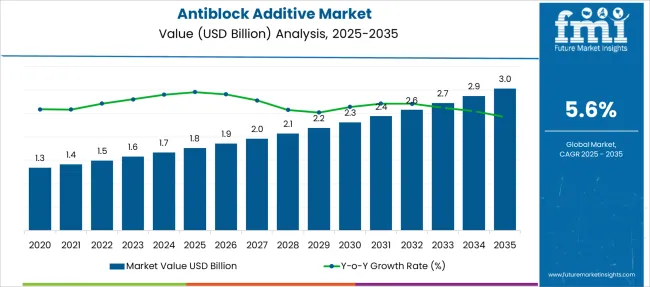

The Antiblock Additive Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Antiblock Additive Market Estimated Value in (2025 E) | USD 1.8 billion |

| Antiblock Additive Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The antiblock additive market is progressing steadily, propelled by growing demand for flexible packaging materials and improved film processing efficiency. Antiblock additives play a critical role in reducing film-to-film adhesion, thereby enhancing handling, converting, and stacking processes across various applications.

The market is witnessing increased consumption in food packaging, industrial films, and agricultural applications, where clarity, machinability, and product protection are paramount. Rising environmental concerns have also driven innovation in biodegradable and recyclable film solutions, where antiblock technologies continue to be vital.

Future growth is expected to be driven by the packaging industry, with strong contributions from emerging economies due to rising retail infrastructure and increasing use of plastic films. As regulations and consumer expectations tighten, market participants are focused on offering high-performance, non-migrating, and food-safe antiblock solutions to support long-term adoption.

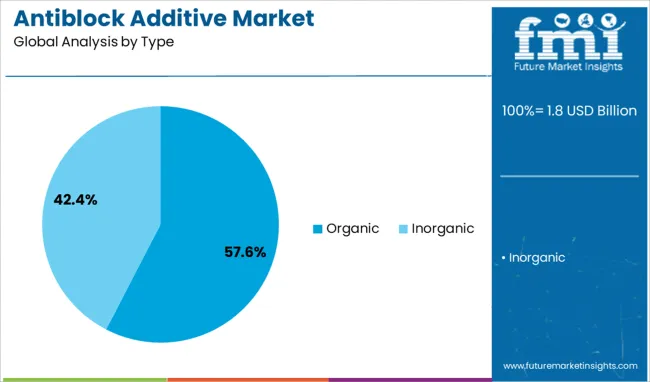

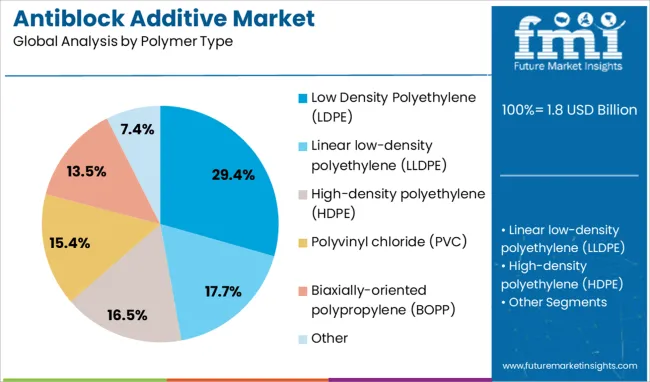

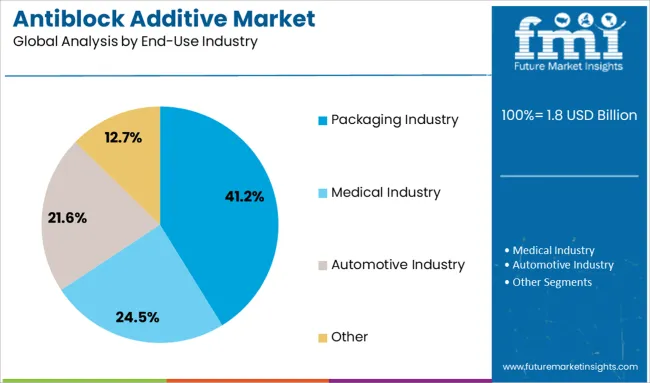

The antiblock additive market is segmented by type, polymer type, end-use industry, and geographic regions. The antiblock additive market is divided by type into Organic and Inorganic. The polymer type of the antiblock additive market is classified into Low-Density Polyethylene (LDPE), Linear Low-Density Polyethylene (LLDPE), High-Density Polyethylene (HDPE), Polyvinyl Chloride (PVC), Biaxially-Oriented Polypropylene (BOPP), and Other. The end-use industry of the antiblock additive market is segmented into the Packaging Industry, Medical Industry, Automotive Industry, and Other. Regionally, the antiblock additive sector is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The organic antiblock additive segment leads the market with a significant 57.6% share, largely attributed to its compatibility with a wide range of polymer films and its favorable performance-to-cost ratio. Organic additives, including amides and natural waxes, are increasingly preferred in food-grade and flexible packaging applications due to their non-toxic nature and regulatory compliance.

The segment benefits from its ability to maintain film clarity, processability, and surface characteristics, which are essential in high-volume packaging environments. Technological advancements aimed at improving dispersion and stability in polymer matrices are further boosting its appeal.

As manufacturers move toward sustainable and bio-based packaging, the use of organic antiblock solutions is expected to gain momentum, reinforcing their dominance across both industrial and consumer packaging lines.

Low density polyethylene (LDPE) accounts for 29.4% of the polymer type segment, showcasing its widespread adoption in flexible film applications that require transparency, softness, and durability. The compatibility of antiblock additives with LDPE films has made them essential in packaging formats such as bags, shrink wraps, and liners.

LDPE’s popularity stems from its mechanical flexibility and ease of processing, which are enhanced through the use of antiblock agents that prevent film sticking during extrusion and winding operations. As demand for lightweight and high-speed packaging solutions grows, the integration of antiblock additives within LDPE films becomes increasingly critical.

Continued focus on improving film quality and operational efficiency will ensure that LDPE remains a key application area within the antiblock additive landscape.

The packaging industry segment dominates the end-use category with a commanding 41.2% market share, driven by the rising need for high-performance, scalable, and recyclable plastic films across retail, food, pharmaceutical, and industrial sectors. Antiblock additives are integral to achieving operational efficiency and product protection during film production and conversion.

The segment's growth is supported by increasing demand for packaged goods, rising e-commerce penetration, and the continuous evolution of flexible packaging formats. Regulatory pressures to reduce plastic waste are also prompting the adoption of antiblock additives that perform well in thinner and recyclable films.

As the packaging sector continues to innovate with sustainable and smart packaging solutions, the reliance on advanced antiblock additives is expected to remain strong, ensuring optimal film performance and visual appeal.

The antiblock additive market is expanding as demand for high-quality polymer films in packaging, agriculture, electronics, and medical industries increases. These additives, typically inorganic agents like silica, talc, and silicates, prevent layers of polyethylene or polypropylene films from sticking together. They enhance film machinability, transparency, and handling. Increasing food packaging needs drive growth, agricultural film applications, and the rising usage of industrial films in emerging regions.

The antiblock additive market includes many suppliers offering similar inorganic and organic products. Without clear performance differentiation, most compete on price, service, and supply reliability. Global companies with broad product lines often dominate large contracts, while regional players focus on specific film grades or local needs. As most antiblock formulations are based on standard compounds like silica or talc, suppliers must find new ways to stand out. Offering customizable blends, better dispersion properties, or improved compatibility with specific polymers can provide a competitive edge. However, investing in such differentiation is costly and not always rewarded in price-sensitive applications. This makes it difficult for smaller or new entrants to grow beyond regional markets. To stay relevant, suppliers must either focus on close customer relationships, enter niche film segments, or invest in specialty formulations tailored to complex multilayer packaging applications.

The rising use of flexible packaging across food, personal care, and consumer goods presents significant growth potential for antiblock additive manufacturers. Films used in snack packaging, frozen foods, and resealable bags require reliable antiblocking to prevent surface adhesion during high-speed production. As food safety and product presentation become more important, manufacturers prefer films that remain easy to unwind, cut, and seal without defects. Agricultural films and industrial liners are also increasing in demand, especially in regions where protective films are used extensively. These applications require antiblock agents that work under varied environmental conditions while maintaining film strength and clarity. Manufacturers who can supply cost-effective additives compatible with polyethylene, BOPP, or multilayer films are well-positioned. Working closely with film extruders and converters allows additive suppliers to tailor products to specific film line conditions, giving them an edge in competitive procurement scenarios.

One clear trend in the market is the shift toward using blended antiblock systems that combine inorganic particles with organic surface modifiers. This approach offers better control over haze, clarity, and surface texture. High inorganic loading often reduces film transparency, which is undesirable in consumer packaging. By combining smaller amounts of mineral particles with organic slip agents, manufacturers achieve the right balance between processability and appearance. These hybrid systems are especially important for multilayer films where optical clarity and smooth surface finish are critical.

Additionally, some converters are moving toward ready-to-use masterbatches that contain antiblock, slip, and antistatic agents in a single package. This simplifies dosing, ensures better dispersion, and reduces processing variability. As more film producers look for integrated solutions, suppliers offering pre-formulated combinations with consistent performance will have a competitive advantage in high-output production settings.

Antiblock additives are primarily made from mineral-based materials like silica, talc, and natural clays, which are subject to fluctuations in availability and cost. These supply issues can stem from mining restrictions, transportation delays, or export controls in major producing regions. When raw material prices rise, additive manufacturers are forced to pass those costs to film producers, who may then reduce usage or switch to lower-cost alternatives. This creates uncertainty in demand forecasting and production planning. For applications that require strict film performance, such as medical packaging or food contact layers, substitution options are limited. Smaller manufacturers with less purchasing leverage often face higher volatility, making it harder to offer stable pricing to customers. Maintaining reliable supply chains and offering flexible formulation options can help offset this constraint, but raw material dependency remains a limiting factor for broader market expansion.

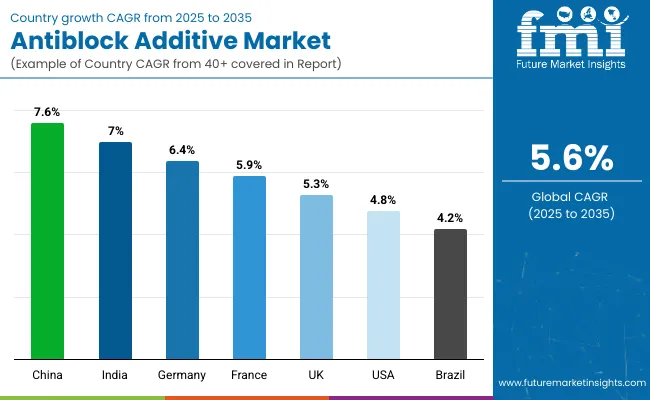

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The global antiblock additive market is projected to grow at a CAGR of 5.6% through 2035, supported by rising demand in plastic films, packaging, and industrial laminates. Among BRICS nations, China leads with 7.6% growth, driven by large-scale film production and expanded converter capacity. India follows at 7.0%, where application in flexible packaging and agricultural films has accelerated usage. In the OECD region, Germany reports 6.4% growth, supported by standardized formulation guidelines and usage in specialty packaging films. The United Kingdom, at 5.3%, has shown steady demand across food-grade plastics and household packaging. The United States, at 4.8%, reflects a mature market with regulated formulations for both commercial and consumer plastic goods. Market operations have been shaped by additive migration limits, compliance testing, and film performance classification. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Widespread use of polyethylene and polypropylene films in packaging and agriculture has contributed to a 7.6% CAGR in the antiblock additive market across China. High-volume extrusion lines have utilized inorganic antiblock agents like talc and silica to prevent film adhesion and blocking during roll processing. Local compounders have expanded supply of masterbatches with controlled particle dispersion to enhance clarity in thin films. High-growth applications such as greenhouse films, stretch wraps, and multilayer pouches have accelerated additive consumption. Demand has been sustained by high-speed film conversion units operating in coastal industrial hubs. Sheet and blown film manufacturers have optimized additive concentrations to balance haze control and coefficient of friction. Increased exports of flexible packaging have driven adoption of stable antiblock formulations across domestic and overseas supply chains.

The antiblock additive market in India is advancing at a CAGR of 7.0%, supported by growth in flexible food packaging and agricultural films. Local producers have incorporated synthetic silica and talc-based additives to reduce blocking in BOPP and LDPE films used in snack and frozen food packaging. Rural demand for mulch and tunnel films has further boosted usage in agricultural sectors. Film converters have relied on cost-effective masterbatches customized for localized processing speeds and gauge ranges. Demand has remained steady due to broader distribution of low-density film applications in semi-urban markets. Use of antiblock formulations has also been recorded in lamination-grade films used for sachets and small pouches. Product trials have focused on minimizing haze while maintaining slip performance during unwinding and sealing processes.

Germany has demonstrated a CAGR of 6.4% in the antiblock additive market, driven by a focus on high-performance films for industrial and consumer packaging. Precision film producers have selected synthetic antiblock agents to retain film transparency and mechanical integrity. Antiblock formulations have been optimized for co-extruded structures used in vacuum bags, stretch sleeves, and heat-shrink applications. Manufacturers have preferred high-purity silica and specialty blends that offer consistent film release during winding and slitting operations. Research institutions have evaluated dispersion behavior in advanced polymer matrices, influencing adoption of next-generation additives. Customized formulations have been deployed in films intended for high-speed automatic packaging lines. Adoption has been enhanced in sectors where interlayer adhesion must be minimized without compromising optics or barrier properties.

Increased focus on film recyclability and processing stability has enabled the antiblock additive market in the United Kingdom to expand at a 5.3% CAGR. Packaging converters have used mineral antiblock agents to improve film separation without disrupting downstream converting processes. Thin-gauge films used in bakery, dairy, and confectionery packaging have applied antiblock systems for improved roll handling and storage. Manufacturers have selected additive masterbatches with minimal haze contribution to meet brand requirements for product visibility. Tailored solutions have been introduced for mono-material and recyclable structures, especially in PE and PP formats. Importers and distributors have partnered with regional processors to deliver grade-specific antiblock variants suitable for thermoforming and sealing applications. Performance metrics have emphasized long-term storage behavior and compatibility with food contact norms.

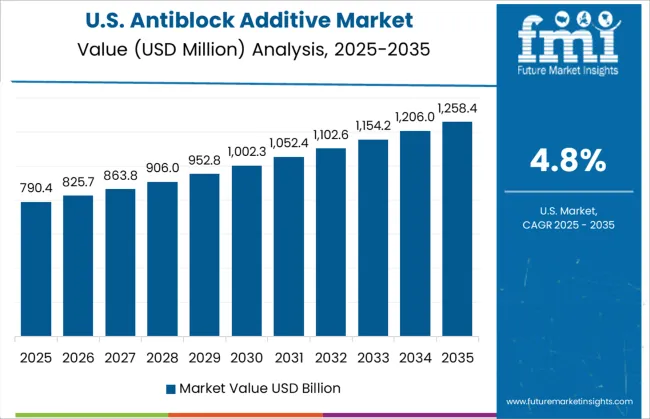

The antiblock additive market in the United States has grown at a 4.8% CAGR, driven by industrial packaging films, labels, and wrap applications. Film manufacturers have implemented antiblock agents to manage adhesion during film winding and stacking processes in multilayer formats. Additives based on diatomaceous earth, silica, and crosslinked polymers have been selected to maintain gloss and optical clarity. Applications in frozen food films, tamper-evident seals, and mailer bags have adopted consistent antiblocking strategies. Roll stock converters have introduced flexible additive packages tailored for specific gauge tolerances. Compatibility with slip agents has been prioritized to maintain consistent surface finish during lamination. Multi-site manufacturing networks have utilized centralized additive sourcing strategies to streamline logistics and ensure batch-to-batch uniformity.

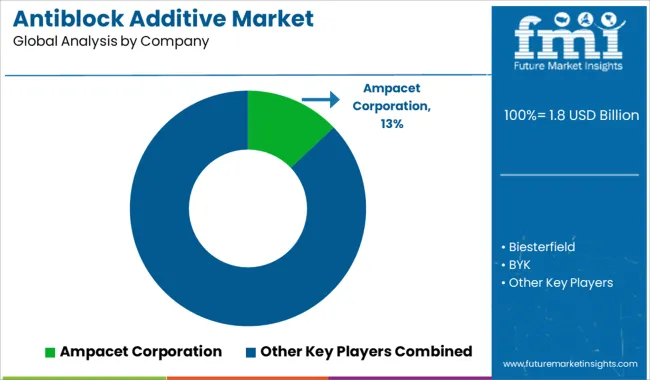

The antiblock additive market features a strong lineup of global chemical and material science companies offering solutions that reduce adhesion between polymer film layers, improving processing efficiency and end-product usability. Ampacet Corporation is among the leading suppliers, known for its advanced antiblock masterbatches tailored for flexible packaging and multilayer film applications.

Evonik Industries AG and BYK provide high-performance additives that enhance surface properties and optical clarity, particularly in polyethylene and polypropylene films. Honeywell International Inc. and Croda International PLC offer synthetic and organic antiblocking agents designed for specialty films in food packaging, medical devices, and industrial liners. LyondellBasell supplies polymer resins with integrated antiblock functionalities, supporting high-throughput film production for both mono- and co-extruded structures. Imerys Performance Additives stands out for its mineral-based solutions, especially diatomaceous earth and talc-based antiblocking additives that ensure thermal stability and consistent dispersion. Momentive and W.R. Grace & Co. contribute specialty siloxane and silica-based additives that provide long-term antiblocking performance without compromising film transparency or sealing properties. Biesterfield and Plastics Color Corporation serve as regional compounders and distributors, offering customized additive packages based on client-specific processing needs. Cargill, while more known for its bio-based innovations, contributes organically derived antiblocking solutions targeting biodegradable and compostable film markets. PolyOne (now Avient Corporation) supports film processors with formulation expertise across various resins, enhancing product consistency and process control in high-speed extrusion environments.

Evonik launched Spherilex 60 AB and Spherilex 30 AB silica grades in early 2025, specifically designed as anti‑block additives for film applications. These grades offer improved slip, reduced blocking, and high clarity, marking a strategic advance in packaging film performance technology.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Type | Organic and Inorganic |

| Polymer Type | Low Density Polyethylene (LDPE), Linear low-density polyethylene (LLDPE), High-density polyethylene (HDPE), Polyvinyl chloride (PVC), Biaxially-oriented polypropylene (BOPP), and Other |

| End-Use Industry | Packaging Industry, Medical Industry, Automotive Industry, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ampacet Corporation, Biesterfield, BYK, Cargill, Croda International PLC, Evonik Industries AG, Honeywell International Inc., Imerys Performance Additives, LyondellBasell, Momentive, Plastics Color Corporation, PolyOne, and W.R. Grace & Co. |

| Additional Attributes | Dollar sales by antiblock additive type including inorganic and organic variants, by polymer type such as LDPE, BOPP, and HDPE, and by application in packaging and agricultural films across North America, Europe, and Asia-Pacific; demand driven by sustainable packaging and film clarity; innovation in biodegradable blends; costs influenced by raw material prices. |

The global antiblock additive market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the antiblock additive market is projected to reach USD 3.0 billion by 2035.

The antiblock additive market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in antiblock additive market are organic and inorganic.

In terms of polymer type, low density polyethylene (ldpe) segment to command 29.4% share in the antiblock additive market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Additives for Metalworking Fluids Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing With Metal Powders Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing and Material Market Trends - Growth & Forecast 2025 to 2035

Additives for Floor Coatings Market

Ink Additives Market Growth – Trends & Forecast 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Global Food Additive Market Size, Growth, and Forecast for 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Paint Additives Market Growth 2024-2034

Amine Additives in Paints and Coatings Market

Silage Additive Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Additive Manufacturing Machines Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Coating Additives Market Growth – Trends & Forecast 2025 to 2035

Understanding Market Share Trends in Brewing Additives

Ceramic Additives Market

Foundry Additives Market

Refining Additives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA