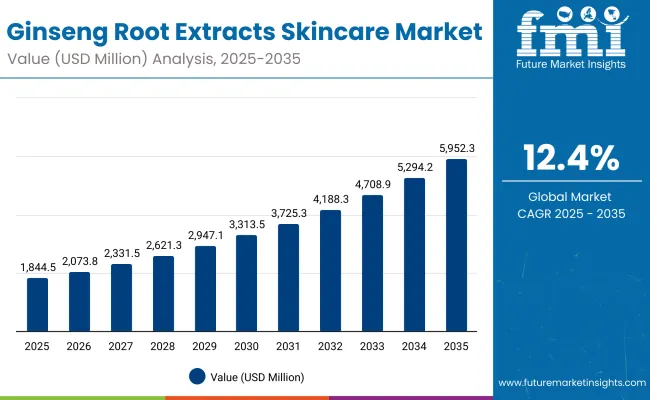

The global ginseng root extracts skincare market is expected to record a valuation of USD 1,844.5 million in 2025 and USD 5,952.3 million in 2035, with an increase of USD 4,107.8 million, which equals a growth of nearly 223% over the decade. The overall expansion represents a CAGR of 12.4% and a 3.2X increase in market size.

| Metric | Value |

|---|---|

| Global Ginseng Root Extracts Skincare Market Estimated Value in (2025E) | USD 1,844.5 million |

| Global Ginseng Root Extracts Skincare Market Forecast Value in (2035F) | USD 5,952.3 million |

| Forecast CAGR (2025 to 2035) | 12.4% |

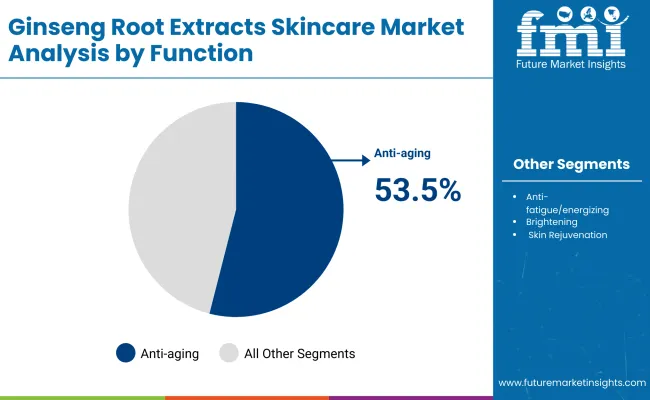

During the first five-year period from 2025 to 2030, the market increases from USD 1,844.5 million to USD 3,313.5 million, adding USD 1,469.0 million, which accounts for 36% of the total decade growth. This phase records steady adoption of ginseng-based formulations across anti-aging serums, brightening creams, and skin rejuvenation masks, driven by the need for natural botanical actives. Anti-aging products dominate this period as they cater to over 53% of skincare applications, reflecting ginseng’s proven role in collagen stimulation and wrinkle reduction.

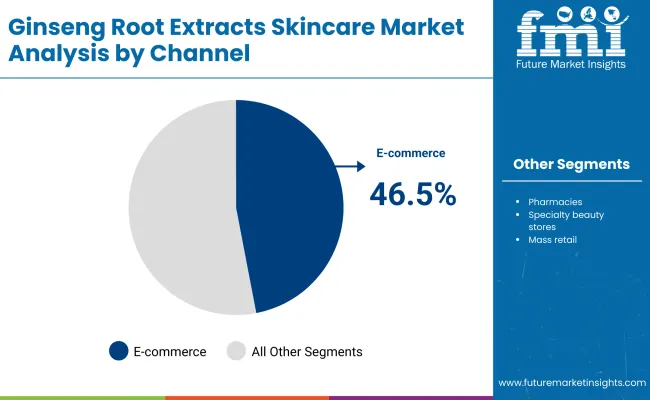

The second half from 2030 to 2035 contributes USD 2,638.8 million, equal to 64% of total growth, as the market jumps from USD 3,313.5 million to USD 5,952.3 million. This acceleration is powered by widespread deployment of clean-label, vegan-certified, and dermatologist-tested skincare lines enriched with ginseng. E-commerce and specialty retail expand significantly, capturing larger channel share by the end of the decade. Software-like enablers in beauty tech, such as AI skin analyzers recommending ginseng products, add recurring value streams, increasing the digital sales share beyond 46% in total value.

From 2020 to 2024, the global ginseng root extracts skincare market grew from an estimated USD 1,120 million to USD 1,740 million, driven by anti-aging and herbal/natural-centric adoption. During this period, the competitive landscape was dominated by Asian beauty brands controlling nearly 65% of revenue, with leaders such as Sulwhasoo, Amorepacific, and Shiseido focusing on premium ginseng serums and creams. Competitive differentiation relied on natural sourcing, K-beauty heritage, and luxury positioning, while dermatologist-tested claims were often bundled as secondary rather than primary value propositions. Vegan and clean-label formats had minimal traction, contributing less than 15% of the total market value.

Demand for ginseng skincare will expand to USD 1,844.5 million in 2025, and the revenue mix will shift as vegan, clean-label, and e-commerce-driven formats grow to over 50% share. Traditional leaders face rising competition from digital-first beauty brands offering AI-powered personalization, subscription-based refills, and eco-conscious ginseng formulations. Major brands are pivoting to hybrid models, integrating beauty tech with herbal actives to retain relevance. Emerging entrants specializing in vegan certification, sustainability, and wellness-driven positioning are gaining share. The competitive advantage is moving away from traditional herbal branding alone to ecosystem strength, omni-channel reach, and digital consumer engagement.

Advances in herbal formulation science have improved efficacy and stability of ginseng extracts, allowing for more potent anti-aging and rejuvenating benefits across diverse skincare applications. Anti-aging has gained popularity due to its suitability for addressing wrinkles, fine lines, and dullness, supported by clinical evidence of ginseng’s collagen-boosting properties. The rise of herbal and natural claims has contributed to enhanced consumer trust and premium positioning in global skincare. Industries such as luxury beauty, derma-cosmetics, and mass retail skincare are driving demand for ginseng-based products that can integrate seamlessly into daily beauty routines.

Expansion of clean-label beauty and wellness-driven formulations has fueled market growth. Innovations in serums, masks, and AI-personalized beauty devices recommending ginseng products are expected to open new application areas. Segment growth is expected to be led by anti-aging function, serums in product type, herbal/natural in claims, and e-commerce in channels due to their precision positioning, consumer trust, and adaptability across regions.

The market is segmented by function, product type, channel, claim, and region. Functions include anti-aging, brightening, anti-fatigue/energizing, and skin rejuvenation, highlighting the core benefits driving adoption. Product type classification covers serums, creams/lotions, masks, and toners to cater to different skincare regimes. Based on channel, the segmentation includes e-commerce, pharmacies, specialty beauty stores, and mass retail. In terms of claims, categories encompass herbal/natural, clean-label, vegan, and dermatologist-tested. Regionally, the scope spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

| Function Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging | 53.5% |

| Others | 46.5% |

The anti-aging segment is projected to contribute 53.5% of the global ginseng root extracts skincare market revenue in 2025, maintaining its lead as the dominant function category. This is driven by ongoing demand for ginseng’s proven anti-aging properties such as wrinkle reduction, enhanced elasticity, and improved skin tone. Anti-aging investments are prioritized by consumers seeking high-efficacy formulations in serums and creams that deliver visible results.

The segment’s growth is also supported by the integration of ginseng with other antioxidants such as vitamin C and hyaluronic acid, which enhance synergy. As premium and luxury skincare continue to expand in Asia, the USA, and Europe, the anti-aging segment is expected to retain its position as the backbone of ginseng skincare demand.

| Channel Segment | Market Value Share, 2025 |

|---|---|

| E-commerce | 46.5% |

| Others | 53.5% |

The e-commerce segment, valued at USD 837.5 million in 2025, is projected to account for 46.5% of the global ginseng root extracts skincare market, positioning it as one of the fastest-growing distribution channels. Its strong performance is attributed to the rising penetration of cross-border e-commerce platforms such as Tmall Global, JD.com, Amazon, and Shopee, which have made ginseng-based serums, masks, and creams widely accessible across both developed and emerging markets. Social media marketing and live-stream shopping events in China and Southeast Asia are particularly effective in boosting sales of ginseng skincare, often creating viral demand during seasonal campaigns.

Consumer preference for personalized shopping experiences online has also been a catalyst. Beauty-tech apps that recommend skincare routines featuring ginseng serums or rejuvenating creams are increasing conversion rates. Subscription-based D2C (direct-to-consumer) models offering monthly ginseng skincare boxes further accelerate digital adoption, particularly among millennials and Gen Z consumers. While offline channels such as specialty beauty stores and pharmacies still lead slightly with 53.5% share (USD 986.3 million), the e-commerce segment’s agility, promotional campaigns, and global reach make it a core driver of future growth, with its share expected to surpass offline channels by the early 2030s.

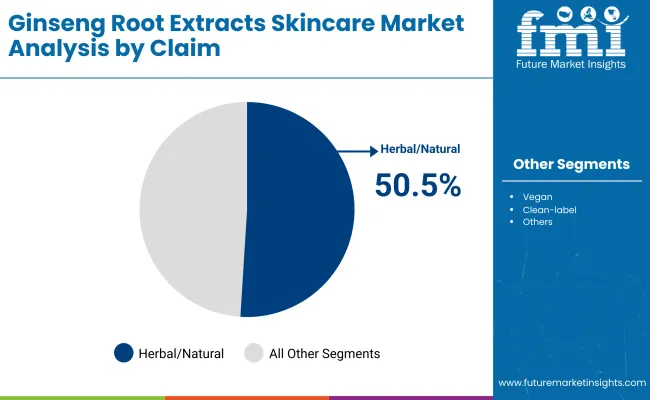

| Claim Segment | Market Value Share, 2025 |

|---|---|

| Herbal/Natural | 50.5% |

| Others | 49.5% |

The herbal/natural claim segment is projected to account for 50.5% of the global ginseng root extracts skincare market revenue in 2025, establishing it as the leading claim type. This category is preferred for its ability to align with consumer trust in botanical skincare, tapping into rising demand for clean beauty.

Its suitability for both luxury and mass-market products, along with its strong presence in Asia-Pacific markets like China, South Korea, and Japan, has made it dominant. Developments in sustainable sourcing and eco-friendly packaging further boost the natural positioning of ginseng products. Given its balance of authenticity and modern consumer demand, herbal/natural claims are expected to maintain their leading role in the global ginseng skincare market.

Rising Clinical Validation of Ginsenosides in Dermatology

One of the strongest drivers in the global ginseng root extracts skincare market is the growing body of clinical studies validating ginsenosides (the active compounds in ginseng) for skincare benefits. Unlike many botanical extracts that rely heavily on traditional knowledge or anecdotal benefits, ginseng has increasingly been backed by peer-reviewed studies showing measurable improvements in skin elasticity, wrinkle reduction, hydration, and brightening. Dermatology clinics in Asia, particularly in South Korea and China, have begun incorporating ginseng extracts into cosmeceutical formulations prescribed alongside standard anti-aging regimens. This clinical credibility has elevated ginseng from a heritage herb into a scientifically endorsed ingredient, positioning it favorably against competitors like retinol or peptides. The result is stronger adoption in both premium skincare brands and dermatologist-tested claims, driving demand globally.

PremiumizationThrough K-Beauty and East Asian Heritage Branding

The second major driver is the premiumization of ginseng-based skincare, propelled by K-beauty exports and East Asian heritage branding. Brands like Sulwhasoo and Amorepacific have successfully marketed ginseng as a luxury anti-aging solution that blends traditional wisdom with modern science. This has created aspirational demand in Western markets such as the USA and Europe, where consumers associate ginseng with holistic wellness and authenticity. Furthermore, in China, ginseng skincare products are perceived as not only beauty enhancers but also cultural extensions of Traditional Chinese Medicine (TCM). This dual appeal luxury in the West and cultural trust in Asia is a unique driver that sustains higher price points, repeat purchases, and consumer loyalty.

High Cost of Extraction and Standardization

A key restraint is the high cost associated with extracting and standardizing ginseng root extracts. Unlike synthetic actives, ginseng requires complex processing to ensure consistent concentration of ginsenosides. This leads to variability in product efficacy, which in turn affects brand reputation if results are inconsistent. The costs of cultivation, aging (many brands highlight “6-year-old red ginseng”), and sustainable farming practices add to the expense. Smaller brands often struggle to compete with large players that control vertical integration of sourcing and extraction. This price barrier restricts penetration in mass retail channels, making ginseng skincare more concentrated in premium and specialty categories, and limiting adoption among price-sensitive consumers.

Regulatory and Labeling Challenges in Western Markets

Another restraint lies in the regulatory complexity of positioning ginseng skincare products in Western markets. In the USA and EU, botanical actives often fall into a grey area between cosmetic claims and therapeutic claims. This forces brands to either understate potential benefits (reducing marketing appeal) or risk scrutiny from regulatory agencies. For example, anti-fatigue or energizing claims based on herbal positioning are often challenged unless supported by robust data. In addition, “herbal/natural” and “clean-label” claims are under increasing regulatory oversight to prevent greenwashing. These hurdles slow down market entry and innovation pipelines in North America and Europe compared to Asia-Pacific, where herbal cosmetics enjoy cultural and regulatory acceptance.

Integration of Ginseng Extracts with Next-Gen Delivery Systems

A major trend shaping the market is the integration of ginseng root extracts with advanced delivery technologies, such as liposomal encapsulation, nanoemulsions, and hydrogel masks. These systems enhance the bioavailability of ginsenosides, ensuring deeper skin penetration and longer-lasting effects. Brands are moving beyond traditional creams and serums to 3D-printed masks, AI-personalized patches, and bio-cellulose sheets infused with ginseng. This innovation is particularly strong in Asia-Pacific and is increasingly being adopted in premium USA and European product lines. The trend positions ginseng not just as a heritage ingredient but as a tech-enabled active, bridging tradition and biotechnology.

E-commerce Acceleration Through Storytelling and Cross-Border Platforms

The second trend is the explosive growth of ginseng skincare sales via e-commerce and cross-border retail platforms. Digital-native consumers are drawn to the storytelling aspect luxury brands narrate centuries-old ginseng heritage while digital-first startups emphasize vegan, sustainable sourcing. Platforms like Tmall (China), Amazon (USA), and Shopee (Southeast Asia) have become critical in educating consumers and scaling niche ginseng brands globally. Live-stream shopping, social commerce, and influencer-led campaigns are amplifying ginseng’s reach. This trend ensures that even niche claims such as “energizing/anti-fatigue” or “dermatologist-tested” gain traction through direct-to-consumer online strategies, reinforcing e-commerce as the fastest growing channel in the ginseng skincare ecosystem.

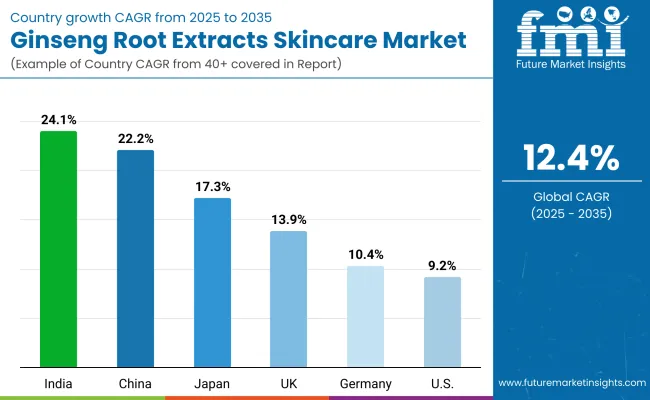

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 22.2% |

| USA | 9.2% |

| India | 24.1% |

| UK | 13.9% |

| Germany | 10.4% |

| Japan | 17.3% |

The country-wise growth outlook for the global ginseng root extracts skincare market (2025 to 2035) highlights strong regional disparities shaped by cultural preferences, consumer spending power, and adoption of herbal actives. India (24.1% CAGR) and China (22.2% CAGR) are projected to record the fastest growth, fueled by a deep-rooted cultural association with herbal medicine and rapid consumer upgrading to premium skincare formats. In China, ginseng is strongly linked to Traditional Chinese Medicine (TCM), which drives both domestic demand and premium positioning across e-commerce platforms. Meanwhile, India’s young consumer base and preference for natural, ayurvedic-inspired beauty products are creating fertile ground for ginseng adoption, especially within serums and brightening creams that align with local skincare routines. Both markets benefit from rising disposable incomes, expanding online retail, and the growing influence of K-beauty, which positions ginseng as both authentic and aspirational.

Mature markets such as the USA (9.2% CAGR), Germany (10.4% CAGR), and the UK (13.9% CAGR) will grow at slower yet steady rates, driven primarily by anti-aging and dermatologist-tested claims. In these regions, ginseng is perceived less as a cultural herb and more as a scientifically validated premium ingredient, making it attractive in luxury and clean-label formulations. The USA market remains the largest in terms of absolute size, but its CAGR reflects saturation and competitive overlap with other actives like retinol, niacinamide, and peptides. In contrast, Japan (17.3% CAGR) shows a unique dual growth path, combining local demand for traditional herbal actives with a highly sophisticated skincare culture focused on innovation, layering, and hybrid formats like essences and toners. Collectively, these differences illustrate how Asia-Pacific (China, India, Japan) will lead the acceleration of ginseng skincare globally, while North America and Europe will maintain steady but more selective adoption patterns.

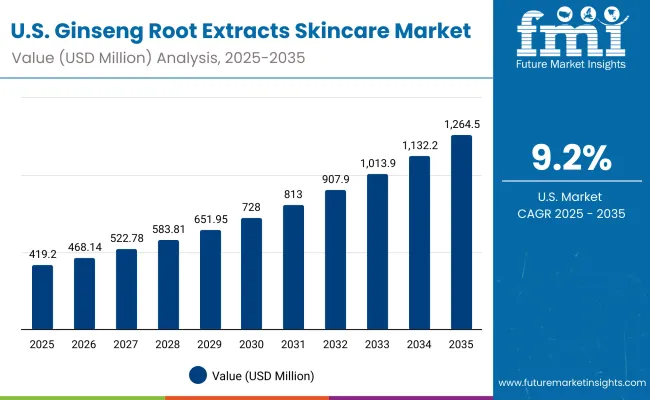

| Year | USA Ginseng Root Extracts Skincare Market (USD Million) |

|---|---|

| 2025 | 419.2 |

| 2026 | 468.1 |

| 2027 | 522.8 |

| 2028 | 583.8 |

| 2029 | 652.0 |

| 2030 | 728.1 |

| 2031 | 813.0 |

| 2032 | 907.9 |

| 2033 | 1,013.9 |

| 2034 | 1,132.3 |

| 2035 | 1,264.5 |

The global ginseng root extracts skincare market in the United States is projected to grow at a CAGR of 9.2%, led by strong consumer adoption of anti-aging and dermatologist-tested claims. Premium serums and creams dominate demand, with USA consumers willing to pay higher prices for clinically validated results. E-commerce platforms and specialty retailers are key growth drivers, as clean-label and vegan-certified ginseng lines appeal to wellness-oriented buyers. Dermatology clinics and medical spas are also integrating ginseng formulations into cosmeceutical treatments, reinforcing credibility. Rising awareness of botanical actives, supported by digital campaigns from K-beauty brands, is boosting penetration across both luxury and mass markets.

The global ginseng root extracts skincare market in the United Kingdom is expected to grow at a CAGR of 13.9%, supported by clean-label positioning, heritage-inspired branding, and luxury skincare uptake. British consumers are increasingly adopting premium ginseng serums and masks, marketed as natural yet scientifically advanced solutions. The luxury beauty retail landscape, including department stores and boutique skincare chains, has fueled visibility for Asian-origin brands. Meanwhile, heritage-inspired botanical positioning resonates with eco-conscious buyers, aligning with UK consumer preference for sustainable and transparent skincare. Digital marketing campaigns, especially influencer-led narratives emphasizing rejuvenation and brightening, are accelerating market growth.

India is witnessing rapid growth in the global ginseng root extracts skincare market, which is forecast to expand at a CAGR of 24.1% through 2035. Rising awareness of K-beauty-inspired regimens and ayurvedic alignment of ginseng as a botanical active are key drivers. Indian millennials and Gen Z consumers are driving demand for brightening and rejuvenating claims, supported by growing social media influence and e-commerce penetration. Local skincare brands are beginning to blend ginseng with ayurvedic and herbal actives, positioning it as both global and culturally relatable. Adoption in tier-2 and tier-3 cities is expanding as affordability improves, aided by D2C beauty startups and online-first distribution.

The global ginseng root extracts skincare market in China is expected to grow at a CAGR of 22.2%, the second highest among leading economies after India. This momentum is driven by cultural association with Traditional Chinese Medicine (TCM), where ginseng is perceived as both a medicinal herb and a premium beauty active. The luxury segment is dominated by Amorepacific and Sulwhasoo, which position ginseng as a prestige anti-aging ingredient. At the same time, mass-market adoption is expanding through cross-border e-commerce platforms like Tmall and JD.com, making ginseng products accessible to younger consumers. Affordable ginseng masks and toners are gaining traction, while premium anti-aging serums remain aspirational.

| Countries | 2025 Share (%) |

|---|---|

| USA | 22.7% |

| China | 12.1% |

| Japan | 7.1% |

| Germany | 15.7% |

| UK | 8.6% |

| India | 5.4% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 21.2% |

| China | 13.2% |

| Japan | 10.1% |

| Germany | 13.7% |

| UK | 7.4% |

| India | 6.1% |

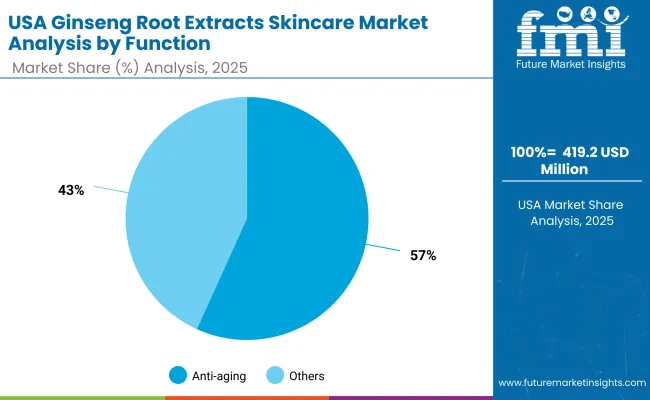

| Function Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging | 56.8% |

| Others | 43.2% |

The global ginseng root extracts skincare market in the United States is valued at USD 419.2 million in 2025, with anti-aging leading at 56.8%, followed by other functions at 43.2%. The dominance of anti-aging products is a direct outcome of the USA consumer base prioritizing visible skin health benefits such as wrinkle reduction, elasticity restoration, and collagen stimulation. This segment thrives particularly in serums and creams, where consumers expect high efficacy supported by dermatologist-tested claims.

Portability in packaging, personalization through AI-driven beauty apps, and clinical-grade branding further enhance adoption, allowing ginseng-based anti-aging products to penetrate both luxury beauty chains and online channels. This advantage positions anti-aging as an essential category in premium skincare routines across urban markets. Other function categories like brightening and rejuvenation remain smaller, though they are gaining traction among younger demographics. With an increasing focus on wellness and clean-label claims, AI-personalized beauty routines integrated with ginseng extracts are expected to expand adoption in the next decade.

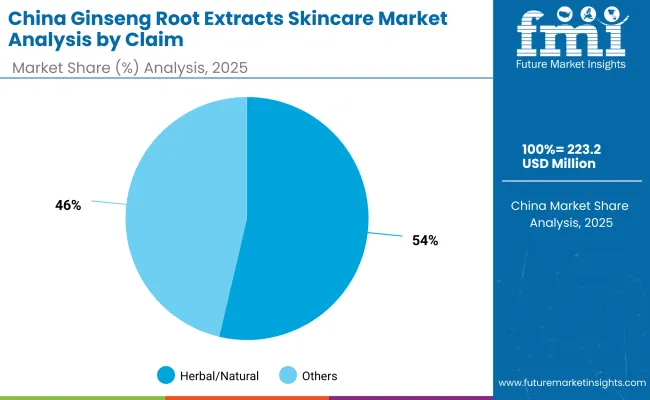

| Claim Segment | Market Value Share, 2025 |

|---|---|

| Herbal/Natural | 53.7% |

| Others | 46.3% |

The global ginseng root extracts skincare market in China is valued at USD 223.2 million in 2025 (based on 12.1% global share), with herbal/natural claims leading at 53.7%, followed by others at 46.3%. The dominance of herbal/natural positioning is a direct outcome of China’s deep cultural connection to Traditional Chinese Medicine (TCM), where ginseng is regarded as both a health and beauty enhancer. Consumers trust ginseng-infused products due to centuries-old familiarity, making them particularly receptive to herbal-branded skincare lines.

Cross-border e-commerce platforms such as Tmall Global and JD.com have amplified availability of both premium K-beauty ginseng brands (e.g., Sulwhasoo, Amorepacific) and local entrants. Younger demographics are adopting ginseng sheet masks, brightening toners, and rejuvenating creams marketed as daily-use herbal essentials. The affordability of mass-market offerings combined with premium anti-aging luxury lines creates a dual growth path across consumer segments. With digital storytelling, influencer-driven campaigns, and heritage-based narratives, herbal/natural positioning is expected to dominate China’s ginseng skincare market through 2035.

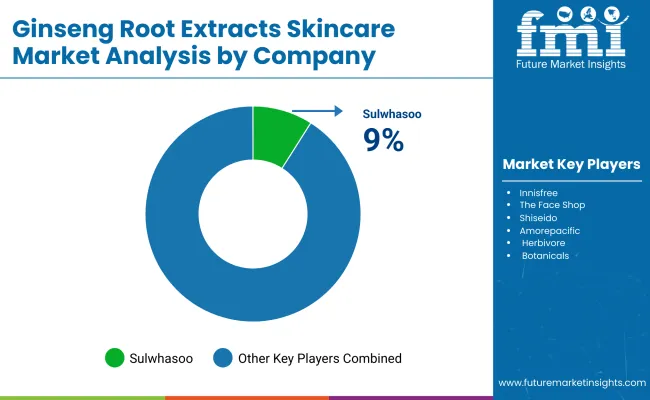

| Company | Global Value Share 2025 |

|---|---|

| Sulwhasoo | 9.0% |

| Others | 91.0% |

The global ginseng root extracts skincare market is moderately fragmented, with K-beauty giants, multinational conglomerates, and niche botanical specialists competing across diverse application areas. Global leaders such as Sulwhasoo, Amorepacific, and Shiseido hold significant share, driven by their premium positioning, luxury branding, and integration of ginseng into anti-aging lines. Their strategies emphasize luxury heritage storytelling, cross-border e-commerce penetration, and dermatologist-tested claims targeting high-income consumers.

Established multinational players like Estée Lauder, Origins, and Dr. Jart+ are focusing on hybrid clean-label and clinical positioning, expanding ginseng’s appeal beyond Asia into North America and Europe. These companies leverage strong distribution in specialty beauty stores, pharmacies, and online platforms, ensuring both mass visibility and premium presence.

Specialized botanical brands such as Herbivore Botanicals, Belif, and The Face Shop focus on natural, vegan, and sustainable skincare narratives, making them relevant for younger demographics that prioritize clean-label beauty. Their strength lies in customization, niche digital marketing, and regional adaptability rather than scale. Competitive differentiation is shifting away from ginseng as a single hero ingredient toward ecosystem-driven skincare solutions, where brands integrate ginseng with other actives (vitamin C, niacinamide, hyaluronic acid) and deliver via advanced formats like serums, sheet masks, and AI-personalized routines. Subscription-based D2C sales, influencer-led campaigns, and eco-conscious packaging are increasingly central to competitive positioning.

Key Developments in Global Ginseng Root Extracts Skincare Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,844.5 million |

| Function | Anti-aging, Brightening, Anti-fatigue/energizing, and Skin rejuvenation |

| Product Type | Serums, Creams/lotions, Masks, and Toners |

| Channel | E-commerce, Pharmacies, Specialty beauty stores, and Mass retail |

| Claim | Herbal/natural, Vegan, Dermatologist-tested, and Clean-label |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sulwhasoo, Innisfree, The Face Shop, Shiseido, Amorepacific, Herbivore Botanicals, Origins, Estée Lauder, Dr. Jart +, and Belif |

| Additional Attributes | Dollar sales by function, product type, and channel, adoption trends in anti-aging and brightening skincare, rising demand for herbal/natural, vegan, and dermatologist-tested claims, segment-specific growth in serums and e-commerce, integration of ginseng with complementary actives (vitamin C, niacinamide, hyaluronic acid), regional trends influenced by K-beauty and clean-label/TCM movements, and innovations in sustainably sourced and biotech-cultured ginseng cell extracts. |

The Global Ginseng Root Extracts Skincare Market is estimated to be valued at USD 1,844.5 million in 2025.

The market size for the Global Ginseng Root Extracts Skincare Market is projected to reach USD 5,952.3 million by 2035.

The Global Ginseng Root Extracts Skincare Market is expected to grow at a 12.4% CAGR between 2025 and 2035.

The key product types in the Global Ginseng Root Extracts Skincare Market are serums, creams/lotions, masks, and toners.

In terms of function, the anti-aging segment is projected to command 53.5% share in the Global Ginseng Root Extracts Skincare Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ginseng Extract Skin Revitalizers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ginseng Market Analysis - Size, Share, and Forecast 2025 to 2035

Ginseng Extracts Market Analysis by Product Type, Form and Application Through 2035

Root Beer Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Beetroot Powder Market Size and Share Forecast Outlook 2025 to 2035

Beetroot Molasses Market

Analysis and Growth Projections for Arrowroot Starch Market

Chicory Roots Market

Licorice Root Market Analysis by Product form, End use, and Region Through 2035

Key Companies & Market Share in the Licorice Root Sector

Elecampane Root Market Size and Share Forecast Outlook 2025 to 2035

Astragalus Root Extract Market Size and Share Forecast Outlook 2025 to 2035

UK Licorice Root Market Insights – Trends, Demand & Growth 2025-2035

Marshmallow Root Extract Market

USA Licorice Root Market Growth – Trends, Demand & Innovations 2025-2035

ASEAN Licorice Root Market Trends – Demand, Growth & Innovations 2025-2035

Europe Licorice Root Market Analysis – Size, Growth & Forecast 2025-2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

Australia Licorice Root Market Report – Growth, Demand & Forecast 2025-2035

Latin America Licorice Root Market Outlook – Size, Share & Industry Trends 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA