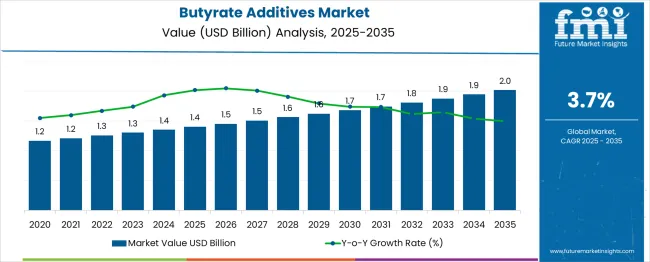

The butyrate additives market shows a stable upward trajectory, expanding from USD 1.4 billion in 2025 to USD 1.9 billion by 2035. Year-on-year increases are modest but consistent, beginning with USD 0.05 billion in 2026 and gradually reaching about USD 0.06-0.07 billion by the early 2030s.

This steady pattern reflects compound-driven gains rather than sharp jumps, indicating market maturity and dependence on incremental demand. Growth is expected from feed manufacturers optimizing animal gut health, especially in poultry and swine applications. Regional traction in Asia and Latin America will support broader expansion, while Europe may drive value via specialized blends. The forecasted pace signals constant investment interest from feed additive suppliers in precision nutrition segments.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.4 billion |

| Industry Value (2035F) | USD 1.9 billion |

| CAGR (2025 to 2035) | 3.7% |

On January 13, 2025, Perstorp Group, a wholly-owned subsidiary of PETRONAS Chemicals Group Berhad (PCG), announced the appointment of Ian Atterbury as Senior Vice President of its Animal Nutrition business. With over 30 years of global experience in the animal nutrition industry, Atterbury brings a wealth of leadership expertise.

Perstorp CEO Ib Jensen highlighted the company’s ambitious growth strategy, emphasizing the importance of Animal Nutrition in Perstorp's future and the opportunity to expand the business through a differentiated product pipeline. Atterbury expressed excitement about joining Perstorp’s innovative team.

The butyrate additives market holds an estimated 2-4% share of the global feed additives market, which is valued at above USD 45 billion. Within the broader animal nutrition market, its share narrows to around 1-2%, as it competes with amino acids, enzymes, and vitamins. In the livestock and poultry feed segment, particularly poultry, butyrates represent a more prominent niche, accounting for nearly 5-6% due to their role in gut health and pathogen control.

Among functional feed ingredients, which include organic acids and prebiotics, butyrates form approximately 6-8% of the value. Within gut health solutions, they are a major contributor, comprising about 10-12% of the segment. Their strategic relevance exceeds their size, as they directly influence productivity and antibiotic-free livestock initiatives.

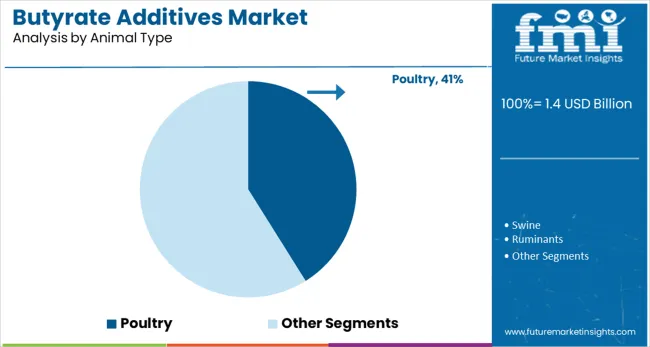

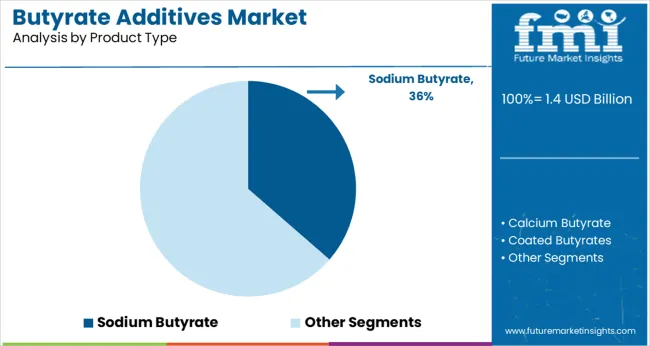

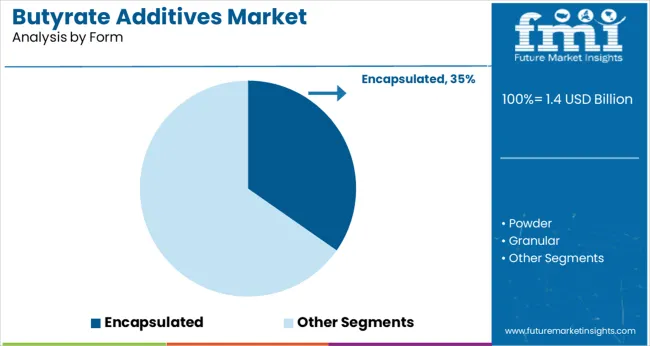

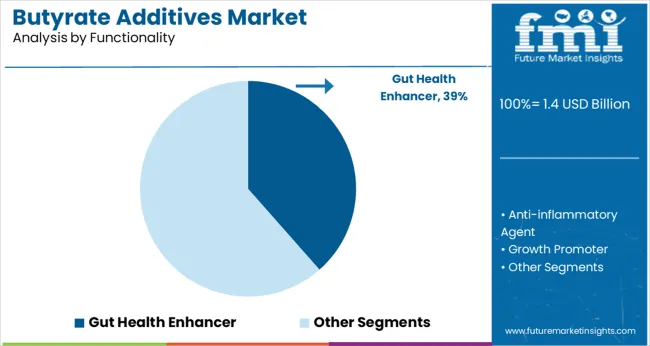

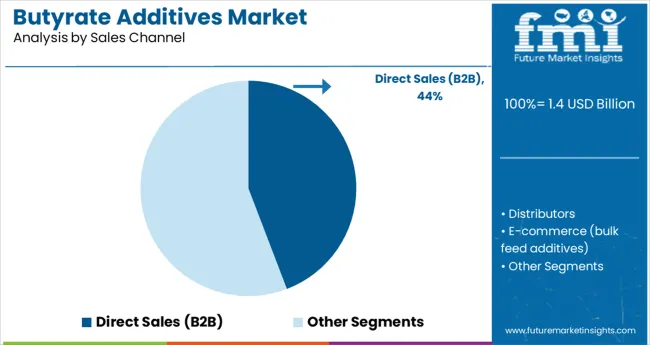

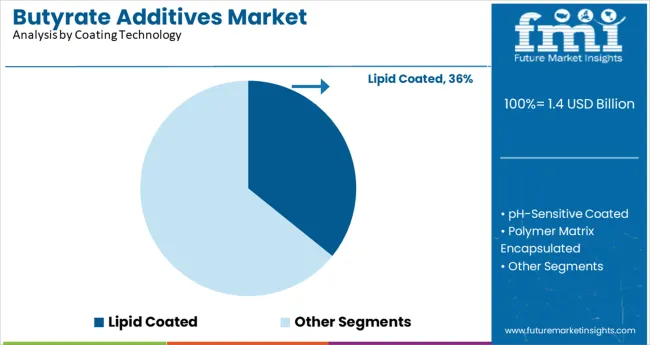

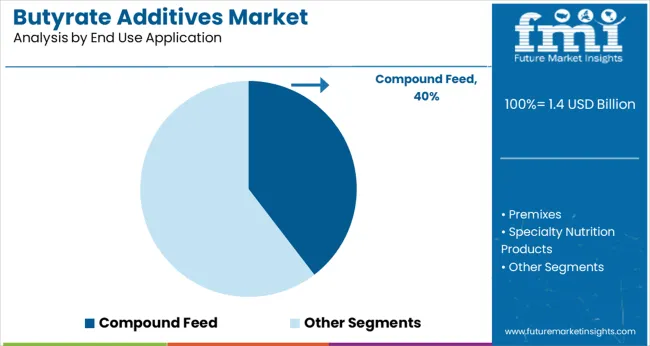

The industry is led by poultry with a 41.1% share, driven by its significant role in improving gut health and feed efficiency. Sodium butyrate is the dominant product type at 36.40%, while encapsulated forms account for 34.70% due to their controlled release benefits. Direct B2B sales dominate the sales channel with a 44.20% share, while compound feed leads in end-use applications at 39.60%. Lipid-coated additives hold a 35.80% share in coating technology.

The poultry segment is the largest in the industry, capturing 41.1% of the industry share. Poultry farming heavily relies on these additives to improve gut health, enhance digestion, and boost overall productivity. By promoting a balanced microbiome and strengthening immune functions, these additives reduce disease risks and foster optimal growth. Their role in enhancing feed efficiency has made them essential in the poultry industry, especially for improving feed conversion rates and overall performance.

Sodium butyrate is the most popular product type in the industry, accounting for 36.40% of the industry share. It is valued for its ability to support gut health and improve feed efficiency in livestock, particularly in poultry. Sodium butyrate helps reduce gut inflammation and enhances the immune system. This product type is widely used because of its superior digestibility, which promotes growth and feed conversion in animals. Its widespread application across farms solidifies its dominance in the industry.

Encapsulated form, accounting for 34.70% of the industry share, is gaining traction due to its controlled-release capabilities. Encapsulation ensures that the active ingredient is protected from degradation, ensuring it reaches the gut effectively for maximum benefit. This technology extends the product’s stability and bioavailability, providing steady effects. Encapsulated butyrate is preferred in livestock feeds where targeted release and gradual absorption are critical to achieving optimal results.

The gut health enhancer functionality leads the industry with a 38.5% share. Butyrate supplements are known for improving gut health by promoting a balanced microbiome and boosting nutrient absorption. These benefits result in better growth rates and enhanced animal productivity. Gut health is critical for livestock, as it directly influences feed efficiency, immunity, and overall animal performance. The increasing focus on gut health in livestock farming has significantly driven the demand for these additives with gut health-enhancing properties.

>

>

Direct sales (B2B) dominate the sales channel segment, capturing 44.20% of the industry share. This sales model is preferred by large-scale feed manufacturers and integrators due to the benefits of bulk purchasing and cost-effective pricing. B2B sales allow for tailored solutions to meet specific customer needs, ensuring that the additives are suitable for particular farming requirements. The direct model also strengthens long-term relationships between producers and end-users, ensuring a consistent supply of butyrate supplements.

Lipid-coated additives hold a 35.80% share in the coating technology segment. This coating protects butyrate from degradation, ensuring it is released effectively within the gut. Lipid-coated technology enhances the stability and bioavailability of the active ingredient, making it more effective in livestock feed. The controlled release of butyrate through lipid coatings ensures that it provides benefits to animals, improving their overall health and feed efficiency.

Compound feed is the largest application segment with a 39.60% share. Butyrate supplements are widely incorporated into compound feeds to enhance digestion and optimize nutrient absorption. This application contributes to better feed efficiency, growth, and overall performance in livestock. The demand for compound feed continues to rise as farmers increasingly recognize the value of these additives in improving feed quality. Butyrate’s role in maintaining gut health is essential for producing high-quality livestock and improving farm productivity.

The global market is expanding due to rising demand for animal protein, a shift towards eco-friendly feed solutions, and increasing emphasis on gut health. Butyrate supplements support livestock productivity by improving feed efficiency and promoting gut health. However, challenges such as high production costs and regulatory barriers may impact industry growth.

Rising Demand for Gut Health and Antibiotic Alternatives

The market is driven by the need for healthier livestock and alternatives to antibiotics. Butyrate has demonstrated significant benefits in improving gut health, boosting feed efficiency, and promoting immune function in animals. As of 2025, these additives are responsible for a 36.4% share of the global feed additives industry. With rising consumer demand for antibiotic-free meat, the adoption of butyrate supplements is increasing across the animal feed industry.

Cost Pressures and Regulatory Challenges

The high production costs associated with butyrate additives, especially sodium butyrate, pose a challenge to the market. Raw material costs have increased by 13% since 2022, and the complex regulatory environment for feed additives further hampers growth. Despite these challenges, regulatory changes favoring natural and eco-friedndly additives are expected to support industry expansion.

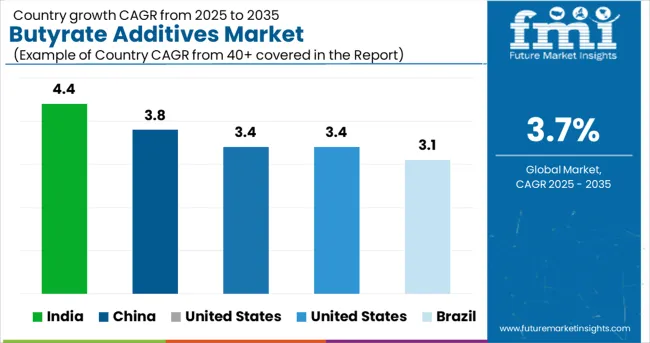

The report includes analysis of over 40 countries, with five profiled below for reference.

| Countries | CAGR (2025-2035) |

|---|---|

| India | 4.4% |

| China | 3.8% |

| United States | 3.4% |

| Australia | 3.4% |

| Brazil | 3.1% |

The global butyrate additives market is projected to grow at 3.7% CAGR from 2025 to 2035. India leads with 4.4%, outperforming the global average by 0.7 percentage points, driven by expanding poultry integration and high uptake in aquaculture feed. China follows at 3.8%, with rising adoption in swine diets and a shift toward encapsulated delivery formats. The United States and Australia, both at 3.4%, remain slightly below the global trend due to limited penetration in cost-sensitive formulations. Brazil lags at 3.1%, impacted by slow regulatory transitions and reliance on traditional acidifiers. BRICS economies are driving growth through intensive livestock systems and functional nutrition mandates, while OECD industries exhibit plateauing demand linked to mature feed manufacturing practices and cost-performance constraints.

The butyrate additives market in India is forecasted to rise at a CAGR of 4.4% between 2025 and 2035. This growth is fueled by an expanding livestock industry, particularly in poultry and swine farming. With rising health awareness, the demand for functional feed additives that enhance gut health is increasing. The regulatory environment is becoming more conducive to the adoption of bio-based additives, encouraging green practices in animal husbandry. Local players are focusing on cost-effective, tailored solutions to meet the needs of small and medium-sized poultry farms.

Demand for butyrate additives in China is expected to expand at a CAGR of 3.8% from 2025 to 2035. The market is driven by the country’s extensive livestock sector and a heightened focus on animal health. The demand for these additives in China is particularly strong within the poultry and swine segments, which are seeking solutions to enhance productivity and health. Domestic manufacturers are increasingly formulating products to meet the needs of the growing number of bio-secure farms, while international suppliers dominate the e-commerce channel.

The U.S. butyrate additives market is projected to grow at a CAGR of 3.4% from 2025 to 2035. The demand is primarily driven by innovations in animal feed, with a focus on optimizing gut health and improving feed efficiency. U.S. poultry and cattle farms are the primary consumers of butyrate supplements, as they seek eco-friednly and cost-effective solutions for high productivity. The trend toward natural and organic feed additives is also gaining traction among consumers, especially in the premium sector.

Demand for butyrate additives in Australia is growing at a CAGR of 3.4% through 2035. The Australian agricultural sector places a strong emphasis on environmental responsibility, driving the demand for natural feed additives like butyrate. With the country’s focus on export-quality meat and dairy products, there is increasing use of butyrate supplements to improve animal health and productivity. The growing trend of urbanization and increased animal product consumption is fostering a higher demand for functional feed solutions in both poultry and livestock farming.

Sales of butyrate additives in Brazilare expanding at a CAGR of 3.1% through 2035. The prominence in poultry and beef production is a significant driver of demand for butyrate supplements, which enhance gut health and feed efficiency. The country’s focus on increasing meat exports to international markets is leading to greater adoption of additives that improve overall livestock performance. Local manufacturers are focusing on providing affordable, effective additives suited to Brazil’s diverse farming environment, especially in secondary cities.

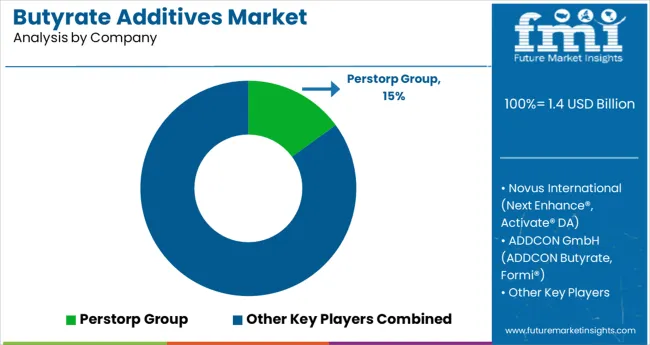

The butyrate additives industry is dominated by key players with strong portfolios and innovation. Perstorp Group is a leader with its Glycare® and ProPhorce™ SR, which focus on gut health and feed efficiency. Novus International follows closely with products like Next Enhance® and Activate® DA, targeting improved animal performance.

ADDCON GmbH is strengthening its market presence with ADDCON Butyrate and Formi®, offering solutions to enhance livestock productivity. Kemin Industries leads in the formulation of ButiPearl™ and EnteroPearl™, emphasizing targeted release for improved gut health. Impextraco remains competitive with XARACOL® and its proprietary butyrate additives, focusing on improving feed conversion and animal growth.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.4 billion |

| Projected Market Size (2035) | USD 1.9 billion |

| CAGR (2025 to 2035) | 3.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand metric tons for volume |

| Product Types Analyzed (Segment 1) | Sodium Butyrate, Calcium Butyrate, Coated Butyrates, Tributyrin, Butyric Acid Blends |

| Form Types Analyzed (Segment 2) | Powder, Granular, Liquid, Encapsulated |

| Animal Types Analyzed (Segment 3) | Poultry, Swine, Ruminants, Aquaculture, Pets |

| Functionalities Analyzed (Segment 4) | Gut Health Enhancer, Anti-inflammatory Agent, Growth Promoter, Feed Efficiency Booster, Pathogen Inhibitor |

| Sales Channels Analyzed (Segment 5) | Direct Sales (B2B), Distributors, E-commerce (bulk feed additives) |

| Coating Technologies Analyzed (Segment 6) | Lipid Coated, pH-Sensitive Coated, Polymer Matrix Encapsulated, Slow-Release Microencapsulation |

| End Use Applications Analyzed (Segment 7) | Compound Feed, Premixes, Specialty Nutrition Products, Veterinary Supplements |

| Regions Covered | North America, Europe, Latin America, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Perstorp Group (Glycare®, ProPhorce™ SR), Novus International (Next Enhance®, Activate® DA), ADDCON GmbH (ADDCON Butyrate, Formi®), Kemin Industries (ButiPearl™, EnteroPearl™), Impextraco (XARACOL®, Impextraco Butyrates) |

| Additional Attributes | Dollar sales, share by coating and product type, growing demand in poultry and swine nutrition, rise in encapsulated feed solutions, expanding role of butyrates in pathogen control across feed channels |

The segment is categorized into Sodium Butyrate, Calcium Butyrate, Coated Butyrates, Tributyrin, and Butyric Acid Blends.

This includes Powder, Granular, Liquid, and Encapsulated forms.

The segment covers Poultry, Swine, Ruminants, Aquaculture, and Pets.

This segment is categorized into Gut Health Enhancer, Anti-inflammatory Agent, Growth Promoter, Feed Efficiency Booster, and Pathogen Inhibitor.

The industry is segmented into Direct Sales (B2B), Distributors, and E-commerce (bulk feed additives).

The segment covers Lipid Coated, pH-Sensitive Coated, Polymer Matrix Encapsulated, and Slow-Release Microencapsulation.

This includes Compound Feed, Premixes, Specialty Nutrition Products, and Veterinary Supplements.

Regional analysis includes North America, Europe, Latin America, East Asia, South Asia & Pacific, and Middle East & Africa.

The industry is projected to reach USD 1.4 billion in 2025.

The industry is expected to grow at a CAGR of 3.7% from 2025 to 2035.

The poultry segment is expected to capture 41.1% share in 2025.

The Asia-Pacific region, particularly India, is projected to register a CAGR of 4.4% from 2025 to 2035.

The industry is projected to reach USD 1.9 billion by 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyhydroxybutyrate Market Size and Share Forecast Outlook 2025 to 2035

DL-3-Hydroxybutyrate Calcium Market Size and Share Forecast Outlook 2025 to 2035

Beta-Hydroxybutyrate Testing Market

Ethyl 3-Hydroxybutyrate Market Size and Share Forecast Outlook 2025 to 2035

Sucrose Acetate Isobutyrate Market

Additives for Metalworking Fluids Market Size and Share Forecast Outlook 2025 to 2035

Additives for Floor Coatings Market

Ink Additives Market Growth – Trends & Forecast 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Amine Additives in Paints and Coatings Market

Coating Additives Market Growth – Trends & Forecast 2025 to 2035

Understanding Market Share Trends in Brewing Additives

Ceramic Additives Market

Foundry Additives Market

Refining Additives Market Size and Share Forecast Outlook 2025 to 2035

Silicone Additives Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Additives Market - Size, Share, and Forecast Outlook 2025 to 2035

Aqua Feed Additives Market Analysis by Species Type, Ingredient and Other Additives Types Through 2035

Lubricant Additives Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA