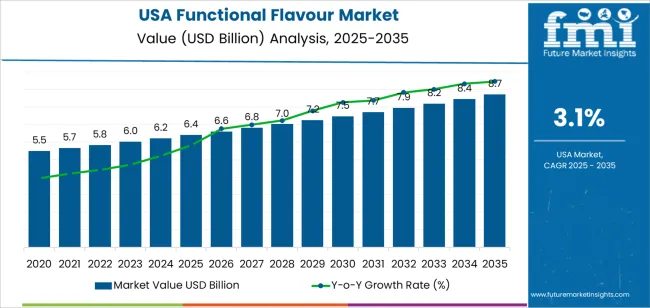

The USA functional flavour demand is valued at USD 6.4 billion in 2025 and is expected to reach USD 8.7 billion by 2035, recording a CAGR of 3.1%. Demand is influenced by steady use of flavour systems in health-positioned foods and beverages, expanded formulation activity among manufacturers, and consistent integration of functional ingredients into mainstream product lines. Functional flavours support the sensory profile of products that contain botanicals, supplements, or nutrient additives, helping maintain taste consistency across ready-to-drink beverages, fortified snacks, and specialised nutrition items. Growth is also shaped by continued interest in natural extracts, plant-derived aromatics, and flavour systems designed to mask bitterness or astringency associated with active ingredients.

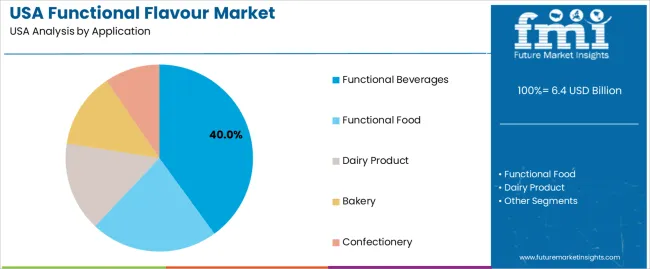

Functional beverages represent the leading application due to their high consumption frequency and their reliance on flavour systems that stabilise taste across caffeine blends, electrolyte solutions, amino-acid formulations, and vitamin-enriched drinks. The segment includes hydration products, energy beverages, and meal-replacement formats that depend on flavour uniformity to support repeat purchasing. Wider use of fruit, botanical, and spice-derived profiles continues to influence formulation choices in this category.

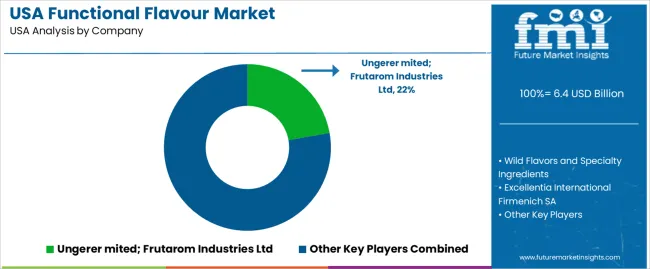

Demand is strongest in the West, South, and Northeast, where beverage manufacturers, contract formulators, and retail-focused brands drive procurement. Key suppliers include Ungerer, Frutarom Industries Ltd, Wild Flavors and Specialty Ingredients, Excellentia International, Firmenich SA, Symrise AG, and Takasago International Corporation, providing natural and synthetic flavour systems for functional product development.

Growth momentum analysis shows a steady early-phase trajectory supported by consistent use of functional ingredients in beverages, fortified foods, and nutritional supplements. Between 2025 and 2029, momentum will remain firm as manufacturers expand formulations that incorporate botanical extracts, natural enhancers, and wellness-oriented flavour systems. Demand stability across ready-to-drink beverages, dairy alternatives, and sports-nutrition products will reinforce this early progression.

From 2030 to 2035, growth momentum shifts toward a more moderate, efficiency-driven pattern. Expansion will rely on incremental reformulation cycles, updated regulatory-compliance practices, and continued preference for clean-label and reduced-sugar products. While innovation in natural flavour carriers and microencapsulation will support ongoing development, adoption rates become more predictable as product categories mature. The overall momentum profile reflects a long-term trajectory shaped by steady consumption, stable formulation practices, and consistent integration of functional flavour systems across USA food, beverage, and nutritional applications.

| Metric | Value |

|---|---|

| USA Functional Flavour Sales Value (2025) | USD 6.4 billion |

| USA Functional Flavour Forecast Value (2035) | USD 8.7 billion |

| USA Functional Flavour Forecast CAGR (2025-2035) | 3.1% |

Demand for functional flavour in the USA is increasing as food and beverage manufacturers seek ingredients that deliver both sensory appeal and added health benefits. Consumers are looking for products that offer wellness support, such as immunity, gut health or mood enhancement, while still delivering appealing taste experiences. Flavour houses are responding by creating systems that mask off-notes of functional ingredients, enhance clean-label credentials and align with trending taste profiles like botanical, spice or exotic fruit flavours.

Growth is further supported by expanding usage of functional beverages, fortified snacks and clean-label nutrition formats that require flavours tailored to support product claims. Advances in flavour technology and data-driven profiling enable faster development and customisation of flavour systems for specific functional applications. Constraints include higher cost of functional flavour systems compared with standard flavours, regulatory complexity around health claims and formulation challenges when combining flavour functionality with active ingredients. Some smaller brands may delay adoption until formulation risk and consumer awareness align more strongly.

Demand for functional flavour solutions in the United States reflects their role in enhancing sensory profiles across functional beverages, fortified foods, and specialised nutrition formats. Application patterns are shaped by product development needs, formulation stability, and evolving consumer preferences linked to health-focused consumption. Type distribution is influenced by cost structures, regulatory frameworks, and availability of natural or synthetic inputs.

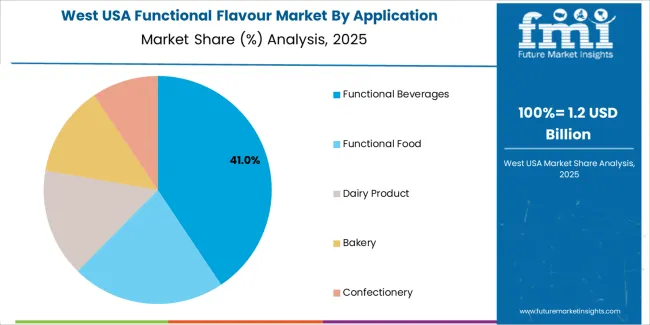

Functional beverages hold 40.0% of national demand, making them the leading application category. Energy drinks, vitamin-infused waters, electrolyte blends, and ready-to-drink wellness products require flavour systems that mask active ingredients while maintaining stability under various processing conditions. Functional food accounts for 22.0%, supporting protein bars, fortified snacks, and nutrient-enriched cereals where flavour uniformity is essential. Dairy products represent 15.5%, using flavour systems in yogurts and fortified milks. Bakery applications hold 13.0%, followed by confectionery at 9.5%, where flavours support sugar-reduced and functional-candy formulations. Application distribution reflects formulation complexity, consumer taste expectations, and product-positioning requirements across health-oriented segments.

Key drivers and attributes:

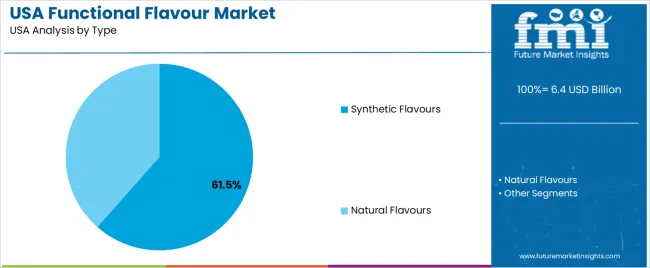

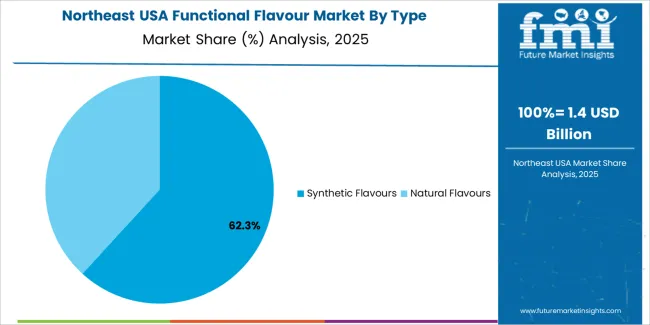

Synthetic flavours represent 61.5% of USA demand and form the leading type category. Their consistency, cost efficiency, and reliable performance in heat-processed or pH-variable formulations support broad use across functional beverages and fortified foods. Synthetic flavours enable precise replication of profiles needed for masking botanicals, proteins, and nutraceuticals. Natural flavours hold 38.5%, driven by clean-label preferences and regulatory considerations in premium and organic-positioned products. Natural inputs support fruit, herbal, and plant-derived profiles but face supply constraints and higher production costs. Type distribution reflects formulation challenges, price sensitivity, and growing but measured interest in natural alternatives within functional categories.

Key drivers and attributes:

Growing interest in health-oriented foods and beverages, rising innovation in flavour systems and increased demand for clean-label products are driving demand.

In the United States, demand for functional flavours, flavour formulations designed not only to taste good but to support health or nutritional claims is rising as brands develop wellness beverages, fortified snacks and specialty dairy items. Consumers are more attentive to ingredients, seeking products that combine sensory appeal with benefits such as digestive support, energy or immunity. Food and beverage companies are using functional flavours to mask nutrient off-tastes (for example from protein or botanicals) and to add taste profiles that reflect natural and botanical sources. The clean-label trend and interest in plant-derived, ecofriendly flavour solutions further strengthen adoption of functional flavour systems.

High development cost, regulatory and labelling complexity, and price sensitivity among consumers restrain broader adoption.

Developing functional flavours requires advanced formulation often combining bioactive ingredients, flavour carriers and masking technologies which increases R&D and production cost. Regulatory guidelines around health-claims, flavour classification, and ingredient safety complicate product development and industry entry. Some consumers remain price sensitive and may opt for standard flavours rather than pay a premium for functional variants, which may slow uptake in cost-conscious segments.

Shift toward botanical-based flavour systems, growth in functional beverage and snack segments, and wider use of customised flavour solutions by brands define key trends.

Flavor manufacturers are increasingly using botanical extracts, adaptogens and natural flavour compounds in functional flavour formulations to meet consumer demand for natural and wellness-oriented products. Functional beverages (such as enhanced waters, energy drinks, wellness tonics) and fortified snacks are adopting these flavour systems to appeal to health-and-wellness oriented consumers. Brands are also investing in customised flavour solutions that match specific formulation needs, such as off-taste masking, nutrient fortification compatibility and multi-sensory profiles, which supports growth of the functional flavour industry in the USA

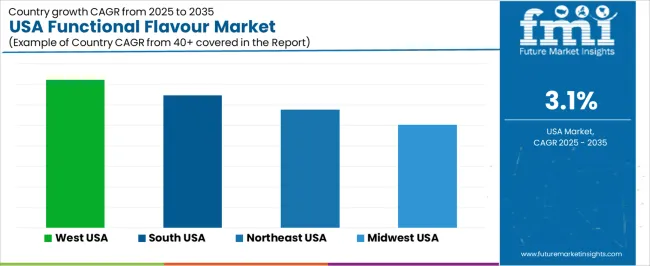

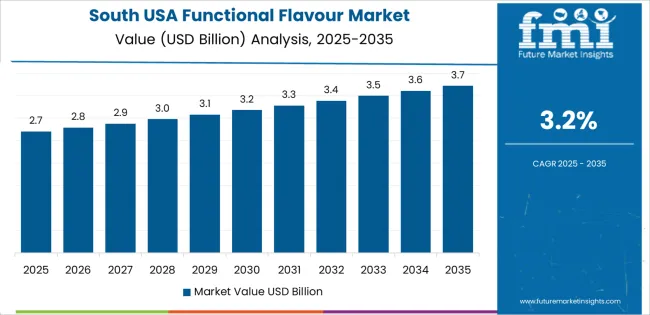

Demand for functional flavour in the USA is increasing through 2035 as food and beverage manufacturers incorporate flavour systems that also deliver nutritional benefits, botanical extracts, and bioactive components. Growth is supported by expanding product development in beverages, snacks, dairy, confectionery, and sports-nutrition categories. Functional flavour solutions include botanical blends, vitamin-infused formulations, natural fruit concentrates, and plant-based aromatic compounds used to enhance both taste and perceived wellness value. Regional trends vary based on processing capacity, consumer health preferences, and innovation activity among manufacturers. The West leads with a 3.6% CAGR, followed by the South (3.2%), the Northeast (2.9%), and the Midwest (2.5%).

| Region | CAGR (2025-2035) |

|---|---|

| West | 3.6% |

| South | 3.2% |

| Northeast | 2.9% |

| Midwest | 2.5% |

The West grows at 3.6% CAGR, supported by strong adoption among beverage companies, plant-based product manufacturers, and functional-food developers across California, Washington, and Colorado. Producers use enhanced citrus, herbal, and berry-derived flavours to differentiate ready-to-drink beverages, protein shakes, and natural snacks. Start-up ecosystems in the region encourage experimentation with ingredients such as adaptogens, botanicals, and antioxidant-rich flavour extracts. Retailers maintain broad assortments of wellness-positioned products using functional flavour systems. Co-manufacturers in Western states work with formulation teams to meet clean-label requirements using natural compounds. Steady demand for low-sugar beverages and fortified snacks sustains ongoing usage across both mainstream and niche product lines.

The South grows at 3.2% CAGR, supported by expanding food and beverage manufacturing hubs in Texas, Florida, Georgia, and Tennessee. Producers integrate functional flavours into hydration beverages, sports drinks, nutrient-fortified snacks, and dairy alternatives. Retail chains in the region increase shelf space for wellness-oriented products using fruit, herbal, and plant-based flavour systems. Contract manufacturers work with brands to incorporate vitamin-infused or mineral-enhanced flavour blends suited for regional consumer preferences. Although conventional flavour systems remain widely used, steady demand for reduced-sugar beverages and functional drink mixes supports increased adoption. Online retailers distribute functional-flavour-based nutritional powders across major metropolitan areas.

The Northeast grows at 2.9% CAGR, supported by established food-processing clusters and steady consumer interest in natural and functional ingredients across New York, Massachusetts, and Pennsylvania. Manufacturers integrate botanical, fruit-based, and nutrient-forward flavour compounds into dairy alternatives, fortified beverages, and bakery items. Retailers maintain consistent assortments of clean-label foods using natural functional flavours. Regional product developers rely on technical service providers to refine formulations for stability, taste balance, and nutritional alignment. Specialty-beverage brands use adaptogen and herbal flavour systems to meet demand from urban, health-conscious consumers. Despite slower population growth, mature retail networks sustain stable consumption levels for functional-flavour products.

The Midwest grows at 2.5% CAGR, supported by large-scale food manufacturing operations and a steady shift toward natural and functional ingredient across Illinois, Minnesota, Wisconsin, and Ohio. Producers use functional flavours in dairy products, nutritional bars, cereals, and bakery items to enhance taste profiles and incorporate added-value components. Regional ingredient suppliers provide fruit concentrates, herbal extracts, and nutrient-enhanced flavour compounds to major food brands. Retailers expand assortments of wellness-oriented products using natural flavour systems. Although adoption rates are moderate compared with coastal regions, consistent production volumes and established supply chains support ongoing demand for functional flavour solutions.

Demand for functional flavour solutions in the USA is shaped by a group of established flavour and ingredient developers supplying beverages, nutraceuticals, dairy products, and functional foods. Ungerer Limited; Frutarom Industries Ltd together hold the leading position with an estimated 22.2% share, supported by controlled extraction processes, consistent flavour stability, and long-standing supply relationships with beverage and nutrition manufacturers. Their position is reinforced by reliable sensory performance and dependable delivery of natural and nature-identical flavour systems.

Wild Flavors and Specialty Ingredients and Excellentia International Firmenich SA follow as major participants, offering flavour systems aligned with clean-label formulations, reduced-sugar products, and performance-focused nutritional blends. Their strengths include documented flavour-modulation capability, stable natural-source extracts, and broad compatibility with beverage, dairy, and functional-nutrition applications. Symrise AG maintains a strong role through its portfolio of botanical extracts, fruit concentrates, and functional-enhancement systems used across wellness-oriented food categories.

Takasago International Corporation contributes significant capability with flavour profiles tailored to USA consumer preferences, supported by steady R&D activity and expertise in natural and high-impact compounds suited to functional beverages and fortified foods.

Competition across this segment centers on flavour accuracy, stability under processing conditions, clean-label compliance, and reliable performance in high-protein or low-sugar formulations. Demand continues to grow as producers develop better-for-you foods, enhanced beverages, and nutrition-focused products that depend on consistent flavour quality and formulation flexibility.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Application | Functional Beverages, Functional Food, Dairy Product, Bakery, Confectionery |

| Type | Synthetic Flavours, Natural Flavours |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | Ungerer; Frutarom Industries Ltd, Wild Flavors and Specialty Ingredients, Excellentia International, Firmenich SA, Symrise AG, Takasago International Corporation |

| Additional Attributes | Dollar sales by flavour type and application categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of flavour houses and functional ingredient manufacturers; advancements in natural flavour extraction, clean-label formulations, and bioactive enrichment; integration with beverage fortification, dairy innovation, functional bakery products, and nutraceutical confectionery in the USA. |

The global demand for functional flavour in USA is estimated to be valued at USD 6.4 billion in 2025.

The market size for the demand for functional flavour in USA is projected to reach USD 8.7 billion by 2035.

The demand for functional flavour in USA is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in demand for functional flavour in USA are functional beverages, functional food, dairy product, bakery and confectionery.

In terms of type, synthetic flavours segment to command 61.5% share in the demand for functional flavour in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Functional Flavour Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Demand for Functional Flavour in Japan Size and Share Forecast Outlook 2025 to 2035

Functional Multi-Layer Coextruded Film Market Size and Share Forecast Outlook 2025 to 2035

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Functional Flours Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Functional Flour Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Functional Safety Market Size and Share Forecast Outlook 2025 to 2035

Functional Printing Market Size and Share Forecast Outlook 2025 to 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA