.9 billion, showcasing consistent year-on-year growth. This upward trajectory is shaped by rising demand for efficient water treatment solutions across both industrial and municipal sectors.

Desalination and purification technologies are increasingly adopted to address water scarcity and ensure access to clean water in regions where fresh sources remain limited. The preference for advanced membrane filtration, reverse osmosis systems, and energy-efficient purification equipment is driving this continuous growth phase. From 2030 to 2035, the market is expected to progress from USD 57.9 billion to USD 86.3 billion, reinforcing the long-term expansion outlook. The growth curve highlights an accelerating need for reliable water purification systems as urban development and industrial expansion continue to intensify water demand. Governments and private stakeholders are investing in large-scale desalination plants, while smaller systems for commercial and residential applications are also gaining traction.

The consistent growth across this decade signals a strong outlook for manufacturers and solution providers, as the focus shifts toward reliable, durable, and high-performing equipment. The market is poised to remain on a steady upward curve, reflecting its importance as a critical component of global water management strategies.

| Metric | Value |

|---|---|

| Water Desalination and Purification Equipment Market Estimated Value in (2025 E) | USD 38.9 billion |

| Water Desalination and Purification Equipment Market Forecast Value in (2035 F) | USD 86.3 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

The water desalination and purification equipment market occupies a critical niche across multiple parent markets, reflecting its essential role in ensuring access to potable and process water. Within the broader water treatment equipment market, this segment accounts for approximately 18% of the total market share, highlighting its importance in industrial, municipal, and commercial applications for producing clean water. In the desalination technology market, the water desalination and purification equipment segment captures around 42% of the market, representing its central role in converting seawater and brackish water into usable freshwater.

Within the industrial filtration equipment market, the segment holds about 12% of the total share, serving industries such as food and beverage, pharmaceuticals, and power generation that require high-purity water. In the municipal water infrastructure market, the segment represents approximately 15% of the market share, driven by investments in urban water supply systems and public health initiatives. In the environmental technology market, water desalination and purification equipment accounts for roughly 8% of the total share, reflecting its contribution to sustainable water management solutions. Collectively, these shares underscore the market’s pivotal position in addressing global water scarcity, supporting industrial processes, and enhancing municipal water systems, while demonstrating its integration across multiple water-focused technology sectors.

Rapid industrialization, population expansion, and climate change effects are placing significant strain on conventional water resources, driving the adoption of advanced purification technologies.

The market is further strengthened by the growing integration of automation, energy-efficient processes, and environmentally sustainable designs in desalination and purification systems. Governments and private entities are increasing investments in large infrastructure projects and decentralized solutions to ensure long-term water security.

Technological advancements such as membrane filtration improvements, hybrid desalination systems, and AI-based monitoring are enhancing operational efficiency and reducing costs, making adoption more feasible across various sectors. The ability of modern systems to deliver consistent water quality while optimizing resource use positions this market for sustained growth, with opportunities emerging in municipal, industrial, and commercial applications worldwide.

The water desalination and purification equipment market is segmented by mode of operation, system scale, application, end use, distribution channel, and geographic regions. By mode of operation, water desalination and purification equipment market is divided into Automatic systems and Manual systems. In terms of system scale, water desalination and purification equipment market is classified into Large-scale systems, Small-scale system, and Medium-scale system.

Based on application, water desalination and purification equipment market is segmented into Desalination, Water purification, Industrial water treatment, Household water treatment, Agricultural water treatment, Healthcare water treatment, and Others. By end use, water desalination and purification equipment market is segmented into Municipal, Industrial, Residential, Commercial, and Others (healthcare, agriculture). By distribution channel, water desalination and purification equipment market is segmented into Direct and Indirect. Regionally, the water desalination and purification equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

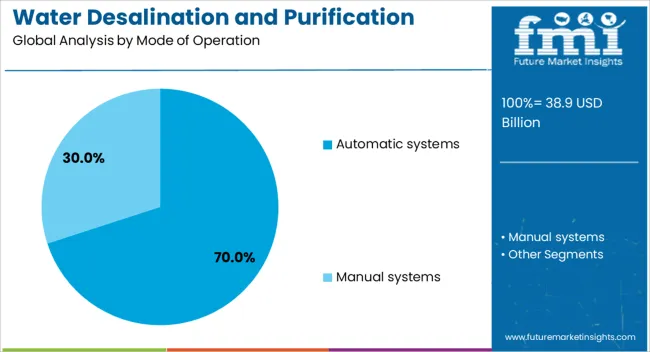

The automatic systems segment is projected to hold 70% of the water desalination and purification equipment market revenue share in 2025, making it the dominant mode of operation. This leadership has been driven by the ability of automatic systems to reduce manual intervention, minimize operational errors, and improve consistency in water quality. Automated controls and real-time monitoring enable precise regulation of system parameters, ensuring optimal performance with minimal downtime.

The demand for these systems has been reinforced by the need for reliable and scalable solutions in municipal and industrial applications where operational efficiency and cost control are priorities. The integration of advanced sensors, programmable logic controllers, and AI-based predictive maintenance capabilities has further enhanced the appeal of automatic systems.

Their ability to adapt to fluctuating input water quality while maintaining stable output has positioned them as a preferred choice for large-scale and remote operations As sustainability and efficiency remain critical objectives, automatic systems are expected to maintain their market leadership.

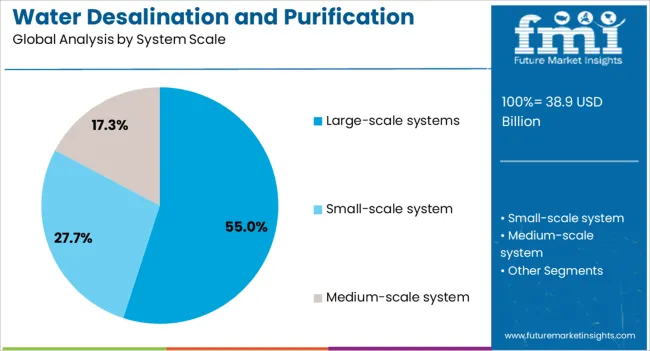

The large-scale systems segment is anticipated to account for 55% of the water desalination and purification equipment market revenue share in 2025, securing its position as the leading system scale. This segment's growth has been influenced by the rising need for high-capacity installations capable of supplying potable water to densely populated urban centers and industrial zones. Large-scale systems provide the advantage of economies of scale, enabling lower production costs per unit of water while meeting high-volume demand.

The adoption of advanced filtration and desalination technologies, coupled with energy recovery systems, has enhanced operational efficiency in large-scale projects. Public sector investments and public-private partnerships have played a critical role in financing and implementing such systems, particularly in regions facing acute water shortages.

The ability to integrate large-scale systems with renewable energy sources, such as solar or wind power, has also contributed to their attractiveness These systems are expected to remain central to long-term water security strategies in both coastal and inland areas.

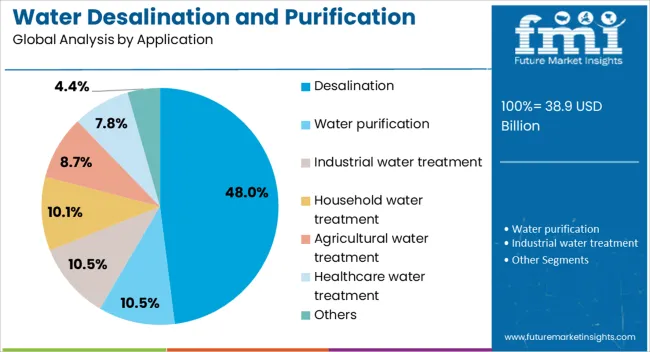

The desalination segment is expected to hold 48% of the water desalination and purification equipment market revenue share in 2025, emerging as the leading application. Growth in this segment has been driven by the increasing reliance on seawater and brackish water sources to meet freshwater needs in water-stressed regions. Desalination technology has advanced significantly, with improvements in membrane efficiency, energy recovery devices, and system automation reducing operational costs and environmental impact.

Governments and industries are prioritizing desalination as a strategic solution to secure a dependable water supply, particularly in arid and semi-arid climates. The integration of smart monitoring and predictive maintenance systems ensures consistent performance and long-term reliability of desalination plants.

Additionally, the diversification of desalination applications, including municipal supply, industrial processing, and agricultural irrigation, has expanded its market reach As global water demand continues to rise, desalination is expected to retain its prominence due to its capacity to deliver large volumes of high-quality water sustainably.

The water desalination and purification equipment market is expanding as demand for reliable freshwater solutions grows across industrial, municipal, and residential sectors. Opportunities are concentrated in large infrastructure projects and water-stressed regions. Trends such as modular systems, energy-efficient operations, and digital monitoring are reshaping adoption patterns. Challenges like high capital costs and maintenance complexity persist, yet companies that deliver cost-effective, high-performance equipment are expected to secure strong market positions.

The water desalination and purification equipment market is witnessing increasing demand due to the pressing need for reliable freshwater solutions across industrial, municipal, and residential sectors. Rapid population growth, industrial expansion, and water-stressed regions are driving adoption of desalination plants and purification systems. Industries such as pharmaceuticals, food and beverages, and power generation are integrating advanced water treatment technologies to ensure quality and regulatory compliance. As freshwater scarcity becomes a critical concern, governments and private players are prioritizing investments in water infrastructure, further propelling demand for high-capacity desalination and purification equipment.

Industrial and municipal infrastructure projects offer substantial growth opportunities for the water desalination and purification equipment market. Governments are initiating large-scale projects to improve potable water access and meet strict water quality standards, while industries are seeking customized solutions to manage wastewater and ensure process efficiency. Regions with arid climates and coastal proximity, such as the Middle East and parts of Asia-Pacific, are actively investing in reverse osmosis and multi-stage flash desalination technologies. Companies providing scalable, high-efficiency equipment with long operational lifespans are positioned to secure major contracts in both municipal and industrial projects.

A notable trend in the water desalination and purification equipment market is the shift toward energy-efficient and modular systems. Reverse osmosis, electrodialysis, and hybrid systems are increasingly preferred for their lower energy consumption and compact design. Digital monitoring and automation are being integrated to optimize performance and reduce operational downtime. Growing awareness of water quality standards and environmental regulations is driving the adoption of advanced filtration, UV treatment, and membrane technologies. These trends are shaping market offerings, emphasizing operational reliability, reduced maintenance needs, and consistent water output quality, aligning with evolving consumer and industrial expectations.

The water desalination and purification equipment market faces challenges related to high capital expenditure, energy intensity, and operational costs. Large-scale installations require significant upfront investment, limiting adoption in smaller municipalities and industries. Maintenance of sophisticated systems, membrane replacement, and skilled labor requirements also pose operational challenges. Competition from alternative water sourcing methods, such as rainwater harvesting and groundwater management, further impacts market penetration. Companies must focus on cost-efficient designs, enhanced durability, and lifecycle management solutions to address these barriers while ensuring consistent water quality and reliability.

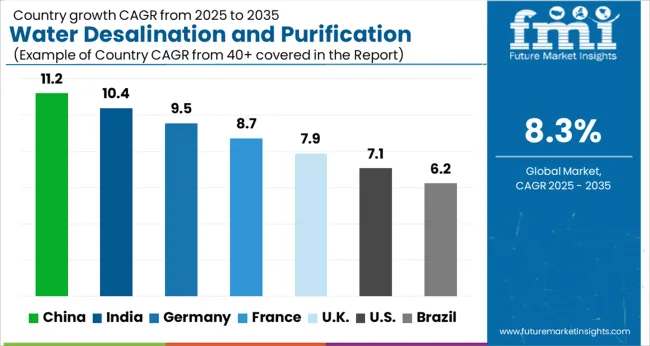

| Countries | CAGR |

|---|---|

| China | 11.2% |

| India | 10.4% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.9% |

| USA | 7.1% |

| Brazil | 6.2% |

The global water desalination and purification equipment market is projected to grow at a CAGR of 8.3% from 2025 to 2035. China leads with a growth rate of 11.2%, followed by India at 10.4%, and France at 8.7%. The United Kingdom records a growth rate of 7.9%, while the United States shows the slowest growth at 7.1%. Rising water scarcity, increasing demand for clean water in industrial and municipal sectors, and government investments in water infrastructure are driving growth. Emerging markets like China and India see accelerated adoption due to urbanization, industrialization, and government initiatives focused on potable water supply, while mature markets prioritize efficiency, advanced technology adoption, and replacement of aging infrastructure. This report includes insights on 40+ countries; the top markets are shown here for reference.

The water desalination and purification equipment market in China is projected to grow at a CAGR of 11.2%. The rapid industrial expansion, urban population growth, and rising water demand in industrial and municipal sectors are fueling adoption. Government initiatives promoting access to clean water and investments in large-scale desalination plants and purification systems further accelerate growth. Additionally, industries such as pharmaceuticals, food and beverage, and electronics continue to drive demand for high-quality purified water solutions.

The water desalination and purification equipment market in India is expected to grow at a CAGR of 10.4%. Growing water stress, rapid urbanization, and rising industrial and municipal water requirements are key drivers. Government programs aimed at improving access to potable water, combined with private investments in desalination and purification technologies, are accelerating market penetration. Furthermore, the industrial and commercial sectors’ need for high-quality water for production processes continues to support market expansion.

The water desalination and purification equipment market in France is projected to grow at a CAGR of 8.7%. France’s focus on sustainable water management, advanced treatment technologies, and regulations ensuring high-quality water supply drives adoption. Investments in municipal water treatment infrastructure and industrial purification systems, particularly in pharmaceuticals and food processing, continue to support market growth. Additionally, growing environmental awareness among consumers and industries is fueling demand for efficient and reliable water treatment solutions.

The water desalination and purification equipment market in the UK is projected to grow at a CAGR of 7.9%. Increasing demand for potable water, aging municipal water infrastructure, and industrial requirements are key growth drivers. The adoption of modern purification technologies, combined with government regulations promoting water quality standards, continues to accelerate market development. Additionally, rising awareness of water reuse and desalination applications in commercial and industrial sectors contributes to steady expansion.

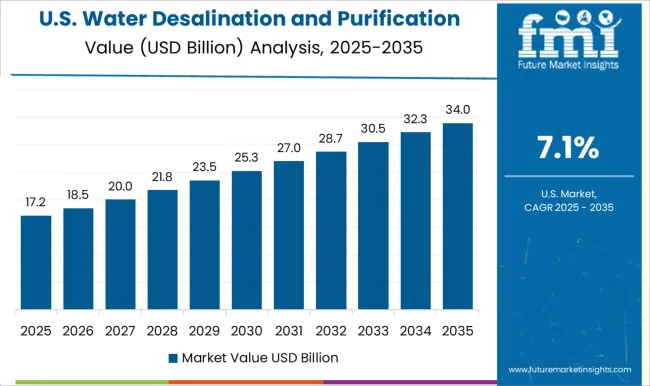

The water desalination and purification equipment market in the USA is projected to grow at a CAGR of 7.1%. Although the market grows moderately compared to emerging economies, demand remains strong due to municipal water treatment needs, industrial requirements, and drought-prone regions. Investments in upgrading aging infrastructure, alongside increasing adoption of high-efficiency desalination and purification systems, drive growth. Consumer and industrial demand for high-purity water in sectors such as pharmaceuticals, electronics, and food processing also supports steady market expansion.

The water desalination and purification equipment market is highly competitive, with Veolia and SUEZ recognized as dominant global players due to their extensive portfolios in integrated water solutions and large-scale infrastructure projects. Veolia has leveraged its expertise to provide comprehensive desalination plants and purification systems that serve municipalities, industries, and coastal cities worldwide.

SUEZ, with its wide international presence, emphasizes advanced membrane technologies and energy-efficient designs, ensuring strong demand across key markets. IDE Technologies, known for pioneering large-scale reverse osmosis plants, has gained recognition for deploying cost-effective solutions in regions facing acute water shortages. Doosan Heavy Industries continues to command attention in Asia and the Middle East through its expertise in thermal desalination technologies and turnkey project delivery. The competitive landscape is further shaped by Toray Industries, Aquatech, Acciona Agua, and Mitsubishi Heavy Industries, along with numerous regional firms grouped under the “others” segment. Toray Industries has positioned itself as a leader in membrane innovation, supplying critical components to desalination and purification systems globally. Aquatech’s strength lies in modular and decentralized treatment systems that appeal to industries seeking scalable water solutions. Acciona Agua, with its strong presence in Spain and Latin America, has gained contracts for large desalination plants that highlight its engineering expertise.

Mitsubishi Heavy Industries adds competitive depth with its focus on industrial-scale projects and advanced purification solutions. The market remains defined by high capital investment, government-backed projects, and ongoing innovation in energy-efficient technologies, making it a space where both global leaders and specialized regional companies play pivotal roles.

| Item | Value |

|---|---|

| Quantitative Units | USD 38.9 Billion |

| Mode of Operation | Automatic systems and Manual systems |

| System Scale | Large-scale systems, Small-scale system, and Medium-scale system |

| Application | Desalination, Water purification, Industrial water treatment, Household water treatment, Agricultural water treatment, Healthcare water treatment, and Others |

| End Use | Municipal, Industrial, Residential, Commercial, and Others (healthcare, agriculture) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Veolia (leading water solutions), SUEZ, IDE Technologies, Doosan Heavy Industries, Toray Industries, Aquatech, Acciona Agua, Mitsubishi Heavy Industries, and Others |

| Additional Attributes | Dollar sales by technology type (reverse osmosis, distillation, electrodialysis, UV filtration), Dollar sales by application (municipal, industrial, residential, agriculture), Trends in energy-efficient desalination solutions, Adoption of brine management and zero-liquid discharge systems, Growth in demand for portable desalination units, Regional patterns of desalination infrastructure development in water-scarce regions. |

The global water desalination and purification equipment market is estimated to be valued at USD 38.9 billion in 2025.

The market size for the water desalination and purification equipment market is projected to reach USD 86.3 billion by 2035.

The water desalination and purification equipment market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in water desalination and purification equipment market are automatic systems and manual systems.

In terms of system scale, large-scale systems segment to command 55.0% share in the water desalination and purification equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Water-based Inks Market Size and Share Forecast Outlook 2025 to 2035

Water Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA