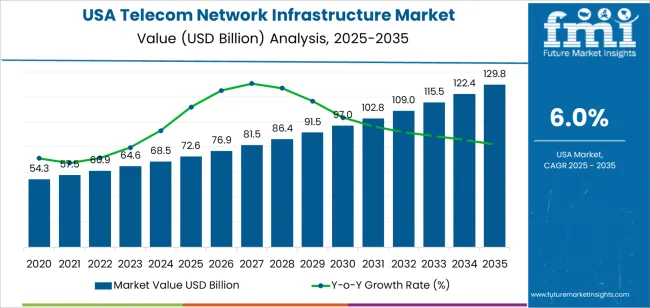

The demand for telecom network infrastructure in the USA is expected to grow from USD 72.6 billion in 2025 to USD 129.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.0%. Telecom network infrastructure, including equipment for 5G, fiber optic networks, data centers, and other related technologies, is critical to meeting the increasing demand for faster, more reliable communications. The rapid expansion of 5G networks, along with the growing need for cloud-based services, is expected to drive significant investment in telecom infrastructure over the next decade.

The market will experience steady growth, starting at USD 72.6 billion in 2025 and rising to USD 76.9 billion in 2026, USD 81.5 billion in 2027, and USD 86.4 billion in 2028. By 2029, demand will increase to USD 91.5 billion, with continued growth expected throughout the 2030s. By 2035, the demand for telecom network infrastructure is forecasted to reach USD 129.8 billion, driven by the expansion of 5G networks, increased data consumption, and continued investment in telecom infrastructure across the USA.

The rolling CAGR analysis for telecom network infrastructure in the USA reveals steady growth over the forecast period, with incremental increases in demand each year. From 2025 to 2030, the CAGR remains relatively consistent, reflecting a stable upward trajectory driven by continued investments in network upgrades and the roll-out of 5G infrastructure. The early years (2025–2029) show steady growth, with the market expanding at a similar rate year over year.

The rolling CAGR starts at 6.0% in 2025 and remains consistent as the market progresses toward the adoption of new technologies. From 2029 to 2035, the CAGR continues to reflect steady growth, with demand rising as telecom providers expand 5G coverage and increase their infrastructure investments. Overall, the rolling CAGR analysis shows a strong and stable demand for telecom infrastructure, driven by technological advancements, the increasing need for data, and the continuous expansion of high-speed networks across the USA.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 72.6 billion |

| Industry Forecast Value (2035) | USD 129.8 billion |

| Industry Forecast CAGR (2025 to 2035) | 6% |

Demand for telecom network infrastructure in the USA is increasing as operators continue rolling out and upgrading networks to support growing data USAge, rising broadband needs, and next generation services. The rollout of 5G networks is a major driver. 5G promises higher speeds, much greater bandwidth, and lower latency, which supports expansion of services such as streaming, remote work, cloud computing, IoT, and mobile broadband. As 5G deployment grows, network carriers need to deploy more base stations, small cells, backhaul fiber, routers, switches, and other infrastructure to ensure coverage, speed, and reliability. This pushes demand for both wireless and wireline infrastructure across urban and rural areas. The increasing demand for broadband services for residential and business users-fueled by streaming, cloud applications, remote work, and online services-also drives network upgrades and infrastructure expansion.

At the same time, growth in data volumes, connected devices, and emerging applications is fueling infrastructure demand. The rise of IoT devices, smart city initiatives, edge computing, and enterprise digitalization increases requirements for network capacity, lower latency, and robust connectivity. Telecom operators and service providers respond by investing in fiber optic networks, edge/data center infrastructure, virtualization and software defined network (SDN) technologies to support flexible, scalable, high capacity networks. As telecom providers seek to support next generation services and prepare networks for future demands, demand for comprehensive network infrastructure remains strong and is likely to grow steadily over the next several years.

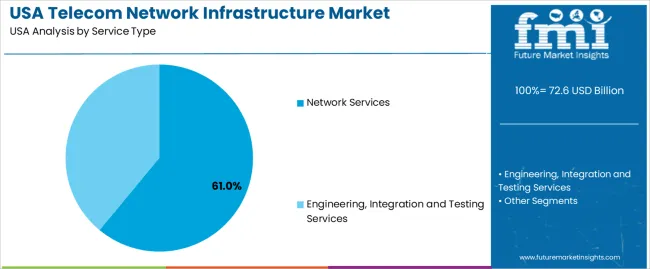

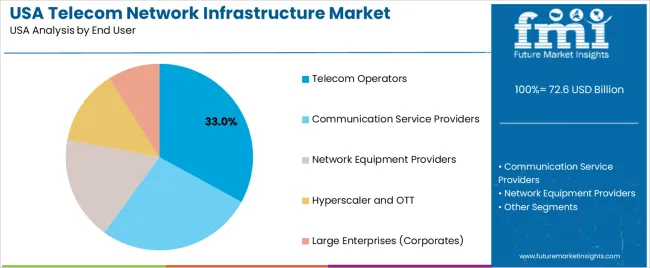

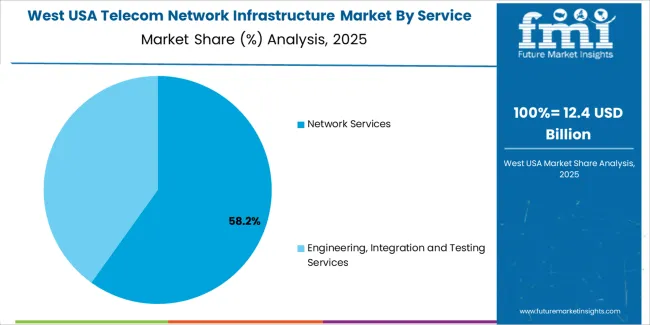

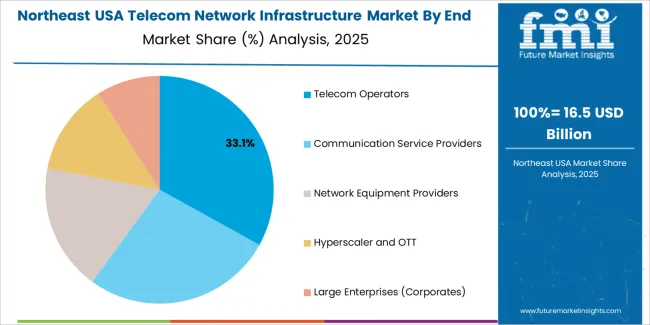

The demand for telecom network infrastructure in the USA is primarily driven by service type and end user. The leading service type is network services, which accounts for 61% of the market share, while telecom operators are the dominant end-user segment, capturing 33% of the demand. Telecom network infrastructure plays a critical role in supporting the rapidly growing demand for data, connectivity, and communication services. As the need for high-speed internet and reliable communication networks continues to expand, the demand for robust infrastructure solutions, including network services, integration, and testing, remains strong in the USA.

Network services lead the demand for telecom network infrastructure in the USA, holding 61% of the market share. Network services are essential for the operation and management of telecom networks, providing the necessary infrastructure for data transmission, network optimization, and connectivity. These services include design, deployment, maintenance, and optimization of network infrastructure, ensuring that telecom networks can support high traffic volumes, new technologies, and growing consumer demand.

The demand for network services is driven by the increasing reliance on telecom networks for both personal and business communication, particularly with the rise of 5G networks and cloud-based applications. As telecom operators and service providers upgrade their networks to support higher speeds, improved reliability, and new services, the demand for network services will continue to grow. With the ongoing digital transformation in various sectors, including healthcare, education, and enterprise applications, network services will remain a central component of the telecom network infrastructure market in the USA.

Telecom operators are the leading end-user segment for telecom network infrastructure in the USA, capturing 33% of the market share. Telecom operators are the primary organizations responsible for providing communication services, including mobile and fixed-line telephony, broadband internet, and wireless data services. As the backbone of the telecommunications industry, these operators require robust, scalable, and efficient network infrastructure to meet the increasing demand for high-speed data and seamless communication across large geographical areas.

The demand from telecom operators is driven by the need to upgrade and expand network infrastructure to support new technologies, such as 5G, and to handle the ever-growing volume of data traffic. Telecom operators are investing heavily in network infrastructure to ensure they can meet consumer expectations for faster speeds, lower latency, and greater reliability. As the demand for wireless and broadband services continues to grow, telecom operators will remain the primary drivers of demand for telecom network infrastructure in the USA. This trend will be particularly strong as 5G deployment expands and the shift toward digital services accelerates.

Demand for telecom network infrastructure in the USA is rising as the need for faster, more reliable connectivity grows across consumer, enterprise, and public sector segments. Network infrastructure-including base stations, fiber optic backhaul, routers, switches, and small cell deployments-is required to support expanding mobile data USAge, broadband uptake, and rising internet traffic. As 5G networks roll out and data consumption increases, both new infrastructure installations and upgrades to existing networks are driving demand. Overall investment in network infrastructure remains high as service providers seek to maintain quality, capacity, and coverage for a digitally connected population.

What are the Drivers of Demand for Telecom Network Infrastructure in the USA?

Several factors drive demand for telecom network infrastructure. First, the ongoing rollout and expansion of 5G networks requires large-scale investment in base stations, small cells, fiber backhaul, and core network equipment to meet higher throughput and lower latency requirements. Second, growth in mobile data consumption, broadband subscriptions, and increasing number of connected devices-smartphones, IoT devices, smart home systems-push network operators to scale capacity and improve coverage nationwide. Third, demand from enterprise users, cloud services providers, and data centres for high speed, low latency connectivity fuels infrastructure upgrades and expansion. Fourth, demand for fixed broadband access and fibre deployment, especially in underserved or rural areas, adds to infrastructure requirements. Finally, transition from legacy networks (2G/3G/4G) toward modern, scalable, and virtualized network architectures prompts major infrastructure refresh cycles.

What are the Restraints on Demand for Telecom Network Infrastructure in the USA?

Despite strong demand, some factors restrain infrastructure growth. High upfront capital expenditure required for deployment and upgrading of network infrastructure-towers, fibre optics, small cell equipment, and core network hardware-can delay or limit roll-out, especially in lower density or rural areas. Regulatory, zoning, and permitting challenges for tower and small cell site deployment can slow expansion of network infrastructure. Supply chain constraints, including semiconductor shortages or delays in fibre optic cable supply, may also hamper timely deployment. In addition, as some parts of the population already have adequate connectivity, marginal benefits in certain mature markets may not justify further heavy investment. Finally, cost sensitivity among smaller service providers or regional carriers may limit their ability to invest in large scale infrastructure.

What are the Key Trends Influencing Demand for Telecom Network Infrastructure in the USA?

Key trends shaping demand include increasing densification of wireless networks through deployment of small cell sites and fibre backhaul to support 5G and future network needs. There is also a shift toward virtualization and cloud based network architectures, with network operators adopting modern core and edge computing infrastructure to support high speed data and low latency services. Expansion of broadband connectivity-particularly fibre to home or business-remains a major trend as demand for high speed internet grows across residential and commercial sectors. Growth in enterprise and data centre connectivity needs, driven by cloud services, remote work, IoT, and data heavy applications, is pushing infrastructure upgrades. Finally, rising investment from both private telecom companies and public sector broadband expansion initiatives is sustaining infrastructure demand across both urban and rural markets.

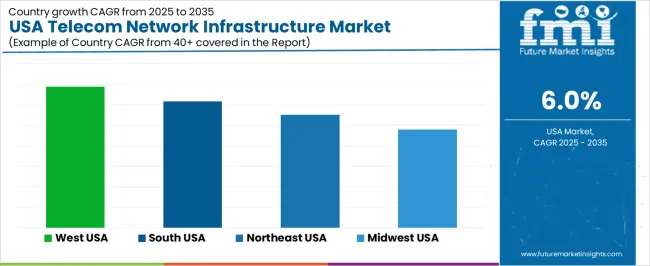

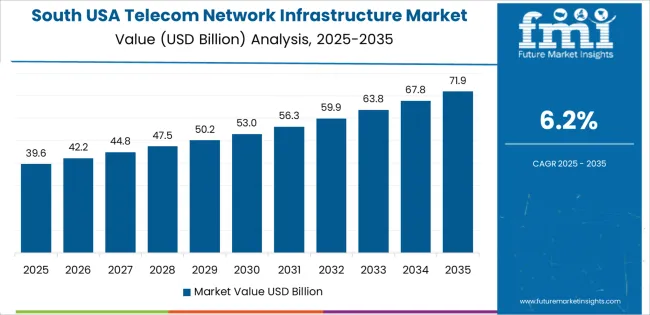

The demand for telecom network infrastructure in the USA is expected to grow across all regions, with the West USA showing the highest projected CAGR at 6.9%. The South USA follows with 6.2%. The Northeast USA is forecast at 5.5%, while the Midwest USA shows a CAGR of 4.8%. The growth reflects rising demand for high speed data services, expansion of 5G networks, increasing mobile and broadband consumption, and continued investment in network densification, fiber, and infrastructure upgrades nationwide. Overall, variations in growth across regions emerge from differences in urbanization, existing network coverage, and local investment dynamics.

| Region | CAGR (%) |

|---|---|

| West USA | 6.9 |

| South USA | 6.2 |

| Northeast USA | 5.5 |

| Midwest USA | 4.8 |

In the West USA, demand for telecom network infrastructure is forecast to grow at 6.9% annually. This region includes large urban centers as well as rapidly expanding suburban and exurban areas that require robust connectivity. The rollout of 5G and increased need for broadband capacity to support streaming, remote work, cloud services, and smart city applications drive investments in cell towers, small cells, fiber optic backhaul, and network densification. Demand for advanced infrastructure is also supported by rising adoption of connected devices and Internet of Things use in sectors such as healthcare, transportation, and enterprise operations. Carriers and network operators are investing heavily to upgrade existing networks and build new nodes to meet growing data traffic and maintain service quality. These trends contribute to strong infrastructure demand in the West USA region.

In the South USA the demand is projected to rise at a CAGR of 6.2%. The region’s mix of growing metropolitan areas and expanding suburbs, combined with rising population, drives broadband and wireless network expansion. Increasing data consumption, mobile penetration, and demand for reliable connectivity for work, education, streaming, and e commerce encourage operators to upgrade infrastructure. The necessity to expand coverage to underserved or rural areas also prompts investments in towers, small cells, and fiber; this ensures broader connectivity and supports digital inclusion. Growth in enterprise requirements — for example, private networks for manufacturing, logistics, and health care — further supports infrastructure deployments. As network operators invest to meet rising demand, infrastructure needs increase steadily across the South region.

In the Northeast USA, demand for telecom infrastructure is estimated to grow at 5.5% CAGR. Dense urban centers and high population densities require robust network capacity to support mobile and broadband services, especially as data use intensifies. Continuous technology upgrades such as 5G deployment, fiber optic expansions, and small cell installations in cities drive demand for infrastructure works. In addition, demand emerges from enterprise networks, data heavy services, cloud access, and IoT adoption. Replacement or upgrade of legacy infrastructure — such as older towers or copper-based links — with modern fiber, switches, and 5G ready components also contributes to growth. Although growth is lower than in rapidly expanding regions, the need for reliable, high capacity connectivity sustains a steady build out of telecom network infrastructure in the Northeast.

In the Midwest USA, demand for telecom infrastructure is projected at a CAGR of 4.8%. The region includes both urban and rural areas, with varying levels of existing network maturity. Growth is driven by expansion of broadband and wireless coverage to underserved or rural regions, upgrades of existing networks to support more devices, and gradual 5G deployment. Industries such as manufacturing, agriculture, and logistics increasingly rely on connected systems and private networks, which fuels infrastructure investment. While growth is more modest compared to coastal or high growth states, the steady modernization of networks, expansion of fiber, and rollout of small cell and tower infrastructure for more reliable coverage contribute to sustained demand growth in the Midwest.

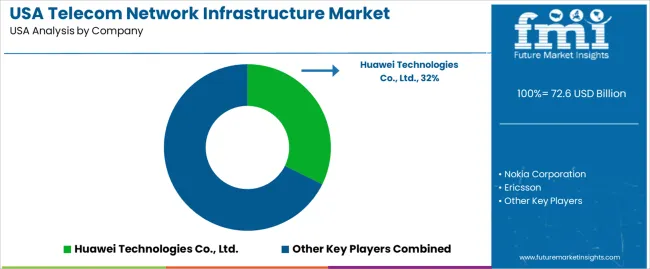

The market for telecom network infrastructure in the USA is shaped by rising demand for network equipment, driven by growth in mobile broadband, 5G deployment, and expansion of enterprise and data driven services. Recent estimates place the broader network equipment market in the US at roughly $35,067.2 million in 2023. Hardware remains the largest and fastest growing segment within that market. Key players such as Huawei Technologies Co., Ltd. (holding about 32.3% share), along with Nokia Corporation, Ericsson, Cisco Systems, Inc. and ZTE Corporation compete to address network infrastructure demand through routers, base stations, transport gear, core networking equipment and mobile broadband solutions.

Competition among these firms is driven by breadth of product portfolios, capacity to support 5G and future proof architectures, and supply chain reliability. Some vendors focus on providing full stack solutions covering radio access networks, core network elements, optical transport and enterprise networking gear. Others emphasise hardware robustness, scalable deployment and service support. With network modernisation needs rising across telecom operators and enterprises, firms position their offerings around performance, compatibility with legacy and new standards, and ability to support high density data traffic. As infrastructure demand grows, market dynamics remain fluid with competitive pressure on technology development, cost efficiency and deployment speed.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Service Type | Network Services, Engineering, Integration and Testing Services |

| End-User | Telecom Operators, Communication Service Providers, Network Equipment Providers, Hyperscaler and OTT, Large Enterprises (Corporates) |

| Key Companies Profiled | Huawei Technologies Co., Ltd., Nokia Corporation, Ericsson, Cisco Systems, Inc., ZTE Corporation |

| Additional Attributes | Dollar sales by service type and end-user show strong demand for network services and engineering/integration services, driven by the growing adoption of telecom infrastructure. Telecom operators and communication service providers are the primary end-users, though hyperscalers, OTT platforms, and large enterprises are increasingly investing in network infrastructure. Companies like Huawei, Ericsson, and Cisco lead the market with advanced solutions for network equipment and services. The market is expected to grow as 5G rollout, digital transformation, and data traffic continue to increase. |

The demand for telecom network infrastructure in USA is estimated to be valued at USD 72.6 billion in 2025.

The market size for the telecom network infrastructure in USA is projected to reach USD 129.8 billion by 2035.

The demand for telecom network infrastructure in USA is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in telecom network infrastructure in USA are network services and engineering, integration and testing services.

In terms of end user, telecom operators segment is expected to command 33.0% share in the telecom network infrastructure in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Telecom Network Infrastructure Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Carrier Infrastructure in Telecom Applications in USA Size and Share Forecast Outlook 2025 to 2035

USA Network Function Virtualization (NFV) Market Insights – Size, Share & Growth 2025-2035

USA Wireless Telecommunication Services Market Growth – Trends, Demand & Forecast 2025-2035

Carrier Infrastructure in Telecom Applications Market - Forecast 2025 to 2035

Demand for Carrier Infrastructure in Telecom Applications in Japan Size and Share Forecast Outlook 2025 to 2035

Infrastructure Projects Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Telecom Site Management Software Market Size and Share Forecast Outlook 2025 to 2035

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Size and Share Forecast Outlook 2025 to 2035

Telecom Mounting Hardware Market Size and Share Forecast Outlook 2025 to 2035

Telecom Billing And Revenue Management Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Telecom Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Telecom Analytics Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Telecom Internet Of Things (IoT) Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA