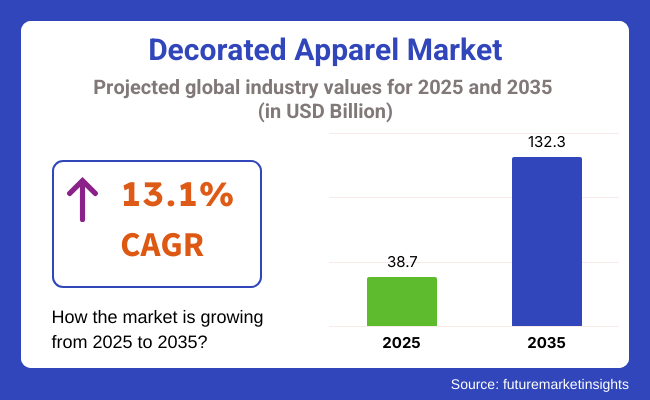

The industry valuation was at USD 38.7 billion in 2025 and is expected to grow at a 13.1% CAGR from 2025 to 2035. The global revenues for decorated apparel market are expected to reach USD 132.3 billion by 2035.

A major key driver of this growth is the surging consumer demand for personalized and fashion-forward clothing, supported by advancements in digital printing and direct-to-garment technologies. The decorated apparel industry has undergone a dynamic transformation as consumers increasingly seek custom-designed garments that reflect personal identity, lifestyle affiliations, or branding.

Driven by social media trends, influencer culture, and rising participation in individual expression, apparel decoration through screen printing, embroidery, sublimation, and digital transfer has gained massive traction across casualwear, sportswear, and corporate merchandise.

eCommerce sites and print-on-demand solutions have enhanced access for independent creators and small businesses. This democratization of custom apparel allows for quicker turnaround, low inventory expense, and hyper-localized designs that appeal to niche markets. At the same time, fashion retailers and sports teams are using customized apparel to drive brand engagement and revenue diversification.

Technological advancements in printing machinery, ink compositions, and embroidery automation are facilitating bright, long-lasting, and complex designs on different fabrics. Sustainability is also at the forefront, with eco-friendly inks, water-based printing, and organic fabric sourcing becoming a key part of purchasing decisions, particularly among Gen Z and millennial consumers.

Asia Pacific is ahead of the pack in manufacturing capability, with North America and Europe leading in brand personalization and retailer sophistication. Cross-border e-commerce and sustainable fashion growth sees the industry poised to reach scale, coupling creativity with mass-market potential and digital agility.

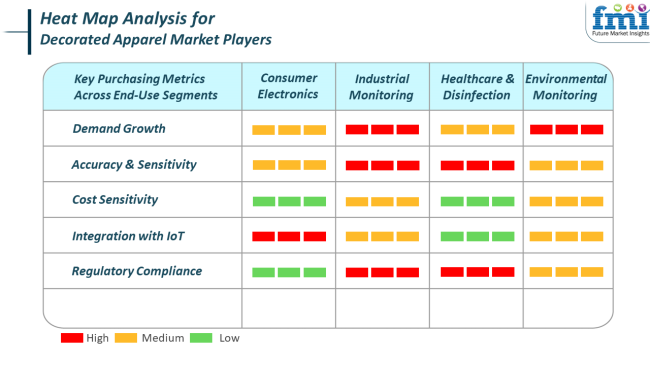

On the consumer electronics side, celebration wear clothing gradually converges into wearable technology or marketing exercises. Digitally printed branded merchandise maintains high demand because of the requirement for accuracy and short-run capacity to match the rapid fashion trend cycles.

Embedded digital technologies for product tracking and customization to enhance overall customer experience. In factory use, safety apparel and embellished uniforms must be resilient, visible, and compliant with work environment specifications. Heat transfer and embroidery are used because they are durable, with intelligent labeling systems increasingly used for workforce identification and brand unity.

In healthcare and environmental monitoring uses, designer clothing is largely applied for functional branding, staff identification, and public outreach. Such applications focus on regulatory compliance, comfort, and durability, especially in scrubs and laboratory coats. Sustainability and low-toxicity decoration methods are high priorities, especially where garments come into close contact with hygiene protocols or green organizational policies.

The industry faces some risks that can influence lasting stability. Intellectual property threat is a top matter-most significantly as tailoring picks up even more ground. Unauthorized replica work of protected logos and ideas may expose factories and platforms to suits.

Supply chain complexity introduces volatility as well. Decorated apparel production requires coordination of blank garment procurement, decoration processes, and just-in-time delivery. Disruptions in any step-such as shortages in textiles or ink composition problems-can have a significant impact on operational efficiency and customer satisfaction.

During the forecast period, the pace at which technology speeds is two-edged as well. Firms that fail to apply next-generation embroidery and printing technology will get commoditized. Still, those who overspend in the absence of clear demand drivers will most likely suffer from capital inefficiency. With end-consumer desires skewed heavily towards personalization and the environment, competitive firms must find a balance between compliance, flexibility, and creativity to remain sustainable.

Between 2020 and 2024, the industry underwent dramatic changes fueled by trends of personalization, growth of e-commerce, and digital print technologies. Customization was at the core of demand, where consumers demanded clothes that embodied individual tastes, cultural identity, and brand personality.

Print-on-demand manufacturing flourished as online marketplaces enabled independent makers and small companies to compete without inventory. Technological innovation, including direct-to-garment and heat transfers, facilitated quality and turnaround.

Sustainability was also starting to impact consumerism, as consumers were pushing companies to use ecologically friendly ink and recycled ink. Social networking and influencer marketing fueled marketplace visibility, particularly in youth-based fashion markets.

Between 2025 and 2035, the industry will continue to trend towards hyper-personalization via AI and automation. Smart fabrics and augmented reality (AR) will revolutionize the user experience with real-time preview customization. The standard will change towards green operations, with biodegradable material and low-impact print technologies emerging as the front-runners.

Digital fashion, i.e., clothing designed for virtual worlds, will be a new niche with the growing popularity of the metaverse. Local production via smart factories and 3D printing of textiles will enable faster delivery and a lighter environmental footprint, and thus, decorated clothing will become a tech- and fashion-led industry.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased customization, print-on-demand capabilities, and online selling | Customization through AI, intelligent fabrics, AR support, and digital fashion innovation |

| DTG printing, screen printing, heat transfer procedures | 3D print fabrics, AI-designed prints, AR try-ons, and automated manufacturing |

| Focus on personal expression, personalized prints, and influencer-influenced designs | Requirement for immersive design, digital clothing, and hyper-personal wearable technology |

| Fashion, team wear, promo wear, and fan wear | Virtual apparel, tech-enabled wearables, limited-run intelligent clothes, and green personalized collections |

| Shift to water-based inks, recycled content, and moral supply | Use of biodegradable materials, closed-loop print systems, and zero-waste production processes |

| Growing regulation of textile waste and chemical usage | Better global norms for sustainable fashion production and product traceability |

| Small business and e-commerce-driven growth | Virtual market expansion and adoption of intelligent clothing in healthcare, lifestyle, and entertainment |

| Improved color accuracy, faster DTG printers, green dyes | AI-driven design platforms, AR-based live customization, and digital-only fashion brands |

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.3% |

| UK | 9.1% |

| France | 8.6% |

| Germany | 8.9% |

| Italy | 8.2% |

| South Korea | 11.7% |

| Japan | 9.0% |

| China | 13.4% |

| Australia-NZ | 9.3% |

The USA is poised to grow at 10.3% CAGR throughout the study. A high demand for customized and expressive fashion trends drives this consistent growth. Demand from consumers for custom prints, embroidery, and digitally illustrated graphics on apparel has increased due to an increased cultural focus on individuality.

Corporate demand has also been strong, particularly in promotional merchandising, team wear, and event-related apparel. Improvements in direct-to-garment (DTG) printing and the swift take-up of digital platforms for wearables customization are fueling additional momentum. Furthermore, the USA retailing ecosystem is conducive to decorating apparel companies with wide online and offline distribution channels.

Social media integration with e-commerce and the growth of print-on-demand services enable small-scale creators and independent labels. While sustainability is an increasingly pressing issue, most companies are making the shift to environmentally friendly inks and recyclable clothing materials.

Advances in production methods and the adoption of AI-powered design tools continue to be instrumental in gaining revenue share. The maturity of the industry is offset by continuous innovation, which renders the USA a solid but competitively transforming sector.

The UK will grow at 9.1% CAGR throughout the study period. It demonstrates a robust mix of heritage fashion and modern customization trends. British consumers are increasingly demanding distinctive clothing that expresses personal style, social values, or affiliations. Demand ranges from fashion retail to music merchandise, corporate gifting, and e-sports teams.

The UK's booming creative economy fuels up-and-coming brands and artists seeking to stand out through bespoke-decorated apparel collections. The digital revolution in the fashion industry has amplified the customer experience with mobile customization apps and live previews.

Additionally, consumerism driven by sustainability is promoting the use of organic materials and water-based dyes, resulting in more sustainable decoration practices. The availability of established garment decoration service providers and the rise of e-commerce marketplaces that facilitate design personalization at scale are crucial drivers of growth.

Although competition continues to be high, the move towards premium personalization and a robust D2C (direct-to-consumer) model is likely to sustain the positive trajectory during the forecast period.

France is anticipated to expand at 8.6% CAGR over the forecast period. France, as a fashion capital of the world, is experiencing an artistic revival in ornamented clothing through designer-digital artisan collaborations. The combination of haute couture trends and streetwear influences has created new opportunities for innovative garment decoration.

French consumers are gravitating toward customized luxury clothing with embroidery, screen printing, and embellishments featuring cultural patterns or avant-garde designs. The sector also enjoys robust institutional support for fashion innovation in the form of grants for sustainable textile innovation and digital fashion technology.

Fashion-tech startups are bringing with them online retail, which is gaining popularity as interactive platforms enable consumers to design and order custom pieces. Local players are riding the wave by fusing traditional craftsmanship with contemporary aesthetics.

Corporate segments and occasions also see a growing demand for branding through embellished clothing. Even as established fashion companies continue to dominate, the willingness to incorporate artisan and digitally augmented decoration should propel steady growth in France.

Germany is likely to register an 8.9% CAGR over the forecast period. Prestigious for its technical acuteness, Germany is characterized by a high emphasis on quality, technological improvement, and environmentally friendly manufacturing. The B2B segment, especially in corporate wear and event wear merchandising, owns the industry.

Customers emphasize durability as well as design refinement, which has resulted in the far-reaching implementation of new printing technology and embroidery equipment. The demand for environmentally friendly clothing decoration is most strongly felt in Germany.

Regulations supporting sustainable textile manufacturing have seen extensive adoption of biodegradable inks and organic base materials. This has made Germany a pioneer of ethically decorated clothing in Europe. Small and medium-sized enterprises are leveraging local production capacity to provide quick-turnaround customized garments, particularly through the Internet.

Digital transformation and the embedding of AI into product customization procedures are transforming Germany into a highly competitive industry, fusing technological knowledge with changing consumer preferences.

Italy will grow at an 8.2% CAGR over the study period. Italy's fashion-oriented economy has huge potential for decorated apparel, particularly in the boutique fashion and artisanal ranges. The industry is dominated by a high preference for handcraft, embroidery, and low-series prints with a focus on artistic heritage and high-end craftsmanship.

Although the segment is less technology-driven than in other Western economies, Italian-decorated apparel is well regarded for its design-driven appeal. Luxury brands are now using personalized design choices as a part of their high-end customer experience.

Concurrently, the increasing presence of online platforms and fashion technology startups is gradually restructuring established distribution frameworks. Italy is backed by a strong tourism sector, wherein personalized garments act as memorabilia and styling statements. Still, comparatively slower digital upgradation and large-scale production are areas of ongoing challenge.

South Korea is likely to grow at 11.7% CAGR over the study period. South Korea's vibrant fashion culture and robust pop culture influence-particularly K-pop and K-drama fandoms-have considerably driven demand for branded and customized apparel. The consumer, especially the youth population, prefers customized clothing that identifies with their personality, lifestyle, and media.

There are fast-moving trend cycles, and hence, speed in apparel decoration and production has become a key success factor. Technology-driven consumers are extremely sensitive to technology innovations in customization platforms, such as AR/VR-facilitated fitting rooms and interactive design systems.

Local influencers and brands often introduce limited-period collections, resulting in high demand for fast-turnaround, customized clothing. Governments' support for textile innovation and sustainability has facilitated the use of environmentally friendly printing and embroidery methods. As its export opportunity expands through online marketplaces, South Korea is becoming a regional center for trend-driven and technology-supported decorated apparel manufacturing.

Japan is expected to grow at 9.0% CAGR during the study period. Japan combines meticulous craftsmanship with a futuristic approach to apparel decoration. Consumers place high value on uniqueness and attention to detail, making decorated garments an attractive segment for both luxury and casual wear. Traditional techniques, such as shibori and sashiko stitching, are being reimagined through modern materials and digital embellishment methods.

The impact of anime, gaming, and local popular culture has also widened the demand for character-inspired and brand-partnered apparel. The infusion of technology in garment decoration activities is reflected in the application of robots for embroidery and design platforms enabled by artificial intelligence.

Japanese brands are utilizing these innovations to serve both local and global markets, specifically in online D2C channels. Japan's love for sophisticated design and cultural narrative means that embellished clothing is a viable growth market.

The China market will grow at a 13.4% CAGR over the forecast period. Being one of the fastest-developing consumer economies, China offers huge opportunities for growth. With a huge population base, growing urbanization, and increasing disposable incomes, the demand for individualized fashion, which showcases uniqueness and social status, is being driven. Domestic brands are growing fast on online platforms, thanks to strong digital infrastructure and data analytics on consumers.

Live shopping, influencer-based products, and gamified customization instruments are widespread throughout Chinese e-commerce platforms. The government's backing for local textile innovations also supports technological upgrades in the printing, heat transfers, and embroidery industries.

The emergence of Gen Z and millennials, who prefer self-expression through fashion more, further propels market uptake. China's production capabilities, scalable strengths, and supply chains enable it to be a worldwide leader in the production and consumption of adorned clothing, thus promising long-term growth prospects.

The Australia-New Zealand market is anticipated to grow at 9.3% CAGR over the forecast period. The growth in the market in this region is fueled by greater consumer interest in sustainable, ethical, and locally sourced fashion apparel.

Demand for decorated garments is being influenced by lifestyle branding, seasonal promotion, and outdoor-themed custom clothing that reflects the active lifestyle of the region. Fashion stores are incorporating personalization elements in online shopping, including embroidery, printing, and patchwork.

Electronic commerce penetration is also high in both nations, and domestic brands are utilizing online platforms to target niche consumer groups. They are also being represented through adorned clothing, bringing a distinct flavor to the market.

Despite the smaller market size compared to North America and Asia, innovation at the level of textile design, focusing on socially responsible sourcing and collaborative design ethos, is assisting New Zealand and Australia in emerging as impactful players within the world of decorated apparel.

Based on product type, embroidery apparel will have the largest share of about 28% in 2025, followed by screen-printed apparel, which will hold about 24%. These segments are intended to meet the growing need for personalized and custom-designed clothing, particularly in fashion, sports, and corporate branding.

Embroidered apparel remains popular because of its high-quality, durable finish and premium look; the technique remains popular for corporate uniforms, promotional wear, and sportswear. Nike and Adidas, for example, use embroidery for the logos on premium collections for an added touch of sophistication and durability.

Therefore, stitching patterns or logos onto fabric enhances the aesthetic appearance of the product and enables long-lasting branding initiatives. In addition, small businesses have experienced an upturn in sales due to custom apparel brands like Custom Ink, which specializes in embroidering custom t-shirts, caps, jackets, or other personalized items and targets both the consumer and the corporation requiring a branded item.

Screen printing perhaps trumps embroidery in being the best feature. The biggest selling point of the method is affordability and versatility, which suit the high-volume application of decoratively finished garments. The bulk orders for promotional t-shirts and jerseys for sports teams are made by fashion retailers, event organizers, and bands popularized by the many colors.

They provide printed apparel for all occasions, whether casual or for uniforms, at very low prices due to this technology. Gildan, Bella, and all others offer it at very low prices. This affordability in scalability is what has made the method so popular, especially in retail and promotional sectors, where cost control becomes a concern.

By end-use, the fashion & retail industry will hold the largest share of 32%, while the second largest is the sports industry, with a 25% share in 2025. These are the prime industries driving the demand for custom- and decorated-apparel range.

The fashion & retail industry is the largest because there are so many emerging trends in personalizing clothes for that extra touch of uniqueness. Fashion brands, streetwear labels, and custom boutiques are starting to explore the world of embroidered or screen-printed apparel as a new way of offering an exclusive product.

Companies like Supreme and Off-White are also known to employ a decorated form of clothing to create offerings that are limited in quantity and marketed as per demand for such higher-quality, custom-made pieces. Even retailers offering this online tracking service, such as H&M and Zara, have entered the industry.

They have attracted many customers. However, the growing trend in sustainable fashion and eco-friendly processes has increased the need for individualized designs, allowing consumers to express their personalities while exercising ethical fashion choices.

Customized sportswear and team jerseys show intricate embroidery or screen printing, and they can be important for professional and recreational athletes. Most of the products in this area are named Nike, Adidas, and Under Armour, which serve team kits, sports uniforms, and fan merchandise that are complemented by players following.

The increasing popularity of sports teams and e-sports, also coupled with the trend of increased athleisure-wearing style, is bringing demand for decorated apparel. Names, logos, and team colors always customize the final product, which is highly important in the sportswear sector because it helps improve brands' visibility and fan connection.

The industry is highly competitive and consists of different companies such as Gildan, Fruit of Loom, Inc., and HanesBrands Inc., which are big players in the customized apparel printing field for promotional and retail purposes. These businesses incessantly improve their products through innovative means by investing in better printing technologies, green materials, and personalized options that are unique to the different customers' needs.

Gildan has focused on developing a diversified line of decorated apparel that supplies a range of customizable items for wholesale. The fruits of Loom, Inc. also focus on high-quality, versatile apparel solutions based on fabric technology and comfort. Even at this time, HanesBrands Inc. still leads the competition with innovative designs coupled with a strong retail presence, thus extending the decorated apparel line both for businesses and consumers.

Other key players like Downtown Custom Printwear and Master Printwear are also expanding in the local and regional industries. They offer personalized services for small- to medium-sized businesses. Emerging industries of Delta Apparel, Inc. and Target Decorated Apparel target their strategies according to sustainability by using eco-friendly textiles and processes. Lynka and New England Printwear concentrate on high-quality decorated apparel with a bent toward customization and customer-centric service.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Gildan | 18-22% |

| Fruit of Loom, Inc. | 15-19% |

| Hanesbrands Inc. | 12-16% |

| Downtown Custom Print wear | 10-14% |

| Master Print wear | 8-12% |

| Other Players | 24-28% |

| Company Name | Offerings & Activities |

|---|---|

| Gildan | Expanding its portfolio with customizable apparel, focusing on sustainable production methods. |

| Fruit of Loom, Inc. | Offers high-quality, customizable apparel solutions, focusing on comfort and fabric innovation. |

| Hanesbrands Inc. | Innovating decorated apparel for both business and consumer use, with a focus on design and retail presence. |

| Downtown Custom Printwear | It specializes in custom printwear for small and medium-sized businesses with a focus on the local region . |

| Master Printwear | Provides high-quality printed apparel with a strong emphasis on design and customer service. |

Key Company Insights

Gildan (18-22%)

Continues to lead with a diverse range of customizable apparel and a strong commitment to sustainability in production.

Fruit of Loom, Inc. (15-19%)

Focuses on comfort and fabric innovation, offering versatile and customizable products for a broad customer base.

Hanesbrands Inc. (12-16%)

Dominates with a strong retail presence and cutting-edge design in decorated apparel, positioning itself as a key leader.

Downtown Custom Printwear (10-14%)

A leader in the custom printwear space for local and regional businesses, providing tailored solutions with a customer-centric approach.

Master Printwear (8-12%)

Known for its high-quality decorated apparel, with a focus on premium offerings and responsive customer service.

Other Key Players

The segmentation is into Paperboard, Paper Bags and Sacks, Tissue Paper, Paper Cups and Containers, Folding Cartons, Envelopes, and Others.

The segmentation is into Food and Beverage, Retail and Consumer Goods, Healthcare and Personal Care, E-commerce and Logistics, Printing and Publishing, Industrial Packaging, and Others.

The report covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The global decorated apparel market is expected to reach a value of USD 38.7 billion by 2025, propelled by the growing popularity of personalized and custom clothing.

The industry valuation is forecasted to hit USD 132.3 billion by 2035, driven by advances in printing technologies, demand for promotional wear, and fashion trends.

China is experiencing a notable surge with a 13.4% CAGR because of its thriving textile manufacturing sector and increasing domestic consumption.

Embroidery apparel is leading the segment due to its perceived premium quality and durability, making it popular for corporate branding and team uniforms.

Prominent companies include Gildan, Fruit of the Loom, Inc., Downtown Custom Printwear, Hanesbrands Inc., Master Printwear, Delta Apparel, Inc., Target Decorated Apparel, Advance Printwear Limited, Lynka, and New England Printwear.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by End User, 2018 to 2033

Table 4: Global Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 5: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 7: North America Market Value (US$ million) Forecast by End User, 2018 to 2033

Table 8: North America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 9: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 11: Latin America Market Value (US$ million) Forecast by End User, 2018 to 2033

Table 12: Latin America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 13: Western Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 15: Western Europe Market Value (US$ million) Forecast by End User, 2018 to 2033

Table 16: Western Europe Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ million) Forecast by End User, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ million) Forecast by End User, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 25: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 27: East Asia Market Value (US$ million) Forecast by End User, 2018 to 2033

Table 28: East Asia Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ million) Forecast by End User, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 11: Global Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 14: Global Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 17: Global Market Attractiveness by Product, 2023 to 2033

Figure 18: Global Market Attractiveness by End User, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ million) by Product, 2023 to 2033

Figure 22: North America Market Value (US$ million) by End User, 2023 to 2033

Figure 23: North America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 24: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 31: North America Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 34: North America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 37: North America Market Attractiveness by Product, 2023 to 2033

Figure 38: North America Market Attractiveness by End User, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ million) by Product, 2023 to 2033

Figure 42: Latin America Market Value (US$ million) by End User, 2023 to 2033

Figure 43: Latin America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 44: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 51: Latin America Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 54: Latin America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 58: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ million) by Product, 2023 to 2033

Figure 62: Western Europe Market Value (US$ million) by End User, 2023 to 2033

Figure 63: Western Europe Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 64: Western Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 71: Western Europe Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 74: Western Europe Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ million) by Product, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ million) by End User, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ million) by Product, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ million) by End User, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ million) by Product, 2023 to 2033

Figure 122: East Asia Market Value (US$ million) by End User, 2023 to 2033

Figure 123: East Asia Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 124: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 131: East Asia Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 134: East Asia Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 138: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 139: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ million) by Product, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ million) by End User, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Apparel Market Size and Share Forecast Outlook 2025 to 2035

Apparel Re-commerce Market Size and Share Forecast Outlook 2025 to 2035

Gym Apparel Market Size and Share Forecast Outlook 2025 to 2035

Pet Apparel Market Analysis - Size, Demand & Forecast 2025 to 2035

Chef Apparel Market Size and Share Forecast Outlook 2025 to 2035

Kids Apparel Market Trends - Growth, Demand & Forecast 2025 to 2035

Rugby Apparel Market Forecast and Outlook 2025 to 2035

Blank Apparel Market – Growth & Demand Forecast 2025 to 2035

Bamboo Apparel Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Apparel and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Sequins Apparel Market Size and Share Forecast Outlook 2025 to 2035

TIC For Apparel Market

Crossfit Apparel Market Size and Share Forecast Outlook 2025 to 2035

Maternity Apparel Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Maternity Apparel Providers

Equestrian Apparel Market Size and Share Forecast Outlook 2025 to 2035

Secondhand Apparel Market Analysis - Size, Share, and Forecast 2025 to 2035

Competitive Overview of Secondhand Apparel Market Share

Second-hand Apparel Market in Europe Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Dye Sublimated Apparel Market is segmented by product, printing technique, distribution and region through 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA