The global telecom site management software market is valued at USD 361.6 million in 2025 and is projected to reach USD 921.0 million by 2035, reflecting a CAGR of 9.8%. Growth in the early forecast years is supported by rising tower density, expanding 5G rollouts, and the need for coordinated oversight of multi-vendor network assets. Operators use these platforms to manage maintenance workflows, site access, energy consumption, asset tracking, and fault reporting across distributed tower portfolios. As infrastructure portfolios grow more complex, software systems that centralize operational data and streamline field activity play a larger role in controlling network costs and improving uptime across urban and rural sites.

Through the later years of the forecast window, adoption remains strong as operators transition toward predictive monitoring, integrated energy-management modules, and automated compliance tracking. Cloud-based architectures and API-linked workflows gain prominence as networks expand and legacy management processes reach capacity limits. Growth becomes increasingly driven by large-scale upgrades, cross-regional network consolidation, and rising emphasis on standardized operational governance across tower assets. By 2035, continuous improvements in analytics, remote diagnostics, and multi-tenant management capabilities are expected to sustain market expansion across both mobile network operators and independent tower companies.

Between 2025 and 2030, the Telecom Site Management Software Market expands from USD 361.6 million to USD 577.1 million, forming a clear peak-to-trough pattern as network operators progress through staggered modernization cycles. The trough period appears early (2025 to 2027), with annual gains of USD 32.3 million and USD 35.4 million, reflecting gradual adoption as operators digitize site-inventory systems, maintenance logs, and alarm management workflows. Mid-cycle acceleration emerges between 2028 and 2030, where yearly increases surpass USD 50 million and approach USD 55.9 million. This first peak is driven by large-scale 5G densification, deployment of tower-sharing optimization platforms, and integration of automated site-audit modules.

From 2030 to 2035, the market rises from USD 577.1 million to USD 921.0 million, producing a second, stronger peak-to-trough structure. The trough appears during 2030 to 2031 with a moderate USD 56.5 million increase, followed by sustained intensification of yearly gains as operators expand multi-vendor orchestration, real-time energy-use analytics, and predictive maintenance systems. By 2034 to 2035, the market reaches its peak, adding USD 82.2 million in a single year as telecom groups standardize AI-driven site-performance engines and upgrade remote-monitoring platforms to support large distributed antenna systems, edge-site clusters, and hybrid power solutions. The decade shows a strong upward peak-to-trough rhythm aligned with continuous network expansion and operational automation.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 361.6 million |

| Market Forecast Value (2035) | USD 921.0 million |

| Forecast CAGR (2025 to 2035) | 9.8% |

Demand for telecom site management software is rising as operators expand mobile networks, densify 5G infrastructure, and integrate distributed assets across large geographic regions. These platforms centralize data on tower locations, power systems, leases, maintenance schedules, and regulatory compliance, enabling operators to manage thousands of sites with consistent documentation and operational oversight. Software providers incorporate GIS mapping, asset-lifecycle tracking, and automated alarm handling to reduce downtime and streamline field-service dispatch. As networks incorporate small cells, edge nodes, and shared infrastructure, operators require unified tools that maintain visibility across multi-vendor equipment. Increasing pressure to control operating expenses drives adoption of platforms that standardize workflows, optimize site access, and improve contract management for rooftop and tower installations.

Market growth is also supported by the rising complexity of energy systems used at telecom sites. Operators deploy hybrid power solutions grid, battery, solar, and generator combinations that require monitoring to reduce fuel consumption and maintain uptime. Site management software integrates energy analytics, remote diagnostics, and predictive-maintenance modules to detect faults and schedule service before failures occur. Tower companies and infrastructure investors rely on accurate digital records to support audit readiness, tenant billing, and asset-valuation processes. Providers strengthen cybersecurity, API integration, and mobile field-force applications to align with corporate IT policies and support real-time data capture. Although deployment and data-migration costs challenge smaller operators, the need for operational efficiency, regulatory documentation, and reliable multi-site coordination ensures continued adoption of telecom site management software worldwide.

The telecom site management software market is segmented by type, application, and region. By type, the market is divided into on-premises and cloud-based software. Based on application, it is categorized into enterprise, government, and other users. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments reflect differences in data-security requirements, infrastructure scale, and operational workflows that influence software selection across telecom site portfolios.

The on-premises segment accounts for approximately 38.0% of the global telecom site management software market in 2025, making it the leading type category. This position reflects the preference among operators managing large site inventories that require direct control over server environments, data storage, and access rights. On-premises systems allow organizations to maintain internal oversight of site-level records, asset databases, maintenance logs, and performance histories without relying on external hosting infrastructure. These systems also support integration with legacy tools used for network monitoring, asset tracking, and power-system management.

Vendors supply on-premises platforms with configurable permission frameworks, audit-ready reporting tools, and synchronization functions for field-team data entry. Adoption is strong in North America and Europe, where operators often maintain mature site networks with established internal IT structures. On-premises solutions are also used by organizations that must comply with regulatory requirements governing sensitive operational data and controlled physical-infrastructure information. The segment maintains its lead because it supports predictable data-security practices, internal server governance, and system customization suited to operators managing extensive networks of telecom towers, rooftop sites, shelters, and power systems.

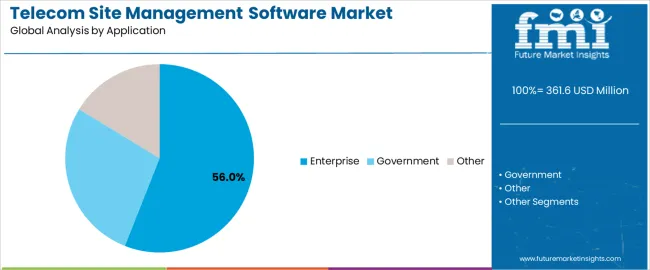

The enterprise segment represents about 56.0% of the total telecom site management software market in 2025, making it the dominant application category. This position reflects the broad operational needs of enterprise telecom operators that maintain large site portfolios for mobile networks, broadband systems, and fixed-line infrastructure. These organizations rely on management platforms to track physical assets, coordinate maintenance activities, document site-access events, and monitor equipment performance across dispersed locations. Enterprises use structured workflows to manage tower inspections, backup-power checks, and equipment upgrades tied to network expansion and modernization.

Software systems provide centralized dashboards, historical data retention, and configurable alerts that support operational planning and compliance with internal standards. Adoption is significant in North America, Europe, and East Asia, where extensive telecom networks require consistent documentation of site conditions and equipment status. Enterprises also benefit from integrated modules that manage contractor assignments, energy-consumption data, and inventory changes across multiple sites. The enterprise segment retains its leading position because large operators require continuous oversight of geographically distributed sites, making centralized software tools essential for maintaining network reliability and coordinating field operations.

The telecom site management software market is expanding as network operators, tower companies and infrastructure providers increasingly adopt digital tools to manage site assets, rollout projects and lifecycle workflows. These solutions consolidate site-data into central repositories, automate field-force operations, track leases and maintenance, and support decision-making across large portfolios. Growth is driven by rapid expansion of 5G infrastructure, densification of cell sites and the complexity of managing multi-vendor ecosystems. Adoption is constrained by legacy system integration, data-quality issues and capital-budget pressures. Providers are investing in cloud-native platforms, analytics-driven modules and AI-powered automation to support efficient site operations and reduce OPEX.

As mobile network operators roll out 5G, small cells, edge data centres and distributed antenna systems, the number of physical sites multiplies and site complexity increases. Operators and towercos require software that can handle site-planning, change-orders, site audits, contractor scheduling and KPI-tracking across thousands of assets. Managing leases, power consumption and site maintenance becomes more challenging with densified networks. Site-management platforms that integrate site-inventory, work-orders and field-force apps enable teams to scale operations while maintaining visibility, helping service providers manage growth with fewer manual processes.

Adoption is hampered by the need to integrate new software with existing OSS/BSS and field-service systems, which may be ageing or fragmented. Data inconsistencies such as mismatched site records, missing schematics or inaccurate asset lists reduce trust in analytics and automation. Some operators face resistance from field-teams accustomed to spreadsheets or disparate tools. Budget constraints and prioritisation of core network rollouts often delay investment in site-management IT. In regions with less-developed digital infrastructure, limited connectivity or lack of skilled software-deployment resources further slow adoption.

Trends in the market include the adoption of AI and machine-learning for predictive maintenance and site-health monitoring, cloud-based platforms offering SaaS delivery and mobile apps for real-time field updates. Site-management software increasingly supports workflow automation for site construction and teardown, site-handover checklists and geo-enabled dashboards. Vendors are focusing on modular platforms that can expand from tower-portfolio management into fibre, small cell, indoor DAS and edge-data-centre support. As operators seek to minimise OPEX, lifecycle-management features such as energy-usage tracking, lease-expiry alerts and contractor performance dashboards are becoming standard components of site-software suites.

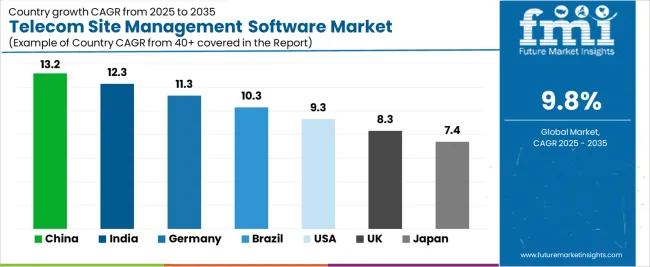

| Country | CAGR (%) |

|---|---|

| China | 13.2% |

| India | 12.3% |

| Germany | 11.3% |

| Brazil | 10.3% |

| USA | 9.3% |

| UK | 8.3% |

| Japan | 7.4% |

The Telecom Site Management Software Market is expanding rapidly across global telecommunications sectors, with China leading at a 13.2% CAGR through 2035, driven by large-scale 5G rollout, expansion of tower infrastructure, and rising adoption of AI-enabled site monitoring platforms. India follows at 12.3%, supported by accelerated telecom infrastructure modernization, digital connectivity initiatives, and demand for cost-efficient remote site operations. Germany records 11.3%, reflecting strong regulatory frameworks, advanced network management requirements, and high integration of smart monitoring technologies.

Brazil grows at 10.3%, benefiting from expanding mobile networks and increased investment in site optimization. The USA, at 9.3%, remains a mature and innovation-focused market emphasizing cloud-based site management, predictive maintenance, and digital twins, while the UK (8.3%) and Japan (7.4%) prioritize high-reliability platforms, energy-efficient site operations, and advanced analytics for next-generation telecom networks.

China is projected to grow at a CAGR of 13.2% through 2035 in the telecom site management software market. National 5G deployment and small-cell densification increase demand for centralized site management platforms. Operators require tools for remote monitoring, power and fuel optimisation, and predictive maintenance to reduce downtime. Vendors supply asset lifecycle modules, inventory control, and site-acquisition workflows tailored to dense urban and rural rollouts. Integration with OSS and field-service systems supports automated ticketing and performance tracking. Energy management features address backup power and diesel replacement planning. Regulatory reporting and safety compliance modules simplify audit processes across large multi-operator infrastructures.

India is projected to grow at a CAGR of 12.3% through 2035 in the telecom site management software market. Expanding mobile broadband networks and rural coverage drives demand for integrated site-management tools. Operators prioritise rapid site activation, field-force coordination, and multi-vendor equipment tracking to support scale deployments. Vendors provide mobile-accessible dashboards, automated inventory reconciliation, and remote alarm escalation workflows. Power reliability modules and solar hybrid management assist off-grid sites. Integration with franchise-based installation teams and local service partners improves deployment velocity. Regulatory reporting and spectrum-sharing considerations require configurable compliance modules adapted to state-level requirements across diverse operational environments nationwide coverage.

Germany is projected to grow at a CAGR of 11.3% through 2035 in the telecom site management software market. High network reliability expectations and dense urban deployments increase demand for integrated site-control suites. Operators require precise asset tagging, contract management, and vendor SLAs to maintain service levels. Software offerings emphasise automated maintenance scheduling, predictive fault detection, and energy efficiency reporting for regulated networks. Integration with certified field tools and digital twins supports planning and retrofits. Data protection and network security protocols shape access controls and audit logs. Long-term service contracts and multi-operator site sharing arrangements drive configurable tenancy modules nationwide.

Brazil is projected to grow at a CAGR of 10.3% through 2035 in the telecom site management software market. Expanding regional networks and coastal installations drive demand for ruggedised site platforms adapted to humid environments. Operators require remote monitoring, corrosion risk alerts, and asset relocation planning to support dispersed sites. Vendors include inventory tracking, mobile field apps, and integrated permit management to ease regulatory approvals. Energy management features support hybrid power systems and seasonal load adjustments. Logistics modules assist saltwater-resistant spare distribution. Local partnerships facilitate rapid deployment and maintenance contracts across varied terrains and jurisdictional permitting regimes nationwide operational support.

USA is projected to grow at a CAGR of 9.3% through 2035 in the telecom site management software market. Network densification, small cell rollouts, and fibre backhaul expansion increase complexity of site inventories. Operators adopt centralized asset registries, remote configuration tools, and automated compliance reports to accelerate turn-up. Vendors supply scalable cloud platforms, role-based access controls, and multi-tenant capabilities for shared infrastructure. Energy analytics and weather-aware maintenance scheduling reduce outage risks. Integration with field-service management reduces truck rolls and maintenance costs. Carrier consolidation and tower company collaborations drive demand for interoperable APIs and standardised site data schemas nationwide operational standards.

UK is projected to grow at a CAGR of 8.3% through 2035 in the telecom site management software market. Urban renewal projects, fibre expansion, and rooftop small-cell sites increase demand for compact site solutions. Operators require compliance tracking for landlord agreements, health and safety inspections, and scheduled maintenance logs. Software packages include tenancy management, automated safety-check workflows, and lease expiry alerts. Integration with GIS and planning databases simplifies site acquisition and permit submissions. Energy dashboards assist in identifying inefficient sites for consolidation. Service providers offer managed maintenance programmes tailored to multi-site portfolios across metropolitan and suburban areas national support contracts.

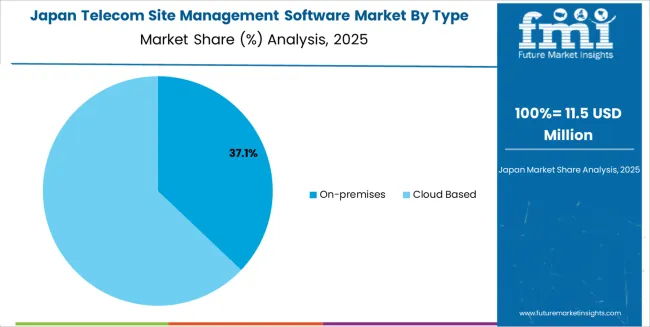

Japan is projected to grow at a CAGR of 7.4% through 2035 in the telecom site management software market. High urban density and constrained tower locations require compact site management and strict access protocols. Operators employ secure remote monitoring, vibration and temperature sensors, and tight inventory controls to maintain uptime. Software supports scheduled inspections, seismic resilience checks, and detailed maintenance logs for regulatory compliance. Integration with local vendors ensures rapid spare-part provisioning. Energy-efficiency modules help reduce operational costs in high-rent urban sites. Managed services provide specialist teams for night-time maintenance and minimal service disruption across metropolitan areas nationwide response capacity.

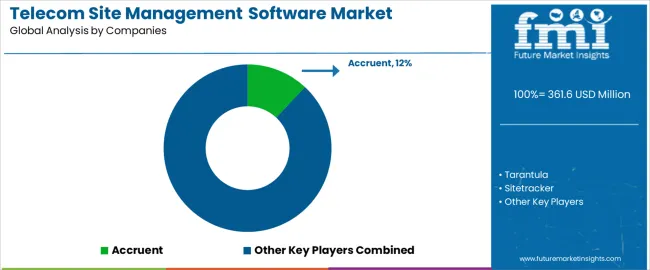

The global telecom site management software market shows moderate fragmentation, shaped by vendors supporting tower operators, mobile network operators, and infrastructure service firms. Accruent maintains a strong position with asset-management platforms designed for tracking multi-site inventories, lease data, and maintenance records. Tarantula and Sitetracker remain central competitors, offering cloud systems that coordinate tower rollouts, project milestones, contractor activity, and field documentation. IT-Development and IFS strengthen the upper tier through field-service platforms used to schedule maintenance, monitor compliance, and structure work-order execution. RSG Telecom, FieldEx, and Praxedo expand mid-range offerings with tools that enable real-time field visibility, integration with mobile devices, and efficient task routing across distributed sites.

WorkOtter and Epicflow contribute workflow and project-execution systems suited for large deployment programs, while Rakuten Symphony, Tehayu, and Smartsheet add flexible cloud frameworks for digital planning, inventory updates, and operational reporting. Etaprise and Asentria broaden the market by providing remote-site supervision, alarm monitoring, and environmental tracking, supporting network uptime requirements. Competition is shaped by integration with OSS/BSS platforms, accuracy in asset tracking, and reliability of field-mobility functions. Strategic differentiation relies on automation features, API interoperability, predictive maintenance analytics, and the ability to support rapid 5G buildouts and long-term infrastructure management across diverse geographic portfolios.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | On-premises, Cloud Based |

| Application | Enterprise, Government, Other |

| End User | Mobile Network Operators, Tower Companies, Other Users |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | Accruent, Tarantula, Sitetracker, IT-Development, IFS, RSG Telecom, FieldEx, Praxedo, WorkOtter, Epicflow, Rakuten Symphony, Tehayu, Smartsheet, Etaprise, Asentria |

| Additional Attributes | Dollar sales by type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with software providers and tower-infrastructure companies, processing requirements and integration specifications, integration with telecom-network modernisation initiatives and asset-management platforms |

East Asia

Europe

North America

South Asia

Latin America

Middle East & Africa

Eastern Europe

The global telecom site management software market is estimated to be valued at USD 361.6 million in 2025.

The market size for the telecom site management software market is projected to reach USD 921.0 million by 2035.

The telecom site management software market is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in telecom site management software market are on-premises and cloud based.

In terms of application, enterprise segment to command 56.0% share in the telecom site management software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Telecom Tower Power System Market Size and Share Forecast Outlook 2025 to 2035

Telecom Mounting Hardware Market Size and Share Forecast Outlook 2025 to 2035

Telecom Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Telecom Analytics Market Size and Share Forecast Outlook 2025 to 2035

Telecom Internet Of Things (IoT) Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Telecom Network Infrastructure Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Telecom Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Telecom Millimeter Wave Technology Market Size and Share Forecast Outlook 2025 to 2035

Telecom Equipment Market Size and Share Forecast Outlook 2025 to 2035

Telecom Cloud Market Size and Share Forecast Outlook 2025 to 2035

Telecom Power Systems Market Size and Share Forecast Outlook 2025 to 2035

Telecom Wireless Data Market Size and Share Forecast Outlook 2025 to 2035

Telecom Managed Service Market Trends - Growth & Forecast 2025 to 2035

Telecommunications Services Market - Growth & Forecast 2025 to 2035

Telecom Enterprise Services Market Analysis - Growth & Forecast through 2034

Telecom Service Assurance Market Trends – Size, Demand & Forecast 2023-2033

Telecom API Platform Market Growth – Trends & Forecast 2023-2033

Telecom Order Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA