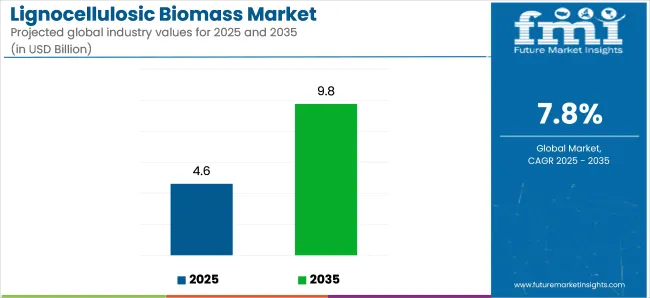

The global lignocellulosic biomass market is projected to grow from USD 4.61 billion in 2025 to USD 9.76 billion by 2035, reflecting a CAGR of 7.8%. The market is driven by the increasing demand for renewable and sustainable energy sources, particularly as the world seeks to transition to cleaner energy solutions.

Lignocellulosic biomass, which includes plant-based materials like agricultural residues, wood chips, and grasses, is being explored as a viable raw material for biofuels and other bio-based products. As energy demands rise globally and the need to reduce carbon emissions becomes more urgent, lignocellulosic biomass is being seen as a key solution in the bioenergy sector.

The demand for lignocellulosic biomass is growing due to its potential as a sustainable feedstock for renewable fuels and bio-based chemicals. Lignocellulosic waste and residues, once seen as mere byproducts, are now being recognized as valuable resources in the production of biofuels, such as ethanol and biogas.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 4.61 billion |

| Market Size in 2035 | USD 9.76 billion |

| CAGR (2025 to 2035) | 7.8% |

Lars Peter Riis, CEO of Chevron Lummus Global, highlighted the importance of these materials, stating: “Lignocellulosic waste and residues can make an important contribution as a new and scalable raw material pool for renewable fuels.” This statement underscores the significant role lignocellulosic biomass will play in advancing renewable energy technologies and reducing dependence on fossil fuels.

Technological advancements are also driving the growth of the lignocellulosic biomass market. Innovations in biomass conversion technologies, such as enzymatic hydrolysis, gasification, and pyrolysis, are enhancing the efficiency and scalability of lignocellulosic biomass utilization. These advancements are making it more cost-effective to convert biomass into biofuels and other valuable products.

As governments worldwide implement stricter emissions regulations and promote the use of renewable energy, the adoption of lignocellulosic biomass as a feedstock for sustainable energy production is expected to rise. The market is also benefiting from increasing investments in research and development aimed at improving the viability of lignocellulosic biomass for large-scale applications

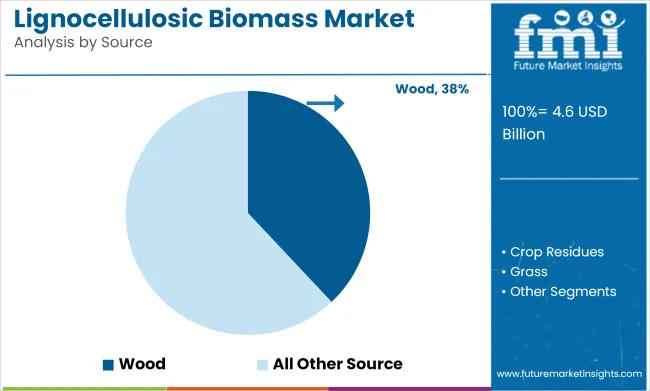

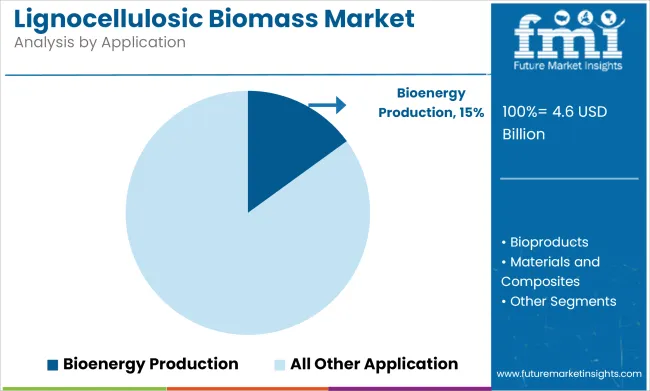

The lignocellulosic biomass market is expected to grow significantly, driven by key segments such as wood as the primary source and bioenergy production as a key application. Wood is projected to dominate the source segment, while bioenergy production will continue to be a leading application for lignocellulosic biomass. These segments are expected to drive the overall market expansion as demand for sustainable energy solutions and renewable resources continues to rise.

Wood is expected to capture 38% of the lignocellulosic biomass market share by 2025. As the most commonly used source of lignocellulosic biomass, wood offers several advantages, including its wide availability, high energy content, and suitability for various industrial applications.

Wood is a key feedstock for biofuels, such as ethanol and biodiesel, as well as for bioelectricity production. Leading companies like UPM-Kymmene, Georgia-Pacific, and West Fraser Timber are prominent in the supply chain of wood-based lignocellulosic biomass, using wood for energy generation and other sustainable products. Wood's renewable nature and the growing focus on reducing carbon emissions have made it a preferred resource for biomass applications.

The increasing adoption of biomass technologies in industries such as forestry, agriculture, and waste management is further driving the demand for wood-based lignocellulosic biomass. As sustainability goals become more stringent, the demand for wood as a renewable, carbon-neutral resource is expected to continue growing, solidifying its dominant role in the biomass market.

Bioenergy production is projected to capture 15% of the lignocellulosic biomass market share by 2025. The use of lignocellulosic biomass for bioenergy production has been growing due to its potential as a renewable energy source. Biomass materials like wood, agricultural residues, and dedicated energy crops are converted into biofuels and biogas to generate electricity and heat, providing a sustainable alternative to fossil fuels.

Companies like Bioenergy DevCo, POET, and Abengoa are leading the bioenergy production segment by converting lignocellulosic biomass into biofuels and biogas for industrial and commercial applications. The bioenergy industry is benefiting from government incentives, environmental policies, and the increasing demand for cleaner energy sources.

The use of lignocellulosic biomass for bioenergy not only reduces reliance on non-renewable energy sources but also helps lower greenhouse gas emissions, making it a critical component of global efforts toward energy transition and sustainability. With growing concerns about energy security and the environmental impact of fossil fuels, bioenergy production from lignocellulosic biomass is expected to continue expanding, maintaining its significant share in the market.

Due to the growing interest in sustainable and renewable alternatives to traditional fossil fuels, lignocellulosic biomass is gaining popularity. Biomass utilization is generally considered carbon-neutral as the carbon dioxide emitted during its combustion is almost equal to the amount of carbon dioxide absorbed by the plants during their growth.

This contributes to reducing net greenhouse gas emissions compared to burning fossil fuels, further boosting lignocellulosic biomass market demand.

The demand for biofuels, including cellulosic ethanol and advanced biofuels, is increasing due to concerns about climate change, energy security, and the desire to decrease reliance on conventional gasoline and diesel. Lignocellulosic biomass, with its high cellulose content, is a key feedstock for biofuel production, which further contributes to its higher demand and boosts the global market.

Lignocellulosic biomass is used in a wide range of applications, including bioenergy, biofuels, biochemicals, bioplastics, construction materials, and more. Its versatility makes it suitable for various industries, which is contributing to its widespread adoption.

Companies operating in this market are adopting various strategies to boost the adoption of renewable energy sources.

For instance,

Ongoing advancements in biotechnology, biochemical engineering, and process optimization have improved the efficiency and cost-effectiveness of lignocellulosic biomass conversion technologies. These advances have made biomass-based processes more competitive and commercially viable.

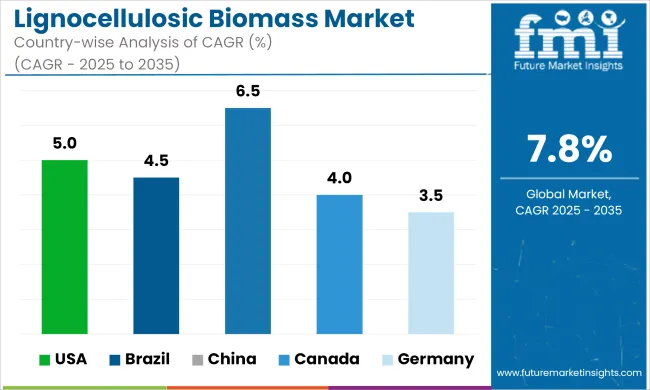

| Countries | Forecast CAGR (2025 to 2035) |

|---|---|

| United States | 5.0% |

| Brazil | 4.5% |

| China | 6.5% |

| Canada | 4.0% |

| Germany | 3.5% |

The demand for lignocellulosic biomass in the United States is projected to rise at a 5.0% CAGR through 2035.

The sales of lignocellulosic biomass in Brazil are estimated to surge at a 4.5% CAGR through 2035.

The lignocellulosic biomass market growth in China is estimated at a 6.5% CAGR through 2035.

The demand for lignocellulosic biomass in China is anticipated to increase at a 4.0% CAGR through 2035.

The sales of lignocellulosic biomass in Australia are estimated to rise at a 3.5% CAGR through 2035.

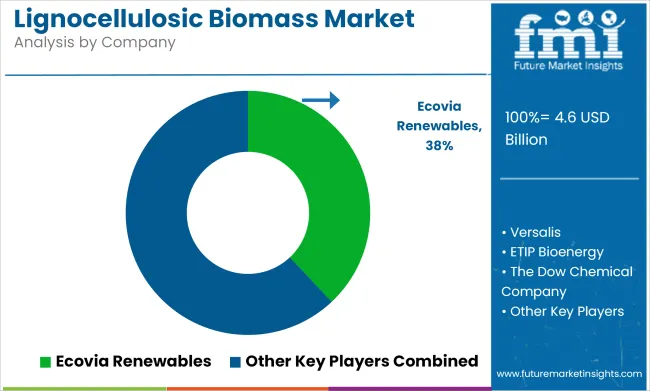

The lignocellulosic biomass market is highly competitive, with leading competitors striving for market share and domination. Established corporations, such as energy giants and biofuel manufacturers, are fiercely competing to benefit on the increased demand for renewable energy sources.

These sector giants use their strong financial positions, broad distribution networks, and technical skill to maintain a competitive edge and grow their presence in critical regions. Furthermore, the industry is seeing the rise of creative startups and specialized businesses focusing in advanced bioenergy technologies, troubling traditional corporate structures and challenging incumbents.

Most lignocellulosic biomass manufacturers use strategies such as mergers & acquisitions, partnerships, distribution agreements, collaborations, and advertisements to gain a competitive edge in the market.

Recent Developments

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 4.61 billion |

| Market Size in 2035 | USD 9.76 billion |

| CAGR (2025 to 2035) | 7.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Sources Analyzed | Wood, Crop Residues, Grass, Agricultural Residues |

| Applications Analyzed | Bioenergy Production, Bioproducts, Materials and Composites, Animal Feed and Bedding, Soil Amendment and Erosion Control, Biomass Power Generation |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, GCC Countries, South Africa |

| Additional Attributes | Dollar sales by source (wood, crop residues, etc.), Dollar sales by application (bioenergy, bioproducts, etc.), Growth trends in biomass power generation and bioenergy sectors, Regional dynamics across key markets in North America, Europe, and Asia-Pacific |

The lignocellulosic biomass market is valued at USD 4.61 billion in 2025.

The global lignocellulosic biomass market value is projected to reach USD 9.76 billion by 2035.

The lignocellulosic biomass market is expected to thrive at a CAGR of 7.8% through 2035.

North America is expected to have a leading market share of 20.8% by the end of 2034.

The global lignocellulosic biomass market registered a CAGR of 5.2% from 2020 to 2024.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biomass Pellets Market Size and Share Forecast Outlook 2025 to 2035

Biomass Gasification Market Size and Share Forecast Outlook 2025 to 2035

Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Woody Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Europe Biomass Pellets Market Analysis & Forecast for 2025 to 2035

Demand for Biomass Pellets in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA