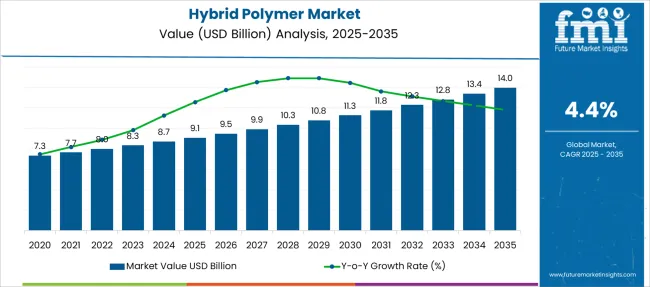

The Hybrid Polymer Market is estimated to be valued at USD 9.1 billion in 2025 and is projected to reach USD 14.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Hybrid Polymer Market Estimated Value in (2025E) | USD 9.1 billion |

| Hybrid Polymer Market Forecast Value in (2035F) | USD 14.0 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The hybrid polymer market is growing steadily, driven by increasing demand for materials that combine the advantages of multiple polymers to enhance performance. Biodegradable polymers have attracted attention due to their environmental benefits and regulatory support aimed at reducing plastic waste. Innovations in polymer chemistry have improved material properties, allowing wider application across industries.

The construction sector has increasingly adopted hybrid polymers for coatings and other applications to improve durability, weather resistance, and sustainability of structures. Rising infrastructure development and the focus on eco-friendly building materials have boosted market growth.

Additionally, advances in coating technology have expanded product functionality, promoting better adhesion and protection. The market outlook remains positive as manufacturers continue to develop versatile hybrid polymer products tailored to construction needs.

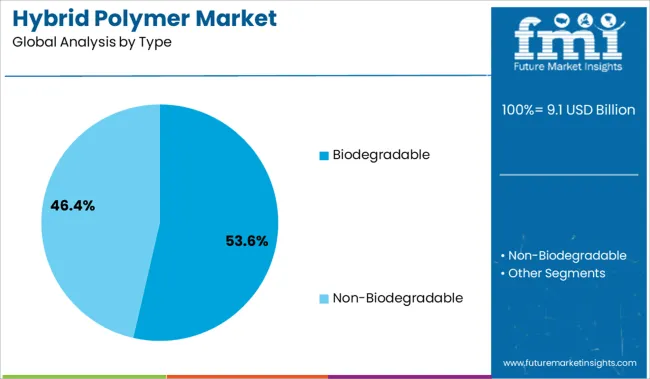

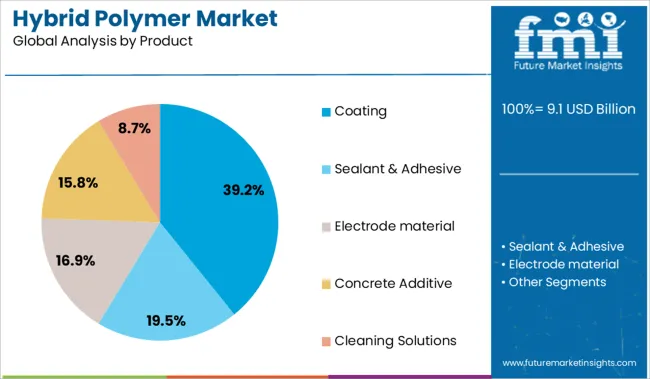

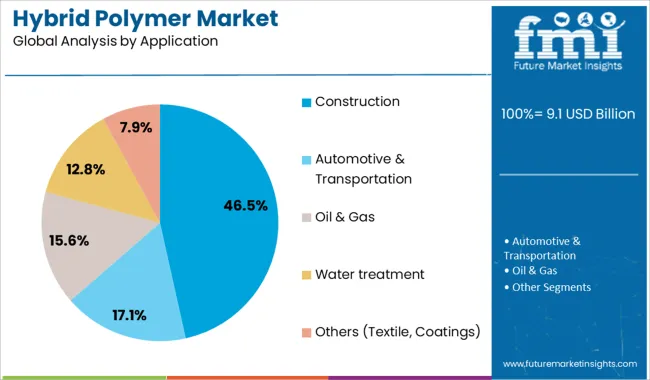

The market is segmented by Type, Product, and Application and region. By Type, the market is divided into Biodegradable and Non-Biodegradable. In terms of Product, the market is classified into Coating, Food packaging, Medical packaging, Personal care packaging, Construction, Automotive, Sealant & Adhesive, Electrode material, Concrete Additive, and Cleaning Solutions. Based on Application, the market is segmented into Construction, Automotive & Transportation, Electrical & Electronic, Food Packaging, Medical Packaging, Personal care packaging, Oil & Gas, Water treatment, and Others (Textile, Coatings). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Biodegradable segment is projected to hold 53.6% of the hybrid polymer market revenue in 2025, leading the type category. Its growth is attributed to rising environmental concerns and regulatory frameworks that encourage the use of sustainable materials. Biodegradable polymers offer the advantage of breaking down naturally, reducing long-term waste accumulation.

The construction industry has embraced these materials to meet green building standards and improve project sustainability. Continuous research has enhanced the mechanical and thermal properties of biodegradable polymers, making them suitable for a variety of applications.

Increasing consumer and corporate preference for eco-friendly products supports the expanding demand for biodegradable hybrid polymers.

The Coating segment is expected to contribute 39.2% of the market revenue in 2025, maintaining its position as the leading product category. Hybrid polymers used in coatings have been favored due to their ability to provide superior protection against corrosion, UV degradation, and chemical exposure.

Construction projects demand durable coatings to extend the lifespan of materials and reduce maintenance costs. The segment has benefited from technological advancements that improve coating performance while enabling easier application processes.

The growing emphasis on sustainable and high-performance coatings in infrastructure and residential construction has driven product adoption.

The Construction segment is projected to account for 46.5% of the hybrid polymer market revenue in 2025, establishing itself as the dominant application area. Hybrid polymers have found extensive use in construction due to their enhanced strength, flexibility, and environmental compatibility.

The sector demands materials that improve building resilience while complying with environmental regulations. Increasing urbanization and government investments in infrastructure have expanded the use of hybrid polymers in coatings, sealants, and composites.

The ability of hybrid polymers to improve energy efficiency and reduce environmental impact aligns well with current construction industry trends. As sustainable building practices continue to advance, the construction segment is expected to remain a key driver of market growth.

The hybrid polymer market has been shaped by rising demand for compostable and recycling-compatible packaging formats. From 2023 to 2025, brand owners increasingly adopted hybrid blends that offered structural strength with reduced environmental impact. These materials have been favored for their compatibility with fiber-based substrates and compliance with producer responsibility mandates. As waste-reducing formats gain regulatory and commercial traction, hybrid polymers are positioned as critical enablers in next-generation packaging.

Key drivers in the hybrid polymer market include increasing demand for lightweight and high-performance materials in automotive, construction, and electronics applications. In 2024, automotive manufacturers accelerated adoption of hybrid polymers to reduce vehicle weight while maintaining structural integrity, supporting fuel efficiency goals.

The construction sector in 2023 boosted demand for hybrid adhesives and sealants due to their superior bonding, flexibility, and resistance to moisture and temperature variations. By early 2025, industrial expansion in Asia Pacific emerged as a key catalyst, with hybrid polymers increasingly integrated into manufacturing systems and infrastructure development. These materials have gained traction due to their dual functionality, combining benefits of different polymer classes in a single formulation.

New packaging formats with environmental compliance have been increasingly embraced, creating significant headroom for hybrid polymer solutions. In 2023, demand was driven by legislative pressure to reduce landfill-destined plastics, prompting brands to trial compostable and lightweight hybrid film alternatives. By 2024, hybrid polymer blends were widely applied in barrier-grade packaging to replace conventional multilayer laminates, which were often incompatible with recycling streams.

In early 2025, packaging manufacturers favored hybrid systems that combined strength and degradability, allowing performance retention without structural overengineering. Preference has shifted toward compost-ready, fiber-compatible packaging that aligns with extended producer responsibility frameworks. These polymers are expected to dominate future flexible packaging developments as brand owners seek performance without waste accumulation.

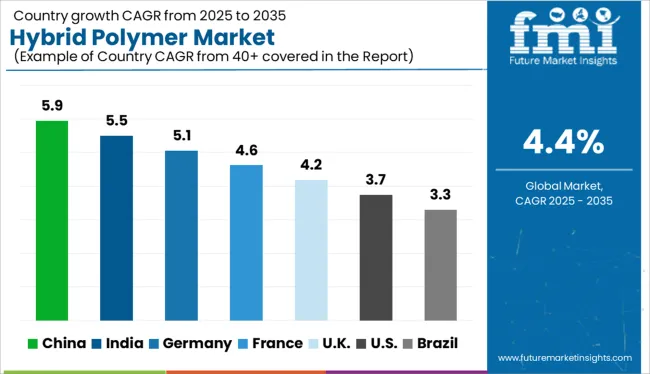

| Country | CAGR |

|---|---|

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The hybrid polymer market is expected to grow globally at a CAGR of 4.4% between 2025 and 2035. Among over 40 countries assessed, China leads with a 5.9% CAGR, followed by India at 5.5% and Germany at 5.1%. France edges slightly above the baseline at 4.6%, while the United Kingdom posts a 4.2% CAGR.

Growth momentum in China and India is shaped by rapid expansion of electronics, adhesives, and construction composites. Germany leverages hybrid polymers in lightweight automotive and industrial coatings. France shows steady adoption across chemical processing and electronics, while the UK reflects cautious growth due to cost constraints in transitioning from conventional materials.

China is set to grow its hybrid polymer market at a 5.9% CAGR, backed by widespread application in automotive coatings, electronics encapsulation, and construction adhesives. Local manufacturers have scaled sol-gel technology and silane-modified resin systems tailored for temperature resilience and mechanical strength. Rising demand from EV manufacturers and advanced infrastructure projects has further accelerated usage. State funding supports hybrid polymer adoption in energy-efficient buildings and wear-resistant applications.

India is projected to expand its hybrid polymer industry at 5.5% CAGR, driven by demand in electronics, water-resistant coatings, and structural bonding. Adoption is seen in appliances, printed circuit boards, and defense-related adhesives. Domestic producers are refining formulations with organo-functional groups for long-term durability. The construction sector integrates hybrid resins in moisture-sealing joint systems for coastal zones.

Germany expects a 5.1% CAGR in hybrid polymers through 2035, fueled by applications in lightweight vehicles, aerospace components, and durable surface finishes. The country’s commitment to low-emission manufacturing fosters interest in hybrid formulations with reduced VOCs. Automotive Tier 1 suppliers increasingly deploy hybrid polymers in chassis bonding and vibration dampening. Innovation centers focus on inorganic-organic blends to improve scratch resistance and thermal flexibility.

France is forecast to post a 4.6% CAGR in hybrid polymer demand, driven by moderate uptake in chemical engineering, semiconductors, and high-performance coatings. Public institutions are investing in hybrid polymer labs to replace traditional binders in corrosion-prone applications. Local players are developing epoxy-silicone hybrids for increased tensile strength. Regulatory push for green chemistry accelerates interest in hybrid systems that offer UV resistance and reduced curing time.

The United Kingdom hybrid polymer market is expected to grow at a 4.2% CAGR, reflecting selective adoption across packaging, construction, and electronics. Specialized sealants and gap fillers for electronics are gaining interest among design engineers. Hybrid polymers are being adopted in moisture barrier systems within green building certification programs. However, high cost of raw materials and conservative procurement cycles have slowed market penetration.

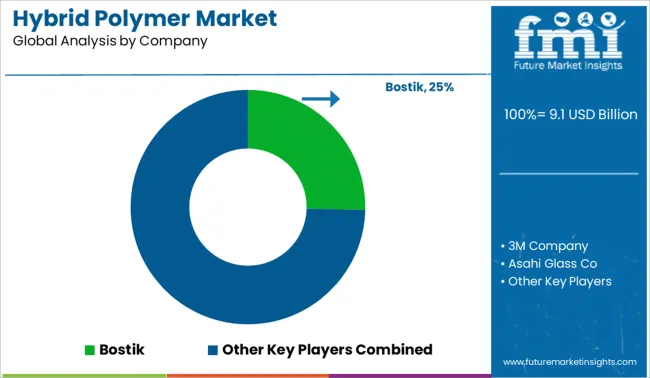

The hybrid polymer market is moderately consolidated, led by Bostik with a significant market share. The company dominates through its advanced silyl-modified polymer technologies, widely adopted in adhesives and sealants across construction and industrial applications. Tier 1 leadership is held exclusively by Bostik. Tier 2 suppliers include 3M Company, Asahi Glass Co, DIC Corporation, The Chemours Company, and Merck KGaA-each offering hybrid resin formulations targeting UV stability, durability, and environmental compliance. Tier 3 players such as Chemguard serve niche segments with specialized coatings and protective chemistries. Market growth is fueled by demand for multifunctional polymers offering chemical resistance, low VOC emissions, and compatibility with multiple substrates.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.1 Billion |

| Type | Biodegradable and Non-Biodegradable |

| Product | Coating, Food packaging, Medical packaging, Personal care packaging, Construction, Automotive, Sealant & Adhesive, Electrode material, Concrete Additive, and Cleaning Solutions |

| Application | Construction, Automotive & Transportation, Electrical & Electronic, Food Packaging, Medical Packaging, Personal care packaging, Oil & Gas, Water treatment, and Others (Textile, Coatings) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bostik, 3M Company, Asahi Glass Co, DIC Corporation, The Chemours Company, Merck KGaA, and Chemguard |

| Additional Attributes | Dollar sales by polymer type (epoxy-silicone, polyurethane-acrylate, silane-modified), Dollar sales by application (adhesives, sealants, coatings, composites), Trends in combining thermal stability with elasticity and chemical resistance, Use of hybrid polymers in electronics, construction, and automotive assemblies, Growth of UV-curable and moisture-cure formulations, Regional patterns of multifunctional polymer adoption |

The global hybrid polymer market is estimated to be valued at USD 9.1 billion in 2025.

The market size for the hybrid polymer market is projected to reach USD 14.0 billion by 2035.

The hybrid polymer market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in hybrid polymer market are biodegradable and non-biodegradable.

In terms of product, coating segment to command 39.2% share in the hybrid polymer market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA