The food stabilizers market is organized into three broad categories: multinational companies, regional players, and niche producers. Leading multinational companies, such as DuPont, Cargill, and Kerry Group, together control around 55% of the market.

Their control is due to wide product portfolios, high R&D spending, and robust global supply chain networks. Local players like CP Kelco, Tate & Lyle, and Südzucker AG control approximately 30% of the market share, emphasizing niche solutions and meeting regional tastes.

The remaining 15% is controlled by specialty manufacturers like Ashland and FMC Corporation, which tend to create novel plant-based or chemical stabilizers. In every building, the leading five companies hold 70% of their segments, reflecting a moderately consolidated sector where market dominance is concentrated, yet smaller entities still play a major role in innovation and specialized uses.

| Market Structure | Top Multinationals |

|---|---|

| Industry Share (%) | 55% |

| Key Companies | DuPont, Cargill, Kerry Group, Tate & Lyle, BASF |

| Market Structure | Regional Leaders |

|---|---|

| Industry Share (%) | 30% |

| Key Companies | Ingredion, CP Kelco, Südzucker AG, Ashland, FMC Corporation |

| Market Structure | Niche & Specialized Brands |

|---|---|

| Industry Share (%) | 15% |

| Key Companies | Small-scale and regional producers focusing on plant and microbial stabilizers |

The market is moderately consolidated, with dominant corporations having major control, while local and niche players fuel innovation.

Pectin (30%) is the market leader because of its high functional abilities in gelation, thickening, and stabilization. It has broad applications across dairy, confectionery, and beverages with CP Kelco and DuPont being leaders through citrus- and apple-based pectin offerings. Agar (20%), which is obtained largely from red algae, is a general stabilizer in plant and vegan foods.

Its application as a possible alternative to gelatin in confectionery and dairy substitutes has increased its demand. Gelatin, xanthan gum, carrageenan, and guar gum find application in processed meat, sauces, and baking, and these stabilizers for texture modification and moisture retention are controlled mainly by Kerry Group and Tate & Lyle.

Seaweed-based stabilizers (30%) remain the leader, especially in dairy, bakery, and plant-based applications, due to their natural emulsification and texture improvement. FMC Corporation and Cargill are among the companies that concentrate on creating innovative seaweed-based stabilizers.

Plant-based stabilizers (20%), including guar gum and pectin, are gaining popularity fast because of their clean-label status. Microbial stabilizers like Xanthan gum are favored in industrial uses where pH and temperature stability are important, and synthetic stabilizers like modified starches are utilized where there is need for durability.

The market for food stabilizers in 2024 witnessed exceptional innovation, sustainability-focused efforts, and regulatory changes. The demand for plant-based products fueled investments in natural stabilizers, especially seaweed and microbial-derived solutions.

Sustainability was the focus, with businesses minimizing carbon footprints through the optimization of ingredient sourcing and production processes. Strategic mergers and acquisitions consolidated the market position of major players, while partnerships with food manufacturers ensured tailored solutions according to changing consumer trends.

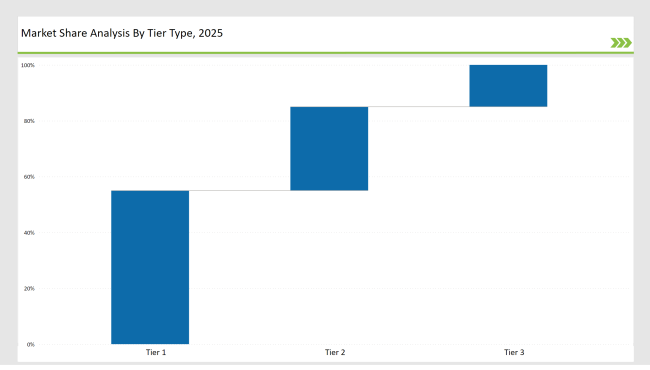

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 55% |

| Example of Key Players | DuPont, Cargill, Kerry Group, Tate & Lyle |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Ingredion, CP Kelco, Südzucker AG, Ashland, FMC Corporation |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 15% |

| Example of Key Players | Smaller niche and regional manufacturers |

| Brand | Key Focus |

|---|---|

| DuPont | Launched clean-label pectin solutions for dairy applications |

| Cargill | Strengthened seaweed-based stabilizer production for beverages |

| Kerry Group | Developed a plant-derived stabilizer blend for alternative dairy products |

| Tate & Lyle | Introduced innovative hydrocolloid stabilizers for food texture improvement |

| Ingredion | Invested in microbial-derived stabilizers for gut-health applications |

| Ashland | Created biodegradable stabilizers for environmentally conscious brands |

| CP Kelco | Expanded pectin production to meet global demand for plant-based stabilizers |

| FMC Corporation | Developed a specialized stabilizer for plant-based dairy and meat alternatives |

| BASF | Partnered with alternative protein companies for improved stabilizer applications |

| Südzucker AG | Introduced a cost-effective stabilizer for sugar-reduced confectionery products |

Accelerating development of alternate protein sources like plant-based foods and cultured meat will also give rise to the creation of high-performance stabilizers. The producers will make investments in the R&D of hydrocolloid mixtures and enzyme-based products to enhance the texture, shelf life, and binding qualities of these novel foods.

The Asia-Pacific and Latin American markets are likely to experience the greatest growth in the stabilizer market, especially in the convenience food, dairy, and bakery markets. The expansion will be backed by increasing disposable incomes and increasing demand for processed food in these countries.

The future of the stabilizer market will also be driven by technological innovation. Formulation technologies based on artificial intelligence will achieve maximum usage of stabilizers in the form of advanced ingredient interactions, leading to cost savings and better functionality in processed foods. This digital formulation technology advancement will enable food manufacturers to develop more efficient and customized stabilizer solutions.

As food makers look for tailor-made stabilizer solutions, expansion of direct B2B selling channels and emergence of personalized formulations will disrupt the conventional distribution systems. This transition will enable the manufacturers to reach specialized stabilizer products and closely collaborate with the suppliers to design innovative and customized stabilizer solutions.

The top Players-DuPont, Cargill, Kerry Group, Tate & Lyle, and BASF-collectively hold around 55% of the global market, benefiting from advanced R&D and extensive supply chain networks.

The bakery segment dominates with a 34% market share, followed by dairy and desserts at 10%, where stabilizers enhance texture, consistency, and shelf life.

Stricter EU and North American regulations are pushing manufacturers toward natural stabilizers, reducing the use of synthetic and chemically modified additives.

Stabilizers play a key role in improving texture and shelf stability in plant-based and cultured meats. Hydrocolloid and enzyme-based stabilizers are expected to see the highest demand growth in this sector.

Microbial stabilizers such as xanthan gum and plant-based stabilizers like pectin are growing rapidly, especially in health-conscious and clean-label product formulations.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

UK Food Stabilizers Market Insights – Demand, Size & Industry Trends 2025–2035

USA Food Stabilizers Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Stabilizers Market Report – Trends, Demand & Industry Forecast 2025–2035

Key Companies & Market Share in the Food Trays Sector

Europe Food Stabilizers Market Analysis – Size, Share & Forecast 2025–2035

Analyzing Food Emulsifier Market Share & Growth Trends

Industry Share & Competitive Positioning in Food Portion Pack

Market Share Insights in the Frozen Food Industry

Silver Food Market Share & Competitive Insights

Market Share Breakdown of Food Packaging Film Providers

Evaluating Seafood Packaging Market Share & Provider Insights

Leading Providers & Market Share in Food Bleaching Agent Industry

Examining Food Testing Services Market Share & Industry Outlook

Market Share Breakdown of Metal Food Cans Industry

Competitive Overview of Foodservice Paper Bag Companies

Market Share Distribution Among Food Service Equipment Companies

Competitive Breakdown of Food Blender and Mixer Providers

Latin America Food Stabilizers Market Trends – Growth, Demand & Forecast 2025–2035

Assessing Snack Food Packaging Market Share & Industry Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA