The dermal fillers market is estimated to be valued at USD 6.6 billion in 2025. It is projected to reach USD 9.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 2.5 billion over the forecast period.

This reflects a 1.4 times growth at a compound annual growth rate of 3.2%. The market's evolution is expected to be shaped by the rising demand for minimally invasive aesthetic procedures, advanced hyaluronic acid formulations, innovative injection techniques, and growing consumer preference for non-surgical cosmetic enhancements, particularly where natural-looking results and safety are prioritized.

By 2030, the market is likely to reach USD 7.7 billion, adding USD 1.1 billion over the first half of the decade. The remaining USD 1.3 billion is expected during the second half, reflecting a steady growth pattern. Product innovation in cross-linking technology, longer-lasting formulations, and specialized applications is gaining traction.

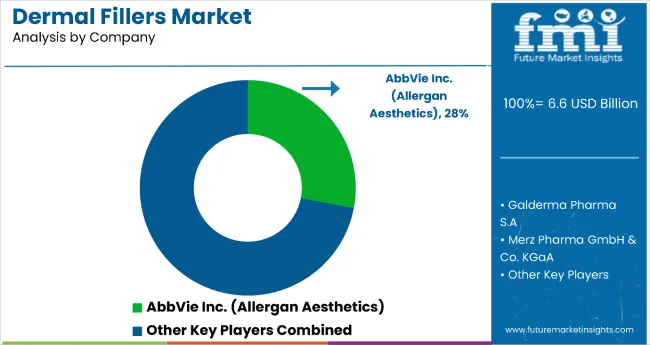

Companies such as AbbVie Inc. (Allergan Aesthetics), Galderma Pharma S.A., and Merz Pharma GmbH & Co. KGaA are advancing their competitive positions through investment in advanced formulation development, clinical research programs, and aesthetic clinic partnerships. Rising aesthetic consciousness, expanding access to trained practitioners, and improved product safety profiles are supporting expansion into cosmetic clinics, medical spas, and plastic surgery applications. Market performance will remain anchored in safety standards, natural-looking outcomes, and patient satisfaction benchmarks.

The market holds a significant and steadily growing share across its parent markets. Within the global aesthetic medicine market, it accounts for 35-40%, due to its widespread application in facial rejuvenation procedures. In the minimally invasive cosmetics segment, it commands a 45-50% share, supported by consumer preference for non-surgical solutions.

It contributes nearly 25-30% to the injectable aesthetics market and 20-25% to the medical spa services segment. In anti-aging treatments, dermal fillers hold around 30-35% share, driven by their effectiveness in volume restoration and wrinkle reduction. Across the cosmetic dermatology market, its share is close to 25-30%, owing to its position as a leading non-surgical aesthetic treatment.

The market is undergoing a strategic transformation driven by rising demand for natural-looking results, advanced hyaluronic acid formulations, and comprehensive aesthetic treatment solutions. Advanced therapeutic technologies using improved cross-linking techniques, longer-lasting formulations, and specialized application methods have enhanced treatment outcomes, safety profiles, and patient satisfaction, making dermal fillers viable alternatives to surgical cosmetic procedures.

Manufacturers are introducing specialized formulations for different facial areas with varying longevity, expanding beyond basic wrinkle treatment to comprehensive facial contouring and volume restoration. Strategic collaborations between manufacturers and aesthetic practitioners have accelerated innovation in product development and market penetration.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 6.6 billion |

| Projected Value (2035F) | USD 9.0 billion |

| CAGR (2025 to 2035) | 3.2% |

The dermal fillers market's steady growth is driven by increasing consumer acceptance of minimally invasive procedures, technological advances in product formulations, and the expansion of aesthetic clinic networks, making it an attractive sector for manufacturers and practitioners seeking innovative cosmetic solutions. The rising preference for non-surgical aesthetic treatments, improved product safety profiles, and growing awareness of available options appeal to consumers and healthcare providers prioritizing natural-looking results and minimal downtime.

A growing understanding of facial anatomy, personalized treatment approaches, and combination therapy protocols is further propelling adoption, particularly in aesthetic clinics, medical spas, and integrated cosmetic practices. Rising disposable income, expanding treatment accessibility, and regulatory approvals for advanced formulations are also enhancing market penetration and consumer confidence.

As minimally invasive aesthetics continue to gain mainstream acceptance and consumer preferences shift toward natural-looking enhancements, the market outlook remains favorable. With patients and practitioners prioritizing safety, efficacy, and natural results, dermal fillers are well-positioned to expand across various aesthetic, medical spa, and cosmetic surgery applications.

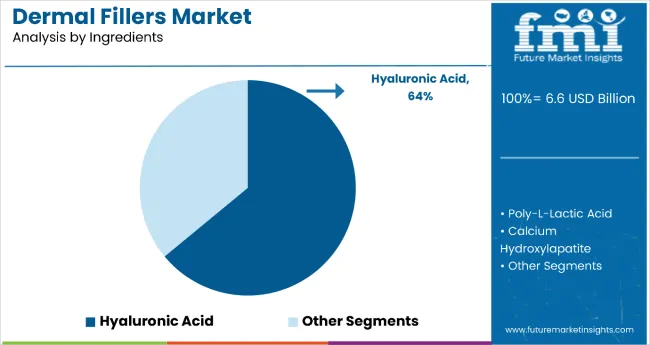

The market is segmented by ingredients, gender, application, distribution channel, and region. By ingredients, the market is divided into hyaluronic acid, poly-L-lactic acid, calcium hydroxylapatite, polymethyl methacrylate, collagen, and polynucleotide (PN). Based on gender, the market is categorized into male, female, and transgender.

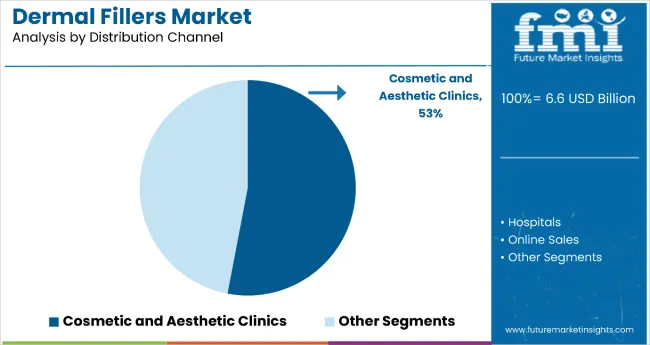

By application, the market is segmented into wrinkle reduction, skin folds/nasolabial folds, augmentation of lips/cheek & chin, scar treatment, hand rejuvenation, jawline and chin lines countering, eyebrows treatment, hollowness under eyes, nose jobs, volume restoration, restoring damaged tissues, restoration of facial fat loss, and dentistry. Based on distribution channel, the market is divided into cosmetic and aesthetic clinics, hospitals, online sales, plastic surgery centers, and medical spas. Regionally, the market is classified into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The hyaluronic acid segment holds a dominant position with 64% of the market share in the ingredients category, owing to its superior biocompatibility, natural occurrence in human skin, and ability to provide natural-looking results with excellent safety profiles. Hyaluronic acid fillers are widely used across aesthetic and medical settings due to their reversibility with hyaluronidase, moisture-retention properties, and versatility in treating various facial areas from fine lines to deep volume loss.

It enables practitioners and patients to achieve optimal aesthetic outcomes while maintaining excellent safety standards and treatment predictability in diverse cosmetic applications. As demand for natural-looking results, biocompatible materials, and reversible treatments grows, the hyaluronic acid segment continues to gain preference in both facial rejuvenation and specialized aesthetic procedures.

Manufacturers are investing in advanced cross-linking technologies, specialized formulation development, and expanded application studies to enhance longevity, improve injection characteristics, and broaden treatment possibilities. The segment is poised to grow further as global aesthetic standards favor biocompatible solutions and safety requirements become increasingly stringent.

Cosmetic & aesthetic clinics remain the core distribution segment with 53% of the market share in 2025, as they provide specialized expertise, personalized treatment planning, and comprehensive aesthetic care for dermal filler procedures. Their functional expertise supports proper product selection, injection technique optimization, and patient outcome management in consumers seeking professional cosmetic enhancement and personalized treatment approaches.

Cosmetic & aesthetic clinics also ensure proper training, safety protocols, and optimization of aesthetic outcomes for filler treatments, while offering integrated care coordination with other aesthetic procedures. This makes them indispensable in modern aesthetic medicine and specialized cosmetic treatment environments.

Ongoing demand for professional aesthetic services and the specialization required for optimal dermal filler outcomes are key trends driving the sustained relevance of cosmetic & aesthetic clinics in this therapeutic area.

In 2024, global dermal fillers adoption grew by 8-10% year-on-year, with North America and Europe taking significant market shares. Applications include facial volume restoration, wrinkle reduction, and comprehensive aesthetic enhancement. Manufacturers are introducing advanced formulations and specialized treatment protocols that deliver superior longevity and natural-looking outcomes.

Hyaluronic acid formulations now support personalized aesthetic positioning. Evidence-based treatment protocols and practitioner training initiatives support healthcare provider confidence. Technology providers increasingly supply pre-filled syringes with integrated safety features to reduce treatment complexity and improve outcomes.

Advanced Formulation Technology Accelerates Dermal Fillers Demand

Manufacturers and aesthetic practitioners adopt advanced hyaluronic acid formulations to achieve superior treatment outcomes, enhance patient satisfaction, and meet rising demand for natural-looking, long-lasting solutions. In clinical studies, advanced cross-linked formulations deliver up to 12-18 months of sustained results compared to 6-9 months for traditional formulations.

Treatments with improved cross-linking technology maintain aesthetic outcomes throughout extended cycles, enhancing patient satisfaction. In aesthetic clinic settings, advanced formulation programs help reduce treatment frequency while maintaining natural appearance by up to 40-50%. Advanced applications are deployed in specialized areas like tear troughs and jawline contouring, increasing adoption in sectors that demand precise aesthetic results. These advantages help explain why advanced formulation adoption rates in aesthetic medicine rose significantly across developed markets.

Cost Considerations and Treatment Maintenance Limit Growth

Market expansion is constrained by treatment costs, maintenance requirements, and the need for repeat procedures. Individual dermal filler treatments can range from USD 500 to USD 2,000 per session, depending on product selection and treatment area, impacting patient accessibility and leading to treatment deferrals in price-sensitive markets.

Multiple sessions and maintenance treatments add cumulative costs over time. Specialized training requirements and practitioner certification extend clinic operational costs by 20-30% compared to basic aesthetic services. Limited availability of experienced injectors restricts treatment access, especially in emerging markets and rural areas. These constraints make widespread adoption challenging in cost-sensitive healthcare systems despite growing aesthetic demand and improved product safety profiles.

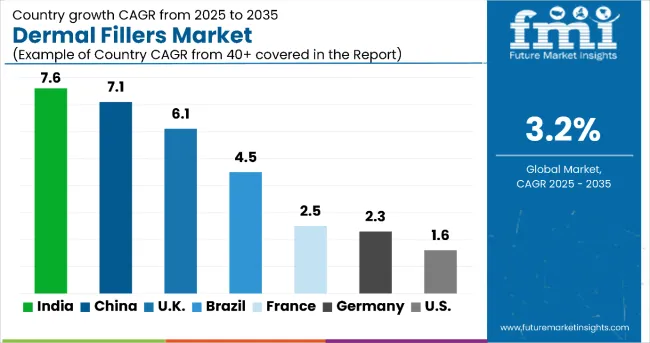

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 7.6% |

| China | 7.1% |

| UK | 6.1% |

| Brazil | 4.5% |

| France | 2.5% |

| Germany | 2.3% |

| USA | 1.6% |

In the dermal fillers market, India leads with the highest projected CAGR of 7.6% from 2025 to 2035, driven by rapid economic development, increasing aesthetic consciousness, and expanding disposable income among the middle class. China follows with a CAGR of 7.1%, supported by urbanization, rising beauty standards, and growing acceptance of aesthetic procedures.

The UK shows strong growth at 6.1%, benefiting from established aesthetic culture and advanced practitioner networks. Brazil demonstrates solid expansion at 4.5%, supported by strong beauty consciousness and cultural acceptance of cosmetic procedures. France and Germany show more mature market growth at 2.5% and 2.3% respectively, supported by established aesthetic markets and steady demand. The USA, with a CAGR of 1.6%, exhibits slower growth due to market maturity and high penetration, reflecting its advanced stage in consumer adoption and market development.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from dermal fillers in India is projected to grow at a CAGR of 7.6% from 2025 to 2035, significantly exceeding the global average. Growth is fueled by rising disposable income, increasing aesthetic consciousness, and expanding access to trained practitioners across major urban centers, including Mumbai, Delhi, and Bangalore. Indian aesthetic markets are increasingly adopting international treatment standards as medical tourism grows and specialty aesthetic services expand.The growing middle-class population with increased spending power on aesthetic procedures drives market expansion.

Key Statistics:

The dermal fillers market in China is anticipated to expand at a CAGR of 7.1% from 2025 to 2035, reflecting strong emerging market dynamics with the second-highest growth rate globally. Growth is centered on rapid urbanization and the adoption of aesthetic procedures in the Beijing, Shanghai, and Guangzhou regions. Advanced treatment protocols and international brand presence are being deployed for diverse consumer segments, while regulatory frameworks support practical treatment application development across various aesthetic settings.Rising disposable income among urban consumers and growing acceptance of minimally invasive aesthetic procedures are key drivers.

Key Statistics:

Demand for dermal fillers in the UK is expected to increase at a CAGR of 6.1% from 2025 to 2035, demonstrating strong growth above the global average. Demand is driven by established aesthetic culture and advanced practitioner networks in the London, Manchester, and Edinburgh regions. Evidence-based treatment protocols and specialized aesthetic centers are increasingly adopting advanced hyaluronic acid formulations for optimal patient outcomes.The UK's well-established healthcare system and advanced medical infrastructure support high-quality aesthetic treatments.

Key Statistics:

Demand for dermal fillers in Brazil is expected to increase at a CAGR of 4.5% from 2025 to 2035, exceeding the global average and reflecting strong cultural emphasis on beauty and aesthetic procedures. Demand is driven by established beauty culture and expanding access to aesthetic treatments in São Paulo, Rio de Janeiro, and Brasília markets. Advanced treatment protocols and international brand partnerships are increasingly adopting comprehensive aesthetic solutions for diverse patient populations.Brazil's strong cultural emphasis on beauty and personal appearance creates sustained demand for aesthetic procedures. Healthcare infrastructure improvements and expanding access to the middle class support market growth.

Key Statistics:

Revenue from dermal fillers in France is projected to grow at a CAGR of 2.5% from 2025 to 2035, reflecting steady mature market expansion below the global average. Healthcare systems in Paris, Lyon, and Marseille are experiencing stable demand for advanced formulations and integrated aesthetic management. French aesthetic institutions are leveraging established treatment protocols to meet quality expectations for comprehensive dermal filler applications.France's mature aesthetic market focuses on quality and natural-looking results rather than rapid expansion.

Key Statistics:

The demand for dermal fillers in Germany is expected to increase at a CAGR of 2.3% from 2025 to 2035, representing steady mature market growth. Demand is driven by advanced healthcare systems and comprehensive insurance frameworks in the Berlin, Munich, and Hamburg markets. Evidence-based treatment protocols and specialized dermatology centers are consistently adopting proven aesthetic solutions.Germany's focus on clinical evidence and safety standards supports steady market development.

Key Statistics:

Sales of dermal fillers in the USA are expected to grow at a CAGR of 1.6% from 2025 to 2035, reflecting mature market conditions with the lowest growth rate among the analyzed countries. Growth is concentrated in advanced formulation adoption and specialized application development in California, Texas, and New York regions. Advanced treatment protocols and established insurance frameworks are being deployed for diverse aesthetic applications, while FDA regulatory guidelines support comprehensive treatment standard development.The USA represents the most mature dermal fillers market globally, with high penetration rates and established treatment protocols.

Key Statistics:

The dermal filler market is moderately concentrated. Global leaders, specialty manufacturers, and regional producers compete based on formulation innovation, clinical efficacy, and practitioner engagement. Allergan Aesthetics (AbbVie) holds an estimated 28% market share, driven by the success of the Juvéderm portfolio in hyaluronic acid-based fillers. Galderma Pharma S.A. follows closely with the Restylane line, supported by an extensive aesthetic product range and long-standing relationships with practitioners.

Merz Pharma GmbH & Co. KGaA, Sinclair Pharma plc (Huadong Medicine Co., Ltd), and LG Chem Ltd. stand out for their advanced formulations, regional expertise, and R&D investment in next-generation fillers. Their focus includes cross-linking technologies, enhanced viscosity control, and precise delivery systems designed for natural, long-lasting results.

Zimmer Aesthetics, Croma Pharma, Prollenium Medical Technologies Inc., and Suneva Medical Inc. strengthen market diversity through niche product lines tailored to specific facial applications and demographic segments. Teoxane SA maintains a competitive edge with its science-driven filler innovations and practitioner education programs.

| Items | Value |

|---|---|

| Quantitative Units (2025) | USD 6.6 Billion |

| Ingredients | Hyaluronic Acid, Poly-L-Lactic Acid, Calcium Hydroxy lapatite, Polymethyl Methacrylate, Collagen, Polynucleotide (PN) |

| Gender | Male, Female, Transgender |

| Application | Wrinkle Reduction, Skin Folds/Nasolabial Folds, Augmentation of Lips/Cheek & Chin, Scar Treatment, Hand Rejuvenation, Jawline and Chin Lines Countering, Eyebrows Treatment, Hollowness Under Eyes, Nose Jobs, Volume Restoration, Restoring Damaged Tissues, Restoration of Facial Fat Loss, Dentistry |

| Distribution Channel | Cosmetic and Aesthetic Clinics, Hospitals, Online Sales, Plastic Surgery Centers, Medical Spas |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, India and 40+ Countries |

| Key Companies Profiled |

Galderma Pharma S.A., Merz Pharma GmbH & Co. KGaA, Sinclair Pharma plc (Huadong Medicine Co., Ltd), Zimmer Aesthetics, Croma Pharma, Prollenium Medical Technologies Inc., Suneva Medical Inc., Allergan Aesthetics (AbbVie), Teoxane SA, LG Chem Ltd. |

| Additional Attributes | Dollar sales by ingredients and application, regional demand trends, competitive landscape, consumer preferences for natural versus synthetic dermal fillers, integration with regulatory and quality standards, innovations in formulation, delivery techniques, and safety standardization for diverse cosmetic applications |

In terms of ingredients, the industry is divided into (hyaluronic acid, oly-L-lactic acid, calcium hydroxylapatite, polymethyl methacrylate, collagenm and polynucleotide (PN).

In terms of gender, the industry is segregated into (male, female & transgender).

In terms of application, the industry is segregated into (wrinkle reduction, skin folds/ nasolabial folds, augmentation of lips, cheek &chin, scar treatment, hand rejuvenation, jawline and chin lines countering, eyebrows treatment, hollowness under eyes, nose jobs, volume restoration, restoring damaged tissues, restoration of facial fat loss and dentistry).

In terms of distribution channel, the industry is segregated into cosmetic and aesthetic clinics, hospitals, online sales, plastic surgery centers and medical spa.

Key countries of North America, Latin America, Western Europe, Eastern, South Asia, East Asia and Middle East and Africa (MEA) have been covered in the report.

The global dermal fillers market is estimated to be valued at USD 6.6 billion in 2025.

The market size for dermal fillers is projected to reach USD 9.0 billion by 2035.

The dermal fillers market is expected to grow at a 3.2% CAGR between 2025 and 2035.

Hyaluronic acid is projected to lead in the dermal fillers market with 64% market share in 2025.

Cosmetic & aesthetic clinics segment is projected to command 53% share in the dermal fillers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dermal Fillers and Botulinum Toxin Market Outlook - Size, Trends & Forecast 2025 to 2035

Competitive Overview of Dermal Fillers Market Share

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Dermal Sprays Market Size and Share Forecast Outlook 2025 to 2035

Epidermal Nevus Syndrome Market

Transdermal Cosmetic Patches Market Size and Share Forecast Outlook 2025 to 2035

Intradermal Injection Market Size and Share Forecast Outlook 2025 to 2035

Transdermal Ultrasound Surgery Market

Toxic Epidermal Neurolysis Market – Trends & Forecast 2025 to 2035

Market Share Insights for Anti-Acne Dermal Patch Providers

Anti-acne Dermal Patch Market Insights – Trends & Forecast 2024-2034

Non-Hyaluronic Acid Dermal Filler Market Size and Share Forecast Outlook 2025 to 2035

Fillers & Extenders Market Size and Share Forecast Outlook 2025 to 2035

Sack Fillers Market Size and Share Forecast Outlook 2025 to 2035

Piston Fillers Market Size and Share Forecast Outlook 2025 to 2035

Breast Fillers Market Analysis - Trends & Forecast 2025 to 2035

Plastic Fillers Market Size and Share Forecast Outlook 2025 to 2035

Polymer Fillers Market Analysis - Size, Share, and Forecast 2025 to 2035

Aseptic Fillers Market Growth - Trends & Forecast 2025 to 2035

Volumetric Cup Fillers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA