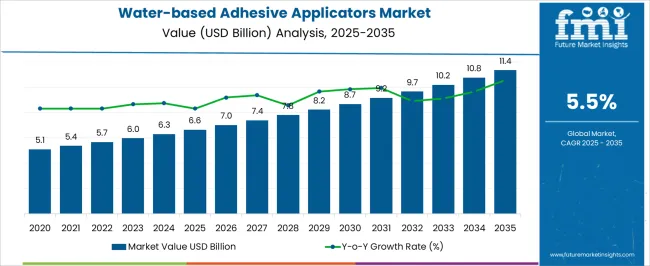

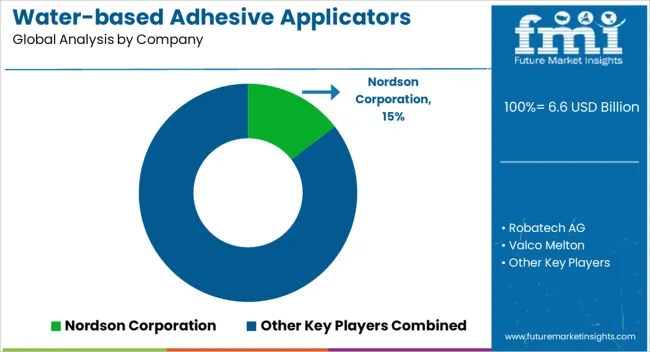

The Water-based Adhesive Applicators Market is estimated to be valued at USD 6.6 billion in 2025 and is projected to reach USD 11.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. Inflection point mapping highlights key transitions in the market's growth trajectory, showing a gradual acceleration followed by more stable growth as the market matures. Between 2025 and 2030, the market grows from USD 6.6 billion to USD 8.7 billion, contributing USD 2.1 billion in growth, with a CAGR of 6.0%. This early-phase growth is driven by increasing demand for eco-friendly adhesives in industries such as packaging, automotive, and construction, as well as growing regulations that push for less toxic, water-based alternatives.

The first inflection point occurs around 2030, when the market reaches USD 8.7 billion, signaling the transition to more moderate growth. From 2030 to 2035, the market expands from USD 8.7 billion to USD 11.4 billion, adding USD 2.7 billion in growth, with a slightly lower CAGR of 5.4%. This deceleration reflects the market’s maturity as more industries adopt water-based adhesives and the early adopters are already saturated. Despite this, demand remains robust, driven by continued technological advancements and the need for more sustainable and safer alternatives. The mapping highlights a strong initial acceleration, followed by steady, stable growth as the market matures.

| Metric | Value |

|---|---|

| Water-based Adhesive Applicators Market Estimated Value in (2025 E) | USD 6.6 billion |

| Water-based Adhesive Applicators Market Forecast Value in (2035 F) | USD 11.4 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The market is experiencing strong momentum due to the global shift toward environmentally friendly adhesive solutions and increasing demand across multiple manufacturing sectors. The current market environment is defined by heightened regulations on volatile organic compounds and growing preferences for non-toxic bonding agents, especially in industries focused on sustainability and compliance.

According to product press releases, investor updates, and industrial news, manufacturers are increasingly integrating intelligent applicator systems that offer precision, reduce waste, and ensure uniform coating. The market outlook remains optimistic, with further expansion expected through advancements in automated application technologies and rising investments in sustainable packaging and construction materials.

A growing emphasis on cost-efficiency, worker safety, and reduced environmental impact is also supporting the widespread adoption of water-based adhesive systems. These dynamics are positioning the market for consistent growth, supported by evolving regulatory standards and increasing reliance on smart, scalable adhesive application systems across industries.

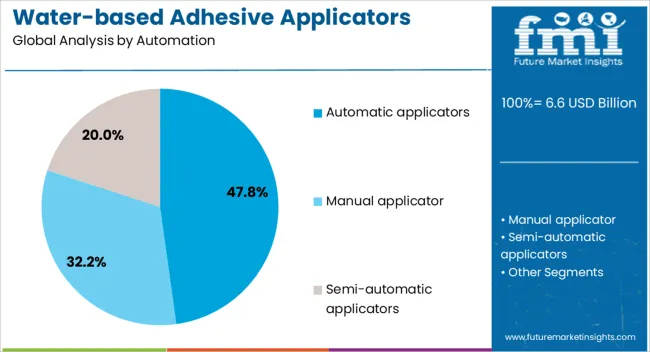

The water-based adhesive applicators market is segmented by automation, end-use industry, distribution channel, and geographic regions. The automation of the water-based adhesive applicators market is divided into Automatic applicators, Manual applicators, and Semi-automatic applicators.

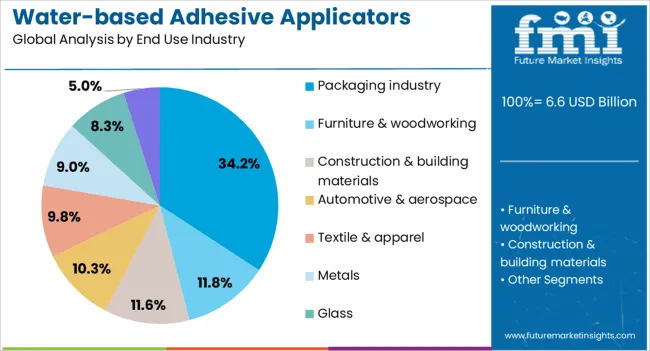

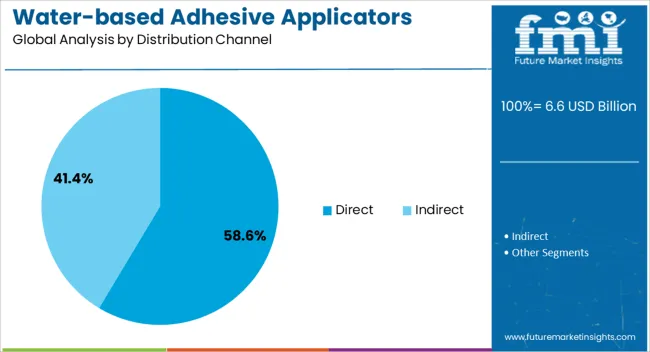

In terms of end-use industry, the water-based adhesive applicators market is classified into the Packaging industry, Furniture & woodworking, Construction & building materials, Automotive & aerospace, Textile & apparel, Metals, Glass, and Others (Foam, textiles/fabrics, leather). The distribution channel of the water-based adhesive applicators market is segmented into Direct and Indirect. Regionally, the water-based adhesive applicators industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automatic applicators segment is projected to account for 47.8% of the Water-based Adhesive Applicators market revenue share in 2025, making it the leading automation type. Rising industrial automation trends and the need for high-volume, consistent adhesive application in production environments are driving this dominance.

It has been noted in technology news sources and investor briefings that automatic systems are being adopted to improve process accuracy, minimize material waste, and reduce manual labor dependency. Businesses in packaging, automotive, and textiles are adopting these systems to maintain production efficiency while adhering to environmental compliance standards.

Additionally, the segment’s growth is supported by the integration of smart sensors and control systems, which enable real-time monitoring and adaptive performance adjustments The operational efficiency and long-term cost benefits associated with automatic applicators have positioned them as the preferred choice for large-scale adhesive applications, particularly in facilities prioritizing throughput, consistency, and quality control.

The packaging industry segment is expected to hold 34.2% of the Water-based Adhesive Applicators market revenue share in 2025, emerging as the dominant end use segment. This leadership is attributed to the surge in demand for eco-friendly, recyclable, and lightweight packaging materials across the food, beverage, and consumer goods industries. Press releases and corporate sustainability reports have highlighted that packaging companies are increasingly using water-based adhesives for carton sealing, labeling, and lamination due to their non-toxic nature and regulatory compliance.

The shift toward paper-based and biodegradable packaging formats has further accelerated the adoption of water-based adhesive technologies. Additionally, supply chain updates from packaging manufacturers indicate that these systems enable faster processing and improved bonding strength without compromising recyclability.

The segment’s growth is also reinforced by rising e-commerce activity, which demands high-performance packaging solutions that align with environmental standards. These factors have collectively supported the packaging industry’s leading position in the market.

The direct distribution channel segment is anticipated to account for 58.6% of the Water-based Adhesive Applicators market revenue share in 2025, establishing it as the largest distribution channel. This growth is being led by manufacturers’ strategic focus on building direct relationships with industrial clients to offer tailored solutions and comprehensive technical support.

Industry bulletins and press statements have indicated that direct sales allow for better product customization, faster service response, and greater control over delivery timelines. As businesses increasingly prioritize efficiency and reliability in sourcing critical production equipment, direct channels are being favored over third-party or indirect sales models.

Moreover, corporate procurement teams are seeking closer collaboration with adhesive system providers to optimize operational integration and performance monitoring. These factors are contributing to the steady rise of direct distribution as the preferred channel, particularly among large-scale users in the packaging, automotive, and construction sectors who demand consistent quality and after-sales support.

The water-based adhesive applicators market is expanding due to the increasing demand for safer and more efficient adhesive solutions across various industries. Water-based adhesives offer key advantages, such as lower levels of volatile organic compounds (VOCs), reduced environmental impact, and easier clean-up compared to solvent-based adhesives. This shift is primarily driven by regulatory pressures and consumer demand for non-toxic products. Industries like packaging, automotive, and construction are adopting these applicators as they align with growing health and safety concerns. As these solutions gain popularity, the market is expected to continue expanding.

The primary driver for the growth of the water-based adhesive applicators market is the rising preference for non-toxic and efficient adhesive solutions. Water-based adhesives offer safer alternatives to solvent-based adhesives, which contain higher levels of VOCs and other harmful chemicals. As governments around the world impose stricter regulations on the use of harmful substances in manufacturing, water-based solutions are becoming more attractive. These adhesives are ideal for a variety of applications, including packaging, automotive, and construction, where health and safety regulations are becoming more stringent. Their ability to offer effective bonding solutions with reduced environmental impact further boosts their adoption across multiple industries.

Despite their many benefits, water-based adhesive applicators face challenges that limit their adoption. One significant issue is the potential performance limitations of water-based adhesives compared to solvent-based options, particularly in certain high-stress applications. Water-based adhesives may not provide the same bonding strength or durability, which can restrict their use in industries requiring strong and long-lasting bonds, such as automotive or heavy-duty packaging. Additionally, the initial cost of water-based adhesive applicators and the specialized equipment required to apply these adhesives can be prohibitive, particularly for small to medium-sized enterprises. The longer drying times associated with water-based adhesives may also slow down production efficiency, making them less suitable for fast-paced manufacturing processes.

The water-based adhesive applicators market presents significant opportunities for growth, particularly in the packaging and automotive industries. The increasing demand for eco-friendly and safe packaging solutions is a key driver, as businesses look for alternatives to solvent-based adhesives for packaging materials like cartons, labels, and flexible packaging. In the automotive industry, water-based adhesives are being adopted for bonding interior components, trim, and other lightweight materials, especially as the push for safer and more health-conscious manufacturing processes increases. Innovations in water-based adhesives, such as improved bonding strength and faster drying times, offer new opportunities for application in a broader range of industries, expanding the market further.

The adoption of water-based adhesives in the packaging industry is a significant trend. As businesses seek to reduce their reliance on harmful substances and enhance product safety, water-based adhesives are gaining popularity in labeling, carton sealing, and other packaging applications. Advances in formulation technology are enhancing the effectiveness of water-based adhesives, making them suitable for a wider range of packaging materials, including paper, cardboard, and flexible plastics. Furthermore, the growing focus on health and safety standards in the food and beverage packaging sector is contributing to the rise in demand for these adhesives. As consumer preference shifts towards safer and cleaner products, the use of water-based adhesives in packaging will continue to grow, driving innovation in this market.

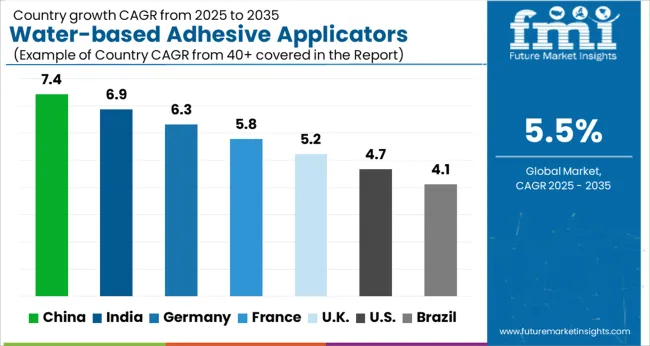

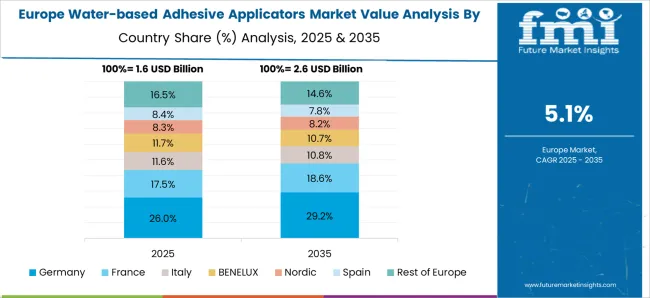

The global water-based adhesive applicators market is projected to grow at a CAGR of 5.5% from 2025 to 2035. China leads at 7.4%, followed by India at 6.9%, and France at 5.8%, while the United Kingdom records 5.2% and the United States posts 4.7%. These rates translate to a growth premium of +35% for China, +26% for India, and +5% for France versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: increasing adoption of water-based adhesives in industries like packaging, automotive, and construction in China and India, while more mature markets like the United States and the United Kingdom experience more moderate growth due to established infrastructure and environmental regulations. The analysis includes over 40+ countries, with the leading markets detailed below.

The water-based adhesive applicators market in China is growing at a CAGR of 7.4% through 2035. China’s booming manufacturing sector, particularly in packaging and automotive industries, is driving the demand for water-based adhesives. With increasing environmental regulations, there is a growing shift toward eco-friendly adhesives that offer better performance and reduced volatile organic compounds (VOCs). China’s government support for eco-friendly manufacturing practices and innovations in green technologies further accelerates the market growth. The country's focus on expanding its infrastructure and modernizing construction practices contributes to the rising adoption of water-based adhesive applicators.

Demand for water-based adhesive applicators in India is projected to grow at a 6.9% CAGR through 2035. The expanding packaging, automotive, and construction sectors in India are the key drivers of market growth. As India focuses on sustainable development and reducing VOC emissions, the adoption of water-based adhesive applicators is increasing. The growing construction industry, along with an increase in eco-conscious consumers, is contributing to the market’s expansion. India’s strong emphasis on improving industrial efficiency and adopting modern manufacturing practices is accelerating the demand for advanced adhesive solutions.

Sale of water-based adhesive applicators in France is growing at a 5.8% CAGR through 2035. France's commitment to reducing environmental impact and promoting green building solutions drives the demand for eco-friendly adhesive applicators. The demand in packaging and automotive sectors continues to rise, with manufacturers opting for water-based adhesives due to their low environmental footprint. The adoption of water-based adhesives in the construction industry, coupled with rising awareness of sustainable manufacturing practices, is contributing to the market growth. France's stringent regulatory standards also encourage the use of environmentally friendly adhesive products.

The UK water-based adhesive applicators market is expected to grow at a 5.2% CAGR through 2035. The growing demand for green, sustainable packaging and low-emission adhesives is driving the market for water-based adhesive applicators. With increasing regulations around sustainability and environmental impact, the UK is focusing on reducing the carbon footprint in its manufacturing processes. This shift is pushing more industries, particularly automotive, packaging, and construction, to adopt water-based adhesive solutions. Furthermore, the UK’s strong commitment to innovation in sustainable technologies further accelerates market growth.

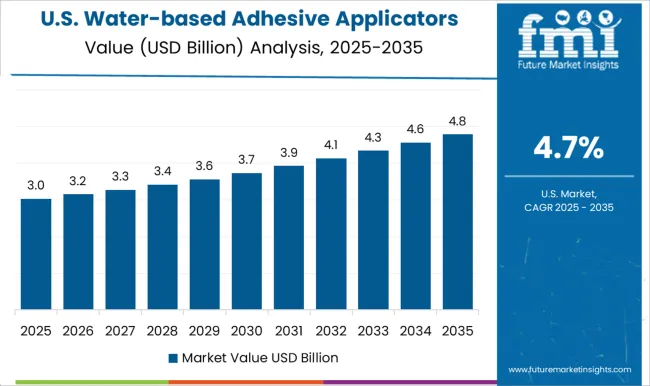

Demand for water-based adhesive applicators in the USA is projected to grow at a 4.7% CAGR through 2035. The USA market is driven by the increasing demand for eco-friendly packaging, automotive applications, and construction products. As regulations around VOCs and emissions tighten, manufacturers are opting for water-based adhesive solutions to meet compliance standards. The growing shift toward sustainable construction materials and packaging solutions, along with increased consumer preference for environmentally friendly products, is contributing to the market’s expansion. The USA is also seeing a rise in innovation and advancements in adhesive technologies that further drive market growth.

The water-based adhesive applicators market is highly competitive, with major players offering a wide range of advanced solutions designed to meet the growing demand for precise, environmentally friendly adhesive applications. Companies are focusing on enhancing their product offerings to improve efficiency, reduce environmental impact, and meet the specific needs of various industrial applications. Nordson Corporation is a key leader, offering innovative water-based adhesive applicator solutions designed for industries such as packaging, automotive, and electronics. Their products are known for providing precise control and high performance, optimizing the adhesive application process. Robatech AG specializes in the development of hot-melt and water-based adhesive applicators, with a strong focus on energy-efficient systems that contribute to reduced environmental impact and enhanced productivity in industrial operations. Valco Melton provides a broad range of adhesive applicator systems, including water-based solutions that focus on precision, reliability, and reduced waste. Their systems are widely used in the packaging and paper converting industries. ITW Dynatec is another key player, offering advanced water-based adhesive applicators that provide consistent and accurate application in industries such as packaging, automotive, and construction. Their systems are designed to ensure minimal adhesive waste and maximum efficiency. Graco Inc. is known for its wide range of fluid handling solutions, including water-based adhesive applicators. Their products are designed for diverse industrial applications, offering durability and precision.

Bühnen GmbH & Co. KG delivers high-quality adhesive application systems that focus on performance and cost-efficiency, catering to industries such as food packaging, automotive, and electronics. Glue Machinery Corporation provides water-based adhesive applicators that emphasize ease of use and customization, supporting a variety of applications in packaging and manufacturing. Henkel AG & Co. KGaA offers a variety of water-based adhesive solutions designed for precision and high-quality bonding in industries such as automotive, electronics, and construction. 3M Company delivers a wide range of adhesive applicators, including water-based systems that are known for their versatility and ability to handle various substrates. Sika AG focuses on water-based adhesive applicators that provide high-performance bonding solutions for construction, automotive, and packaging applications. Franklin International specializes in providing water-based adhesive applicator systems that meet the needs of the woodworking, packaging, and furniture industries. H.B. Fuller Company offers a wide range of adhesive products, including water-based applicators designed to provide consistent bonding and enhanced efficiency. Ad Tech (FPC Corporation) and Surebonder (FPC Corporation) provide reliable water-based adhesive applicator solutions designed for precise application in packaging, electronics, and automotive sectors. Dymax Corporation offers advanced water-based adhesive applicators that ensure fast curing times and high bonding strength in industries such as medical device manufacturing and electronics.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.6 Billion |

| Automation | Automatic applicators, Manual applicator, and Semi-automatic applicators |

| End Use Industry | Packaging industry, Furniture & woodworking, Construction & building materials, Automotive & aerospace, Textile & apparel, Metals, Glass, and Others (Foam, textiles/fabrics, leather) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nordson Corporation, Robatech AG, Valco Melton, ITW Dynatec, Graco Inc., Bühnen GmbH & Co. KG, Glue Machinery Corporation, Henkel AG & Co. KGaA, 3M Company, Sika AG, Franklin International, H.B. Fuller Company, Ad Tech (FPC Corporation), Surebonder (FPC Corporation), and Dymax Corporation |

| Additional Attributes | Dollar sales by product type (precision applicators, bulk applicators, automated systems) and end-use segments (packaging, automotive, electronics, construction, furniture). Demand dynamics are driven by the need for sustainable, efficient adhesive solutions and automation in industrial applications. Regional growth is strong in North America and Europe, while Asia-Pacific expands due to increased manufacturing and packaging demands. Innovation focuses on enhancing applicator precision, speed, and energy efficiency with smart applicators offering real-time control. |

The global water-based adhesive applicators market is estimated to be valued at USD 6.6 billion in 2025.

The market size for the water-based adhesive applicators market is projected to reach USD 11.4 billion by 2035.

The water-based adhesive applicators market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in water-based adhesive applicators market are automatic applicators, manual applicator and semi-automatic applicators.

In terms of end use industry, packaging industry segment to command 34.2% share in the water-based adhesive applicators market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.