The USA Network Function Virtualization (NFV) market is expected to grow significantly over the forecast period, driven by increasing adoption of cloud-based network services especially on-premises solutions and the accelerated 5G deployment will continue to benefit the market and the growing need for cost-effective network solutions. The market will increase from USD 10,637.9 million in 2025 to USD 34,238.7 million in 2035, at a CAGR of 12.4%.

Market Attributes and Growth Projections

| Attributes | Values |

|---|---|

| Estimated USA Market Size in 2025 | USD 10,637.9 million |

| Projected USA Market Size in 2035 | USD 34,238.7 million |

| Value-based CAGR (2025 to 2035) | 12.4% |

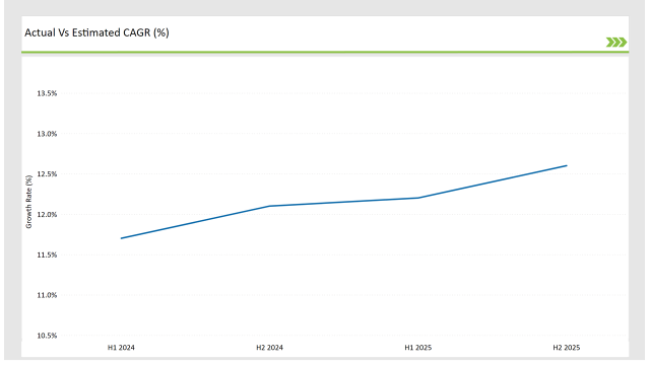

The table below presents semi-annual growth rates, offering insights into industry trends.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 11.7% (2024 to 2034) |

| H2 2024 | 12.1% (2024 to 2034) |

| H1 2025 | 12.2% (2025 to 2035) |

| H2 2025 | 12.6% (2025 to 2035) |

CAGR for both semi-annual periods varied due to industry adjustments reflected in the market. For positive changes, H1 2024 showed 11.7% CAGR figure, H2 2024 increased by 40 BPS reaching 12.1%, an early hint to NFV uptake. The CAGR rose over 12.2% in H1 2025 and 12.6% in H2 2025 further cementing the sector’s momentum in network transformation.

| Date | Development / M&A Activity & Details |

|---|---|

| Jan-25 | Verizon expands its NFV-based cloud-native 5G core to improve service agility. |

| Oct-24 | AT&T acquires a US-based NFV solution provider to enhance network automation. |

| Mar-24 | IBM collaborates with leading USA enterprises for AI-driven NFV deployment. |

| Sep-24 | Cisco introduces NFV-powered security solutions for USA-based data centers. |

| Dec-23 | The FCC announces new regulations to support NFV adoption for telecom operators. |

Growing Adoption of 5G and Edge Computing

Telecom operators (e.g., AT&T, Verizon, T-Mobile) are deploying NFV-based architectures to scale networks, optimize resources, and support low-latency applications. With its potential to facilitate dynamic network slicing and flexible service deployment, NFV takes center stage as the demand for autonomous vehicles, smart cities, and IoT applications escalates. The Federal Communications Commission (FCC) champions open RAN as well as virtualized infrastructure, spurring on NFV deployment across sectors from healthcare to finance to logistics.

Expansion of Cloud-Native Network Infrastructure

Cloud-native NFV solutions are the next logical step for USA enterprises and telecom providers looking to enhance flexibility, scalability, and cost efficiency in their networks. Cloud providers like AWS, Microsoft Azure, and Google Cloud are catalysts for this change and help companies migrate away from hardware or appliance-based networks to software-defined networking (SDN) and virtualized network functions (VNFs).

Private 5G and SD-WAN - Secure & Automated Virtualization of Networks Private 5G and SD-WAN solutions are on top of the trends because they enable secure and automated virtualization of the networks. These factors are driving the growth of NFV-based networks in government agencies and the USA Department of Defense to enhance cybersecurity and improve network resilience, thereby providing secure and scalable infrastructure.

Increasing Adoption of AI-Driven NFV Automation

In the United States, the rise of AI and machine learning have transformed NFV management and orchestration facilitating self-optimizing networks, real-time fault detection, and predictive analytics. AT&T and Verizon are using AI-driven automation tools to identify anomalies, optimize bandwidth and improve security.

Intent-based networking (IBN) with AI provides dynamic adaptation of any network to changes in traffic demands. But, with company’s expanding their IoT and edge computing deployments, AI-driven NFV automation will help to drive Network Capex down, increasing network agility and improving operational efficiencies.

Growth of Open-Source NFV Ecosystems and Standardization

The open-source NFV builders will get benefits such as openness Interoperability: Over the last few years in the US, the NFV market has been moving towards open-source NFV frameworks, which help in reducing costs and can also run vendor neutral. For open-source NFV platforms, organizations like Open Networking Foundation (ONF), Linux Foundation, and ETSI are aggressively promoting open-source NFV platforms to speed up multi-vendor ecosystem adoption along with API-based integrations.

Realizing the benefits of open-source MANO solutions, Rakuten Mobile, DISH Network, and AT&T are at the forefront of deploying these technologies to build flexible, scalable, and cost-effective networks. The drive for open NFV ecosystems has led to deeper collaboration between cloud providers, telecom operators, and software-defined networking (SDN) vendors are leading to the ongoing development in NFV adoption.

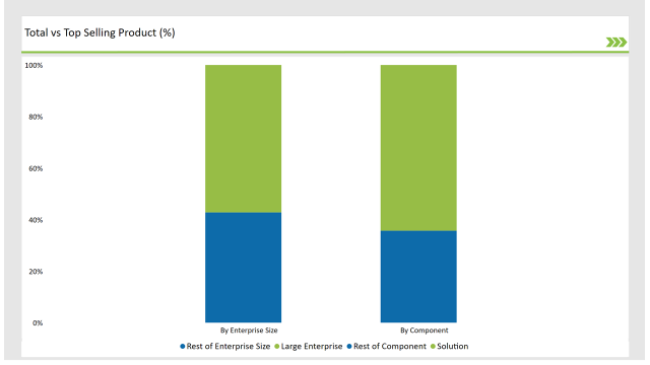

| Component | Market Share (2025) |

|---|---|

| Solution | 64.3% |

| Others | 35.7% |

Telecom providers and enterprises continue to prioritize NFV solutions, driving solutions to 64.3% market share. Consulting, integration, and managed services account for 35.7%, ensuring seamless NFV deployments.

| Enterprise Size | Market Share (2025) |

|---|---|

| Large Enterprise | 57.2% |

| Others | 42.8% |

Large enterprises lead with 57.2% market share, investing in NFV-based infrastructure for improved efficiency and security. Medium enterprises contribute 28.6%, while small enterprises adopt NFV solutions to enhance IT operations cost-effectively.

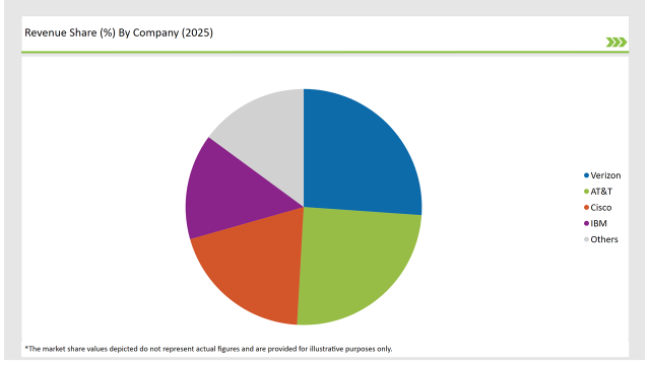

| Vendors | Market Share (2025) |

|---|---|

| Verizon | 26.1% |

| AT&T | 24.8% |

| Cisco | 19.7% |

| IBM | 14.5% |

| Others | 14.9% |

The USA NFV market will expand at a CAGR of 12.4% from 2025 to 2035.

The market will reach USD 34,238.7 million by 2035.

Key drivers include 5G deployment, cloud-based NFV adoption, and AI-driven network automation.

The West Coast and Northeast lead NFV adoption due to major telecom and data center hubs.

Major players include Verizon, AT&T, Cisco, and IBM.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Network Function Virtualization (NFV) Market Share & Industry Leaders

Network Function Virtualization (NFV) Market by Component, by Enterprise Size and by End User & Region Forecast till 2035

UK Network Function Virtualization (NFV) Market Insights – Demand, Size & Industry Trends 2025-2035

GCC Network Function Virtualization (NFV) Market Report – Trends & Innovations 2025-2035

Japan Network Function Virtualization (NFV) Market Trends – Growth, Demand & Forecast 2025-2035

Germany Network Function Virtualization (NFV) Market Analysis – Size, Share & Forecast 2025-2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Cloud-Native Network Function Market – Next-Gen Telecom Solutions

Demand for Functional Flavour in USA Size and Share Forecast Outlook 2025 to 2035

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Functional Multi-Layer Coextruded Film Market Size and Share Forecast Outlook 2025 to 2035

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Functional Flours Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Functional Flour Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA