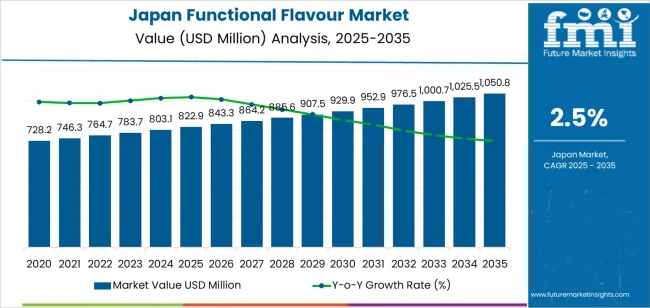

The demand for functional flavor in Japan is projected to grow from USD 822.9 million in 2025 to USD 1,050.8 million by 2035, reflecting a CAGR of 2.5%. Functional flavors are increasingly being integrated into food and beverage products to provide not only taste but also health benefits such as digestive health, immune support, and cognitive enhancement. These flavors are becoming popular among health-conscious consumers looking for flavorful yet nutritious products. Japan's strong tradition of functional foods and nutraceuticals positions it as a key market for the growth of functional flavors. Consumer interest in personalized nutrition and functional ingredients is also increasing, contributing to demand growth.

The functional flavor market will also benefit from innovations in flavor technology that enhance the sensory experience while delivering health benefits. The growing popularity of plant-based diets, along with increased interest in functional beverages such as probiotics and fortified drinks, will drive demand for flavors that offer both taste and nutritional value. The rise of natural and clean-label ingredients will also contribute to the expansion of the market, as consumers are increasingly looking for transparent and health-focused alternatives.

From 2025 to 2030, the demand for functional flavor in Japan will grow from USD 822.9 million to USD 929.9 million, contributing an increase of USD 107 million in value. This phase will see accelerated growth driven by the increasing incorporation of functional ingredients in both food and beverage products. The inflection point in this period is expected to occur around 2027, where the market will experience a sharp uptick as demand for personalized nutrition, immune-boosting products, and wellness-driven foods becomes more mainstream. This period marks the initial acceleration as consumers begin to adopt functional flavors in their daily diets, driven by the rise of functional drinks and the expanding availability of fortified foods across various retail and foodservice channels.

From 2030 to 2035, the market will grow from USD 929.9 million to USD 1,050.8 million, adding USD 120.9 million in value. During this phase, the growth rate will stabilize, reflecting a mature phase in the market as the demand for functional flavors becomes more standardized. The inflection point here will be marked by the transition from rapid adoption to steady growth, with a more incremental increase as the market reaches greater saturation. The continued introduction of new functional products and innovative flavors will still drive growth, but at a slower pace compared to the earlier stage. The market will reach a point where most consumers are already familiar with functional foods, and growth will be driven by product differentiation and brand loyalty.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 822.9 million |

| Industry Forecast Value (2035) | USD 1,050.8 million |

| Industry Forecast CAGR (2025 to 2035) | 2.5% |

Demand for functional flavorings in Japan is rising as food and beverage manufacturers develop products that deliver not just taste but also health related benefits. The broader flavor market in Japan generated around USD 979 million in 2024 and is projected to reach about USD 1,492 million by 2030, implying a compound annual growth rate (CAGR) of approximately 7.3 %. These functional flavor formats support applications in products such as functional beverages, fortified foods and snack items targeted at wellness oriented consumers.

Another key driver is the changing consumer mindset in Japan, where an ageing population and heightened focus on preventive health are influencing product innovation. Flavors that enhance or complement health functions-such as botanical, herb based or plant derived taste profiles-are becoming increasingly popular. At the same time, distribution channels such as convenience stores, e commerce and health food retail are expanding the reach of products incorporating functional flavor concepts. Challenges persist, including high expectations for taste and quality, regulatory scrutiny around novel ingredients and competition from domestic formulations. Nevertheless, the alignment of taste innovation, health functionality and manufacturing capability suggests that demand for functional flavor in Japan will continue to grow steadily.

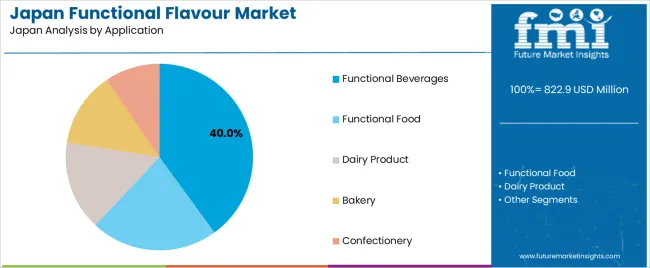

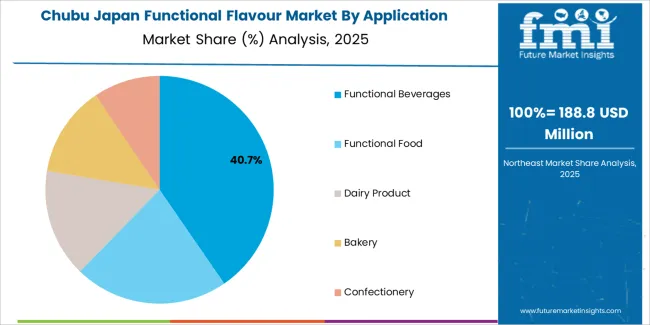

The demand for functional flavors in Japan is driven by type and application. The leading type is synthetic flavors, capturing 61.5% of the market share, while the dominant application is functional beverages, accounting for 40% of the demand. Functional flavors, which provide both taste enhancement and functional benefits such as improved digestion, energy, or immune support, are increasingly sought after by health-conscious consumers. This demand is fueled by the rising popularity of products that offer both flavor and health benefits across various food and beverage categories.

Synthetic flavors lead the market for functional flavors in Japan, accounting for 61.5% of the demand. Synthetic flavors are produced using chemical compounds to replicate the taste and aroma of natural substances, often at a lower cost and with greater consistency. These flavors are widely used in functional food and beverage products because they can be tailored to provide a specific taste profile while ensuring stability and cost-effectiveness.

The preference for synthetic flavors is driven by their affordability, availability, and the ability to create a wide variety of flavors with precise control over taste. As functional beverages and foods become more popular, particularly those targeting specific health benefits (such as energy drinks, digestive aids, or immunity boosters), synthetic flavors offer a practical solution for manufacturers to meet consumer expectations for both taste and functional effects. With ongoing innovation in flavor technology, synthetic flavors are expected to maintain their leadership in the functional flavors market in Japan.

Functional beverages are the leading application for functional flavors in Japan, capturing 40% of the demand. Functional beverages, such as energy drinks, sports drinks, probiotic beverages, and fortified teas, are growing in popularity as consumers seek drinks that provide more than just hydration. These beverages are designed to offer additional health benefits, such as enhanced energy, improved digestion, or immune support, making them a key area for the application of functional flavors.

The demand for functional flavors in beverages is driven by the increasing consumer focus on health and wellness. As people become more health-conscious, they are turning to beverages that offer functional benefits, and flavors play a critical role in ensuring these products are not only beneficial but also enjoyable to consume. Functional flavors help enhance the taste of beverages while complementing their health-promoting properties. As the trend toward functional beverages continues to grow, the demand for functional flavors in this segment is expected to remain strong in Japan.

Demand for functional flavour systems in Japan is growing as food and beverage manufacturers seek to differentiate through enhanced taste profiles paired with health oriented positioning. Japanese consumers show strong interest in flavours that support wellness attributes such as gut health, immunity and beauty, aligning with functional food trends. The country’s mature food processing sector, vigorous innovation culture and ageing population further frame demand for functional flavour. At the same time, regulatory constraints, the need for subtle Japanese taste preferences and premium pricing moderate rapid expansion.

Several factors underpin growth of functional flavour usage in Japan. First, expansion of functional food and beverage markets supports demand for flavour systems that match health related claims with appealing taste. Second, consumer awareness of wellness, longevity and preventive health-especially in Japan’s ageing demographics-drives reformulation and new product launches that incorporate functional flavour profiles. Third, manufacturers’ need to retain sensory appeal while reducing sugar, salt or fats pushes development of flavour systems that can compensate in cleaner label formats. Fourth, premiumisation trend in Japanese retail means flavoured products with added functionality command higher price points, enhancing the value proposition for suppliers.

Despite favourable conditions, several restraints exist in the Japanese market. Costs of developing and validating functional flavour systems-especially when aligned with health claims or nutrient fortified formats-are higher, which may limit uptake in cost sensitive categories. Regulatory hurdles around functional claims and flavour labelling in Japan impose complexity for formulators and flavour suppliers. Consumer taste expectations in Japan are exacting-flavours must reflect subtle umami or delicate profiles rather than bold flavours common in other markets, increasing development challenge. Lastly, large volumes remain in traditional flavour systems, so functional flavour is still a niche share relative to total flavour usage.

Important trends shaping the market include growth of flavours derived from botanical, clean label and natural sources (such as yuzu, green tea, matcha) that align with wellness positioning in Japan. Another trend is integration of flavour systems into product formats aimed at specific health benefits-such as digestive support, collagen beauty drinks or hydration solutions-leading flavour suppliers to develop tailored profiles for these segments. Third, collaborations between flavour houses and food service / retail brands to deliver limited edition, culturally relevant flavour innovation cycles are accelerating. Finally, digital and sensory tools (such as flavour profiling analytics) are being used by Japanese manufacturers to optimise flavour fit for local taste preferences while supporting functional claims.

The demand for functional flavor in Japan is driven by the growing consumer interest in products that not only taste good but also provide health benefits. Functional flavors are used in a wide range of food and beverage products, including snacks, drinks, dairy products, and processed foods, to enhance taste while offering functional benefits such as improved digestion, immune support, and cognitive function. With an aging population and a strong cultural emphasis on health and wellness, Japanese consumers are increasingly looking for foods that offer more than just taste-they want products that contribute to their overall health.

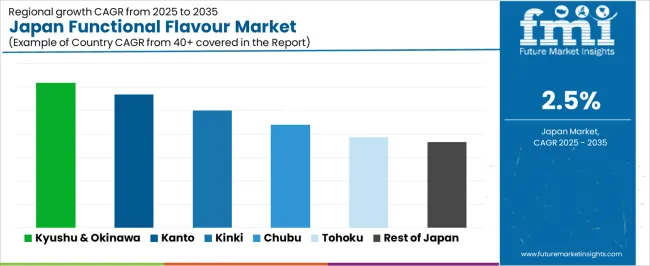

The demand for functional flavor is also supported by innovations in the food and beverage industry, where manufacturers are using natural and plant-based ingredients to provide health benefits while maintaining the delicious taste consumers expect. The rise in popularity of functional foods, such as those enriched with probiotics, prebiotics, vitamins, and minerals, has created opportunities for the inclusion of functional flavors. Regional variations in demand are influenced by factors such as local dietary preferences, consumer awareness, and the availability of functional ingredients. Below is an analysis of the demand for functional flavor across different regions in Japan.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 3.1% |

| Kanto | 2.8% |

| Kinki | 2.5% |

| Chubu | 2.2% |

| Tohoku | 1.9% |

| Rest of Japan | 1.8% |

Kyushu & Okinawa leads the demand for functional flavor in Japan with a CAGR of 3.1%. The region’s strong focus on health and wellness, particularly in Okinawa, which is known for its population’s longevity and healthy lifestyle, has contributed to the rising popularity of functional foods and beverages. Consumers in Kyushu & Okinawa are increasingly seeking products that not only taste good but also offer functional health benefits such as improved digestion, immune support, and mental clarity.

Additionally, Kyushu & Okinawa's emphasis on traditional, natural ingredients and local food practices further supports the demand for functional flavors derived from plant-based and natural sources. As the region continues to embrace healthy eating habits and preventive healthcare, the demand for functional flavor is expected to grow at a higher pace compared to other regions.

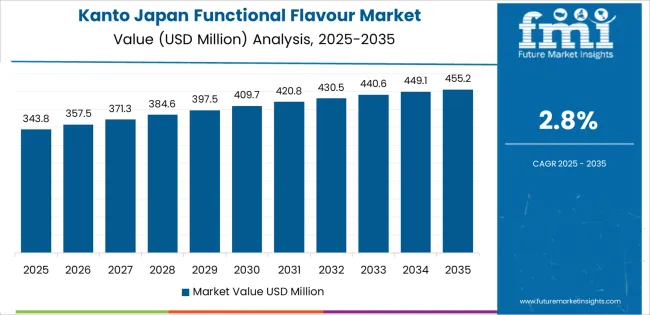

Kanto shows strong demand for functional flavor with a CAGR of 2.8%. As the economic and cultural hub of Japan, Kanto, which includes Tokyo and its surrounding areas, has a large population of health-conscious consumers who are increasingly seeking products that offer both functional and sensory benefits. The region’s booming food and beverage industry, driven by innovation and consumer demand for healthier alternatives, is a major driver of this trend.

In Kanto, there is a growing interest in foods and drinks that provide added health benefits, such as those fortified with vitamins, probiotics, and antioxidants. The region’s robust retail infrastructure, which includes supermarkets, health food stores, and online retailers, makes it easier for consumers to access functional food products. As health and wellness trends continue to rise in Kanto, the demand for functional flavor will remain strong.

Kinki, with a CAGR of 2.5%, shows steady demand for functional flavor. The region, which includes cities like Osaka, Kyoto, and Kobe, is known for its strong food culture and increasing interest in health and wellness. As consumers in Kinki become more health-conscious and prioritize functional benefits in their diets, the demand for functional flavor continues to grow steadily.

Although the growth rate is slightly lower than in Kyushu & Okinawa and Kanto, the steady demand for functional flavors in Kinki is driven by the region's increasing focus on food innovation and the growing popularity of functional foods, such as probiotic-rich yogurts, fortified beverages, and snacks. The region’s diverse food industry, coupled with rising health awareness, supports continued growth in the market for functional flavor.

Chubu demonstrates moderate growth in the demand for functional flavor with a CAGR of 2.2%. While the region’s demand for functional flavor is slower compared to Kyushu & Okinawa and Kanto, it is still driven by the rising interest in healthier food options and functional foods. Chubu, known for its industrial base and strong presence in the manufacturing sector, is increasingly seeing a shift towards food innovation that caters to health-conscious consumers.

The demand for functional flavor in Chubu is primarily driven by the increasing availability of functional ingredients in local food products, particularly in beverages, dairy, and snacks. As consumers in the region become more aware of the benefits of functional foods, the demand for products that provide health benefits alongside great taste is expected to continue growing at a moderate pace.

Tohoku, with a CAGR of 1.9%, and the Rest of Japan, with a CAGR of 1.8%, show slower growth in the demand for functional flavor compared to more urbanized regions. These areas tend to have more traditional diets, with a slower adoption of newer food trends like functional flavors. The growth of functional flavor is more gradual in these regions, though there is still growing interest as consumers become more aware of the health benefits associated with functional ingredients.

The slower growth rate can be attributed to fewer food innovations and less access to specialty functional food products compared to urban centers like Kanto and Kinki. However, as health trends continue to spread across Japan and more retailers in these regions begin to offer functional food options, the demand for functional flavors is expected to gradually increase.

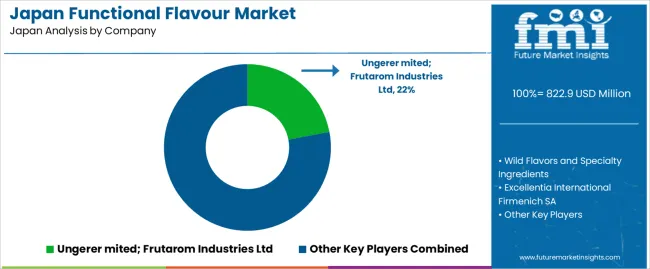

The demand for functional flavors in Japan is increasing as consumers seek products that not only taste good but also provide health benefits. Companies like Ungerer Ltd; Frutarom Industries Ltd (holding approximately 22% market share), Wild Flavors and Specialty Ingredients, Excellentia International, Firmenich SA, Symrise AG, and Takasago International Corporation are key players in this market. Functional flavors, which are incorporated into a wide range of products such as beverages, snacks, and health supplements, offer added health benefits such as immune support, stress relief, and digestive health, aligning with the growing consumer interest in functional foods and wellness.

Competition in the functional flavor industry is driven by product innovation, health benefits, and sensory appeal. Companies are developing new flavors that provide added value, such as the inclusion of vitamins, minerals, or plant-based ingredients with specific health claims. Another area of competition is the ability to tailor flavors to specific consumer preferences and regional tastes, with Japanese consumers known for their distinct flavor profiles and high standards for food quality. Additionally, companies are increasingly focusing on natural, clean-label ingredients to meet the rising demand for products with simple, recognizable ingredients. Marketing materials often highlight the functional benefits of flavors, such as enhanced energy, relaxation, or improved gut health, alongside taste profiles that appeal to consumers. By aligning their products with the growing demand for both health-enhancing and great-tasting food options, these companies aim to strengthen their position in Japan’s functional flavor market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Type | Synthetic Flavors, Natural Flavors |

| Application | Functional Beverages, Functional Food, Dairy Product, Bakery, Confectionery |

| Key Companies Profiled | Ungerer Limited, Frutarom Industries Ltd, Wild Flavors and Specialty Ingredients, Excellentia International Firmenich SA, Symrise AG, Takasago International Corporation |

| Additional Attributes | The market analysis includes dollar sales by type, application, and company categories. It also covers regional demand trends in Japan, driven by the growing need for functional flavors in beverages, food products, and confectionery. The competitive landscape highlights major players focusing on innovations in natural and synthetic flavor ingredients. Trends in the increasing demand for health-oriented, functional products that combine flavor and nutritional benefits are explored, along with advancements in flavor formulation technologies and their applications in various food categories. |

The demand for functional flavour in Japan is estimated to be valued at USD 822.9 million in 2025.

The market size for the functional flavour in Japan is projected to reach USD 1,050.8 million by 2035.

The demand for functional flavour in Japan is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in functional flavour in Japan are synthetic flavours and natural flavours.

In terms of application, functional beverages segment is expected to command 40.0% share in the functional flavour in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA