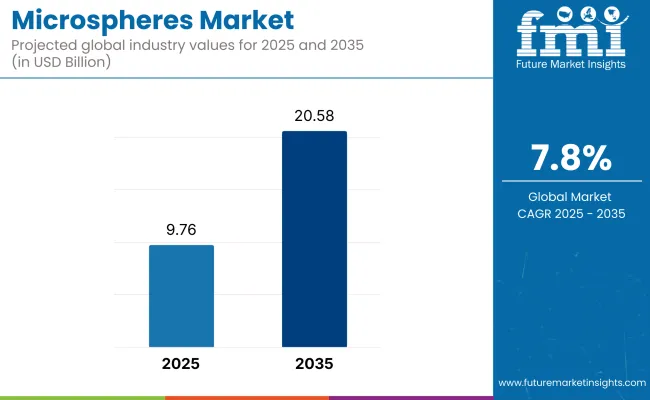

The global microsphere industry is set to reach USD 9.76 billion in 2025. The industry is poised to soar at a CAGR of 7.8% over the forecast period between 2025 and 2035. The total market valuation at the end of 2035 is forecasted to reach around USD 20.58 billion.

The global microsphere industry witnessed tremendous growth, especially in the medical and construction industries. The medical sector witnessed a remarkable growth in the use of microspheres in targeted drug delivery systems, which improved the effectiveness of treatments for chronic diseases. Microspheres were also used more frequently in diagnostic imaging, resulting in more precise and early detection of medical conditions.

Microspheres are lightweight concrete and insulation materials in the construction sector, enhancing structural strength and energy efficiency.

North America and Europe were the most advanced technological regions, whereas the Asia-Pacific region saw the highest industry experienced rapid growth due to expanding efficiency and structural integrity.

The microsphere industry is set to make consistent growth over the following decade. The continued innovation of biodegradable and sustainable microspheres is projected to provide new opportunities in environmental uses, including soil remediation and water purification. In the healthcare sector, the development of multifunctional microspheres integrating therapeutic and diagnostic functions (theranostics) is projected to advance and provide personalized medicine solutions.

The automotive and aerospace sectors also are expected to expand their utilization of microspheres in weight-saving composite materials in an effort to enhance fuel efficiency and emissions reduction.

Future Market Insights (FMI) carried out a comprehensive survey of major stakeholders in the microsphere industry, highlighting trends, challenges, and opportunities in the future. The most striking revelation was the growing use of microspheres in the pharmaceutical and medical industries.

Stakeholders highlighted that the application of microspheres in drug delivery systems, diagnostic imaging, and regenerative medicine has gained traction driven by ongoing research and development. Stakeholders also referred to the increasing demand for biodegradable and bioresorbable microspheres, especially in targeted therapy applications, which is likely to create new growth opportunities.

The other important revelation of the survey was the expanding use of microspheres in the automotive and construction sectors. Industry players mentioned that microspheres are finding applications in lightweight concrete, insulation, and composite structures for increasing durability and energy efficiency. In the auto sector, microspheres are being used to reduce the weight of auto components by the automakers, helping improve fuel economy and emissions.

However, although such applications provide rich opportunities, stakeholders also noted that increased R&D efforts were needed to enhance the performance and sustainability of microsphere-based materials.

Despite the encouraging industry growth, stakeholders voiced apprehensions concerning standardization and regulatory issues. The survey established that the absence of globally agreed quality standards for microspheres causes variability in product performance from one industry to another. In addition to this, compliance with strict environmental and safety regulations presents a major challenge, particularly for producers keen on expanding their business globally.

| Country/Region | Impact of Government Regulations and Mandatory Certifications |

|---|---|

| United States | The USA Food and Drug Administration (FDA) regulates microspheres used in medical applications, requiring compliance with Good Manufacturing Practices (GMP). For environmental and industrial uses, the Environmental Protection Agency (EPA) enforces regulations to ensure safety and environmental protection. |

| European Union | The European Medicines Agency (EMA) oversees the use of microspheres in pharmaceuticals, mandating adherence to GMP standards. The Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation requires companies to register chemical substances, including microspheres, to assess their environmental and health impacts. |

| Japan | The Pharmaceuticals and Medical Devices Agency (PMDA) regulates microspheres in medical devices and drugs, enforcing stringent quality and safety standards. Industrial applications are subject to the Chemical Substances Control Law, which requires notification and evaluation of chemical substances. |

| China | The National Medical Products Administration (NMPA) supervises the use of microspheres in medical products, necessitating compliance with Chinese GMP standards. The Ministry of Ecology and Environment enforces regulations on chemical substances to ensure environmental safety. |

| India | The Central Drugs Standard Control Organization (CDSCO) regulates medical applications of microspheres, requiring adherence to Indian GMP standards. The Ministry of Environment, Forest and Climate Change oversees the management and regulation of chemical substances to prevent environmental hazards. |

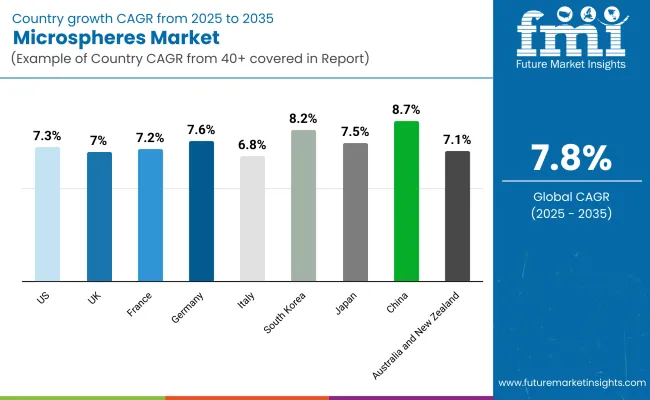

The United States microsphere industry is anticipated to surge at a CAGR of 7.3% over the next decade. The expansion of the industry is driven by its advancement in the healthcare sector. The healthcare sector uses medical diagnostics, drug delivery systems and others.

Additionally, the United States is a centre for R&D and encourages the innovation of microsphere uses in numerous fields, with the aerospace and automotive fields being at the forefront of companies demanding lightweight materials. Industry conditions are also aided by favourable regulatory frameworks, as well as significant investments in nanotechnology.

FMI opines that United States microsphere sales will grow at nearly 7.3% CAGR through 2025 to 2035.

The microsphere industry in the United Kingdom is estimated to see a CAGR of about 7.0% over the forecast years of 2025 to 2035. With a robust focus on biomedical research and an established pharmaceutical sector, the United Kingdom is a favourable industry for microsphere technologies, especially in drug delivery and diagnostic applications. In addition, the emphasis on sustainable construction practices in the UK has contributed to a higher usage of microspheres for lightweight and insulating building materials. Additionally, government initiatives and support for advanced manufacturing and material sciences further contribute to industry growth.

FMI opines that United Kingdom microsphere sales will grow at nearly 7.0 % CAGR through 2025 to 2035.

France’s microsphere industry is estimated to surge at an industry value of nearly 7.2% CAGR from 2025 to 2035. The presence of a well-established healthcare infrastructure in the country coupled with strong investments towards medical research, enhances the adoption of microspheres in therapy and diagnostics. Also, microsphere-embedded composites have become a popular choice in France’s key automotive and aviation industries that need weight reduction and increased fuel economy. When research institutions and industry collaborate on projects to further microsphere applications, government funding is often involved.

FMI opines that France microsphere sales will grow at nearly 7.2% CAGR through 2025 to 2035.

The microsphere industry in Germany is likely to expand at a CAGR of 7.6% by the projected period from 2025 to 2035. The country has been dominating in various sectors such as engineering and manufacturing. It utilises microspheres to enhance product quality and performance across different sectors.

This trend is spurred by the nation's focus on innovation and high-quality standards encouraging the integration of advanced materials like microspheres to enhance efficiency and sustainability. Besides, the use of microspheres in Germany's healthcare sector is underpinned by a robust network of research institutions and industry partnerships for a range of medical applications.

FMI opines that Germany microsphere sales will grow at nearly 7.6% CAGR through 2025 to 2035.

From 2025 to 2035, the microsphere industry is expected to grow at a CAGR of approximately 6.8% in Italy. One of the major drivers in the microsphere industry is the pharmaceutical and biomedical industries, which are continuously expanding across the country, with applications of microspheres being found in drug delivery systems as well as in various other diagnostic tools. The construction sector in Italy also utilizes microspheres to produce lightweight materials that are conducive to building. Government benefits for technological innovation and green practices further bolster the industry's positive outlook.

FMI opines that Italy microsphere sales will grow at nearly 6.8% CAGR through 2025 to 2035.

The South Korean microsphere industry is expected to grow at a CAGR of 8.2% during the forecast period. Microspheres are employed in a range of applications, such as components and electronic displays, in the nation's advanced electronics and semiconductor industries. Furthermore, a strong focus on healthcare innovation results in the widespread adoption of microspheres in drug delivery systems and medical devices which further Increases the adoption of microspheres in South Korea. The work of the government to support research and development, as well as high-tech manufacturing, creates a good environment for the industry to grow.

FMI opines that South Korea microsphere sales will grow at nearly 8.2% CAGR through 2025 to 2035.

Japan's Microspheres industry is estimated to experience a CAGR of approximately 7.5% over the period 2025 to 2035. Famous for its technology, Japan incorporates microspheres in a range of sectors, including electronics, automotive and health care. An ageing population boosts demand for advanced medical therapies that employ microspheres in targeted treatments and diagnostics. The growing industry for microspheres is also attributed to academia-industry collaborations along with government initiatives that promote innovation.

FMI opines that Japan microsphere sales will grow at nearly 7.5% CAGR through 2025 to 2035.

The microsphere industry in China will grow at a CAGR of 8.7% during the upcoming decade. Its growth has been driven by rapid industrialisation, urbanisation, automotive and others.

Government initiatives in China that promote advanced manufacturing and research in materials science contribute to the development and adoption of microsphere technologies. Furthermore, the growing middle class in China is looking for better healthcare services, which booms the healthcare industry in the country for microspheres in an array of medical applications.

FMI opines that China microsphere sales will grow at nearly 8.7% CAGR through 2025 to 2035.

The industry for microspheres in Australia and New Zealand is anticipated to increase slowly owing to a CAGR of approximately 7.1% during the period from 2025 to 2035. The emphasis on healthcare in both countries also drives the use of microspheres for medical diagnostics and treatment. Microspheres also play a major role in construction by helping create materials that are compatible with different weather. The growth outlook of the industry is boosted by the government funding of research and innovation and collaboration between universities and industry.

FMI opines that Australia-New Zealand microsphere sales will grow at nearly 7.1% CAGR through 2025 to 2035.

Hollow microspheres will see growing demand in various industries because of their lightness characteristics and capacity to increase insulation, buoyancy, and strength within composite materials. The building construction industry will be dependent on hollow microspheres to manufacture lightweight concrete and insulating materials with enhanced energy efficiency and strength.

The oil and gas sector will also continue to incorporate hollow microspheres into cement and drilling fluids, lowering density and enhancing flowability. These advantages will propel global adoption, with hollow microspheres becoming an industry favourite for achieving performance improvement at lower material weight and cost.

Solid microspheres will be used more by paint and coatings manufacturers to enhance abrasion resistance, improve surface finish, and optimize viscosity. The automotive and aerospace industries will also rely on solid microspheres to create high-performance materials that fuel efficiency and component life. With continued breakthroughs in material science, solid microspheres will find greater acceptance in various high-precision applications.

The building composites industry will generate a strong demand for microspheres as the industry focuses on materials that are both lightweight and resistant. Hollow microspheres will find extensive applications in cement, plaster, and concrete products to enhance insulation while lowering overall density without affecting strength. Green building practices will further promote the use of microspheres to construct energy-efficient buildings with better fire resistance and longevity.

Health and biotechnology will remain a driving force for microsphere applications, as drug delivery, medical imaging, and regenerative medicine drive the industry forward through innovation. Solid microspheres will be pivotal in targeted therapies for drugs to achieve controlled dosing and extended-release.

Researchers will look for new formulations involving biodegradable microspheres to reduce side effects and enhance patient care. Increased demand for sophisticated imaging methodologies will also fuel the use of microspheres in contrast agents and diagnostics.

The coatings and paints industry will increasingly depend on microspheres to improve product performance and sustainability. Microspheres will enhance scratch resistance, UV protection, and thermal insulation in automotive, industrial, and architectural coatings. Companies will concentrate on using environmentally friendly microspheres to minimize volatile organic compounds (VOCs) and develop coatings that provide superior durability and environmental advantages.

Personal care products and cosmetics will use microspheres to add texture, application, and sensory attractiveness. Hollow microspheres will be applied in skin care products to make them more spreadable and less greasy, while solid microspheres will be utilized as efficient carriers of active substances for anti-ageing and sun care products. The tendency to go green and have natural and biodegradable cosmetics will promote the use of environmentally friendly microspheres that provide functional characteristics without causing any damage to the environment.

The oil and gas sector will also continue to blend microspheres into drilling compounds, cement, and wellbore stabilization solutions. Microspheres, being hollow, will enhance fluid flow and make drilling compounds lighter, resulting in increased efficiency and cost reduction. As the industry is shifting attention towards minimizing the environmental footprint, the application of microspheres to create environment-friendly and high-performance drilling products will gain greater traction.

The auto industry will fuel the demand for microspheres as producers hunt for lightweight materials to increase fuel efficiency and lower emissions. Microspheres will be integrated into coatings, plastics, and composites to increase durability and performance while staying cost-effective. Electric vehicle makers will investigate microsphere-enriched materials to maximize battery efficiency and structural parts.

Other sectors such as electronics, aerospace, and packaging will also experience greater microsphere adoption owing to their capability of improving material performance, increasing thermal insulation, and offering economic savings. New areas of microsphere application will evolve as continued R&D initiatives ensure, thus opening up more doors for use in various sectors.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry experienced steady growth, driven by demand in the healthcare, construction, and automotive industries. The COVID-19 pandemic caused initial disruptions, but recovery was strong due to the increased use of medical applications and sustainable materials. | The market is expected to accelerate with advancements in material science, growing applications in drug delivery, and increased demand for lightweight, high-performance materials in the automotive and aerospace sectors. |

| Regulatory frameworks evolved, with stricter environmental and safety regulations impacting production and material selection. Compliance with REACH and FDA regulations became a priority for manufacturers. | Governments will likely introduce more stringent sustainability and safety standards, pushing companies to develop eco-friendly and biodegradable microspheres, and fostering innovation in the sector. |

| R&D investments focused on improving microsphere performance in coatings, healthcare, and insulation materials. The development of bio-based microspheres gained traction, but adoption remained in the early stages. | The research will drive the commercialization of advanced biodegradable and bioresorbable microspheres, with increased funding in nanotechnology and targeted drug delivery solutions. |

| The medical industry saw rapid adoption of microspheres in imaging, controlled drug delivery, and minimally invasive procedures. | Microspheres will play a larger role in personalized medicine, regenerative therapies, and advanced diagnostics, expanding their use in next-generation treatments. |

| Automotive and aerospace industries increased usage of microspheres to reduce weight and enhance fuel efficiency, but high production costs limited widespread adoption. | As lightweight becomes a priority for electric vehicles and sustainable aviation, demand for microsphere-infused composites will rise, reducing costs and improving efficiency. |

| Asia-Pacific emerged as a high-growth region due to rapid industrialization and expansion of the healthcare sector, particularly in China and India. | The region will continue leading industry growth, with China and India dominating due to large-scale manufacturing and increasing investments in advanced materials. |

| Sustainability concerns led to a shift toward eco-friendly microspheres, but industry penetration remained limited due to high production costs and lack of standardization. | Industry-wide adoption of sustainable microspheres will grow, with manufacturers focusing on reducing carbon footprints and increasing recyclability in various applications. |

The microsphere industry can be classified as a part of the advanced materials and speciality chemicals sector. It is also linked to other industries including healthcare, construction, automotive, aerospace, and oil & gas, making it a valuable part of the larger material science and industrial manufacturing segments.

For microspheres, demand is also constantly rising as economies are transitioning to be more sustainable and energy efficient. It is an essential element across various industries. Microspheres are used in the healthcare sector, a key driver for their adoption, which is being primarily driven by the rise in healthcare spending, growing global geriatric population and developing interested in targeted drug delivery. Pharmaceuticals & Biotechnology companies are spending on research & development which is contributing to the innovation of Bioresorbable & Controlled-release microspheres.

Rising urbanization and infrastructure spending in the construction sector drive the demand for microspheres in lightweight concrete, insulation, and coatings. The continuous focus on green buildings and sustainable construction materials further boost the industry growth.

The microsphere industry offers several growth opportunities in sustainable materials, high-performance composites, and biomedical applications make it possible. Pharmaceutical firms and biotech companies are looking to explore this lucrative space that offers improved drug delivery systems due to the increasing demand for biodegradable microspheres in the fields of pharmaceuticals and regenerative medicine. The automotive and aerospace industries seek lightweight materials to improve fuel efficiency and battery performance in electric vehicles, and microsphere-infused composites can provide that.

Moreover, the growing application of microspheres in innovative coatings for thermal insulation and longevity in construction and industrial applications will help the industry prospects. Companies should investigate transactions on r&d to develop economical and germ-free alternatives to conventional microspheres while also taking into consideration the tightened regulations on environmental protection. Long-term growth will require strategic partnerships with end-user industries and government-supported sustainability initiatives. Another critical factor to capitalizing on emerging industry potential due to higher production capacity in high-growth regions like Asia-Pacific will enable competitive pricing to capture this potential.

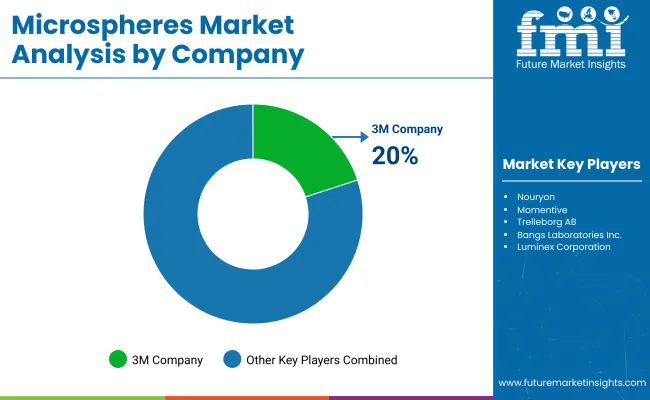

The microsphere industry is influenced by the competitive dynamics of the industry based on the strategies of the market leaders to attain a competitive advantage. Major companies are emphasizing a mix of price strategies, innovation, collaboration, and geographical expansion to consolidate their industry position. Price strategies differ based on whether microspheres are hollow or solid and their use. For example, firms manufacturing high-performance microspheres used in cutting-edge applications such as medicine or space exploration tend to use premium pricing, whereas firms serving cost-sensitive industries such as construction rely on competitive pricing to achieve broader market bases.

Innovation continues to be the driving force for growth in the microsphere industry. Top players are putting significant investments in R&D to create sophisticated materials with improved properties like better thermal insulation, lightweight nature, and longevity. For instance, bio-based and environmentally friendly microsphere innovations are picking up steam as sustainability emerges as a major concern across industries. Firms are also using nanotechnology to design microspheres of specific size distribution and custom function, targeted to niche use in drug delivery, coatings, and composites.

Collaborations and partnerships are another vital strategy utilized by industry players. Firms are establishing strategic partnerships with universities, research institutions, and other industry participants to drive innovation and increase product offerings.

3M Company

AkzoNobel N.V.

Trelleborg AB

Momentive Performance Materials Inc.

Sigmund Lindner GmbH

Chase Corporation

Potters Industries LLC (PQ Corporation)

Other Players (Regional and Niche Companies)

Hollow and Solid

Construction Composites, Health and Biotechnology, Paints and Coatings, Cosmetics and Personal care, Oil and Gas, Automotive and Others.

North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia and Middle East and Africa

The rising use of lightweight materials, drug delivery, and energy-efficient coatings is driving growth.

Regulations are pushing companies toward biodegradable and eco-friendly alternatives, especially in healthcare and coatings.

Advancements in nanotechnology and material science are enhancing drug delivery, regenerative medicine, and high-strength composites.

Healthcare, automotive, aerospace, and construction are leading due to demand for high-performance and sustainable materials.

Firms are focusing on innovation, partnerships, and geographic expansion while ensuring regulatory compliance.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Expandable Microspheres Market Size and Share Forecast Outlook 2025 to 2035

Injectable Osteoarthritis Microspheres Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA