The worldwide beer bottling kit market experienced stable growth, supported by growing homebrewing and an increasing craft beer culture. As a result, there’s been more and more emphasis on personal brewing, especially from the millennial and Gen Z consumer segment, which has culminated in increased demand for DIY bottlers.

In 2024, E-commerce platforms and the likes were the spearhead in existing industry expansion and making the kits more available at different corners of the world. Moreover, sustainability has become an important consideration, manufacturers started to develop more eco-friendly packaging, and efficient bottling methods that aim to appeal to environmentally conscious consumers.

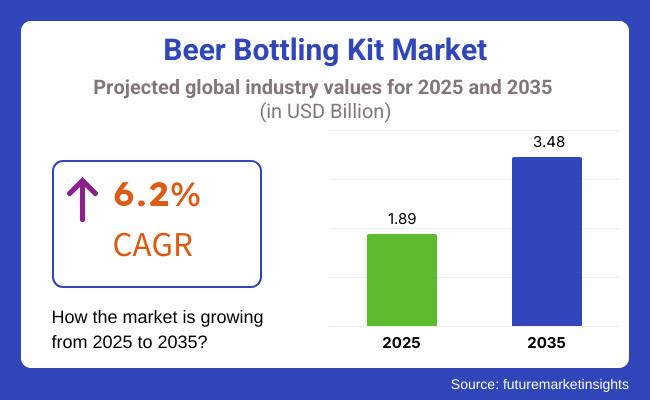

The trend is expected to continue towards an upward segment as we look towards 2025 and beyond with an approximate market of USD 1.89 billion in 2025 and approximately USD 3.48 billion by the year 2035 at a CAGR of 6.2%. The innovation of automated process and smart bottling technologies are expected to maximize the convenience and efficiency of consumers, hence attracting more potential consumers.

We will see an even more push for sustainable and biodegradable materials in line with the world’s environmental goals. However, since rising disposable incomes and derailing demand for artisanal and homebrewed beverages, are set to drive strong growth in the beer bottling kit sector over the long term, especially with rising investments in product development and distribution channels.

In addition, alliances between craft breweries and bottling kit companies are predicted to open up new avenues of growth. Lots of breweries are developing lines of homebrew-friendly products that encourage consumers to make their favourite flavors at home.

Beer bottling kits being made available for subscription are also on the rise, providing consumers with a convenient option for regular deliveries of brewing supplies. Furthermore, technological developments, like automatic filling systems and precision chrome tools, are streamlining residence brewing and attracting newcomers. Social media and online brewing communities are likely contributing to industry growth, as enthusiasts share recipes, techniques, and product recommendations.

Future Market Insights (FMI) adopted a multi-faceted approach for analyzing the beer bottling kit segment that involved a comprehensive survey of key stakeholders, such as manufacturers, suppliers, and brewery operators. It sought out what drives, challenges, and awaits the industry. The key highlight is the growing need for automated bottling solutions.

Automation improves efficiency and minimizes contamination risk while guaranteeing the uniformity of product quality in beer bottling processes. According to stakeholders, resulting in a higher adoption rate for automated beer bottling kits.

The survey also revealed increasing consumer interest in craft beers with unusual flavors. This trend has led to breweries diversifying their offerings, which requires flexible bottling solutions that can accommodate different beer types and packaging styles. So adaptability equipment is required to cope with this developing necessity, said the stakeholders.

The survey disclosed a significant trend towards sustainability among consumers and producers alike. There is a rising interest in green bottling techniques, for instance, in recyclable and energy-efficient equipment. Reflecting these environmental issues, stakeholders acknowledged, is not only socially ethical but also enhances reputation and garners environmentally friendly customers.

| Countries | Regulation Details |

|---|---|

| Germany | Implements container-deposit legislation covering plastic, aluminum, and glass containers for beverages like water, beer, and soft drinks. Exclusions apply to containers for milk products, wine, spirits, and certain dietary drinks. Sizes below 100 mL and above 3 L are also excluded. |

| United States | Several states have container-deposit laws (bottle bills) requiring deposits on beverage containers to promote recycling. The specifics vary by state, including the deposit amount and types of containers covered. |

| Australia | Enforces container-deposit schemes where consumers pay a deposit on beverage containers, refundable upon return, aiming to reduce litter and promote recycling. |

| Norway | Operates a deposit-return system for beverage containers, achieving high recycling rates through efficient collection and processing infrastructure. |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Steady growth (~6.2% CAGR) driven by craft beer and homebrewing trends. | Continued ~6.2-6.3% CAGR fueled by automation and premiumization. |

| COVID-19 lockdowns led to a surge in homebrewing and DIY bottling kits. | Growing demand for convenience with a shift towards automation. |

| Manual and semi-automatic kits dominated, with slow automation adoption. | Smart and automated bottling kits with IoT integration will gain traction. |

| Initial push for sustainability, but adoption remained slow. | Eco-friendly materials, recyclability and energy-efficient solutions will dominate. |

| North America & Europe led the industry; Asia-Pacific showed emerging interest. | Asia-Pacific will grow rapidly due to rising disposable incomes and craft beer culture. |

| Recycling & packaging regulations started influencing manufacturing practices. | Stricter environmental laws will drive innovation in eco-friendly bottling solutions. |

| E-commerce expanded as the key sales channel, making kits more accessible. | Online sales remain strong, with physical retail expanding in emerging sectors. |

| Product differentiation was the focus; new players entered the industry. | Investments in automation, sustainability, and premium kits will increase. |

The segment is also divided into rinsers, cappers, and fillers as per different types of beer bottling kit. Fillers account for a majority of these since they are crucial to allowing the beer flow consistently and right at the point of filling. The need for advanced filling systems like automated and precision-controlled fillers is growing as breweries try to reduce waste and enhance efficiency.

Cappers are also seeing remarkable growth since proper sealing is essential to retain beer quality and shelf life. Rinsers represent a smaller share, however, they are a requirement that contributes to hygiene and the prevention of contamination in both commercial and home-based setups.

The commercial breweries are the major segment in the beer bottling kit market owing to the increasing number of microbreweries and large-scale production plants for beer. Breweries are implementing automated and high-capacity bottling solutions in addition as the demand of craft and specialty beers increases.

In contrast, the home-based segment of the Brewery industry is experiencing consistent growth, supported by rising preferences for customized brewing experiences and DIY culture. The homebrewers are increasingly opting for compact and user-friendly bottling kits, especially through online channels, this in turn is driving growth of this segment.

The high efficiency, consistency, and capability of running large production volumes with minimal human effort drives the sector for automatic bottling kits. These systems are increasingly adopted by commercial breweries looking to optimize production speed and minimize labor costs.

Manually operated bottling kits are still relevant, of course, primarily to homebrewers and other small-scale homebrewers that would prefer easy to find parts over an automated bottling kit. Yet, as technology progresses, and automation becomes a cheaper alternative, even more petite to mid-sized breweries are slowly leaning toward semi-automatic or fully automated solutions.

The online distribution channel has established itself as the fastest growing segment, providing convenience, a larger variety of product options, and competitive pricing. Bottling kits are easily accessible through e-commerce platforms, and these products are also very affordable, boasting a dedicated user base consisting of homebrewers and small businesses.

The offline channel, including specialty brewing stores and industrial suppliers which is especially relevant for commercial breweries that need custom or bulk orders, remain important. But even as in-person shopping continues as a huge driver of sales, experts agree that future purchases are where online platforms will reign supreme as digital usage climbs and direct-to-consumer business models gain traction.

The USA leads the beer bottling kit market due to its strong craft beer scene and homebrewing culture. Its diverse population has given rise to strong sectors for both commercial and home breweries. As microbreweries and brewpubs proliferate across the country, the need for additional bottling devices especially more sophisticated systems that automate the process for greater efficiency and consistency has also grown.

Homebrews are gradually generating big sales in the United States, and the local homebrewing community has exploded as beer enthusiasts look for quality manual bottling kits. The ease at which these kits are advertised through digital platform has also impelled the growth, as consumers have access to diverse products available over online stores. On the whole, the USA beer sector is dominated by innovation and premiumization.

New to the UK market, two breweries come highly recommended in the classic British setting where old meets new in a brew. A rise in demand for smaller brewing equipment has resulted from the rising popularity of craft beers, particularly in terms of bottling kits designed for microbreweries.

With a rising demand for local, artisanal beers amongst UK consumers, many breweries are upgrading to bottling equipment that can provide the authenticity and quality that they desire in the black stuff, while quality bottling equipment is redefining the ‘honesty’ of the product.

The homebrewing segment is also significant, as hobbyists look for reliable and user-friendly bottling kits. There is a large and established distribution channel for both online and offline, offering purchasing choices for consumers. The UK segment stands somewhere between historical brewing tradition and modern fashion.

France has seen the development of a beer bottling kit market alongside its own wine industry. This growth of craft breweries, introduced consumers to new types of beer requiring specialized bottling equipment. This new taste landscape has led French breweries, both large and small, to invest in bottling solutions that preserve product quality, while adapting to the changing tastes of consumers.

Driven by a growing interest in homebrewing in Greece, which, although smaller than other European countries, is on the rise, the industry for good bottling kits is on the rise. And with a combination of online and 'brick-and-mortar' retailers selling equipment, the sector is accessible to a wide range of consumers. France’s sector is one where beer diversity and quality production are getting a better seat at the table.

Germany with one of the highest rates of beer consumption in the world has a very strong beer culture that has evolved over centuries. Germany is expected to account for nearly 21% of the demand share in the Europe beer bottling sector. The industry for beer bottling kits is significant, supported by many breweries, from major scale ones to small craft breweries.

Precision and quality are the hallmarks of German breweries, which has created a need for advanced bottling and canning equipment that assures the same. a homebrewing scene is regulated but strong, and people are looking for high-quality bottling kits to recreate authentic German beer styles. Despite this, both online and offline distribution channels are solid, indicating the government attempts to protect their world-renowned beer culture.

Speaking of hops, Italy's beer industry has boomed thanks to a flourishing craft beer scene which adds flavour to what was once dominated by the industry giants and a healthy dose of competition to the country's famous wine industry. As a result of the growing number of microbreweries, request for effective bottling kits for modest production has been almost all over the world.

Italian consumers are discovering a wider range of beer styles, which has motivated breweries to acquire the gear needed to play around but without sacrificing quality. As homebrewing attracts more fans, they are looking for reliable bottling devices. Bottling kits can be found on the segment through an assortment of online platforms as well as specialist stores. The Italian segment is creative and open to new brewing frontiers.

Since then, South Korea's beer market has seen a remarkable transition, with an increasing trend towards craft beers and homebrewing. The states also have relaxed some of their regulations on microbreweries, which has driven a demand for bottling equipment that can work for small-scale runs.

Breweries are updating their bottling equipment to produce a wide variety of beer flavours as consumers become increasingly adventurous. Homebrewing clubs and homebrewing communities are appearing, with people in need of quality bottling kits to make their own beers. Online platforms are emerging as a popular distribution channel with a broad product offering. A beer revolution is underway in South Korea.

Every country has its own beer culture and styles of crafting. The increasing number of craft breweries has shaped a plethora of different beer styles and a consequent necessity for tailored bottling equipment. From small, family-run businesses to major conglomerates, Japanese breweries are investing in bottling solutions that maintain product quality while appealing to changing consumer tastes.

The homebrewing community is slowly taking shape and they're looking for quality bottling kits. The industry is sustained by a combination of online and offline retailers that make equipment available to many types of audiences. Japan’s segment is indicative of a rising demand for diversity and quality in brew.

China is home to one of the largest beer markets worldwide, with a fast-growing segment of craft beer. Bottling kits that can fill small to medium numbers of bottles have seen increasing demand as microbreweries become more frequent. Chinese consumers are branching out to different beer styles, and breweries are investing in equipment to experiment without sacrificing quality.

With homebrewing becoming more common, its fans are looking for dependable bottling options. Which includes a mix of online outlets are specialized retailers, set consumers up to create an assortment of bottling kits. It is a creative place with brewers who are willing to play with a new brewing techniques.

Beer is everything in Australia and New Zealand, with more than half of the beer brewed in a craft way. Both countries have seen this sharp increase of microbreweries, calling out for bottling lines capable of small-scale production.

Consumers continue to favour local products and artisanal beers, encouraging breweries to seek bottling systems that are true to their drinks. The home-brewing crowd is significant, with hobbyists looking for solid and easy-to-use bottling kits. Online and offline distribution channels are also widely spread.

There is stiff competition in the segment of beer bottling kits from the prominent players, including Krones AG, GEA Group, and Carlsberg Group, who are occupying large shares in the industry. Ubiquitous among bottlers are advanced technologies integrated into the machines from Krones AG, keeping commercial breweries efficient and reliable.

GEA Group, which expanded its presence through specialized process technology and components to the brewing industry, has also further strengthened its hold. In September 2024, Carlsberg Group, a name at home in beverages, made a USD 3.3 billion takeover bid for Britvic. The acquisition facilitated the release of Carlsberg Britvic in January 2025, and it grew much larger into the soft drinks industry and improved Carlsberg's global

One of the biggest deals was Carlsberg's purchase of Britvic, which enabled the brewer to broaden its beverage portfolio. Decoupled and high-speed bottling line of Krombacher Brauerei started an endeavored modernization for its bottling plant, for which it invested well over 100 million euros over six years.

The program, initiated in 2024, involved the implementation of cutting-edge sorting technology, as well as material flow optimization to improve sustainability outcomes and operational efficiency. This trend is driving technological and economic modernization and innovation, as major corporations are placing significant investments in automation, digitization, and sustainability.

The main difference among products is the level of automation involved that massive-scale automatic bottling systems are fantastic for big offering breweries, and small kits exist for home-based and bootstrap-style brewers who seek affordability.

Capacity is also a key differentiator in which high-capacity systems cater to commercial breweries, while smaller-capacity kits serve craft brewers and enthusiasts. Moreover, technological integration is a key barometer.

Systems that are capable of features like automatic cleaning, precise filling, and continuous monitoring are becoming prominent as they help the manufacturers in maximizing operational efficiency and maintaining the quality of the yield. These factors show how the industry is still innovating, with the aim of differentiating products and catering to the changing needs of breweries worldwide.

| Category | Details |

|---|---|

| Pall Corporation | 22-27%: Leader due to advanced cross-flow systems (e.g., CFS NEO), strong in North America/Europe, backed by Danaher. |

| Alfa Laval | 18-22%: Strong player with scalable spiral membrane systems, dominant in Europe, appealing to mid-sized breweries. |

| Pentair | 15-20%: Gains share with sustainable X-Flow BMF systems, popular in craft and Asia-Pacific industry. |

| SUEZ (Veolia) | 10-15%: Leverages water treatment expertise, growing in emerging industries with nanofiltration solutions. |

| Other Players | 20-25%: Includes Koch Membrane Systems, Microdyn-Nadir, Asahi Kasei; focus on niche/regional sectors. |

Several macroeconomic factors shape the beer bottling kit industry, places such as international beer intake preferences, industrial automation, supply chains for raw materials, and regulatory policies. A segment of the overall food and beverage processing equipment segments, this segment is being driven by both commercial brewing operations as well as increasing consumer interest in home brewing.

The continued need for efficient, economical, and sustainable bottling solutions is a primary growth driver. Beer consumption is highly influenced by income levels and economic stability. As a result, these factors directly impact bottling equipment demand. In places where people drink a lot of beer, breweries are always upgrading or adding bottling lines, which helps to grow.

Automation and digitalization are becoming an important part, enhancing the operational efficiency, labor cost reducing and waste reduction in the bottling process. Availability and prices of raw materials in particular, stainless steel, glass and aluminum are decisive elements determining production costs. Even supply chain disruptions or trade restrictions can cause price variations, affecting the fluctuations.

Additionally, advancements in bottling solutions are also shaped by government regulations regarding alcohol production, packaging sustainability, and safety standards. Growing demand for green practices, lightweight and recyclable materials are re-shaping equipment design and are becoming the foundation for sustainability in the segment evolution.

The beer bottling kit market is expected to see substantial growth through the forecast period because of the new technology has been added. Two big opportunities are automation and smart bottling technology, where smart IoT systems, AI-driven monitoring, and real-time analytics are becoming more common in brewing to increase efficiency and quality assurance.

Another major growth area is increasing demand for sustainable and eco-friendly packaging as governments and consumers demand biodegradable, lightweight, and recyclable materials. This trend offers great opportunities for equipment manufacturers in which the equipment manufacturers can benefit from this trend by designing the bottling kits that are in line with the environmental regulations.

There are significant opportunities in the craft beer and home brewing segments, where smaller breweries and individual brewers are seeking affordable, flexible, and compact bottling solutions. There are few companies around the world that can tap into emerging sectors, especially Asia, Africa and Latin America with their growing disposable income and beer consumption.

When companies build a strong local presence and distribution networks in these regions they can gain a competitive advantage. So manufacturers must capitalize on these opportunities by investing in R&D for smart and automated bottling solutions.

Brands should focus on developing energy-efficient equipment that is energy-efficient and water-saving to adhere to the sustainability initiatives would also boost the brand reputation. In order to reach a wider customer base, a company should grow its products and manufacture products for both large commercial brewers and smaller craft brewers. Furthermore, strong after-sales services including maintenance, training and parts provisioning could help improve customer retention and pave the way for growth in this fiercely competitive domain.

The factors driving the growth of the beer bottling kit industry include a rise in craft beer demand, increasing automation, and a growing trend toward sustainable packaging. You have to become all-around entertainer and pro shop in order to satisfy that buyer in an efficient, cost-effective and eco-friendly way.

The bottling process is being revolutionized by automation, leading to better efficiency, lower labor costs, and consistent quality. Contemporary systems integrate IoT sensors, AI-driven monitoring, and predictive maintenance, enabling breweries to maximize output while reducing waste and downtime.

For all large-scale commercial breweries or small craft breweries, modern bottling equipment is beneficial. Whereas macrobreweries tend to utilize high-speed, fully automated systems, craft brewers and homebrewers, by contrast, need space-efficient, flexible, and affordable bottling solutions that enable small crate production.

Sustainability is an increasingly important consideration as breweries turn to energy-efficient equipment, lightweight packaging, and recyclable materials. Regulators, as well as changing consumer sentiments, are pushing organizations in that direction to innovate carbon foot print neutral solutions.

Bottling kits are available in manual, semi-automatic, and full-on or fully automated models. Homebrewers and small craft breweries generally use manual systems, but automated solutions are available for commercial breweries as they can produce beer faster and more efficiently.

Table 1: Global Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 4: Global Volume (MT) Forecast by Equipment Type, 2018 to 2033

Table 5: Global Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Volume (MT) Forecast by Application, 2018 to 2033

Table 7: Global Value (US$ Million) Forecast by Mode of operation, 2018 to 2033

Table 8: Global Volume (MT) Forecast by Mode of operation, 2018 to 2033

Table 9: North America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 12: North America Volume (MT) Forecast by Equipment Type, 2018 to 2033

Table 13: North America Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Volume (MT) Forecast by Application, 2018 to 2033

Table 15: North America Value (US$ Million) Forecast by Mode of operation, 2018 to 2033

Table 16: North America Volume (MT) Forecast by Mode of operation, 2018 to 2033

Table 17: Latin America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 20: Latin America Volume (MT) Forecast by Equipment Type, 2018 to 2033

Table 21: Latin America Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Volume (MT) Forecast by Application, 2018 to 2033

Table 23: Latin America Value (US$ Million) Forecast by Mode of operation, 2018 to 2033

Table 24: Latin America Volume (MT) Forecast by Mode of operation, 2018 to 2033

Table 25: Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 28: Europe Volume (MT) Forecast by Equipment Type, 2018 to 2033

Table 29: Europe Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Europe Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Europe Value (US$ Million) Forecast by Mode of operation, 2018 to 2033

Table 32: Europe Volume (MT) Forecast by Mode of operation, 2018 to 2033

Table 33: East Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 36: East Asia Volume (MT) Forecast by Equipment Type, 2018 to 2033

Table 37: East Asia Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: East Asia Volume (MT) Forecast by Application, 2018 to 2033

Table 39: East Asia Value (US$ Million) Forecast by Mode of operation, 2018 to 2033

Table 40: East Asia Volume (MT) Forecast by Mode of operation, 2018 to 2033

Table 41: South Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 44: South Asia Volume (MT) Forecast by Equipment Type, 2018 to 2033

Table 45: South Asia Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia Volume (MT) Forecast by Application, 2018 to 2033

Table 47: South Asia Value (US$ Million) Forecast by Mode of operation, 2018 to 2033

Table 48: South Asia Volume (MT) Forecast by Mode of operation, 2018 to 2033

Table 49: Oceania Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 52: Oceania Volume (MT) Forecast by Equipment Type, 2018 to 2033

Table 53: Oceania Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: Oceania Volume (MT) Forecast by Application, 2018 to 2033

Table 55: Oceania Value (US$ Million) Forecast by Mode of operation, 2018 to 2033

Table 56: Oceania Volume (MT) Forecast by Mode of operation, 2018 to 2033

Table 57: MEA Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: MEA Volume (MT) Forecast by Country, 2018 to 2033

Table 59: MEA Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 60: MEA Volume (MT) Forecast by Equipment Type, 2018 to 2033

Table 61: MEA Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: MEA Volume (MT) Forecast by Application, 2018 to 2033

Table 63: MEA Value (US$ Million) Forecast by Mode of operation, 2018 to 2033

Table 64: MEA Volume (MT) Forecast by Mode of operation, 2018 to 2033

Figure 1: Global Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 2: Global Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Value (US$ Million) by Mode of operation, 2023 to 2033

Figure 4: Global Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 10: Global Volume (MT) Analysis by Equipment Type, 2018 to 2033

Figure 11: Global Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 12: Global Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 13: Global Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Volume (MT) Analysis by Application, 2018 to 2033

Figure 15: Global Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Value (US$ Million) Analysis by Mode of operation, 2018 to 2033

Figure 18: Global Volume (MT) Analysis by Mode of operation, 2018 to 2033

Figure 19: Global Value Share (%) and BPS Analysis by Mode of operation, 2023 to 2033

Figure 20: Global Y-o-Y Growth (%) Projections by Mode of operation, 2023 to 2033

Figure 21: Global Attractiveness by Equipment Type, 2023 to 2033

Figure 22: Global Attractiveness by Application, 2023 to 2033

Figure 23: Global Attractiveness by Mode of operation, 2023 to 2033

Figure 24: Global Attractiveness by Region, 2023 to 2033

Figure 25: North America Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 26: North America Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Value (US$ Million) by Mode of operation, 2023 to 2033

Figure 28: North America Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 34: North America Volume (MT) Analysis by Equipment Type, 2018 to 2033

Figure 35: North America Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 36: North America Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 37: North America Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Volume (MT) Analysis by Application, 2018 to 2033

Figure 39: North America Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Value (US$ Million) Analysis by Mode of operation, 2018 to 2033

Figure 42: North America Volume (MT) Analysis by Mode of operation, 2018 to 2033

Figure 43: North America Value Share (%) and BPS Analysis by Mode of operation, 2023 to 2033

Figure 44: North America Y-o-Y Growth (%) Projections by Mode of operation, 2023 to 2033

Figure 45: North America Attractiveness by Equipment Type, 2023 to 2033

Figure 46: North America Attractiveness by Application, 2023 to 2033

Figure 47: North America Attractiveness by Mode of operation, 2023 to 2033

Figure 48: North America Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 50: Latin America Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Value (US$ Million) by Mode of operation, 2023 to 2033

Figure 52: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 58: Latin America Volume (MT) Analysis by Equipment Type, 2018 to 2033

Figure 59: Latin America Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 60: Latin America Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 61: Latin America Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Volume (MT) Analysis by Application, 2018 to 2033

Figure 63: Latin America Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Value (US$ Million) Analysis by Mode of operation, 2018 to 2033

Figure 66: Latin America Volume (MT) Analysis by Mode of operation, 2018 to 2033

Figure 67: Latin America Value Share (%) and BPS Analysis by Mode of operation, 2023 to 2033

Figure 68: Latin America Y-o-Y Growth (%) Projections by Mode of operation, 2023 to 2033

Figure 69: Latin America Attractiveness by Equipment Type, 2023 to 2033

Figure 70: Latin America Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Attractiveness by Mode of operation, 2023 to 2033

Figure 72: Latin America Attractiveness by Country, 2023 to 2033

Figure 73: Europe Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 74: Europe Value (US$ Million) by Application, 2023 to 2033

Figure 75: Europe Value (US$ Million) by Mode of operation, 2023 to 2033

Figure 76: Europe Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 82: Europe Volume (MT) Analysis by Equipment Type, 2018 to 2033

Figure 83: Europe Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 84: Europe Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 85: Europe Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Europe Volume (MT) Analysis by Application, 2018 to 2033

Figure 87: Europe Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Europe Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Europe Value (US$ Million) Analysis by Mode of operation, 2018 to 2033

Figure 90: Europe Volume (MT) Analysis by Mode of operation, 2018 to 2033

Figure 91: Europe Value Share (%) and BPS Analysis by Mode of operation, 2023 to 2033

Figure 92: Europe Y-o-Y Growth (%) Projections by Mode of operation, 2023 to 2033

Figure 93: Europe Attractiveness by Equipment Type, 2023 to 2033

Figure 94: Europe Attractiveness by Application, 2023 to 2033

Figure 95: Europe Attractiveness by Mode of operation, 2023 to 2033

Figure 96: Europe Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 98: East Asia Value (US$ Million) by Application, 2023 to 2033

Figure 99: East Asia Value (US$ Million) by Mode of operation, 2023 to 2033

Figure 100: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 106: East Asia Volume (MT) Analysis by Equipment Type, 2018 to 2033

Figure 107: East Asia Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 108: East Asia Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 109: East Asia Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: East Asia Volume (MT) Analysis by Application, 2018 to 2033

Figure 111: East Asia Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: East Asia Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: East Asia Value (US$ Million) Analysis by Mode of operation, 2018 to 2033

Figure 114: East Asia Volume (MT) Analysis by Mode of operation, 2018 to 2033

Figure 115: East Asia Value Share (%) and BPS Analysis by Mode of operation, 2023 to 2033

Figure 116: East Asia Y-o-Y Growth (%) Projections by Mode of operation, 2023 to 2033

Figure 117: East Asia Attractiveness by Equipment Type, 2023 to 2033

Figure 118: East Asia Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Attractiveness by Mode of operation, 2023 to 2033

Figure 120: East Asia Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 122: South Asia Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia Value (US$ Million) by Mode of operation, 2023 to 2033

Figure 124: South Asia Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 130: South Asia Volume (MT) Analysis by Equipment Type, 2018 to 2033

Figure 131: South Asia Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 132: South Asia Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 133: South Asia Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia Volume (MT) Analysis by Application, 2018 to 2033

Figure 135: South Asia Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia Value (US$ Million) Analysis by Mode of operation, 2018 to 2033

Figure 138: South Asia Volume (MT) Analysis by Mode of operation, 2018 to 2033

Figure 139: South Asia Value Share (%) and BPS Analysis by Mode of operation, 2023 to 2033

Figure 140: South Asia Y-o-Y Growth (%) Projections by Mode of operation, 2023 to 2033

Figure 141: South Asia Attractiveness by Equipment Type, 2023 to 2033

Figure 142: South Asia Attractiveness by Application, 2023 to 2033

Figure 143: South Asia Attractiveness by Mode of operation, 2023 to 2033

Figure 144: South Asia Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 146: Oceania Value (US$ Million) by Application, 2023 to 2033

Figure 147: Oceania Value (US$ Million) by Mode of operation, 2023 to 2033

Figure 148: Oceania Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 154: Oceania Volume (MT) Analysis by Equipment Type, 2018 to 2033

Figure 155: Oceania Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 156: Oceania Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 157: Oceania Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: Oceania Volume (MT) Analysis by Application, 2018 to 2033

Figure 159: Oceania Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: Oceania Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: Oceania Value (US$ Million) Analysis by Mode of operation, 2018 to 2033

Figure 162: Oceania Volume (MT) Analysis by Mode of operation, 2018 to 2033

Figure 163: Oceania Value Share (%) and BPS Analysis by Mode of operation, 2023 to 2033

Figure 164: Oceania Y-o-Y Growth (%) Projections by Mode of operation, 2023 to 2033

Figure 165: Oceania Attractiveness by Equipment Type, 2023 to 2033

Figure 166: Oceania Attractiveness by Application, 2023 to 2033

Figure 167: Oceania Attractiveness by Mode of operation, 2023 to 2033

Figure 168: Oceania Attractiveness by Country, 2023 to 2033

Figure 169: MEA Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 170: MEA Value (US$ Million) by Application, 2023 to 2033

Figure 171: MEA Value (US$ Million) by Mode of operation, 2023 to 2033

Figure 172: MEA Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: MEA Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: MEA Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 178: MEA Volume (MT) Analysis by Equipment Type, 2018 to 2033

Figure 179: MEA Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 180: MEA Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 181: MEA Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: MEA Volume (MT) Analysis by Application, 2018 to 2033

Figure 183: MEA Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: MEA Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: MEA Value (US$ Million) Analysis by Mode of operation, 2018 to 2033

Figure 186: MEA Volume (MT) Analysis by Mode of operation, 2018 to 2033

Figure 187: MEA Value Share (%) and BPS Analysis by Mode of operation, 2023 to 2033

Figure 188: MEA Y-o-Y Growth (%) Projections by Mode of operation, 2023 to 2033

Figure 189: MEA Attractiveness by Equipment Type, 2023 to 2033

Figure 190: MEA Attractiveness by Application, 2023 to 2033

Figure 191: MEA Attractiveness by Mode of operation, 2023 to 2033

Figure 192: MEA Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beer Fermenter Market Size and Share Forecast Outlook 2025 to 2035

Beer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Beer Dispensers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Pasteurization Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beer Glass Chillers Market Size and Share Forecast Outlook 2025 to 2035

Beer Packaging Market Size, Share & Forecast 2025 to 2035

Beer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beer Keg System Market Forecast & Outlook for 2025 to 2035

Beer Dispensing Machine Market Trends - Growth, Demand & Analysis 2025 to 2035

Beer Line Cooling System Market Trend Analysis Based on System, Application, and End-Use, and Region 2025 to 2035

Beer Filter System Market insights by Equipment Type, Type, Filtration Process, Application, and Region 2025 to 2035

Market Share Insights for Beer Bottles Providers

Assessing Beer Canning Machines Market Share & Industry Trends

Competitive Overview of Beer Glassware Market Share

Beer Brewing Machine Market

Beer Cans Market

Beer Line Cleaning Kit Market Trend Analysis Based on Product, End-User, Type, and Region 2025 to 2035

Root Beer Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Home Beer Brewing Machine Market Analysis & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA