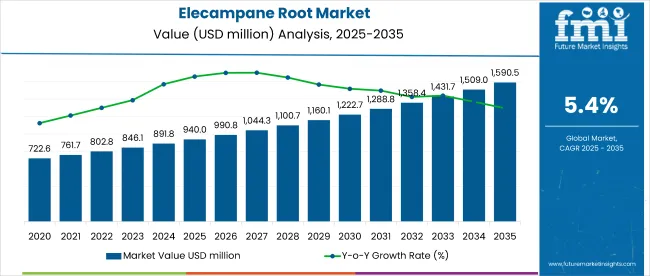

The global elecampane root market is worth USD 940 million in 2025 and is expected to reach USD 1,590.5 million by 2035, reflecting a CAGR of 5.4%.

Rising consumer awareness of natural and herbal remedies is driving the popularity of elecampane root, a historically used ingredient in traditional medicine, as it gains traction in modern health supplements due to its proven medicinal properties. The ongoing shift towards organic and natural products is further driving demand for elecampane root, which is commonly sold in dried root, powder, and supplement forms.

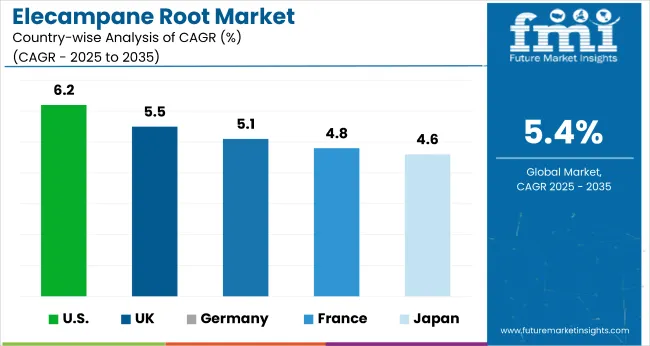

In 2025, the North America region is estimated to hold the largest share of the elecampane root market, driven by increasing consumer interest in natural health solutions. The market in the USA is growing at a robust CAGR of 6.2%.

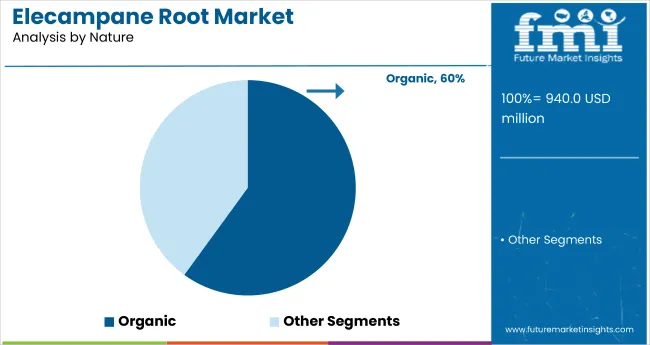

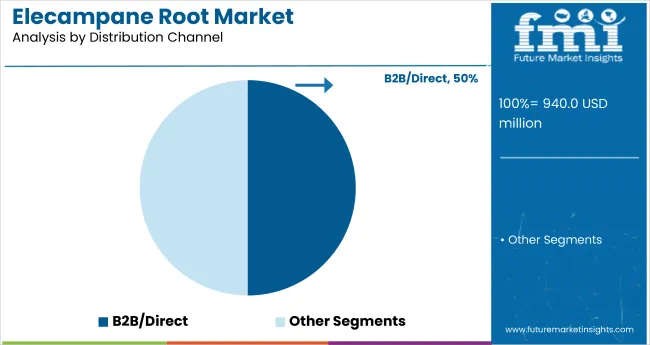

Meanwhile, the UK and Germany closely follow this growth with prominent CAGRs of 5.5% and 5.1% respectively. By nature, the conventional segment is anticipated to lead with 60% of the market share, while the B2B/direct sales channel is expected to dominate the distribution channel with 50% of the market share in 2025.

The market holds a relatively small share within its parent markets. While precise percentages are not readily available for every segment, it can be estimated that the market holds about 0.5% to 1% of the herbal supplements market due to the niche nature of elecampane root compared to more widely used herbs. In the botanical extracts market, it likely represents around 1% given the growing use of various plant-based ingredients.

Within the broader natural remedies market, its share is around 1% to 2%. Its presence in functional foods and nutraceuticals is also limited but growing with an expanding consumer preference for herbal ingredients.

Looking ahead, the market for elecampane root is expected to continue benefiting from government initiatives that promote the consumption of herbal and organic products. Additionally, the growing interest in sustainability and clean-label products will likely drive innovation within the market.

Industry players are focusing on developing new delivery forms, such as capsules and tinctures, to cater to consumer convenience. Moreover, evolving government regulations around the sale of herbal products will play a crucial role in shaping market dynamics, with stricter guidelines potentially influencing product availability.

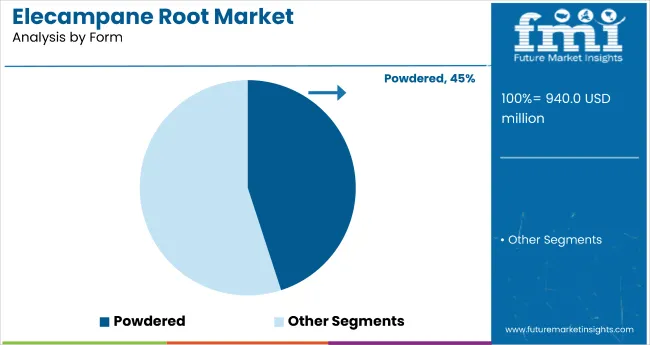

The market is segmented into nature, form, end use, distribution channel, and region. The nature, the market is bifurcated into organic and conventional. In the form, the market is segmented into cut-form, powdered, and liquid.

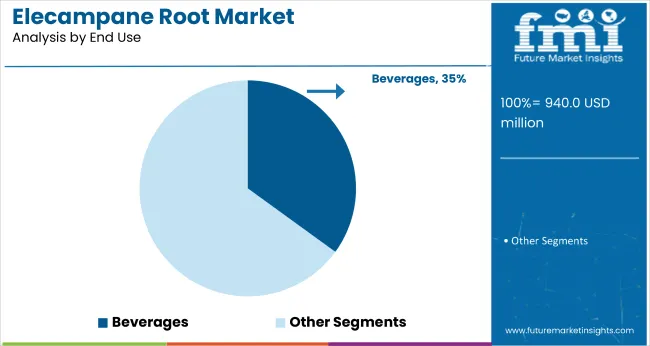

Based on end-use, the market is classified into beverages, non-alcoholic, alcoholic, foodservice/horeca (hotels, restaurants, cafes), pharmaceuticals, nutraceuticals, animal supplements, personal care & cosmetics, and household/retail.

By distribution channel, the market is divided into B2B/direct, B2C/indirect, supermarket/hypermarket, specialty stores, drug stores, and online retailers. Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia, Oceania, the Middle East & Africa.

The organic segment dominates the market, accounting for an estimated 60% share in 2025, driven by its affordability, widespread availability, and established supply chains. While organic products are gaining traction, conventional offerings continue to appeal to a broader consumer base due to their lower costs and consistent product quality.

The powdered form will remain the leading segment, driven by strong preference for its easy handling, storage, and versatility in applications such as supplements and food products. Its broad appeal across nutraceuticals, pharmaceuticals, and food & beverage industries makes it particularly lucrative.

In the end-use segment, beverages dominate, driven by strong demand across both non-alcoholic and alcoholic categories, including health-oriented drinks, functional beverages, and juices. This segment accounts for 35% of the market share. The foodservice/HoReCa sector also contributes significantly, supported by a growing trend of health-conscious consumers opting for natural and organic ingredients in restaurant and café settings.

The distribution channel segment is dominated by B2B/direct sales, where manufacturers supply directly to businesses such as retailers, restaurants, and other producers. This segment accounts for 50% of the market share. However, online retailers are rapidly gaining traction, driven by convenience and the expanding reach of e-commerce platforms.

Recent Trends in the Elecampane Root Market

Challenges in the Elecampane Root Market

The USA leads with the highest growth, projected at a CAGR of 6.2% from 2025 to 2035, driven by rising demand for natural remedies and herbal supplements. The UK follows with a CAGR of 5.5%, supported by the shift toward plant-based and organic health products. Germany shows steady growth at 5.1% CAGR, fueled by increasing demand for natural remedies and organic certifications.

France has a slightly slower pace at 4.8% CAGR, driven by consumer interest in herbal products and functional foods. Japan grows at the lowest rate of 4.6% CAGR, reflecting strong demand due to traditional herbal medicine and an aging population.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

Revenue from elecampane root in the USA is expected to grow at a CAGR of 6.2% from 2025 to 2035. Demand for natural remedies and herbal supplements continues to rise, driven by increasing consumer awareness of health and wellness. The growing preference for natural respiratory and digestive health products is significantly boosting the market for elecampane root.

The elecampane root market in the UK is anticipated to rise at a CAGR of 5.5% from 2025 to 2035. Growth is supported by a shift toward herbal and natural medicine, particularly in urban areas where consumers are more inclined to adopt alternative wellness solutions. Supportive government regulations promoting the use of organic ingredients are further stimulating market expansion.

Sales of elecampane root in Germany are projected to grow at a CAGR of 5.1% from 2025 to 2035. Demand is primarily driven by the country’s focus on holistic health solutions, particularly in natural and organic medicine. Market expansion is further supported by rising consumer preference for organic health supplements and the increasing presence of online retailers.

The French elecampane root market is anticipated to experience a CAGR of 4.8% from 2025 to 2035. The country is witnessing increased preference for natural and herbal health products, particularly in urban regions. Additionally, France’s food and beverage industry plays a significant role by integrating natural herbal ingredients into functional foods.

The elecampane root industry in Japan is estimated to grow at a CAGR of 4.6% from 2025 to 2035. The country's deep-rooted tradition in herbal medicine fuels demand for natural remedies such as elecampane root. With an aging population, there is rising interest in health supplements targeting respiratory and digestive health.

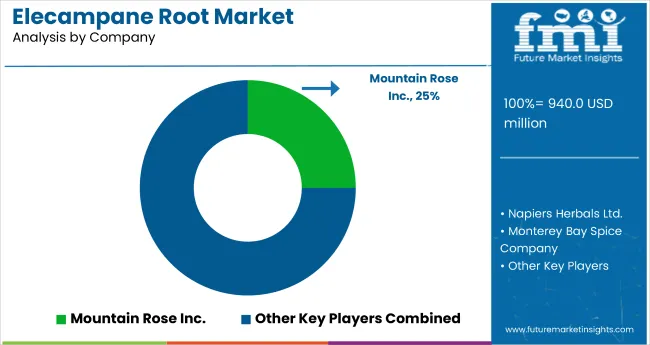

The market is moderately fragmented, with key players such as Mountain Rose Inc., Napiers Herbals Ltd., Monterey Bay Spice Company, Starwest Botanicals Inc., Organic Herb Trading Co., and Furnace Creek Farm leading the competition. These companies have established themselves as prominent suppliers of organic and high-quality herbal products.

They compete based on product innovation, sourcing sustainability, and the ability to provide a broad range of organic, natural, and medicinal herbs. Price competition is also a critical factor, with companies focusing on cost-effective sourcing and efficient supply chain management to offer competitive pricing.

Top companies are strategically positioning themselves by forming partnerships with retail and e-commerce platforms to expand their market reach. Additionally, they are investing in R&D to create new product forms and improve formulations, especially focusing on meeting the growing demand for clean-label and organic products. Expansion into emerging markets, particularly in Europe and North America, and increasing online sales through established platforms, further strengthen their competitive positions.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 940 million |

| Projected Market Size (2035) | USD 1,590.5 million |

| CAGR (2025 to 2035) | 5.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD millions/Volume in kilotons |

| By Nature | Organic, Conventional |

| By Form | Cut-Form, Powdered, Liquid |

| By End Use | Beverages (Non-Alcoholic, Alcoholic), Foodservice/HoReCa, Pharmaceuticals, Nutraceuticals, Animal Supplement, Personal Care & Cosmetics, Household/Retail |

| By Distribution Channel | B2B/Direct, B2C/Indirect, Supermarket/Hypermarket, Specialty Stores, Drug Stores, Online Retailers |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Mountain Rose Inc., Napiers Herbals Ltd., Monterey Bay Spice Company, Starwest Botanicals Inc., Organic Herb Trading Co., Furnace Creek Farm |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The global elecampane root market is estimated to be valued at USD 940.0 million in 2025.

The market size for the elecampane root market is projected to reach USD 1,590.5 million by 2035.

The elecampane root market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in elecampane root market are organic and conventional.

In terms of form, cut-form segment to command 46.8% share in the elecampane root market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Root Beer Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Beetroot Powder Market Size and Share Forecast Outlook 2025 to 2035

Beetroot Molasses Market

Analysis and Growth Projections for Arrowroot Starch Market

Ginseng Root Extracts Skincare Market Size and Share Forecast Outlook 2025 to 2035

Chicory Roots Market

Licorice Root Market Analysis by Product form, End use, and Region Through 2035

Key Companies & Market Share in the Licorice Root Sector

Astragalus Root Extract Market Size and Share Forecast Outlook 2025 to 2035

UK Licorice Root Market Insights – Trends, Demand & Growth 2025-2035

Marshmallow Root Extract Market

USA Licorice Root Market Growth – Trends, Demand & Innovations 2025-2035

ASEAN Licorice Root Market Trends – Demand, Growth & Innovations 2025-2035

Europe Licorice Root Market Analysis – Size, Growth & Forecast 2025-2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

Australia Licorice Root Market Report – Growth, Demand & Forecast 2025-2035

Latin America Licorice Root Market Outlook – Size, Share & Industry Trends 2025-2035

Curcuma Longa (Turmeric) Root Extract Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA