The demand for battery management systems (BMS) in Japan is expected to grow from USD 467.5 million in 2025 to USD 873.4 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.5%. As the adoption of electric vehicles (EVs), renewable energy solutions, and energy storage systems continues to increase, the need for advanced BMS technology is becoming more critical. These systems ensure the efficient management of battery performance, safety, and longevity, all of which are essential as demand for high-capacity energy storage solutions grows across various sectors, including automotive, industrial, and residential.

The growing trend toward electrification in Japan, driven by both environmental regulations and the shift toward cleaner energy, will significantly contribute to the rise in demand for BMS technology. Battery management systems are essential in electric vehicle batteries, enabling optimal performance and safety. Moreover, with Japan’s emphasis on expanding its renewable energy infrastructure, the BMS industry is also benefiting from increased investments in energy storage systems to balance the intermittent nature of renewable power generation.

Innovation in BMS technology, such as improvements in battery life, charging speed, and efficiency, will continue to drive the growth of this sector. As battery technologies advance, there will be a growing need for more sophisticated systems to manage these increasingly complex and higher-performing batteries. Japan’s commitment to reducing carbon emissions and increasing its reliance on clean energy solutions will further fuel the demand for BMS as an integral component of EVs and energy storage systems.

Between 2025 and 2030, the demand for battery management systems in Japan will increase from USD 467.5 million to USD 600.3 million, adding USD 132.8 million. This growth is driven by the rising adoption of electric vehicles and energy storage systems as Japan accelerates its efforts toward achieving carbon neutrality. As more automakers in Japan focus on electric vehicle production and as energy storage solutions become more mainstream, the demand for BMS will experience rapid growth during this phase.

From 2030 to 2035, the demand is expected to continue accelerating, growing from USD 600.3 million to USD 873.4 million, adding USD 273.1 million. The latter phase will see the widespread adoption of electric vehicles, coupled with further advancements in battery technology, resulting in stronger growth for BMS systems. As energy storage systems and smart grid applications expand, the demand for battery management systems will grow in parallel, playing a pivotal role in the efficient and safe operation of these high-capacity storage solutions.

| Metric | Value |

|---|---|

| Demand for Battery Management System in Japan Value (2025) | USD 467.5 million |

| Demand for Battery Management System in Japan Forecast Value (2035) | USD 873.4 million |

| Demand for Battery Management System in Japan Forecast CAGR (2025-2035) | 6.5% |

The demand for battery management systems (BMS) in Japan is growing due to the increasing adoption of electric vehicles (EVs) and the expansion of renewable energy storage solutions. As Japan transitions toward a more sustainable energy landscape, the need for advanced battery management systems to optimize the performance, safety, and longevity of batteries becomes critical. BMS plays a key role in ensuring the safe operation of battery packs by monitoring temperature, voltage, and state of charge, thus preventing potential failures and extending battery life.

Japan’s strong automotive industry, with major manufacturers actively investing in EV technology, is one of the primary drivers of BMS demand. As the government pushes for stricter emissions regulations and more sustainable transportation solutions, EVs and hybrid vehicles are becoming increasingly popular, creating a significant demand for reliable and efficient battery systems. The growing demand for energy storage systems, driven by renewable energy adoption, is also a key factor. BMS solutions are crucial in managing large-scale battery storage systems that help stabilize energy grids and store solar or wind energy for later use.

Technological advancements in BMS, such as improvements in software, sensor technologies, and real-time monitoring, are contributing to greater efficiency and safety in battery operations. As Japan continues to lead in both automotive innovation and clean energy solutions, the demand for advanced battery management systems is expected to rise steadily through 2035.

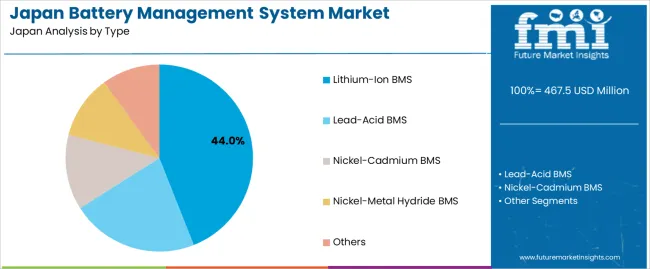

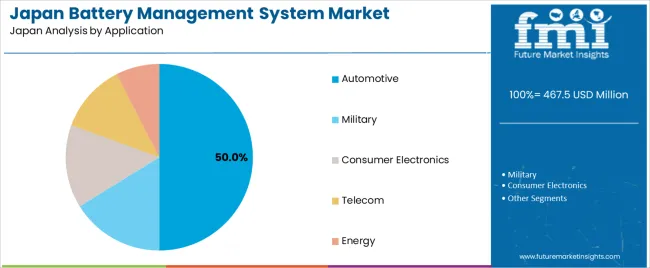

Demand for battery management systems (BMS) in Japan is segmented by type, topology, and application. By type, demand is divided into lithium-ion BMS, lead-acid BMS, nickel-cadmium BMS, nickel-metal hydride BMS, and others. The demand is also segmented by topology, including centralized, modular, and distributed. In terms of application, demand is divided into automotive, military, consumer electronics, telecom, and energy. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Lithium-ion battery management systems (BMS) account for 44% of the demand for BMS in Japan. Lithium-ion batteries are widely used across various industries due to their high energy density, long lifespan, and lighter weight compared to other battery types. These batteries are increasingly being adopted in applications like electric vehicles (EVs), consumer electronics, and renewable energy storage. The rising demand for EVs and portable electronics, combined with the need for efficient energy management and safety, has driven the growth of lithium-ion BMS. As the shift towards sustainable energy solutions continues, lithium-ion BMS will maintain its dominant share, supporting industries focused on energy efficiency, environmental impact reduction, and technological advancements.

Centralized topology accounts for 45% of the demand for battery management systems in Japan. This configuration is highly favored in large-scale applications such as electric vehicles, energy storage systems, and industrial machinery, where centralized control of the battery pack provides better system efficiency and cost-effectiveness. Centralized BMS allows for easier monitoring and management of the entire battery system from a single point, reducing the complexity of wiring and ensuring optimal performance and safety. It also enables more accurate battery monitoring, which is critical in high-capacity applications. As the demand for large-scale battery systems in sectors like automotive and energy grows, centralized BMS will remain the dominant topology choice due to its ability to effectively manage and optimize battery performance.

Automotive applications account for 50% of the demand for battery management systems in Japan. The growing adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) has driven significant demand for advanced BMS, which are essential for monitoring the health and performance of the vehicle’s battery pack. Automotive BMS help ensure safety, optimize battery life, and manage power distribution effectively in EVs, making them critical components in the automotive industry's transition towards electrification. The increasing focus on reducing carbon emissions and the adoption of stricter fuel efficiency regulations has accelerated the shift to electric vehicles, driving the demand for BMS in the automotive sector. As Japan continues to invest in sustainable transportation solutions, automotive applications will continue to dominate the demand for battery management systems in the country.

Key drivers include strong uptake of EVs, increasing deployment of grid‑scale battery energy‑storage systems (BESS), regulatory and environmental pressures to improve battery lifecycle and reuse (second‑life applications), and technological advances in battery chemistry and IoT/analytics for real‑time battery health monitoring. Restraints include high cost of advanced BMS development, the rapid pace of change in battery technologies (which requires frequent BMS upgrades), stringent safety and certification regulations, and the challenge of retrofitting or replacing legacy battery systems in existing installations.

Why is Demand for Battery Management Systems Growing in Japan?

In Japan, demand for BMS is growing because major automakers and energy companies are responding to domestic and global goals for decarbonisation, electrification and renewable‑energy integration. As more EVs enter the industry and governments and utilities deploy battery‑based storage systems to stabilise grids and integrate intermittent wind/solar generation, BMS solutions become indispensable for managing battery health, safety, thermal stability and charging/ discharging cycles. Japan’s emphasis on second‑life batteries re‑using EV batteries for stationary storage creates further demand for BMS that can handle varied battery states and applications. The transition to cleaner transportation, modern grids and battery recycling/reuse is thus driving uptake of more sophisticated BMS across automotive and energy‑storage sectors.

How Are Technological Innovations Driving Growth of Battery Management Systems in Japan?

Technological innovations are expanding the potential and adoption of BMS in Japan by improving system accuracy, intelligence and flexibility. Advances include integration of IoT and AI for predictive maintenance, remote diagnostics, real‑time battery health analytics and adaptive thermal management. New battery chemistries (such as solid‑state batteries) and higher‑capacity battery packs demand more advanced BMS architectures that can manage different voltage profiles, safety conditions and second‑life applications. Modular and distributed BMS topologies are increasingly used to scale across large pack sizes and make maintenance easier. Packaging for grid‑scale BESS, enhanced cell‑balancing capabilities, fault‑tolerant designs and software updates over‑the‑air all contribute to growth and differentiation of BMS solutions in the Japanese industry.

What Are the Key Challenges Limiting Adoption of Battery Management Systems in Japan?

Despite strong growth, adoption of BMS in Japan faces several key challenges. One is cost pressures: advanced BMS with sophisticated sensors, software and control capabilities add to battery system cost, which can slow adoption in cost‑sensitive applications or smaller systems. Another is technological uncertainty: as battery chemistries rapidly evolve (e.g., solid‑state, alternative materials) and system architectures change (modular packs, second‑life reuse), BMS providers must continually upgrade and adapt, which can be resource‑intensive. Regulatory and certification complexity in Japan is also significant safety standards, environmental/ recycling requirements and grid‑integration rules can increase time‑to‑industry. Finally, for legacy installations or smaller scale systems, simpler battery management may suffice and advanced BMS may be seen as over‑engineering, which limits uptake.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 8.1% |

| Kanto | 7.4% |

| Kinki | 6.5% |

| Chubu | 5.7% |

| Tohoku | 5.0% |

| Rest of Japan | 4.8% |

The demand for battery management systems (BMS) in Japan is growing across all regions, with Kyushu & Okinawa leading at an 8.1% CAGR. This growth is primarily driven by the increase in electric vehicle (EV) adoption and the push toward renewable energy solutions. Kanto follows with a 7.4% CAGR, fueled by the strong presence of EV manufacturers and battery companies in Tokyo. Kinki shows a 6.5% CAGR, driven by its well-established manufacturing and automotive sectors. Chubu experiences a 5.7% CAGR, supported by its focus on automotive and electronics. Tohoku and the Rest of Japan show more moderate growth at 5.0% and 4.8%, respectively, driven by expanding adoption in industrial and residential sectors for energy storage systems.

Kyushu & Okinawa is experiencing the highest demand for battery management systems in Japan, with an 8.1% CAGR. This growth is largely driven by the region's increasing focus on renewable energy and electric vehicles (EVs). Kyushu has become a hub for solar energy installations and energy storage systems, driving the need for effective battery management solutions to optimize energy usage and storage.

Okinawa, with its emphasis on sustainability and clean energy, is also contributing to this growth, as local policies encourage the adoption of EVs and energy-efficient technologies. The region’s strong commitment to reducing carbon emissions and integrating renewable energy sources into its grid is driving demand for battery management systems. As the region continues to invest in green technologies and infrastructure, the demand for BMS solutions to manage energy storage, EV batteries, and power grids will remain strong.

Kanto is experiencing strong demand for battery management systems, with a 7.4% CAGR. This growth is largely attributed to the region's concentration of electric vehicle manufacturers, battery companies, and technology innovators. Tokyo, as a major hub for automotive and electronics industries, has seen a rapid rise in the adoption of electric vehicles (EVs) and energy storage systems, both of which require efficient BMS solutions to ensure the optimal performance of batteries.

The Kanto region's emphasis on sustainability and the promotion of EV infrastructure, including charging stations and green energy solutions, is driving the need for advanced battery management systems. With the growing adoption of EVs and renewable energy storage technologies, Kanto is expected to continue leading the way in battery management systems demand, as these technologies become essential for energy efficiency, battery longevity, and overall system reliability.

Kinki is seeing steady growth in demand for battery management systems, with a 6.5% CAGR. The region’s automotive and manufacturing sectors, particularly in cities like Osaka, are significant contributors to this growth. As electric vehicle (EV) adoption continues to rise, Kinki’s established automotive industry is increasingly incorporating advanced battery management systems to ensure the performance and longevity of EV batteries.

In addition, the region’s focus on energy-efficient technologies and industrial applications is supporting the demand for BMS solutions. Kinki’s manufacturers, especially those involved in electronics and industrial automation, are adopting battery management systems for applications such as energy storage and backup power systems. As the region continues to modernize its manufacturing processes and increase its use of renewable energy sources, the demand for battery management systems is expected to grow steadily, supporting the broader trend of energy efficiency and sustainability.

Chubu is experiencing moderate growth in demand for battery management systems, with a 5.7% CAGR. The region’s industrial base, particularly in cities like Nagoya, is contributing to this demand, driven by the growing adoption of electric vehicles (EVs) and energy storage systems. As the automotive industry in Chubu, known for its major manufacturers, increasingly shifts toward electric and hybrid vehicles, the need for efficient and reliable battery management solutions is becoming more apparent.

Chubu’s focus on advanced manufacturing technologies and its growing interest in renewable energy projects, such as solar and wind energy, are driving the adoption of energy storage solutions that rely on BMS. As the region embraces green technologies and cleaner energy sources, the demand for battery management systems is expected to continue to grow at a moderate pace, supporting both the automotive and energy sectors in Chubu.

Tohoku is seeing moderate growth in demand for battery management systems, with a 5.0% CAGR. The region’s push for renewable energy sources, particularly solar power, is contributing to the rising adoption of battery storage systems that require effective BMS solutions to manage energy storage and distribution. As Tohoku continues to invest in green technologies and renewable energy infrastructure, the demand for reliable battery management systems to optimize energy usage and ensure system reliability is growing.

While the region’s automotive and industrial sectors are less concentrated compared to other areas like Kanto and Kinki, Tohoku is seeing increased interest in energy-efficient solutions, including EV charging infrastructure and energy storage systems. This growing focus on sustainability and energy independence is driving demand for advanced battery management systems in Tohoku, supporting steady growth in the sector.

The Rest of Japan is experiencing steady growth in demand for battery management systems, with a 4.8% CAGR. While the growth is more moderate compared to other regions, the increasing adoption of renewable energy and electric vehicles in rural and less urbanized areas is contributing to this trend. As local governments and businesses in these areas invest in clean energy technologies, the need for efficient energy storage and battery management solutions is rising.

The Rest of Japan’s growing awareness of environmental issues and the need for sustainable energy solutions is driving the adoption of BMS in various sectors, including residential, commercial, and industrial applications. With continued government support for renewable energy projects and the expansion of EV infrastructure, the demand for battery management systems is expected to grow steadily across the Rest of Japan. The gradual shift toward green technologies and energy-efficient systems will help sustain this growth over the long term.

Demand for battery management systems (BMS) in Japan is witnessing strong growth, underpinned by the country’s strategic focus on electrification, renewable energy storage, and advanced mobility. As Japanese automakers accelerate electric‑vehicle development and energy‑storage systems for grid and industrial applications gain prominence, the need for robust BMS capable of monitoring battery health, managing charge/discharge cycles, and ensuring safety has become increasingly critical.

In Japan’s demand landscape, Texas Instruments holds an approximate 35.0% share, highlighting its prominent role in supplying BMS controllers and support systems to Japanese OEMs and energy‑storage integrators. Other key suppliers contributing to Japanese demand include Toshiba Corporation, Infineon Technologies, STMicroelectronics, and NXP Semiconductors, all providing semiconductor solutions, system integration, and BMS platforms tailored for Japan’s high‑reliability manufacturing and energy‑infrastructure industries.

Key growth drivers in Japan include the drive for higher EV penetration and stricter vehicle‑emissions targets, expansion of grid‑scale battery‑storage deployments to support renewable integration, and increasing demand for next‑generation battery chemistries (such as solid‑state batteries) that require advanced BMS capabilities. While challenges such as high development costs, the need for rigorous safety certification, and competition from domestic system‑builders exist, the outlook for BMS demand in Japan remains very positive as the country moves toward a more electrified and sustainable energy future.

| Items | Values |

|---|---|

| Quantitative Unit | USD million |

| Type | Lithium-Ion BMS, Lead-Acid BMS, Nickel-Cadmium BMS, Nickel-Metal Hydride BMS, Others |

| Topologies | Centralized, Modular, Distributed |

| Application | Automotive, Military, Consumer Electronics, Telecom, Energy |

| Key Players Profiled | Texas Instruments, Toshiba Corporation, Infineon Technologies, STMicroelectronics, NXP Semiconductors |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Additional Attributes | Dollar sales by battery type, topology, application, and regional distribution with a focus on automotive, military, and energy sectors |

The global demand for battery management system in japan is estimated to be valued at USD 467.5 million in 2025.

The market size for the demand for battery management system in japan is projected to reach USD 873.4 million by 2035.

The demand for battery management system in japan is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in demand for battery management system in japan are lithium-ion bms, lead-acid bms, nickel-cadmium bms, nickel-metal hydride bms and others.

In terms of topologies, centralized segment to command 45.0% share in the demand for battery management system in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Battery Management System Market Growth – Trends & Forecast 2023-2033

Battery Operated Light Market Forecast and Outlook 2025 to 2035

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Cyclers Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Battery Electrolytes Market Analysis & Forecast by Type, End-Use, and Region through 2035

Battery Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Battery Swapping Charging Infrastructure Market Trends and Forecast 2025 to 2035

Battery Leasing Service Market Analysis & Forecast by Business Model, Battery Type, Vehicle Type, and Region Through 2025 to 2035

Battery-Free Sensors Market Insights - Trends & Forecast 2025 to 2035

Battery Manufacturing Machines Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA